Bank profitability in Spain: A debate in need of perspective

Spanish banks announced record earnings growth in 2022, in tandem with the ongoing process of financial normalisation, in which interest rates increased, after years in negative territory. Despite strong performance, challenges remain, and banks must stay profitable and solvent on account of their systemic importance to a country’s business and social fabric, while pushing ahead with necessary cost-cutting and digitalisation.

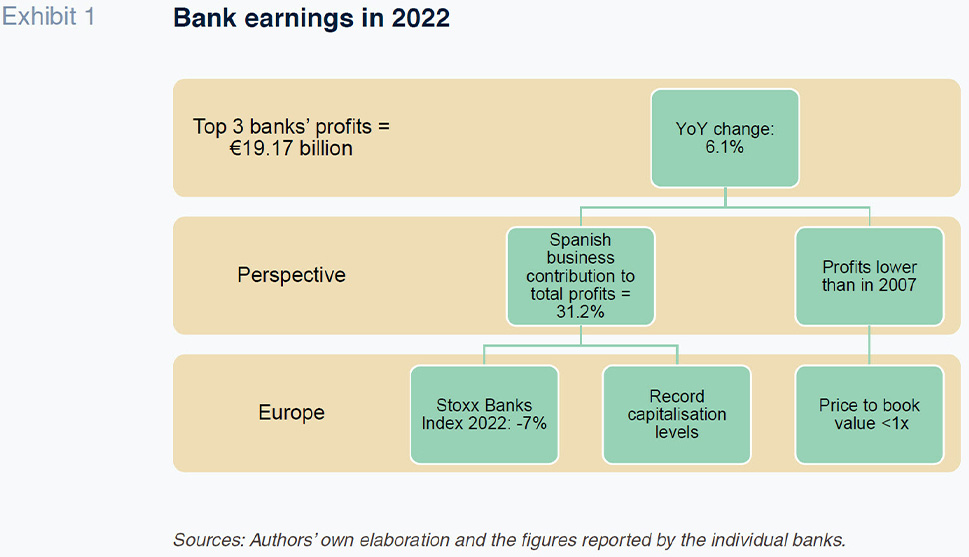

Abstract: The Spanish banks announced record earnings growth in 2022, in tandem with the ongoing process of financial normalisation, in which interest rates increased, after years in negative territory. Spain’s top three banks reported aggregate net profit of 19.17 billion euros last year, up 6.1%. Looking at the six largest banks, that figure rises to 20.85 billion euros. Although the absolute figures are eye-catching, it is important to note that they remain below 2007 levels. More importantly, this solid performance comes a time when the Spanish banks, along with their European peers, continue to face difficulties in increasing their earnings per share. The European Stoxx Bank Index contracted by 7% in 2022 with the vast majority of the banks trading at P/BV multiples of under 1x. Moreover, the banking business is facing challenges on the demand side. Household borrowings increased by just 0.3% year-on-year in January 2023, while corporate borrowings contracted by 0.7%. Fundamentals for 2023 do not point to significantly higher credit growth. Going forward, it will be key to consider a broader spectrum of factors in order to bring more perspective to the interpretation of banks’ profitability. Those factors include the considerable structural changes unfolding in recent years, such as complex mergers, sometimes taking place over a brief time span. As well, the balance between the volume of financing extended and deposits captured has improved relative to during the financial crisis, with the loan-to-deposit ratio at around 1x today, compared to 1.6x in 2007. Finally, solvency too has improved, with capitalisation substantially higher than prior to the financial crisis. Within this context, it is important to highlight the essential role banks play in underpinning a country’s business and social fabric. They must remain profitable and solvent on account of their systemic importance and relevance at critical times, such as during the pandemic, while pushing ahead with the necessary cost-cutting and transformational digitalisation.

Introduction: The earnings debate

2023 ushered in new debates about economic challenges. Somewhat surprisingly, the banks’ earnings became part of that debate. Some have said that the banks’ earnings are “excessive” at a challenging time of rampant inflation and economic slowdown. However, one thing has little to do with the other. The confusion may stem from a number of associations at different levels. For example, at the global level, there has been debate around the tax contribution made by certain companies, specifically the tech players. There has also been debate around the extent to which competition really exists, with the information handled by the tech sector again at the heart of that topic. However, the scrutiny has recently spread to other companies, including the banks and energy companies, associating their profits with the increase in costs derived from the war in Ukraine, issues in various supply chains and the increase in interest rates. In the US, where the oil companies have significant market power and clout, the government has moved to demand lower profits or a higher tax contribution. However, there are no signs of that happening in Europe and certainly not in Spain. Much less in the banking sector.

Elsewhere, methodological confusion abounds and makes its way into public discourse all too easily. One such misguided notion is that concentration (market share) and market power are directly related. Academic research into industrial organisation has been disproving that relationship for years; in fact, the evidence shows that often such a relationship does not even exist. More specifically, there are many industries in which there are few competitors yet intense competitive rivalry, and others in which there is a large number of participants but the level of competition around prices and/or volumes appears weaker. In the case of the banks, and the Spanish system is no exception, competition has remained intense even though the number of competitors has declined. Indeed, the sector consolidation that has taken place was driven precisely by the need to build scale in order to survive in a market that now requires less physical infrastructure than in the past but a bigger digital footprint (the “platformisation” of banking). The “traditional” banks, whose population has decreased, not only need to compete more intensely with each other, they have to develop or bring in services offered by other financial and non-financial players and compete with companies of all kinds in an increasingly broad number of segments.

Moreover, since the financial crisis, the banking sector has been plagued by profitability issues with most entities around the world trading at less than their book values.

In this paper, we take a look at the Spanish banks’ earnings in that context, noting how their growth in the post-pandemic era is not only attributable to the increase in interest rates but also a change of circumstances. There is sufficient evidence to state that the growth in earnings is far less significant than the absolute figures might indicate, and that further upside is limited by a number of uncertainties and conditioning factors. The banks will have to continue to shrink their physical structures and evolve their business models in order to deliver the profitability demanded by the market, which is none other than that which guarantees their viability.

The backdrop for our analysis is the 2022 earnings reported by the banks at the start of this year. Last year’s business environment was marked by rising interest rates, with the markets anticipating the monetary authorities. Having started 2022 in negative territory, in February 2023, 12-month Euribor traded at a monthly average of 3.534%.

However, the business environment is uncertain, precisely on account of that tightening and other economic unknowns. According to the Bank of Spain, household borrowings increased by just 0.3% year-on-year in January, while corporate borrowings actually contracted by 0.7%. It is also important to look at the impact of interest rates on the banks’ liabilities (and not just their assets). It is possible that the banks in Spain and other countries will have to increase the remuneration offered on their deposits (although they never penalised deposits when official and market rates were negative, they did increase their commissions). Note that there has been a significant shift in the composition of savings that takes time to unwind. Whereas 15 years ago term deposits vastly outweighed current accounts, that situation has inverted today. As of January 2023, private sector demand deposits amounted to 1.49 trillion euros in Spain, more than six times the amount held in term deposits (231 billion euros).

As for the monetary environment, official rates in the eurozone are expected to rise further. On February 2nd, 2023, the ECB signalled its intention to “stay the course in raising interest rates significantly at a steady pace and in keeping them at levels that are sufficiently restrictive to ensure a timely return of inflation to its 2% medium-term target”. As a result, the Governing Council raised interest rates by another 50 basis points at its last monetary policy meeting in March.

Likewise, in its capacity as supervisor, on February 8th, 2023, the ECB decided to keep its capital requirements steady this year, signalling that the “banks remain resilient”, framed by the results of its Supervisory Review and Evaluation Process (SREP) for 2022. The SREP was conducted amid deteriorating economic conditions and financial market dynamics following Russia’s invasion of Ukraine. The ECB observed that “on average, banks maintained solid capital and liquidity positions, with the vast majority holding more capital than the levels dictated by capital requirements and guidance stemming from the previous SREP cycle.”

The banks’ earnings: The need for perspective

In 2022, pending publication by the Bank of Spain of the official aggregate figures, the top three Spanish banks reported net profit of 19.17 billion euros (Exhibit 1), growth of 6.1%. Taking the six largest banks, that figure rises to 20.85 billion euros. While the absolute figures may be eye-catching, several factors should be borne in mind. Firstly, again looking at the three largest banks, over two-thirds of total net profit was generated outside Spain, evidencing the international competitiveness of the Spanish banking sector. That geographic diversification reduces their risk and earnings volatility, thereby shoring up their financial stability. Secondly, those profits are still lower than those reported in 2007, right before the financial crisis. More importantly, they come at time when the Spanish banks, along with their European peers, continue to find it hard to increase their earnings per share. The European Stoxx Bank Index contracted by 7% in 2022, with the vast majority of the banks trading at P/BV multiples of under 1x. In tandem, shaped by stringent regulatory requirements, the banks also reported record levels of capitalisation.

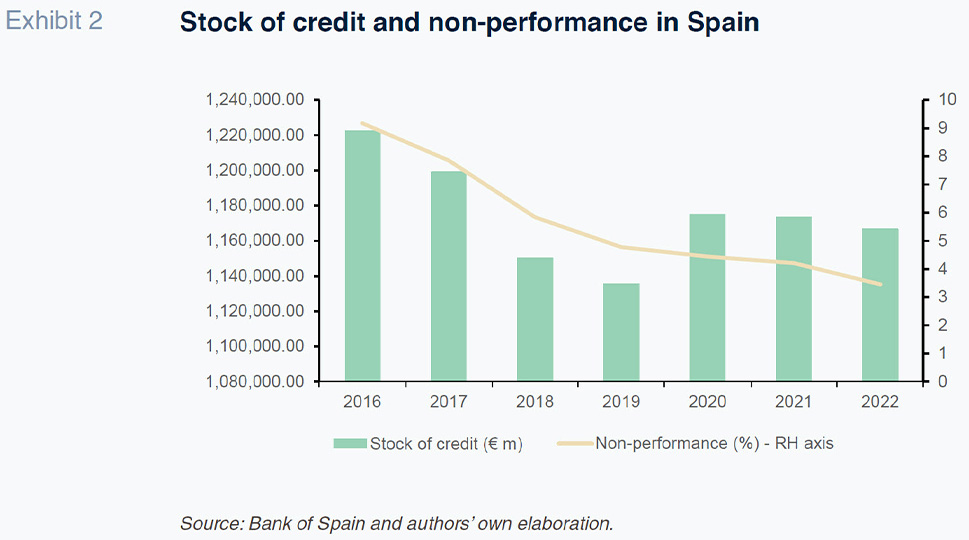

It is possible that the banks’ earnings growth will slow going forward due to stagnating demand for credit, similarly, related with the increase in interest rates and prospect of an economic slowdown. In addition to the flow data outlined in the introduction, note that, as shown in Exhibit 2, the stock of private sector credit in Spain has contracted from 1.22 trillion euros in 2016 to 1.16 trillion euros in 2022. Lending volumes increased, however, by 39.36 billion euros in 2020, thanks to the banks’ role providing the need for additional funding sparked by the health pandemic. That additional financing entailed risks but also allowed many Spanish companies to survive. Despite that development, and the new risks posed by inflation and the economic slowdown, non-performance, far from increasing, has fallen from 9.18% in 2016 to 3.45% in 2022.

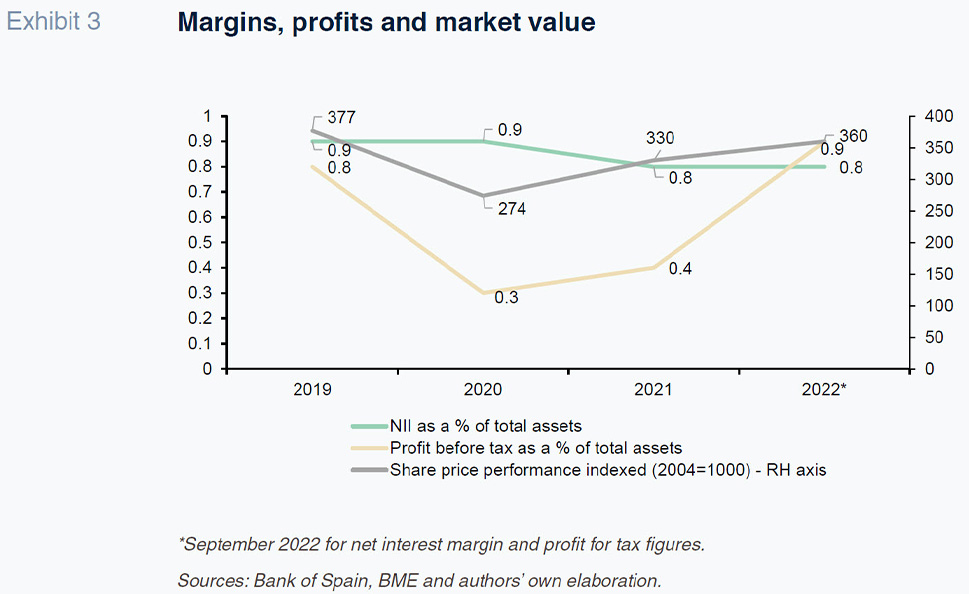

In the business environment described, one might think that the rise in interest rates would have unlocked significant growth in net interest income. However, the banks’ net interest margins were steady at around 0.8%-0.9% of average total assets (Exhibit 3) as of September (it is conceivable that the December figures will reveal a degree of growth). Profit before tax has increased since collapsing in the year of the pandemic, gradually climbing back to 0.9%. Nevertheless, the banks’ aggregate market capitalisation at year-end 2022 was still lower than at the end of 2019, before the pandemic, having digested three very challenging years.

Conclusions: Interpretations and social value

The analysis presented in this paper suggests that in 2022, the Spanish banks recorded earnings growth in tandem with the ongoing financial normalisation process in which rates increased and abandoned their negative terrain. It also points to further room for recovery as the banks’ share prices and earnings per share metrics (as with all relative measures which should be studied to analyse earnings performance) remain below both their pre-pandemic and pre-financial crisis levels, even though circumstances were very different then.

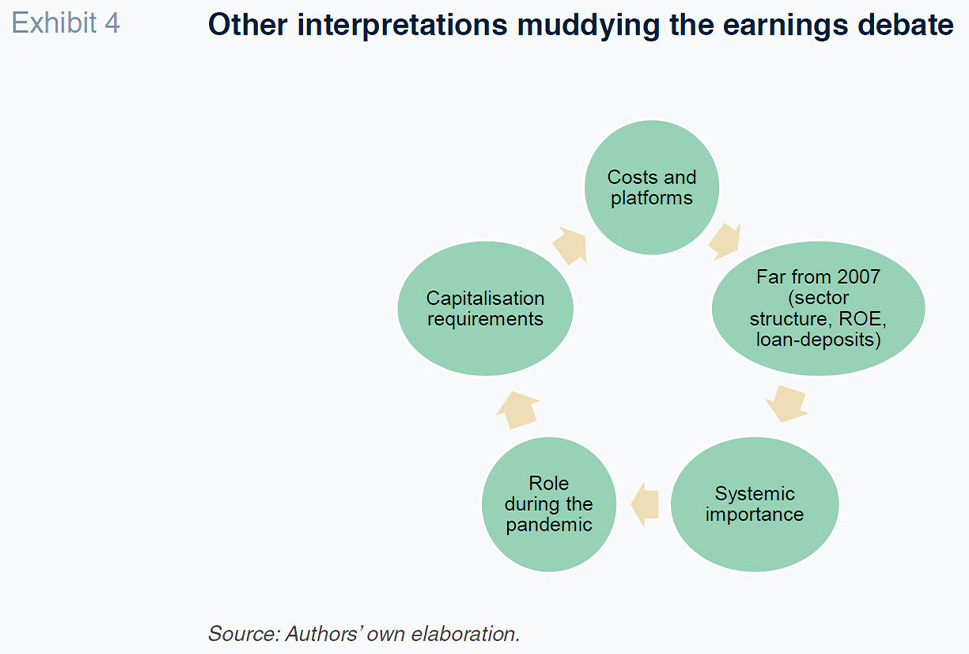

The financial business has unquestionably been affected by demand factors. 2022 was by no means a buoyant year in terms of growth in private sector credit nor do current fundamentals point to significantly higher growth in 2023. As shown in Exhibit 4, it is important to consider a broader spectrum of factors in order to bring more perspective to interpretation of the banks’ earnings. Those factors specifically include the considerable structural changes unfolding in recent years, which have materialised in complex mergers, sometimes several in a short span of time. Elsewhere, the balance between the volume of financing extended and deposits captured is better today than during the financial crisis. The loan-to-deposit ratio stands at around 1x today, compared to 1.6x in 2007. Solvency has also improved: Capitalisation levels are substantially higher than before the financial crisis.

It is important to recall that the banks are essential to underpinning a country’s business and social fabric. It is important that they remain profitable and solvent on account of their systemic importance and relevance at critical times, such as during the pandemic. Lastly, the banks are currently in the midst of necessary transformational cost-cutting and digitalisation processes.

Santiago Carbó Valverde. University of Valencia and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas