Spanish economic forecasts panel: July 2020*

Funcas Economic Trends and Statistics Department

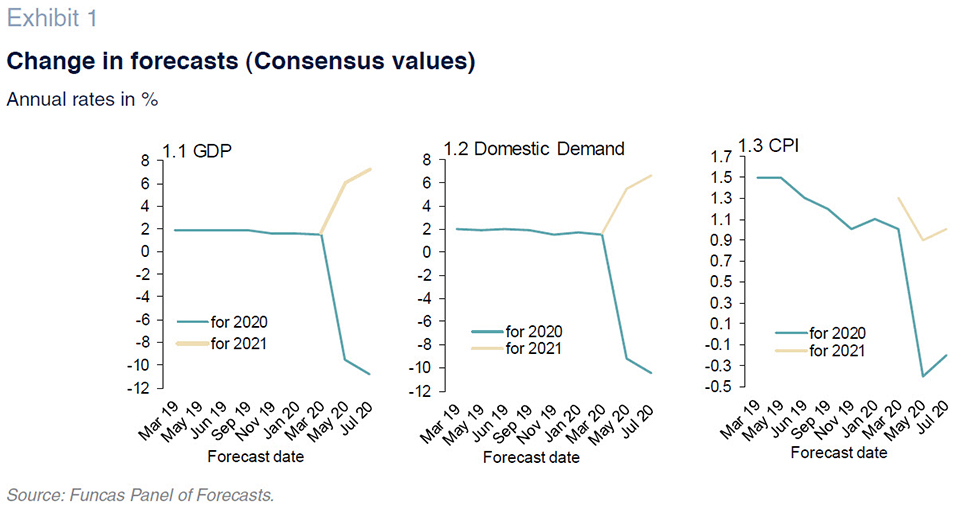

The Spanish economy will contract by 10.8%, worse than previously expected

The available indicators suggest that, following the sharp contraction sustained in the second half of March as a result of the measures adopted to curb the pandemic, GDP hit bottom in April and embarked on a recovery in May which picked up steam in June as the various lockdown restrictions were rolled back.

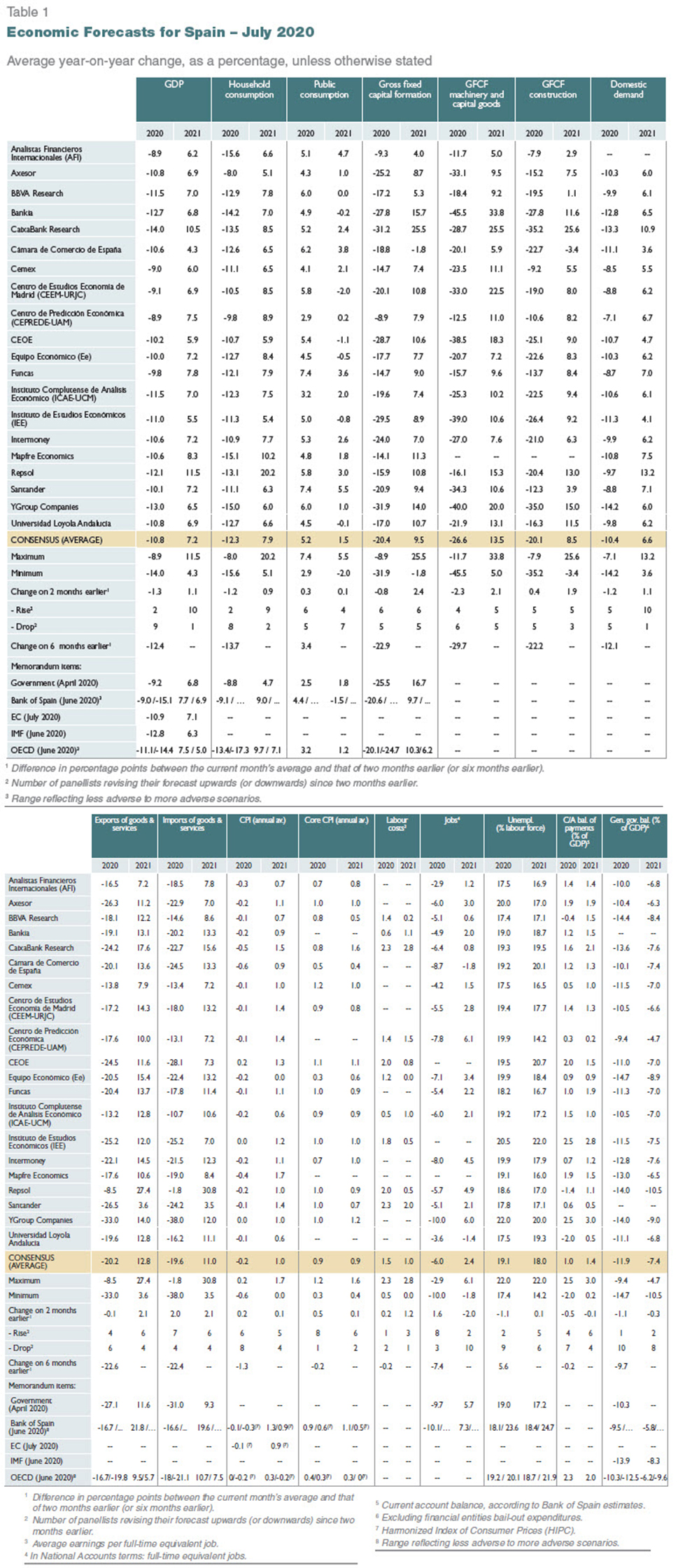

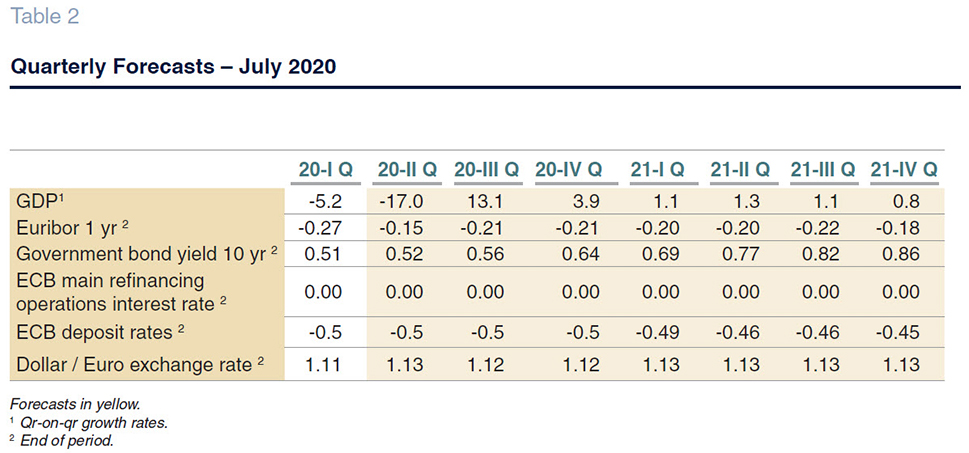

The consensus GDP forecast for 2020 is for a contraction of 10.8%, up from 9.5% in our last report, with nine of the panellists having become more pessimistic (Table 1). The quarterly pattern forecast is as follows: -17% in 2Q20, +13.1% in 3Q20 and +3.9% in 4Q20 (Table 2).

Both domestic demand and foreign demand are forecast to detract from GDP growth. The former is expected to erode GDP by 10.1 percentage points (1.2 points more than in the last set of forecasts) and the latter by 0.7 percentage points. The analysts agree that the various components of private demand will be hit hard but their forecasts fall within a wide range, particularly with respect to investment. Foreign trade is similarly expected to sustain a significant fall, although it is worth noting a slight improvement in the forecast for the drop in imports compared with the last report. Public spending is the only component expected to stay clearly in positive territory.

The consensus growth forecast for 2021 has increased to 7.2%

The consensus forecast for growth in 2021 stands at 7.2%, which is up 1.1 percentage points from the May report, with the following quarterly growth profile: 1.1%, 1.3%, 1.1% and 0.8% (Table 2). That means that the recovery in 2021 will remain incomplete, serving to only partially mitigate the contraction sustained in 2020.

The rebound in 2021 should be driven mainly by renewed domestic demand –forecast to contribute 6.4 percentage points to growth– with all components recovering, while growth in public spending eases. Foreign trade is expected to contribute 0.8 percentage points to growth in 2021.

In the event of a major second wave in Autumn, the 2020 GDP contraction could widen to 14.3%

In the event of a new outbreak in Autumn of a magnitude requiring fresh lockdown measures, whether full or partial, the contraction in GDP in 2020 could, according to the analysts who answered this specific question, widen to 14.3%. It is worth highlighting the fact that there is a 6.7 percentage-point difference between the highest and lowest estimate in this respect. The growth forecast for 2021 in such a scenario would fall to 5.9% Note that one analyst has already factored such a scenario into his/her baseline forecasts.

Lack of inflationary pressure in 2020 and 2021

The onset of the pandemic triggered an unprecedented correction in crude prices that trickled through to inflation, which remained in negative territory throughout the second quarter (compared to growth of close to 1% at the start of the year). However, in recent weeks, oil prices have been staging a recovery and are currently trading at over $40 per barrel, prompting the analysts to revise their inflation forecasts slightly higher.

Specifically, the consensus forecast for average inflation in 2020 has increased by 0.2 percentage points to -0.2%. The forecast for 2021 has also been raised by 0.1 percentage points to 1%. The estimates for core inflation have been raised to 0.9% in 2020 and 2021.

The year-on-year rates forecast for December 2020 and December 2021 stand at 0% and 1.2%, respectively (Table 3).

Employment has been rising since May, albeit without making up all the ground lost

Following the sharp initial impact on employment at the start of the COVID-19 crisis, when nearly 800,000 social security contributors were lost by comparison with February (using the monthly averages), the numbers improved in May and June. A similar trend is evident in the furlough scheme numbers. Out of an initial 3.3 million people who were initially affected, 1.5 million returned to work by the end of June.

The consensus forecast for employment, in terms of full-time equivalents, is for a contraction of 6% in 2020 and a recovery of 2.4% in 2021. That would put the average unemployment rate at 19.1% this year and 18% in 2021.

External surplus to narrow in 2020 and 2021

To April, Spain presented a current account deficit of 2.4 billion euros, compared to a surplus of 900 million euros in the same period of 2019, due to the sharp drop in receipts from tourism, which was only partially mitigated by the effect of the correction in oil prices.

The balance of payments deficit presented in the first few months of the year is highly seasonal. The consensus forecast is for a surplus of 1% of GDP in 2020 as a whole (down 0.5pp from the May report) and of 1.4% in 2021 (down 0.1pp).

Public deficit set to soar in 2020 and 2021

In the first four months of the year, the deficit at all levels of government except for the local governments stood at 24.04 billion euros, compared to 6.74 billion euros at the same juncture of 2019. The expenditure related with COVID-19 amounted to nearly 8.9 billion euros, while public revenue fell by 3 billion euros.

The consensus forecasts point to a public deficit of 11.9% of GDP in 2020 (up 1.1pp from the May forecasts) and of 7.4% in 2021 (+0.3pp).

The external environment remains highly adverse, despite the rebound observed recently

The main sentiment and confidence indicators have recovered from the all-time lows recorded in April for the global and European economies alike. However, the situation is highly varied, mirroring the incidence of the pandemic. The health emergency is hitting Latin America particularly hard, whereas China and other Asian countries appear to be recovering. Moreover, the rebound is being stymied by the emergence of fresh outbreaks, particularly in the US and, to a lesser degree, in Europe.

In its June economic forecasts, the IMF said it was expecting global GDP to contract by 4.9%, which is nearly 2 percentage points worse than it was estimating only two months earlier. All of the G20 countries other than China are expected to enter a recession (with China growing just 1%, its worse result since it embarked on its programme of market reforms). The eurozone is expected to contract by twice the global average. The IMF experts also flag the risks of a second wave necessitating the reintroduction of fresh lockdown measures, which would have a devastating effect on the economy.

The European Commission’s Summer forecasts point in the same direction and single out the role of potential aggravating factors, notably the severity of the business restrictions introduced in the event of new outbreaks, the weight of tourism and other mobility-dependent sectors, and the marginal scope for fiscal policy manoeuvring in highly-indebted countries.

Though both the IMF and the EC are forecasting robust growth in 2021, such projections assume that the pandemic does not worsen this Autumn.

In such a scenario, the analysts virtually all agree that both the global and EU-specific external environment is unfavourable for Spain’s economy. However, over half of the analysts believe that the international climate could improve in the months to come, a somewhat more optimistic outlook than expressed in our last report.

Unanimous appraisal of the extraordinary expansionary monetary policy measures

Since our last report, central banks have increased their exceptional liquidity support measures. In June, the ECB decided to increase the government debt repurchase programme (PEPP) designed to help cover the costs of the pandemic by 600 billion euros. That decision put the size of the programme at 1.35 trillion euros, thus facilitating meeting the states’ burgeoning financing needs. In Spain, for example, the scheme for the provision of state-backed guarantees to businesses facing liquidity issues, particularly SMEs, has been increased by 40 billion euros.

Market conditions have reflected the shift to a more accommodating monetary policy and the expectation that this is the stance that will prevail for a prolonged period. The 12-month EURIBOR has eased to -0.3%, close to pre-crisis levels and nearly 0.2 percentage points lower than in May. Likewise, the yield on Spain’s 10-year government bonds has been cut to nearly 0.4%, while the country risk premium (spread compared to the German sovereign bond) has been reduced to 90 basis points. As a result, the Treasury is managing to issue bonds on favourable conditions, across all maturities of the yield curve.

The analysts unanimously agree that monetary policy is expansionary and should remain so for the coming months. Although interest rates are still expected to climb gradually higher during the projection horizon, they are forecast to remain at relatively moderate levels, facilitating the funding of the measures taken in response to the pandemic.

Slight euro appreciation vis-à-vis the US dollar

Since the May assessment, the euro has appreciated slightly against the dollar. Analysts have integrated the fact that, while Europe moves ahead with the phasing out of lockdown measures, the US is still subject to new outbreaks of the pandemic. The analysts expect the euro to remain relatively stable going forward, ending 2021 at 1.13, close to the current values.

A majority of analysts believe that fiscal policy should stimulate the economy until at least 2022

The analysts agree that fiscal policy is clearly expansionary. Moreover, all but one believe that this is the direction fiscal policy should take for the months to come. None of the analysts is calling for fiscal policy tightening at present.

They differ in opinion as to when fiscal policy should start to focus on reducing the structural deficit. Of the 18 analysts providing feedback on this point, 10 believe that such a policy shift should not happen before 2022, with the rest thinking it should occur sooner (Table 4).

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.