Household and non-financial corporate accounts for 2022

Statistical revisions have confirmed initial assumptions over the impact of the pandemic on household and corporate accounts. In the case of households, their favourable performance in light of the pandemic was even better than originally anticipated, while in the case of corporates, not only did they bear the brunt of pandemic economic fallout, but their performance was indeed worse than anticipated.

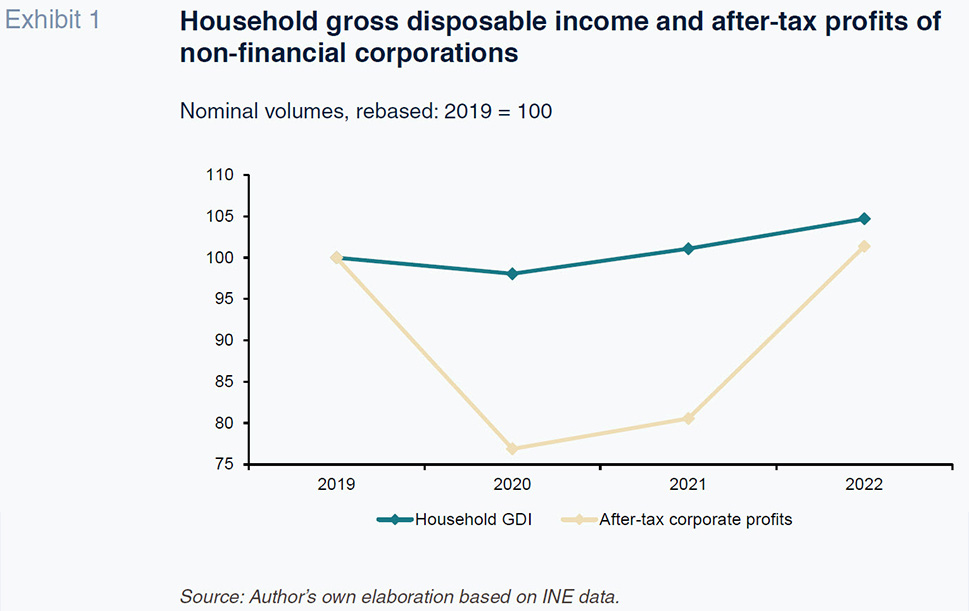

Abstract: The pandemic has had a relatively limited impact on the aggregate level of household finances in Spain with the sector’s GDI recovering to 2019 levels by 2021. The household sector also set aside a significant savings buffer, which following official statistics revisions, turned out to be even higher than initially estimated at 137 billion versus 94 billion euros. In the case of the corporate sector, revised figures show that the negative impact of the pandemic on corporate income was actually stronger than originally anticipated. Indeed, between 2020 and 2021, the non-financial corporations generated a net lending position of 12.2 billion euros, instead of the initially reported surplus of close to 78 billion euros. As a result, the original conclusion drawn that the household sector’s accounts had held up remarkably well in 2020-2021, in contrast to the impairment sustained by the business sector, not only remains valid, but rather the contrast between the two sectors’ performances is starker than originally thought. In 2022, however, the corporate sector’s finances fared better than those of the household sector, fully recovering from the hit taken in 2020. Nevertheless, corporate profits (after tax) have increased by less compared to pre-pandemic levels than household income (+1.4% vs. +4.7%), partly due to lower growth in their pre-tax income and partly due to the relatively bigger increase in the effective tax rate sustained by the corporate sector- a major topic of debate at present.

Introduction

2022 was the first full year without pandemic-related restrictions. Although tourism recovered sharply, the onset of an energy crisis as a result of the war in Ukraine further fuelled the inflationary pressures that emerged in 2021, prompting monetary policy tightening. Against that backdrop, Spanish GDP registered growth of 5.5%, extending its recovery after the sharp contraction of 2020, albeit without revisiting 2019 levels in real terms. In the job market, the trend in the number of people in work (and social security contributors), which continued to register strong momentum, rising above pre-pandemic levels, contrasted with that in the number of hours work, which continued to trail that benchmark.

Growth in employment was the main driver of household income

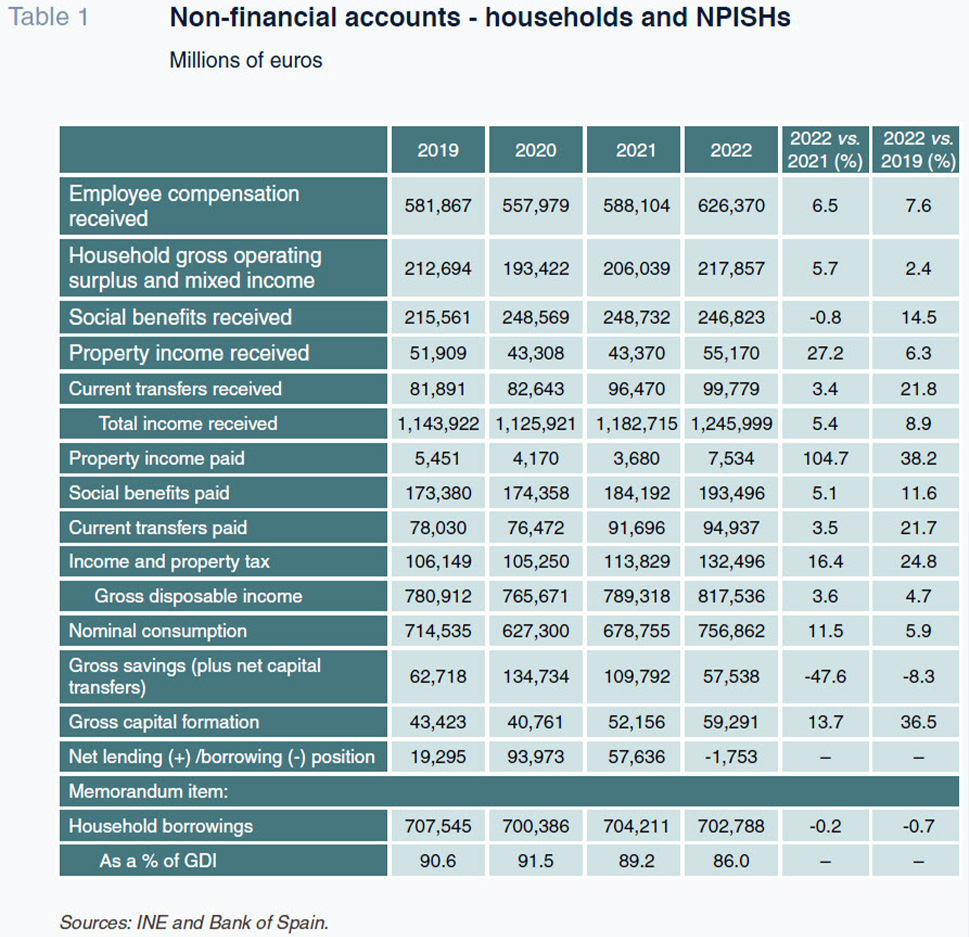

Before analysing the household sector’s accounts in 2022, it is important to note that the figures for 2020 and 2021, analysed by Fernández (2022), have sustained considerable corrections with respect to the numbers originally published by Spain’s Official Statistics Office (INE), considerably changing some of the conclusions drawn at the time. Specifically, gross disposable income (GDI) in the household sector recovered more intensely than initially estimated (already topping pre-pandemic levels in nominal terms in 2021), and the savings generated were higher than first reported, as were, by extension, the surplus savings accumulated between 2020 and 2021: 137 billion euros versus an initially estimated 94 billion euros. Note, however, that the rampant inflation of the last two years has eroded that pool of savings by around 10% in real terms. On the other hand, the 2021 gross fixed capital formation (GFCF) figure was revised significantly downwards. As a result, the conclusion reached at the time on the basis of the figures at hand that all of the savings accumulated in 2021 went to investments no longer holds. In fact, only a small percentage of those surplus savings was invested. As a result, the households sector’s net lending position was also substantially higher than initially indicated (64 billion euros higher over the two years). That surplus was used to purchase financial assets but not to repay debt, which increased for the first time in 12 years.

Turning to 2022 (Table 1), the employee compensation earned by Spanish households increased by 6.5% thanks to growth in employment and, to a lesser degree, growth in average compensation per wage-earner. Property income received by housholds increased by 27.2%, fuelled by the recovery in dividends collected, which did not revisit the record level of 2019 but were higher than in previous years. Household interest income (before the allocation of FISIM) decreased by 14%. Lastly, social benefits collected decreased by 0.8% due to the elimination of most of the aid related with COVID-19.

Taxes paid on income and property increased by 16.4%, which is well above the growth in pre-tax income (measured in national accounting terms), implying a significant increase in the effective tax rate. Social security contributions increased in line with the growth in the related tax base. In 2020, contributions decoupled from the growth in wages (which fell as a result of the pandemic while social security payments by households increased slightly) due to specific measures taken at the time, mainly subsidisation of the contributions due for workers put on furlough. In 2022, however, with those measures virtually all eliminated, the effective rate implied by social security contributions over wage compensation was considerably higher than in the years before the pandemic.

As a result of all these factors, household GDI increased by 3.6% in 2022 to 4.7% above 2019 levels, the lowest nominal rate of growth among the European countries for which these figures are available. Household consumption, meanwhile, increased by 11.5%, which is higher than in 2019 in nominal terms but still lower in real terms. The fact the nominal spending outpaced disposable income drove a reduction in gross savings to 58.46 billion euros, just over half of the year-earlier figure, as was expected given that the 2021 figure was abnormally high due to the pandemic-related restrictions that persisted for much of the year. The savings generated in 2022 were equivalent to 7.2% of GDI, which is a little higher than the 2014-2019 average of 6.8%. Spanish households –as a whole– were therefore able maintain their healthy saving rate (even saving a little more than before the pandemic) despite high inflation, thanks largely to the growth in employment (the key driver of the growth in income), at the cost of a full recovery in consumption in real terms. At any rate a saving rate of 7.2%, only slightly above pre-pandemic levels, no longer denotes surplus savings on top of the buffer built up in the two previous years.

Having increased in 2021, GFCF increased further in 2022, to 59.29 billion euros, which is higher than the savings figure, so that the household sector generated a small net borrowing requirement of 1.75 billion euros. Ideally, the household sector should generate a net lending position, but so long as the deficit is one-off and small in scale, it is not a concern in terms the build-up of potential imbalance. Moreover, it is important to consider the surplus savings accumulated in prior years. In fact, despite the deficit, the household sector deleveraged, having increased their borrowings the year before. As a percentage of their GDI, household borrowings fell to 86%, the lowest reading since 2002 and also below the eurozone average.

The volume of investments by households in 2021 and 2022 was higher than the figures reported prior to the pandemic but that increase in investing activity by comparison with previous levels only represents, on aggregate, 23% of the surplus savings generated in 2020 and 2021. The bulk of those savings was therefore channelled into financial assets.

Corporate earnings recovered from the pandemic in 2022

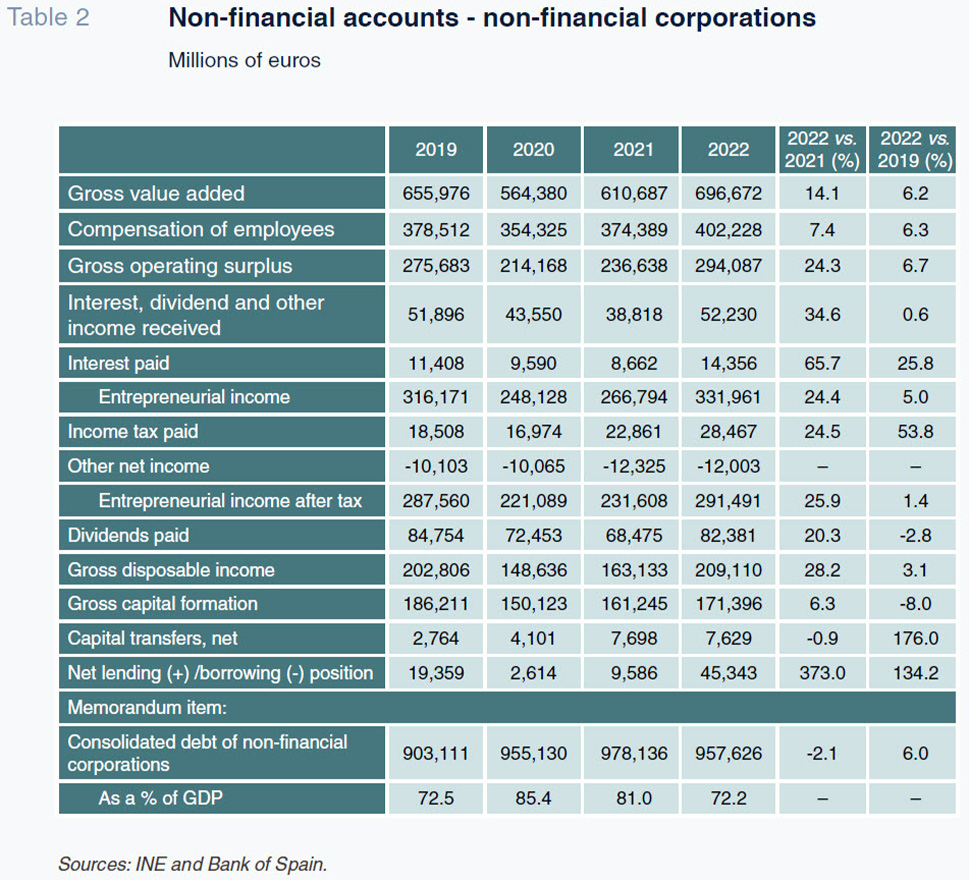

The non-financial corporations’ financial statements for 2020 and 2021 have also undergone considerable corrections: the drop in gross operating surplus (GOS) in 2020 was higher than initially estimated and the recovery in 2021, weaker. That, coupled with different trends in other components of these enterprises’ gross disposable income, means that their aggregate GDI for the two years was actually 61.5 billion euros lower than commented on in Fernández (2022). Between 2020 and 2021, the non-financial corporations generated a net lending position of 12.2 billion euros, instead of the initially reported surplus of close to 78 billion euros. As a result, the conclusion drawn at the time that the household sector’s accounts had held up remarkably well in 2020-2021, in contrast to the impairment sustained by the business sector, not only remains valid, but rather the contrast between the two sectors’ performances is starker than originally thought. Indeed, household GDI in 2021 was 1.1% higher than in 2019 (and not 2.8% lower), while corporate profits after taxes (to make the figures comparable with household GDI, in both cases using national accounting figures), were 19.5% below that threshold (and not 14.2% lower).

Turning to 2022 (Table 2), the sector’s GOS increased a sharp 24.3% to rise 6.7% above pre-pandemic levels, one of the lowest gaps with respect to 2019 levels in Europe, with only France lagging further behind. The non-financial corporations’ gross profit ratio (GOS over gross value added, GVA) was 42.2%, which is slightly higher than in 2019, but lower than the ratio observed every year between 2012 and 2018. It is worth highlighting the sharp increase recorded in the fourth quarter, which is when the bulk of that growth was concentrated. As for net property income, interest payments increased considerably while interest income fell, albeit offset by growth in other sources of income, including dividends. Corporate profits, i.e., entrepreneurial income before the payment of dividends and taxes, increased by 24.4%, thus recovering last year from the contraction sustained at the onset of the health crisis.

Corporate income tax payments increased very much in line with their profits. Unlike what happened in the household sector, where the effective tax rate increased in 2022, in the business sector it was in 2021 when tax payments increased by proportionately more than profits, driving the effective rate to well above pre-pandemic levels, where it stayed in 2022. Note that the remarkable increase in tax collection in the last two years, which has jumped from 35.2% of GDP in 2019 to 38.4% in 2022, and the possible explanatory factors, are a major topic of debate at present (García-Miralles and Martínez Pagés, 2023; Government of Spain, 2023). The substantial increase in the effective tax rate paid by Spanish corporations means that although their GOS was 6.7% higher in 2022 than in 2019, their after-tax profits (before dividend payments) were only 1.4% higher.

The non-financial corporations’ gross disposable income, measured as their profits after the payment of tax and dividends, which is equivalent to their savings, increased by more than their GFCF, giving rise to a net lending position of 45.34 billion euros, significantly above the 2021 surplus of 9.59 billion euros. Note that the significant growth in capital transfers received compared to long-run levels may be related with the receipt of the NGEU funds.

Some of that net lending position was used by the corporations to repay debt, following nominal growth in borrowings during the previous three years, especially in 2020. However, nominal borrowings at year-end 2022 remained higher than at year-end 2019. Relative to GDP, on the other hand, the non-financial corporations’ consolidated debt fell to the lowest level since 2003, at 72.2%.

Conclusions

As noted at the time, the pandemic had a relatively limited impact on household finances in Spain (on aggregate), with the sector’s GDI recovering to 2019 levels by 2021. The household sector also set aside a significant savings buffer, which following official statistics revisions, turned out to be even higher than initially estimated. It was corporate income that bore the brunt of the economic fallout from the pandemic. In light of the revised figures, that impact was higher than initially calculated.

In 2022, however, the corporate sector’s finances fared better than those of the household sector, fully recovering from the hit taken in 2020 (Exhibit 1). Nevertheless, corporate profits (after tax) have increased by less compared to pre-pandemic levels than household income (+1.4%

vs. +4.7%), partly due to lower growth in their respective pre-tax income and partly due to the relatively bigger increase in the effective tax rate sustained by the corporate sector. Note, lastly, that the growth figures are always cited in nominal terms. Both sectors’ purchasing power, however, remains below pre-pandemic levels.

References

FERNÁNDEZ SÁNCHEZ, M. J. (2022). Spain’s household and corporate accounts: Two years after the pandemic. SEFO, Spanish and International Economic & Financial Outlook, Vol. 11, No. 3, May.

https://www.funcas.es/wp-content/uploads/2022/05/SeFO-11_3Fernandez.pdfGARCÍA-MIRALLES, E. and MARTÍNEZ PAGÉS, J. (2023). Government revenue in the wake of the pandemic. Tax residuals and inflation. Bank of Spain Economic Bulletin, 2023/Q1, Article 16.

https://repositorio.bde.es/bitstream/123456789/29791/1/be2301-art16e.pdfGOVERNMENT OF SPAIN (2023). Actualización del Programa de Estabilidad 2023-2026 [Updated Stability Programme for 2023-2026], Chapter 3.3.2, April 2023.

https://portal.mineco.gob.es/RecursosArticulo/mineco/economia/macro/Programa_Estabilidad/

Programa_Estabilidad_2023-2026.pdf

María Jesús Fernández. Senior Economist at Funcas