Shadow banking: A distortion of the banking business

Since the great recession, shadow banking has been growing worldwide, especially in the US and the Eurozone. However, monetary tightening and new capital requirements for private equity will likely slow down shadow banking growth.

Abstract: Since the onset of the financial crisis in the US in 2007, what has become known as the shadow banking system has attracted the attention of analysts, sparking growing concern about its role as a destabilising force. In the meantime, international financial system globalisation and innovation, coupled with regulatory trends across the world’s main regions, particularly in the area of bank solvency, have only increased the relative importance of the shadow banking system, particularly in the US and eurozone. Yet, it is noteworthy to examine the diverse factors underpinning the extension of shadow banking within these two regions. In the eurozone, although there are limitations given the lack of available financial literature on this topic, according to our empirical analysis, the expansion of shadow banking is mainly being driven by regulatory pressure, whereas in the US, the profitability of financial intermediation more broadly is the main impetus for shadow banking growth. Going forward, ongoing interest rate tightening, coupled with restrictive monetary policies, will drain financial system liquidity. At the same time, modified capital requirements for private equity and investment funds will entail high capital requirements for these types of vehicles. The combination of these two factors will foreseeably slow shadow banking growth.

What do we mean by shadow banking?

The first thing we need to do is define what is meant by shadow banking. The term ‘shadow banking’ is attributed to Paul McCulley, former CEO of PIMCO and professor at Cornell Law School and the Georgetown McDonough School of Business, who coined the term back in 2007 to refer to all financial intermediation activity taking place outside of the banking system.

The best-known study of the phenomenon is that undertaken by the Financial Stability Board (FSB), which brings together the national authorities responsible for financial stability all around the world. That institution defines shadow banking as “credit intermediation involving entities and activities outside the regular banking system”. In other words, all entities that undertake the activities performed by the banks on the credit side but which, by not directly taking deposits and, thereby, not taking household or business savings, are not regulated in the same way as traditional commercial banks.

Until 2018, the FSB’s reports used to be called the Global Shadow Banking Monitoring Report. Subsequently, however, in a sign of the sector’s diversity, the FSB decided to switch from shadow banking to ‘non-banking financial institutions (NBFIs), which is the term it continues to use today to refer to these entities, as it better depicts their varied nature.

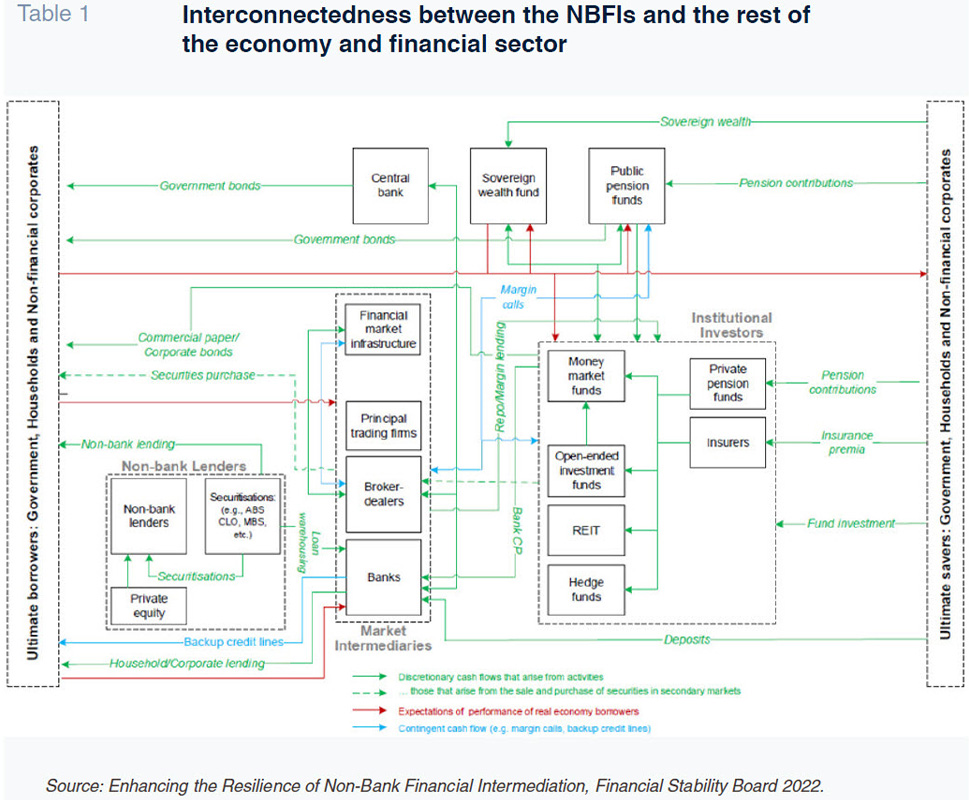

The NBFI ecosystem is increasingly complex and strongly interrelated with the rest of the financial system (Fan and Pan (2020) and Grillet-Aubert, et al. (2016)), where it goes for the financing it needs to carry on its business activities. Within the universe of NBFIs there are insurers, which are governed by their own set of regulations, pension funds, also under the umbrella of a specific regulatory framework, and a host of other entities the FSB dubs other financial institutions (OFIs). Some of those entities fall under the umbrella of a bank or other regulated entity on account of their business model or nature so that they do carry on regulated activities. There are other types of entities that are not under that umbrella, however.

In order to better understand the nature of those entities, Table 1 depicts the connection between the NBFIs and the rest of the financial and economic system.

Description of a reality in the shadows

In light of the foregoing, it is vital to describe and contextualise the shadow banking phenomenon in order to understand its significance.

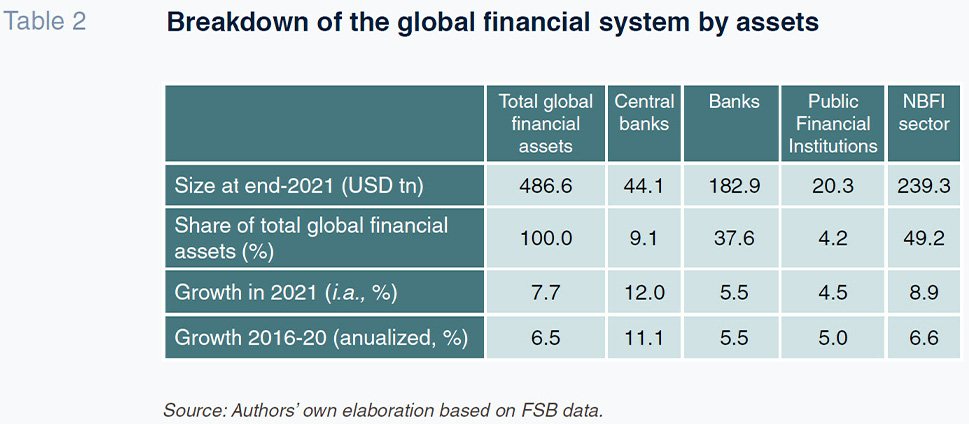

As noted by the FSB in its most recent Global Monitoring Report on Non-Bank Financial Intermediation, published in December 2022, the sector has been registering almost double-digit growth in recent years, specifically by 8.9% in terms of total assets in 2021, according to the latest figures available.

As noted earlier, the main types of entities included under the NBFI definition are insurance corporations, pension funds, other auxiliary financial institutions, and ‘other financial institutions’ or OFIs, a catch-all category that mainly includes investment funds of all kinds (FSB, 2022).

Despite the fact that the NBFIs’ total share of assets has increased, Table 2 shows how the banks, as standalone institutions, continue to account for the biggest share of financial assets, specifically 37.6% of total global financial assets. The banks are followed by the OFIs, which command 31.2% of total global financial assets, pension funds, at 9.2%, and insurance corporations, at 8.3%.

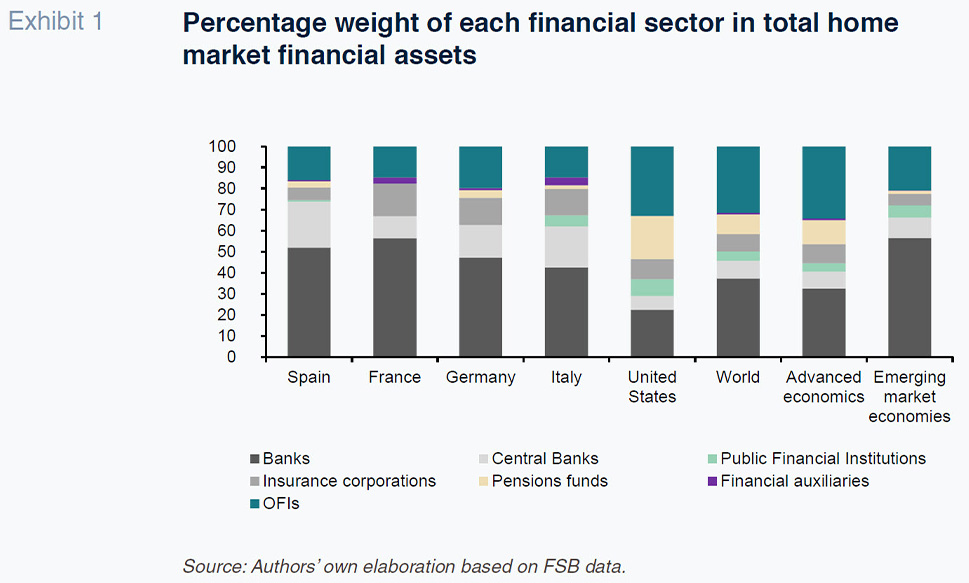

Exhibit 1 shows the weight of assets for each category of firms as a percentage of each country’s total financial assets. In Spain, the banking sector garners 52% of all financial assets and is followed by the Bank of Spain, which holds almost 22%. OFIs account for nearly 16% of the total, equivalent to nearly 73% of GDP, with the remainder of the pie made up of insurance companies (6%) and pension funds ( approximately 3%). Albeit with some differences, that pattern is broadly similar in the main European countries, with the banks continuing to dominate.

Turning to the US, the picture changes. There, where the financial markets are more developed and businesses and society are more accustomed to tapping them for financing, the weight of the banks in the financial sector is significantly lower, at around 22.5% of total assets. In contrast, the OFIs and pension funds account, between them, for over half of the total (33.0% and 20.4%, respectively), indicating the scale of those sectors in the US economy.

In emerging economies with less developed financial markets, the weight of the banks is considerably higher than in advanced economies, where investment funds account for a substantial weight of total assets.

As already noted, the FSB includes a plethora of different types of entities in the OFI category, notable among which: money market funds; other investment funds; hedge funds; REITs; finance companies (FinCos); broker-dealers; structured finance vehicles; trust companies; captive financial institutions and money lenders; and central counterparties.

Although they do not all fit into the shadow banking concept (with the FSB itself having moved away from that term to categorise them), some are channelling credit to the economy beyond the reach of bank regulations. Indeed, their monitoring by the FSB and global credit supervisors and regulators is all the more prescient in the current context on account of their relevance to the economy.

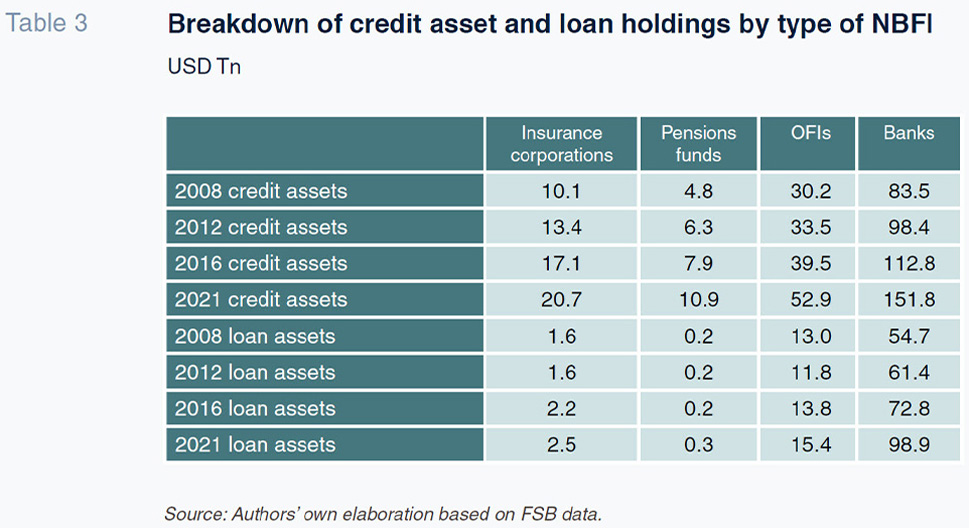

According to the data published by the FSB, presented in Table 3, the NBFIs’ credit asset holdings have been growing over the past 14 years.

Loans held by NBFIs have also increased in volume since 2008 to stand at around 18 trillion dollars worldwide. Although the weight of their loan holdings has declined by comparison with 2008 (to 15.5% from 21.5%), their volume has increased. Hence the keen interest in analysing, supervising, and monitoring them.

Delving deeper into the composition of those holdings by entity type reveals that the OFIs have increased their share of both credit and loan holdings. Within that category, investment funds held the biggest volume of credit assets as of year-end 2021.

In the current environment of high inflation, financing conditions are changing considerably, a development that is affecting NBFIs and their customers’ contributions.

Firstly, market volatility drove assets under fund management around 7% lower last year. Over 90% of the drop in assets under management is attributable to asset devaluation, with the upward trend in interest rates sparking a significant correction in financial asset prices. The remaining decrease, while not significant, was shaped by a drop in customer capital contributions and financial institution funding, with prevailing uncertainty and tighter bank regulations playing a key role in the decrease in contributions by households and businesses to these kinds of vehicles.

Given these entities’ weight in the economy, in the next section, we attempt to estimate the factors that determine the size of shadow banking systems.

Factors determining the size of shadow banking systems in the eurozone

In this section, we take a look at the factors that determine the size of the shadow banking systems in the countries comprising the eurozone. There is an obvious shortage of data. The FSB (2022) only provides the size of those systems for Spain, Belgium, France, Germany, Ireland, Italy, Luxembourg and the Netherlands.

Nevertheless, that block of countries represents 89% of the eurozone GDP, [1] so an analysis of those figures is sufficiently representative of the European reality.

Elsewhere, in line with previous shadow banking studies (Kim, 2016), we use the FSB’s OFI segment as our proxy for this part of the financial sector (2022). That segment includes all financial intermediaries other than banks, insurance corporations, and pension funds.

Having determined the estimation sample and the variable to be explained (value/size of the OFI segment, using the natural logarithm), we came up with a range of assessments in order to understand which factors best explain the importance of this segment of the financial intermediation sector.

The variables analysed are: The value of the OFI segment, Regulatory capital ratio, return on equity (ROE), GDP per capita, creation of the Single Supervisory Mechanism (SSM), NPL ratio, changes in NPLs, financial development index, Net profit over RWA and Net Interest Margin over total assets.

From a methodological standpoint, we used panel data analysis since we have information for several countries over a given period of time. That approach is consistent with pre-existing literature (Kim, 2016).

The first analyses performed indicated a lack of statistical significance around the following variables: ROE, NPLs/total assets, financial development index, net profit/RWAs, relative and absolute change in NPLs, and NII/total assets.

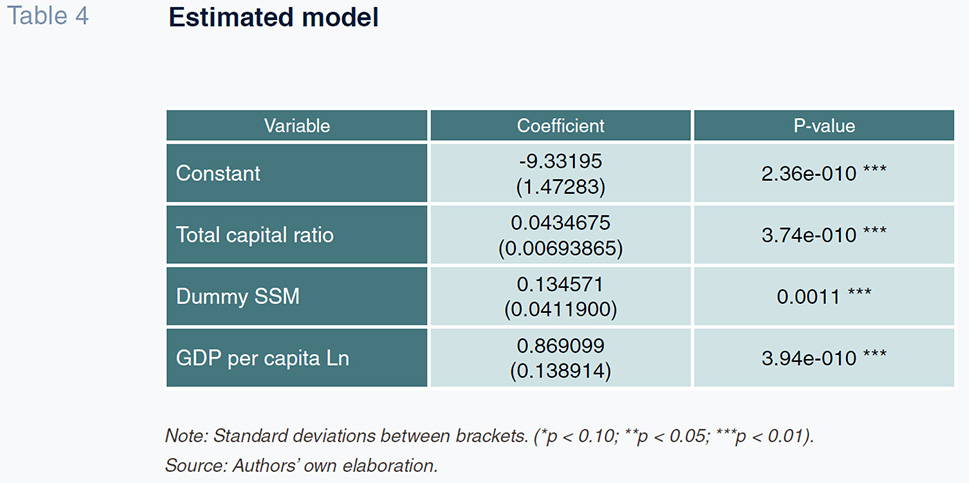

Table 4 accordingly provides the final model [2] with the statistically significant variables selected so as to yield valid conclusions.

The results yield some interesting conclusions about the factors that are correlated with the size of shadow banking systems in the eurozone.

Firstly, they indicate the importance of regulations in the weight of shadow banking in Europe, a conclusion underpinned by the sign of the total capital ratio and SSM variables. Without a doubt, therefore, the existence of more stringent bank regulations (an intense thrust since the creation of the second pillar of the Banking Union, the Single Supervisory Mechanism) encourages entities subject to less intense regulations to corner segments of the market where the banks are more reluctant to lend on account of more stringent capital limits. This enhances resilience and financial stability of the financial system (Gebauer and Mazelis (2020)).

Secondly, higher national wealth also implies growth in the incidence of shadow banking in the eurozone as, logically, an increase in wealth leads to growth in investment activities, some of which are tapped by this segment of the financial intermediation spectrum by offering higher returns.

Analytical comparison between the eurozone and the US

Having analysed the key determinants of the size of the shadow banking system in the eurozone, we looked at whether those conclusions can be extrapolated to the world’s largest international banking system, that of the US. To do that we conducted variance decomposition analysis [3] in the two regions to analyse the relative importance of each explanatory variable in determining the size of their shadow banking segments.

The databases used to perform that analysis in each geography are those described in the previous section. The specific variables used in the analysis are the size of the OFI segment (natural log), GDP per capita (natural log), the bank system capital ratio, and the NPL ratio.

We also include the ROE in the US analysis and the 12-month Euribor in the eurozone analysis. Let us explain the difference in variables. In the eurozone, the shadow banking sector has been increasing in size significantly since 2013 as a result of the creation of a number of investment institutions in response to the ECB’s implementation of expansionary monetary policy and the attendant reduction in interest rates (which eventually turned negative), which ultimately prompted the financial institutions to become commercially active, urging customers to move their funds to off-balance sheet products (such as investment funds, which are part of the shadow banking system) in order to improve their funding costs. Moreover, in the case of the eurozone, the banks’ profitability is significantly determined by their net interest margins, in turn, dependent on the interest rate curve, implying that the 12-month Euribor is also a good proxy for ROE in that specific market.

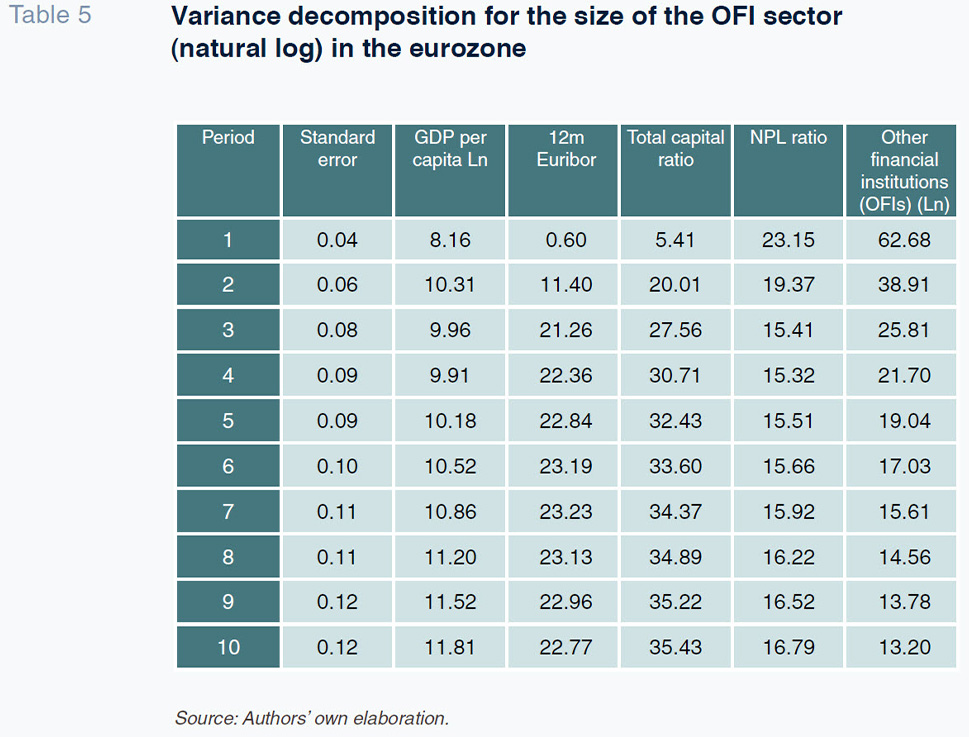

Table 5 provides the variance decomposition for the eurozone. It shows how, consistent with the results obtained in the previous section, the variable that makes the biggest relative contribution to determining the size of the shadow banking segment in the eurozone is that related to solvency requirements, measured using the capital ratio (with a contribution of approximately 35% in the medium- and long-terms). 12-month Euribor makes a relatively meaningful contribution in the medium- and long-terms of approximately 23%, which is consistent with the thesis presented in the paragraph above. [4] The GDP per capita and NPL variables play a smaller role in the eurozone, with contributions of under 20%.

It is important to highlight their importance in matters of financial stability. An increase in interest rates, together with the start of the withdrawal of the extraordinary expansionary measures (liquidity) as we are seeing at present, ‘quantitative tapering’ in other words, in which savers will increasingly be interested in deposits, could give rise to tensions in the financial markets. Those liquidity tensions could cause turbulence in the markets derived from the withdrawal of monetary stimuli. However, the impact on the bank channel should be limited as the financial institutions are currently less dependent on the financial markets for funding than in the past.

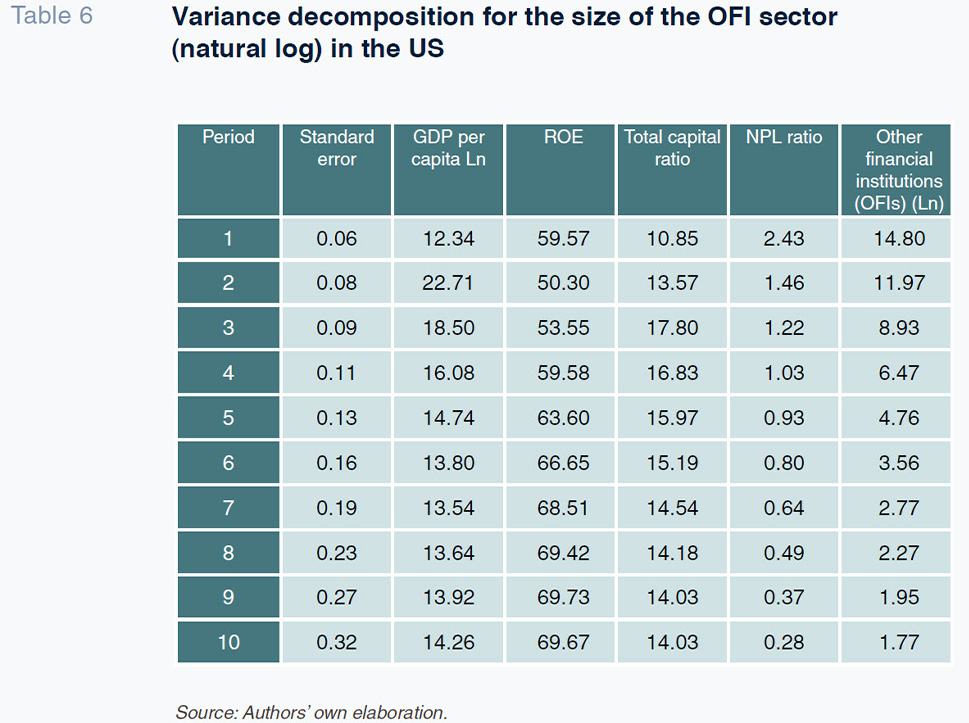

Table 6 provides the variance decomposition for the US. It reveals that the results obtained for the eurozone do not hold for the North American banking system – the regulatory burden, measured using the capital ratio, which plays a prominent role in determining the size of the shadow banking system in the eurozone, plays a secondary role in the US, making a relative contribution of just under 15%. In contrast, in the US, the banking system’s ROE is the most important variable in determining the size of the country’s shadow banking system, with a relative contribution of over 50%.

These results lead us to the conclusion that in the eurozone, shadow banking emerges as an alternative to the provision of financing in an attempt to circumvent the regulatory burden, whereas in the US, the size of the shadow banking system increases, in general, when the business of extending financing is more profitable, irrespective of the regulatory burden. As for GDP per capita, the relative contribution of this variable is similar in the US and eurozone, at around 10%-15%.

Conclusions

Since the dawn of the Great Recession, and most particularly since the start of the last decade, shadow banking has grown significantly worldwide, including in two of the world’s most important financial systems, those of the US and the eurozone, as analysed in this paper. However, the factors driving this phenomenon differ between the two regions. Our results suggest that in the eurozone it is regulatory pressure that is chiefly responsible for the growth in the size of its shadow banking system, whereas in the US, it is the profitability of financial intermediation in general that primarily determines its size. The trend in interest rates also plays a meaningful role in the eurozone. Having turned negative in 2014, the entities had an incentive to deviate some of their customers’ funds to off-balance sheet structures which ultimately constitute part of the shadow banking system. Looking to the future, we are facing interest rate tightening, coupled with the withdrawal of extraordinary monetary policy measures as far as financial system liquidity is concerned. Also, modified capital requirements for private equity and investment funds are due to take effect, on a staggered basis, in the coming months, [5] so that the institutional investors subject to the Basel III prudential regulations will have to set aside significantly more capital. As a result of those two factors, it is foreseeable that the intense growth observed in shadow banking over the past decade will slow. We will see if we are right in upcoming publications by the FSB.

Concerning our study, it must be borne in mind that the conclusions derived from our empirical analysis depend on the specific sample used to build our econometric models. Thus, our analysis faces the limitation that the conclusions obtained are based on the specific sample, the time period and the OFI’s definition considered.

In addition, the limitations regarding the availability of information of the FSB database both at the country and time period level led us to analyze a great part of the eurozone’s financial system (but not the whole of it) from 2014. Although it is from that year that the Single Supervisory Mechanism was adopted, a broader sample period could have brought us a deeper understanding of the OFI’s main determinants, especially prior to the 2008 financial crisis.

However, although there is a lack of literature on the subject and it is under constant investigation, the conclusions obtained shed light into the importance of banking regulation and supervision concerning the solvency, stability and resilience of the financial system. In fact, our results suggest that, while increased regulation may increase the prevalence of shadow banking in some regions, broadly speaking, more developed regulatory and supervisory frameworks are an entry barrier for banks’ undertaking certain (and riskier) funding activities which ultimately promotes financial stability.

Notes

Eurostat data from the third quarter of 2022.

Specifically, a random effects panel data model. We opted for the random effects approach over the fixed effects approach in light of the result of the Hausman Test as it was not possible to reject the null hypothesis that the GLS estimators are consistent. Elsewhere, given the existence of autocorrelation and heteroskedasticity, the model was estimated using Beck-Katz standard deviations. Lastly, the model yields results in which cross-sectional dependence is not observed and the model’s residuals follow a normal distribution.

The VAR model built for each geography in order to perform the variance decomposition analysis was estimated using a constant and lag interval of 1. In addition, the selected ordering of the Cholesky decomposition assumes that the size of the shadow banking segment has no impact on the rest of the explanatory variables but that the variables do impact the size.

Note, as gleaned from the analysis, the correlation between 12-month Euribor and the size of the shadow banking sector is negative. Specifically, in our time sample, the linear correlation coefficient is -0.88.

According to the Proposal for a Regulation of the European Parliament and of the Council, amending Regulation (EU) No. 575/2013 as regards requirements for credit risk, credit valuation adjustment risk, operational risk, market risk and the output floor.

References

CARBÓ VALVERDE, S. and RODRÍGUEZ FERNÁNDEZ, F. (2017). Shadow banking. Spain in the global context.

Spanish and International Economic & Financial Outlook, SEFO, Vol. 6 No. 4. Funcas. Retrievable from

https://www.funcas.es/wp-Content/uploads/Migracion/Articulos/FUNCAS_SEFO/032art09.pdfFAN, H. and PAN, H. (2020). The Effect of Shadow Banking on the Systemic Risk in a Dynamic Complex Interbank Network System.

Complexity, 2020.

https://doi.org/10.1155/2020/3951892FINANCIAL STABILITY BOARD, FSB. (2022a). Global Monitoring Report on Non-Bank Financial Intermediation.

FINANCIAL STABILITY BOARD, FSB. (2022b). Global Monitoring Report on Non-Bank Financial Intermediation 2022, Financial Stability Board. Retrievable from

https://www.fsb.org/2022/12/global-monitoring-report-on-non-bank-financial-intermediation-2022/FINANCIAL STABILITY BOARD, FSB. (2022c). Enhancing the Resilience of Non-Bank Financial Intermediation.

GEBAUER, S. and MAZELIS, F. (2020). Macroprudential regulation and leakage to the shadow banking sector.

ECB Working Paper Series, Nº 2406. Mayo 2020.

https://doi.org/10.2866/722519GRILLET-AUBERT, L.,

et. al. (2016). Assessing shadow banking – non-bank financial intermediation in Europe. European Systemic Risk Board.

Ocassional Paper, Nº 10/July 2016.

KIM, S. (2016). What drives shadow banking? A dynamic panel evidence.

Eighth IFC Conference on “Statistical implications of the new financial landscape.” Basel, 8–9 September 2016.

MARTÍNEZ-MIERA, D. and REPULLO, R. (2019). Markets, Banks and Shadow Banks.

Working Papers Series, No. 2234, February 2019. European Central Bank.

Francisco del Olmo. Alcalá University and IAES

Diego Aires. Madrid’s Carlos III University

Fernando Rojas. Madrid’s Autónoma and Carlos III Universities

Antonio Mota. Madrid’s Autónoma University