Gender diversity on corporate boards: Enhancing sustainability outcomes for Spain’s IBEX 35 companies

Institutional changes, such as quotas and evolving social norms, which have promoted gender diversity in boardrooms and at the corporate executive level, are believed to have positively impacted ESG outcomes within firms. Empirical evidence shows that woman directors seem more influential on sustainability issues, while women executives have a stronger impact on gender agendas; nevertheless, preliminary analysis shows that the impact of both groups on these respective areas appears to be limited.

Abstract: Historically, corporate boards were predominantly male due to societal norms and systemic barriers limiting women’s participation in senior leadership. More recently, institutional changes, such as board quotas and evolving social norms, now promote gender diversity in boardrooms. Such changes are believed to have positively impacted ESG outcomes within firms. Through an examination of annual reports across Spain’s IBEX-35 companies over the six-year period from 2017-2022, preliminary findings reveal that the overall impact of the presence of women directors and executives is limited except as regards sensitivity related to ESG issues, although the causality between gender diversity and ESG sensitivity cannot be confirmed. That said, the presence of woman directors is often linked to sustainability committees, providing diverse perspectives that improve the social and environmental responsibility of the companies. In the case of women executives, they seem to have a stronger impact on gender agendas.

Introduction [1]

Until recently, corporate boards were predominantly male due to societal norms and systemic barriers limiting women’s participation in senior leadership (Gabaldon et al., 2016; Grau et al., 2020). Institutional changes, such as board quotas and evolving social norms, now promote gender diversity in boardrooms (Krook, 2007; Terjesen and Sealy, 2016). This movement believes that balanced gender representation can enhance governance, promote societal equality, better represent clients and have broader societal impact (Gabaldon et al., 2016; Grau et al., 2020).

Gender diversity on boards has attracted attention for its impact on firms’ sustainability outcomes (Ben-Amar et al., 2017; Gabaldón et al., 2023; Galbreath, 2011). As sustainability becomes crucial for businesses, stakeholders demand responsible practices incorporating ESG factors. The existing hypothesis is that the presence of women on corporate boards positively influences sustainability initiatives and outcomes (Campopiano et al., 2023). Meanwhile, research increasingly suggests that gender-diverse boards prioritize sustainability and adopt long-term value creation strategies (Campopiano et al., 2023). Women bring unique perspectives and values, broadening the range of issues considered, challenging groupthink, and fostering holistic decision-making.

This study examines the impact of female board membership for Spain’s top listed companies, over the six years period from 2017 through 2022, using the concept of institutional logics. Institutional logics are defined as “systems of cultural elements (values, beliefs, and normative expectations) by which people, groups, and organizations make sense of and evaluate their everyday activities and organize those activities in time and space” (Haveman and Gualtieri, 2017; p. 1).

Women on boards and women executives and their impact on the logics surrounding sustainability

Gender diversity, particularly the inclusion of women on corporate boards and in executive roles, has gained significant attention due to its potentially favorable impact on sustainability and ESG outcomes (Ben-Amar et al., 2013; Ben-Amar et al., 2017; Khemakhem et al., 2023; Manita et al., 2018). Women’s representation in leadership has been linked to positive sustainability outcomes, reflecting the diverse perspectives, experiences, and values they bring to decision-making (Campopiano et al., 2023; Gabaldón et al., 2023). Research indicates that companies with greater gender diversity on boards and executive teams are more likely to prioritize sustainability and exhibit better ESG performance (Ben-Amar et al., 2017). Women directors and executives bring unique insights, broadening decision-making, enhancing risk assessments, and improving strategic planning (Campopiano et al., 2023). Their presence also promotes stakeholder engagement and transparency, as diverse leadership better addresses the concerns of various stakeholders, including employees, customers, investors, and communities (Brink et al., 2010).

The impact of gender diversity on sustainability and ESG outcomes is shaped by factors such as corporate culture, leadership dynamics, and industry context. Companies prioritizing diversity and inclusion benefit more from gender diversity, fostering environments where women thrive. Research shows that greater gender diversity at the executive level leads to prioritizing sustainability, stronger corporate governance, and higher corporate social responsibility (Ali and Konrad, 2017).

Building on the idea that women are closely associated with ESG outcomes, gender diversity on boards should correlate positively with logics related with gender, sustainability, inclusivity, and ESG factors (Zhang, 2020). The presence of women on boards impacts organizational values and priorities towards greater gender equality, environmental stewardship, social responsibility, and ethical governance. Boards with diverse gender representation are more likely to embrace multiple institutional logics that prioritize gender equity and inclusivity, recognizing the importance of diverse perspectives in decision-making. Additionally, gender-diverse boards are inclined to adopt sustainability logics, acknowledging the interconnectedness between business operations and environmental and social outcomes. Such boards align with ESG considerations, recognizing the materiality of environmental and social risks and opportunities in long-term value creation. Consequently, gender diversity on boards serves as a catalyst for integrating gender, sustainability, inclusivity, and ESG logics into organizational practices and decision-making frameworks. Women on boards may advocate for comprehensive ESG reporting, ensuring environmental and social risks and opportunities are addressed in corporate disclosures. They bring diverse perspectives to board discussions, prompting broader consideration of stakeholder interests and sustainability goals, reflected in the corporation’s ESG reporting.

Methodology: Measuring the relationship between women directors, women executives and the corporate ESG agendas

Spain has made significant progress in advancing gender diversity on corporate boards through legislative interventions. In 2007, Spain became one of the first countries in the world, after Norway, to introduce a gender quota for corporate boards, requiring that at least 40% of board members be women, although this quota was not enforced by any punitive measure (Gabaldon and Giménez, 2017).

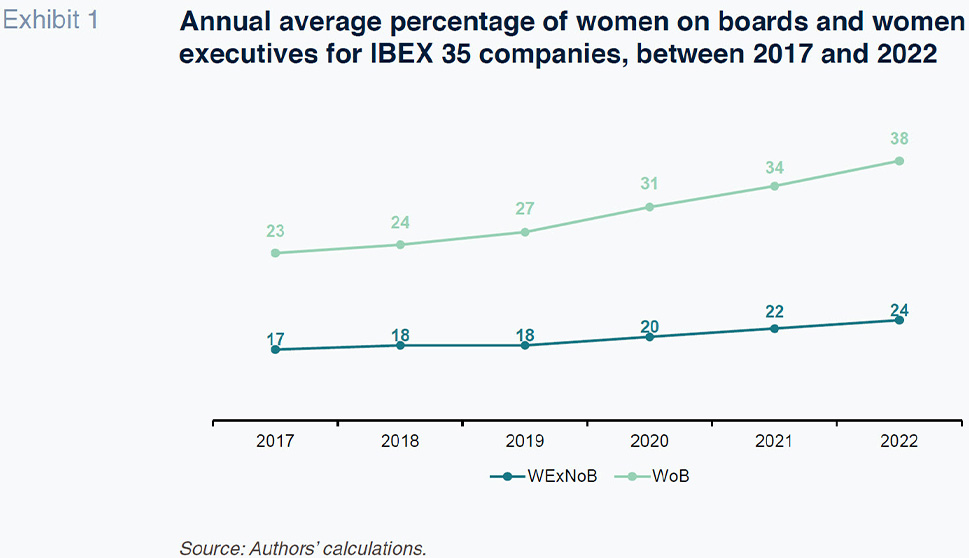

The trajectory of female representation on corporate boards and among executive ranks has become increasingly visible since 2017 in Spain. The acceleration of this trend has been particularly pronounced from 2019 onwards. Over the specified period, a notable increase of 15 percentage points in the presence of women on boards has been observed, alongside a corresponding increase of 7 percentage points in overall female executive representation.

Moreover, an intriguing observation emerges regarding the influence of regulatory compliance on gender diversity dynamics within corporate entities. Specifically, it appears that regulatory adherence exerts a more pronounced impact on enhancing female representation within board compositions compared to its effects on Top Management Teams (TMTs).

We use panel data analysis to examine data from annual reports of companies included in the Spanish IBEX-35 index from 2017 through 2022. Our final sample consists of 206 firm-year observations.

For the dependent variables, Women on Boards (WoB) and Women Executives Not on Boards (WExNoB), we use data from the Spanish Statistical Office (Instituto Nacional de Estadística), to measure the presence of women on the board of directors and the top management teams of IBEX 35 companies.

The independent variables we use in both our models are counts of mentions of the following terms: “ESG”, “Gender”, “Inclusivity”, and “Sustainability”, when these items appear as stand-alone, or they are used in the same paragraph with the words “Board” and “Executive”. The data analysis process involved three steps: first, we established the institutional logic words based on previous studies (Besharov and Smith, 2014; Haveman and Gualtieri, 2017) which used vocabulary measures. Second, we retrieved annual reports of all the companies in English for the period 2017-2022, from the investors’ section of the companies’ websites. We chose to focus on the annual reports published in English, because these are publicly listed companies, they are mandated to publish the same information in English as they do in Spanish. Last, we processed the annual reports using Python coding [2] to get the resulting word counts included in our models.

The results of our econometric analysis show that a greater number of women on boards exhibits a positive correlation with increased mentions of ESG criteria, Gender, Inclusivity, and Sustainability within corporate discourses. However, among these variables, only Sustainability demonstrates statistical significance. This suggests that the involvement of women on boards may contribute to a more comprehensive perspective that emphasizes sustainability concerns. Consequently, boards with higher female representation might be deliberately constituted to prioritize sustainability considerations in corporate decision-making processes.

At the same time, we also find that an increased presence of women in executive roles shows a positive association with references to Gender, Inclusivity, and Sustainability within corporate discourses. However, among these variables, only Gender exhibits statistical significance. This observation suggests that female executives may prioritize concerns regarding gender representation over those related to ESG criteria or sustainability. This inclination towards addressing issues of representativity could underscore the motivations driving the prominence of gender-related discourse within companies led by women executives.

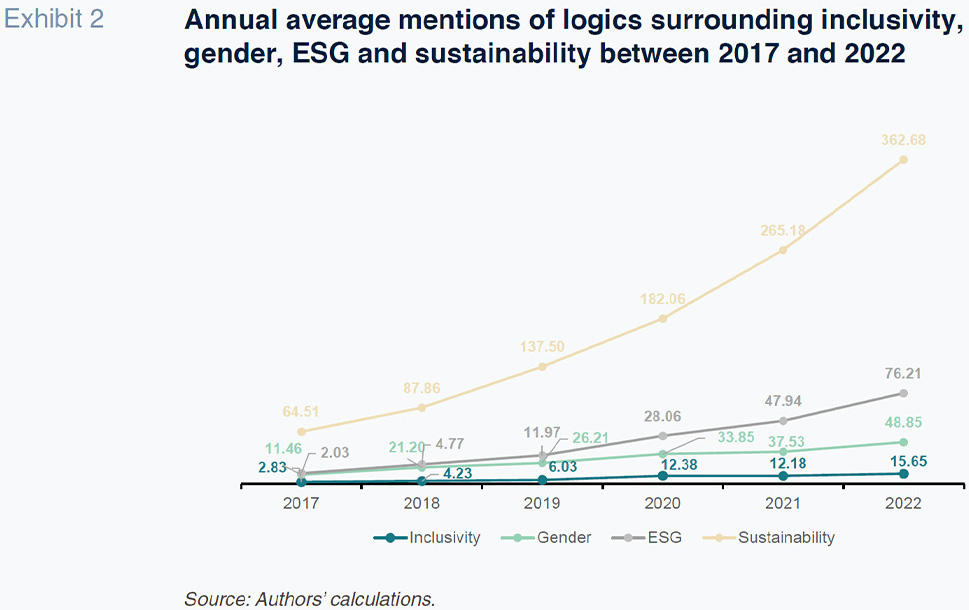

Women directors, women executives and corporate logics surrounding sustainability and gender agendas

On average, corporate reports denote ESG-related matters approximately 28 times per annual report, ranging from 0 to 385 mentions of environmental, social, and governance dimensions. Parallelly, gender discourse manifests an average frequency of 29 mentions per report annually, from 0 to 144 references. The thematic analysis of inclusivity shows, with an average of 8 mentions per report per annum, a range of 0 to 100 mentions denoting inclusivity-related concepts. Lastly, the discourse surrounding sustainability emerges as a focal point, with an average of 182 mentions per report per year, spanning a gamut from 0 to 967 mentions encapsulating sustainable practices and principles.

The growing number of mentions to the different themes in corporate reports shows the increasing importance of these themes for corporations. This could be due to the corporate governance rules that companies have to follow, like having more women on their boards. However, it could also indicate that different stakeholders are more interested in these topics, placing them into the agenda and corporate outcomes. Over a seven-year period, there has been a significant increase in references to sustainability, surging from a modest number to a much higher frequency by 2022, representing a substantial amplification (362 mentions by 2022). Similarly, mentions of ESG considerations have shown exponential growth, starting from a minimal base and expanding to 76 mentions in 2022. Moreover, the thematic discourse around gender has undergone a notable increase, starting from 11 mentions per report in 2017 and undergoing approximately a fourfold increase by 2022. Similarly, references to inclusivity show a substantive increase, sevenfold times larger, to attain 15 mentions in 2022.

Although these two streams to logics seem to be very correlated, when analyzing these data deeper, our findings suggest no strong correlation between women on boards and the frequency of ESG and sustainability mentions in corporate discourse. While more women on boards positively correlates with mentions of ESG criteria, Gender, Inclusivity, and Sustainability, only Sustainability shows statistical significance. This indicates that women on boards may contribute – or be correlated – to a greater emphasis on sustainability concerns.

Conclusions

The analysis shows women on boards have limited impact on corporate reporting, mainly influencing sustainability references. One potential explanation could be that women directors are often selected for sustainable committees due to their expertise, diverse perspectives, and commitment to social and environmental responsibility, enhancing corporate sustainability. In Spanish listed corporations, women’s integration on boards involves dynamics of corporate compliance. Compliance-driven initiatives, like Spain’s non-mandatory gender quotas, push for increased diversity, sometimes resulting in symbolic compliance–superficial efforts to meet quotas without fostering genuine inclusion.

The pressure to increase gender diversity on boards has grown alongside sustainability regulation. Women on boards often serve as ESG representatives, naturally enhancing sustainability focus. Without a counterfactual–what if only men were hired–we cannot isolate the effect of women on sustainability. However, the results show that women on boards do not significantly influence corporate gender discourse, contrary to previous research assumptions.

When we do the same exercise for women executives, we find that the increased presence of women in executive roles is positively associated with references to Gender, Inclusivity, and Sustainability in corporate discourse. However, only Gender shows statistical significance. This suggests female executives may prioritize gender representation over ESG criteria or sustainability. This focus on representation may drive the prominence of gender-related discussions in companies led by women executives.

Women executives face barriers like the “glass ceiling,” limiting their ability to drive substantial change. Regulatory constraints and entrenched gender dynamics in boardrooms hinder their influence on corporate governance and decision-making. However, women executives do impact gender discourse in corporate reporting.

Women executives can dismantle the “glass ceiling” in corporate hierarchies, fostering genuine equity and inclusivity. As pioneers in male-dominated fields, they challenge gender biases and systemic barriers. Leveraging their leadership, they advocate for gender diversity, championing policies that promote equal opportunities and cultivate diverse talent pipelines. Their strategic approaches enhance organizational performance and highlight the benefits of diverse leadership teams. Moreover, women executives serve as role models and mentors, inspiring future female leaders and nurturing supportive ecosystems. Their presence at the top amplifies diverse perspectives and fosters empowerment and collaboration. Consequently, their impact extends beyond individual success to drive systemic shifts towards a more equitable corporate landscape.

In a nutshell, women directors seem more influential on sustainability, while women executives have a stronger impact on gender agendas.

Notes

This research has benefitted from the financial support of Funcas.

References

ALI, M. and KONRAD, A. M. (2017). Antecedents and consequences of diversity and equality management systems: The importance of gender diversity in the TMT and lower to middle management.

European Management Journal, 35(4), pp. 440–453.

https://doi.org/10.1016/j.emj.2017.02.002BEN-AMAR, C., HAFSI, T. and LABELLE, R. (2013). What Makes Better Boards? A Closer Look at Diversity and Ownership.

British Journal of Management, 24(1), pp. 85–101.

https://doi.org/10.1111/j.1467-8551.2011.00789.xBEN-AMAR, W., CHANG, M. and MCILKENNY, P. (2017). Board Gender Diversity and Corporate Response to Sustainability Initiatives: Evidence from the Carbon Disclosure Project.

Journal of Business Ethics, 142(2), pp. 369–383.

https://doi.org/10.1007/s10551-015-2759-1BESHAROV, M. L. and SMITH, W. K. (2014). Multiple institutional logics in organizations: Explaining their varied nature and implications.

Academy of Management Review, 39(3), pp. 364–381.

https://doi.org/10.5465/AMR.2011.0431BRINK, M., VAN DEN, BENSCHOP, Y. and JANSEN, W. (2010). Transparency in Academic Recruitment : A Problematic Tool for Gender Equality?

Organization Studies, 31(1), pp. 1459–1483.

https://doi.org/10.1177/0170840610380812CAMPOPIANO, G., GABALDÓN, P. and GIMENEZ-JIMENEZ, D. (2023). Women Directors and Corporate Social Performance: An Integrative Review of the Literature and a Future Research Agenda.

Journal of Business Ethics, 182(3).

https://doi.org/10.1007/s10551-021-04999-7GABALDÓN, P., DE ANCA, C., MATEOS DE CABO, R. and GIMENO, R. (2016). Searching for Women on Boards: An Analysis from the Supply and Demand Perspective.

Corporate Governance: An International Review, 24(3), pp. 371–385.

https://doi.org/10.1111/corg.12141GABALDÓN, P. and GIMÉNEZ, D. (2017). Gender diversity on boards in Spain: A non-mandatory quota. In

Gender Diversity in the Boardroom (Vol. 1, pp. 47–74). Cham.: Palgrave Macmillan.

https://doi.org/10.1007/978-3-319-56142-4_3GABALDÓN, P., GIMENEZ-JIMENEZ, D. and CAMPOPIANO, G. (2023). Women directors and sustainability: A contribution of networking activities. In

Research Handbook on Corporate Governance and Ethics. https://doi.org/10.4337/9781800880603.00017GALBREATH, J. (2011). Are there gender-related influences on corporate sustainability? A study of women on boards of directors.

Journal of Management and Organization, 17(1), pp. 017–038.

https://doi.org/10.1017/S1833367200001693GRAU, P., MATEOS DE CABO, R., GIMENO, R., OLMEDO, E. and GABALDÓN, P. (2020). Networks of Boards of Directors: Is the’Golden Skirts’ Only an Illusion?

Nonlinear Dynamics, Psychology, and Life Sciences, 24(2), pp. 215–231.

HAVEMAN, H. A. and GUALTIERI, G. (2017). Institutional Logics.

Research Encyclopedia, Business and Management, 1–15.

https://doi.org/10.1093/acrefore/9780190224851.013.137KHEMAKHEM, H., ARROYO, P. and MONTECINOS, J. (2023). Gender diversity on board committees and ESG disclosure: evidence from Canada.

Journal of Management and Governance, 27(4), pp. 1397–1422.

https://doi.org/10.1007/S10997-022-09658-1/FIGURES/2KROOK, M. L. (2007). Candidate gender quotas: A framework for analysis.

European Journal of Political Research, 46(3), pp. 367–394.

https://doi.org/10.1111/j.1475-6765.2007.00704.xMANITA, R., BRUNA, M. G. and DANG, R. (2018). Board gender diversity and ESG disclosure: evidence from the USA.

Journal of Applied Accounting Research, 19(2), pp. 206–224.

https://doi.org/10.1108/JAAR-01-2017-0024TERJESEN, S. and SEALY, R. (2016). Board Gender Quotas: Exploring Ethical Tensions From A Multi-Theoretical Perspective.

Business Ethics Quarterly, 26(01), pp. 23–65.

https://doi.org/10.1017/beq.2016.7ZHANG, L. (2020). An institutional approach to gender diversity and firm performance.

Organization Science, 31(2), pp. 439–457.

Patricia Gabaldon and Raluca Valeria Ratiu. IE Business School, IE University, Spain