Regional government debt: Recent trends and outlook

Despite having one of the most advanced fiscal rule frameworks in Europe, Spain remains the OECD country where regional governments’ debt has grown the most since the Great Recession. Even in the context of more difficult financing conditions at present, it will be important to address existing challenges to the extraordinary regional financing mechanisms, while adapting the current fiscal stability framework to the new European rules.

Abstract: Following nearly two decades of legislative action, Spain’s fiscal rule framework is among the most advanced and rigid within Europe, systematically placing the country among the top quartile of the EU-27 in terms of fiscal governance. Nevertheless, data on regional governments’ deficit and indebtedness reveal a significantly weaker commitment to budget stability. Strong regional debt growth has largely been underpinned by collapsing revenues and high, rigid public spending in key public services, such as healthcare and education. Yet, debt levels differ significantly across regions, with just two regions, Catalonia and Valencia, accounting for 44.1% of the growth in regional debt stock between 2007 and 2022. Beyond the debate about exit strategies for the extraordinary financing mechanisms implemented since 2012, it is important to think about adapting the current fiscal stability framework to layer in the requirements that will come into force under the new European rules and the need to address identified shortcomings.

Regional Government Debt: The institutional framework [1]

Spain’s regional governments (Comunidades Autónomas) have always been entitled to borrow. However, that ability has also always been subject to controls and limits beyond the market discipline imposed by investors. Article 14 of Spain’s Regional Government Financing Organic Law, passed in 1980, introduced restrictions on their ability to borrow. Essentially it established a ‘golden rule’ whereby the governments are obliged to use the proceeds to fund capital investments. In the following decade, the so-called budget consolidation scenarios came into play as part of a larger strategy pursued in the public sector to tackle the country’s adoption of the euro. The rollout of the common currency was accompanied by a raft of budget stability laws which articulated a comprehensive stability framework. Following a succession of reforms, the benchmark text today is the Budget Stability and Financial Sustainability Organic Law of 2012 (the Financial Sustainability Act), under which all the subcentral treasuries are bound by a structural budget balance rule, a debt limit (13% of GDP, applied homogeneously) and a spending rule. That legislation contemplated a long transition period that ended in 2020, which is when the first two rules took effect. Until then, at the regional level, those matters were addressed by fiscal targets set by the central government (specifically by the Fiscal and Financial Policy Council [CPFF for its acronym in Spanish]), and at the local level by the requirement to keep budgets balanced or in surplus. Those deficit targets were defined in nominal terms, relative to GDP, and, generally, in the same manner for all the regional governments. The spending rule has been in operation. The ‘definitive period’, which started in January 2020, proved short-lived on account of the pandemic: the regulatory framework was suspended in March when the escape clause was activated across Europe. And that is how things remain in 2023, pending redefinition of the European fiscal rules and deactivation of the escape clause, foreseeably in 2024. In short, Spain has done what it had to in terms of legislation and rule-setting, especially in the last 20 years. The country’s formal fiscal rule framework is among the most advanced and rigid in Europe. The European Commission’s calculations systematically rank Spain among the top quartile of the EU-27 in terms of fiscal governance (European Commission, 2023). And that assessment is not much different looking at the data for subnational governments under the umbrella of the OECD (Vammalle and Bambalaite, 2021). Nevertheless, data on regional fiscal deficit and debt reveal a significantly weaker commitment to budget stability.

Recent trend in regional government debt

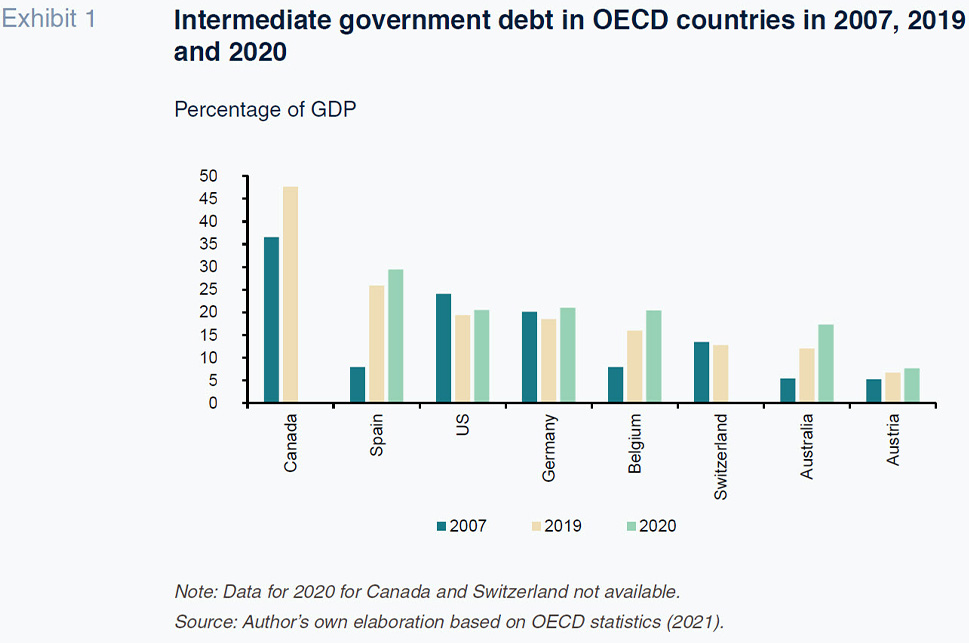

Exhibit 1 compares the trend in the financial liabilities of the regional governments of Spain with those of intermediate governments in the OECD with federal structures over the past 15 years. In 2007, right before the Great Recession, Spain’s indebtedness was similar to that of Austria, Australia and Belgium. The Great Recession turned that situation on its head. Spain is the country where regional public debt has increased most intensely, ranking second by 2019, behind only Canada. In fact, considering the Canadian provinces’and other intermediate governments’ long history compared to the relatively short life of Spain’s regional governments, the stock of debt piled up in Spain should prompt reflection over the institutional framework intended to ensure budget stability and the incentives around the subcentral governments.

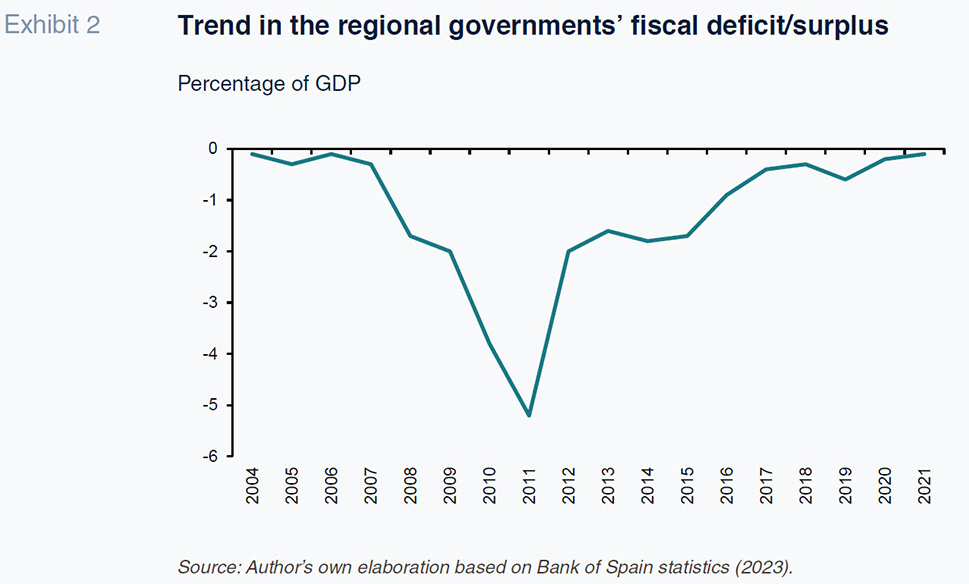

Exhibit 2 sheds light on the chief cause of the current stock of debt. The regional governments’ deficit breached the 5% mark in 2011, after four straight years (2009-2012) of deficits of 2% or more.

The explanation lies with a combination of collapsing revenue, especially that most closely related to the real estate bubble, and spending hard to pare back by virtue of being concentrated in fundamental public services such as education, healthcare, and social services. The contrast provided by developments during the pandemic is stark. When the pandemic came along, the central government provided the regional governments with financial shelter, supplying them with funding as if their tax revenue was not going to change by comparison with initial forecasts and setting up extraordinary and well-endowed financing funds (Lago Peñas, 2021). Indeed, their aggregate finance income in 2020 and 2021 looks more like the boom years prior to the Great Recession.

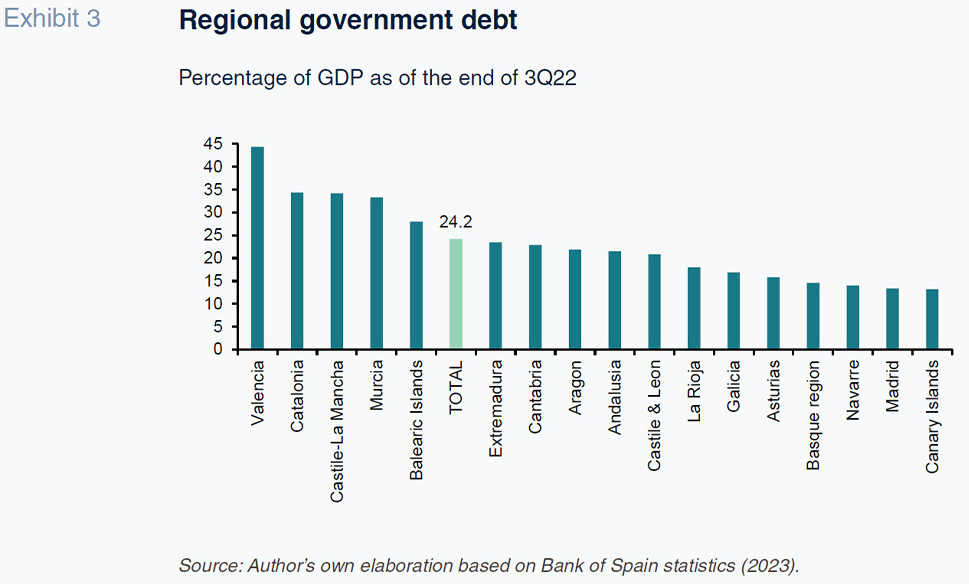

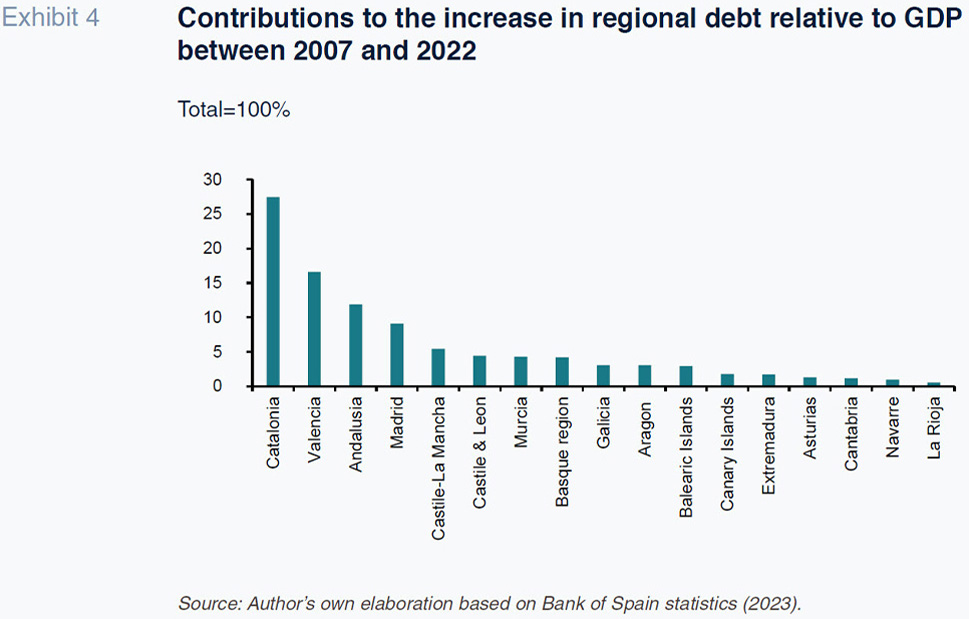

Nevertheless, the aggregate trend depicted in the exhibits above masks the existence of sharp differences from one region to the next. Exhibit 3 shows how, in terms of regional GDP, financial liabilities in Valencia have reached nearly 45%, tripling the leverage ratios presented by the Canary Islands, Madrid, Basque region, Asturias and Navarre, while another three regions (Catalonia, Castile-La Mancha and Murcia) registered levels well above 30%. Exhibit 4 reinforces this idea. An analysis of individual accountability for the growth in regional government debt between 2007 and 2022 shows that nearly half of the increase (44.1%) is attributable to just two regions: Catalonia and Valencia.

Extraordinary financing mechanism

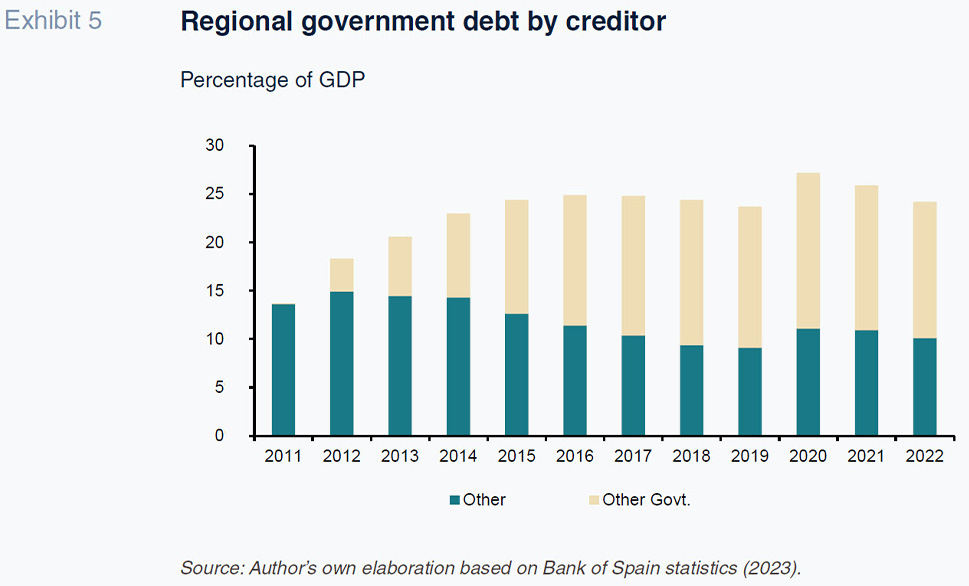

The difficulty in accessing the financial markets triggered the need for additional funding that was ultimately channelled via “extraordinary financing mechanisms” set in motion by the central government starting in 2012. [2] The immediate result was a significant change in the roster of creditors (Exhibit 5). While in 2011 the sum borrowed by the regional governments from the central government was residual (a scant 0.1% of Spanish GDP), by the third quarter of 2022, that ratio had increased to 14.1%, implying that 57.8% of regional government debt is currently in the hands of the Ministry of Finance. In fact, the rest of the regional governments’ debt has decreased in absolute terms from 145 to 132 trillion over the same period, and as a percentage of GDP, from 13.6% to 10.1%.

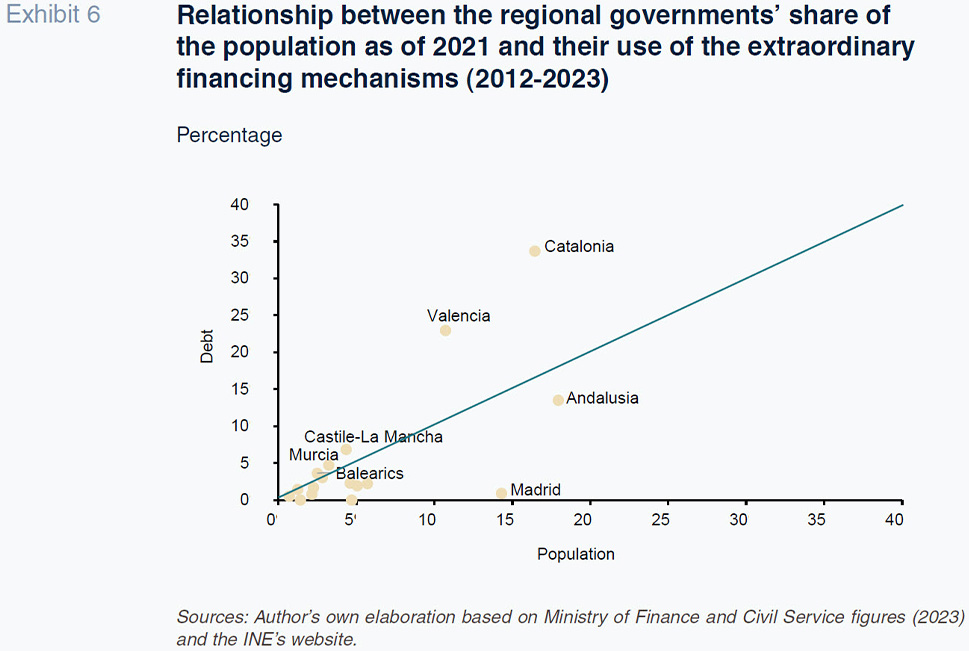

Delving into the regional breakdown of the extraordinary mechanisms availed of, we see a repeat of the above-mentioned asymmetries. Exhibit 6 shows the regions’ share of the Spanish population and, by comparison, their shares of extraordinary financing schemes. Valencia and Catalonia account for around 27% of the population but absorb 57% of that funding. The other regions which have garnered disproportionate extraordinary funding relative to the populations are Castile-La Mancha, Murcia and the Balearics. Between them, those five regional governments have received 72% of the extraordinary mechanism funds while only representing 37% of the population. Madrid is the total opposite. Ranking third in population size, the region has barely used the extraordinary mechanisms.

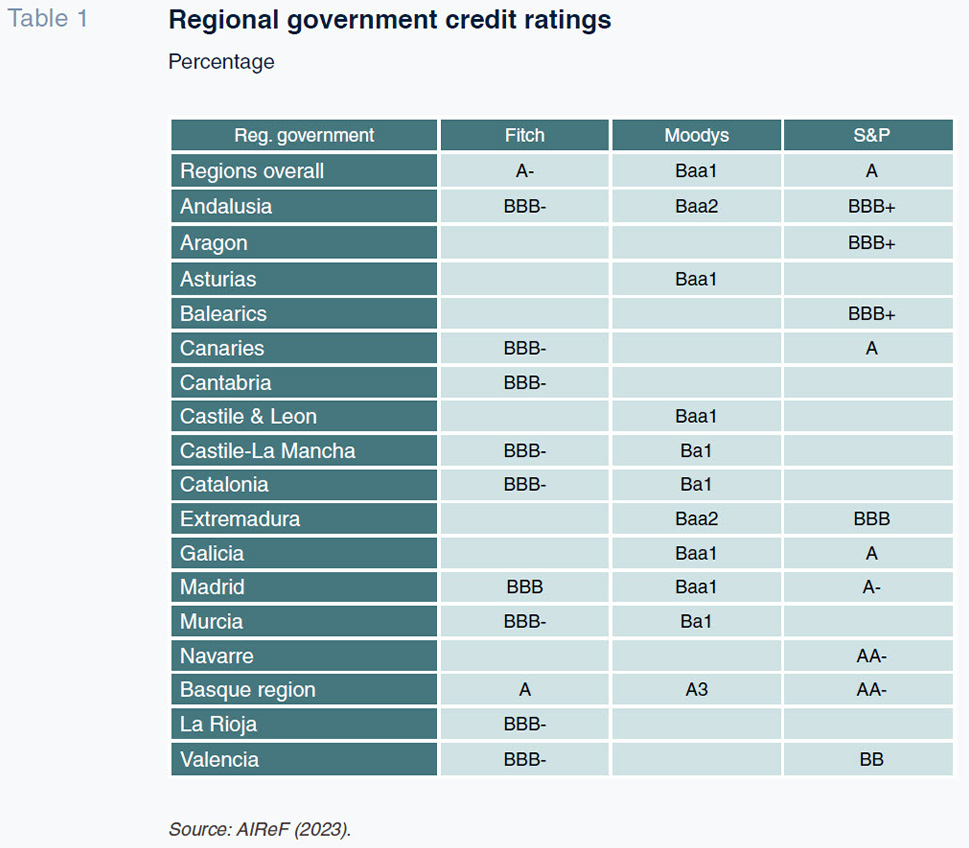

Despite the enormous differences in leverage ratios, the range in which the regions’ credit ratings move is relatively narrow (Table 1). Those ratings are no doubt influenced by the existence of a state guarantee.

Challenges posed by public debt at the regional level

The favourable borrowing terms of recent years are fast becoming a thing of the past. The extraordinary bond repurchase programmes, suspension of the fiscal rules and negative interest rates made what was nothing like normal feel like normal. As regards the regional governments, it is now time to think about a horizon without extraordinary financing mechanisms. The problem is that not all pathways are feasible. If some of the regional governments were to suddenly return to the market, the risk premiums would be prohibitive. Indeed, the interest burden forecast for the end of the year on Treasury bonds would imply regions such as Catalonia and Valencia having to earmark 10% or more of their ordinary budgets to debt service (although it is true that the increase in interest spending could take time to kick in depending on the average life of the outstanding debt and the spreads demanded on new issues).

In addition, sharp asymmetry in the use of the extraordinary financing mechanisms from one region to the next complicates the possible solutions regarding accumulated debt up until the present enormously. Symmetric debt forgiveness would be insufficient. However, asymmetric forgiveness would most likely run up against strong political and social opposition in the regions that have tapped those channels to a lesser degree. It is true that in some cases, there is an element of underfinancing relative to the levels the regional financing model itself recognises and is supposed to guarantee. But that argument does not hold across the board. Moreover, formulas that imply forgiveness may send negative messages about the probability of future bailouts and the credibility of the Spanish fiscal stability framework.

Some analysts have proposed an alternative solution, which would entail leaving aside the debate about the principal outstanding and concentrating on its cost and maturity, to ensure that the debt burden is sustainable for all. It is true that, in this case, the most indebted communities would continue to be supported in a similar way to how they are being supported today, as the Treasury would have to borrow at much higher rates throughout the life of that debt. It would, however, most certainly be more politically acceptable and, ultimately, would ensure that the interest burden does not become an unbearable burden for anyone. Moreover, if a reform of the autonomous regions’ financing regime is undertaken which leads to its improvement, the regional governments’ financial projections would spark renewed investor interest, allowing them to return to the markets without having to pay significant premiums in respect of future deficits, so refinancing the debt that is not in the hands of other public administrations. A decision needs to be taken in 2023.

Beyond the debate about the extraordinary financing mechanisms, it is important to think about adapting the current fiscal stability framework to layer in the requirements that will come in under the new European rules and the need to address the identified shortcomings.

With respect to the European dimension, in light of the draft proposals by the European Commission, there is a range of possibilities, including the following three alternatives (Lago Peñas, 2023): Firstly, replicating the European regime, with a spending rule calibrated for each region as a function of its distance to the anchor ultimately established in terms of debt-to-GDP. Secondly, preserving the essence of the transitional regime in place until 2020, continuing to articulate fiscal stability around a deficit target expressed as a percentage of GDP. The Fiscal and Financial Policy Council would have to debate and determine the vertical distribution of the deficit across the different levels of government and its horizontal allocation across the regional governments. The third route would be to do away with deficit and debt targets, instead applying the spending rule calculated for the public administrations as a whole at the regional level. Both solutions based on application of a spending rule and those that continue to orbit around a deficit target would have to be combined with the creation of individual regional stabilisation funds designed to enable the generation of financial buffers during periods of growth in order to ensure the financing of essential public services when spending has to be cut.

As for the solutions to the shortcomings detected, it is worth highlighting three. It is imperative to reform the financing system to give the regional governments more room to borrow so that they align their spending and ordinary revenue decisions better. International experience shows that decentralisation of fiscal capacity is a fundamental factor in delivering effective compliance with fiscal rules. Secondly, it is time to revisit the preventive, corrective and coercive measures stipulated in chapter IV of the Financial Sustainability Act as experience has proven that they are not applicable for economic policy reasons: in their stead, it is important to create credible expectations around the existing or new measures to be applied at the regional level. Lastly, it would be strongly advisable to reinforce the multilevel governance structures articulating the federal system (particularly the committee of regional government presidents and the Fiscal and Financial Policy Council). Such reforms would not require amending the Constitution but would require broad political consensus, making them hard to achieve in the short- or medium-term. The goal of reforming the committee would be to have it meet more regulatory and become the central axis for high-level policy debate about matters with regional implications. The Council, meanwhile, needs more physical and human assets to handle all of the technical work required to underpin that multilevel governance thrust, while the internal rules should be changed so that votes are carried out with higher levels of consensus than at present.

Notes

The author would like to provide an acknowledgement to Diego Martínez López for his feedback on an earlier version of this paper.

Implementation of those mechanisms additionally implied the partial suspension of the so-called ‘golden rule’. As per item 9 of additional provision 1 of the Financial Sustainability Act, introduced on December 21st, 2013: “Credit transactions arranged by the regional governments with a charge against the additional financing mechanisms whose financial terms and conditions have been previously approved by the central government’s Steering Committee for Economic Affairs shall be exempted from the mandatory state authorisation and shall not be subject to the restrictions contemplated in article 14 of Organic Law 8/1980 on Regional Government Financing and transitional arrangement three of this Act.”

References

Santiago Lago Peñas. Professor of Applied Economics at Vigo University and Senior Researcher at Funcas