Spanish economic forecasts panel: March 2023*

Funcas Economic Trends and Statistics Department

The GDP growth estimate for 2023 has been increased by two-tenths reaching 1.5%

In the last quarter of 2022, GDP grew, according to provisional figures, by 0.2%, above the panelists’ forecasts, boosted by a positive foreign sector that more than offset negative domestic demand. GDP grew by 5.5% for the year as a whole.

Indicators for the first quarter of this year are generally positive for industry, construction and services.

Due to better-than-expected performance in recent months, the GDP growth estimate for 2023 has been revised upwards by 0.2pp to 1.5%. As for the quarterly profile, the panelists´ forecast for the first quarter is for a 0.1% growth in GDP, and for quarterly growth of around 0.4-0.5% for the rest of the year (Table 2).

The contribution of domestic demand will be 1.2 pp, which is 0.1pp less than the previous forecast, while the foreign sector will add 0.3pp, compared to the zero-contribution predicted by the last panel. The growth forecast in public consumption was revised upwards while household consumption and investment in all sectors was revised downwards. In foreign trade, import growth was revised downward and export growth upward (Table 1).

The forecast for growth in 2024 is 2.1%

For the first time, this panel requests projections for 2024. The consensus forecast for GDP growth is 2.1%, which would represent an acceleration of 0.6pp over 2023.

The contribution of domestic demand is expected to reach 2pp. Given this, public consumption is expected to moderate, while investment and private consumption are forecast to accelerate (Table 1). The foreign sector is expected contribute 0.1pp to GDP growth.

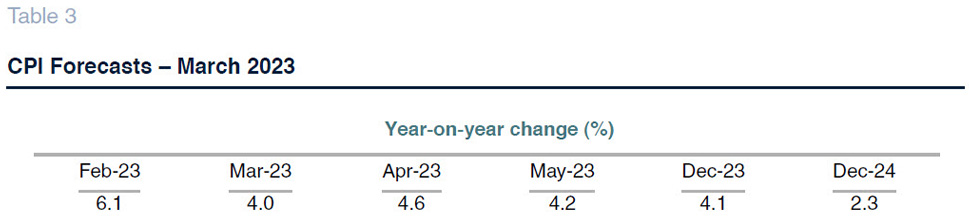

Upward revision of overall and core CPI forecast

The moderation of the overall CPI that began in September 2022 has been interrupted since the beginning of this year. As for core inflation, it continues to reach record highs, ending up at 7.6% in February.

Given the persistence of inflationary pressures, the forecast for the average annual rate has been raised by 0.2pp to 4.2%. By 2024, prices are expected to increase by 2.8%. As for core inflation, the forecast has also been raised to 5.5%, and is expected to moderate to 3.3% in 2024.

The expected year-on-year rates for December 2023 and December 2024 are 4.1% and 2.3%, respectively.

Employment will continue to grow and the unemployment rate will fall to 12.4% in 2024

According to Social Security enrollment figures, the labor market has continued its positive trend. In the first two months of the year, all sectors, except agriculture, have created employment, with the services sector being the main driving factor.

The panelists´ forecast for employment growth is 1.1% for 2023 and 1.6% for 2024. The implied forecast for productivity and unit labor cost (ULC) growth is derived from the forecasts for GDP, employment and wage growth. Productivity per full-time equivalent job is expected to grow by 0.4% this year –one tenth of a percent more than in the previous panel–, and by 0.5% in 2024. As for ULCs, they are expected to increase by 3.2% in 2023 and by 2.8% in 2024.

The unemployment rate is forecast to average 12.9% per year in 2023, falling to 12.4% in 2024 (Table 1).

The trade surplus remains positive

While figures are still provisional, the balance of payments account recorded a surplus of 11,775 million euros in 2022, 0.9% of GDP, slightly above the previous year’s 11,524 million euros. Again, the forecast estimates points to a surplus of 0.5% and 0.6% of GDP in 2023 and 2024, respectively (Table 1).

Public deficit lower than expected since the previous Panel

The consolidated balance of public administrations, excluding local authorities, amounted to -25.8 billion euros up since November, compared to -61.9 billion euros in the same period of the previous year. This improved result is due to a higher-than-expected increase of 49.515 billion euros in revenues, much greater than the 13.447 billion euros increase in expenditures.

The panelists foresee a reduction in the deficit of the general government sector over the next two years. In 2023 it is expected to reach 4.2% of GDP, which is 0.1pp less than in the previous panel, with a 3.7% result expected in 2024.

The international landscape remains uncertain

For the time being, the global economy is holding up better than expected against the impact of inflation. Since the beginning of the year, economic indicators have picked up: the PMI indicator for global purchasing managers rose above the 50 expansion threshold in February. Energy markets have continued to moderate, while geopolitical risk is perceived to be lower, giving the economy some breathing space. The resilience of labor markets is another favorable factor. In its latest outlook for 2023, the OECD revised its projection for global growth to 2.6% (0.4 points higher than in the November outlook) and to 0.8% in the case of the eurozone (0.3 points higher).

Despite these results, the environment remains very uncertain, firstly due to the persistence of inflation and its derivatives. The loss of purchasing power could begin to have an impact on household consumption figures once the savings surplus has been exhausted. Moreover, the tightening of monetary policy has brought vulnerabilities in the financial system to the surface. The bankruptcy of SVB was followed by a liquidity crisis at Credit Suisse, unleashing severe turbulence in the financial markets, the consequences of which have not been included in this Panel.

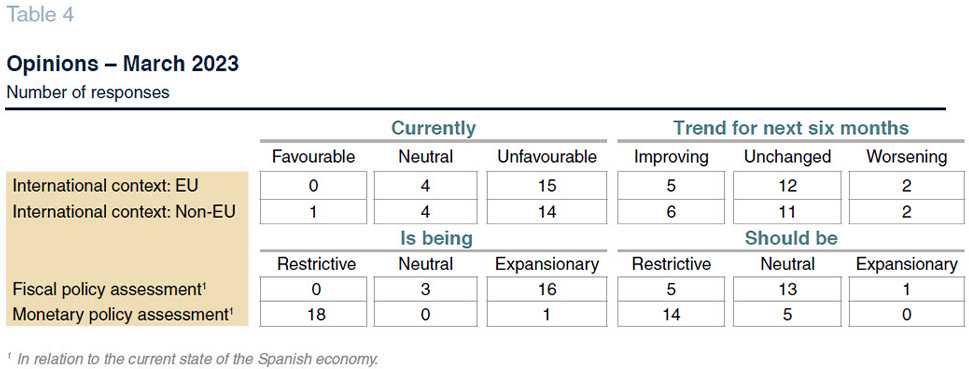

Within this context, the panelists maintain their pessimistic assessment of the external environment, both in Europe and beyond. Moreover, most believe that this environment will not change in the coming months, although fewer believe that the outlook could worsen in the EU (with 2 analysts forecasting a deterioration, compared to 5 in the January panel).

Interest rates will continue to rise

Since the publication of the January panel, the ECB raised benchmark rates by 50 basis points, while the Federal Reserve hiked rates by 25 bps. The recent failure of SVB bank –prior to the closing of this Panel– has immediately dampened the rise in Euribor and lowered expectations of discounted rate hikes in the futures markets, with the prospect of central banks slowing the pace of monetary policy tightening going forward for fear of further instability in the financial system.

The participants in this survey, who in January considered that the maximum interest rate in the eurozone would be around 3.5%, have raised their forecasts to 4%, a level that would be reached in the second quarter of this year and would remain as such until mid-2024. During the second half of next year, the monetary authority could cut interest rates by 50 basis points.

Consistent with the higher expected level of monetary policy intervention rates, expectations have also been raised with respect to the one-year Euribor, which is expected to peak in the second half of this year at 4%, and then decline to below 3.5% by the end of 2024. With respect to the Spanish 10-year government bond, it is projected to peak at 3.8% at the end of this year and then decline to 3.5% in the second half of 2024.

The Euro will appreciate against the dollar

In recent months, the Euro has tended to recover some of the ground lost against the dollar, as a result of the ECB’s interest rate hike path, so markets anticipate a narrower financial yield differential between the two sides of the Atlantic. Analysts are forecasting a slight appreciation in the coming months (Table 2), following a slightly steeper slope than that predicted by the previous panel.

* The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.

This Panel has been prepared before the current episode of financial turbulence.