Spain’s bank-sovereign nexus (I): A view from the sovereign side

The link between bank and sovereign debt risk intensified during Europe’s recent financial crisis. However, close analysis of Spain’s experience with sovereign bond stress shows that while foreign investors exacerbated volatility by reducing their holdings of Spanish government debt, domestic banks reacted in the opposite manner, and therefore, had a stabilising impact on the country’s public debt markets.

Abstract: Concerns over the nexus between bank risk and sovereign risk, which intensified during the sovereign debt crisis of 2010-2012, have returned to the forefront in recent months due to: i) concerns over Italy’s borrowing costs, ii) the spill-over effect this can have on the country’s banking sector; and, iii) the attendant need for eurozone reform. It is against this backdrop that an analysis of the bank-sovereign nexus is undertaken using Spain as the primary case study. This paper, part of a two part series

[1], focuses on the public debt part of the relationship and demonstrates that while foreign investors reacted more volatilely during times of sovereign bond stress by dramatically reducing their holding of Spanish sovereign bonds, domestic banks helped stabilise Spain’s public debt market by increasing their share of Spanish government debt.

Introduction

The feedback loop between bank and sovereign risk has been a persistent concern over the past eight years in Europe. This relationship intensified during the initial years of the financial crisis due to the increase in sovereign bonds held by financial institutions, particularly in countries that experienced greater financial stress, like Spain. As a result, a debate emerged over the regulatory treatment of those public debt holdings. The dispute centred around whether regulatory policies had encouraged banks to hold an excessive amount of their own countries’ sovereign bonds, and if this had exacerbated the precarious connection between bank and sovereign debt risk.

The recent election in Italy has brought this debate back into focus. Concerns have been expressed over Italy’s fiscal health, following the formation of its new populist government and the possibility that the country may leave the eurozone. The extraordinary volatility and subsequent drop in price of Italian sovereign bonds has had a negative effect on the share prices and credit risk premiums (CDSs) of major Italian banks. Of particular worry is the knock-on effect for two of Italy’s largest banks, UniCrédit and Intesa, whose public debt holdings exceed 100% of their own funds. The Financial Times has covered the relationship between bank and sovereign risk (dubbed the ‘doom loop’) and has advocated for a limit on banks’ public debt holdings.

The banking sector’s role in the public debt market

The sovereign debt held on banks’ balance sheets is at the root of the so-called ‘bank-sovereign nexus’. Despite the risk inherent in these links, it should be noted that both parties have benefited from this close relationship.

In this article, we focus on the role of a country’s treasury, which issues the public debt purchased by banks. A second upcoming article will tackle the implications of those purchases for the banking sector.

Banks’ fulfil a series of important functions that underpin the public debt market. First, banks act as ‘market makers’. By injecting liquidity into the marketplace, sovereign bonds can be bought and sold on a recurring basis. In their role as debt distributors, banks expand the number of investors that can purchase public debt securities. Thus, the banks’ activities benefit both debt issuers and investors.

Second, banks act as a stabilising agent through their purchase of sovereign bonds. For example, situations may occur where sovereign bonds are majority-held by certain types of investors whose investment profiles make them prone to massive and/or swift sell-offs which exacerbate price and interest rate volatility, with evident ramifications in terms of financial stability. Under these circumstances, banks, which traditionally exhibit a buy-and-hold investment profile, can help to support sovereign debt markets.

The interdependence between banks and sovereign issuers becomes far more evident during a financial crisis. Most recently, this was demonstrated in the eurozone, with a particularly deleterious effect in Spain.

Banks as stabilising agents in the Spanish public debt market

The early 2000s were marked by a period of sustained economic growth in Spain. This coincided with a decline in both the absolute and relative volume of outstanding public debt (as a percentage of GDP). In this context, foreign investors began to purchase a larger share of Spanish sovereign bonds, while Spanish banks scaled back their holdings of Spanish public debt.

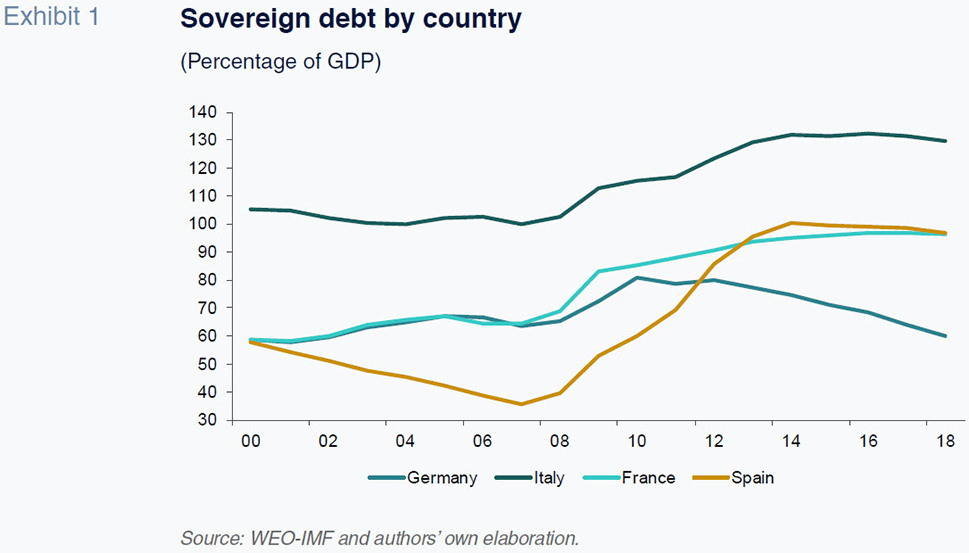

Although the advent of the financial crisis in 2008 prompted a sharp increase in public borrowing across the developed world, measured in terms of GDP, this trend varied substantially. Overall, the increase in public debt was equivalent to 15% of these countries’ GDP. As shown in Exhibit 1, in France and Italy, however, this number rose to 30%. Even more dramatic was the 63% increase in public debt as a percentage of Spain’s GDP. Specifically, public borrowing rose from a low of 37% of GDP in 2007 to 100% in 2013.

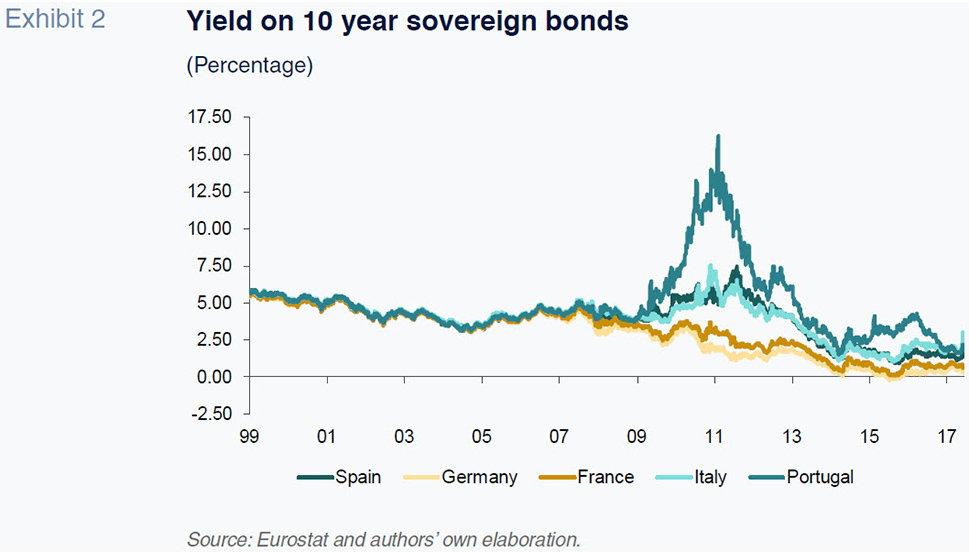

A period of volatility ensued as economic prospects declined and sovereign issuers experienced a considerable spike in their funding requirements. As shown in Exhibit 2, the increase in sovereign bond yields was particularly sharp in peripheral eurozone economies, such as Portugal, Italy and Spain. The so-called ‘core countries’, which include France and Germany, experienced only moderate increases in their funding costs.

As extensively documented by scholars like De Grauwe and Ji (2012), this divergence in risk premiums cannot be entirely attributed to countries’ economic circumstances. These authors found that the trend in sovereign debt spreads was correlated with fears of a possible break-up of the eurozone. They also observed several instances of contagion during the crisis. Doubts about the solvency of one country (e.g. Greece) had a tendency to spark concerns about other peripheral eurozone economies.

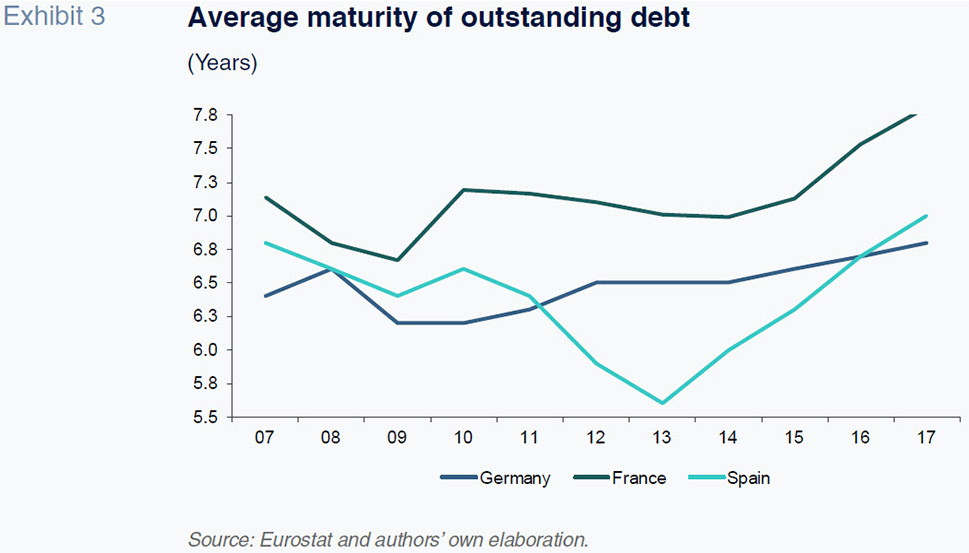

Pressure from the financial markets forced eurozone treasuries to adapt their financing strategies. Faced with an increase in funding needs and a steady rise in borrowings costs, the treasuries shortened bonds’ maturities. This action was more intense in those countries under greater financial strain, such as Spain. However, in countries, such as France and Germany, where financing conditions did not deteriorate, the average maturity on bonds issued during this period remained largely stable (Exhibit 3).

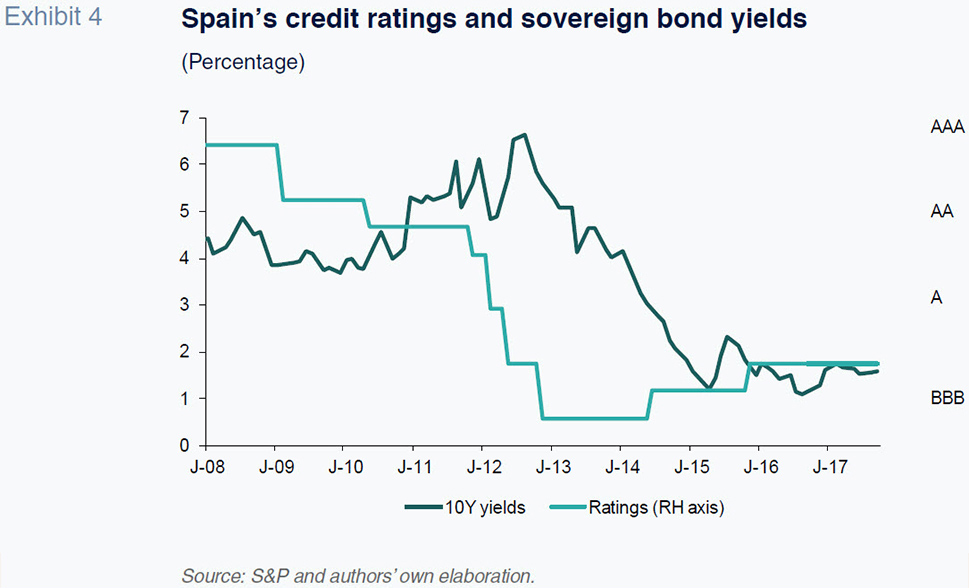

In addition to the increase in borrowing costs, eurozone credit ratings also declined. S&P downgraded Spain’s sovereign bond rating from AAA in 2009 to BBB− in October 2012. Thus, Spain went from the highest possible credit rating to the lowest investment grade credit rating in just three years. This left the country just one downgrade away from high-yield or junk bond status. These actions were substantiated by a downturn in macroeconomic forecasts. At this time, the eurozone was experiencing a double-dip recession coupled with the prospect of reduced support from the European Central Bank, which contributed to widespread doubt over the future of the currency union.

These downgrades were both a reflection of and cause behind the deterioration of financing conditions. As shown in Exhibit 4, the ratings downgrades coincided with a rise in sovereign bond yields.

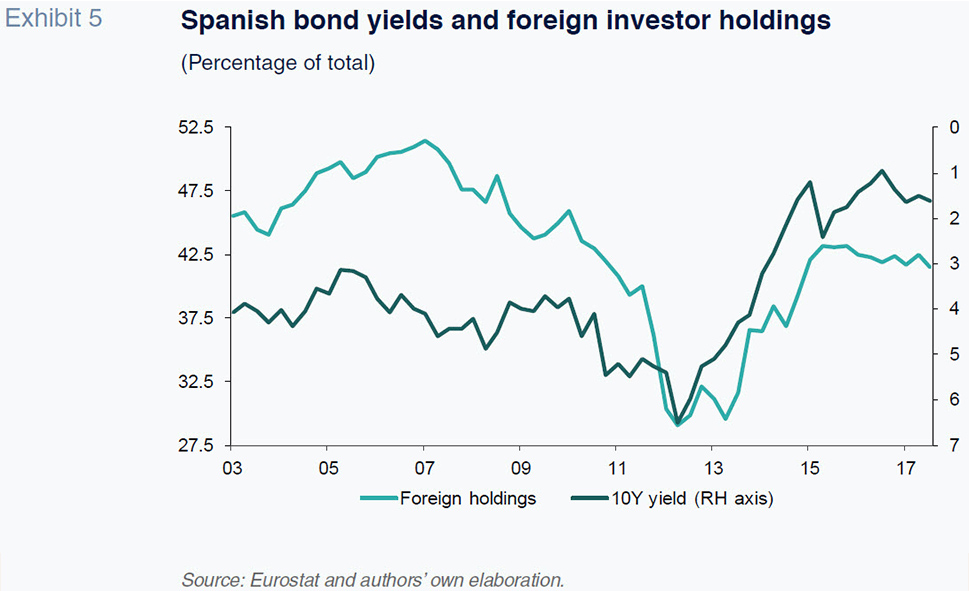

The turbulence that marked 2008 to 2012 resulted in considerable changes in the composition of the Spanish Treasury’s investor base. Particularly noteworthy is the contrast in the behaviour displayed by domestic and foreign investors. Foreign investors reacted to the economic downturn by slashing their debt holdings. The sell-off, which began in 2007, reached its peak in 2012. During that period, the share of Spanish sovereign debt held by foreign investors fell from 50% to 30%.

The decline in foreign holdings of Spanish government debt coincided with the spike in the country’s bond yields. This rise in borrowing costs persisted until foreign investors began to increase their share of Spanish bonds again. Specifically, between 2012 and 2017, foreign investors’ Spanish debt holdings increased from 30% to 43%.

There is extensive literature documenting the pro-cyclical effect of movements in yields on foreign investor holdings. Authors such as Blake, Sarno and Zinna (2014) have corroborated that foreign investors often exacerbate these market movements (Exhibit 5).

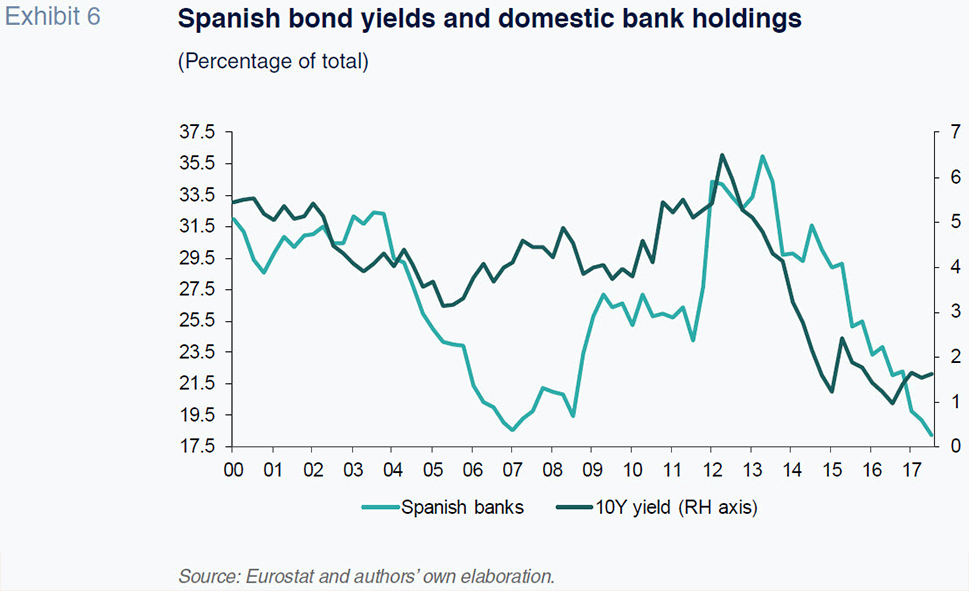

In contrast to foreign investors, Spanish banks actually increased their share of Spanish government debt during episodes of market stress and weakened economic prospects. As Exhibit 6 shows, this took place during two periods.

The first increase in domestic banks’ holdings occurred in 2008 when there was a sharp decline in global macroeconomic conditions. During this period, stress in the peripheral debt markets was limited. The root causes of the global financial crisis lay in the US and confidence in the eurozone remained steady. Nevertheless, Spanish banks increased their share of Spanish government bonds from 18% of total public debt to 27% in 2009.

The domestic banks significantly increased their public debt holdings again between 2011 and 2012. At this time, there was a further deterioration in economic conditions, which left few alternatives for bank lending activity. Unlike the previous period, there was also a general loss of confidence amongst eurozone investors. Consequently, Spanish banks’ relative public debt holdings rose from 25% to nearly 35%.

Transmission of sovereign risk to the banks

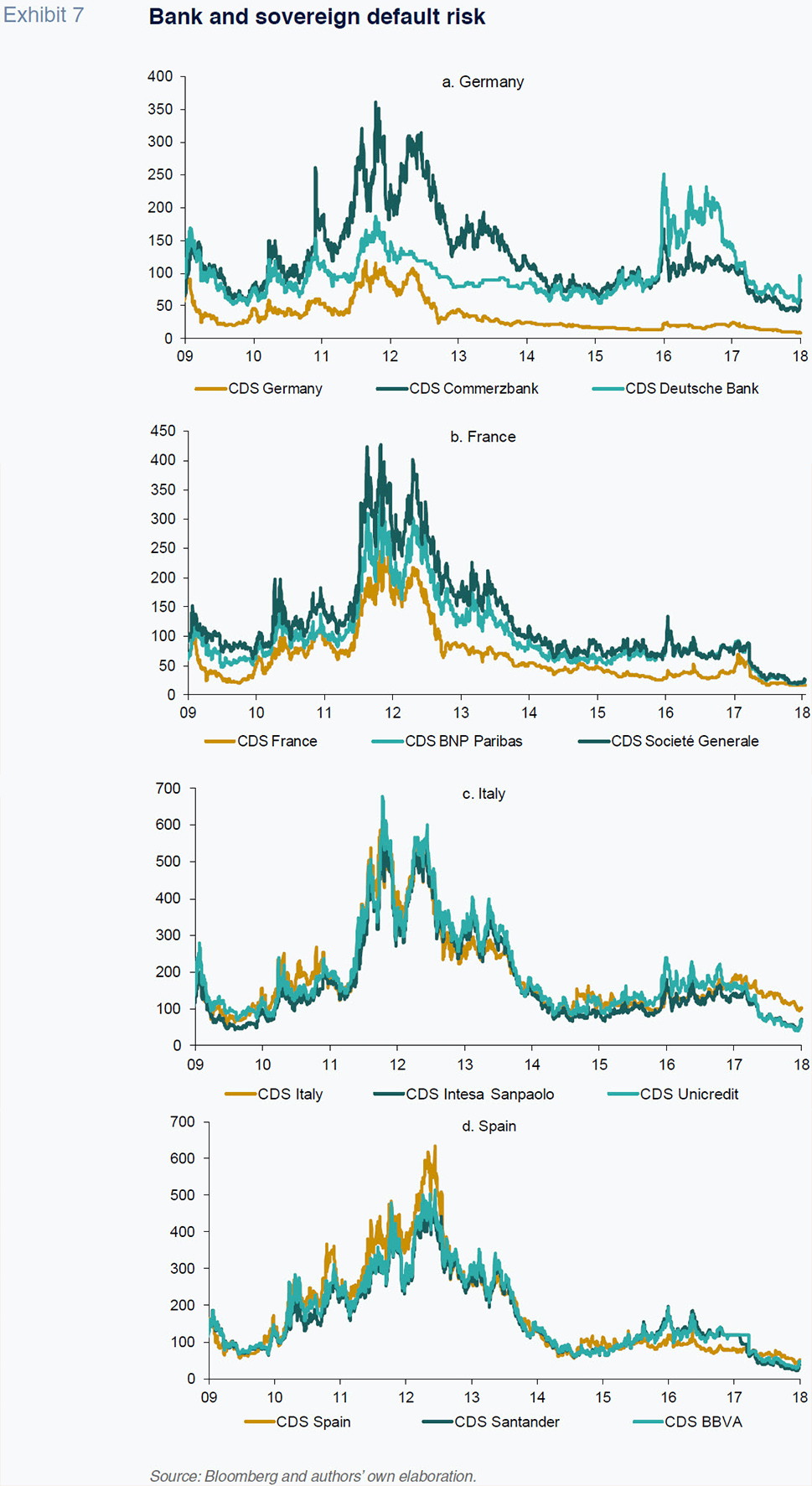

The period of sovereign bond stress overlapped with an increase in the cost of default insurance (CDSs) faced by the main banks in various countries. The positive correlation between sovereign bond stress and banks’ CDS spreads can be attributed to multiple factors, which have been extensively analysed in academic literature.

One factor is the increase in sovereign bond spreads. This causes a drop in the price of the public bonds, which in turn weakens the creditworthiness of the financial institutions that hold the distressed debt.

An analysis of the trend in the banks’ and sovereign issuers’ CDS spreads reveals several points of interest. Exhibit 7 plots the trend in CDS contracts for the sovereign bonds of Germany, France, Italy and Spain and each of those countries’ two largest banks.

This mapping exercise illustrates how the CDS spreads of sovereigns and financial institutions across the eurozone increased sharply between 2008 and 2012. The relationship between domestic banks and government borrowing is particularly strong in the case of Italy and Spain. This suggests that in countries where solvency concerns arise, the transmission of risk from sovereigns to financial institutions is more pronounced. The correlation even holds during the early years of the international financial crisis (2008-2009) during which public debt holdings were relatively small and serious fears about the integrity of the eurozone had yet to materialise.

The same exhibits depict a contrast between what happened between 2008 and 2010 compared to 2015 and 2016. During the latter period, fears regarding the health of certain financial institutions had a mixed impact on eurozone entities as a whole, as is evident in these entities’ CDS spreads.

Interestingly, between 2015 and 2016, the trend in sovereign CDS spreads was consistent with economic conditions and, broadly speaking, stable. Thus, during the latter period, we have not seen substantial contagion of banking risk to sovereign risk in any of the main eurozone economies. This demonstrates that in the context of upbeat economic prospects, the cost of insuring against sovereign default has proven relatively isolated from concerns over the solvency of individual banks.

Conclusion

We can draw several conclusions from the above analysis regarding the role played by financial institutions during the crisis via their holdings of Spanish government debt. Foreign investors reacted more volatilely, sharply reducing their holdings during times of stress in the Spanish sovereign bond market. Insofar as their behaviour does not coincide with a deterioration in macroeconomic fundamentals, foreign investors can play a destabilising role in a country’s public debt markets.

Conversely, by increasing their holdings during periods of sovereign bond stress, domestic banks became a source of stability. Of note is the fact that these financial institutions increased their sovereign debt holdings in 2008 and 2009 even as the economy contracted and sovereign bond yields remained relatively high. While the intensification of the sovereign-bank nexus could have harmful consequences, it is important not to underestimate the role played by the domestic banks as stabilising agents and market makers.

Notes

This article is the first in a two-part series on the link between sovereign and bank risk. This first article analyses the situation from the perspective of the sovereign issuer, while the upcoming article, to be published in the September SEFO, will examine this issue from the perspective of the investors (the banks).

References

BLAKE, D.; SARNO, L., and G. ZINNA (2014), The market for lemmings: is the investment behaviour of pension funds stabilizing or destabilizing?, Bank of England mimeo.

DE GRAUWE, P., and Y. JI (2012). “Mispricing of sovereign risk and macroeconomic stability in the Eurozone,” JCMS: Journal of Common Market Studies, 50(6): 866-880.

Ángel Berges and Victor Echevarria. A.F.I. - Analistas Financieros Internacionales, S.A.