The effects of the pandemic and inflation crisis on Spanish corporates’ funding gap

Significant changes in the dynamics of the supply and demand for credit are disproportionately increasing the financing needs of Spanish SMEs and microenterprises, while increasing constraints for access to credit, thus notably widening their financing gap. Public financial instruments, both at the national and regional level, could serve as a key economic policy tool for lending financial support to the productive sector at a time of heightened uncertainty.

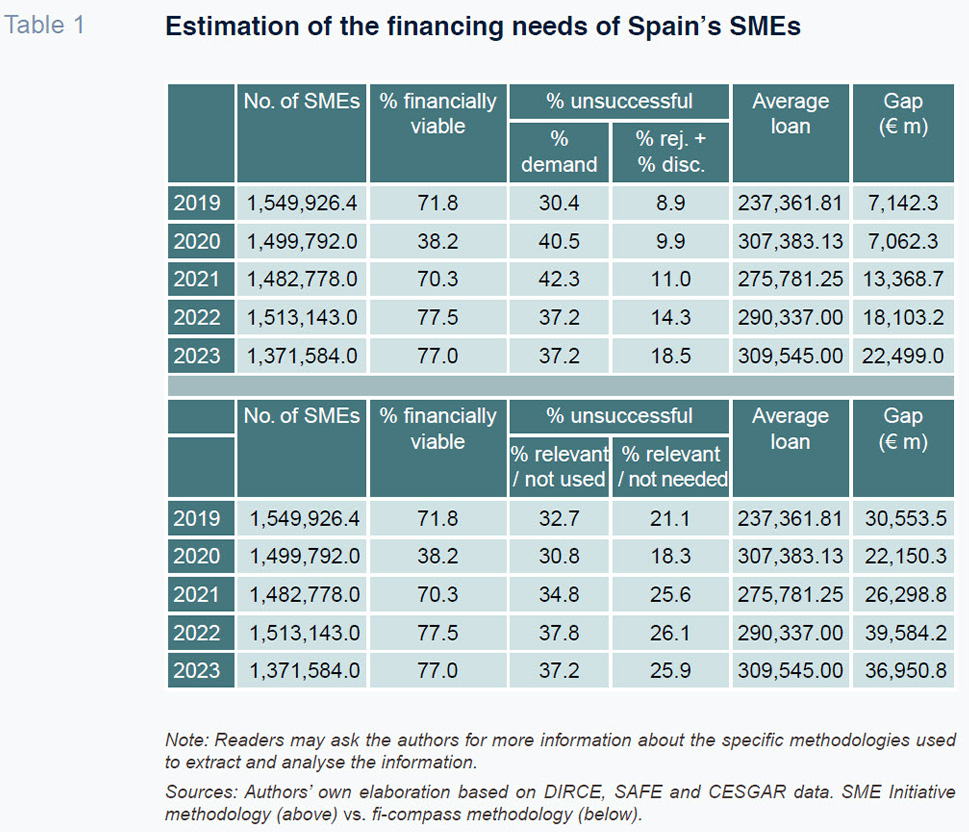

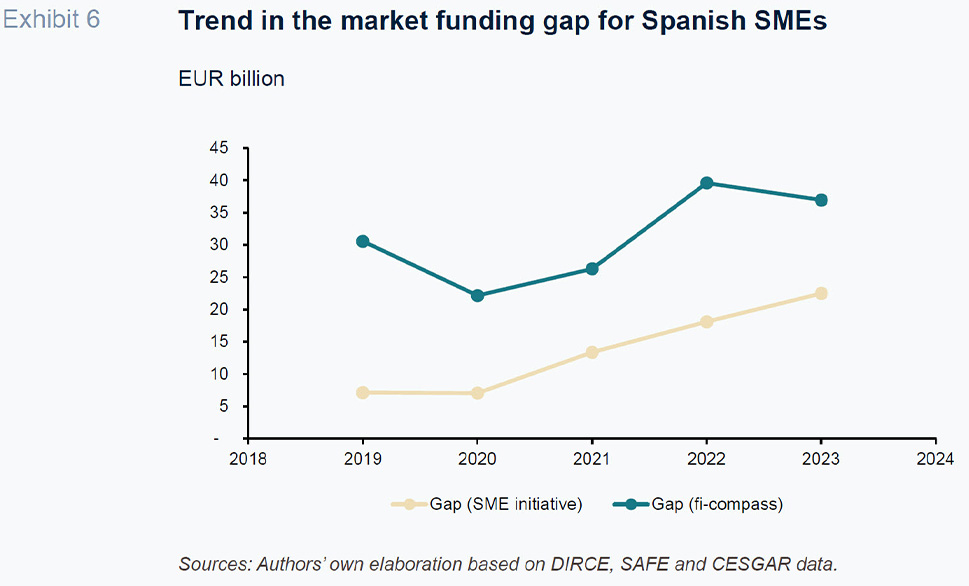

Abstract: Recent financial markets volatility, derived from the economic crises and the transition underway towards a more resilient, digital and green economy, has brought about significant changes in the supply and demand for credit. These changes have disproportionately affected SMEs and micro enterprises, as they are more vulnerable to structural failures in the credit market, which have been aggravated by the prevailing situation. Specifically, SMEs’ financing needs have increased, shaped by the transformation of the productive model, which has translated into growth in demand for bank loans and for other types of financing. However, these needs have come up against greater financing constraints as a result of a range of factors, including the uptick in interest rates to curb inflation, driving growth in the cost of financing and, with it, in the incidences of loan rejections and discouraged borrowers. As a result, the estimated shortfall in SME financing has increased to between 22.5 billion euros (per the SME initiative methodology) and 36.9 billion euros (per the fi-compass methodology) in 2023 – between 1.5% and 2.5% of Spanish GDP in 2023, respectively. These figures indicate that the average funding gap increased by 58% between 2019 and 2023, and by 76% between 2020 and 2023. Within this context, public financial instruments, both at the national and regional level, could serve as a key economic policy tool for lending financial support to the productive sector at a time of heightened uncertainty.

Market failures and the financing needs of Spain’s SMEs

The credit market is affected by certain structural failures that impact access to financing for enterprises. These failures, such as the incidence of asymmetric information, justify public sector intervention to correct them (Akerlof, 1970; Berger and Udell, 1992; Berger and Udell, 1995; Stiglitz and Weiss, 1981; Diamond, 1984).

In addition to the inefficient allocation of resources that takes place as a result of moral hazard or adverse selection, access to financing is affected by other failures that are structural in nature (AIReF, 2023). Those failures include suboptimal credit allocation as a result of the difficulties in integrating activities that generate positive externalities, such as innovation, digitalisation and the green transition, into traditional risk, cost and benefit assessments. They can also arise from the existence of highly fragmented markets around few providers or the presence of incomplete markets, such as in the case of the capital financing market, which restricts alternatives in accessing financing despite a growing appetite for such instruments.

As a result of these failures, corporations, and to a greater degree SMEs and micro enterprises, face issues accessing financing. This access issue, known as the funding gap, is the result of unsatisfied financing needs derived from rigidities on the supply side, fuelling surplus demand whereby financially viable companies or with interesting projects are expelled from the market for other reasons than their financial solvency. The funding gap therefore represents the volume of financing that the companies expelled from the market could access if the sources of friction described above did not exist; in other words, the volume of financing that would be provided if all the companies in need of financing were able to obtain it (fi-compass, 2019).

This funding gap, which is structural in origin, is exacerbated by exogeneous factors such as the current uncertainty generated by the recent crises, the surge in inflation associated with the onset of geopolitical conflicts or the abrupt interruption in activity caused by the measures taken to halt the spread of the pandemic, which had an asymmetric impact on the sectors of the economy and on the distribution of market income (Gambau et al., 2022; Amores et al., 2023).

Furthermore, in response to these factors, the economy is undergoing a process of recovery and transformation to enhance its resilience against future shocks. This could lead to an increase in demand for financing, at a time of growing supply constraints in an environment of heightened uncertainty, driving the funding gap even higher.

Against this backdrop, the purpose of this paper is twofold. First, analyse the trend in the financing needs of Spain’s SMEs between 2019 and 2023, based on the estimation of the market funding gap. Secondly, analyse the main drivers of these changes considering both the demand and supply side. To do that we used information compiled from the aggregated results of the European Central Bank’s Survey on the Access to Finance of Enterprises (SAFE), the SME financing reports published by CESGAR and the Bank of Spain’s Bank Lending Survey.

Trend in financing needs and main drivers

The most recent crisis in the wake of the pandemic, aggravated by the fallout from the subsequent armed conflicts (inflation dynamics, monetary tightening), has highlighted the need for corporate investments that bring about changes in the productive model to focus more on digitalisation, the green transition and territorial and social cohesion, in line with the main pillars of the Recovery, Transformation and Resilience Plan. This scenario has affected coverage of Spanish SMEs’ financing needs, bringing to light changes in the demands of companies in need of financing and in the use of sources for covering those needs.

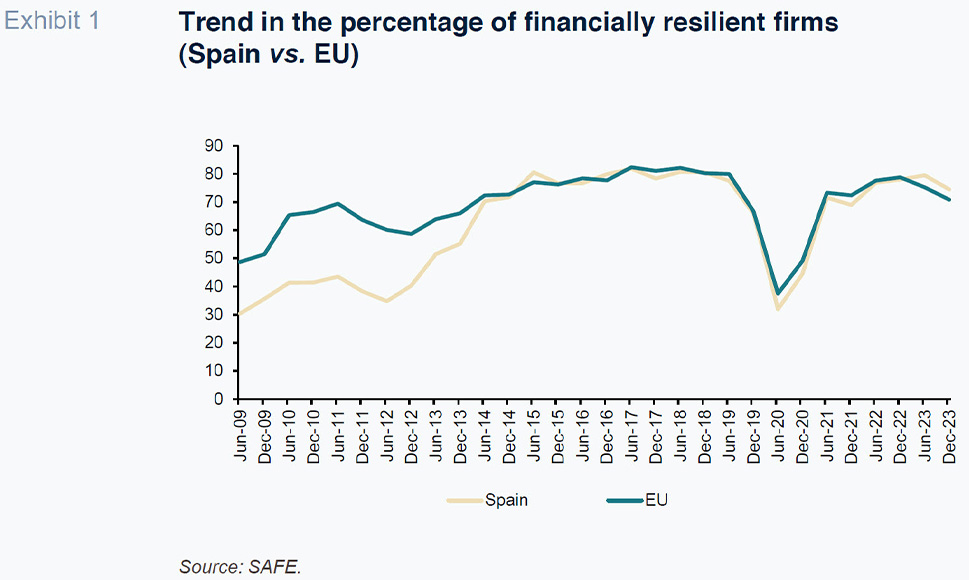

Following the onset of the pandemic, the number of financially resilient SMEs in Spain fell abruptly, from 80% in 2019 to 32% in 2020 (widespread economic lockdown, slump in sales and supply chain bottlenecks). However, one year later, that percentage had recovered to 70%, in part thanks to the rollout of extraordinary public intervention-induced measures to sustain the productive framework (e.g., COVID surety facilities with public guarantees). The trend in the EU was similar, likewise thanks to comparable business support measures.

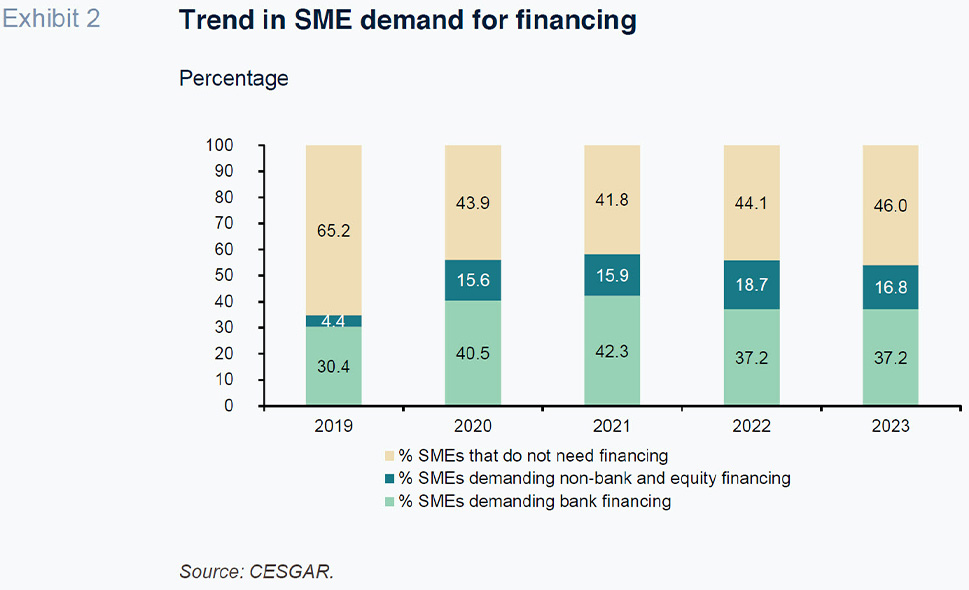

The widespread improvement in the financial solvency of SMEs in the context of a shifting productive model has been accompanied by growth in the SMEs’ funding requirement, which increased from 34.8% in 2019 to 54% after the pandemic. The stress endured by the firms led to liquidity issues and the need to reinforce the SMEs’ capital structure – this was due to both the drop in revenue because of pandemic´s business restrictions and an increase in production costs due to the breakdown of supply chains and a surge in inflation.

Among the SMEs in need of financing, the percentage that needed bank finance has fallen in the last four years by 18 percentage points (pp), from 87.4% in 2019 to 69% in 2023. This pattern suggests a shift in their needs, marked by a shift away from bank products towards alternative sources of financing, [1] either by reinforcing their equity or borrowing from entities other than banks. However, as a result of growth in the absolute financing requirement, demand for bank financing increased to 37.2% in 2023 (+6.8pp), while demand for other sources of financing tripled, from 4.4% in 2019 to 16.8% in 2023.

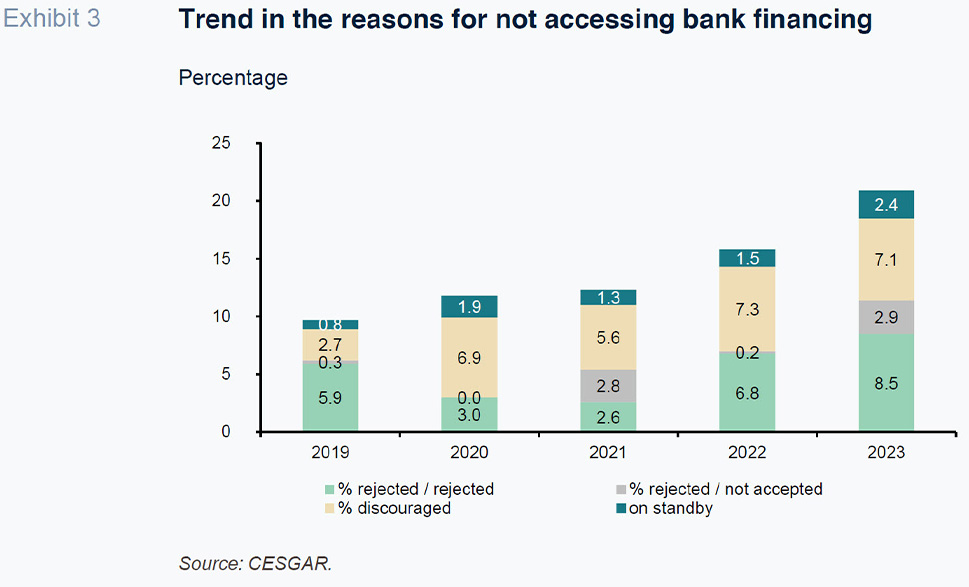

Despite the growth in demand for bank financing as a result of the increased financing requirement, access to financing has become more problematic, as is evident in the fact that the percentage of firms obtaining that financing has fallen from 87% in 2019 to 79% in 2023 (-8.1pp). That is the result of several factors:

- The number of firms that did not access bank financing, either because their application was rejected by the bank (contraction in supply) or the firm did not accept the terms and conditions (generally on account of high costs) has increased. Note in this respect that the reduction in the application rejection rate by the banks in 2021 may be attributable to public sector intervention to shore up the system’s solvency with an exceptional package of business support measures (COVID guarantee schemes). When those measures were eliminated in 2022, the rejection rate ticked back above pre-pandemic levels (5.9% in 2019 vs. 8.5% in 2023).

- The number of firms discouraged from borrowing out of concern over its cost has increased. This reflects their expectations about loan costs in the wake of ECB monetary tightening to curb the surge in inflation.

- The number of firms waiting for the banks to respond to them about their applications has also increased. The reasons for this phenomenon are related with uncertainty about the economic outlook, the trend in the applicants’ credit metrics, potential saturation at the banks in the face of other programmes (repayable public support in the form of public loans or guarantees channelled via the banks), banking sector concentration, the emergence of financing needs in risker sectors or activities for which the banks have lower tolerance thresholds (innovation and digitalisation, for example).

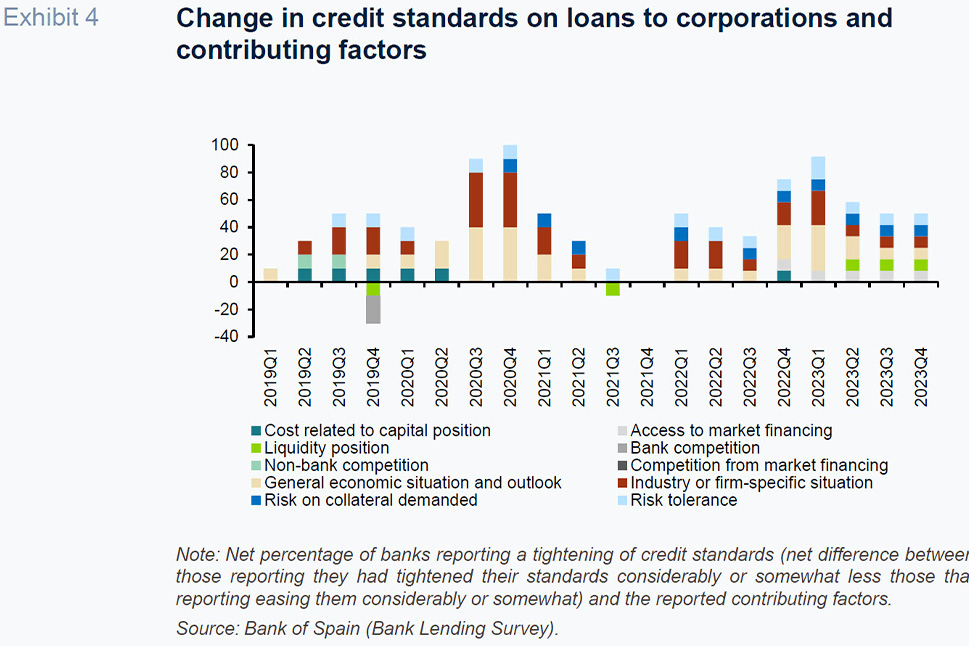

Looking further into the reasons for the first explanatory factor, the contraction in supply, according to the ECB’s Bank Lending Survey, the main reason was an increase in perceived risks, associated with:

- Deteriorating economic prospects at the general level and at the sector and company levels; and

- Lower tolerance for risk on the part of the banks, as depicted in the following exhibit.

In contexts of heightened uncertainty, and, therefore, high risk, the banks tend to penalise the financing they grant to SMEs relatively more than that extended to large enterprises. This is due to their expected reduced financial strength and because of the presence of market failures, which translates into greater constraints in accessing credit or a relatively bigger increase in the cost of the financing offered to these types of of firms.

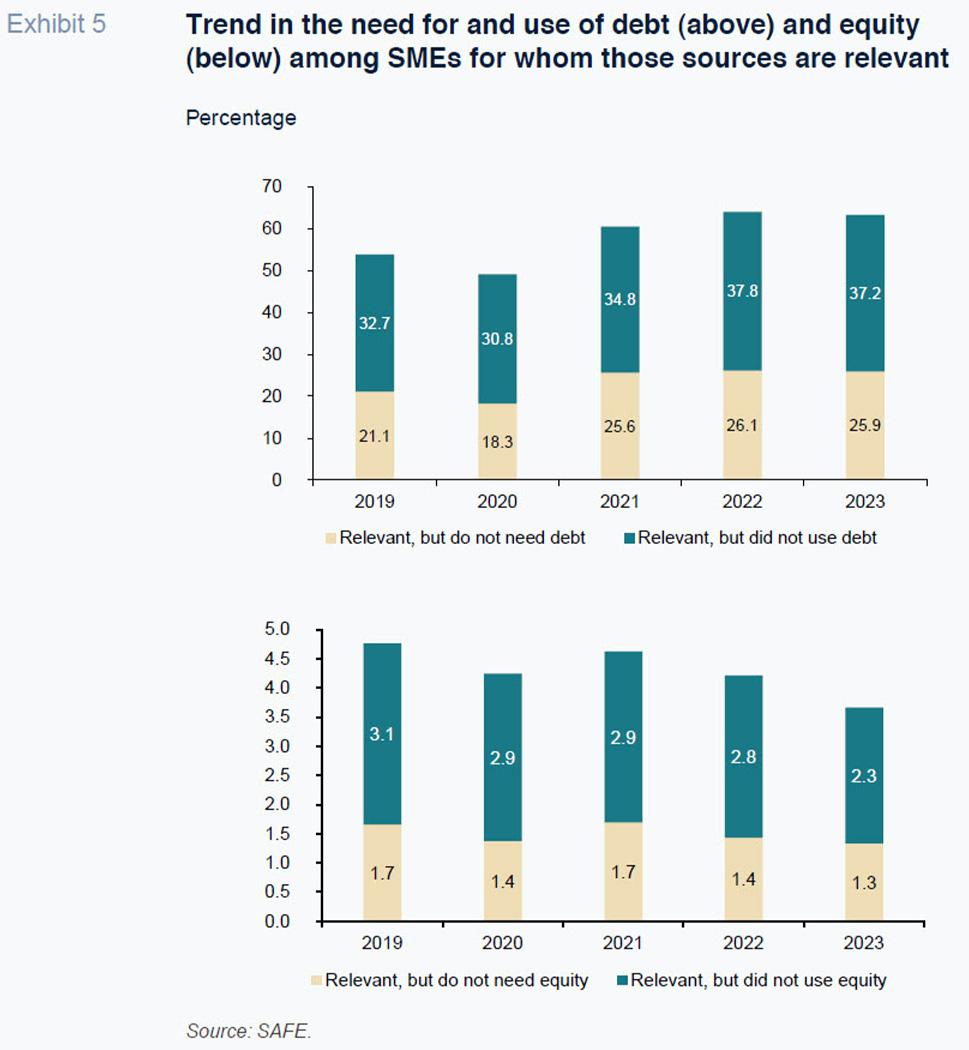

Due to these factors, demand for financing in the SME segment is trending towards other types of finance. An analysis of the SAFE results reveals that between 2019 and today, Spanish SMEs have been tending towards greater use of and/or need for alternative sources of financing to bank debt such as equity (Exhibit 5).

The survey shows that the firms that responded that they did not need or use bank financing despite considering it relevant to them increased by 5 percentage points between 2019 and 2023 (to 26% and 37%, respectively). In contrast, the firms that reported that they did not need or use equity financing fell slightly to 1.3% and 2.3%, respectively in 2023. Therefore, although the appetite for equity products remains low (still at small percentages even at firms that view equity financing as relevant to their enterprises), a shift is emerging in the demand for this type of financing, with the number of firms reporting not needing it or using it decreasing.

The funding gap in the credit market

As noted, the recent economic environment has affected the factors that determine both the supply of financing and demand for it. Specifically, the SMEs’ need for financing has increased, shaped by the transformation of the productive model, which has translated into growth in demand for bank loans and for other types of financing. However, these needs have come up against greater financing constraints as a result of a range of factors, including the uptick in interest rates to curb inflation, driving growth in the cost of financing and, with it, in the incidences of loan rejections and discouraged borrowers.

To explain the extent to which these factors may have influenced the increase in Spanish SMEs’ financing needs, in this section we estimate the funding gap using the methodology proposed by fi-compass (2019) and the aggregated results from the SAFE surveys from 2019 to 2023. According to this methodology, the funding gap is defined as the financing needs for those SME´s that were “unsuccessful” when demanding a bank loan from financial entities.

To complete this vision of the market’s failure, we return to the methodology for estimating the number of “unsuccessful” firms presented in the ex-ante assessment of the SME initiative undertaken by the Spanish government’s European Funds Department (2013), as it explains the factors that may be responsible for the market failure and the increase in the financing gap. Those explanatory factors include changes in bank demand, the rejection rate (whether loans are rejected or not accepted), and the percentage of firms discouraged from borrowing due to market-related reasons.

The first conclusion drawn from our analysis of the estimated funding gap is that financing needs have increased considerably since 2020, the year in which the funding gap represents the lowest value (Table 1).

Although it might seem counter-intuitive, the pandemic year exhibits the lowest funding gap in the period analysed (unmet financing needs). This is because the increase in demand for bank financing, coupled with the rise in funding levels to address the new needs of surviving enterprises, was not sufficient to offset the overall high firm’s mortality rate and the abrupt decline in their financial viability during that year.

In other words, pandemic-related financing needs reached their lowest point because many businesses were unable to access the market, either due to their declining financial viability or their own demise. Despite a non-significant increase in rejection rates or demotivation, this context resulted in decreasing (fi-compass) or stable (SME initiative) financial requirements.

As shown before, one reason for this neutral result on the supply side is the package of extraordinary and urgent measures enacted to ensure the sustainability of the firms, particularly those targeted at shoring up their financial solvency, such as the ICO-COVID guarantees schemes and other guarantees lines provided by CESGAR as guarantor of the Guarantee System That meant that while they were in force (2021) the rate of loan application rejection by the banks fell to record lows (Exhibit 3), keeping credit flowing to the economy despite a drop of over 30pp in financially viable firms in 2020.

Once the worst of the pandemic-related restrictions were lifted, which is when inflation began to wreak havoc, the funding gap began to climb steadily, increasing to around 15 billion euros by 2023, using both methodologies. This increase in financing needs came about despite a backdrop of intense firms’ destruction (-12%), in which the ones that survived have improved their financial viability (+7%) and their demand for financing (+22%), underpinned by a stronger willingness to invest (+30%).

However, the biggest contribution to the increase in the funding gap stems from the increase in the percentage of firms whose application is rejected or that do not accept the terms offered (high cost), coupled with growth in borrowers discouraged by market uncertainty (+108%). This factor, as a symptom of supply side restrictions, drove the unsatisfied financing need to between 22.5 billion euros (SME initiative method) and 36.9 billion euros (fi-compass method) in 2023. These results indicate that the average funding gap increased by 58% between 2019 and 2023, and by 76% between 2020 and 2023.

These figures, which represents between 1.5% and 2.5% of Spanish GDP in 2023 respectively, reflect well the scale of the unsatisfied financing needs of the Spanish SMEs, which compromise economic growth and employment creation in the medium- and long-term, as well as the investments needed to transform the economy and its productive assets in the short-term.

Public intervention as a tool for supporting corporate investment

The increase in the funding gap derived from structural market failures, and exacerbated by the economic context, justifies public sector intervention to bring about a more efficient allocation of market results.

Public financial instruments are a good tool for intervening in the financing market. Evidence of this is the strong push that has been made at the European level since the 2014-2020 programming period through structural funds, but whose greatest representation has come with the recent deployment of funds to aid the transformation and transition of the economy towards a more resilient, digital, and green productive model. Specifically, Next Generation EU or Invest EU funds are the prime examples of the strong commitment to these types of instruments.

Not only at the European level but also at the national level, the role of the state as a financial agent had already been formalised through several bodies and public organisations that support firms and provide a straightforward response to market failures. In Spain, these organisations notably include the ICO as a national promotional bank, and other strategic bodies for accessing to public financing, such as CERSA (guarantees), CDTI (science and technology), ENISA (start-ups and innovation), COFIDES (internationalization) and SEPIDES (industry support).

A good example of the countercyclical market response is the guarantee scheme designed and implemented during the pandemic through the instruments allocated to ICO and CERSA. As seen, this scheme sustained the flow of credit by bolstering the system’s solvency, thereby preventing an exponential increase in SMEs’ financing needs.

In parallel, and associated with the rollout of the NGEU funds, we are seeing a strong commitment to capital markets development by designing and implementing financial instruments in the form of private equity or quasi-equity funds with the aim of kick-starting private investment in smaller firms at a time of growing appetite for alternatives to bank financing.

Additionally, we are seeing at the regional level financial support initiatives using financial instruments conceived of to cover the funding gap. These instruments are designed and implemented by the ecosystem of agents that comprise the regional development agencies (ADRs), regional finance institutes (IFAs) and mutual guarantee societies (SGRs).

In sum, clear strategic public support for SME financing is emerging at the supranational, national, and regional levels. Ongoing reinforcement of the guarantee system, coupled with the opening of new alternative financing markets and reinforcement of the classic public liquidity channels, should remain key economic policy instruments on the intervention side of the solution.

The new strategic targets around the twin digital and green transitions are bound to continue to increase the SMEs’ financing needs, requiring public intervention to help complement and correct the market to make it more relevant, effective and efficient. Against that backdrop, it is essential for public planners and decision-makers to carry out ex-ante and ex-post assessments of those interventions in order to continue to provide accurate financial support to SMEs at a time of ongoing uncertainty.

Notes

Equity, supplier finance, grants, family offices, business angels, etc.

The Guarantee System is made up of CERSA, the 17 mutual guarantee societies and SAECA.

References

AIREF (2023).

Study of public sector financial instruments to support productive sectors of the Spanish economy. Public Expenditure Evaluation Division.

https://www.airef.es/wp-content/uploads/2023/11/INSTRUMENTOS-FINANCIEROS-DEL-SECTOR-PU%CC%81BLICO_web.pdfAKERLOF, G. A. (1970). The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism.

The Quarterly Journal of Economics, 84, pp. 488-500.

https://www.jstor. org/stable/1879431AMORES, A., BASSO, H., BISCHL, J., DE AGOSTINI, P., POLI, S., DICARLO, E., FLEVOTOMOU, M., FREIER, M., MAIER, S., GARCÍA-MIRALLES, E., PIDKUYKO, M., RICCI, M. and RISCADO, S. (2023). Inflation, Fiscal Policy, and Inequality.

ECB Occasional Paper, No. 2023/330.

BCE. (2019).

Report Survey on the access to finance of enterprises. https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/index.en.htmlBCE. (2020).

Report Survey on the access to finance of enterprises. https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/index.en.htmlBCE. (2021).

Report Survey on the access to finance of enterprises. https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/index.en.htmlBCE. (2022).

Report Survey on the access to finance of enterprises. https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/index.en.htmlBCE. (2023).

Report Survey on the access to finance of enterprises. https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/index.en.htmlBERGER, A. N. and UDELL, G. F. (1992). Some evidence on the empirical significance of credit rationing.

Journal of Political Economy, 100(5), pp. 1047-1077.

https://scholarcommons.sc.edu/cgi/viewcontent.cgi?article=1006&context=fin_ facpubBERGER, A. N. and UDELL, G. F. (1995). Relationship lending and lines of credit in small firm finance.

Journal of business, 68(3), pp. 351-381.

https://www.jstor.org/stable/2353332CESGAR. (2019).

9th SME Financing in Spain report. https://cesgar.es/xiii-informe-financiacion-de-la-pyme-de-sgr-cesgarbrel-542-de-las-pymes-ha-necesitado-financiacion/CESGAR. (2021).

10th and 11th SME Financing in Spain reports. https://cesgar.es/xiii-informe-financiacion-de-la-pyme-de-sgr-cesgarbrel-542-de-las-pymes-ha-necesitado-financiacion/CESGAR. (2022).

12th SME Financing in Spain report. https://cesgar.es/xiii-informe-financiacion-de-la-pyme-de-sgr-cesgarbrel-542-de-las-pymes-ha-necesitado-financiacion/CESGAR. (2023).

13th SME Financing in Spain report. https://cesgar.es/xiii-informe-financiacion-de-la-pyme-de-sgr-cesgarbrel-542-de-las-pymes-ha-necesitado-financiacion/DIAMOND, D. W. (1984). Financial intermediation and delegated monitoring.

The Review of Economic Studies, 51(3), pp. 393-414.

https://doi.org/10.2307/2297430MANZANO, D. (1984). Financial intermediation and delegated monitoring.

The review of economic studies, 51(3), pp. 393-414.

https://doi.org/10.2307/2297430DIRECCIÓN GENERAL DE FONDOS EUROPEOS. (2013).

Ex ante assessment of the EU SME Initiative. https://www.fondoseuropeos.hacienda.gob.es/sitios/dgfc/es-ES/ipr/fcp1420/p/Prog_Op_Plurirregionales/Documents/Eval_ex_ante_SME_initiative.pdfFI-COMPASS. (2019).

Gap analysis for small and medium-sized enterprises financing in the European Union. Final Report European Commission and European Investment Bank.

GAMBAU, B., PALOMINO, J. C., RODRÍGUEZ, J. G. and SEBASTIAN, R. (2020). COVID-19 restrictions in the US: wage vulnerability by education, race and gender.

Applied Economics, Vol. 54, No. 25.

GOVERNMENT OF SPAIN. (2023). Recovery, Transformation and Resilience Plan.

https://planderecuperacion.gob.es/STIGLITZ, J. E. and WEISS, A. (1981). Credit rationing in markets with imperfect information.

The American Economic Review, 71(3), pp. 393-410.

https://www.researchgate.net/publication/

4733120_Credit_Rationing_in_Markets_With_Imperfect_ Information

Borja Gambau Suelves. Analistas Financieros Internacionales, Afi. Red por las buenas prácticas en evaluación, RedEv

Montaña González Broncano. Analistas Financieros Internacionales, Afi