Spain’s private sector debt service ratio: An international comparison

The rate tightening embarked on by the ECB in mid-2022 has had a negative impact on debt sustainability for both Spanish corporations and households; however, the ultra-low rate environment until 2022, together with ongoing private sector deleveraging, offset the spike in interest rates such that debt service costs did not increase in 2023. As a result, last year, debt service for both Spanish corporations and households, at 34.7% of gross operating surplus and 5.6% of gross disposable income, respectively, remained low relative to international standards.

Abstract: The rate tightening embarked on by the ECB in mid-2022, which was paused in September 2023, has had a negative impact on debt sustainability. In the case of Spain’s corporations, the interest burden doubled between 2022 and 2023, surpassing the 40 billion euros mark. The interest burden on household borrowings increased by 66% to over 24 billion euros. Looking at the share of income that has to be earmarked to interest payments, the percentage almost doubled in 2023 in the business sector (from 7% to 13%), increasing by less, and from a much lower base, in the case of the household sector (from 1.8% to 2.6%). Nevertheless, the interest burden is below the EU-27 average in the corporate segment (9% vs. 12% as of the third quarter of 2023) and very similar among households (2.4% vs. 2.5%). As well, the ultra-low rate environment until 2022 coupled with private sector deleveraging drove a drastic reduction in debt service costs (interest costs and principal repayment), which did not increase in 2023, as the spike in interest costs was offset by ongoing deleveraging. In 2023, Spain’s corporations earmarked 34.7% of their gross disposable income to debt service, while its households set aside 5.6%. These are low readings relative to international standards.

Foreword

The financial health of corporations and households depends on the amount of income they have to set aside each year to service their debts, which means covering interest and principal payments. Interest expense depends on interest rates while principal payments depend on borrowing levels. Therefore, debt service costs are shaped by: (i) debt sustainability (the number of years needed to repay outstanding debt, which in turn depends on the level of indebtedness); and (ii) the financial burden implied by those borrowings (the amount of income that has to be earmarked to pay interest, which in turn depends on market rates).

The purpose of this paper is to analyse each of these factors behind debt service costs, an important indicator of financial health. Our analysis distinguishes between corporations and households in order to provide an overall vision of the non-financial private sector. Throughout we will compare the situation in Spain with that of other countries. While we analyse the period since the start of the Great Recession in 2008 until 2023 (private sector indebtedness peaked in Spain in 2008), we focus on analysing developments between 2022 and 2023, as monetary policy changed tack in July 2022, when the ECB raised its rates for the first time. It went on to raise them 10 times more, leaving its benchmark rate at 4.5% in September 2023.

To analyse the above-mentioned factors underpinning debt service costs, we need to first look at leverage levels (borrowings as a percentage of GDP). Next, given that debt sustainability depends on the ability to repay the debt from gross disposable income, we analyse the latter. Thirdly, we focus on the importance of interest rates, analysing the percentage of income earmarked to paying interest. Lastly, the overall effect of these variables yields the debt service ratio, which is the percentage of gross disposable income that corporations and households have to set aside to pay interest and repay their loans annually.

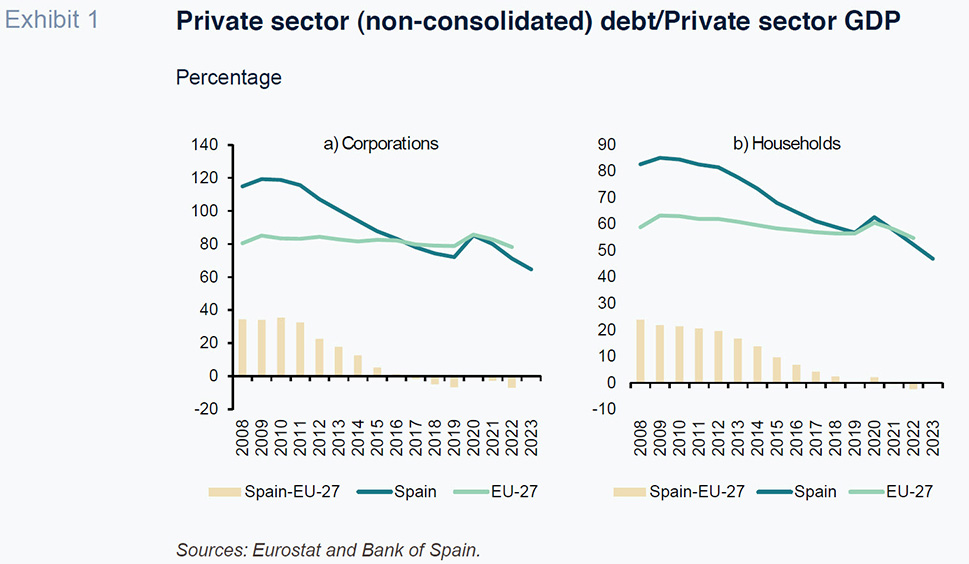

Trend in private sector debt

The credit bubble that formed during the economic boom and burst along with the financial crisis of 2007-08 fuelled growth in private sector borrowings in Spain in both the corporate and household segments. In 2008, the private sector leverage ratio (consolidated debt) over GDP reached 197.4%, which was nearly 60 points above the EU-27 average. Since then the sector has deleveraged intensely: by 2023 the leverage ratio was 86pp below that peak. In 2022, the last year for which figures are available for the EU-27, Spain’s private sector leverage ratio was 9.4pp below the European average and lower than the ratios reported by Portugal, Finland, Ireland, Belgium, France, Denmark, Sweden, the Netherlands, Cyprus and Luxembourg.

In the corporate segment, where leverage reached very high levels, deleveraging has also been intense (50pp), decreasing from 115% of GDP in 2008 to 64.7% in 2023. Having started at a leverage ratio that was 34pp above the EU-27 average, since 2017, Spain’s corporate leverage ratio has trailed below that average, specifically by 7pp in 2022. The household sector, meanwhile, deleveraged by 35.7pp between 2008 and 2023, from 82.6% of GDP to 46.9%. Leverage in this sector converged with the EU-27 average by 2021, coming in 2.4pp below it in 2022.

The flip side of the private sector deleveraging effort in Spain is evident in the trend in the stock of credit, which had decreased by 37% from the peak of 2008 by the end of 2023. That is 687 billion euros less debt. In fact, the January 2024 figure is the lowest in 16 years, evidencing why the banking business in Spain has had a hard time generating returns in excess of their cost of capital.

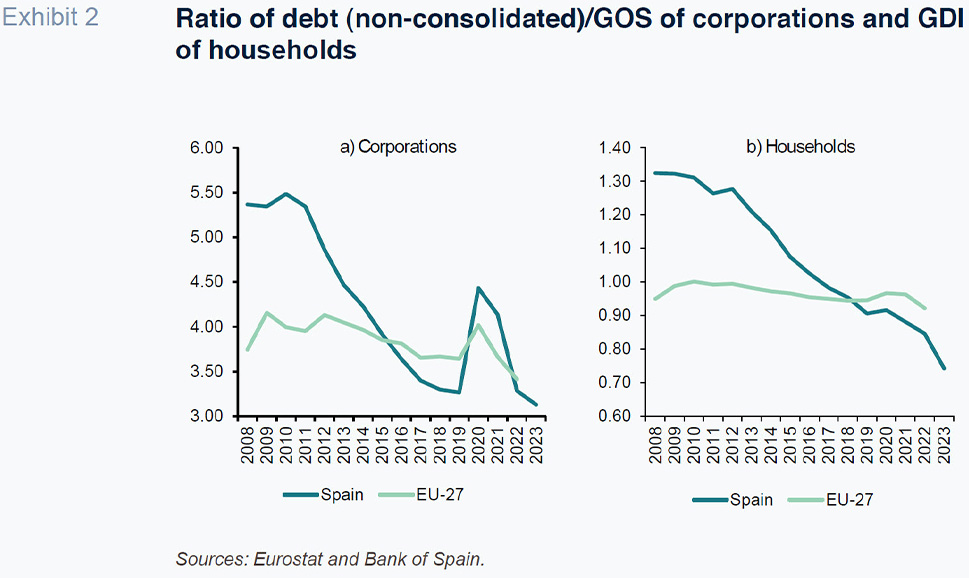

Private debt sustainability

Debt sustainability measures the capacity to service debt using gross disposable income as the proxy in the case of the household sector and gross operating surplus in the case of the corporate sector. In the latter, with the clear exception of 2020, when revenue collapsed as a result of the fallout from the pandemic, the ratio of debt to gross operating surplus has been trending clearly lower, from a peak of 5.5x to 3.1x in 2023. That means that when the financial crisis broke out in 2008, Spain’s corporations needed over five years’ profit to repay their debt, whereas they currently need little more than three years’ earnings. The comparison with the EU-27 has shifted: back in 2008, the Spanish corporate sector’s debt was far less sustainable (requiring 1.6 years longer to repay its debt: 5.4 vs. 3.7 years); by 2022 (the most recent figures available across Europe), Spain’s businesses were in a relatively more comfortable position, needing one month less than their European peers to fully repay their debt (3.3 vs. 3.4 years). In 2023, that period of time fell a little further in Spain, from 3.3 to 3.1 years.

Turning to the household sector, the length of time required to repay its debt is much shorter than in the corporate sector and its debt sustainability has improved considerably during the period analysed. Whereas in 2008, a Spanish household needed on average 1.32 years of gross disposable income to pay off its debt (compared to 0.9 years for an average European household), by 2023 it only needed 0.74 years of disposable income. Using the 2022 figures to enable a comparison with the EU-27 average, the sustainability ratio was 0.85 years in the case of a Spanish household, below the European average of 0.92. The develeraging effort by Spain’s households since 2018 means that the sector’s debt sustainability is now better than the EU-27 average. Combining the two aggregates yields a similar conclusion: in light of the deleveraging undertaken in recent years and the income available to Spanish corporations and households, the Spanish private sector’s debt is currently more sustainable as it needs fewer years of income to repay its debt than its European counterparts.

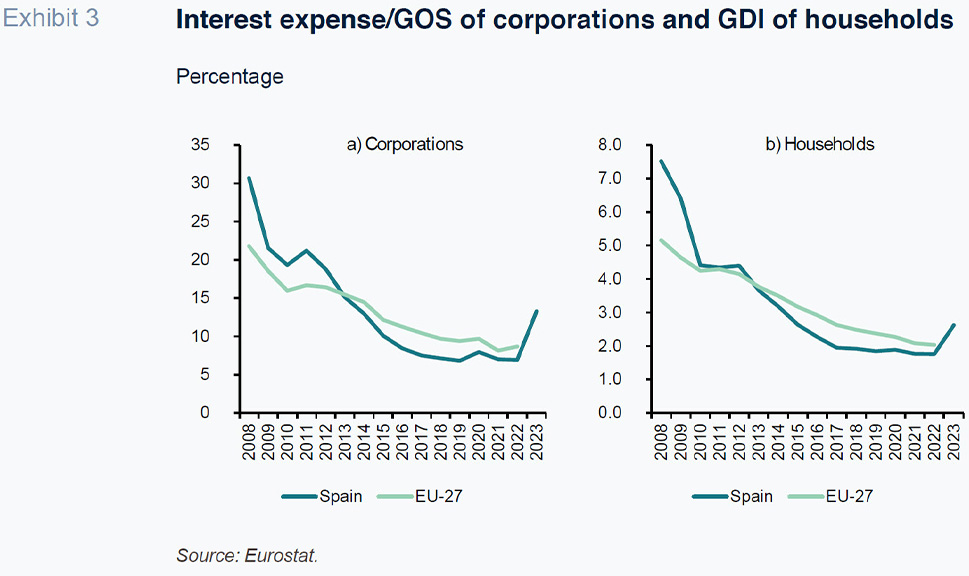

Interest burden

In addition to having to repay their debt from their gross operating surplus (in the case of corporations) and gross disposable income (households), both agents have to pay interest on their borrowings at regular intervals, at amounts that generally depend on the trend in market rates. Corporations and households therefore have to earmark some of their income to paying interest, a burden which is greater the more income they have to set aside. This percentage is higher the more debt they owe and the higher the interest rate applied.

As shown in Exhibit 3, the high level of indebtedness taken on by Spanish corporations in 2008 meant that they had to earmark 31% of their gross operating surplus that year to paying interest on their borrowings, which was 9pp above the European average. Thanks to the deleveraging undertaken in the ensuing years, that burden has been declining steadily, reaching just 7% in 2022, helped by the fact that the ECB’s monetary policy was markedly expansionary during those years (its benchmark rate was under 1.5% from the end of 2011 until November 2022). However, following the bout of inflation unleashed in 2022 and the sudden and sharp shift in ECB policy slant, which translated into an intense wave of rate increases, the interest burden borne by corporations in Spain jumped from 7% in 2022 to 13% in 2023. In other words, it doubled in just one year. The most recent comparable figures for Europe date to the third quarter of 2023: as of the first nine months of 2023, the interest burden faced by Spanish corporations was 9%, which was below the 12% borne by their European peers. Focusing exclusively on the standalone figures for the third quarter of 2023, however, the burden in Spain rises to 15%, which was 2pp above the EU-27 average. And in the fourth quarter (for which we only have figures for Spain), that burden had increased further to 16.3%.

In the household segment, the interest burden is much lower, mainly because of much lower borrowing levels. The deleveraging embarked on by Spain’s households since 2008, favoured by very low interest rates, has sharply reduced their interest burden. Whereas in 2008, a Spanish household had to set aside an average of 7.5% of their gross disposable income to pay interest, by 2022 that percentage had dropped to just 1.8%. And whereas in 2008 that burden was higher than the average borne by European households (7.5%

vs. 5.2%), since 2013 is has been lower. As with the corporate sector, the downward trend was truncated in 2022 as a result of the sharp increase in interest rates: in 2023, Spanish households had to use 2.6% of their income to pay interest, compared to 1.8% in 2022. During the first nine months of 2023, again to permit a comparison at the European level,

[1] the average interest burden in the EU-27 also increased, from 1.8% to 2.5%, albeit a little less intensely than in Spain. As a result, the Spanish burden (2.4%)is now in line with the European average (2.5%). Looking at the standalone figures for the third quarter of 2023, the Spanish figure was slightly above the EU-27 average (2.7%

vs. 2.6%), and by the fourth quarter had risen further, to 3.2%.

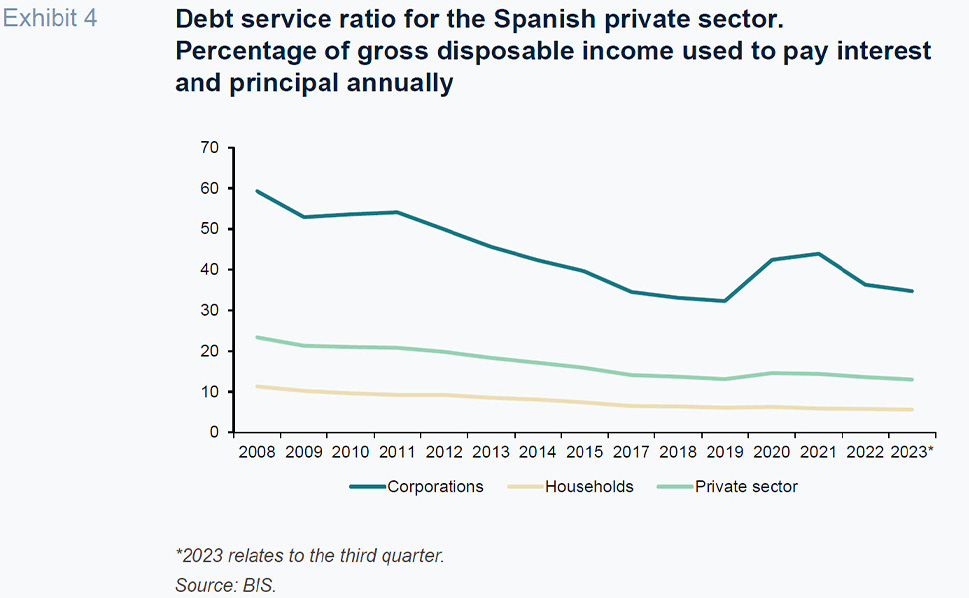

Debt service

Having analysed the burden borne by Spanish corporations and households to pay principal and interest on their debt, we need to bring the two dimensions together for a complete picture of private sector debt service costs. On this occasion, however, we focus on the amount of debt repaid annually rather than the total stock of outstanding debt. That provides a picture of the amount of income households and corporations have to set aside each year to pay interest and principal amortisations. In addition to interest payments, the financial burden needs to include other debt-related costs such as bank fees.

That is the analysis performed by the Bank of International Settlements (BIS) in its statistics on the percentage implied by this burden (repayment of principal and interest expense) relative to gross disposable income, before interest and dividend payments. That indicator is called the debt service ratio. Obviously, the higher the ratio, the less sustainable the debt and the higher the likelihood of non-performance. The BIS tracks the debt service ratio separately for corporations and households for 17 countries, 12 of which are European. The other five are the US, Canada, Australia, Japan and Korea. For the private sector as a whole, the available sample is much deeper.

The BIS data show that Spanish corporations’ debt service ratio peaked at 59.3% in 2008, decreasing to 32.3% in 2019. The loss of income during the pandemic drove a subsequent uptick, to 43.9% in 2021. The ratio then fell back in both 2022 and 2023 (to September), although the latest data point (34.7%) remained above the 2019 figure. Back in 2008, Spain’s debt service ratio was the second highest in the BIS sample. By 2023, its ratio was the fifth lowest, with only Germany, Italy, the UK and Australia behind it.

In the household segment, the debt service ratio is clearly lower than in the corporate segment. Spanish households’ debt service ratio also peaked in 2008; that year they had to set aside 11.3% of their income to paying principal and interest on their debt. In contrast to the corporations, the subsequent deleveraging by households did not stop with the pandemic, as their income was less affected, in part thanks to the mitigating measures, such as the furlough scheme, put in place. As a result, the household sector’s debt service ratio reached a new low in 2023, of 5.6%, which is half of the 2008 figure. At present, the debt service burden borne by Spanish households is the second lowest in the sample, with only Italy better off in this respect. That contrasts clearly with the situation in 2008, at the start of the Great Recession, when Spanish households’ debt service ratio was the eighth highest of the 17 countries in the sample.

Combining households and corporations, the snapshot of Spanish private sector debt is one of significant improvement since 2008, driven mainly by deleveraging in a context of low interest rates. Whereas in 2008, the private sector needed 23.4% of its gross disposable income to service its debt (pay for interest, fees and amortisations), by September 2023, that figure was 10pp lower (13%). This blended ratio did not deteriorate in 2023, as the effect of higher interest rates was more than offset by ongoing deleveraging, as well as growth in disposable income.

For this private sector aggregate, the BIS provides data for 64 countries. In 2008, Spain presented the fifth highest debt service ratio. However, by 2023, it reported the ninth lowest, ranking only slightly above Germany (10.8%) and Italy (10.6%).

Conclusions

The intense deleveraging undertaken by the Spanish private sector since 2008, against the backdrop of low interest rates, has had an enormously positive impact on the sustainability of its debt and the burden implied, with the percentage of income used to pay interest falling intensely. This situation has shifted since mid-2022 as a result of the change in ECB monetary policy in an attempt to curb inflation. The scale of the ECB’s official rate increases led to a doubling in the interest paid by Spanish corporations between 2022 and 2023 (to a little over 40 billion euros), with the interest paid by households increasing by 66% (to just over 24 billion euros). Therefore, in just one year, Spain’s private sector has seen its interest bill increase by 29.6 billion euros (85%), to 64.4 billion euros.

The sharp increase in interest rates has also triggered a doubling in the interest burden borne by Spain’s corporations: from 7% of their gross operating surplus in 2022 to 13% in 2023. The burden borne by the household sector also increased (from 1.8% to 2.6%), but was much lower relative to income. Despite the increase, the interest burden in Spain is below the EU-27 average in the corporate sector (9% vs. 12% in the first nine months of 2023) and similar in the case of the household sector (2.5%). However, the standalone figures for the third quarter of 2023 reveal a higher burden for both Spanish corporations (15% vs. 13%) and households (2.7% vs. 2.6%) relative to their European peers. In the fourth quarter, the interest burden figures for Spain increased further, to 16.3% and 3.2% for its corporations and households, respectively.

Combined, the level of indebtedness and financial burden shape the debt service ratio, i.e., the percentage of income that has to set aside each year to pay interest and principal. Focusing on the trend between 2022 and 2023, which is when rates increased sharply, Spain’s private sector debt service ratio actually decreased, as the increase in interest payments was more than offset by the reduction in debt levels and growth in disposable income In the first nine months of 2023, Spain’s corporations spent 34.7% of their income on debt service, while its households earmarked 5.6% of their income, low levels compared to international standards and very far from the peaks of 2008.

Notes

For quarterly figures we use seasonally-adjusted numbers.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF