EU trade and investment in the midst of re-globalisation

An analysis of EU trade and foreign direct investment flows reveals a relative decline in the EU’s competitive position, notably with respect to the US and China, with the EU now a major net exporter of capital to invest in companies located in other countries. Greater participation by member states in the single market has played a mitigating role but is insufficient to offset the broader weakness unless supported with strategies for revitalising investments within the bloc.

Abstract: An analysis of EU trade and foreign direct investment flows reveals a relative decline in the EU’s export position in global trade as well as a weakening of foreign direct investment (FDI) inflows, with the EU now a major net exporter of capital to invest in companies located in third countries. Although the EU continues to present a current account surplus, this resilience reflects largely lethargic imports rather than a boom in exports of goods, albeit it is worth noting that Europe has fared better in its trade in services. As with the drop in the market share commanded by European goods exports, the trend in FDI evidences a loss of attractiveness of the EU relative to the US and China. Indeed, a comparison between FDI outflows and inflows reveals Europe as a heavy net exporter of capital, which means a significant share of the savings available in Europe is being used to invest in companies located in other countries. That said, there has been an intensification of trade and investment among member states (intra-EU). The mitigating role played by the single market has had particularly healthy benefits for economies like Spain, where labour and energy costs are relatively low. The advantages of the single market can also be enhanced through measures that boost the investment of excess savings within the bloc. Nevertheless, even in its enhanced form, the single market can only partially mitigate the weakening of the external position of the EU vis-à-vis other economic powers. This highlights the importance of a revitalisation strategy which includes the capital markets union and the deployment of a common European investment budget, as a follow on from Next Generation EU funds.

Foreword

In the early 1990s, a proliferation of free trade agreements and a spate of economic opening ushered in a period of transformation and collaboration at the global level. In recent times, however, growing economic interdependence has been flagged as a source of risk, especially since the onset of the pandemic. This perception has led to the rethinking of economic policy goals. One of the most remarkable aspects of this “re-globalisation” process is the escalation of import tariffs between the world’s two largest economies, China, and the US, against the backdrop of weakening global trade (WTO, 2023).

This paper takes a look at the reorientation of international trade and investment flows since the pandemic, paying particular attention to the European Union’s position relative to the US and China. On the basis of this analysis, we highlight some of the main challenges for European and Spanish economic policy.

Relative decline in the EU’s export position in worldwide trade

Despite the succession of adverse shocks (pandemic, inflation in the price of imported supplies and the war in Ukraine and its ramifications in the energy markets, particularly the gas market), the EU continues to present a trade surplus with the rest of the world. [1]

However, the resilience of the surplus is more a reflection of lethargic imports (as a result of European economic weakness) than a boom in exports. Indeed, European firms have lost ground overseas, particularly in the trade in goods, with their market share decreasing by one percentage point between 2019 and 2023 (Exhibit 1).

During the crisis induced by the pandemic, EU exports contracted sharply. Since then, exports have recovered gradually, in line with the normalisation in consumption patterns. The recovery in activity has been concentrated in the services sector, while the goods trade has been dragged down by bottlenecks and the accumulation of unfilled orders during the pandemic. Today, trade in goods continues to lag trade in services.

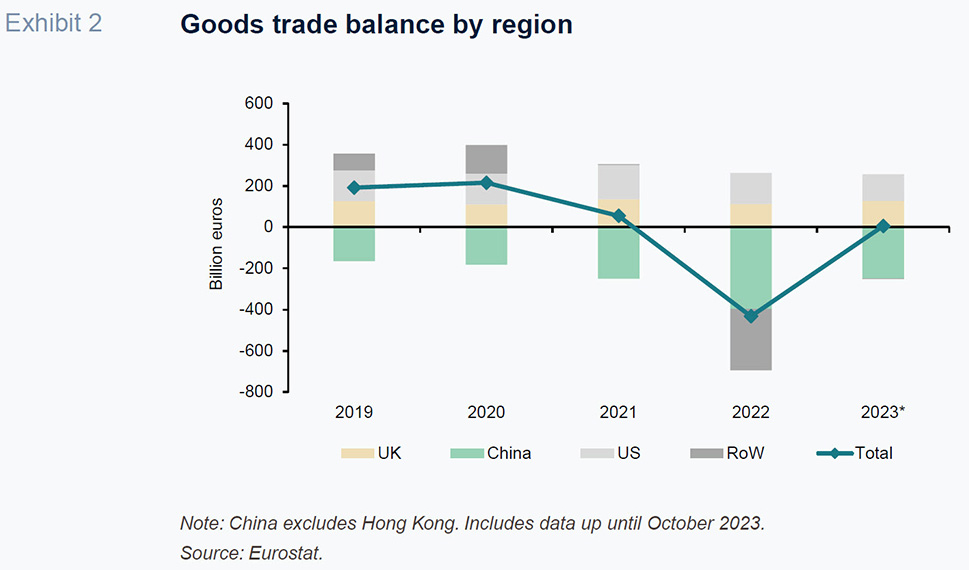

Drilling down into the figures reveals considerable changes in trade balances in geographic and product terms. Firstly, the EU’s trade deficit with China has widened and the surplus with the US has narrowed slightly (Exhibit 2). China has cemented its position as the leading supplier of goods to the EU, accounting for 21% of total imports in 2022, compared to being third place as a destination. The trade deficit with China has worsened significantly, peaking at 396 billion euros in 2022. Simultaneously, the US stands out as the main destination for EU goods, absorbing 20% of total exports in 2022, above the pre-pandemic level. In contrast, European trade with the UK and Russia has shrunk, shaped by Brexit and the sanctions imposed following the invasion of Ukraine, respectively.

Secondly, the figures point to an acceleration in the energy transition. Before the conflict in Ukraine, Russia was the EU’s largest energy supplier, with a market share of 14.5% of Europe’s energy imports. By the third quarter of 2023, that share had collapsed to 6.5% (Balteanu and Viani, 2023). The recent increase in demand for products and services related with green energy (solar panels, wind turbines and liquid biofuels) has helped reduce Europe’s energy dependence in general. Spending on green energy imports more than doubled year-on-year in 2022, according to Eurostat.

Lastly, the EU presents a growing deficit in its trade in high-tech goods, which include products used in computing activities and in the aerospace, telecommunications and pharmaceutical sectors. The balance of trade in these high-tech products has gone from a surplus of 17 billion euros in 2019 to a deficit of 36 billion in 2022. Imports and exports of these goods have a positive impact on competitiveness and play a key role in EU policies related with the environment and the digital transition (Eurostat, 2024). However, this thrust towards a greener and more digital Europe is also unlocking new sources of economic vulnerability due to limited access to certain components and raw materials that are essential for these technologies. In particular, trade in electric and hybrid vehicles has intensified, with these vehicles currently accounting for more than 40% of all vehicles imported by the EU.

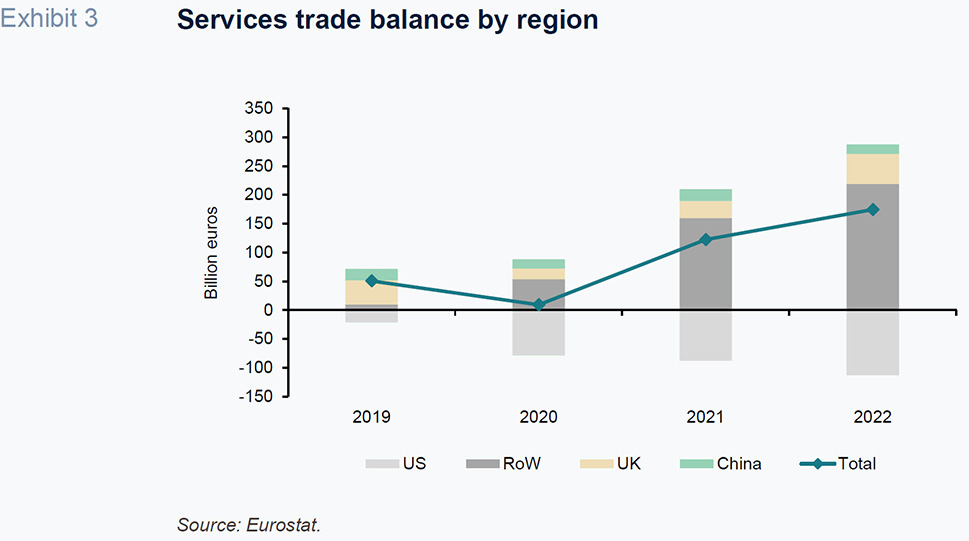

Europe has fared better in its trade in services than in goods. The EU plays a fundamental role in the global supply of market services, including business services, which account for 23% of total market service exports, according to Eurostat. Business services include consultancy, management, technical and sales services and research and development activities, among others. All of which results in a surplus in the EU’s trade in travel and non-travel services (Exhibit 3).

The balance of trade in services with China presents a small surplus (not enough to offset the deficit in its trade in goods with the Asian giant) and with the US, a deficit. The figures reveal sharp growth in non-travel services, particularly in the business services segment. Services related with tourism were affected by the European governments’ response to the health crisis, which included travel restrictions, contact tracing and lockdowns. However, neither the fallout from the war in Ukraine nor the loss of Russian and Ukrainian tourists in Europe, nor the traveller dissuasion factor exerted by the continent’s geographic proximity to the conflict, or price inflation, prevented sector receipts from revisiting pre-pandemic levels as early as the second quarter of 2022.

Weakening FDI in Europe

As with the drop in the market share commanded by European goods exports, recent trends in foreign direct investment (FDI) reveal a loss of attractiveness of the European economy relative to other economic powers. FDI includes investment in productive activities by non-residents, greenfield operations or the acquisition of companies, the reinvestment of profits and the expansion of existing production capacity. FDI is therefore sensitive to changes in the competitive positioning of the productive apparatus.

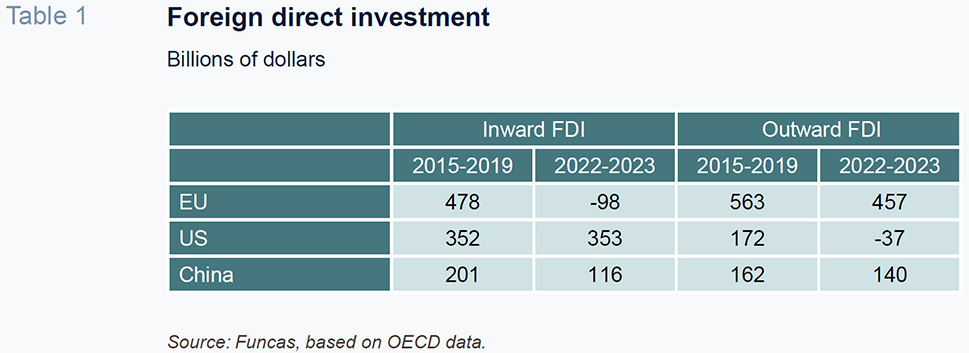

The figures point to considerable deterioration (Table 1). Firstly, in the most recent period, foreign investors have been divesting, in contrast to healthy inflows of foreign capital before the pandemic (annual average of 478 billion dollars between 2015 and 2019). By comparison, inflows of Chinese FDI have lost momentum but remain positive. And, the US emerges as the big winner, capturing a growing share of global FDI, fuelled by the powerful incentives created by the Inflation Reduction Act and Chips Act.

Secondly, the EU is exporting more capital than the other super powers: FDI outflows amounted to 457 billion dollars in the last two years, a very high level by any standard. A comparison between the FDI outflows and inflows reveals Europe as a heavy net exporter of capital, which means that a significant share of the savings available in Europe is being used to invest in companies located in other countries. The EU was already registering a net outflow of FDI before the pandemic, but the imbalance was far less pronounced than is the case today. In contrast, the US has gone from exporting capital before the pandemic to becoming one of the most attractive destinations for FDI. China, meanwhile, ranks somewhere in the middle: it has become a net exporter of capital, but the volumes of capital involved are much lower by comparison with the EU.

The mitigating role of the single market

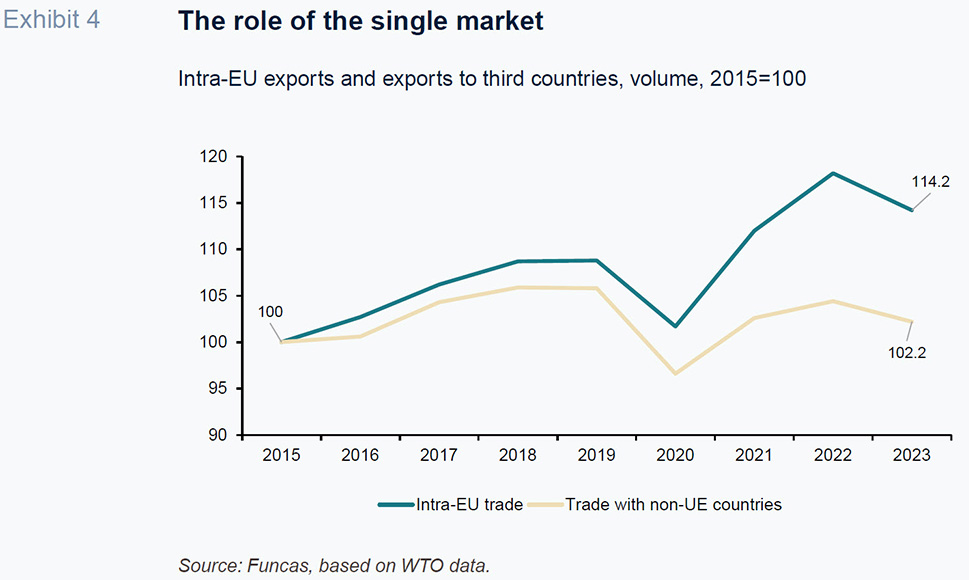

While trade with non-EU countries has stagnated, intra-EU trade has intensified, underlining he the importance of the single market (Exhibit 4). The share of intra-EU goods stood at 62% of total exports in 2022, up three points from 2019, suggesting that member states are choosing to participate more in this common market, not only for the economic benefits it brings but also for the security and stability that it brings in times of global adversity. Integration of trade in services within the EU too is progressing well, albeit more gradually than in goods. Likewise, the numbers show considerable growth in FDI flows between European countries.

The growing weight of trade and investment flows within the EU partly reflects the need to shorten supply chains to tackle the disruption generated by the health and energy crises. Geopolitical tensions have also highlighted the importance of security, providing an added incentive to reorganise production chains and bring them closer to the European consumer. Security has also become an explicit economic policy target: for example, Europe’s strategic response to the energy crisis is articulated around the REPowerEU plan which seeks to foster the deployment of more sustainable sources of energy and reduce dependence on fossil fuels sourced from trade partners that may be considered less reliable. Another factor is the surge in trade barriers, creating a trend of concentration in flows within trade blocs.

Despite its benefits, the intensification in intra-EU trade and investment is insufficient to offset the broader weakness. Moreover, the proliferation of state aid threatens to weaken the integrity of the single market itself (Torres and Sanchez Juanino, 2023).

[2] The countries with more room for fiscal manoeuvre are using exemption clauses to the single market in order to provide direct support to their industries through state aid instruments.

Policy challenges

One of the challenges emerging from this brief analysis is the importance of strengthening the integrity of the single market, in order to continue to mitigate global uncertainties. The single market has helped cushion the broader trade decline, while also bringing security and stability in times of adversity.

The mitigating role played by the single market has had particularly healthy benefits for economies like Spain, which enjoy a favourable competitive position, nurtured by relatively low labour and energy costs. In fact, the balance of trade between Spain and the rest of the EU presents a large and growing surplus. It is therefore crucial for Spanish economic policy to prioritise the integrity of the European market and return to normal application of the state aid tools.

Nevertheless, the single market can only partially mitigate the slowdown in trade flows to third countries, which is threatening a decline in Europe’s external position relative to other economic powers. In light of this risk, Europe needs to pursue a productive revitalisation strategy, to which end it is important to get savings moving into investments in the bloc. There are several alternatives to achieve this, most importantly the capital markets union and the deployment of a common European investment budget, as a follow on from Next Generation EU funds.

The EU presented a current account surplus throughout the pandemic and subsequent energy crisis; that surplus increased to 3% of GDP in 2023, which is slightly below the pre-pandemic level (2015-2019 average: 3.4%).

This has prompted the Commission to consider a new management model, dubbed the “single market emergency instrument”, with the aim of buttressing the market against future challenges (single market emergency instrument – European Commission).

References

Raymond Torres. Funcas

Patricia Sánchez Juanino. National Institute of Economic and Social Research and Funcas