Episodes of financial instability: “Separating the wheat from the chaff”

The recent bouts of financial instability in the US and Europe (Credit Suisse) have raised concerns over the implications of monetary tightening underway. Although the European banking sector, including the Spanish banks, is proving generally more resilient than its US counterparts, the instability has had a pronounced adverse impact on most financial intermediaries and heightened concerns regarding potential spillovers from the shadow banking system.

Abstract: The episodes of financial instability observed in the US and in Europe at Credit Suisse in March and the ensuing international contagion have given pause for thought about the implications of financial normalisation via monetary tightening underway. Although the European banking sector, including the Spanish banks, is proving generally more resilient, the bouts of instability had a pronounced adverse impact on most financial intermediaries. As for the Spanish banks, they continue to bolster their solvency while keeping non-performance low. Although it is hard to draw comparisons and the market environment is very volatile, an analysis of the 12-month returns in the various banking sectors one month on from the fall of SVB and Credit Suisse shows the Spanish banking sector outperforming the European and US averages. The chief challenge is for the US supervisor to convince the markets that it can reform its supervisory mandate quickly enough to prevent similar situations from occurring among its mid-size banks. Meanwhile, most international analysts and institutions are flagging non-bank financial intermediaries, and the shadow banking ecosystem in general, as potential sources of instability worth monitoring.

Introduction: Episodes of financial instability and bailouts

The spring ushered in unexpected bouts of financial instability in the US and Europe (Credit Suisse) that have sowed doubts that will be hard to dispel. During times of economic or financial instability, the ‘blame’ gets shared around all those involved. The two most prominent cases and those that have caused the most trouble were Silicon Valley Bank (SVB) in the US and Credit Suisse in Switzerland. Although the latter was somewhat more predictable, the fall of SVB in the US has shone the spotlight on the supervision of small- and mid-sized banks in that country. Some blame the supervisor for failing to detect the problem sooner, with some also against light-touch regulation of those banks following measures introduced by the Trump administration in 2018. Although Europe has been able to navigate the recent financial turbulence from a position of relatively greater financial strength, it is not, logically, immune from these episodes of contagion.

Other causes identified include the accumulation of debt and its renegotiation during periods when rates were zero or negative, leaving scantly solvent companies struggling to survive now that rates have gone up. Moreover, the global economy is transitioning to a greener, more digital, and automated model and the current debate about artificial intelligence is as worrying as it is enthralling. The financial intermediation terrain faces tailwinds (“financial normalisation”) and headwinds (possibility of contagion, economic slowdown).

The change of sentiment was also marked by the Global Stability Report put out by the International Monetary Fund (IMF), which naturally weighed in on the recent events. That document, published on 12 April, notes that “the sudden failures of Silicon Valley Bank and Signature Bank in the United States, and the loss of market confidence in Credit Suisse, a global systemically important bank (GSIB) in Europe, have been a powerful reminder of the challenges posed by the interaction between tighter monetary and financial conditions and the build-up in vulnerabilities”. The IMF believes that “the forceful response by policymakers to stem systemic risks reduced market anxiety”.

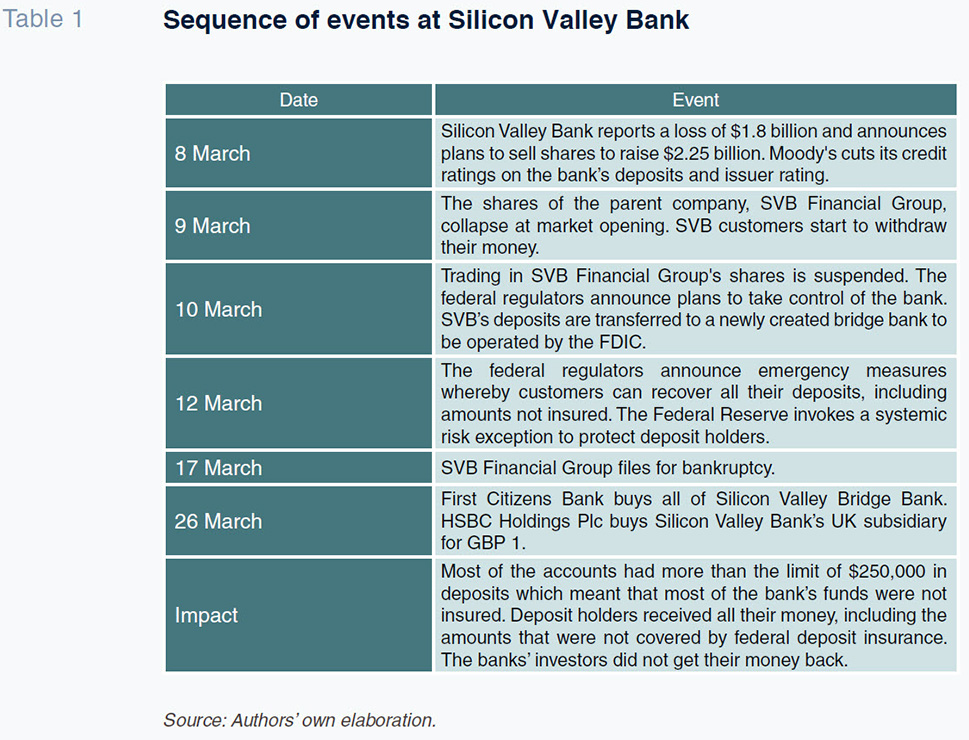

Table 1 provides the sequence of events around the fall of Silicon Valley Bank. That timeline shows how the bank’s business and reporting systems were deficient, having failed to sufficiently cover market risk, prompting a run on its deposits. Ultimately, the Fed decided to cover all deposits, including those worth more than the limit for federal deposit insurance. By protecting liquidity, the contagion was curbed but questions remain about the capital adequacy of the country’s small- and mid-sized banks.

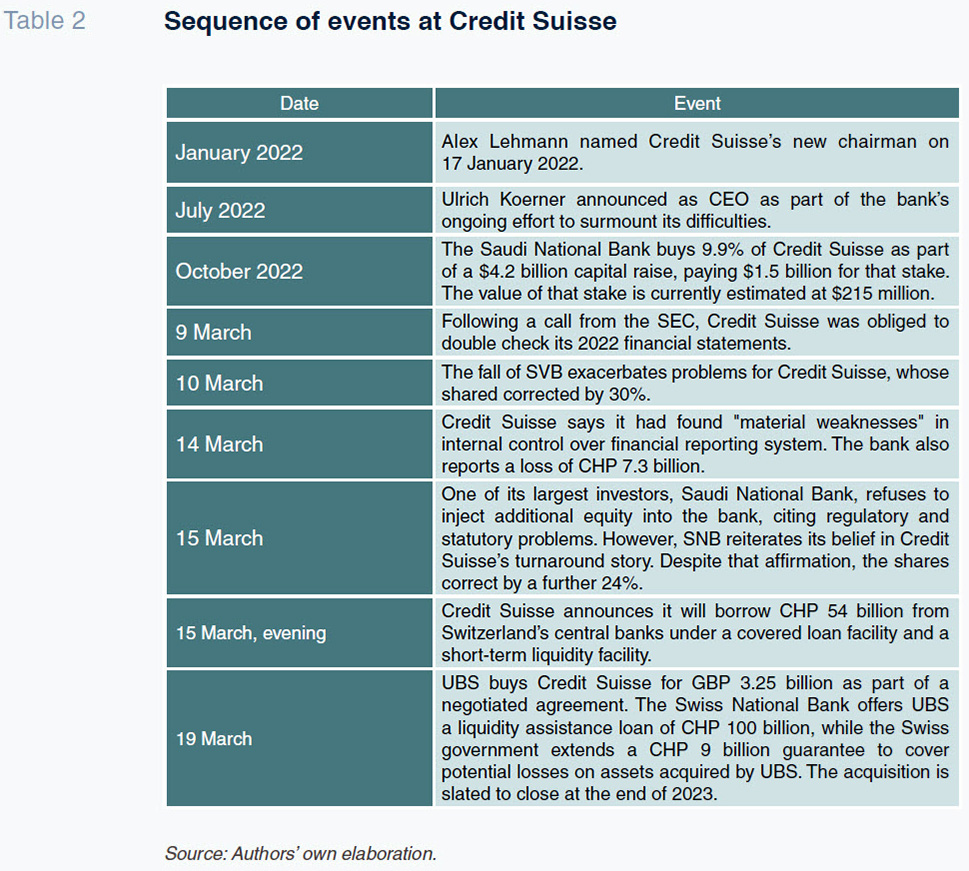

The Credit Suisse case is a little more complex. The analyst community believes that its problems were the result of a series of factors, including risky investments, a lack of leadership or clear business strategy, customer lawsuits and regulatory and statutory problems. The auditors forced the bank to revisit its financial statements, identifying substantial “material weaknesses” in the bank’s internal controls and the market environment was ripe for a share price rout, ultimately forcing its absorption by UBS (Table 2).

The Swiss regulatory and supervisory responses point to an isolated case, so that the market’s concerns remain focused on the US response to the problems in its mid-sized banks. The US ultimately covered the uninsured deposits (those over the federal deposit insurance limit) of the two banks that failed and provided additional liquidity under a new Bank Term Funding Program approved by the Federal Reserve. In Switzerland, the Swiss National Bank provided emergency liquidity support to Credit Suisse, which was later absorbed by Union Bank of Switzerland (UBS) as part of a state-endorsed acquisition. Nevertheless, as the IMF stresses in its report, “market sentiment remains fragile, and strains are still evident across a number of institutions and markets, as investors reassess the fundamental health of the financial system.”

In parallel, the Federal Reserve is considering ending an exemption that allows certain mid-size banks to conceal losses on their security holdings. That initiative is being spearheaded by the Vice Chair for Supervision at the Fed, Michael Barr, and is expected to be passed in the coming days. Barr has said that the supervisors repeatedly identified risks at SVB from 2021 and even took measures to restrict its growth in 2022 because they went unaddressed. He called SVB’s failure “a textbook case of mismanagement”, citing its highly concentrated business model, excessively rapid growth, deficient interest rate risk management and reliance on uninsured deposits. Review of the supervisory model could lead to the reinforcement of the rules for banks with between USD 100 and 250 billion of assets.

One month after the events took place, on 21 April, the Financial Stability Oversight Council (an advisory board set up during President Obama’s term in office) released bank regulation reform proposals for public comment. That body signalled the need to pass new rules to accelerate assessment of financial stability risks and facilitate the designation of non-bank institutions as systemically important, subjecting them to Fed supervision. The Treasury Secretary, Janet Yellen, supports these reforms, saying that they eliminate certain “inappropriate hurdles” to supervising entities based on their activities and not their legal form of incorporation. The new rules would allow for ample engagement between regulators and a company under review. Hedge fund, mutual fund and portfolio managers would be included, evidencing the regulators’ concern that new episodes of financial instability could come from non-bank institutions. That is the prime outstanding concern and one that is shared by the IMF, other institutions, and multiple analysts. Despite the fact that the risks have come to light as a result of episodes of stress in the banking sector, the resilience of the global financial system will depend essentially on the performance of the non-bank financial intermediaries (NBFIs), which constitute what is known as the ‘shadow banking’ system.

The response in the eurozone and the situation in Spain

The first financial instability problems at SVB caught the European Central Bank a few days away from its March monetary policy decisions. It stuck with the expected agenda, stating that it believed that the problem did not apply to the eurozone, but admitted that the possibility of contagion warranted caution, noting that it would factor financial stability matters into its next monetary policy decisions. There was much anticipation around the remarks by the President of the ECB, Christine Lagarde, before the European Parliament’s Committee of Economic and Monetary Affairs on 20 March, where she said that the financial stability issues could have an impact on demand doing some of the work that monetary policy and interest rate increases would otherwise have had to do. As for Credit Suisse, Lagarde said that she believed the eurozone banks were resilient and their exposure to Credit Suisse, limited. She did warn, however, that the banks should prepare for slower economic growth, higher funding costs and lower lending volumes. Some sceptics believe that the ECB will be forced to choose between combatting inflation and preserving financial stability. However, the ECB believes that for the time being that issue is relative and under control.

The events coincided in the eurozone with publication by the ECB, on 18 April 2023, of the recommendations made by an independent group of experts around European bank supervision, specifically, the results of an external assessment of the Supervisory Review and Evaluation Process (SREP), which includes recommendations on how to make it more efficient and effective. The report finds that the organisation is now “sufficiently robust and mature to make processes leaner” if necessary. However, it recommends that the ECB focus on impactful qualitative measures to encourage banks to tackle weak business models and governance practices.

Turning to Spain, on 20 April, the Bank of Spain published its supervisory statistics for credit institutions for the fourth quarter of 2022, enabling an analysis of how the banks were placed right before the financial instability unfolding in 2023. Capitalisation of the credit institutions operating in Spain increased slightly in the fourth quarter of 2022. Their common equity tier 1 capital (CET1) averaged 13.23% (compared to 13.05% in 3Q). Their liquidity coverage ratio dipped to 178.45% but remained very significantly above the regulatory requirement (100%). Meanwhile, the banks’ non-performing loan (NPL) ratio in Spain continued to come down, averaging 3.12% in the fourth quarter of 2022, which is nearly 50 basis points lower year-on-year. On the other hand, the ratio of stage-2 loans (under ‘special monitoring’ using Bank of Spain nomenclature) increased slightly, from 6.25% to 6.42%.

In April, the Bank of Spain also published its Financial Stability Report, in which it alluded to the international banking turbulence: “Since March 2023, the serious financial problems seen at Silicon Valley Bank (SVB), other medium-sized US banks and Credit Suisse have driven down bank stock prices.” The Bank of Spain believes that this “increases the risk of higher financing costs and liquidity stress for the banking sector worldwide, including Spanish banks, and may have a negative impact on the favourable financial position with which they started out in 2023.” The Spanish supervisor also shares the ECB’s and IMF’s view that the recent uptick in risk aversion in the financial markets has increased concern at the global level around vulnerabilities in the non-bank financial intermediary (NBFI) segment. It notes that in the past, “investment fund and other NBFI sectors have exhibited procyclical behaviour, exacerbating downward price corrections, and there are no signs that a different pattern would emerge if risk aversion were to continue or intensify. In Spain, investment funds have better liquidity positions which limit this risk. However, corrections in global financial markets, which may be triggered by the build-up of vulnerabilities in NBFI segments in other geographical areas, would still affect the Spanish financial system as a whole.”

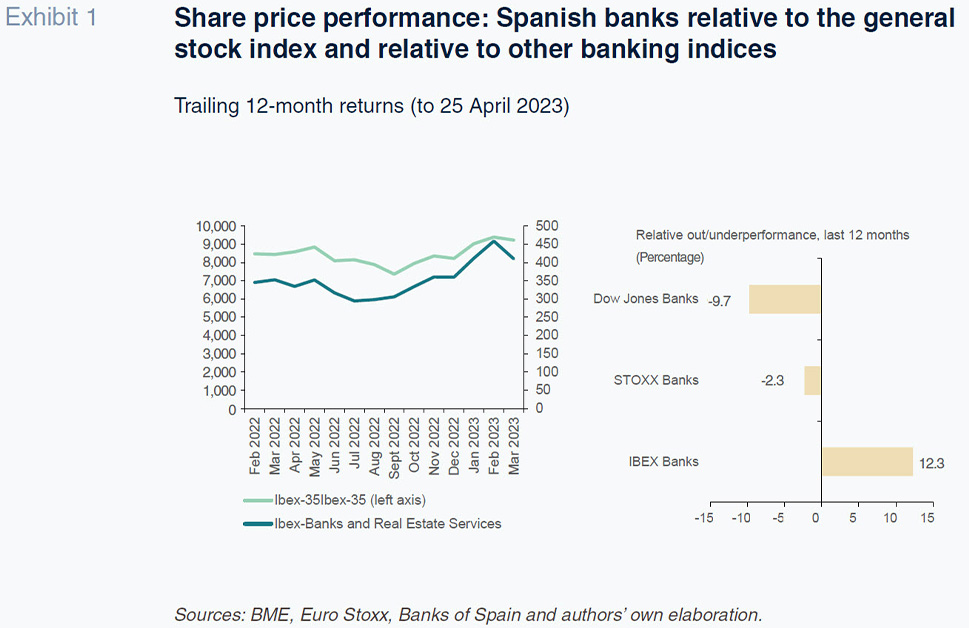

Although it is hard to draw comparisons and the market environment is very volatile, an analysis of the 12-month returns for the various banking sectors one month on from the fall of SVB and Credit Suisse (Exhibit 1), shows the Spanish banking sector outperforming the European and US averages. Over that timeframe, the cumulative annual returns are -9.7% in the case of the Dow Jones Banks, -2.3% for the EURO Banks STOXX and +12.3% in the case of the Ibex Banks.

Conclusion: “Separating the wheat from the chaff”

In the wake of recent financial events, it is necessary to apportion responsibilities in order to avoid fresh episodes of instability. Businesses and the banks must assume their corporate responsibility and reporting duties; households need to tack stock of current events and improve their financial acumen so as to take smart saving and spending decisions; and governments need to be cautious and help educate about the need for economic and financial stability.

The role of the supervisor is essential as the situation remains fragile. At the time of finishing this article, in the US, another mid-size bank, First Republic Bank, was experiencing a run on its deposits, prompting a collapse in its share price, and leaving it in a delicate financial situation. The lessons learned from the episodes of March show that financial contagion is a significant international risk factor. They also suggest that it is time to clarify who is who, to “separate the wheat from the chaff”. That task will be particularly challenging in the US where considerable concern around the mid-size banks remains.

Overshadowing above all those issues is the problem – portended for years now – of how numerous companies and financial intermediaries will digest a process of financial normalisation involving interest rate increase over a short period of time. The analysis provided in this paper shows that this concern is particularly acute in the case of the non-bank financial intermediaries and the shadow banking system in general, which are more vulnerable to movements in interest rates and to market risks overall.

Santiago Carbó Valverde. University of Valencia and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas