Spain’s insurance business in 2023 and outlook for 2024

After a strong performance in 2023 under a high interest rate scenario, a softer than expected economic landing, coupled with the containment of inflationary pressures, paving the way for a period of rate cuts, foreshadow a new scenario for the Spanish insurance business in the quarters to come. Nevertheless, under the new scenario, insurance sector conditions and prospects remain largely bright, allowing for a robust outlook and the continued sizeable contribution to banks’ profits.

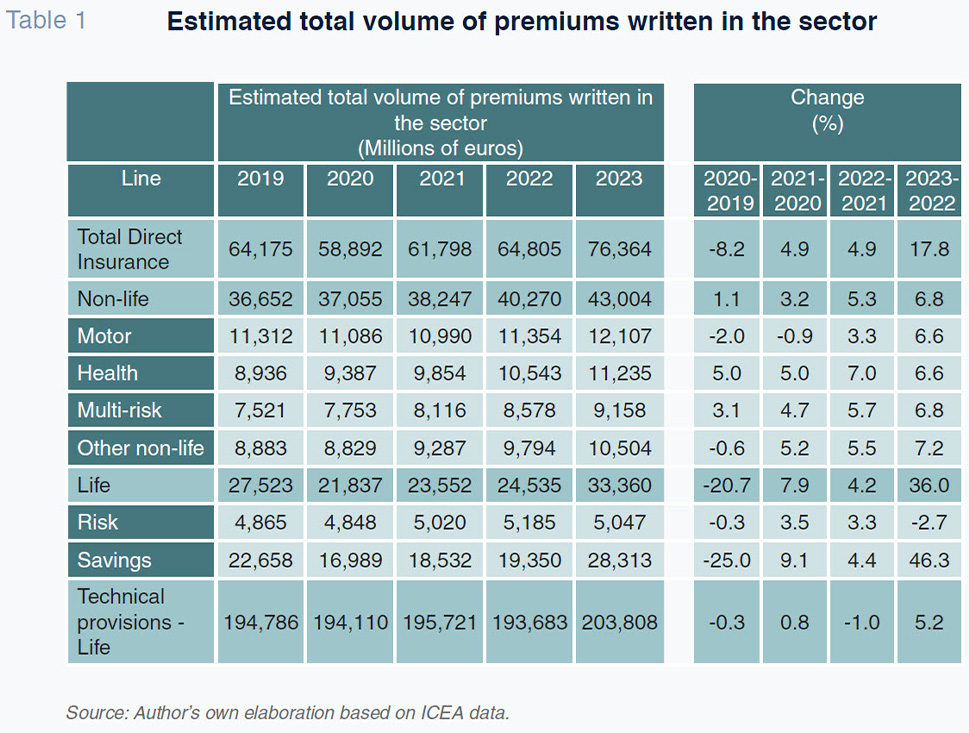

Abstract: As was expected in response to the extraordinarily rapid and intense period of interest rate hikes throughout 2023 in the midst of rampant inflation, last year’s unique performance marked a turning point for certain lines of the Spanish insurance business. Indeed, the more than 76 billion euros of premium revenues recorded by the Spanish insurance sector in 2023 marks a new record. That sharp top-line growth – 18% from 2022 – was driven mainly by the life insurance business. Turning to the non-life business, growth in premium revenues remained remarkably solid, the highest in recent years, at close to 7%. This noteworthy growth was driven by business growth in real terms but probably more so by the revaluation of policy premiums as a result of the adverse impact of inflation, which had been weighing on the business since 2022. However, a softer than expected economic landing, coupled with the containment of inflationary pressures, paving the way for a period of rate cuts, foreshadow a new scenario for the business in the quarters to come. Nevertheless, under the new scenario, if Spain’s relatively favourable economic forecasts are on target, we would be looking at a new record in premium revenues for the sector of over 80 billion euros in 2024. This means sector conditions and prospects remain largely bright for the insurance sector as a whole, allowing for a robust outlook and the continued sizeable contribution to banks’ profits.

Foreword

Now that we have the revenue and earnings figures for the insurance providers for 2023, in this paper we assess their performance last year and then delve into a forward-looking analysis, shaped by the shifting macroeconomic context and current financial conditions.

Last year, the economy was conditioned by the central banks’ commitment to their decisive switch in monetary policy, raising their benchmark rates to tackle the bout of rampant inflation unleashed by the pandemic and the fallout from the war in Ukraine.

Global economic growth stuttered as a result. However, inflationary pressures were reined in, faster than initially anticipated. Indeed, the central banks have begun to taper their official rates from the peaks reached one year ago, as inflation started to approach their targeted levels. This fresh change of tack is substantiated by the fact that growth, fundamentally in Europe, has slowed significantly. Spain, however, is holding up relatively well and momentum is quite dynamic.

The prospect of a period of anchored inflation, enabling further rate cuts, is propping up the markets. And despite the prevailing geopolitical instability, the equities markets are at record levels, accompanied by moderate credit spreads.

The business

In this context of high rates, the more than 76 billion euros of premium revenues recorded by the Spanish insurance sector in 2023 marks a new record. That sharp top-line growth – 18% from 2022 – was driven mainly by the life insurance business.

The momentum in this line of business was in turn boosted by the newfound attractiveness of its products following the “normalisation” of interest rates after so many years at or below zero. That was particularly true for the traditional life and savings products, many of which had ceased to be of interest to policyholders in the previous conditions. Moreover, unit-linked life-savings products, which boast much higher penetration in Spain than in many neighbouring economies and had continued to perform quite well during the ultra-low rate years, remained buoyant in 2023. As a result, the sale of life-savings products soared by no less than 50% from 2022 levels. In contrast, life-risk products, which in premium terms accounts for only around 15% of the life insurance business (albeit particularly profitable for the sector), stagnated or even contracted somewhat, undoubtedly shaped by the slowdown in the granting of new mortgages to which this line is heavily linked.

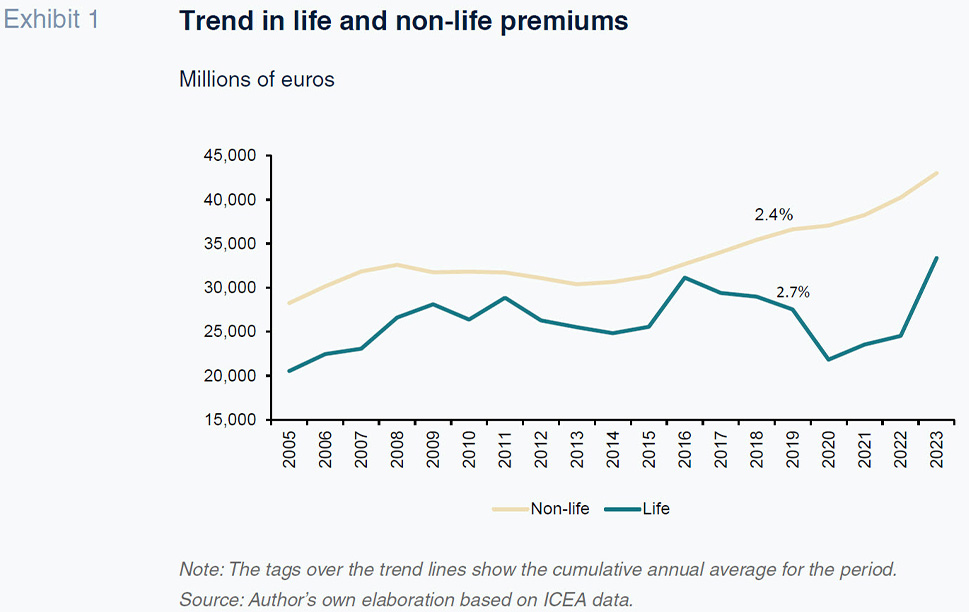

This combination of growth in life-savings and stagnation in life-risk translated into the above-mentioned overall surge in the life insurance business, which registered staggering growth of 36% in 2023, as shown in Table 1 and Exhibit 1.

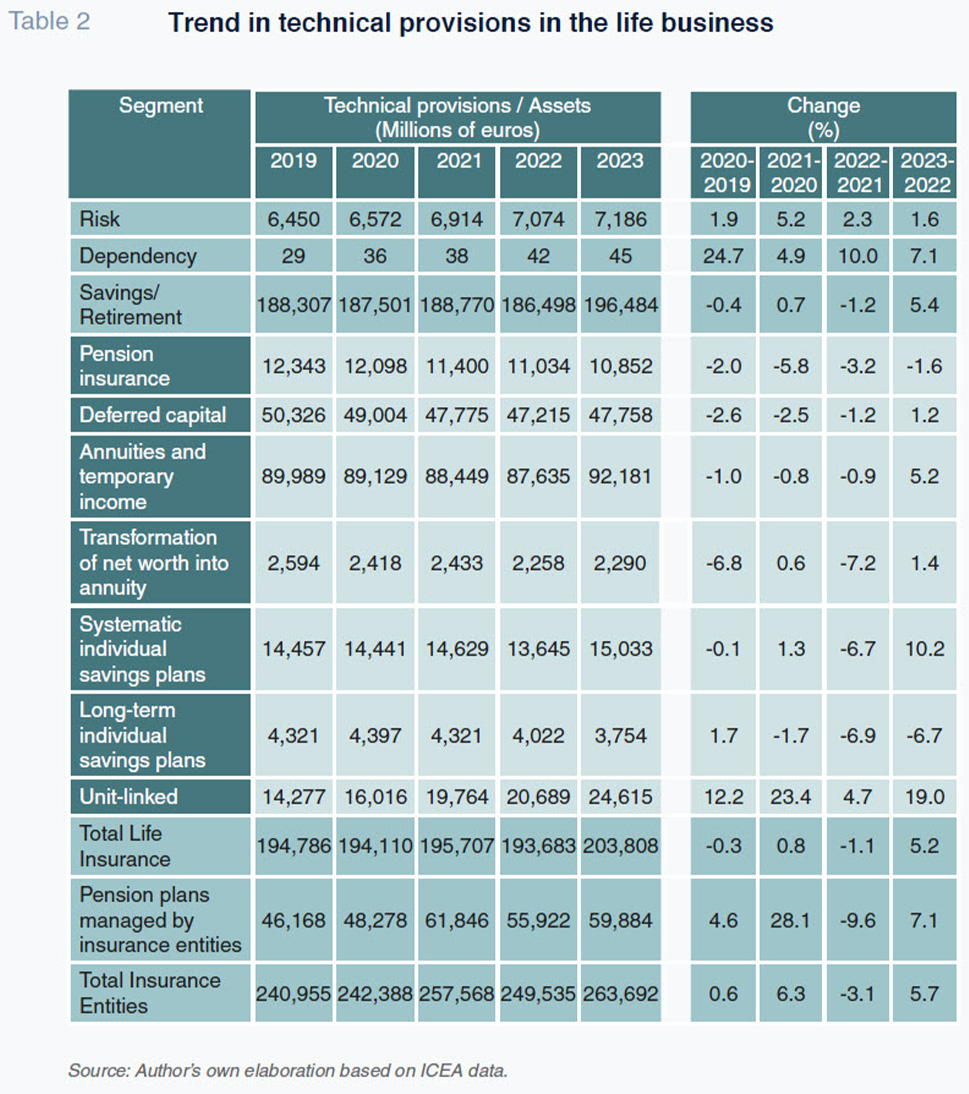

In terms of provisions, which is a better indicator for monitoring the life insurance business, the growth of 5.25% recorded in 2023 is indicative of the substantial growth in the business after so many years of virtual stagnation, as shown in Table 2.

Turning to the non-life business, growth in premium revenues remained remarkably solid, the highest in recent years, at close to 7%. This noteworthy growth was driven by business growth in real terms but probably more so by the revaluation of policy premiums as a result of the adverse impact of inflation, which had been weighing on the business since 2022. The increase in claims costs affected some lines particularly hard (e.g., but not only, motor insurance). Interestingly, the growth in premiums was very similar across the four main categories of non-life insurance (motor, multi-risk, health and other), with all of them coming in at around the overall growth figure of 6.8%. The latter three categories extended the momentum of recent years, while motor insurance picked up after years of weakness, albeit largely as a result of the above-mentioned adaptation of policy premiums.

Sector profits and margins

As was the case in 2022, the momentum in revenue from non-life products was not accompanied by an analogous increase in claims costs in 2023. Both the motor and multi-risk insurance lines experienced significant growth in these costs, for the third year in a row since the pandemic, with claims last year reaching one of the highest levels in recent years. Claims in the motor insurance business, at over 80%, were particularly high and the highest in 15 years. Inflation was a key factor behind the increase in claims costs, affecting multi-risk as well as motor insurance. This process, which only began to ease substantially during the second half of the year, had a considerably lower impact in health and other non-life categories (which were probably better able to pass through the effects of inflation), so that their claims rates were relatively stable.

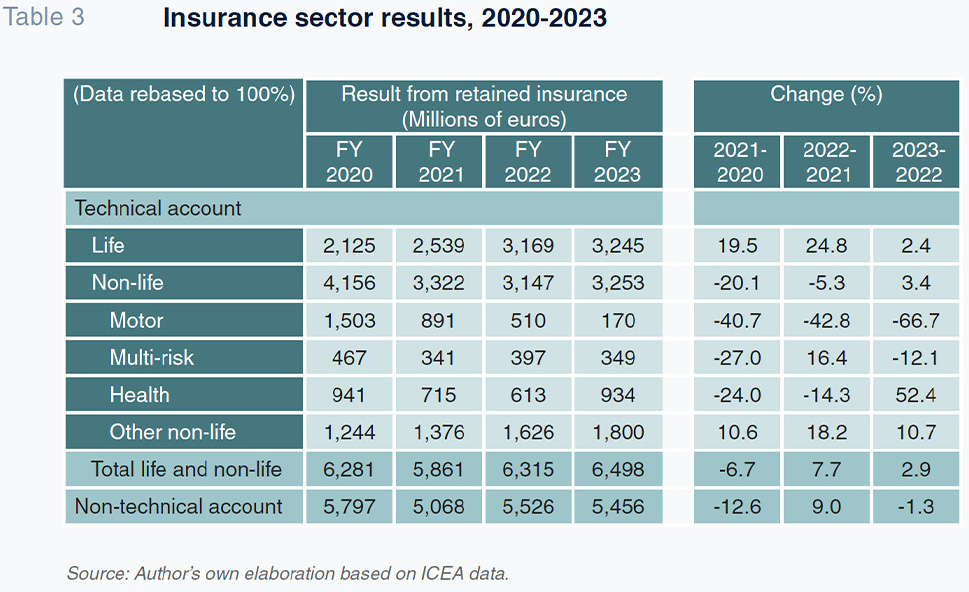

The margin implied by the technical account for the non-life business as a whole, relative to retained premiums, is largely the result of this uneven trend in claims across the different categories. The collapse in the technical margin in the non-life insurance business as a whole (from 5.06% to just 1.63% [1]) was largely offset by the improvement in the margin in health (from 6.07% to 8.70%). As a result, the aggregate technical account for the non-life business came to 3.25 billion euros, which is similar to the level recorded during the last two years.

Elsewhere, the favourable interest rate climate in 2023 meant that for the second year in a row the technical margin in the life business was largely similar in absolute terms to that reported by the non-life business (3.25 billion euros), after a long period of substantially lower figures. In 2022, that performance had been shaped by the rate normalisation already embarked on and the extraordinary release by some undertakings of sizeable provisions on old product portfolios with actuarial commitments at high rates; in 2023 it was shaped by ongoing normalisation and far more significantly, growth in product sales volumes.

The combination of trends in the life and non-life businesses yielded blended aggregate sector profit of close to record levels: almost 6.5 billion euros in the technical account and 5.5 billion euros of estimated profits (margin on the non-technical account). Looking back in time, this figure is only slightly lower than the exceptional result of 2020 (the year of the pandemic) when profit hit almost 5.8 billion euros under highly unusual circumstances.

The just over 5.46 billion euros of aggregate profits recorded by the sector in 2023 implied a return on equity (ROE) of 12.86%, down slightly from 2022 but still comfortably in the double digits, where it has been steady in recent years. The sector’s solvency ratio was an equally ample and robust 241.9% at year-end 2023, two points above the 239.8% reported by the sector watchdog for 2022.

Outlook

Lastly, in terms of the outlook for 2024, we think the situation will continue to benefit the sector. Even though the main economies, particularly the European economies, are expected to remain sluggish in the coming quarters, the Spanish economy is expected to continue to rank towards the top of the growth league tables, reporting GDP growth very close to the 2.5% recorded in 2023, in light of the healthy indicators already released so far this year. In parallel, inflation should continue to ease although it is not expected to close in on the ECB’s target of 2% until next year.

Logically, this ongoing economic momentum should continue to have a positive impact on growth in revenue in the insurance lines more exposed to the cycle: in non-life, in the case of motor insurance; and in life, in the case of life-risk. In life-savings, interest rate conditions will remain favourable for business development. However, volumes are likely to adjust more ostensibly to the downtrend in interest rates in the second half of the year. Competition has also increased somewhat as a result of the recent relative improvement in remuneration on bank deposits.

As a result, in non-life as a whole, we are looking for continued robust growth in premiums of close to 5% (down by around 2 percentage points from 2023). Elsewhere, after the explosive growth of 36% recorded last year, momentum in life should remain healthy, albeit logically not as intense: we are estimating growth of around 10%. If these forecasts are on target, we would be looking at a new record in premium revenues for the sector of over 80 billion euros in 2024.

In parallel with this topline growth, we think claims costs will fare better in non-life insurance, helped by the anticipated let-up in inflation. It is likely that margins will improve now that premiums have been restated for the initial surge in inflation. Margins should also be lifted, barring surprises in the market, by higher returns on investment portfolios, given their performance in recent quarters. In short, it is reasonable to expect an improvement in profitability against the backdrop of fairly healthy and consistent growth, albeit naturally not as frothy as that seen last year.

Notes

Note that prior to the pandemic, this percentage was over 8%, depicting the scale of the impairment sustained in margins in this business.

Daniel Manzano. PhD in Economics and partner at Afi