Updated stress testing of the financial sector in the context of high interest rates

While European banks are better positioned to offset potential capital depletion via stronger NII generation, the upward shift in the rate curves is impacting the value of the banks’ investment portfolios. Within this context, the stress tests remain a constantly evolving tool capable of adapting to new sources of risk, such as climate, cybersecurity, geopolitical and pandemic risks, that are not captured in scenarios that only consider stressed financial conditions but can still wreak havoc on the economy and, by extension, the banking system.

Abstract: In keeping with the stipulated biennial schedule for stress testing significant banks, the European supervisor (ECB/SSM) has completed its exercise for 2023-2025, using year-end 2022 as its starting point. In parallel, its American counterpart (the Federal Reserve) has stress tested its significant banks, publishing its results one month ahead of the ECB. Several aspects distinguish this set of tests from those undertaken since 2014 when, in conjunction with the launch of the Banking Union initiative, it was decided to place stress tests at the heart of the supervisory function. The last round of tests (in 2021) focused on the potential impairment of credit as a result of the pandemic at a time when interest rates of zero per cent were preventing the banks from generating reasonable minimum margins. Compared to the zero-rate environment that shaped all the previous stress tests, the 2023 tests are the first to take place against the backdrop of high rates that are unlocking new risks (market, interest rate and liquidity risks) that did not affect the previous rounds of tests. It is for that reason that the European and American supervisors have tentatively introduced the simulation of bond portfolio loss scenarios related with the spike in interest rates, albeit as an exploratory exercise with no immediate impact on capital requirements. While the general conclusion derived from the exercise is that the European banks are better positioned to offset potential capital depletion via stronger NII generation (as is also apparently reflected in the listed banks’ market values), the upward shift in the rate curves is impacting the economic value of the banks’ investment portfolios. Against this backdrop, the stress tests are and must remain a constantly evolving tool capable of adapting to new sources of risk and new types of scenarios, notably including climate, cybersecurity, geopolitical and pandemic risks, that are not captured in scenarios that only consider stressed financial conditions but can nevertheless wreak havoc on the economy and, by extension, the health of the banking system. The supervisors need to continue to boost the quality and effectiveness of their methodologies in order to look forward and ensure that the banks remain able to carry out their financial intermediation role, especially in times of heightened uncertainty.

EBA 2023 stress tests: Methodology, scenarios and results

In January 2022, against the backdrop of a complex environment marked by Russia’s invasion of Ukraine and the central banks’ firm determination to bring inflation back to target, the European Banking Authority (EBA) launched its newest set of stress tests.

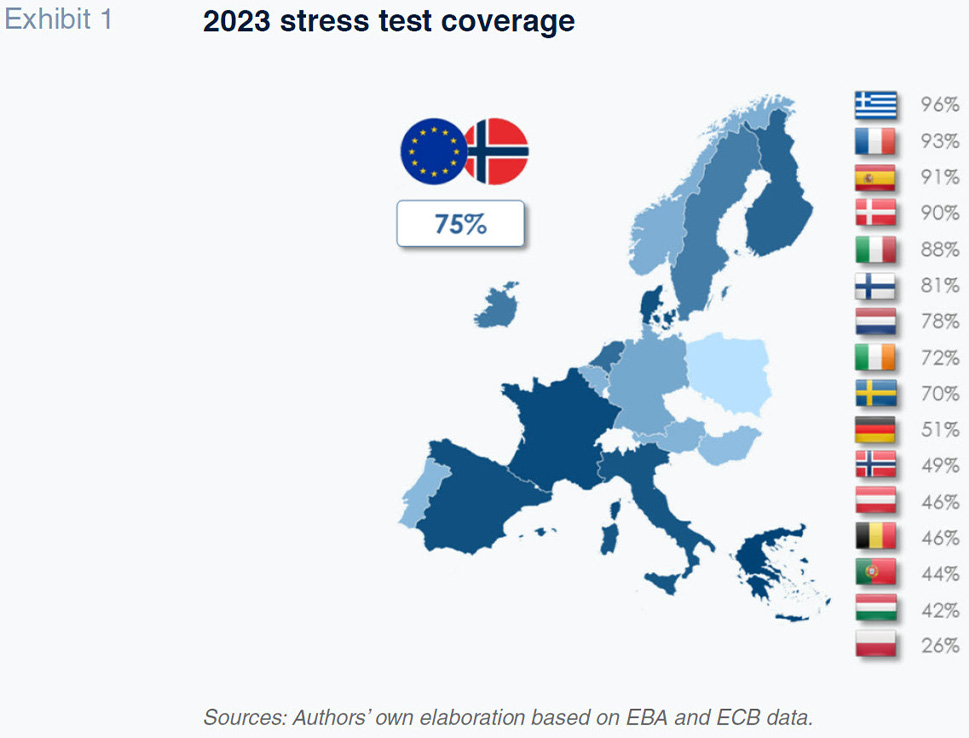

For this round of tests, the EBA has increased the universe of major banks whose results are published individually to 70 banks representing on average roughly 75% of their respective banking systems’ total assets, which is larger than the sample tested in 2021 (50 banks with asset coverage of around 70%).

The rest of the significant banks under the Single Supervisory Mechanism (SSM) are also tested and the results of each of their tests, while not published separately, are used as input for determining the level of capital required by the ECB as part of its Supervisory Review and Evaluation Process (SREP).

Methodology: Key aspects and key new developments

Stress-testing methodology has evolved over time in the various jurisdictions in which they are carried out. In Europe, the methodology was made more uniform following the creation of the Single Supervisory Mechanism in 2014, when the loss of confidence triggered by the bank crises engulfing several countries, including Spain, made it imperative to create effective tools capable of injecting transparency into bank asset valuations in order to reinforce the financial system’s credibility. Since then, the EBA has been responsible for the methodology used in the five rounds of stress tests it published biennially (only interrupted by the coronavirus health crisis), with the ECB and the rest of the national supervisors monitoring them and taking the results on board for the purposes of setting minimum capital requirements.

Over the past decade or so, the stress tests have moved towards a bottom-up approach, in which, framed by certain limits and guidelines provided by the EBA, the banks actively participate in generating the required three-year projections, providing increasingly granular information, which creates greater analytical risk but adds sophistication to the tests.

The European regulator (EBA) has paid closest attention to five key areas in its methodological guidelines: (i) credit risk, (ii) market risk, counterparty risk and credit valuation adjustments (CVA), (iii) net interest income, (iv) conduct and other operational risks; and, (v) non-interest income, expenses and capital.

In addition to these areas, for which the banks are allowed to calibrate their models within the guidelines set by the EBA, for the first time in 2023, the EBA’s methodology includes ‘top-down’ parameters, defined by the supervisors, to project net fee and commission income. This modification implies a paradigm shift by moving the responsibility for carrying out the prospective business performance estimates from the banks to the supervisors: under this approach, the banks simply provide the supervisor with the starting data requested and apply the ‘top-down’ growth parameters for test purposes.

In addition to this change in the fee and commission estimation model, there have been a few important changes to the methodology for generating the net interest income projections:

- The methodology for projecting interest expenses has been changed to avoid impacts deemed inconsistent with banking industry dynamics: [1] sight deposits costs are modelled using a beta coefficient of 0.5 times the short-term interbank curve (1-month Euribor) in the case of deposits taken from households and 0.75 times in the case of sight deposits taken from non-financial companies.

- There is new guidance for reassessing the margin on new liabilities at the starting point: [2] due to differences between the spot rate and the annual average curve in fixed-rate portfolios and differences between the spot rate and the curve at year-end 2022 in floating-rate portfolios and sight deposits.

- Elsewhere, the banks were allowed to offset the costs from replacing maturing TLTRO funding instruments by decreasing the volume of replacement funding with available liquid assets. Constraints were put in place on both the amount and the perimeter of liquid assets that banks could use. [3]

Macroeconomic and financial scenarios

In the adverse scenario, the economic contraction modelled results in a reduction in GDP of 6% in the European Union and of 5.4% in Spain. Note that the adverse scenario is more severe relative to the baseline scenario in the case of the Spanish economy with a difference, or ‘delta’, between the forecasts in the two scenarios of 12.1 percentage points in Spain compared to 10.5 points in the EU, where 2022 GDP is the base (100). Inflation is also more severe in the adverse scenario, with HICP reaching close to 10% in 2023 in both Spain and the European Union, easing thereafter.

The employment indicators modelled are significantly worse throughout the entire projection horizon: unemployment is forecast to spike to 18.5% in Spain (+6.5pp) versus the baseline scenario and to 12.2% in Europe (+5.9pp).

In this adverse scenario, the interbank and swap rate curves sustain a sharp upward shift across all tenors during the first year as a result of more aggressive monetary intervention in order to mitigate the effects of persistent inflation. The increase in rates is particularly pronounced at the short end of the curve (+245bp in 1-month Euribor relative to the rate prevailing at year-end 2022) and a little less aggressive at the long end (+176bp in the 10-year IRS relative to year-end 2022), so generating greater pressure on bank funding costs, which are mainly benchmarked against short-term rates on account of their shorter duration.

Moreover, the increase modelled in long-term rates is very asymmetric, with the peripheral European economies penalised relatively more: the yield on the 10-year Spanish bond is estimated at 7.02% in 2023, with the Italian bond at 7.96%, whereas the German and French 10-year bond yields are modelled at 4.23% and 4.69%, respectively.

Results of the conventional stress tests

The results published correspond to the scenarios and methodologies detailed above, subject to additional adjustments made by the supervisors in order to cast the projections provided by the banks in a more prudent light.

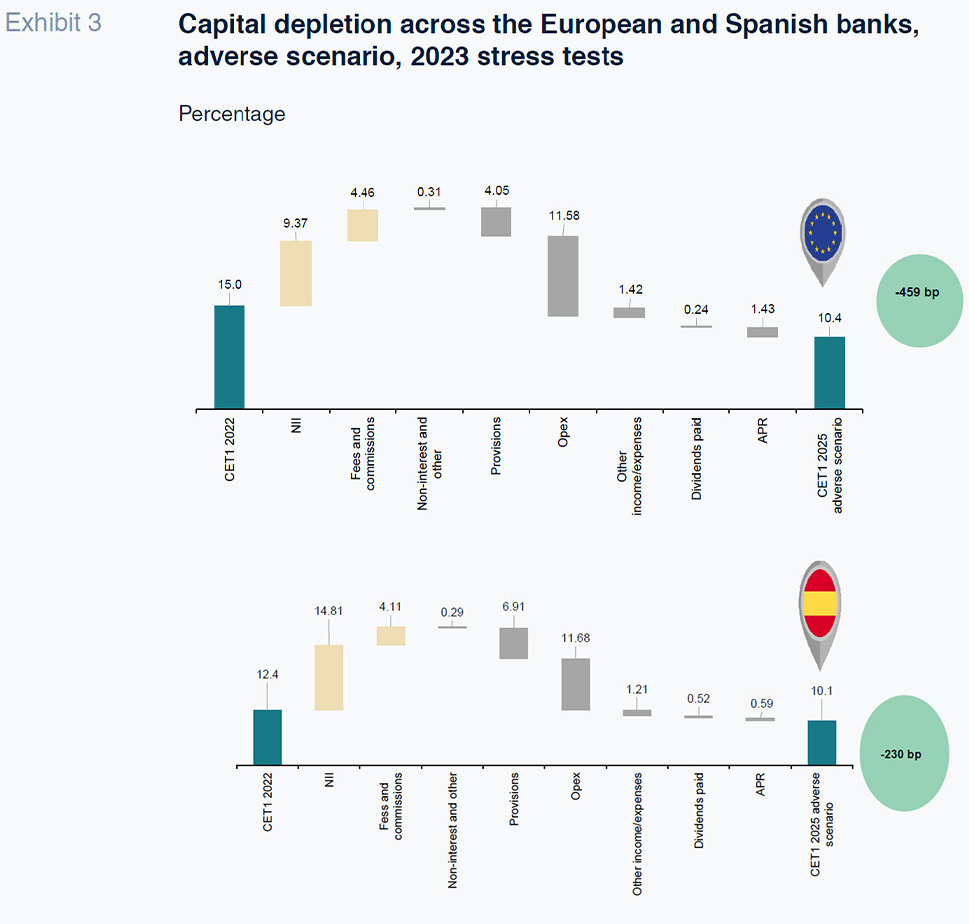

Despite the severity of the scenarios contemplated in the most adverse scenario, the European banks look capable of maintaining solid solvency levels. Their common equity tier 1 (CET1) ratio remains above 10% in the harshest scenario, which marks a cumulative decrease of 459 basis points from 2022 levels, an improvement on the 2021 stress test results (cumulative decrease of 485bp), giving the supervisors confidence in the financial system’s ability to continue to support the economy, even in times of pronounced stress.

The results are heterogeneous across the various banking systems:

- The Spanish banks are among most resilient, projected to yield a cumulative drop in CET1 of 230bp. The smaller cumulative decrease allows the Spanish banks to project similar capitalisation levels to the European banks as a whole in 2025 (just above 10%), despite starting from substantially lower levels.

- The German and French banks fare relatively worse, showing significant shrinkage of their capitalisation levels. The German and French banking systems have relatively reduced income generation capacities, leaving below-average capitalisation levels relative to their European peers.

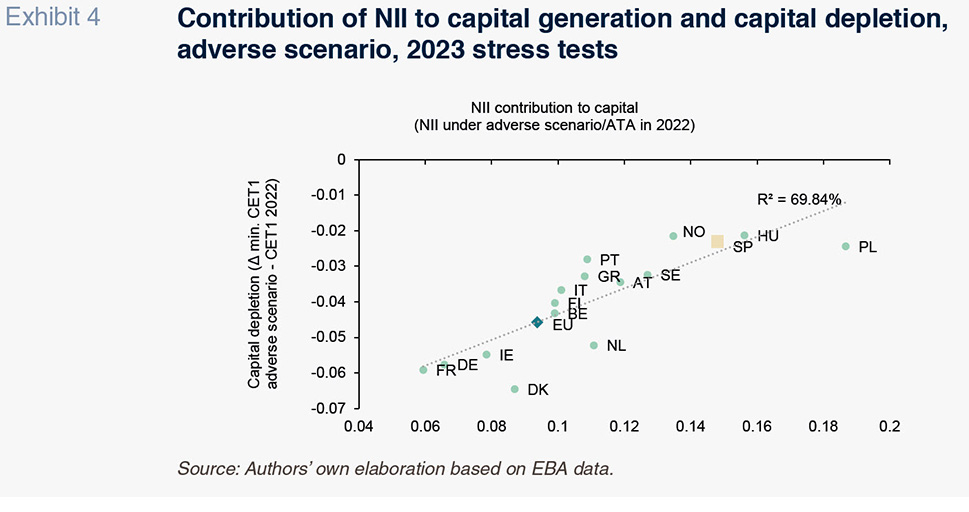

As shown in Exhibit 3, the ability to generate net interest income is the main reason for the Spanish banks’ resilience in the face of the stress tests relative to the broader universe of European banks.

That relatively greater earnings generation capability as the reason for lower capital depletion is not only evident at the aggregate banking system level but also across the individual EU countries, as shown in Exhibit 4. The countries whose entities’ net interest income (NII) makes a bigger contribution to capital in the starting point year (2022) have banking systems that are best positioned to absorb CET1 erosion via other impacts (credit risk, market risk,

etc.) given that the methodology precludes NII growth in the adverse scenario.

More specifically, the Spanish banks with a higher percentage of assets at floating rates and greater international diversification reported organic growth in capital in 2022 and, in general, continue to do so throughout the projection period.

The ECB’s standalone data collection exercise to assess unrealised losses on bond portfolios

Shortly after the stress tests were launched in Europe, a number of regional US banks and Credit Suisse were caught up in bank runs, prompting the ECB to ask the banks for additional information about their fixed-income portfolios, with a particular focus on those carried at amortised cost, for which valuation fluctuations are not recognised either in profit and loss or in equity. The ECB asked for this information in order to fortify its oversight of the banks’ liquidity and interest rate risk in the current climate of rising rates but this is not part of the stress tests nor an input for determining minimum capital requirements and therefore cannot yet be considered part of the stress test methodology per se. [4]

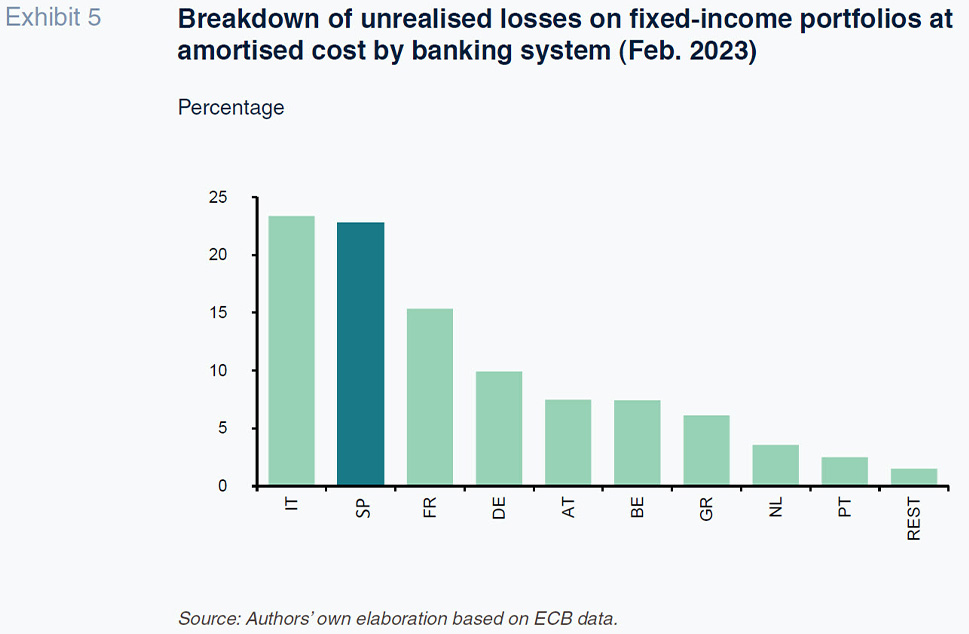

The estimate made by the ECB, using information as of February 2023, is based on the difference between the carrying amount of bond positions in portfolios carried at amortised cost and their fair value. Since the yields on bond securities have increased sharply over the past 18 months, the banks would suffer losses in the event that assets had to be sold off at market value.

According to the information collected by the supervisors, the cumulative unrealised losses of the 98 significant institutions comprising the SSM stand at close to 73 billion euros, which is 5.5% of those instruments’ carrying amount (1.3 trillion euros).

A couple of observations with regard to this estimate:

- The ECB factors in the banks’ hedging instruments, mainly interest rate derivatives, which mitigate the unrealised losses by around 40 billion euros.

- These potential losses would only materialise in the event of an extreme event forcing the sale of these portfolios (‘gone concern’), so changing the business model for which they are held for accounting standard purposes from held-to-maturity (the business model under which no valuation impacts are recognised in earnings or equity).

Of total estimated unrealised losses as of February 2023, the biggest share (46% of the total) is concentrated among banks resident in Italy and Spain, which also happen to be the banks with the highest volumes of these assets on their balance sheets (646 billion euros | 49% of the total).

In addition, the ECB estimates that in a scenario of sharp interest rate increases such as that modelled in the stress tests, the amount of these unrealised losses would increase by a further 155 billion euros (net of hedges). The European supervisor has stressed that this scenario-based exercise, the results of which have not been published bank by bank, are in no way part of the stress tests and cannot be interpreted as an additional impact of those tests.

Contrast with the Fed’s stress tests in the US

One month before the ECB, the Federal Reserve (the Fed) presented the results of its stress tests on the major US banks. Unlike the EBA’s stress tests, the Fed uses a wholly top-down approach, looking nine quarters out and it publishes the results annually.

The Fed modelled a harsher scenario in terms of NII generation and impairment provisions, characterised by a sharp contraction in GDP (-5.9%) and increase in unemployment (+5.6pp) in year one of the projection period and, in contrast to the European tests, a drop in rates across all curve tenors.

In the adverse scenario, the tested banks’ CET1 contracts by 541 billion dollars on aggregate, dipping by 2.3 percentage points of average total assets at the point of lowest capitalisation in the nine quarters projected to 10.1%, compared to 12.4% at present. All the supervised institutions would, nevertheless, remain above the minimum required level of capitalisation in the worst-case scenario.

Of the cumulative depletion observed in the adverse scenario, 78% (424 billion dollars) is attributable to higher loan impairment losses. Specifically, the spike in provisions is concentrated in the credit card, SME and non-residential real estate segments, where provisions are high relative to asset volumes.

By comparison with prior tests, the 2023 stress tests point to a similar level of capital depletion (2.3pp) as in prior years (albeit somewhat smaller), mainly as a result of the projected interest rate trajectory. The drop in the rate curve relative to the levels observed in 2022 has a negative impact on future NII generation but does mitigate the losses on bond portfolios at fair value through equity.

Lastly, and similarly not part of the stress tests or used as an input for capital requirement calculation purposes, the Fed also carried out additional analysis of market shocks on bond portfolios. The Fed’s assessment differs from the European exercise in several ways:

- The Fed only models this ‘exploratory market shock’ for the eight global systemically important banks, whereas the European supervisor assessed unrealised losses for the 98 significant banks under the ECB’s direct supervision.

- The Fed analysed the potential losses on held-for-trading portfolios, while the ECB assessed the portfolios classified at amortised cost which are expected to be held to maturity.

- The Fed models a scenario for this shock that is totally different from that prescribed in its annual stress tests, in which inflation and interest rates both continue to climb higher, potentially unlocking higher losses on those portfolios.

Most surprisingly, the impact on capital of this exploratory shock is equivalent to just 1.1pp of CET1, which is slightly smaller than the impact on held-for-trading portfolios modelled in the Fed’s stress tests (1.3pp of CET1). The reason given by the Fed is the reduced sensitivity of these portfolios to counterparty credit impairment in a context of economic recession than in a climate of rising interest rates.

As a result, this second assessment provides the US supervisor with comfort around the resilience of the financial sector in the face of different scenarios, inflation paths and interest rate trends.

Conclusions and challenges for future stress tests

The new rate environment has created challenges for the bank supervisors, which were accentuated by the spell of banking crises unleashed in March, initially affecting some regional American banks but later engulfing a global Swiss bank.

While the general conclusion is that the banks are better positioned to offset potential capital depletion via stronger NII generation (as is also apparently reflected in the listed banks’ market values), the upward shift in the rate curves is impacting the economic value of the banks’ investment portfolios. Even if those losses do not materialise, as the banks intend to hold the investments to maturity, it is important to analyse them for the purposes of setting a minimum amount of capital framed by a bank resolution or ‘gone concern’ perspective.

Against this backdrop, the stress tests are and must remain a constantly evolving tool capable of adapting to new sources of risk and new types of scenarios, notably including climate, cybersecurity, geopolitical and pandemic risks that are not captured in scenarios that only consider stressed financial conditions but can nevertheless wreak havoc on the economy and, by extension, the health of the banking system.

Notes

The definition of the adverse scenario marked by sharp rate increases, especially at the short end of the curve, explains the severity of this measure. Moreover, given the static balance sheet assumption, the banks cannot model, for example, shrinkage in liability balances or a potential shift from sight to term deposits on account of cost pressures.

The margin on new business is projected using the sum of the initial margin and the tightening in the risk premium over the IRS. To the extent that the initial margin is shaped significantly by rates that were very volatile in the reference year (2022), the requirement to use average rates (which are lower, yielding higher margins) versus year-end rates (which are higher, yielding lower margins) is an important one.

Although the European banks have largely repaid their TLTRO funding, when the stress tests were performed, there were prepayment windows looming in June 2023 and 2024. The supervisor introduced a funding cost penalty for replacing any TLTRO funds not offset by liquid assets held at current accounts with the Eurosystem of central banks.

The current EBA stress test methodology factors in impacts, via market risk, on the measurement of portfolios of assets at fair value through equity and at fair value through profit or loss.

Ángel Berges. Vice-President of Afi

Jesús Morales. Senior consultant at Afi