Spanish economic forecasts panel: November 2022*

Funcas Economic Trends and Statistics Department

GDP growth estimate for 2022 increases to 4.5%

According to INE’s estimate, third quarter GDP grew by 0.2%, one tenth of a percentage point more than expected by the panelists. Domestic demand contributed 1pp, while the foreign sector contributed negatively to growth by 0.8pp. Leading indicators showed a weakening trend, despite mixed results.

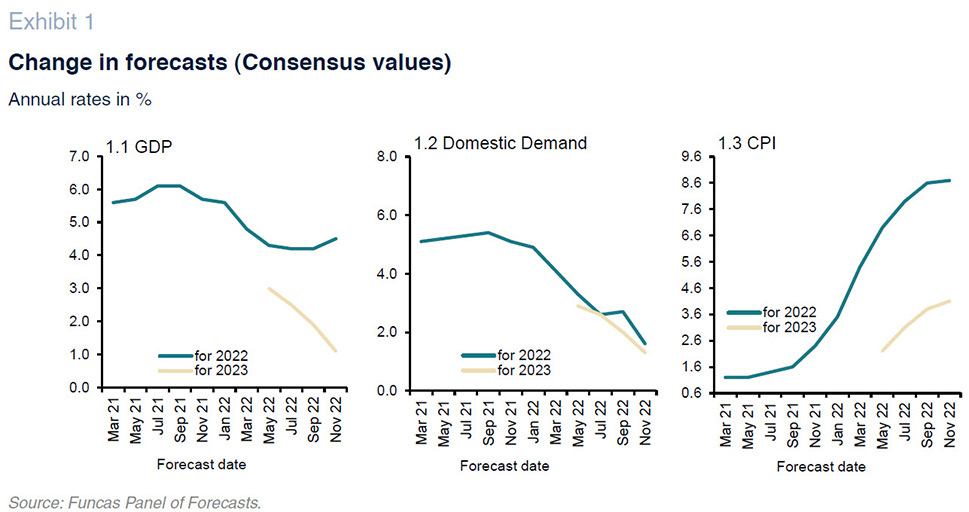

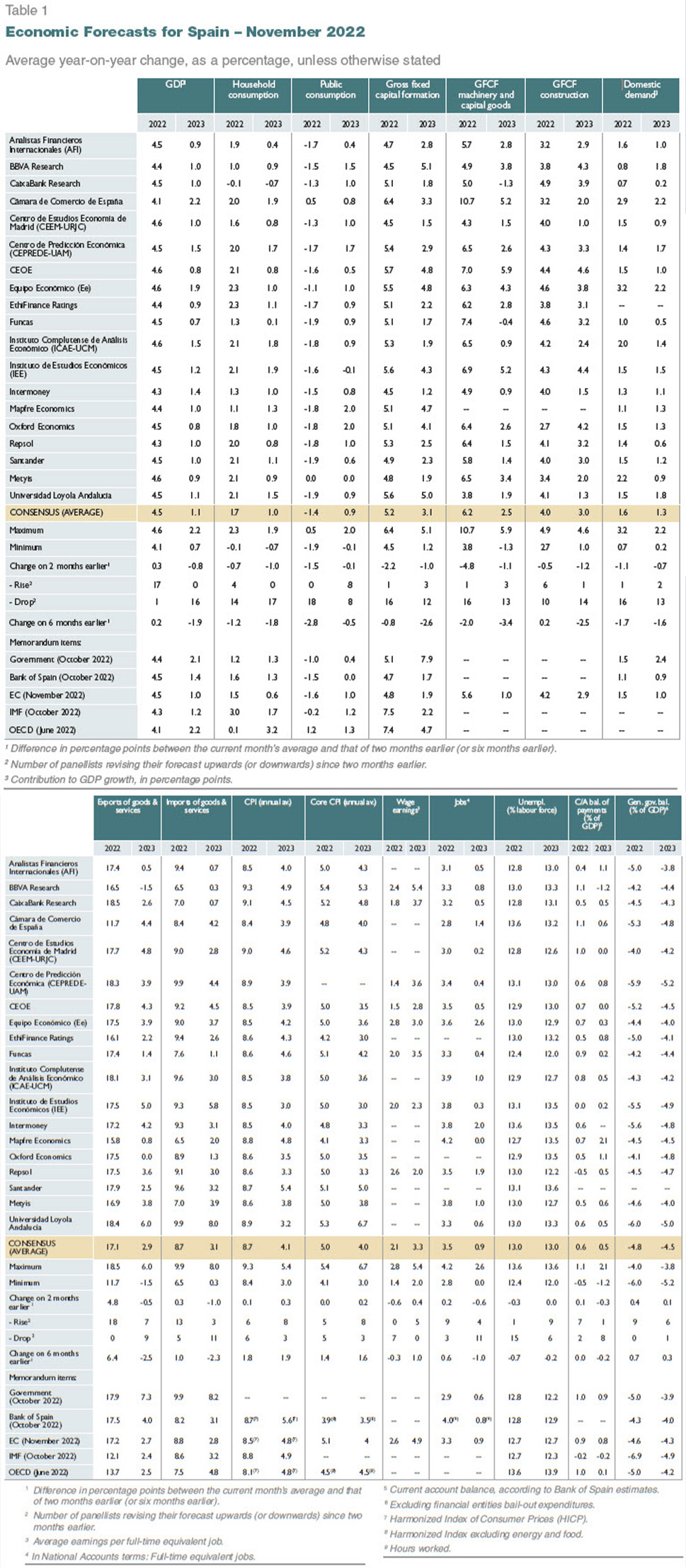

For the year as a whole, the analysts´ forecast stands at 4.5%, 0.3pp higher than the previous Panel, which had not yet incorporated the National Accounts´ revised figures, according to which the economy would have grown 0.4pp more year-on-year in the first half of the year than previously anticipated. A large majority of the analysts expect negative growth for the fourth quarter.

In terms of the composition of GDP growth, the contribution of the foreign sector is expected to be 2.9pp (1.4pp more than the last Panel), and domestic demand is forecast to decline 1.1pp to 1.6pp, compared to the September Panel. The growth projected for all components of domestic demand has been revised sharply downward. With respect to the foreign sector, almost all panelists have revised upward their forecasts for export growth at a greater rate than forecasts estimating an increase in import growth.

The 2023 forecast is down to 1.1%

Most panelists have revised downward their forecast for GDP growth for 2023, leading to an average of 1.1% (0.8pp lower than the last Panel). As for the quarterly profile, zero growth is expected in the first quarter, followed by growth of around 0.5%-0.7% for the remaining quarters of the year (Table 2).

The foreign sector is expected to make a contribution of -0.2pp, while domestic demand will contribute 1.3pp to GDP growth – 0.7pp less than the last forecast. Both investment and household consumption are expected to register lower growth than in 2022, while public consumption will return to positive rates, compared to this year’s decline (Table 1).

Inflation hits a ceiling

After reaching rates above 10% in June, July and August, CPI moderated in September and October, due to a better performance of energy prices and base effects. Meanwhile, core inflation reached its peak in August at 6.4%. In the remaining months of the year, inflation is expected to continue to moderate, largely due to base effects (Table 3).

The analysts have revised their estimate for the average inflation rate for this year by 0.1pp, up to 8.7%, while core inflation stayed at 5%. With respect to next year, the forecast for the headline rate is up by 0.3pp to 4.1%, and core rate inflation by 0.2pp to 4% (Table 1).

The projected year-on-year rates of the overall index for December 2022 and December 2023 are 7.1% and 2.8%, respectively (Table 3).

Unemployment reduction stalls

According to the Labour Force Survey, the seasonally adjusted pace of employment growth weakened in the third quarter, after eight quarters of uninterrupted growth. The unemployment rate increased to 12.7%, but is 1.9pp lower than a year ago. On the other hand, Social Security enrollment grew in August and September, followed by a weakening in October.

The analysts´ forecast for employment growth has increased by 0.2pp to 3.5% for 2022 and has been reduced by 0.6pp to 0.9% for 2023. The implied projection for productivity and unit labor cost (ULC) growth is derived from the forecasts for GDP, employment and wage growth. Productivity per full-time equivalent job will increase by 1% this year and by 0.2% in 2023. ULCs are expected to increase by 1.1% in 2022 –0.7pp less than in the last Panel– and by 3.1% next year -0.6pp more.

The average annual unemployment rate will continue to fall to 13% in 2022 -0.3pp lower than in the last Panel- and will remain as such in 2023.

Trade surplus maintained despite higher energy bills

The current account of the balance of payments recorded a surplus of 1.02 billion euros up to August, compared to 4.73 billion euros in the same period of the previous year. This worsening mainly reflects the result of a larger deficit in the income balance and a decline in the surplus of the balance of goods and services due to the higher energy costs.

The panelists expect a positive balance of 0.6% of GDP for the year as a whole -0.1pp more than in the last Panel-, and 0.5% for 2023, after a downward revision of 0.3pp (Table 1).

Public deficit forecast improves

As of August of this year, the fiscal deficit, excluding local authorities, was 34.93 billion euros lower than in the same period last year. This improvement was due to a larger than expected increase in revenue of 42.33 billion euros, greater than the increase of 7.13 billion euros in expenditures.

The analysts expect the overall deficit to decrease more intensely in 2022 and 2023 than previously estimated in September. Specifically, the projection for the public deficit would be 4.8% of GDP this year and 4.5% next year. Note this year´s forecast is more optimistic than the government´s, while more pessimistic for 2023 (Table 1).

The international landscape looks unfavorable and could get worse in the months to come

The weakening of the world economy that was already apparent in the last Panel has been confirmed. Economic indicators point in a recessionary direction at the end of the year – the global purchasing managers´ index (global PMI) is below 50, marking the threshold for a contraction. In its autumn round, the IMF put world economic growth at 2.7% for the coming year, just two tenths of a percent above the recession threshold in global terms. The European economy is one of the hardest hit by the energy crisis. In its latest projections, the European Commission places the eurozone on the brink of recession, with an anticipated growth of 0.3% in 2023, compared to 2.3% in the July forecast.

The supply shock generated by the sharp rise in the price of commodities, especially energy supplies, is the main factor behind the global slowdown. Although the markets are pointing to a slowdown of the pressures (the price of a barrel of Brent crude had stabilized at around $95 at the time of writing, while gas prices are falling as reserves approach their limit), the economy is still suffering.

Moreover, major central banks are becoming increasingly explicit in their willingness to cool demand to moderate the second-round effects of inflation.

In the face of such turbulence, the analysts´ assessments of the international environment in the coming months as adverse are practically unanimous, both within and outside the EU, and could even worsen in the coming months (Table 4). This pessimism was already explicit in the former Panel.

Interest rates will continue to rise until mid-2023

Since the September panel, the Federal Reserve has raised interest rates twice, by a total of 150 basis points – decisions motivated by the persistence of price and wage pressures, together with the resilience of the US economy. The ECB has also adjusted its interest rates twice, following in the footsteps of its US counterpart. The principal interest rate (deposit facility) has reached 1.5%, and ECB President Christine Lagarde promises a further tightening until there are tangible signs of a de-escalation of inflation. Moreover, the ECB intends to reduce the outstanding amount of bonds in its portfolio as soon as interest rate adjustments have taken place. It has also decided to reconsider bank lending incentives (TLTRO III) and to facilitate repayments of such operations.

The process of “quantitative tightening” (QT) of monetary policy has been reflected in the markets. The one-year Euribor now stands at 2.8%, eight tenths of a point higher than in September. And the yield on the Spanish 10-year bond is above 3.1%, 30 basis points higher than in September. The risk premium has stabilized at moderate levels around 105 points, a number indicative of the absence of financial tensions in the public debt market, at least for the time being.

The analysts have integrated the change in monetary regime, revising their interest rate forecasts sharply upward. The ECB’s principal interest rate is expected to be close to 2.5% at the end of the forecast period (Table 2), one point higher than in the last Panel. Euribor has been revised by a similar magnitude to above 3%, while the 10-year bond yield is expected to reach close to 3.5%, almost half a point higher than in the September forecast.

After the euro´s depreciation against the dollar, parity will be maintained

In recent months, the euro has tended to weaken against the dollar, occasionally falling below parity. However, as a result of the ECB’s interest rate hike, the markets are anticipating a narrowing of the yield spread between the two sides of the Atlantic. Thus, after a period of depreciation, the euro has stabilized around parity against the dollar. Analysts expect little change in this position (Table 2), in line with the previous forecast.

Macroeconomic policy should focus on fighting inflation

Concerns about inflation and its costs for households and businesses are reflected in analysts’ views on economic policy. Thus, while there is still a majority of opinions supporting the expansionary nature of fiscal policy at present (Table 4), the number of panelists who believe that fiscal policy should be more neutral or even restrictive in relation to the economic cycle is growing. Likewise, all members believe that monetary policy should not be expansionary, but either neutral or restrictive (there were two analysts that still advocated an accommodative policy in the last Panel).

* The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.