Responses to the energy crisis: The cases of Germany, France, Italy and Spain

The emergency measures rolled out in Germany, Spain, France and Italy to mitigate the impact of the war in Ukraine provide a short-term solution to the budding energy crisis. However, their long-term efficacy is questionable, and they also exacerbate tensions between inflation-curbing targets and energy model transformation ambitions, highlighting the importance of formulating a big-picture plan to transition away from the recent measures towards a long-term, sustainable energy strategy.

Abstract: The global shortage of fossil fuels, which developed in the middle of last year and gained momentum in the aftermath of the invasion of Ukraine, has had a strong macroeconomic impact. The most visible effects are higher inflation and slower economic growth, moving Europe to the brink of stagflation. In this context, this article compares the responses to the energy crisis of Germany, France, Italy and Spain. All four countries carried out similar measures, with a view to: i) cushion the impact of higher energy costs on vulnerable households and enterprises (especially in Germany and France); ii) directly curb inflation via oil price subsidies (all four countries) or electricity price caps (notably France and Spain); and iii) tackle windfall profits (in particular in Italy). These initiatives may help attenuate consumer price trends, while also reducing the burden of the crisis on disadvantaged groups and sectors. However, they are temporary in nature, so they are not necessarily adapted to a long-lasting crisis – not to mention the fact that their cost to the public accounts ranges from 15 to nearly 30 billion euros over the next few months. Moreover, the measures leave entirely open their consistency with energy transition goals.

Introduction

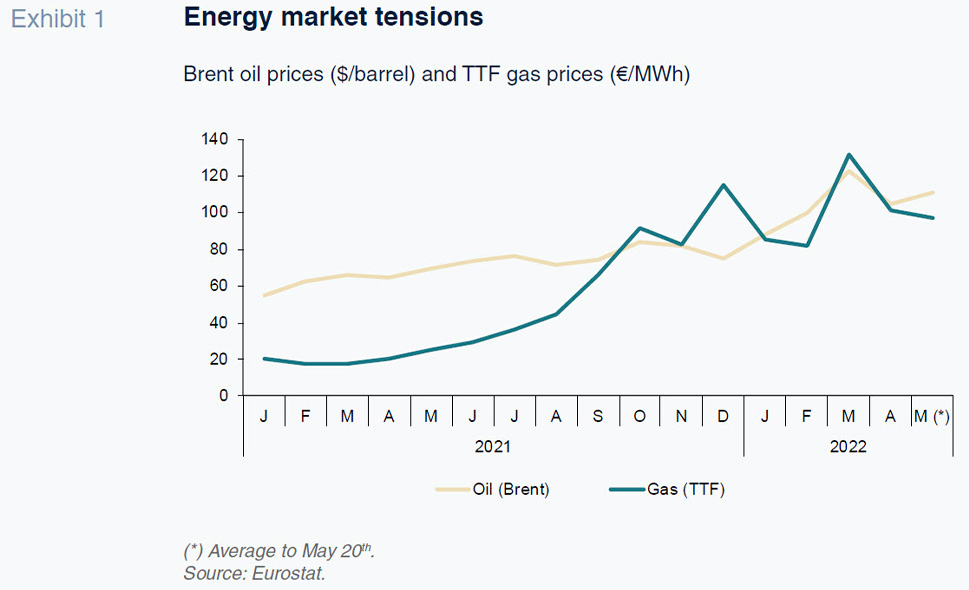

Having collapsed in the midst of the pandemic as a result of the economic paralysis, the energy markets have roared back to life, generating a supply shock which is spreading through the global economy. A barrel of Brent crude oil is currently trading at over 110 dollars, which is nearly four times the price observed at the start of 2021 (Exhibit 1). Over that same period, the benchmark for gas prices in the European market (Dutch TTF futures) has increased more than fivefold (to close to 85 euros per MWh). In both markets, in addition to the clear-cut rally, prices have been highly volatile, especially since the invasion of Ukraine.

This scenario has clouded the economic outlook, particularly for net importers, such as the European Union. [1] In the face of such a deterioration in expectations, governments have rolled out different emergency measures, as outlined in this paper, which focuses on the responses to the energy crisis in Germany, Spain, France and Italy – the EU’s four largest economies.

Objectives of the measures

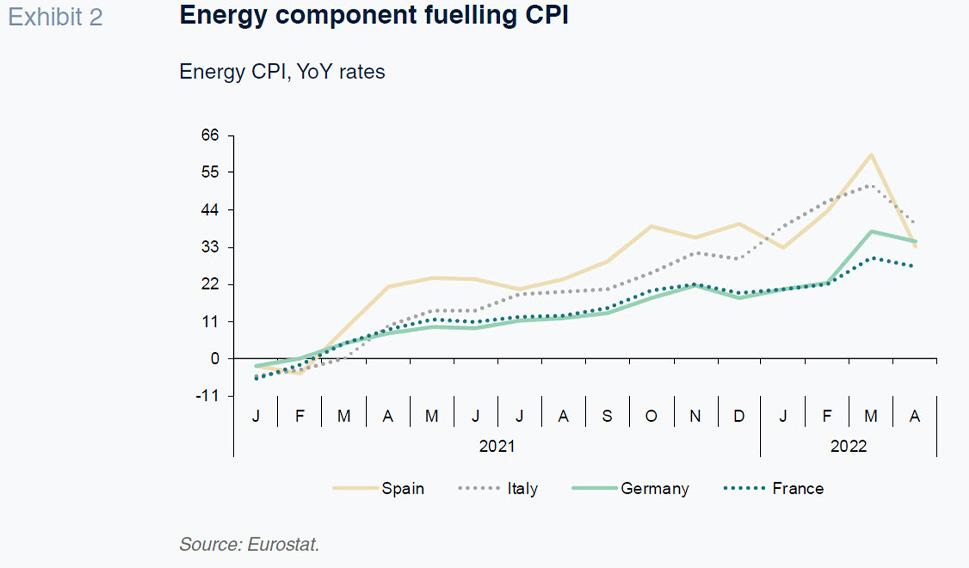

The emergency plans rolled out in recent months are designed to mitigate the main channels of transmission of the exponential growth in energy prices, chief among which inflation, which is rising sharply in all European countries. In April, eurozone CPI reached 7.4%, fuelled mainly by energy costs (Exhibit 2). As is well known, Russian gas is crucial to electricity price formation, even in countries like Spain whose dependence on Russia is relatively small. Higher electricity bills are precisely what caused the abrupt uptick in inflation observed since mid-2021. More recently, the higher cost of electricity has spilled over to other goods and services, driving core CPI to close to 3.5%. As a result, the primary goal pursued by the measures taken so far is to control energy prices, the prime source of prevailing inflation.

Secondly, policies also seek to shield specific vulnerable groups from the effects of inflation. As household income is increasing at a slower pace than spiralling prices (average collectively-bargained wages are increasing by less than 3% in all four economies under analysis), purchasing power is being eroded. To keep up their spending, households can dip into the savings set aside during the pandemic. However, since that is not happening so far, an abrupt slowdown in consumption is unavoidable. Moreover, low-income households with meagre savings buffers are facing major difficulties making ends meet, thereby sparking social unrest.

Spanish businesses are also encountering new difficulties in the form of costs that were already rising sharply before the conflict. In Spain, for example, the industrial price index registered unprecedented year-on-year growth of 47% in March, fuelled by energy costs (135%), spilling over to non-energy products (14%). That sharp upward trend echoes, above all, the surge in the cost of commodities and other crucial inputs, such as chips and metals. So far, the growth in those costs has only been partially passed on to end prices by non-energy firms, suggesting that profits are being squeezed, thus threatening another harsh blow for businesses less than two years after the eruption of the pandemic.

That squeeze on margins, coupled with bottlenecks and the uncertainty exacerbated by the war, is weighing on business investment. Without a doubt, the European funds can offset this risk to a degree. For that to happen, however, in addition to resolving the delays in their management, it is important to prioritise deployment of the funds so as not to add further to inflation. Some sectors, like construction, were already experiencing rising costs and supply issues before the conflict.

Thirdly, to finance some of the spending triggered by the cost-compensation schemes, governments have introduced other measures designed to reduce the windfall profits reaped in the wholesale electricity market, a marginal price system.

Key lines of initiative

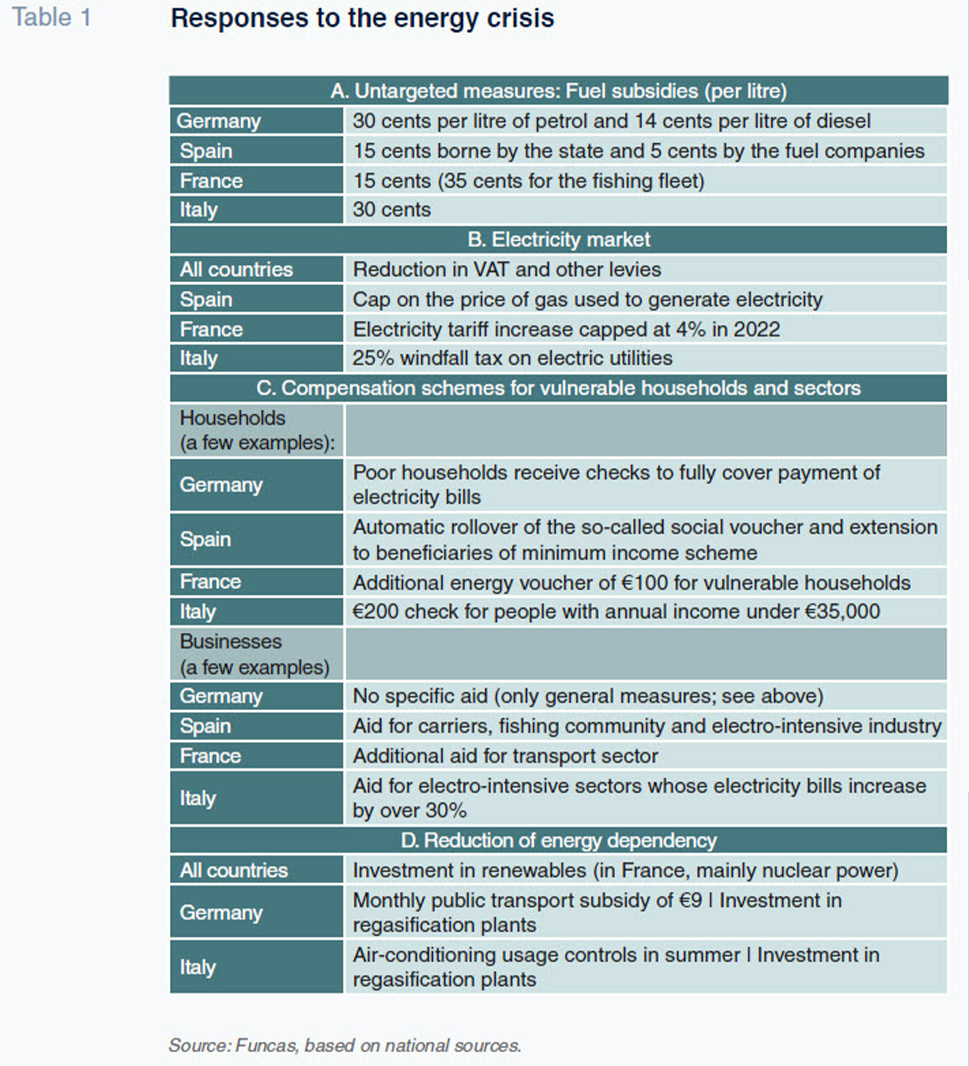

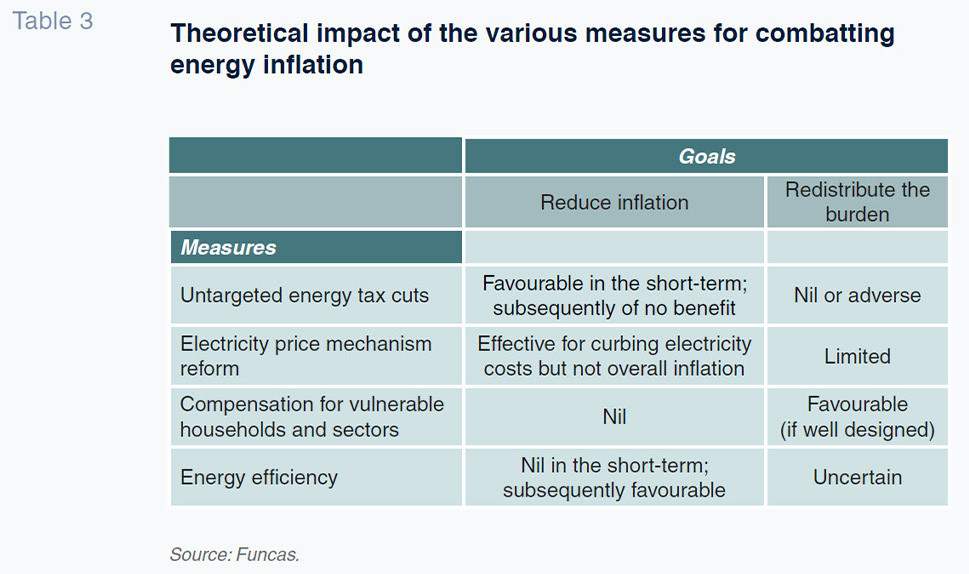

More specifically, governments are trying to contain energy inflation and its impacts by means of four different lines of intervention: untargeted tax measures; reforms designed to alter how the market –especially the electricity market– operates; compensation for specific groups; and initiatives designed to encourage energy savings and the use of alternative sources of supply. [2]

The measures with the most immediate impact include all-encompassing energy tax breaks and subsidies to alleviate energy bills for consumers as a whole –

i.e., these are untargeted measures. The most common such measure consists of reducing duties on hydrocarbons, applicable to individuals and businesses alike, irrespective of their income levels. The most emblematic, announced in the context of deep social unrest as a result of the sudden spike in oil prices, includes a discount at petrol stations, ranging from 20 cents per litre of fuel in Spain to 30 cents in Germany and Italy and up to 35 cents in France (Table 1). Another widespread move has been to cut VAT on energy products and other indirect taxes and surcharges on electricity consumption.

Given their untargeted nature, these measures are proving particularly expensive for the public coffers. In Germany, for example, the budget impact is estimated at 15 billion euros.

Electricity price formation reforms, designed to take direct aim at inflation, are more heterogeneous. France is the only one of the four major economies to limit the price paid by end consumers for their electricity – price increases have been capped at 4% for 2022, so that costs that exceed that threshold will generate a tariff deficit, which will be borne by the public operator (adding to EDF’s debt, which at year-end 2021 stood at 43 billion euros).

In Spain, the authorities are negotiating a price mechanism with the European Commission that will limit the price of gas used in the electricity market and is expected to take effect in the coming weeks. That limit will initially be set at 40 euros, almost half of the traded price (on MIBGAS) in May, from where it will gradually increase to 70 euros. That mechanism, which will be put in place for one year, will alleviate electricity bills (official estimates put the saving at around 15% to 20%). However, unlike the French measure, it will not prevent price fluctuations. Indeed, the difference between the price cap and market gas prices will be offset in electricity bills depending on the energy consumed.

All of the countries analysed have rolled out ambitious energy cost compensation schemes. Here the goal is not to contain inflation but rather to mitigate its impact on the more vulnerable groups. These schemes pay particular attention to individuals facing financial difficulties. In Germany, the lowest income households will receive checks to cover their electricity bills in full, whereas in the other three countries, the governments will hand out vouchers as a function of income levels and, in the case of Italy, recipients’ health situation. These schemes also contemplate a broad range of circumstances affecting businesses, including carriers, the fishing community, electro-intensive industries and small companies in general. The only exception is Germany, which is not providing businesses with any specific aid.

Among those initiatives, it is worth highlighting the 20% reduction in energy bills for businesses in electro-intensive industries in Italy experiencing price increases in excess of 30%. These are, therefore, income compensation schemes similar to those rolled out during the pandemic to help the sectors most affected by the business restrictions.

Lastly, in terms of reducing dependence on hydrocarbons, particularly Russian oil and gas, some modest steps have been taken to limit demand for energy, such as the reduction in public transportation prices in Germany and the obligation in Italy to set air-conditioning thermostats at no less than 25 degrees this summer. Demand-curbing measures are not therefore the governments’ preferred choice in tackling the energy crisis. In contrast, the promotion of renewable sources of energy, electric vehicles and energy-efficiency investments is fairly common in the EU. That effort is being intensified under the scope of the Next Generation EU funds and comes as good news for Spain, which presents a significant comparative advantage in the sector.

Elsewhere, given Russia’s threats to cut off gas supplies altogether, efforts have intensified to diversify sources of supply, including the construction of new regasification plants (particularly in Germany and Italy), expansion of storage capacity and upgrade of interconnection infrastructure in Europe. France, in particular, is prioritising consolidation of its nuclear power programme.

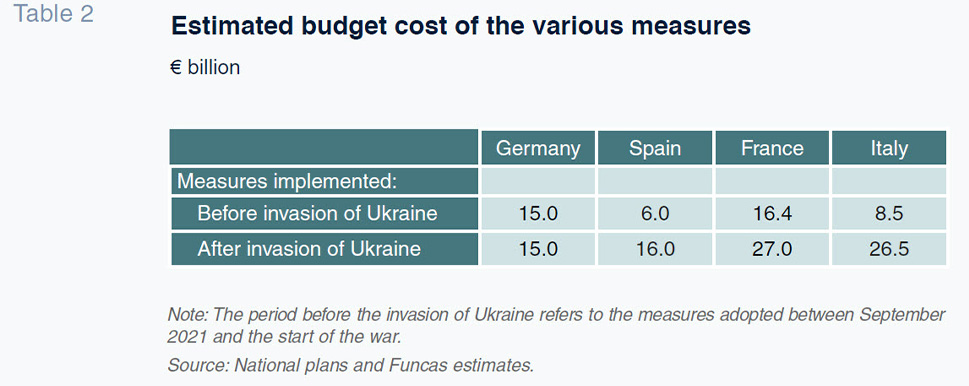

The budget costs of the emergency plans are considerable (Table 2). The funds earmarked prior to the invasion of Ukraine amounted to between 6 and 16.4 billion euros. Since then, all of the economies have rolled out emergency measures with an additional cost of between 15 billion euros in Germany and 27 billion euros in France. Moreover, they are time-limited measures which may have to be extended depending on the course taken by inflation. All of which before considering the cost of the investments announced to reduce dependence on Russian gas. As noted above, the measures applied to the population at large, such as the fuel price subsidies, are the most onerous. The energy investment programmes are also costly in the short-term but are expected to deliver savings in the medium- to longer-term.

Finally, it is worth noting that each country plans to finance those programmes differently. France is essentially using the general state budget, whereas Germany and Spain are tapping part of the tax receipts generated directly by the growth in prices (via VAT or carbon allowances, for example) to finance their measures. Italy has introduced a windfall profit tax of 25% in the energy sector.

Expected effects

The four types of measures described in the previous section exert different economic impacts, at least in theory (Table 3). The most immediate measures deployed to curb inflation are the widespread reductions of energy taxes and surcharges, with a direct impact on the prices borne by consumers. However, their effectiveness tends to get diluted over time. Moreover, by failing to focus on the neediest consumers, across-the-board cuts are usually relatively costly for the public coffers, while only of limited effectiveness in terms of shielding the business community. Lastly, measures of this kind interfere with market signals, therefore conflicting with energy transformation goals.

Changes to price formation mechanisms can also help thwart the inflationary spiral in the short-term. One example is to place a cap on the price of the gas coming into the electricity system. [3] Depending on its design, the cost-benefit trade-off of this measure could be relatively favourable. However, this formula also creates the need to ensure market rules contemplate incentives to shift to renewable energy and transform production and consumption habits.

The income compensation schemes targeted at vulnerable groups and sectors are undoubtedly the most effective at shielding the productive apparatus and fostering social cohesion. However, they do not have a direct impact on inflation; nor do they provide an incentive for structural transformation. The lessons offered by the aid provided to heavy industry in the 1970s highlight the importance of accompanying relief measures with energy-efficiency incentives or run the risk of artificially propping up zombie technologies in the long-run.

Programmes designed to foster energy savings and investment in renewable sources are therefore essential even though they will only tackle the effects of the crisis in the long-term. Their effectiveness will depend on the coherence between those investments –covered by the European funds– and market incentives.

In short, the emergency plans rolled out in the wake of the onset of war in Ukraine provide a short-term solution to the budding energy crisis. However, they are unlikely to tackle inflationary forces in a durable manner. They also exacerbate the tension between inflation-curbing targets and energy model transformation ambitions. The effectiveness of some of the initiatives, particularly non-targeted tax cuts or widespread fuel subsidies, is questionable, despite being the option of choice for all four economies analysed. All of this highlights the importance of moving away from the recent measures justified by the urgent circumstances towards a strategy which takes into account long-term energy transition goals.

Notes

As noted in the IMF’s World Economic Outlook of April 2022.

See the latest Bank of Spain’s annual report.

Raymond Torres. Director of Macroeconomic and International Analysis, Funcas