The ECB´s normalisation strategy: Uncertainty and legacies

The ECB is facing an extraordinary situation in which it is unable to rely on an economic slowdown alone to curb inflation. Only with decisive and swift action on normalisation of both interest rates and its monetary policy toolkit, comprised of legacy long-term liquidity injections and asset purchases, can the ECB prove its determination to bring inflation back in line with official targets and anchor inflation expectations.

Abstract: The ECB is facing an extraordinary situation in which it is unable to rely on an economic slowdown alone to curb inflation. Reduced worker bargaining power has raised the risk of a cost-of-living crisis with a negative impact on consumption, without necessarily reducing underlying inflation, which apart from commodity prices, according to some economists, is being driven in part by global corporations’ price– and margin-setting power. Only with decisive and swift action can the ECB exhibit its determination to bring inflation back in line with levels compatible with its symmetric target of 2% and keep inflation expectations solidly anchored. In line with these objectives, after 13 years of monetary accommodation, interest rate normalisation has begun in 2022 and is progressing at a rapid pace, despite still high levels of uncertainty, largely underpinned by geopolitical tensions arising from the invasion of Ukraine. As well, the ECB this year has also embarked on normalisation of its monetary policy toolkit. Instruments, such as its longer-term refinancing operations (TLTROs) and its asset purchase programmes, a significant legacy from the last period of monetary accommodation, are in the process of being unwound, bringing about a reduction in the size of the ECB´s balance sheet.

The Great Moderation, globalisation and inflation

The period known as the Great Moderation is important to understanding the idea apparently behind the ECB’s strategy today. It was a very long period (from the end of the 1980s until 2007) of global growth in which the developed economies were able to bring inflation down to low levels and eke out sustained growth without any major interruptions. In other words, it was a period of prosperity. Long-term interest rates, at around 2% — 2.5% at present, with benchmark ECB rates at 2%, would appear to be discounting a world similar to that back then: neither the deflation of the major financial crisis that began in 2008 or the world of spiralling inflation of the 1970s. That is the world the ECB appears to be set on preserving. For that to happen, normalisation needs to take place fast, spurred by decisive action that anchors inflation expectations at today’s widely accepted levels.

The roots of the Great Moderation are multiple but there is consensus around three factors: mass application of the information and communication technology created in the 1980s to processes, organisations and “things”; globalisation, understood not only as the growth in global trade but also the mass relocation of activities, changes in patterns of specialisation in emerging economies and expansion of the global supply chains; and the secular decline in workers’ bargaining power at the global level, in turn responsible for the decline in the labour share of income (Stansbury and Summers, 2020). Wage moderation during that period, in the US and EMU alike, was responsible for the low consumer price inflation and generation of a long cycle of productive investment and corporate earnings growth. The growth in earnings per share at listed companies translated into unprecedented share price gains.

The creation of a credit bubble, mainly linked to the property market in some markets, and its spillover through its financing onto the international bond markets, laid the foundations for the (provisional) self-destruction of the Great Moderation. Its bursting translated into the Global Financial Crisis (GFC) of 2007-2008.

The mitigation of and recovery from the GFC took 13 years of highly expansionary monetary policy all around the world coupled with a parallel process of bank recapitalisation (private and with public bailouts) and reform. These were hard times for the economy: first a very harsh recession, followed by years of slow growth, dragged down by the need for the banks to absorb their losses and dilute and transform their exposures. Against that backdrop, inflation remained very subdued and wages stagnated, losing a greater share of the income pie. The fear of deflation crept in. Just as the worst seemed to be over, the Great Lockdown brought personal mobility to a standstill between 2020 and 2021, further fuelling fears of deflation.

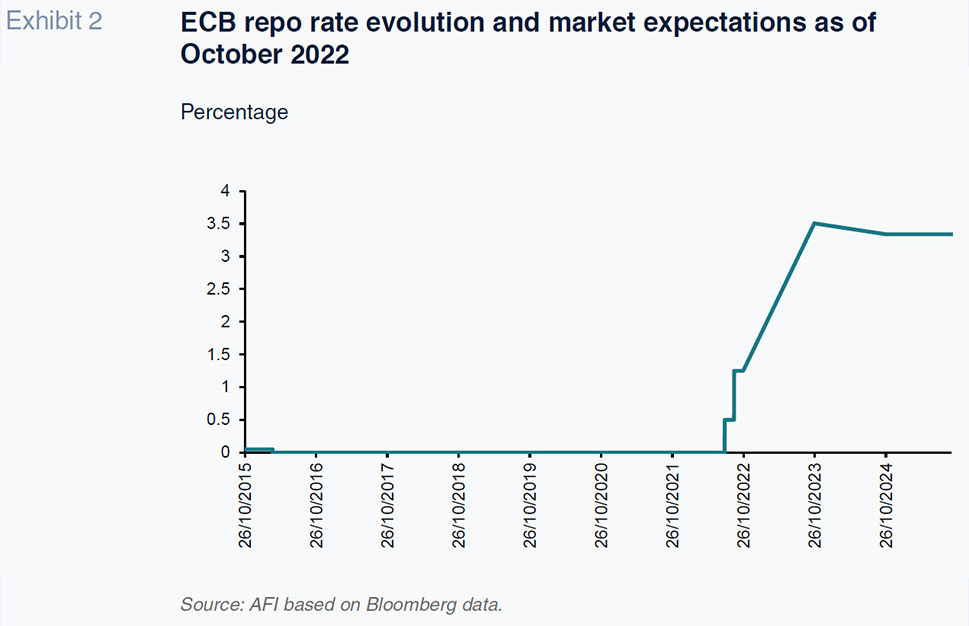

Balance sheet crises are long and surmounting them requires perseverance over many years. After the onset of the GFC, the ECB halted the rate hikes introduced in 2006 and 2007, slashing its rates from 4.25% in October of that year to 1% in just a few months, switching from auctions to fixed-rate injections that provided the massive pools of liquidity the system needed. Rates stayed at 1%, with a deposit facility rate of almost zero, until 2011. At that juncture the ECB raised rates slightly, a misstep triggered by a mirage of a recovery – only to cut them again a few short months later. It lowered its main refinancing operations (MRO) rate to 0.25% by November 13th, 2013, with a corridor of between 0% and 0.75%. While the MRO edged towards the threshold of zero, the deposit facility rate turned negative in 2014, hitting -0.50% in September 2019, where it remained until July 2022.

Gradual normalisation

The protracted expansionary cycle known as the Great Moderation ground to a sudden halt, giving way to 13 years of contained deflation and zero rates. However, the underlying factors that had fuelled growth – technology, globalisation and labour’s declining share of income – appeared to be intact. The period elapsing between the end of 2021 and July 2022 could be defined as one of gradual normalisation. It was driven by the fact that extreme monetary accommodation had proven a success, as it had made way for a recovery and dissipated the fear of deflation. However, the European economy was still growing significantly below its potential and had yet to revisit pre-pandemic income levels. That situation was the result of a structural gap related with the reduced flexibility of the European economy as well as the fact that fiscal policy responses were faster in the US than in Europe, due to institutional differences.

Meanwhile, it was already clear that Russia’s invasion of Ukraine in February and, to a lesser degree, the international supply friction generated by China’s zero-COVID policy and the infamous global value chain bottlenecks created by the return of mass international mobility, were seriously inflationary. The ECB needed to signal prudence and a message of gradualism. On the one hand, vigilance of inflation, which was climbing dangerously, but also alertness to the economic slowdown induced by the very run-up in prices, on the other.

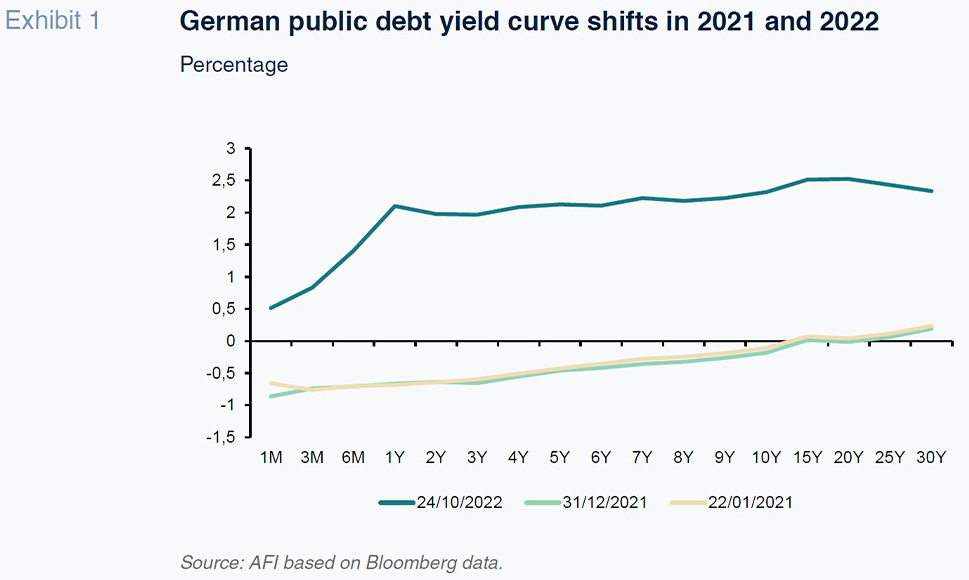

At that stage the ECB limited itself to announcing a new direction. The first changes in implementation, such as the end of asset purchases from June, would be framed by a “meeting-by-meeting” approach, i.e., without providing forward guidance (Lane, 2022a), in which the incoming data would mark the path spanning the considerable distance from a zero MRO rate to the appropriate terminal rate. Meanwhile, the AAA-bond curve in the eurozone shifted upwards, towards 2 — 2.5%, and the dollar strengthened against the euro, in anticipation of the new environment.

Normalisation during a cost-of-living crisis

Since the summer, the normalisation process has been recalibrated, marked by a far more belligerent ECB. Last May, Fabio Panetta, a member of the ECB’s Executive Committee, said that the process of normalising monetary policy was happening at a point in time that is anything but normal (Panetta, 2022): the external shock of energy prices, linked to the war in Ukraine, was pushing inflation higher than had been expected, to levels of close to 10% in nearly all countries. It was clear that more in-depth analysis was needed to define a strategy that would be effective in a rapidly deteriorating environment.

Isabel Schnabel, another member of the ECB’s Executive Committee, has outlined the evolution in the ECB’s strategic thinking in her recent public presentations. She coined the term, the globalisation of inflation (Schnabel, 2022a). She said that the resurgence of underlying inflation was being shaped by global conditions in which the large firms could pass on the increase in the cost of their inputs – energy, transport, raw materials – to end sales prices, boosting their profits along the way. In that context, domestic devaluation alone is not sufficient to curb inflation. Inflation then depends on firms’ pricing power and how their higher profits could then translate into higher wages. The thinking was that only by firmly anchoring inflation expectations, guided by decisive and swift action by the ECB, could inflation be quelled. That was the start of the end of the gradualism approach.

Shortly after, in August, that same executive flagged the risk that we were entering a new phase, which she coined the Great Volatility (Schnabel, 2022b), a convulsive period of unwinding globalisation which needs to be kept at bay. Given the level of uncertainty, monetary action needed to be more forceful than prudent, more determined than gradual. At the end of September, in her third presentation, she introduced another new term, the cost-of-living crisis (Schnabel, 2022c). She stressed that in a context of “secular decline in the bargaining power of workers” – another of the factors underpinning the Great Moderation – inflation could translate into a dangerous loss of private consumption. She argued that the decline in real wages will neither open the door to second-round effects via a recovery in purchasing power nor a let-up in underlying inflation, which is being shaped globally by firms’ ability to control their profit margins more than by internal demand.

As always, the key for the economy and for curbing inflation is determination of the terminal rate level. The decision taken at the end of October to increase the MRO rate by 75 basis points to 2% (and the deposit facility rate to 1.5%), following 50bp and 75bp hikes in July and September, respectively, should be analysed against that backdrop. The starting point for normalisation was so low – zero – that swift and sharp rate increases were needed to anchor expectations.

What is the terminal rate for the normalisation process underway? Official benchmark rates have already been raised by 2pp. That is a clear message regarding the ECB’s determination to deliver its inflation target of 2%. The ECB plans to revise its strategy and its terminal rate “meeting by meeting”. Further increases will be determined largely by the trend in inflation expectations. The Bank of Spain’s Governor recently provided the results of that institution’s models (Hernández de Cos, 2022): a median terminal rate of 2.25%—2.50% would allow inflation to return to 2% – the targeted level – by the end of 2024. The markets are currently discounting somewhat bigger increases.

The ECB’s legacy balance sheet and its management

Interest rates are the channel for transmitting monetary policy. Specifically, as is well known, the ECB attempts to influence the 1-day interbank rate (formerly EONIA, currently €STR) so that, by shaping market expectations for where that rate is headed, it can influence money market rates and by extension the entire rates curve, as exemplified by the euro interest rates swap curve or 19 different euro-denominated public debt yield curves.

The Great Recession and the Great Lockdown kicked off a large and complex period in which credit and liquidity were the protagonists. Monetary accommodation had to be articulated in the absence of a fully functioning interbank market. That market jammed up: the banks were unwilling to lend to each other without sufficient guarantees. The liquidity needs of a portion of the banking system, to which the rest of the system was unwilling to lend money, had to be provided by the ECB at longer tenors than the one week provided under its conventional liquidity facility.

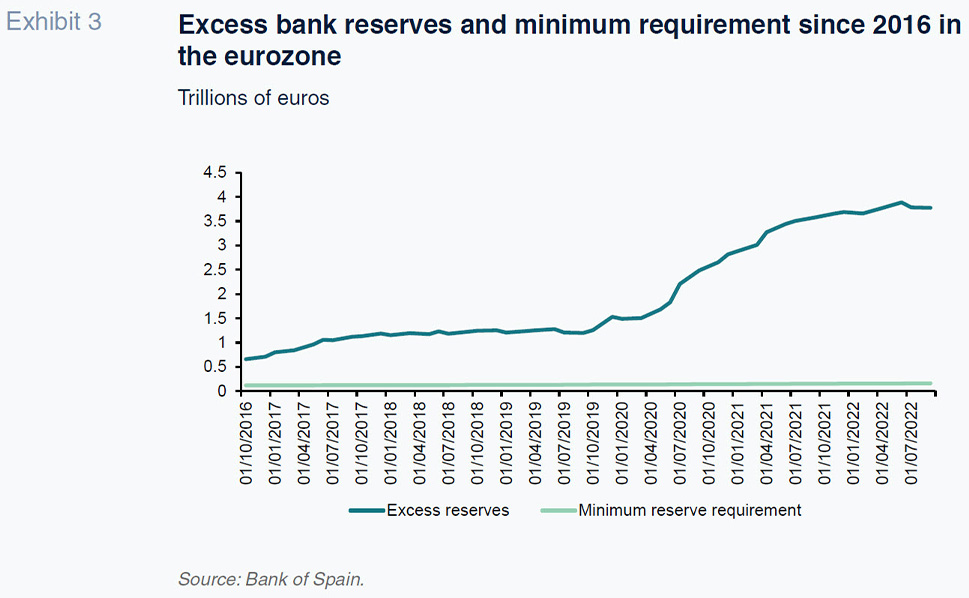

On top of the liquidity injected under its permanent facility – the MRO, a weekly repo – the ECB introduced the LTRO facilities (2- and 3-year repos) and, later, the TLTRO facilities, which also attempted to stimulate growth in lending by means of individualised targeting.

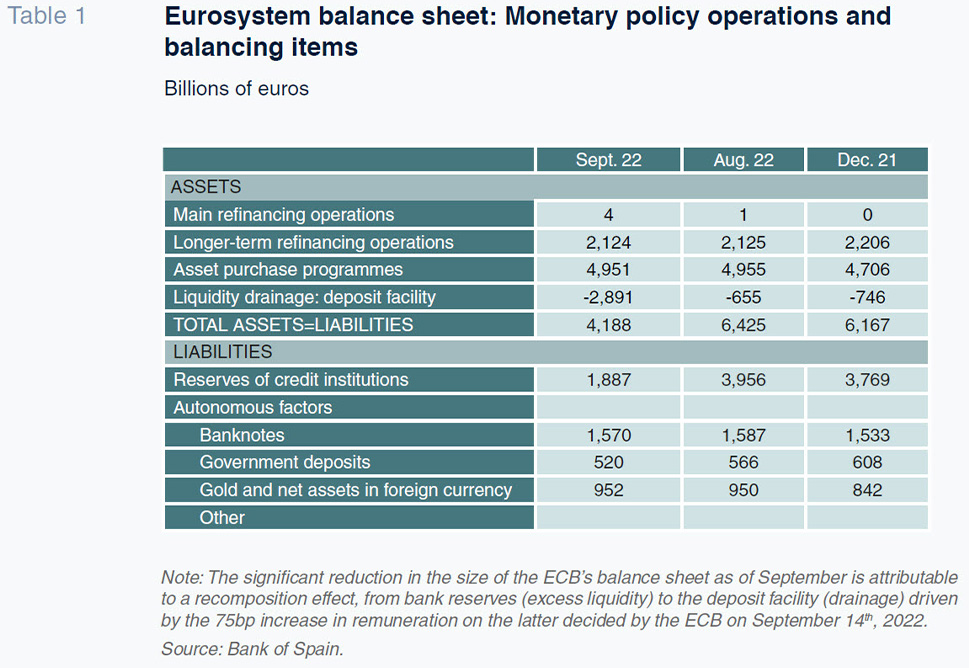

The last extraordinary injection took place in December 2021. The current balance of long-term refinancing operations, the result of the renewal and repayment of the various waves of TLTROs, stands at 2.1 trillion euros, with mandatory repayments due at the end of 2022, 2023 and 2024. The system has been holding onto that funding until maturity until now; however, on October 27th, 2022, the ECB removed deterrents to early voluntary repayment of outstanding TLTRO III funds by changing the benchmark rate charged on them. The subsidised cost of those long-term injections, at a time of heightened uncertainty, incentivised the accumulation of surplus bank reserves at the ECB, deposited in the daily facility or held in its reserve accounts. In 2019, the ECB reformed the excess liquidity remuneration system by exempting a portion of banks’ excess liquidity holdings from the negative interest rate on the ECB’s deposit facility. After the rate increase of September, the system transferred part of its excess liquidity holdings to the deposit facility, so reducing the size of the ECB’s balance sheet, a trend that is set to continue.

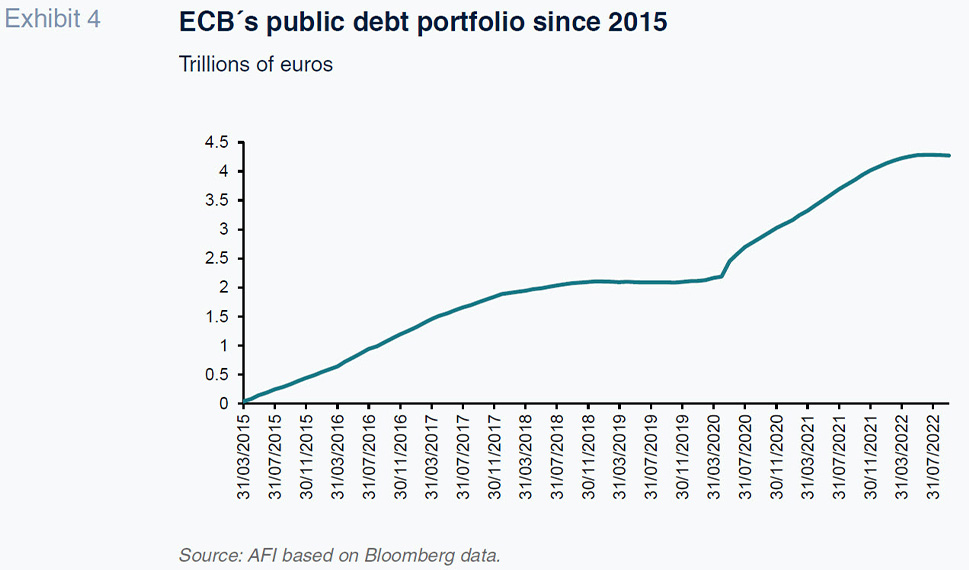

Elsewhere, the fragmentation of the public debt market, whereby borrowing terms decoupled from fundamentals in the so-called peripheral sovereigns, emerged as a new threat in 2012. Yields on those sovereign bonds began to trade at a significant premium fuelled by fears of the break-up of the euro, raising the attendant redenomination risk. The volatility in risk premium curves jeopardised the transmission of monetary policy to the interest rate curve. That is another of the legacies weighing on the current phase of normalisation. This is despite the fact that the asset purchase programmes – first announced in 2012 as part of the ‘whatever it takes’ speech by the then President of the ECB, Mario Draghi, in the midst of the euro crisis – and the rollout of common investment and spending policies in the EMU went a long way to mitigating that risk (Amor, Jiménez and Pino, 2022).

The later asset purchase programmes (public and private bonds, and the pandemic-specific programme, the PEPP) were designed to have a direct downward influence on the entire yield curve so as to prevent fragmentation in the public debt markets at the national level. In June of this year, the ECB eliminated those purchase programmes, albeit agreeing to reinvest the proceeds from portfolio holdings as they mature. It also announced a contingency programme for use in specific circumstances in the bond markets.

Conclusions: Anything but normal normalisation

The ECB is facing an extraordinary situation in which it is unable to rely on an economic slowdown alone to curb inflation. To the contrary, the reduced bargaining power of workers would likely usher in a prolonged period of loss of wage purchasing power – a cost-of-living crisis – with a negative impact on consumption, without necessarily reducing underlying inflation. Aside from commodity price volatility, today’s inflation is a phenomenon related in part with global corporations’ price– and margin-setting power. Only with decisive and swift action can the ECB exhibit its determination to bring inflation back in line with levels compatible with its symmetric target of 2% and keep inflation expectations solidly anchored.

Interest rate normalisation in 2022, after 13 years of monetary accommodation, while shrouded by significant uncertainty, a lot of which shaped by the geopolitical tension related to the invasion of Ukraine, is clearly progressing at a rapid pace.

As well, in 2022, the ECB has also embarked on normalisation of its monetary policy toolkit. Instruments such as its longer-term refinancing operations (TLTROs) and its asset purchase programmes, a significant legacy from the last period of monetary accommodation, will be unwound naturally. The ECB’s balance sheet will respond to that approach and continue to shrink.

References

AMOR, J. M., JIMÉNEZ, S. and PINO, J. (2022). EMU peripheral sovereign debt: Resilience in the face of monetary policy and geopolitical risks.

Spanish Economic and Financial Outlook (SEFO), Vol. 11, No. 2 (March).HERNANDEZ DE COS, P. (2022). “Monetary policy in the euro area: Where do we stand and where are we going”. Bank of Spain, September. Retrievable from

www.bde.esLANE, P. R. (2022a). “Monetary policy in the euro area: The next phase”, speech, ECB, August 29

th. Retrievable from

www.ecb.europa.euLANE, P. R. (2022b). “The transmission of monetary policy”, speech, ECB, October 11

th. Retrievable from

www.ecb.europa.euPANETTA, F. (2022). “Normalising monetary policy in non-normal times”, speech, ECB, May 25

th. Retrievable from

www.ecb.europa.euSCHNABEL, I. (2022a). “The globalisation of inflation”, speech, ECB, May 11

th. Retrievable from

www.ecb.europa.euSCHNABEL, I. (2022b). “Monetary policy and the Great Volatility”, speech, ECB, August 27

th. Retrievable from

www.ecb.europa.euSCHNABEL, I. (2022c). “Monetary policy in a cost-of-living crisis”, speech, ECB, September 30

th. Retrievable from

www.ecb.europa.euSTANSBURY, A. and SUMMERS, L. H. (2020). “The declining worker power hypothesis: An explanation for the recent evolution of the American economy”.

Working Paper 27193, NBER.

Ignacio Ezquiaga. Afi