Tightening bank financing terms and conditions: Current situation and implications

Increasing interest rates across the eurozone are restricting access to bank loans, while at the same time leaving households and businesses with outstanding credit in a more vulnerable position. Fortunately, in the case of Spain, both businesses and households are in a stronger position to face these challenges given the significant private sector deleveraging effort that has taken place in the wake of the previous financial crisis.

Abstract: Access to bank loans has become tougher in recent months primarily as a result of the increase in interest rates. Borrowing rates have risen due to a combination of factors: central bank rate hikes; perceptions of increase in risk; an increase in the banks’ aversion to lend; the prospect of an economic slowdown; and the recent bout of financial instability. That said, since January 2021, when 12-month Euribor hit a record low, Spanish banks’ lending rates have increased by less than in the eurozone on the whole. Specifically, however, while corporate lending rates in Spain are lower than the eurozone average, mortgage and consumer lending rates are higher. The rate of growth in new lending activity has slowed, with business lending outpacing household lending by a wide margin. The growth in interest rates is leaving businesses and households poorer. Considering that in 2022, businesses earmarked 6.9% of their gross disposable income to the payment of 14.36 billion euros of interest, with households spending 0.8% (6.44 billion euros), an increase of 2 percentage points in borrowing costs in 2023 would increase the two segments’ interest burden by a combined 33 billion euros. The good news is that both the business and household segments are better positioned to tackle the increase in borrowing costs than in the past thanks to significant deleveraging: the ratio of private debt-to-GDP decreased by 23pp between 2020 and 2022.

Introduction

The years of low inflation and low rates are a thing of the past since a combination of supply and demand shocks set off a period of high inflation that has forced the central banks to abandon their monetary accommodation and raise rates. In the eurozone, the ECB’s rate of interest on main refinancing operations, which was left at 0% for more than six years (from March 2016 to July 2022), has been raised seven times to stand at 3.75% as of 4 May 2023. The benchmark interest rate most widely used to price bank loans, 12-month Euribor, entered negative territory in February 2016, where it remained until 2022, since when that market rate has rallied to 3.757% (as of April). As a result, it is back to trading at November 2008 levels. In other words, Euribor has undergone a very significant increase in a short period of time (4.2pp in 18 months), implying a dramatic shift in bank financing terms and conditions for businesses and households. An increase of that speed and scale in interest rates is also a clear risk for the banks, as borne out by recent bank failures in the US as a result of the sizeable losses built up on their fixed-income investments (Silicon Valley Bank, Signature Bank and First Republic Bank). The financial instability which has also affected the European banks (spurred in part by the problems at Credit Suisse) is another reason for tighter borrowing terms and conditions. In fact, according to the most recent eurozone bank lending survey, published by the ECB on 2 May, the banks report having substantially tightened their criteria for approving new household or business loans due to higher perceived risk, reduced risk tolerance and higher funding costs. In its most recent Financial Stability Report (2023), the IMF also expressed its concern about the impact of tighter borrowing terms.

Against that backdrop, the purpose of this paper is to analyse the recent trend in bank financing terms and conditions in Spain in the European context. In the case of non-financial corporations, we analyse the role played by size in explaining differences in terms and conditions, distinguishing between loan costs as a function of the amount applied for and whether the applicant is a large or small enterprise. In the case of households, we distinguish between mortgage and consumer loans. In all instances, we use the new lending activity data provided by the ECB as that information best reflects the movements in interest rates. The information on interest rates is complemented by the feedback provided by the banks in the ECB’s survey of their lending standards and conditions in respect of the first quarter of 2023.

Recent trend in bank loan interest rates

The benchmark rate most widely used to price bank loans in Spain, 12-month Euribor, hit a record low in January 2021, when it reached -0.505%. It continued to trade around that level until December of that year (-0.502%), when it embarked on a rally which would see it abandon negative readings by April 2022, rising to 3.757% a year later. In other words, an increase of 4.2 percentage points (pp) in a little under 18 months.

Although the pass-through of the increase in benchmark rates to bank loan prices has been less intense, it has been sufficient to imply a significant change in borrowing terms and conditions.

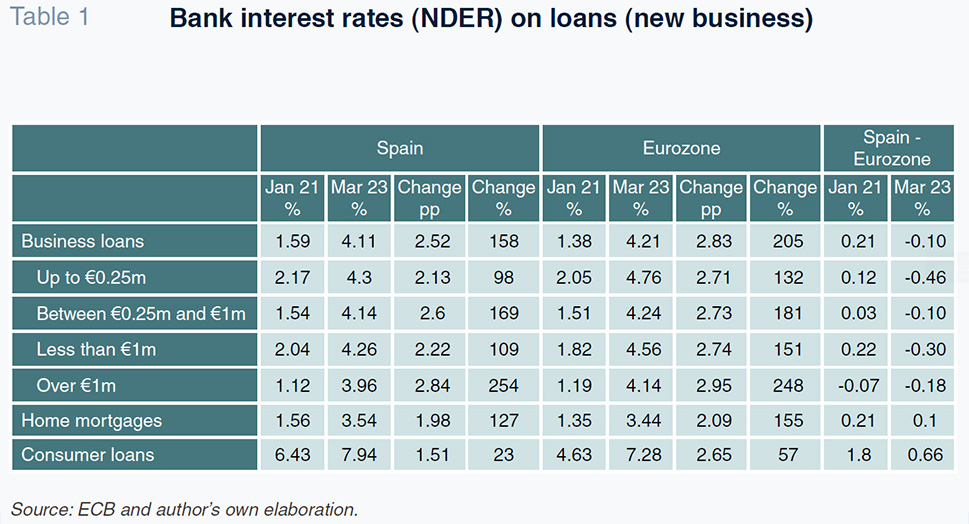

[1] As shown in Table 1, between January 2021 (when 12 Euribor bottomed out) and March 2023 (the most recent figure available at the time of writing), the rate charged for new business loans had increased by 2.52pp in Spain, which is a little less than the eurozone average of 2.83pp. The increase in the cost of home mortgages has been smaller: 1.98pp in Spain vs. 2.09pp in the eurozone. Borrowing costs have increased the least in the consumer loan segment: 1.51pp in Spain, which is much less than the increase observed in the eurozone (2.65pp). As a result, the pass-through of the increase in Euribor to bank loan rates has been bigger in the business segment than in the household segment and lower in Spain than in the eurozone.

In the case of business loans, the data reveal significant differences depending on loan size. In the case of smaller loans (less than 250,000 euros), the cost increase has been smaller (2.13pp) and lower than in the eurozone (2.71pp). For loans of over 1 million euros, the increase has been far more significant and lower in Spain (2.84pp) than in the eurozone (2.95pp). Given that smaller-sized loans are far more common in the SME segment, the pass-through of market rates is proving less intense in this segment than that being sustained by large enterprises, and also smaller in Spain than in the eurozone.

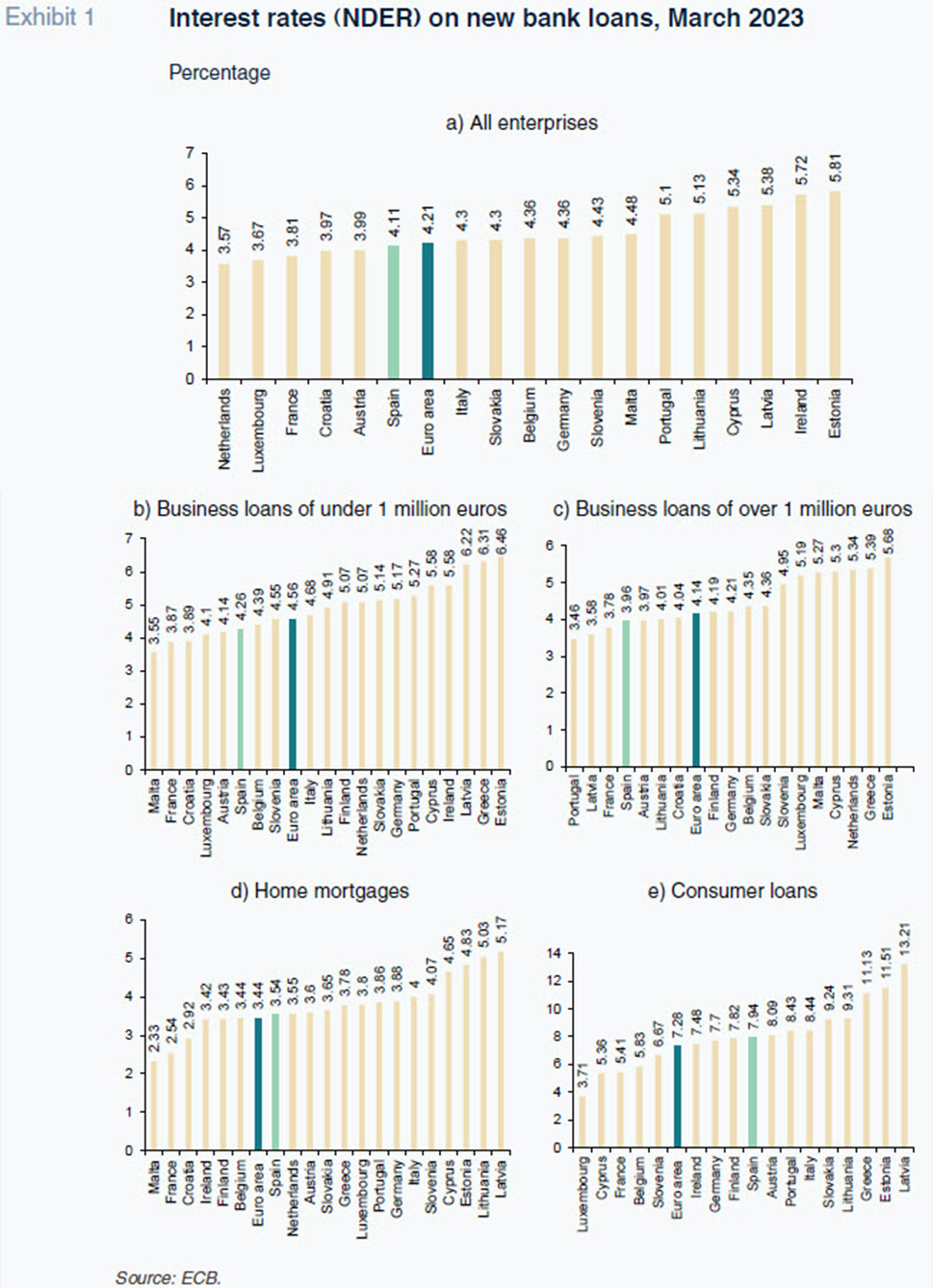

In the wake of the changes arising in the two years analysed since the start of 2021, nowadays the Spanish banks are charging businesses 10 basis points (bp) less for loans than the European banks on average. Rates are lower on all loans to companies regardless of the amount Thus, on loans of less than one million, the interest rate is 30 bp less and increases to 46 bp on those of less than 250,000 euros. On loans of more than one million euros, Spanish banks set an interest rate 18 bp lower.

Looking at the most recent figures (using data as of March 2023), businesses in Spain pay less for bank loans than in the eurozone and in Italy and Germany, but not France. In the household segment, the cost of a home mortgage is a little higher in Spain (3.54% as of March 2023) than in the eurozone (3.44%), but lower than in Germany (3.88%) or Italy (4.00%). Consumer loans also cost more in Spain (7.94%) than in the eurozone (7.28%), France (5.41%) or Germany (7.77%), but less than in Italy (8.44%).

Changes in the banks’ attitude to lending: Contributing factors

Are the banks tightening their screening criteria? To answer this question, we turn to the latest eurozone bank lending survey conducted by the ECB which covers the first quarter of 2023, [2] a period clearly affected by the interest rate increases, as well as the financial instability following the fall of Silicon Valley Bank and Signature Bank in the US and the bailout of Credit Suisse in Europe.

In the business loan segment, the Spanish banks have been tightening their loan approval credit standards since the first quarter of 2021, as evidenced by a higher percentage reporting tightening than easing of those standards. The biggest difference is observed in the last quarter of 2022, when the diffusion index constructed by the ECB [3] stood at 17 points, up 4pp from the previous quarter and 3pp above the eurozone average. In the first quarter of 2023, that index fell back to 8pp but remained positive. The reasons for the tightening reported in the first quarter of 2023 include economic weakening, greater risk aversion, more stringent collateral requirements and market funding difficulties. That quarter there were no significant differences between SMEs and large enterprises in credit standard tightening, in contrast to the previous quarter where tightening clearly affected SME lending more. Credit standard tightening is more pronounced in Spain than in the eurozone, where the diffusion index was 13.6. The banks reported an increase in loan application rejections in the first quarter of 2023, marked by a higher diffusion index for SME applicants relative to large enterprises (8 vs. 5). The increase in the loan application rejection rate is similar in Spain and the eurozone (7.5), with the European banks scantly differentiating by enterprise size.

In the case of home mortgages, the Spanish banks have also been tightening their credit standards since the third quarter of 2022, albeit by less than the in eurozone in the last two quarters (10 vs. 12.2 in the last quarter). The contributing factors in the first quarter of 2023 include the economic downturn, reduced availability of market funding, the outlook for the housing markets, banks’ reduced tolerance for risk and less creditworthy borrowers. On the other hand, the banks reported reduced competition from non-banks. Loan application rejection rates also increased (albeit by less than in the eurozone, with diffusion indices of 5 and 11.5, respectively), as has been the case for the last four quarters.

Lastly, it is in the consumer loan segment that the Spanish banks’ credit standards have tightened the most, as evidenced by a diffusion index that has been consistently above the eurozone index for the last three quarters (17 vs. 4.8 in the first quarter of 2023). The main factor contributing to the deterioration in standards in this segment is the reduced creditworthiness of loan applicants, with the effect of reduced risk tolerance, higher collateral requirements and access to market funding making smaller contributions. The application rejection rate increased in the last quarter (diffusion index: 8) and by more so than in the eurozone (5).

Changes in lending terms and conditions

Turning our attention to the terms and conditions set by the banks when lending money to businesses, the tightening is clear, marked by a diffusion index of 25 points in the last quarter, higher in the case of SMEs (25) than large enterprises (18), extending the trend of the last three quarters. That tightening is more pronounced in Spain than in Europe, where the index is half as high, at 12 points. The factors contributing to the tightening include the increased spreads applied by the banks, the economic downturn and, to a lesser degree, more stringent collateral requirements and reduced risk tolerance.

In the mortgage segment, the Spanish banks have also tightened their terms and conditions, with a diffusion index of 25 points, very much in line with that of the last three quarters and almost twice the eurozone average (14.2). The tightening is most evident in the increase in borrowing costs (30 points), the spreads applied by the banks (15) and perceived risk (15). Terms and conditions around collateral were unchanged, while the competition factor eased.

Lastly in consumer financing, lending terms and conditions tightened even more significantly, as is evident in a diffusion index of 25 points, which is considerably more than twice the eurozone average (9.6). That tightening is manifest in the spreads applied and collateral required. The contributing factors include higher perceived risk and greater difficulties in accessing funding. The banks report reduced perceived competition, however.

Trend in new loans and credit lines

The volume of new loans extended to businesses and households depends on supply factors (such as the credit standards and terms and conditions applied by the banks, analysed above) and demand factors. The most recent data on new lending activity show business lending slowing (measured in terms of average annual growth in credit extended in the last 12 months) since the end of 2022. Having neared an annual rate of growth of 25% in November 2022, that rate fell back to 11.7% in March. It is on operations of less than 250,000 euros where it grows the most (14.8% in March 2023) and on those of more than one million euros where its rate of growth has slowed down the most.

In the household segment, loans to new transactions have been slowing clearly for a year now, with trailing 12-month growth dropping from 23% in February 2022 to only 2% in March 2023. The mortgage segment lost the most momentum; recall, however, that growth in this category approached 40% at the end of 2021, financing sharp growth in home purchases. Growth had fallen back from those heady levels to 2% by March 2023 (the reading is actually negative if we compare the credit extended in the last three months with the volume for the same three months of the previous year). That trend is clearly heavily influenced by the ascent in Euribor (to which most mortgages are benchmarked) and the loss of purchasing power as a result of inflation. Consumer credit, which was hit heavily by the pandemic, started to recover in early 2022. Since then, however, the rate of growth has stabilised at around 5%, being 6% in the last data of March 2023. In credit for other uses (other than mortgages and consumer loans), lending volumes were shrinking by 4% as of March, compared to growth of 23% a year earlier.

Key takeaways

- The fact that benchmark interest rates have increased so sharply in such a short space of time has increased the cost of bank loans, albeit by considerably less that the surge in market rates. In parallel, primarily as a result of poorer growth prospects, the banks’ risk perception has increased and they have become more risk averse, which has translated into tighter loan terms and conditions, more so in the case of loans to small enterprises relative to large enterprises. These supply-side factors, coupled with demand dynamics, in the current context of growing financial instability, explain the downtrend in growth in new lending activity observed in recent months. However, new credit to companies continues at high rates (11.7%), but not to households (2%), with lower growth in loans for home purchases (2%) than for consumption (6%).

- The most recent figures (as of March 2023) places the interest rate on new loans in Spain below the euro area rate for companies, but higher for households, both for mortgages and for consumption.

- The run-up in interest rates has the effect of impoverishing businesses and households who now have to spend more of their disposable income on debt service. In 2022, Spanish businesses earmarked 6.9% of their gross disposable income to interest payments totalling 14.36 billion euros, compared to 0.8% in the case of its households (6.44 billion euros). Considering the stock of outstanding debt in 2022, those figures translate into average costs of 1.5% for the business segment and 0.91% for the household segment. If we assume that the average cost increases by at least 2pp in 2023, the interest payable by the two segments combined would increase by at least 33 billion euros.

- The good news is that both the business and household segments are better positioned to tackle the increase in bank loan costs than

in the past thanks to significant deleveraging. The ratio of private sector debt to GDP decreased by 23pp between 2020 and 2022 (to 125.1%), with deleveraging more intense among businesses (-13.2pp to 72.2%) than households (-9.4pp to 53%). Those levels are well below the leverage observed in both sectors at the onset of the financial crisis of 2007-08 (193% of GDP in December in the private sector, of which 111.4pp was attributable to the business segment and 81.8pp to Spanish households). Both segments have also shored up their financial strength: the percentage of disposable income taken up by interest payments has improved sharply from highs of 25.6% in the business segment and 3% in the case of households in 2011 to less than one third of those levels (6.9% and 0.8%, respectively) in 2022.

- Although the interest rate increases are not a major concern for the reasons outlined above, there are vulnerable groups who face higher interest burdens with scant disposable income to spare. In the household segment, the extension at the end of 2022 of the code of good practices for mortgaged households is a welcome measure but could prove insufficient, in which case direct aid from the public sector may be necessary, as some regional governments are already offering.

Notes

The Bank of Spain (2023) has found that the pass-through of the increase in Euribor to the average rate on the stock of household mortgages and loans to non-financial corporations was 30% in 2022. In our analysis, we focus on new transactions and not the average rate on the stock of loans.

[2]

The survey was carried out between 22 March and 6 April 2023.

[3]

The diffusion index = the percentage of lenders who reported they had tightened their credit standards + 0.5 times the percentage reporting having tightened them ‘somewhat’ – the percentage who reported they had eased their credit standards – 0.5 times the percentage reporting having eased them ‘somewhat’.

References

BANK OF SPAIN. (2023). Financial Stability Review, April.

EUROPEAN CENTRAL BANK. (2023). Bank Lending Survey, May.

IMF. (2023). Global Financial Stability Report, April.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF