The return of geopolitical risk: The economic effects of the war in Ukraine

Russia´s invasion of Ukraine will have economic effects in the short-term through channels such as commodities, trade, and financial markets. Importantly, the current geopolitical conflict may also have serious implications over the longer-term by challenging globalisation, leading to a potential restructuring of existing supply chain networks.

Abstract: The invasion of Ukraine by Russian forces implies a shift in the international paradigm impacting global geopolitical dynamics prevailing since the fall of the Berlin Wall. An event of such magnitude (a black swan in financial terminology) will not only have effects on the economic cycle in the short-term but may also alter the underlying trends that have defined the economy’s performance in recent decades. In the near-term, the increase in political risk will impact the economy via multiple channels, such as commodity prices, commercial ties, uncertainty and financial stability. At the same time, the return of policies articulated around blocks of geopolitical influence could imply a threat to the globalisation that has been intact since China joined the global production chain. Specifically, this may occur through triggering structural changes in the global economy, particularly on the supply side. Making this transition in Europe will require reconfiguring economic, foreign, defence and energy policy, potentially providing the long-awaited impetus for European integration.

Short-term effects

Having navigated the last major variant of COVID-19 (Omicron) better than feared, but not so well as to avoid the sharp mismatches between supply and demand, the global economy faces a new challenge as the war in Ukraine implies yet a new supply shock and, therefore, an increase in economic risks. Recently, the International Monetary Fund (IMF, 2022) lowered its forecast for global growth for this year by 0.8 percentage points to 3.6%, [1] cutting its GDP forecasts for 143 of the 198 economies under its coverage. In other words, nearly all countries will be negatively affected to a greater or lesser degree by the distortions caused by the armed conflict, the exceptions being the major commodity producers.

In addition, the nature of the disruption and its timing are a challenge in terms of economic policy response as the room for manoeuvre is limited following the effort made in the past two years to mitigate the effects of the pandemic. Therefore, the increase in geopolitical risk will have economic, financial and social repercussions on top of diplomatic and military ramifications. And they are all interrelated, with the scope for a seismic shift in the major trends that have shaped the international economy since China joined the global production chain towards the end of the 1970s.

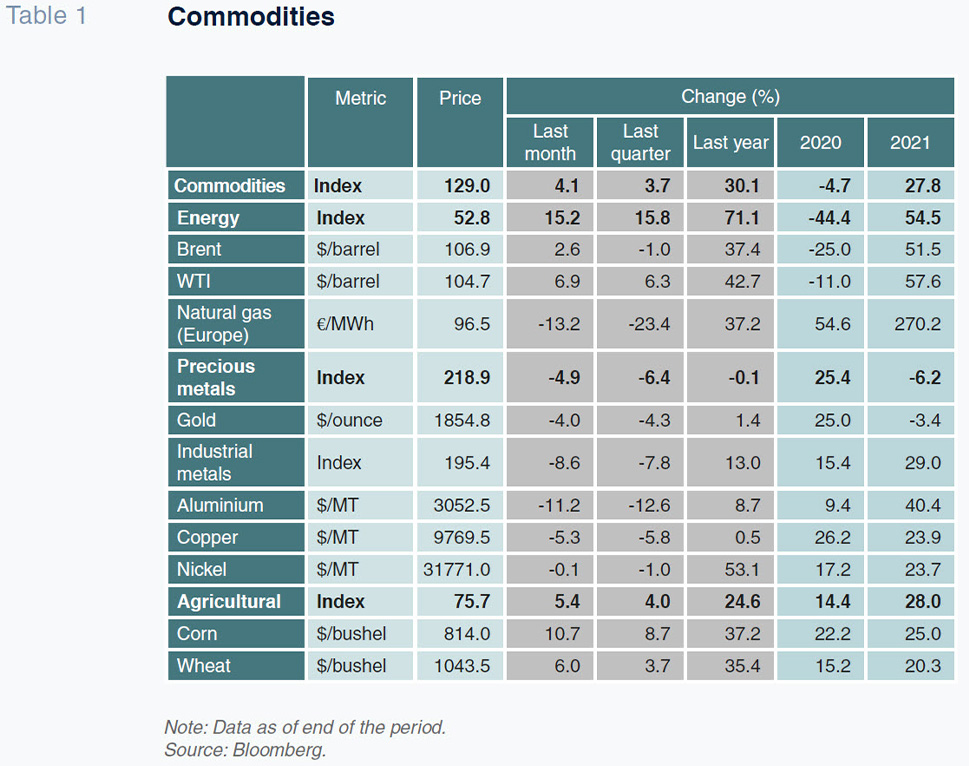

The transmission channels in the short-term include commodity prices, trade ties, confidence levels and financial stability. The most direct impact is already being felt in the form of the biggest increase in commodity prices since the 70s, which, in addition to its direct consequences for inflation, will rapidly spread to disposable income and, by extension, growth and employment. Between the start of the year and the beginning of May, commodity prices have surged 30%, with all categories registering growth, from energy (+60%), to industrial metals (+21%) and farm products (+26%).

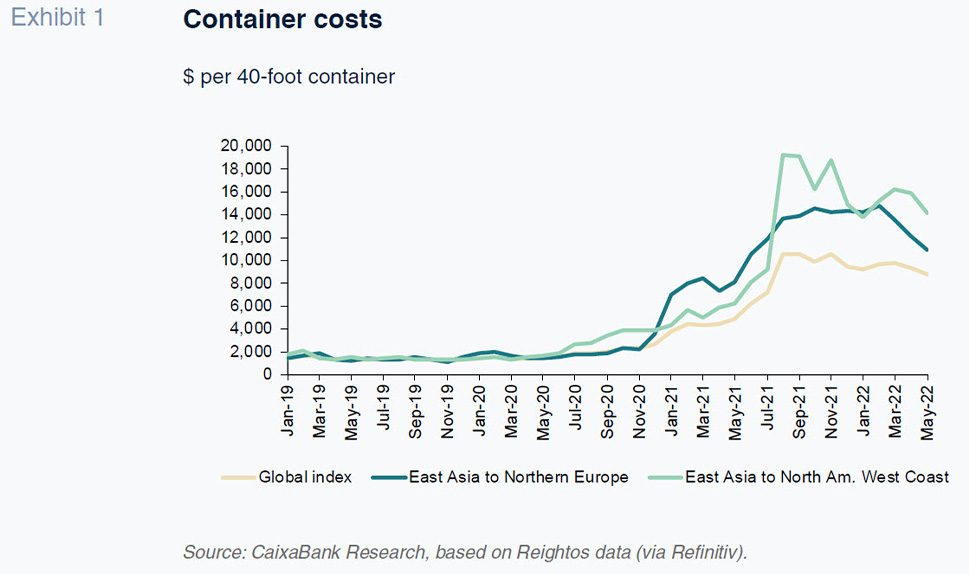

The problem is that the supply shock has come on the heels of a strong rally in the prices of these products in 2021 (+25%), due to supply chain bottlenecks. It is, therefore, a disruption that comes at a time when the effects of the mismatches between supply and demand that marked global economic trends in 2021 (evident, for example, in the cost of shipping containers) have not disappeared.

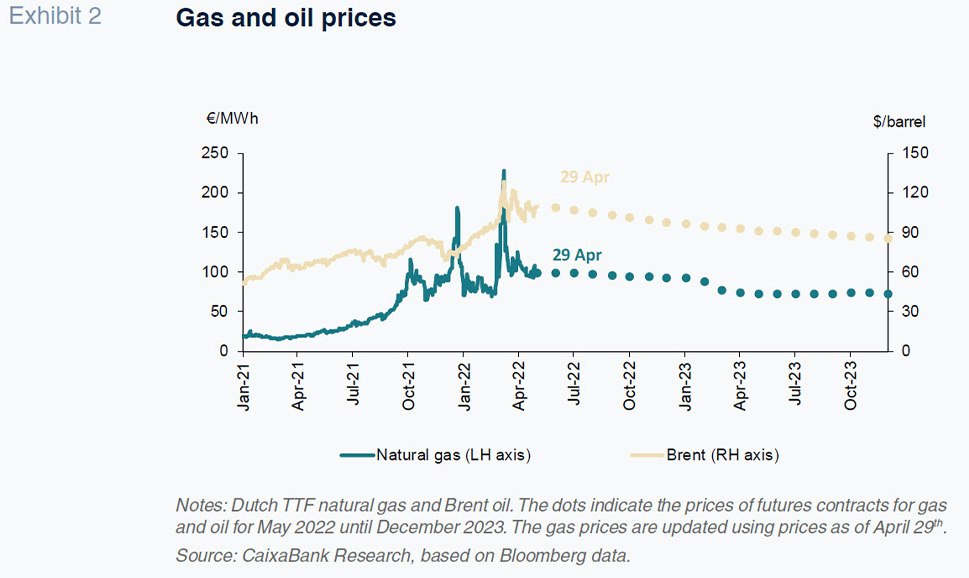

It is obvious that the spike in oil and gas prices will prove the main source of contagion, particularly in Europe, where Russia is the source of 20% of all oil imports and 35% of natural gas imports. According to the International Energy Agency, Russia is the world’s third largest oil producer, at 10.5 million barrels per day (behind the US and Saudi Arabia) and its exports account for 11% of the worldwide total.

Last December, nearly all of the economic scenarios for 2022 were predicated on the –all-important– assumption than crude prices would average around $75 (having rallied by 50% in 2021); today, futures prices point to a price of around $105/bbl this year and, more importantly, only a slight easing in 2023, to $96. By the same token, natural gas

[2] futures are pointing to an average price of €96/MWh this year (2023: €82/MWh), compared to €47/MWh on average in 2021. In short, since the start of the conflict, oil and natural gas futures contracts, in addition to presenting significant volatility, have priced in increases in the medium-term (2023 and 2024), assuming that the mismatch between supply and demand will not be resolved immediately.

If we assume a negative impact on growth of around 0.25pp for every €10 increase in average oil prices and of another 0.25pp for every €30/MWh increase in gas prices, it is very likely that a good number of the industrialised nations are looking at an adverse impact of close to one percentage point this year on account of the spike in energy prices alone. That will ultimately depend on the governments’ ability to accommodate the supply shock, limiting its incidence in the short-term so as to avoid second-round effects.

The good news is that households in most developed economies are still holding on to some of the surplus savings set aside in 2020 and 2021,

[3] which will help lower-income households to absorb the short-term effects of the increased prices of basic necessities. It is important to underscore the impact of the growth in agricultural commodity prices (over 50% since January 2021) for a good number of emerging economies for whom the weight of food in CPI is very high.

[4] According to the World Trade Organisation, 35 African countries are highly dependent on grains from Ukraine and Russia, which could lead to shortages and, thereby, considerable social tension, in the months to come.

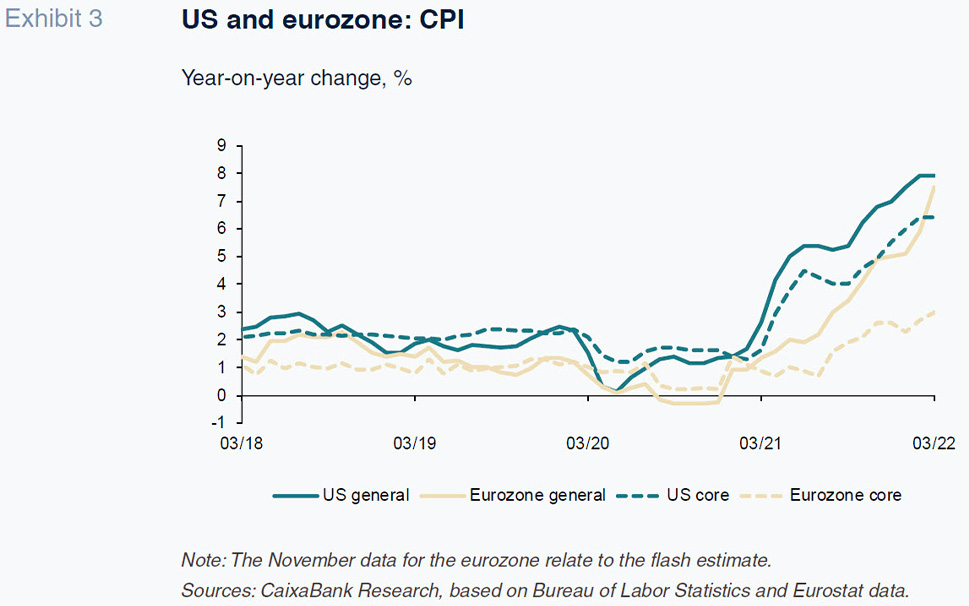

The problem is exacerbated by the fact that the supply shock comes at a particularly fragile time, as inflation had already been hovering at abnormally high levels [5] for a year. Following the contraction in global supply prompted by the widespread lockdowns of 2020, global production has been unable to keep up with the extraordinary rebound in global demand as soon as mobility restrictions were lifted, [6] compounded by the shift in consumer habits induced by the lockdowns and home-working phenomenon, triggering growth in expenditure on durable goods (computers, televisions, etc.).

The result is that the world’s sophisticated and efficient value chains have displayed fragility in the last two years in the face of events such as COVID and the armed conflict, in addition to the inability to adapt to changes in demand. Therefore, the supply shock comes immediately on the heels of another disruption, at a time of great economic fragility, with inflation well above expected levels and central banks likely to be proven with hindsight to have been behind the curve in trusting for much of last year that the spike in prices would prove transient. All of which limits the scope for monetary policy intervention and increases the likelihood of second-round effects.

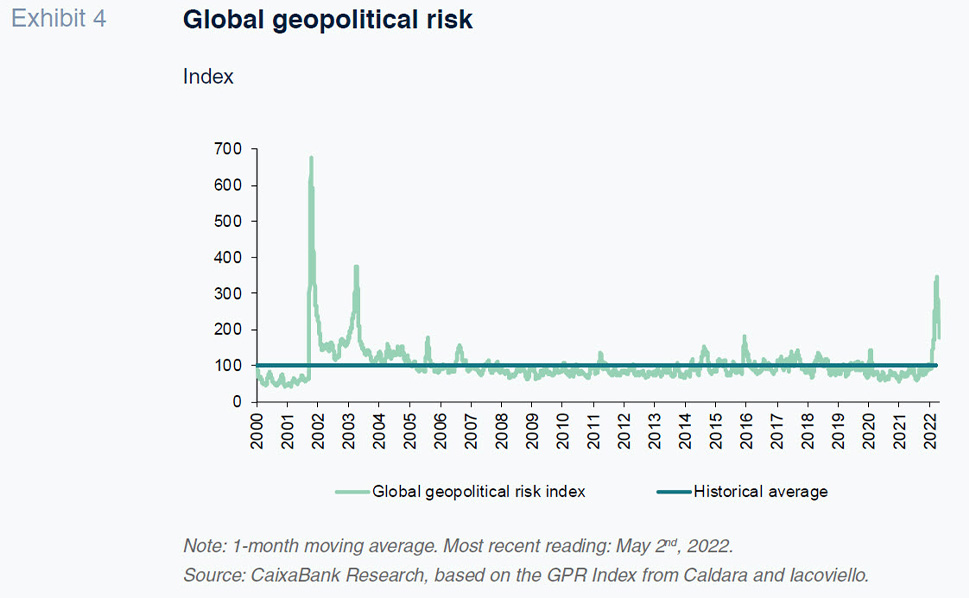

The second channel of transmission is the increase in uncertainty and its impact on confidence and spending and investment decisions, given that we are watching the war play out live, in real time, over social media. The Caldara and Iacovello geopolitical risk index (GPR) has almost doubled from before the hostilities began. Moreover, it has reached its highest level since the onset of the war in Iraq in March 2003 (Garcia-Arenas y Carreras Baquer, 2022).

How will the erosion of confidence affect economic agents’ decisions? For now, consumer confidence has eroded by more than business sentiment and within the corporate sector, the players in the manufacturing sector appear more concerned than those in services. Although all readings remain consistent with an economy still in growth territory. Nevertheless, as expected, confidence has eroded more considerably in Europe due to its proximity to the epicentre of the conflict. In April, the composite business sentiment index (PMI) came in at 51.0 points, down from 52.7 points in March, the lowest reading in 22 months. The key for growth, as is nearly always the case, will be the trend in private consumption, shaped by the negative effects of prevailing inflation on purchasing power and the existence of pent-up savings which could be released, potentially counteracting the downturn in expectations.

It is easier to predict the effects derived from trade ties with Russia, i.e., the trade channel effects. Russian goods and services exports account for around 2% of the global total (0.2% in the case of Ukraine). However, that exposure is very asymmetric: Russian imports account for 7% of gross goods and services imports in the EU-27, a figure that rises above 20% in the case of Bulgaria, and ranges between 8% and 17% in the case of Finland and the Baltic nations, compared to just 1% in Ireland or Spain, for example. The real problem, however, are the energy ties, as Russia is the world’s second largest oil exporter (with a share of 11%) and the largest natural gas exporter (25%), Europe being its main sales market. As a result, as expected, Russia is a prominent trade partner in the mining and coke refined oil derivative manufacturing sectors, where it commands shares of 21% and 42%, respectively, of total EU-27 imports. That high dependence is evident not only in the countries closest to Russia’s borders, but also across the EU’s major economies, including Germany, France and Italy, with percentages of between 13% and 20% in mining and 15% and 24% in refined oil products.

Using the OECD’s input-output tables

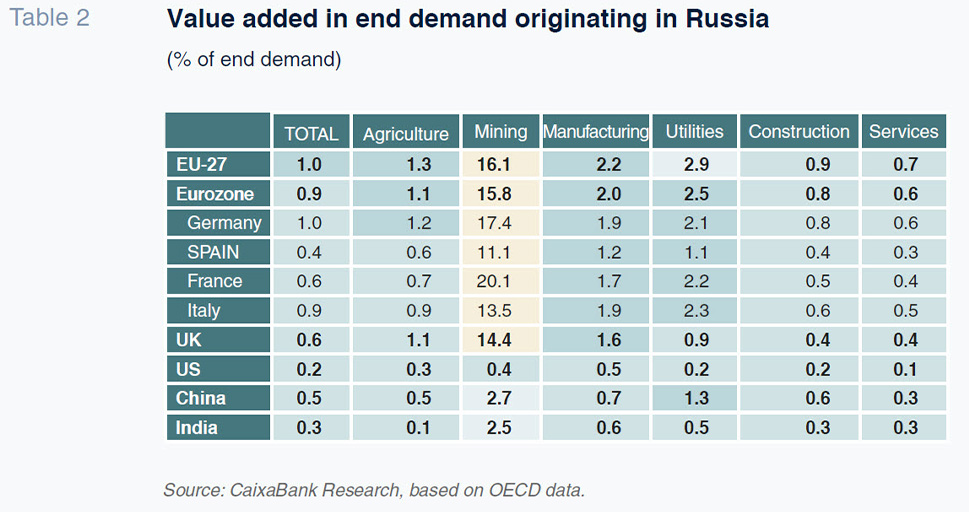

[7] it is possible to analyse gross imports by country and to filter for the effect of intermediate inputs to determine the real impact of a country in the productive process of its trade partners. It is a good way of approximating the level of economic integration and, therefore, interdependencies across countries and sectors. For example, if we import a good into a given country, but most of that good has been made in other countries, the gross import figures fail to reflect the reality of the underlying economic ties. Something which is possible with the OECD tables. As a result, it is possible to map out the origin of the goods produced, consumed and exported in a given country by filtering for the intermediate goods along the entire value chain.

As a result, if we focus on end demand in the various European countries, the weight of Russia in value added is not very significant, just 1% of the total. [8] By country, as expected, the more dependent countries are Lithuania (6.2%), Bulgaria (5.7%), Cyprus (4.4%), Latvia (4.1%) and Estonia (3.8%). [9] However, breaking the figures down at the sector level once again reveals widespread high dependence on Russian commodities in the mining (16.1%) and coke and refined oil product (16.8%) sectors. In other sectors such as electricity, gas and water services (utilities), that dependence is circumscribed to specific countries, including Bulgaria (26% of end demand), Slovakia (16%), Latvia (17.9%) and Lithuania (19%). Note that in the case of Germany, 17% of end demand for mining sector products comes from Russia, a figure that rises to 19% in the case of refined products. Spain is the EU country in which Russian imports account for the lowest share of end demand, although dependence in the mining sector is also high (11% of end demand). In short, data support the perception that the potential impact via trade ties is moderate as economic integration with Russia is not significant. The problem, however, is the relatively high dependence of strategic sectors, mainly energy related, in many countries. Indeed, Russia’s weight in the energy sector implies a significant ‘footprint’ in many products, most notably in certain manufacturing sectors.

Lastly, the financial channel is another potential source of transmission to growth, due to the banks’ direct exposure to Russia and the instability that could arise in certain segments of the financial markets as a result of monetary tightening in the wake of the slew of bad news on the inflation front in recent months. As for the former, the international banks’ exposure to Russia is very limited (around 100 billion euros) and has been halved since Russia annexed Crimea. In the case of the European banks, the only systems with significant exposure to Russian residents are those of Austria and Italy (4.5% and 1.5% of GDP, respectively); all other countries’ exposure is very small.

The run-up in inflation is set to have a more significant impact on the financial markets. Although inflation looks to be close to peaking in much of the OECD, the worry is the spillover to core inflation and the knock-on effects for long-term inflation expectations, which are edging nearer to 3% than 2% on both sides of the Atlantic. That is shaping a shift in central bank messaging and a sharp increase in the nominal yield demanded by investors all along the interest rate curve to compensate for their exposure to inflationary risks. The market is discounting more aggressive monetary policy normalisation with official rates currently expected to reach close to 3% in the US and 1.5% in the EMU. [10] Those levels would have a potentially moderate effect on financial stability and growth, especially if they are sufficient to anchor inflation expectations at 2%, although they contrast with the financing conditions economic agents have gotten used to over the last decade (average 12m EURIBOR: 0.05%).

In the short-term, therefore, we are looking at a very different scenario to that seen in recent decades and the key lies with the interaction between interest rates, inflation and uncertainty all at much higher levels than we are used to, especially for highly indebted economies. The fact that the economic structure and the flexibility of the factors of production are very different from those prevailing in the 1970s reduces the risk of stagflation. However, it will not be easy to conduct economic policy in order to protect the more vulnerable agents’ income, apportion the loss of activity generated by a supply shock fairly, allow prices to send the right signals for rebalancing the markets most affected by the war or avoid second-round inflation effects. Or at least not without triggering a cooling-off in economic activity in light of the need to normalise monetary policy. As the economic authorities face the umpteenth crossroads in recent years, the price to be paid for an appropriate response to the current challenges (political and economic) could be stagnant growth for two or three quarters in exchange for minimising the threat of stagflation, which would imply many more sacrifices in the medium-term.

Structural changes

Although the effects of the armed conflict on economic prospects will remain front of mind over the coming months, the longer-term impacts on some of the trends that have shaped global economic performance in recent decades may prove even more important. The search for greater strategic autonomy (especially in Europe) will drive the reformulation of foreign policy, including energy, defence and competition policies, with knock-on effects for the economy. It is obvious that the return to areas of geopolitical influence will have negative impacts on foreign trade, just as doubts about the resilience of value chains are beginning to translate into incipient searches for vertical integration in sectors where the supply chain bottlenecks have been particularly disruptive. In fact, in its most recent World Economic Outlook (WEO), the IMF warns of the return of a global economy split into geopolitical blocks with different technology standards, cross-border payment systems and, even, reserve currencies. The consequence would be a reduction in potential output (loss of efficiency in the long-term), increase in volatility and a long adaptation process if the framework that has governed international trade relations during the last 75 years breaks apart.

In short, after three decades of progress, the globalisation process is now being challenged by a host of open-ended issues (COVID, geopolitics, trade wars, etc.), thus raising the question of whether it might be necessary to redesign a global production chain that has not been capable of getting back on its feet in over five years. The loss of efficiency in global supply could be offset by reduced dependence on countries presenting high political risk. Such regimes with ‘poor-quality democracies’ represent 31% of global GDP (The Economist, 2022) and imply a risk for trade relations that is hard to quantity or cover. Country risk analysis can assess a country’s payment capacity by analysing its liquidity and solvency but it is much harder to estimate non-democratic regimes’ ‘willingness’ or ‘inclination’ to adhere to openness and rule of law. It is harder, therefore, to measure political risk.

We are not only talking about moral matters, but also security in the event of disruptive effects caused by political tensions. We can call it deglobalisation, reglobalisation, nearshoring or strategic autonomy but either way we are moving towards the reformulation of value chains, which will imply sacrificing a degree of efficiency in order to gain resilience. It is impossible to tell where that change of paradigm will lead us but it is unlikely we’ll ever get back to the status quo we had before Trump took power.

The question is not whether we are on the cusp of a deglobalisation process but rather what is the best way of transitioning towards a new equilibrium. That process will not be easy, immediate or cost-free but in all likelihood the changes are already underway. The paradox is that globalisation, apparently the most robust vertex of the Rodrik trilemma [11] up until the pandemic, may now be the component that has to be sacrificed in light of the wear and tear sustained in recent years.

The good news is that Europe has once again responded forcefully to a huge challenge for the second time in just over two years. If the European integration process advances piecemeal between crises, the materialisation of three major moments of instability (financial crisis, COVID and Ukraine) since 2008 has raised the gauntlet. A response of the calibre warranted by the circumstances wrought by the war in Ukraine, as we are seeing to date, will require reconfiguring economic, foreign, defence and energy policy, so giving the much awaited definitive push towards European integration.

Notes

The downgrade compared to the October 2021 forecasts is 1.3 percentage points.

Dutch TTF Gas Futures, the benchmark used in Europe.

Surplus savings in Spain are estimated at close to 90 billion euros, most of which are in liquid assets, which in an environment of rampant inflation should be used to offset the loss of purchasing power.

According to the IMF, food represents 40% of consumer spending in Sub-Saharan African countries, compared to 20-25% in other emerging economies and 16-18% in developed economies.

Year-on year rates of CPI in April: 7.5% in the EMU, 7.4% in Germany, 8.3% in Spain and 8.3% in the US.

Demand fuelled by extremely expansionary monetary and fiscal policies.

TiVA (Trade in Value Added).

For example, in China, that share is 2%.

The incidence of the value added by Russia is minimal in the US (0.2%) and in China (0.5%).

The increases observed along the rate curve are as follows: 12m EURIBOR at 0.2%; the 12/12 FRA at 1.5%; the 10Y Spanish bond at 2% and the 10Y Treasury bond at 3%.

It is not possible to pursue globalisation, national sovereignty and democracy simultaneously; one must be sacrificed.

References

CANALS, C., PINHERO, L. and SÁNCHEZ, R. (2022). European dependence on Russia: a primary issue. Monthly Report. Caixabank Research.

THE ECONOMIST (2022). Trading with the enemy (March 2022).

GARCIA-ARENAS, J. and CARRERAS BAQUER, O. (2022). Geopolitical uncertainty and economic growth: the indirect impact of the Ukraine conflict in Spain. Monthly Report. Caixabank Research.

IMF (2022). World Economic Outlook, April.

José Ramón Díez-Guijarro. Caixabank Research and CUNEF