Bank margins: Price, volume and composition effects - Spain in a European context

Two years since the start of the rate hiking cycle, various factors have shaped the trend in margins, with some clearly positive while others less favourable, raising doubts over the sustainability of current margins. A disaggregation of the rate, volume and funding reconfiguration effects helps to explain the incremental growth in the Spanish banks’ net interest margin relative to their European counterparts.

Abstract: The two years since the start of rate tightening have been marked by very positive net interest margin dynamics in the European banking sector in general and in the Spanish sector in particular. Within this context, various factors have shaped the trend in margins, with some making a clearly positive contribution compared to others that have been less favourable and have even called into question the sustainability of current margins. Broadly speaking, the return on interest-bearing assets has been boosted significantly by the rate effect, compared to a neutral or even negative volume effect, in line with meagre growth in credit, especially in Spain. As regards the cost of deposits, this has been shaped by a different strategy pursued by the Spanish banks compared to their European peers as a whole. This liability price management strategy has contributed to a different pattern in funding inflows and outflows and significant reconfiguration of the banks’ pool of funding, marked by a bigger share of wholesale funding, particularly during the past year, when the banks have taken advantage of sharp tightening in their bond spreads. A disaggregation of the rate, volume and funding reconfiguration effects helps to explain the incremental growth in the Spanish banks’ net interest margin relative to their European counterparts.

Growth in the European and Spanish banks’ net interest margins

The rate increases initiated by the European Central Bank (ECB) mid-2022 have translated into a clearcut improvement in the profitability of the European banks and, especially, the Spanish banks, shaped primarily by the key profit and loss line item: the net interest margin. The improvement began gradually in 2022, in line with the lag historically observed between the repricing of assets versus liabilities, with wholesale funding repricing faster, in general, than asset repricing, as analysed in a recent paper (Alberni et al., 2022). In contrast to the moderate growth observed in 2022, the banks’ net interest income took off in 2023, with the European banks registering year-on-year growth of nearly 20% and the Spanish banks (in respect of their businesses in Spain) recording growth of 52%.

The improvement in net interest income was shaped by a range of factors, with some making positive contributions and others having a neutral impact, or even a negative impact in the case of the Spanish banks.

Interest income: Contributing factors

On the interest income side of the equation, growth has been substantial in both Europe and Spain, due largely to the increased profitability of the retail business, i.e., the return on loans to customers.

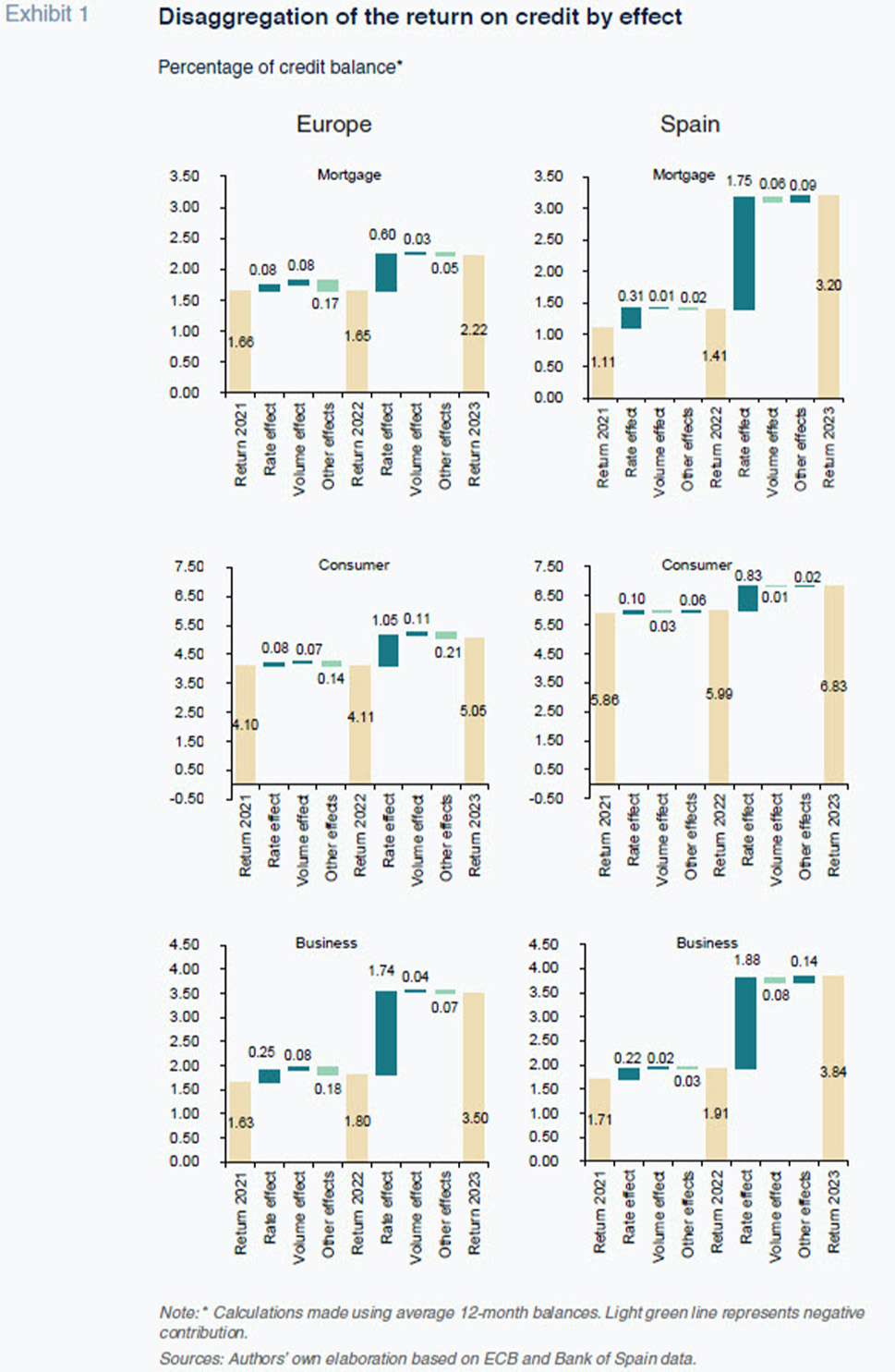

Turning to the factors that shaped the increase in the profitability of the banks’ credit portfolios, Exhibit 1 analyses the various drivers of the trend in the total return on credit for each segment, differentiating between: the rate effect (change in the average return associated with the change in interest rates); volume effect (change in the average return derived from the increase or decrease in the stock of credit), and other factors (mainly associated with changes in the composition of the stock of credit). The exhibit illustrates how portfolio repricing (rate effect) is the main factor explaining the improvement in interest income in Europe and Spain in all three key segments (mortgage, consumer credit and business loans) in 2023.

On the other hand, the volume effect had a very slight positive effect in the case of the European banks, albeit this positive contribution has been smaller in 2023.

In contrast, the contribution of the volume effect in 2023 in Spanish banks has been negative in the main loan segments.

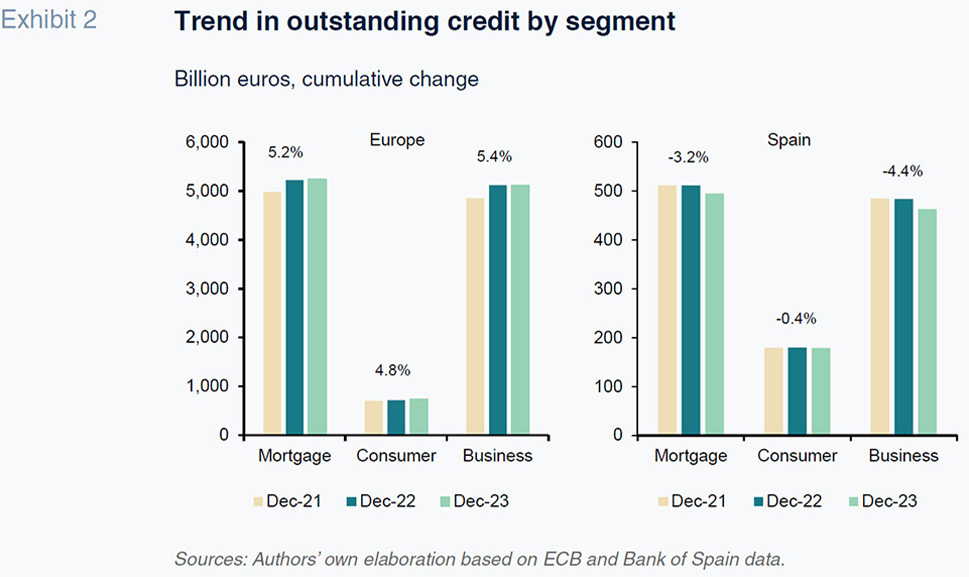

This volume effect is aligned with the trend observed in outstanding credit balances in the various segments analysed. As shown in Exhibit 2, on aggregate in Europe, despite tightening financial conditions since mid-2022 and more sluggish economic growth last year, loans to individuals held steady or increased very slightly in 2023, albeit breaking the upward momentum that carried on throughout 2022, despite the start of rate tightening in the middle of that year. In 2022 and 2023, credit increased by a cumulative 5% to 5.5% in all three segments in Europe.

In contrast, the volume of credit extended by the Spanish banks has contracted considerably in the mortgage and business lending segments, mainly in 2023 (mortgage credit: -3.1%; business loans: -4.3%), having held steady in 2022. The shrinkage of those loan books is the result of: (i) a drop in lending activity, marked by double-digit contractions year-on-year; and, (ii) an increase in repayments, specifically an uptick in mortgage prepayments and the cancellation of the state-guaranteed loans extended to businesses during the pandemic.

The increase in repayments, which has led to a bigger contraction in the stock of credit in the Spanish system, has been shaped by a third factor: the composition effect. This has do with the fact that the Spanish banks are more exposed to loans extended at floating rates of interest, whereas the European banks are more exposed to fixed-rate loans, in both the mortgage and business loan segments. This also explains why the average return on the credit portfolio across the different segments has reached a higher level in Spain than in Europe even though the pass-through of the increase in official rates to new loan prices has been relatively lower in Spain (partially compensated by the fact that they have offered relatively less for deposits).

Average bank funding costs

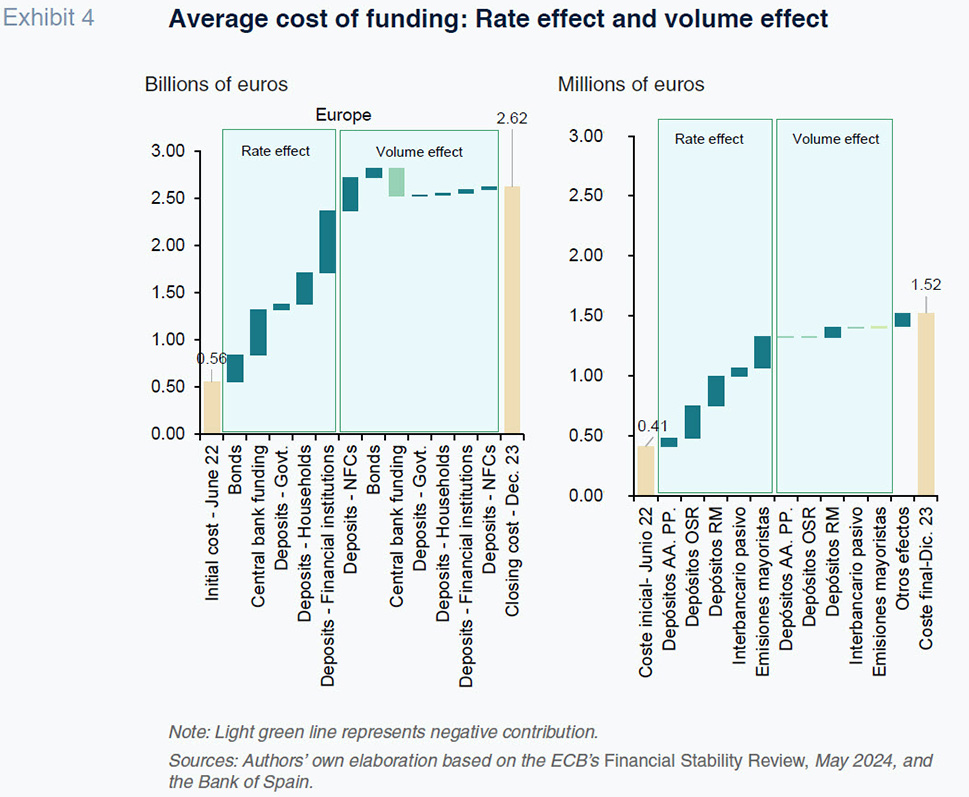

On the liability side of the equation, bank funding sources have become more expensive across the board, with the average funding cost increasing in Europe and Spain alike. However, the relative weight of deposits among the banks’ sources of financing also comes into play. This is because the banks’ financing costs in the interbank and wholesale markets are shaped directly by benchmark or market rates that can be considered an exogenous factor, whereas the rates the banks pay on their deposits are an endogenous factor, i.e., a variable over which they have influence or managerial discretion. As a result, the rates offered for deposits followed different patterns in both regions, shaping the trend in the flows in and out of the main liability items and the composition of the sector’s funding structure.

The Spanish banking sector has managed deposit pricing more cautiously than the European banks, especially in the retail segment, holding back from increasing the rates offered more intensely until the second quarter of 2023. This more moderate increase in deposit rates was in turn substantiated by a number of factors related with the banks’ relative liquidity positions:

- Although several of Europe’s largest banking systems had sizeable liquidity buffers in common, the Spanish banks presented (and continue to present) above-average liquidity ratios. According to the data published by the European Banking Authority (EBA) in its Risk Dashboard as of June 2022, the Spanish banks reported a liquidity coverage ratio (LCR) of 200.2%, compared to a European average of 164.9%, and a net stable funding ratio (NSFR) of 178.3%, compared to an average of 167.1%. As of year-end 2023, that same publication revealed a lingering gap: LCRs of 178.3% and 167.1%, respectively, and NSFRs of 131.2% versus 126.8%.

- Not only did the Spanish banks have a more comfortable liquidity position, as we saw above, demand for credit in Spain was notably weak and the banks’ loan books shrank by more than those of their European peers, further alleviating pressure on system liquidity.

- Note, lastly, that the Spanish banks were particularly active in the debt capital markets in 2023, offsetting the reduction in interbank funding sources (mainly use of ECB liquidity under the scope of its targeted longer-term refinancing operations, specifically TLTRO III) and a considerable outflow of deposits at the start of 2023, which has since stabilised. This demonstrates the Spanish banks’ ability to take advantage of windows of opportunity in the capital markets, an ability that allowed them to raise nearly 50% more financing in 2023 than in 2022, tapping into strong demand from investors and more stable issuance costs during the second half of last year, as borne out by the data published by the Bank of Spain in its Spring Financial Stability Report.

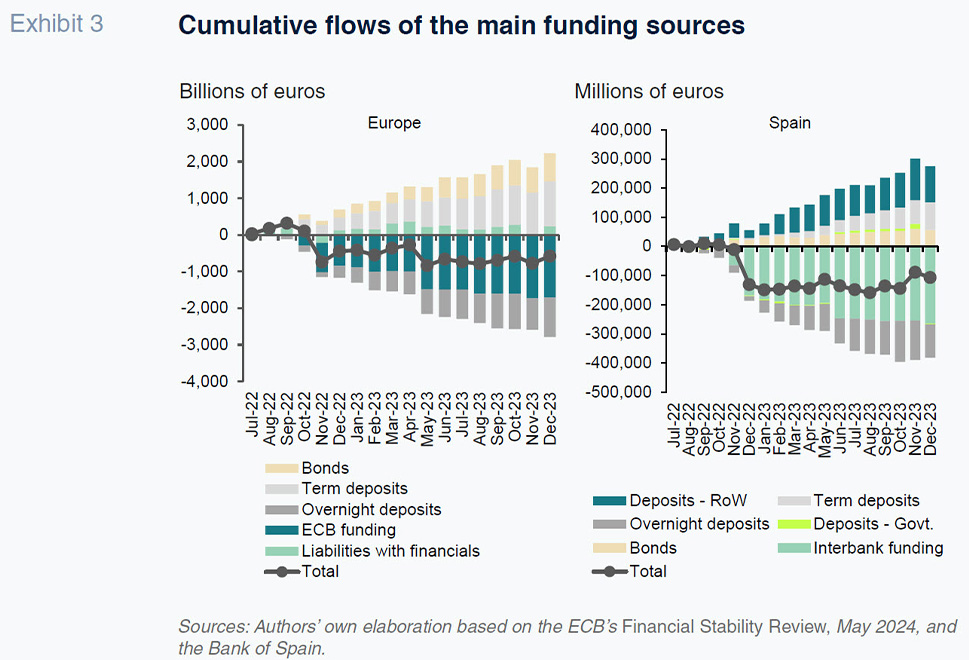

Due to more cautious management of deposit remuneration rates in Spain relative to Europe, funding flows have also etched out contrasting patterns. As shown in the ECB’s most recent Financial Stability Review, which dates to May 2024, the European banks’ liabilities decreased by almost 508 billion euros between July 2022 and December 2023, shaped largely by the 1.7 trillion euro decrease in central bank funding. In addition, the volume of overnight deposits decreased by 1.1 trillion euros, whereas term deposits increased by 1.2 trillion euros across the European system, so that deposits made a positive net contribution to total bank liabilities.

As shown in Exhibit 3 the Spanish banks’ central bank funding also decreased, as the Spanish sector had been one of the heaviest users of the TLTRO III programme, with this exposure contracting by 265 billion euros since July 2022 as the banks repaid those facilities. Therefore, the main difference lies with deposits, where overnight deposits decreased by 114 billion euros in the Spanish system, with term deposits increasing by somewhat less, 95 billion euros, triggering a net decrease in the stock of deposits which has been largely offset by the growth in bond issues, as well as healthy dynamics in deposits outside of Spain.

Within this distinct pattern, it is worth highlighting two key matters: i) the negative trend in credit in Spain relative to Europe has meant that the reduction in most interbank funding has not had to be replaced by other sources of funding; and, ii) the Spanish banks were in a strong position relative to other European systems where a shortfall of available liquidity relative to TLTRO III repayments forced them to search for alternative sources of financing, including deposits.

As a result, the European banks’ average funding costs increased by 2 percentage points between June 2022 and December 2023, whereas the Spanish banks’ costs increased by just one percentage point. In both instances, the increase was driven by the rate effect, mainly associated with deposits and wholesale issues, but also a composition effect, due to a shift towards more expensive sources of funding than the ECB interbank facilities they have been repaying.

In short, it is clear that the significant improvement in bank margins has been marked by the increase in interest rates and the impact on the return on credit, rather than business volumes, which have had barely any impact on the improvement. The fact that lending volumes have actually detracted from margin growth clearly raises questions about the banks’ ability to further increase or defend their margins in the coming quarters unless credit activity comes back to life, as the positive repricing effect appears to have run its course now that the ECB has started to taper its official rates.

References

Alberni, M., Berges, Á. and Rodríguez, M. (2022). Translating EURIBOR increases into improved banking margins: Differential timing on asset and liability repricing.

Spanish and International Economic & Financial Outlook, Vol. 11(5).

https://www.sefofuncas.com/pdf/Alberni-11-5-1.pdf

Marta Alberni, Alejandro Montesinos and María Rodriguez. Afi