Monetary policy changes: Scale and implications

The ECB’s recent rate cut contrasts with the Fed’s recent decision to leave its target rate range unchanged, reflecting the divergent attitudes of the main central banks to inflation, with potential implications for the global economy. Going forward, clear central bank communication remains key to mitigating market volatility and strengthening economic stability in an increasingly complex environment.

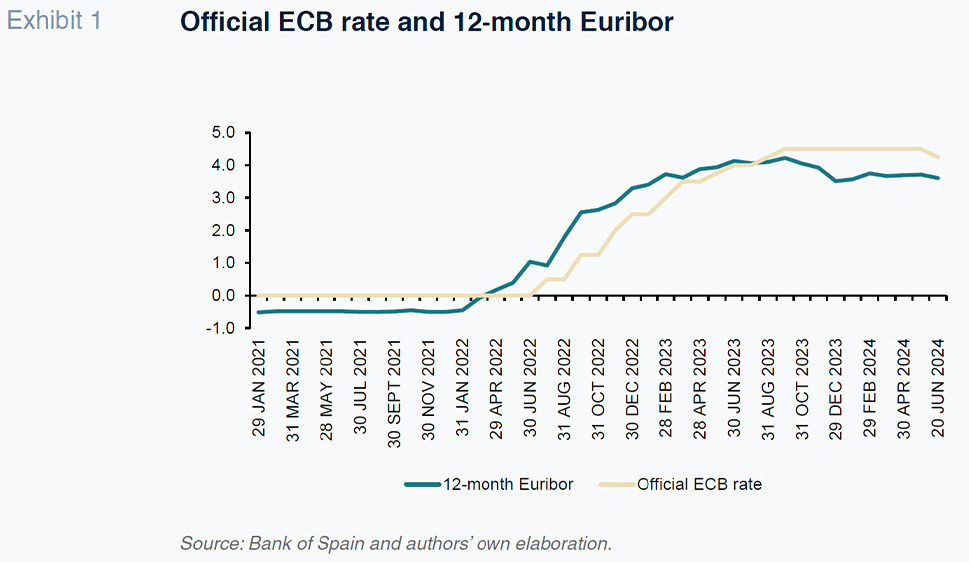

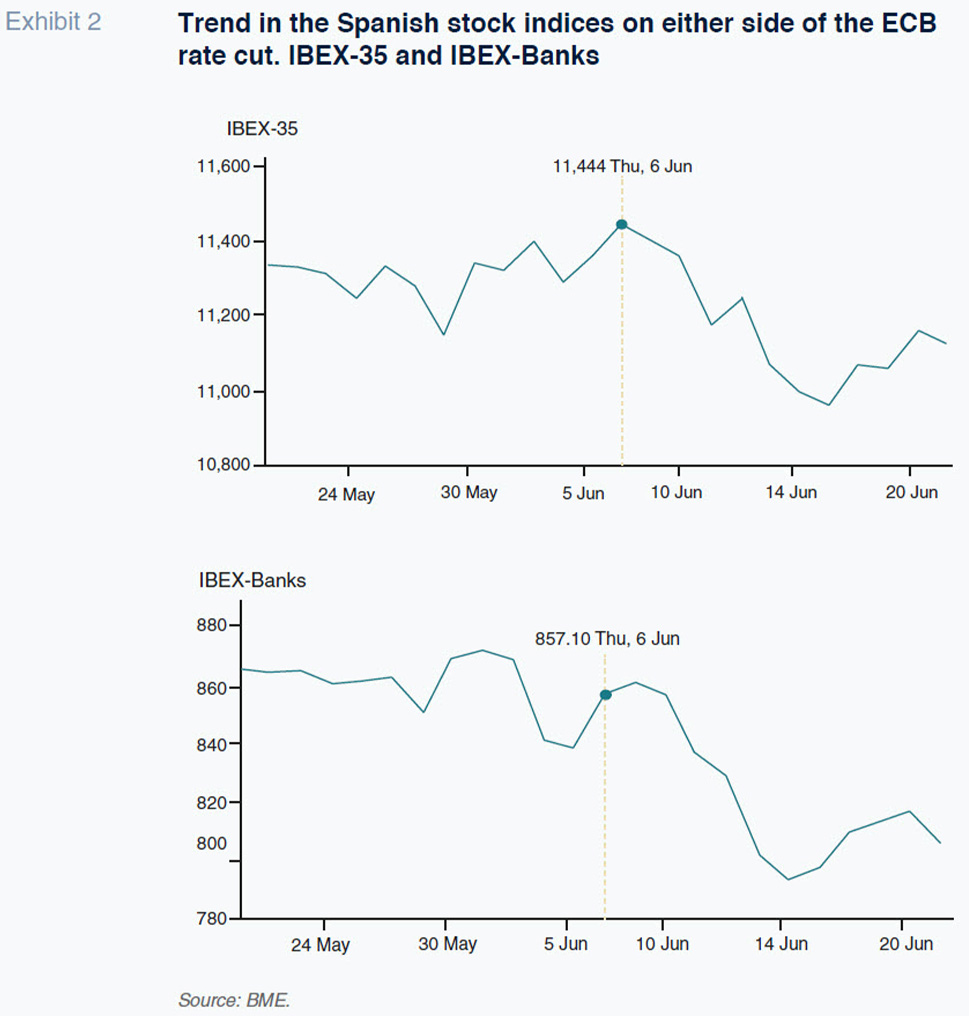

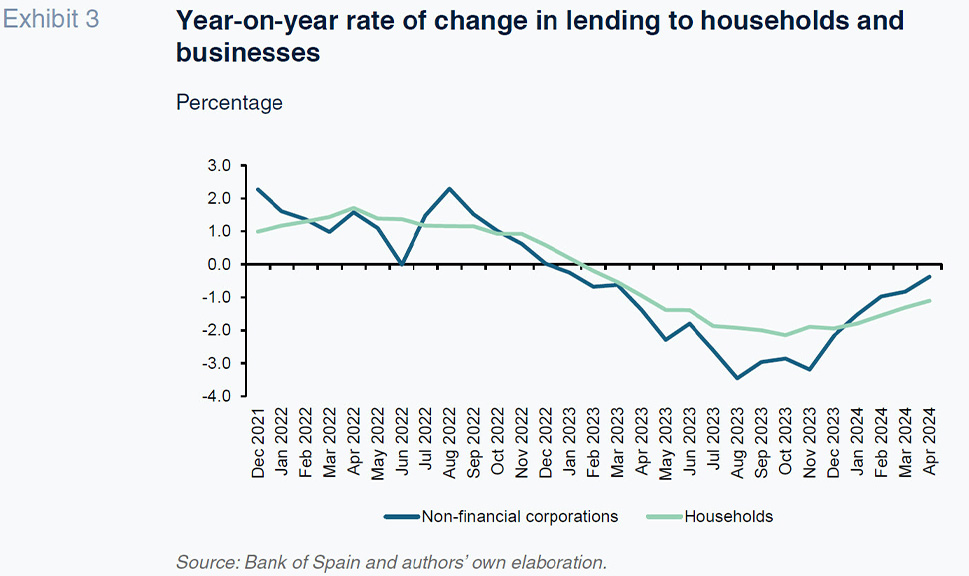

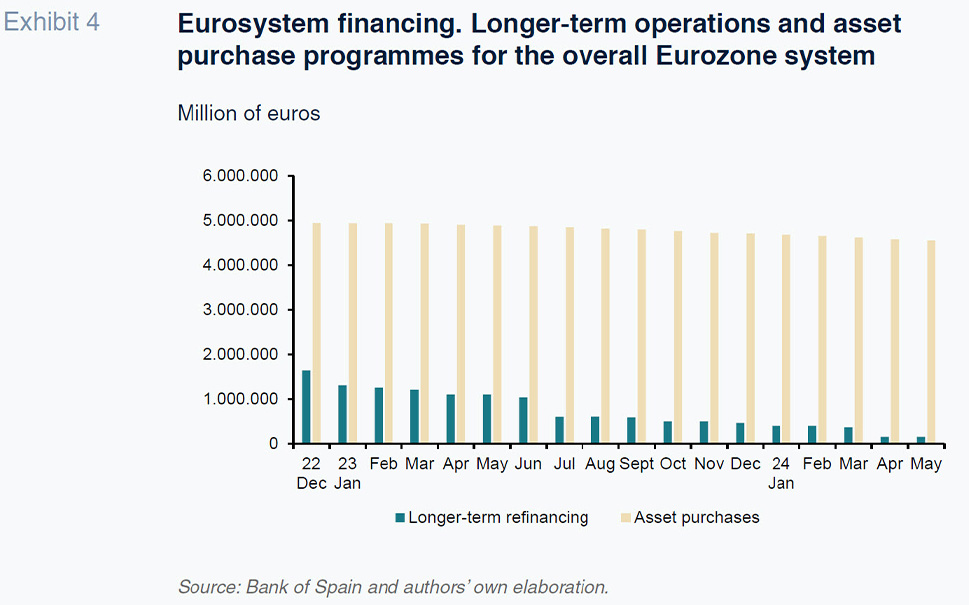

Abstract: In June 2024, the ECB cut the rate on its main refinancing operations by a quarter of a point to 4.25%, convinced by the let-up in inflationary pressures and drop in core inflation. 12-month Euribor has been trading between 3.4% and 3.9%, reflecting market expectations about future rate cuts by the ECB. However, the effects of the rate cut have been minor as the credit channel remains relatively rigid. The volume of financing extended to the non-financial sector has been trending lower in 2023 and 2024, with credit contracting over this timeframe. For now, even in the face of the more favourable financing conditions, it is not likely that demand for credit will increase significantly in the coming months. Despite the rate tightening, the ECB’s liquidity policy continues to play a crucial role. Even though the ECB has pared back its long-term refinancing operations, it continues to operate its asset purchase programmes, providing the market with stability but also prolonging dependence on official funding – although the tapering of its long–term financing programmes could increase financial volatility. In contrast, the Fed left its target range for the federal funds rate at 5.25-5.50%, evidencing its conservative approach to inflationary risks. The divergent decisions reflect different attitudes towards inflation, with potential implications for the global economy. In any event, the bond markets have responded to the ECB’s move with a reduction in yields, while the equity markets have been mixed, reflecting uncertainty around the effectiveness of these measures. Going forward, clear central bank communication strategies remain key to mitigating market volatility and strengthening economic stability in an increasingly complex environment.

The Eurozone moves first

The most recent meetings of the European Central Bank (ECB) and US Federal Reserve (Fed) mark an important turning point in global monetary policy. Both institutions have fine-tuned their stances in response to economic developments and inflation dynamics, albeit taking different approaches. The ECB, in its meeting in June 2024, decided to lower its rate by 25 basis points, to leave the rate on its main refinancing operations at 4.25%. It based its decision on its assessment that inflationary pressures have eased, with core inflation showing signs of moderation. Nevertheless, the ECB acknowledged that internal inflationary pressures, especially those derived from wage growth, remain strong, with inflation expected to remain above the central bank’s target of 2% until well into next year.

Meanwhile, the Fed decided to leave its target range for the federal funds rate at 5.25-5.50%, underlining that it has no plans to cut rates until it is more confident that inflation is moving sustainably towards the 2% mark. The Fed continues to reduce its holdings of Treasury bonds and mortgage-backed securities, evidencing a more conservative line in response to persistent inflation risks.

These movements indicate a shift in monetary policy tack in both regions. The ECB, after a prolonged period of high rates to rein in inflation, has begun to take a more flexible position in response to the improved outlook for inflation and the economy. In contrast, the Fed remains firm around its restrictive stance, underscoring its commitment to controlling inflation before considering any type of monetary easing. The importance of these decisions lies with their potential impact on the global economy. The ECB’s more flexible position could stimulate growth in the Eurozone, supporting business and consumers via more favourable financing conditions. However, it is too soon to expect a major impact considering the small size of the rate cut, coupled with stagnant lending activity in recent years. There is also a risk that overly premature easing could rekindle inflationary pressures if the underlying economic conditions do not stabilise sufficiently. As for the Fed, the US central bank’s conservative position reflects concern about inflationary risks it fears could threaten economic stability in the long-term. Leaving rates high might curb inflation but it could also restrict growth and increase borrowing costs for businesses and households, at a time of considerable geopolitical and electoral uncertainty.

Beyond these traditional macroeconomic analyses, predicting the way expectations will play out and agents will react to this fresh shift in monetary policy is complex. In just a few years, we have gone from zero, or negative rates, to sharp increases concentrated in a short spell of time. Against this backdrop, the creation and anchoring of expectations around monetary policy has become far more complex, as the policy transmission channels have not always worked with the desired speed or impact. As a result, there is no clear consensus about the impact the rate cuts might have and even less consensus about how low rates might go. One of the reasons lies with the institutions themselves, as monetary policy remains inherently contingent on how inflation dynamics evolve and unfold. Another reason is that the economic agents no longer internalise monetary policy as they did in the past. Many households and businesses have experienced a period of exceptional monetary policy circumstances since the financial crisis which makes it hard for them to interpret these signals. Lastly, an important part of monetary policy is not related with interest rates at all but rather control over liquidity and here the importance of the “official” financing mechanisms, particularly those related with the buyback of debt, remain very significant.

Impact on financial institutions and markets

Euribor, the interbank lending rate, which tends to reflect the market’s expectations about future ECB movements, has varied significantly in response to the latest monetary policy decisions (Exhibit 1). 12-month Euribor has oscillated between 3.4% and 3.9% in recent months, reflecting fluctuating market expectations about potential rate cuts by the ECB. The trend in Euribor discounts changes in official rates and affects the rates applied to loans and deposits, thereby – theoretically – affecting lending activity.

The financial markets have had a mixed reaction. Whereas some stock exchanges have registered modest gains, the bond market is exhibiting cautious optimism about the scope for additional cuts. Exhibit 2 shows how the stock market indices corrected in the wake of the ECB’s decision (both the blue chip IBEX-35 benchmark index and the bank stocks index), compared to a moderate rally in the weeks prior to the rate cut announcement. It is hard to pin down any cause and effect here as the possible effects of the reduced cost of money were very probably already priced in by the market.

Impact on households and businesses

Lending to non-financial corporations, households and the public sector has been contracting year-on-year since 2023 (Exhibit 3). One might think that the rate hikes of recent years may have cooled lending activity; however, the reality is that growth in lending to businesses and households has been very subdued in recent years, with the exception of loans to the non-financial corporations during the pandemic, thanks to the state-guaranteed loan schemes. For now, despite the more favourable financing conditions, it is not likely that demand for credit will increase significantly in the coming months. A key factor affecting the effectiveness of rate cuts is the proportion of fixed-versus-floating-rate mortgages and loans. In Spain, approximately 75% of new mortgages arranged in recent years were extended at fixed rates.

It is even harder to predict how the latest monetary decisions will affect financial savings. More time will have to elapse – and we may well need to see more rate cuts – before we can observe this reaction.

For the business community, the reduction in interest rates will imply lower borrowing costs. Companies may take advantage of the lower rates to finance new investments, expand operations or refinance existing debt. However, the business community’s response may well be moderate as for companies to have an incentive to expand their stock of capital (net positive investment rate), the rate of return on those investments needs to be comfortably above the user cost of capital, which is still unlikely to be the case.

It is not just about rates: “Official” liquidity continues to play its part

Although much of the news coverage focuses on the movements in interest rates, other monetary decisions, such as those related with liquidity, are equally important. Despite paring back its longer-term refinancing programmes, the ECB’s asset purchase programmes (mainly debt) continue to provide the market with a significant source of liquidity (Exhibit 4). This is helping keep market conditions stable, indirectly benefitting businesses. However, this strategy also entails risks as the central bank cannot become a crutch for the European sovereign debt markets.

These liquidity programmes have had a mixed impact on the financial system. On the one hand, they have provided crucial liquidity during episodes of financial stress, helping stabilise the markets and keep the flow of credit moving. On the other hand, the downsizing of these programmes could lead to increased volatility in the financial markets. This dynamic is particularly relevant in the context of the recent European elections in which political uncertainty has driven sovereign risk premiums higher in some countries. These movements reflect the market’s perception of credit risk and economic stability and any change in political expectations could have a significant impact on financing costs and financial stability.

Some considerations for the months ahead

The ECB is expected to remain cautious. Analysts anticipate the ECB will continue to cut rates in the second half of 2024, albeit at a modest pace. Persistent economic uncertainty and geopolitical tensions are making it hard for the ECB to normalise monetary policy quickly.

The differences in monetary policies on either side of the Atlantic are also affecting exchange rates. The combination of a laxer ECB and a stricter Fed has caused the dollar to appreciate against the euro. This movement in the exchange rate has wide implications, affecting trade balances and capital flows between regions. The market’s sensitivity to these decisions is not uniform and is influenced by multiple amplifying and mitigating factors, many of which are geopolitical in nature.

Central bank communication plays a crucial role in managing this sensitivity. Unexpected or ambiguous announcements can fuel volatility, whereas clear and predictable communication can stabilise market expectations. For example, the clarity with which the ECB communicated its assessment that inflationary pressures had eased and its decision to lower rates helped mitigate adverse reactions. Investors’ pre-existing expectations are another key factor. If a monetary decision coincides with market expectations, reactions tend to be moderate. However, decisions that surprise the market may trigger more extreme reactions. An analysis of the recent movements by the ECB and Fed reveals how market expectations about future policies influence the immediate reactions to policy announcements. The ECB’s announcement on 24 June that it was cutting rates prompted an immediate reduction in sovereign bond yields in the Eurozone, although a few days later the EU Parliamentary elections and the snap election announced in France drove those yields back up again. The stock markets had a mixed reaction, with some indices posting moderate gains and others remaining stable or even correcting, evidencing uncertainty about the effectiveness of the move. On the other hand, the Fed’s restrictive policy underlined its commitment to controlling inflation, driving the dollar higher against the euro, and negatively affecting the US stock markets, in anticipation of higher borrowing costs and possible economic cooling.

In short, the central banks’ ability to anticipate and react to changing market dynamics will be crucial in the coming months. A comprehensive approach which combines well-communicated monetary policies and a constant watch over financial innovation has the potential to not only mitigate volatility but also to bolster global economic stability. Agility and transparency are the most important tools in the central banks’ kit as they strive to balance growth and control inflation in an increasingly interconnected and technologically advanced world.

Santiago Carbó Valverde. University of Valencia and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas