Spanish economic forecasts panel: May 2022*

Funcas Economic Trends and Statistics Department

Consensus GDP growth forecast for 2022 trimmed to 4.3%

The Spanish economy grew by 0.3% in the first quarter of 2022, according to the provisional numbers, 0.4 percentage points below the consensus forecast. Domestic demand detracted from growth by 1.2 percentage points, driven by a sharp drop in private consumption, whereas external demand contributed 1.5 points, thanks to growth in exports combined with a drop in imports. As for the start of the second quarter, the scant indicators available so far point to contraction or similar readings to those observed in previous months, other than the service sector indicators, which are rebounding strongly (confidence index, PMI and Social Security contributor numbers).

The consensus forecast for GDP growth in 2022 stands at 4.3%, down 0.5 points from our last survey, with 15 of the analysts having trimmed their estimates. As for the quarterly profile, the analysts are expecting lower growth for the remainder of the year (Table 2).

Domestic demand is expected to contribute 3.3 percentage points, down 0.8 percentage points from the last set of forecasts. The analysts have cut their forecasts for public and private consumption, and for investment, especially construction, sharply. External demand, meanwhile, is expected to make a one-point contribution to GDP, up 0.3 percentage points from the last set of estimates, shaped by lower import estimates (Table 1).

The forecast for 2023 is 3%

The consensus forecast is for growth of 3% in 2023, implying a 1.3 percentage point slowdown with respect to the 2022 forecast. That forecast is in line with the most recent forecasts published by the Bank of Spain and international organisations, such as the IMF.

The anticipated slowdown is attributable to a slight easing in the contribution by domestic demand but above all to the expectation of a flat contribution by foreign trade (which is expected to contribute one point to growth this year) (Table 1).

Inflation expected to ease in 2023

The headline inflation rate continued to climb to a new record level of 9.8% in March. In April it fell back to 8.3%, but core inflation continued to rise, to 4.4%. The reduction in headline inflation points to an easing in energy product tightness; however, the increase in core inflation suggests that higher production costs are being passed on to less volatile components of the index.

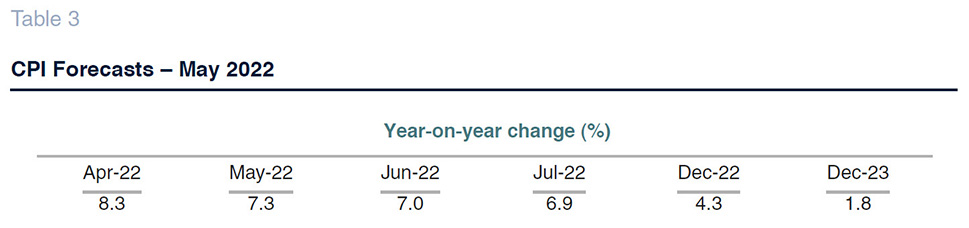

The consensus forecast for average inflation in 2022 has increased by 1.5 percentage points to 6.9%. Headline inflation is expected to trend lower over the course of the year to reach 4.3% year-on-year by December (Table 3). In 2023, inflation is expected to come down considerably to 2.2% on average and to end the year at 1.8% year-on-year. Core inflation, meanwhile, is estimated at 3.6% and 2.4% in 2022 and 2023, respectively.

Unemployment rate could fall to 13.2% in 2023

According to the labour force survey, employment increased by 1.1% in the first quarter, adjusting for seasonal effects, marking slight easing from the growth observed during the last two quarters. The rate of unemployment decreased 2.3 percentage points year-on-year to 13.6%.

The rate of growth in Social Security contributors points to a more pronounced slowdown in job creation in the first quarter than that gleaned from the labour force survey. However, that reading registered strong growth in April, albeit concentrated in the services sector in general and the hospitality sector in particular. The consensus forecast for job growth in 2022 has been trimmed by 0.6 percentage points to 2.9%; the forecast for 2023 is for growth of 1.9%.

The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULCs). Productivity per full-time equivalent job is expected to increase by 1.4% this year and by 1.1% in 2023. Meanwhile, ULCs are expected to increase by 1% in 2022 and by 1.2% in 2023.

The average annual unemployment rate is expected to continue to come down to 13.7% in 2022 (down 0.2pp from the last Panel) and to 13.2% in 2023.

Ongoing balance of payments surplus

According to the definitive figures, Spain recorded a current account surplus of 11.3 billion euros in 2021, which is 0.9% of GDP – slightly greater than the surplus of 9.25 billion euros recorded in 2020. In the first two months of 2022, the trade surplus deteriorated year-on-year, while the income deficit narrowed. As a result, the current account deficit deteriorated by 622 million euros.

The consensus forecasts point to a current account surplus of 0.6% of GDP in 2022 (down 0.1pp from the last survey) and of 0.7% in 2023.

Downtrend in public deficit

Spain recorded a public deficit of 6.8% of GDP in 2021, 0.5 percentage points below the consensus forecast, compared to a deficit of 10.1% in 2020. Throughout the first few months of 2022, the various levels of government are displaying a considerable improvement in their financial health.

The analysts are expecting the deficit to come down over the next two years to 5.5% in 2022 and to 4.8% in 2023. Those numbers would imply missing the government’s targets by 0.5pp and 0.9pp, respectively.

International context marred by consequences of the war

The outlook for the global economy has become more uncertain since our March survey. The invasion of Ukraine has compounded existing tensions in the energy and commodities markets. Faced by the risk of supply shortages, Brent oil is trading at around $115/barrel, compared to $100 in March, while the benchmark for gas prices in Europe, the TTF index, remains at high levels fuelled by the fear of an interruption in supply from Russia. The collapse in exports from the regions affected by the conflict has also sent cereal prices soaring, with grave consequences for the major importing nations, particularly the poorest countries. All of which, exacerbated by the Chinese government’s zero COVID policy, has triggered further supply chain disruptions, intensifying bottlenecks in industry, as evidenced in the manufacturing PMI suppliers’ delivery. Geopolitical turbulence and supply chain friction are aggravating inflationary pressures, foreshadowing monetary policy tightening. The Federal Reserve has embarked on rate tightening, which has had ripple effects on the financial markets.

All of this has clouded the prospects for economic recovery. In its spring forecasts, the IMF cut its estimate for global growth in 2022 by 0.8 percentage points to 3.6%. More recently, the European Commission has also revised its forecasts for the European economy downwards. It is now forecasting growth of 2.7% in 2002, down 1.6 points from its last forecast, made before the war broke out, and growth of 2.3% in 2023 (down 0.1pp).

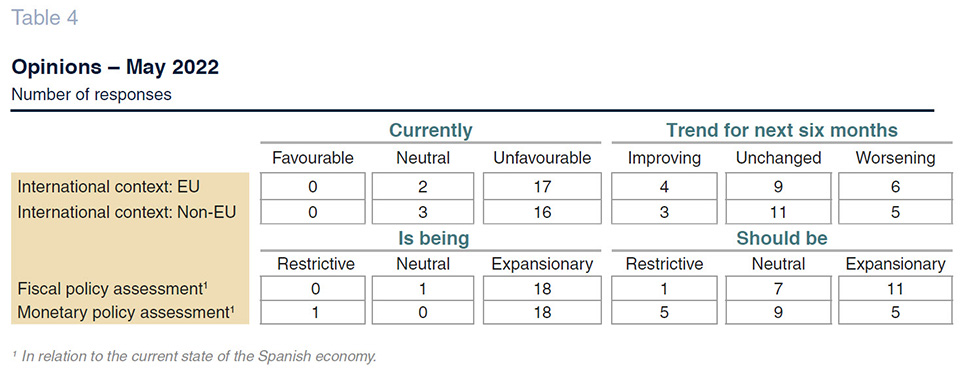

Virtually all of the analysts surveyed view the external climate as unfavourable, both in the EU and beyond, an assessment unchanged from the last Panel. And a wide majority of analysts believe that negative environment will persist or deteriorate in the months to come.

The withdrawal of monetary stimulus measures is accelerating in the face of persistent inflation

Given the persistence of inflationary pressures as a result of the run-up in the cost of energy and other inputs, the leading central banks are accelerating the withdrawal of their monetary stimulus measures. That shift is ushering in the end of the public and private debt repurchase programmes (both those initiated during the pandemic and those previously in existence), obliging the various states to refinance in the capital markets, without the backing of a central bank. Meanwhile, the Federal Reserve has already increased its benchmark rate twice (from 0-0.25% at the start of the year to 0.75-1% today) and has announced additional hikes in the coming months. The ECB is emitting increasingly explicit signs that it plans to increase the rate on its deposit facility, stuck in negative territory since 2014. The challenge is to contain second-round effects from energy inflation without sparking financial tension in the eurozone of the calibre seen in 2011.

The markets have taken stock of the shift in monetary policy. 12-month forward EURIBOR (the leading indicator for the trend in the deposit facility rate, controlled by the ECB) has tightened from -0.24% in March to above +0.2% at the time the Panel results were written up, the first positive reading since 2016. The yield on the 10-year Spanish bond is trading above 2.1%, compared to 1.4% in March. The risk premium has widened slightly to close to 110 basis points.

The analysts expect market rates to continue to inch higher over the projection horizon (Table 2), reflecting significantly sharper tightening than they had been forecasting in March. EURIBOR at the end of the projection horizon is estimated at 1% and the yield on 10-year Spanish bonds, at 2.5%.

Euro approaching parity with the dollar

Monetary tightening is proceeding at a faster rate in the US than on this side of the Atlantic, driving euro depreciation against the dollar. The exchange rate is approaching parity compared to €/$1.10 in March. The analysts, however, expect monetary conditions to converge, enabling the euro to regain some of the ground lost against the greenback during the projection horizon (Table 2).

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.