Deposits and the transmission of monetary policy

Bank deposits have been shown to play a role in shaping monetary policy and access to credit. Crucially, firms entering the tightening cycle relying on credit from lenders with higher duration gaps could be significantly less likely to obtain funding as tightening starts, with this likelihood becoming increasingly lower for banks experiencing deposit outflows.

Abstract: Bank deposits have been shown to play a role in shaping monetary policy and access to credit. This mechanism could be far more pronounced as interest rates experience large and unexpected hikes, and even stronger after a long period of low interest rates. The reasons are twofold: First, at low rates, many banks aimed to extract the maximum value from their deposits franchise by taking interest rate risk and increasing their duration gap. This would mean that many banks would enter the rate hike period with a large duration gap so deposit withdrawals would render their duration gap more pronounced. Second, higher increases in rates would make the stability of “cheap” deposit funding more uncertain as depositors consider alternative sources of funding. Research shows that in euro area countries, banks experiencing deposit outflows choose to reduce credit rather than increase the interest rate they charge. Crucially, firms entering the tightening cycle mostly connected to lenders with higher duration gaps could be significantly less likely to obtain credit as tightening starts, with the likelihood becoming even lower for banks experiencing deposit outflows. More broadly, this phenomenon relates to concerns about financial stability from central banks’ tightening their stance after a long period of ample liquidity and balance sheet expansion.

Introduction [1]

Traditionally, in macroeconomic models, banks used to be considered as a passive conduit for monetary policy: As policy rates change, banks transmit homogeneously changes in their cost of funding to the asset side of their balance sheet thus shifting the credit supply, just as markets adapt rapidly to the new rates. However, by now, there is a well-established strand of evidence that documents how banks are an active part of the transmission mechanism (Bernanke and Gertler, 1995), and how their characteristics determine additional supply effects in the provision of credit to the economy via the bank lending channel. Building on this, there is a rich and expanding macroeconomic literature using general equilibrium macroeconomic models that incorporates financial frictions (see Dou et al., 2020). There is also evidence that heterogeneity in banks’ capital position (Peek and Rosengren, 2000 and Jimenez et al., 2012), income gap (see Gomez et al., 2021), or their ability to generate liquidity by securitizing their assets (Loutskina and Strahan, 2009) affects the supply of credit.

Among those bank characteristics, the importance of deposits as a key component of the transmission of monetary policy has been recently emphasized (Dreschsler et al., 2017). Previously, the idea was that under most instances, if changes in the monetary policy affected the volume of deposits, banks would be able to easily complement deposits with alternative forms of funding, reflecting the changes in the new policy rate without altering the transmission of monetary policy.

According to the main tenet of the bank deposit channel, as policy rates increase, banks earn more via an augmented markdown on deposits. As the opportunity cost of holding deposits increases, savers move out of sight deposits and into higher yielding products, from term deposits to money market funds. However rather than repricing the yield on deposits, which would increase the cost of the whole stock, banks prefer to let marginal savers move out. Their market power allows banks to implement only a low pass-through of policy rates and keep a high markdown on the majority of deposits. Furthermore, instead of compensating the outflow with funding at market rates, they prefer to reduce lending correspondingly. This mechanism points out the importance of banks’ differences in funding structure in explaining how increases in rates affect the loan supply.

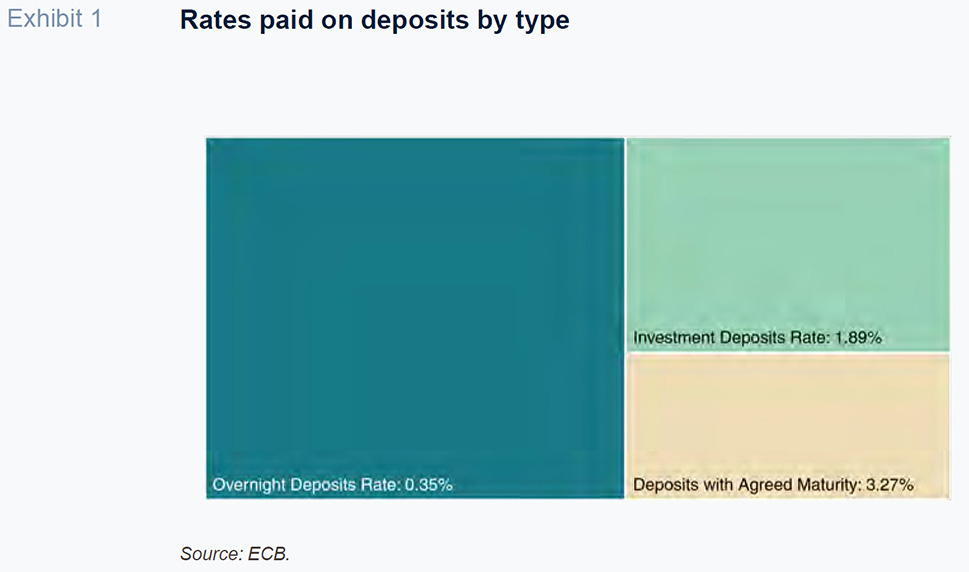

This channel appears important for several reasons, first deposits are by far the largest funding source for banks. Also the most prevalent source of bank deposits would be overnight deposits which are those which are less sensitive to changes in market rates. As Exhibit 1 shows, in October 2023, the average overnight deposit rate of deposits outstanding in the euro area was 0.35%, while the rates paid for investment deposits and for those with agreed maturity were 1.9% and 3.3% respectively.

Previous literature

Recent work on the mentioned bank deposit channel builds on the fact that banks have market power in the market for deposits, which leads to a limited pass-through from market to deposit rates, which is called “low deposits beta” (Drechsler et al., 2021). There is significant evidence that banks have significant market power (see e.g. Focarelli and Panetta, 2003) and that bank deposits are quite “sticky”. This is attributed to imperfect oligopolistic competition in the deposit markets (see Hannan and Berger, 1991; Neumark and Sharpe, 1992). Empirically, Drechsler et al. (2017) show that banks adjust their balance sheets to the outflow of deposits by reducing lending, and more so where they have more market power on deposits.

Another consideration is the stability of deposits. The role of deposits can also be seen through the lens of the literature modelling banks as liquidity providers that engage in maturity transformation (Diamond and Dybvig, 1983; Gorton and Pennacchi, 1990; Diamond and Rajan, 2001; Kashyap et al., 2002). This dual role renders banks vulnerable to liquidity risk, as deposits are usually a source of stable funding but can be subject to rapid outflows. This means that there is a hidden fragility in funding structures based on deposits, which in extreme cases can lead to runs when there are doubts about banks’ solvency, as witnessed by the failure of Silicon Valley Bank in the Spring of 2023.

Monetary policy

The mentioned effect of deposits on banks’ lending would heavily depend on the level of monetary policy rates. When the central bank raises the policy rate, holding low-yielding cash and deposits becomes more costly for savers as alternative investments becomes more profitable. Households then have an incentive to reduce their holdings of deposits. This decline would depend on the gap between the policy rate and the remuneration of deposits and on banks’ market power over their local deposit markets. From a funding perspective, banks can lift the interest rate they pay on deposits or, raise funds from other sources of funding (e.g., by issuing bonds). In both cases, there would be a major increase in banks’ funding costs.

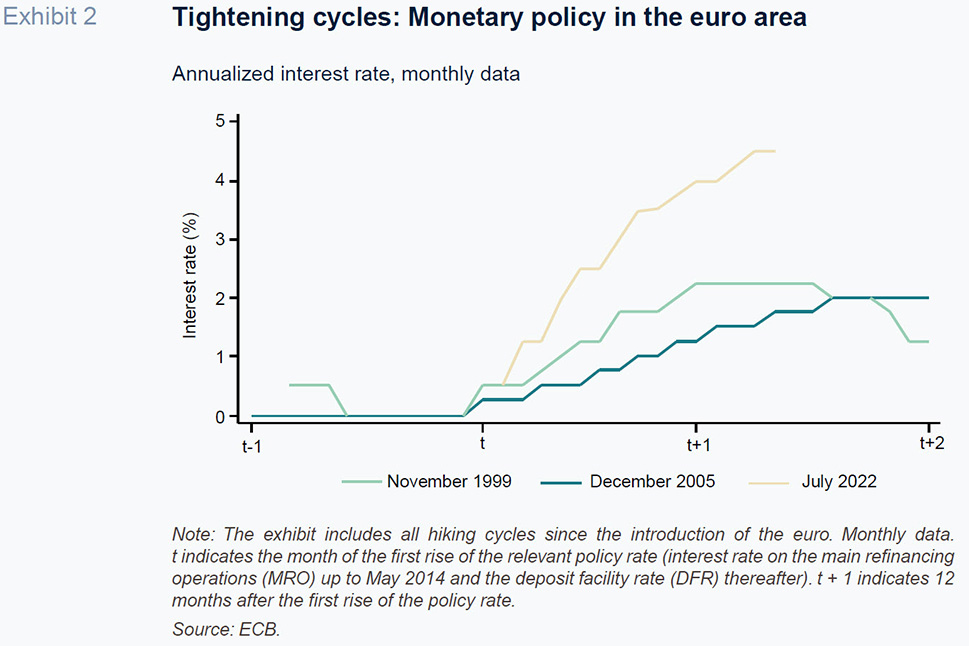

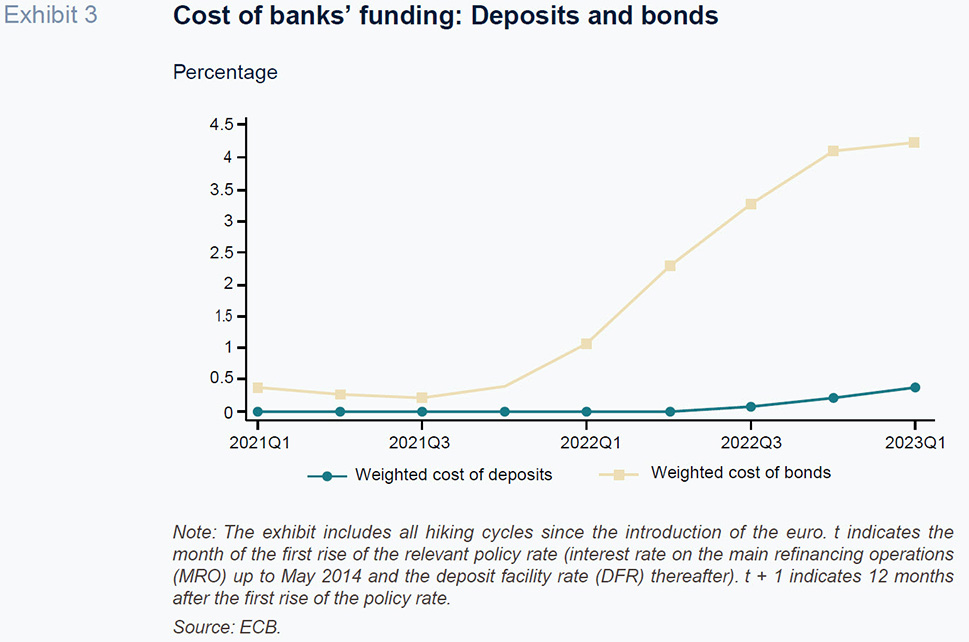

This is what happened in the euro area from early 2022 to late 2023 which saw the largest increase in monetary policy interest rates since the creation of the euro (see Exhibit 2). This appears particularly relevant: as the ECB started raising reference rates the cost of deposit funding by banks increased only modestly –by around 50bps–, while that of bank bonds rose by four times as much, by 400 basis points in 2023Q1 (Exhibit 3). Despite the moderate increase in deposit rates, a bank augmenting its deposit remuneration by 50bps would suffer from an increase of 80% of its overall funding costs. This is due to the large amounts of deposits outstanding which represent more than 75% of banks’ funding in the euro area, and to the fact that banks can’t raise rates only on marginal deposits, as they would do if they funded on markets, but they have to do it for the whole funding base.

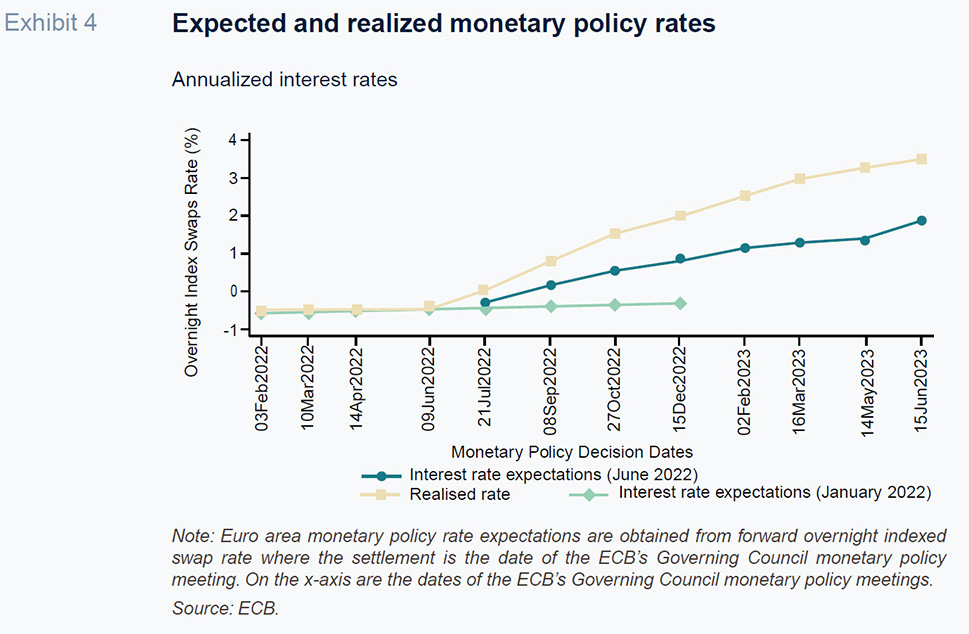

The other connected component is that as interest rates increase quickly, deposits that had been considered stable would suddenly become unstable. This would be particularly the case if rates increase unexpectedly after a long period of low interest rates. Indeed, at low rates many banks aimed to extract the maximum value from their deposits franchise by taking interest rate risk and increasing their duration gap, since deposits were considered a stable form of long-term funding particularly in periods of low interest rates. This would mean that many banks would enter the hiking period with a large duration gap so deposit withdrawals would render their duration gap more pronounced. This is indeed what happened in 2022-2023 as the jump in rates was mostly unanticipated, particularly in its magnitude (see Exhibit 4).

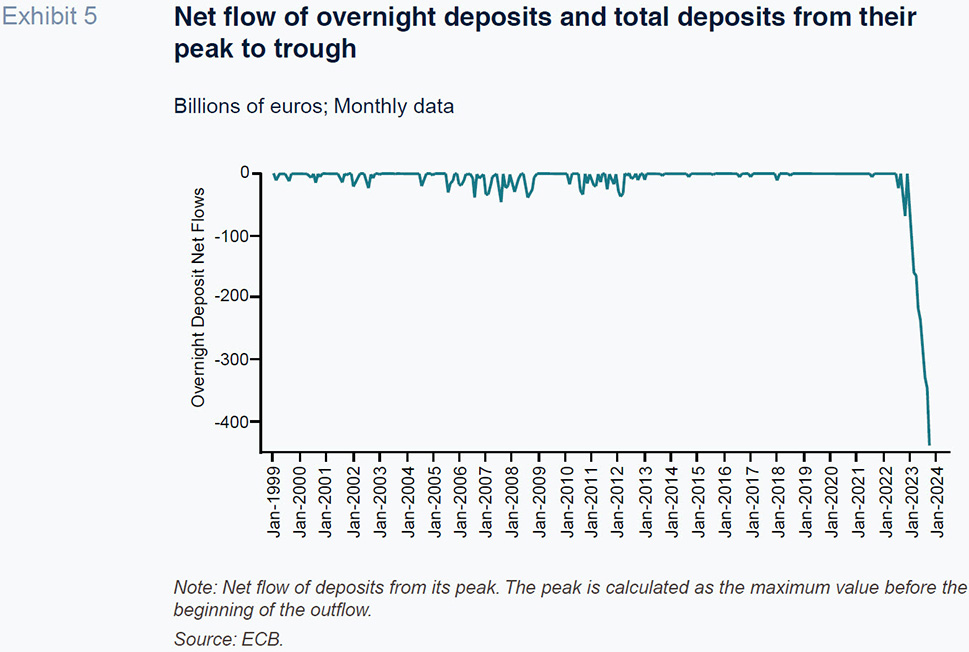

Due to the increase in lending rates and contained deposit rates, banks’ profits (and their stock market prices) experienced a turnaround and suddenly improved, which was mostly due to greater short-term net interest rate revenues, as the pass-through of higher rates to depositors was mostly slow and incomplete. In its wake, banks also had the biggest reductions in sight deposits since the creation of the euro in 1999. Part of the outflow was compensated by an increase in term deposits, but the overall net flow implies a sizeable reduction in the total volume of deposits (see Exhibit 6). Many banks experienced a net outflow, which they did not replace with other sources of funding.

Conclusions: Implications for borrowers and financial stability

If the withdrawal of deposits is large enough and the new funding too onerous, many banks would prefer to reduce their new lending to new borrowers. In the latter case, monetary policy is effectively transmitted to the loan supply via changes in the quantity of deposits for two reasons. First, the jump in funding rates would force banks to raise their lending rates and thus augment the likelihood of adverse selection. Second, the widening gap from “cheap” sight deposits to “expensive” alternative sources in the funding of loans could prove so large that the granting of new loans is no longer profitable.

Recent work by Cappelletti et al. (2024) shows that this was indeed the case. Using an extensive credit register that includes the vast majority of bank-firm lending relationships in euro area countries, they find that banks experiencing deposit outflows reduce credit rather than increase the interest rate they charge (to the same borrower relative to other lenders). This credit restriction is stronger for fixed rate and longer maturity loans and larger for banks coming into the hiking period with a larger unhedged duration gap. In other words, firms entering the tightening cycle mostly connected to lenders with higher duration gaps were significantly less likely to obtain credit as the tightening started. This likelihood becomes even lower for banks experiencing deposit outflows. This is consistent with banks trying to minimize changes to their duration gap, in line with findings by Drechsler et al. (2018b). Thus, banks choose to reduce lending in correspondence with net funding outflows. This mechanism highlights the importance of banks’ differences in funding structures in explaining how increases in rates affect the loan supply. This is linked to recent work on the impact of interest rate changes on financial stability. Jiang et al. (2023) explore the financial stability consequences associated with the unrealized losses on securities portfolio that appear due to the unprecedented speed of interest rate rises by the Federal Reserve and show that these losses significantly increased the fragility of the US banking system to uninsured depositor runs.

More broadly, this relates to concerns about the financial stability implications of central banks tightening their stance after a long period of ample liquidity and expansion of central banks’ balance sheets (Acharya et al., 2023).

Notes

The views expressed in this article are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

References

ACHARYA, V., CHAUHAN, R., RAJAN, R. and STEFFEN, S. (2023). Liquidity Dependence and the Waxing and Waning of Central Bank Balance Sheets. National Bureau of Economic Research Working Papers, 31050. NBER.

BERNANKE, B. and GERTLER, M. (1995). ‘Inside the black box’: The credit channel of monetary policy transmission. Journal of Economic Perspective, 9, pp. 27–48.

CAPPELLETTI, G., MARQUÉS-IBÁÑEZ, D., REGHEZZA, A. and SALLEO, C. (2024). As Interest Rates Surge: Flighty Deposits and Lending. European Central Bank Working Paper Series, 2923.

DIAMOND, D. W. and DYBVIG, P. H. (1983). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91.

DIAMOND, D. and RAJAN, R. (2001). Liquidity risk, liquidity creation, and financial fragility: A theory of banking. Journal of Political Economy, 109, pp. 287–327.

DOU, L., MULEY, A. and UHLIG, H. (2020). Macroeconomic models for monetary policy: A critical review from a finance perspective. Annual Review of Financial Economics, 12, pp. 95–140.

DRECHSLER, I., SAVOV, A. and SCHNABL, P. (2017). The Deposits Channel of Monetary Policy. The Quarterly Journal of Economics, 132(4), pp. 1819–1876.

DRECHSLER, I., SAVOV, A. and SCHNABL, P. (2018b). Liquidity, risk premia, and the financial transmission of monetary policy. Annual Review of Financial Economics, 10, pp. 309–328.

DRECHSLER, I., SAVOV, A. and SCHNABL, P. (2021). Banking on deposits: Maturity transformation without interest rate risk. The Journal of Finance, 76(3), pp. 1091–1143.

FOCARELLI, D. and PANETTA, F. (2003). Are mergers beneficial to consumers? evidence from the market for bank deposits. American Economic Review, 93(4), pp. 1152–1172.

GOMEZ, M., LANDIER, A., SRAER, D. and THESMAR, D. (2021). Banks’ exposure to interest rate risk and the transmission of monetary policy. Journal of Monetary Economics, 117.

GORTON, G. and PENNACCHI, G. (1990). Financial intermediaries and liquidity creation. Journal of Finance, 45, pp. 49–71.

HANNAN, T. and BERGER, A. N. (1991). The rigidity of prices: Evidence from the banking industry. American Economic Review, 81, pp. 938–945.

JIANG, E., MATVOS, G., PISKORSKI, T. and SERU, A. (2023). Monetary tightening and U.S. bank fragility in 2023: Mark-to-market losses and uninsured depositor runs? National Bureau of Economic Research Working Papers, 31048, NBER.

JIMENEZ, G., ONGENA, S., PEYDRO, J.-L. and SAURINA, J. (2012). Credit Supply and Monetary Policy: Identifying the Bank Balance-Sheet Channel with Loan Applications. American Economic Review, 102(5), pp. 2301–2326.

KASHYAP, A., RAJAN, R. and STEIN, J. (2002). Liquidity risk, liquidity creation, and financial fragility: A theory of banking. Journal of Finance, 57, pp. 33–73.

LOUTSKINA, E. and STRAHAN, P. E. (2009). Securitization and the declining impact of bank finance on loan supply: Evidence from mortgage originations. The Journal of Finance, 64(2), pp. 861–889.

NEUMARK, D. and SHARPE, S. A. (1992). Market structure and the nature of price rigidity: Evidence from the market for consumer deposits. The Quarterly Journal of Economics, 107, pp. 657–680.

PEEK, J. and ROSENGREN, E. (2000). Collateral damage: Effects of the japanese bank crisis on real activity in the United States. American Economic Review, 90, pp. 30–45.

REPULLO, R. (2020). The deposits channel of monetary policy a critical review. CEMFI Working Paper, No. 2025.

TELLA, S. D. and KURLAT, P. (2021). Why Are Banks Exposed to Monetary Policy? American Economic Journal: Macroeconomics, 13(4), pp. 295–340.

David Marques-Ibañez, Alessio Reghezza, Carmelo Salleo and Giuseppe Cappelletti. European Central Bank