Social Security budget for 2023

While the indexation of contributory pensions constitutes the main driver of Social Security expenditure growth in 2023, an increase in the number of pensioners as well as growth in average pensions could prompt a greater than budgeted expenditure outlay. Although the budgetary deficit for 2023 will yet again be covered by state lending, the size of the contributory shortfall could reach 1.8% of GDP.

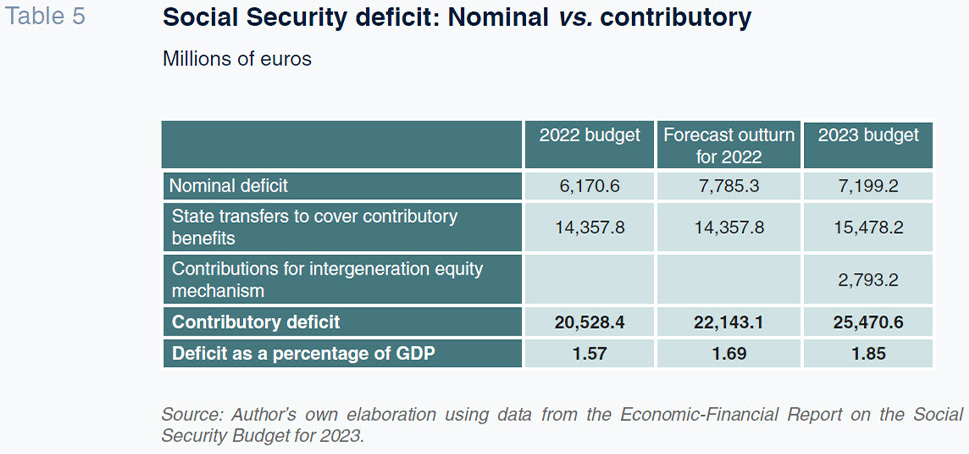

Abstract: The indexation of contributory pensions is the main driver of the budgeted growth in Social Security expenditure in 2023. The increase in the number of pensioners and in the average pension could imply higher than budgeted spending. On the revenue side, the main development is the first-time application of an additional common contingency contribution of 0.6% to fund the so-called intergenerational equity mechanism. The separation of funding sources between contributory and non-contributory, in line with the Toledo Pact recommendations, and the contribution to balancing the budget is addressed by state transfers, which now account for over 20% of non-financial income. The nominal deficit is forecast at 7.18 billion euros in 2023 and is once again covered by a new loan from the state. However, the overall hole in the contributory block of the Social Security system could reach 25.47 billion euros, equivalent to 1.8% of GDP. By year-end, the Social Security’s debt with the state will stand at over 106 billion euros. The real problem, however, is not the volume of debt piled up with the state but rather the financial sustainability of the Social Security system in the medium- and long-term. That is why it is important to accurately trace the expected trajectory in revenue and expenses, especially those related to the pension system, which will determine the system´s overall health.

Introduction

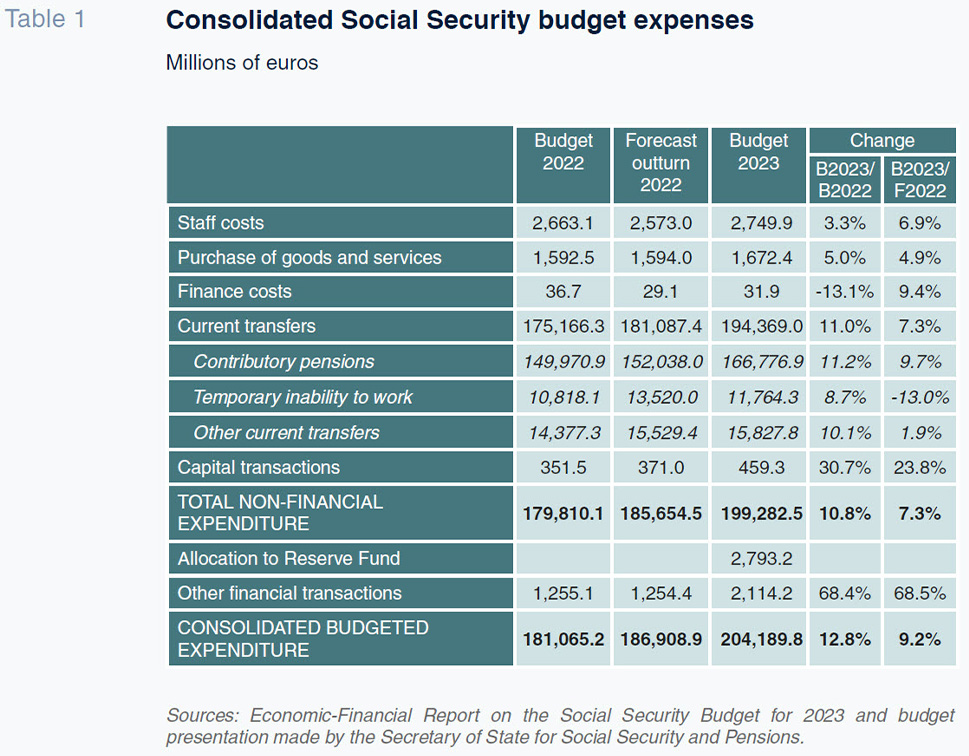

The budget for the Social Security in 2023 contemplates non-financial expenditure of 199.28 billion euros, marking growth of 7.3% from the estimated outturn for the 2022 budget, specifically estimated expenditure of 185.65 billion euros. The growth is driven primarily by expenditure on contributory pensions, which are budgeted to increase by 9.7% to 166.78 billion euros, equivalent to 83.7% of the Social Security’s budget in 2023. Noteworthy movements among the other items of expenditure include the expected 13% decrease in the cost of coverage for the temporary inability to work (to 11.76 billion euros), having been revised upwards in 2022 to cover benefits derived from COVID-19 related illness, and the budgeted increase of 21.4% in transfers to the regional governments for dependent care coverage (to 3.52 billion euros). As for financial transactions, the main novelty is the recovery of the contribution to the balancing Reserve Fund, budgeted at 2.96 billion euros (Table 1).

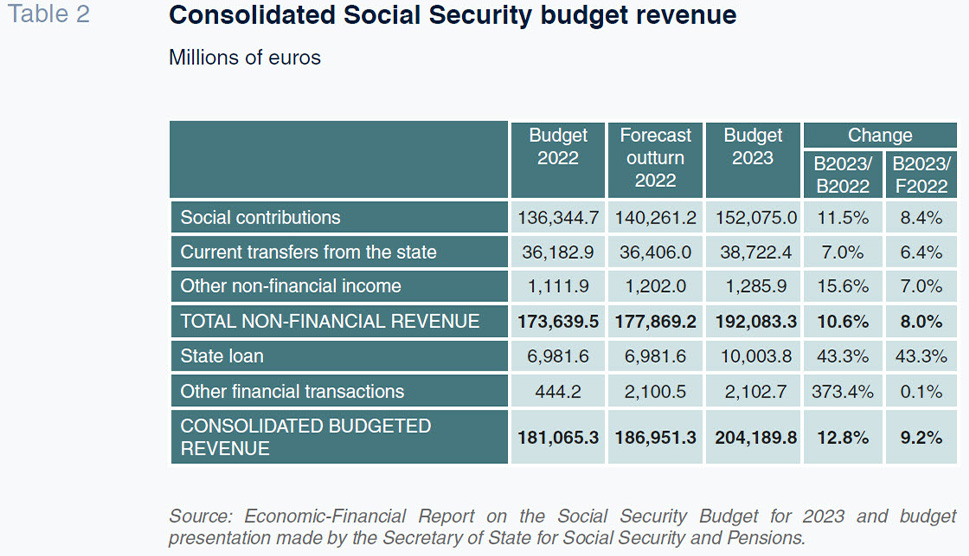

On the revenue side, social contributions are budgeted 8.4% above the estimated outturn for 2022, at 152.08 billion euros (79.2% of total non-financial income), although 2.79 billion euros of that total corresponds to the new intergenerational equity mechanism created for transfer to the Reserve Fund, so replacing the former sustainability factor. If we subtract out that additional contribution (0.6% of the common contingency contribution base), like-for-like growth in contributions drops by two percentage points to 6.4%. The second biggest source of income is current transfers by the state, which total 38.72 billion euros in the 2023 budget (20.2% of total current non-financial income), growth of 6.4% by comparison with the estimated 2022 figure. In total, therefore, non-financial income is budgeted to increase by 8.0%, a rate that dips to 6.4% stripping out the intergenerational equity mechanism (Table 2).

The result is a nominal budget deficit of an estimated 7.2 billion euros, slightly below the deficit expected for the Social Security system in 2022, of 7.79 billion euros. However, if the contribution associated with the intergenerational equity mechanism is subtracted from the revenue budgeted in 2023, the deficit widens to 9.99 billion euros.

The cost of indexing pensions

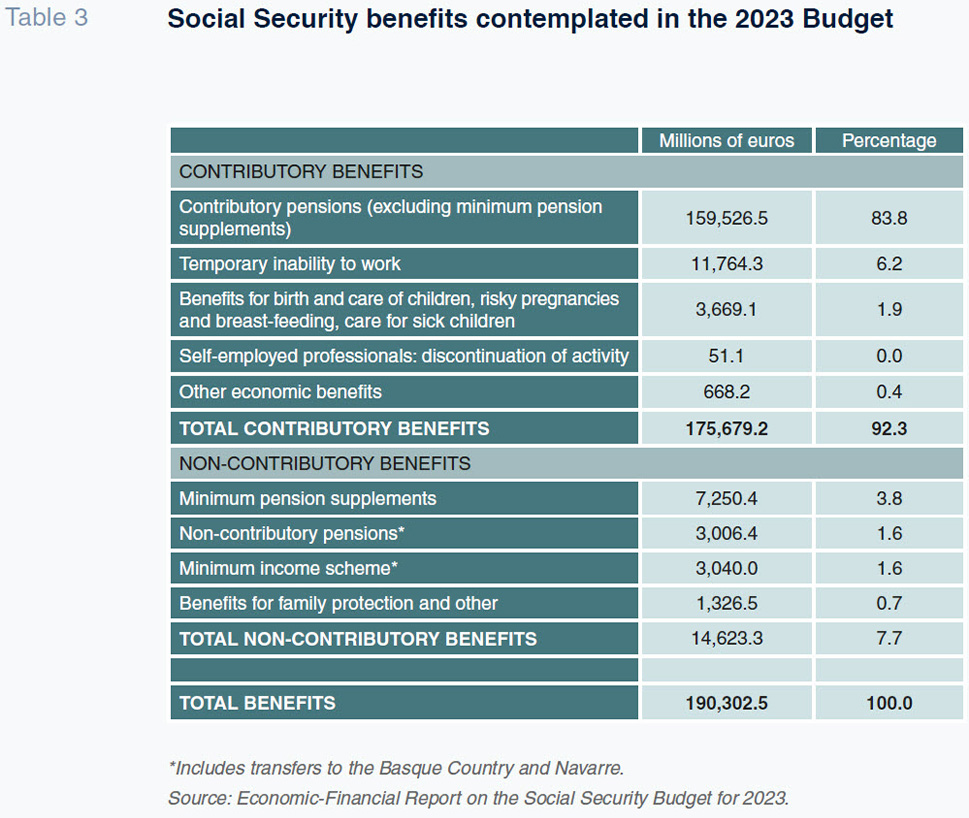

The core purpose of the Social Security system is to provide the financial benefits that, looking exclusively at the current transfers to which they give rise, i.e., excluding the associated management costs, sum to 190.3 billion euros in the 2023 budget, equivalent to 95.5% of total budgeted non-financial expenditure (Table 3). The rest of the system’s expenditure goes to fund social services, notably those related with enabling personal autonomy and dependent care and healthcare assistance for specific beneficiaries (the mutual societies that collaborate with the Social Security, INGESA, the management entity that deals with health benefits in the cities of Ceuta and Melilla, and ISM, the entity that handles those benefits for seafarers) and common services.

The indexation of benefits for inflation, most particularly pensions on account of their magnitude, is the main factor behind the budgeted increase in Social Security expenditure in 2023. Contributory pensions, non-contributory pensions and the minimum income scheme are all being restated for the average year-on-year rate of inflation for the 12 months prior to December 2022. At the time of writing, that rate is forecast by Funcas at 8.5%. If, as noted in the so-called 2023 Budget Yellow Book, expenditure on contributory pensions ultimately comes in at the currently estimated 152.04 billion euros in 2022 (Ministry of Finance and Civil Service, 2022, p.162), an increase of 8.5% on the payroll corresponding to December 2022 leads to the budgeted expenditure figure for 2023 of around 166.7 billion euros. However, two other factors influence total expenditure: growth in the number of pensioners, which is estimated at around 1% in light of recent trends; and growth in the average pension, of another 1%, taking a conservative stance. If those assumptions are met, total expenditure on contributory pensions will exceed the budget by around 3.1 billion euros, for a total of roughly 169.9 billion euros. It is also possible, given the outlook for a pension hike of 8.5% in January 2023, that we could see a rise in early retirements in the final weeks of 2022: those pensioners would suffer a small penalty on their starting pensions due to earlier retirement, which would be offset by the indexation effect.

The impact of the restatement of all public pensions for CPI, on the terms contemplated in Spanish Law 21/2021 (December 28th, 2021) on ensuring pension purchasing power and other measures for reinforcing the financial and social sustainability of the public pension system, will be even higher than estimated for the Social Security as it also affects the special pension scheme for civil servants, boosting public spending by a further 1.5 billion euros purely on account of indexation. Sticking to the strictly contributory public pensions, the legal indexation guarantee will add over 16 billion euros of government spending which will become structural vis-à-vis subsequent budgets.

The increasing weight of state transfers

Revenue from contributions is the basis of any contributory Social Security regime such as Spain’s. Benefits are correlated, some more closely aligned than others, with the trend in contributor contributions. That is the case, for example, with pensions, sick pay and maternity/paternity/childcare leave. There are also non-contributory benefits which, as their name suggests, are not tied to contributions, such as the non-contributory pensions, the minimum income scheme and the family protection benefit, which are covered by transfers from the state. Nevertheless, contributions command the predominant share of the Social Security’s financing, specifically an estimated 79.2% of budgeted non-financial income in 2022, equivalent to 11.0% of the GDP forecast for that year.

There are two key novelties in the contribution regime in 2023. Firstly, the new contribution regime for the self-employed underpinned by 12 brackets, each with maximum and minimum bases, which will be rolled out gradually over time as part of a transition to a regime based on contributions aligned with actual earnings. Secondly, introduction of an additional contribution of 0.6% of the common contingencies base, which will be transferred to the Reserve Fund by way of an intergenerational equity mechanism (refer to Bandrés, 2021). In addition, the Budget Act increases the maximum contribution base by 8.6% to 4,495.50 a month and ties increases in the minimum bases to those introduced to the minimum wage.

Excluding the additional contribution for the intergenerational equity mechanism, revenue from contributions in 2023 is budgeted 6.4% above the estimated 2022 figure, a more than acceptable rate which would imply repeating the performance of 2022, underpinned by the outlook for growth in contributors and increase in contribution bases.

The other major system funding source is current transfers from the state, which more than doubled in 2020 as a result of extraordinary contributions to offset the impact of COVID-19 on the Social Security’s finances. Those transfers jumped from 15.64 billion euros in 2019 to 35.79 billion in 2020, 36.11 billion euros in 2021, a forecast 36.44 billion euros in 2022 and a budgeted 38.72 billion euros in 2023. The consolidation of transfers at that level from 2021 stems from a new provision in the General Social Security Act as a result of a recommendation made in the 2020 Toledo Pact which perpetuates an annual state transfer with the purpose of compensating for certain items of expenditure qualifying as “undue” and contributing to the system’s financial equilibrium.

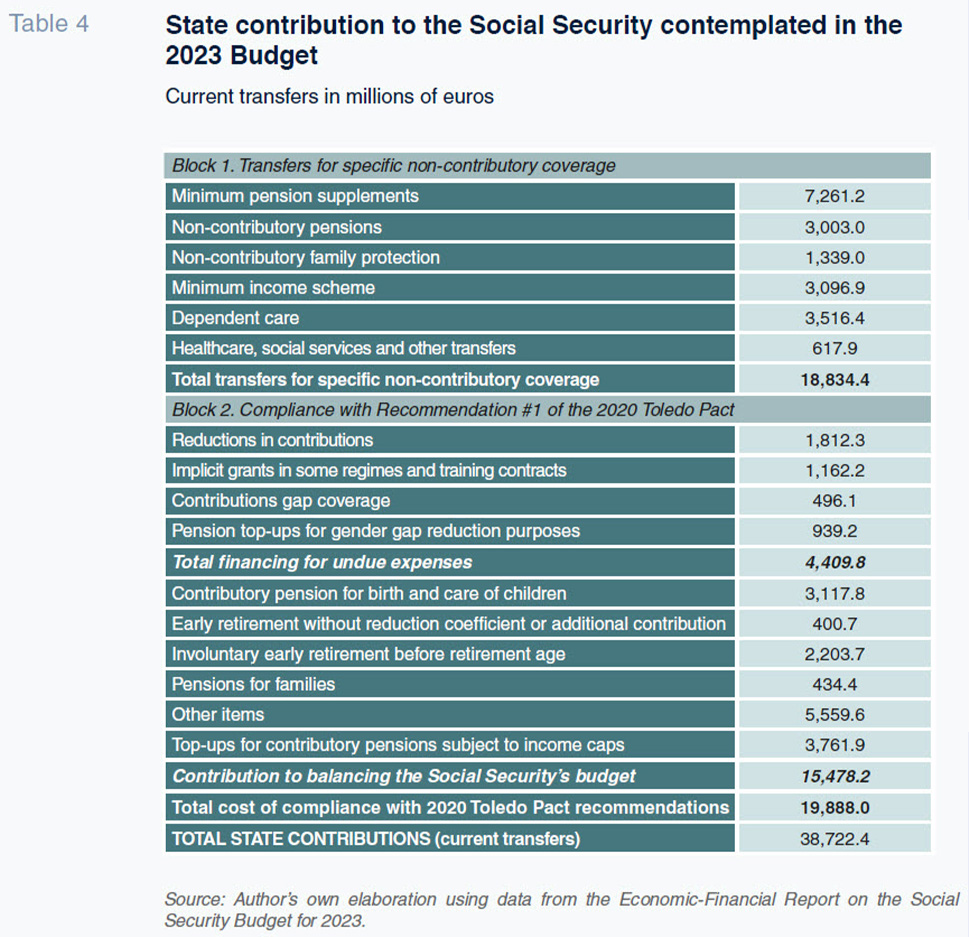

Table 4 sets forth the current state transfers budgeted for 2023, which are set to increase by 6.4% by comparison with the forecast for 2022. As shown, the first block, totalling 18.83 billion euros, is made up of transfers for specific non-contributory coverage stemming from the separation of sources of financing for contributory and non-contributory benefits. More specifically, the state contributions finance the contributory pension top-ups to reach a minimum threshold, non-contributory pensions, non-contributory family protection benefits, the minimum income scheme and coverage for care provision and other social and health services. The second block amounts to 19.89 billion euros and responds to recommendation one of the 2020 Toledo Pact. It is made up of different items related with financing for contributory benefits for birth and care of children, reductions in contributions for certain groups, implicit grants for certain special regimes, contributory pension top-ups to reduce the gender gap, the cost of early, involuntary pension coverage and other unspecified items.

Nominal and contributory deficit

The financing of all of the first block and some of the second block via taxes (state transfers) does not raise any concerns insofar as is covers concepts that derive from social or economic policy goals and do not fit with the contributory nature of the Social Security system. In that second block, the reductions in contributions, implicit grants, filling of coverage gaps and top-ups for gender gap reduction purposes classify as “undue” expenses. In the 2023 Budget, expenditure on those items is budgeted at 4.41 billion euros. The remaining 15.48 billion euros is earmarked to spending functions that can be considered contributory in nature. In short, of the 38.72 billion euros of current transfers by the state to the Social Security, just 23.24 billion euros relate to coverage of non-contributory benefits and social and economic policy goals, while 15.48 billion euros are really transfers intended to plug some of the shortfall in contributions with respect to the cost of the country’s contributory benefits.

As a result, the “real” contributory deficit is bigger than what we have called the “nominal” deficit. If we add to the nominal deficit (7.2 billion euros) the 15.48 billion euros of current state transfers that go to cover contributory benefits and spending functions, and deduct from revenue the 2.79 billion euros of contributions that correspond to the intergenerational equity mechanism, the contributory deficit in 2023 jumps to 25.47 billion euros, equivalent to 1.8% of the GDP forecast next year, slightly above the 1.7% corresponding to the 2022 budget outturn using the same calculation methodology (Table 5). Spain is by no means the only country that finances part of its system’s contributory benefits with taxes. Many European countries have basic pension systems that are financed totally or partly by taxes and many top up the funding for their benefit systems with general taxes. However, the greater the divergence between benefits and contributions, the lower the system’s contributory nature and that ultimately affects the nature of the model. Looked at another way, coverage of any financial imbalance in the contributory system is equivalent to transferring the Social Security’s deficit to the state, creating a mass of structural deficit on top of that of the state itself that has to be financed either via higher taxes, reduced spending in other areas or more public debt.

The financing of the “nominal” deficit implied by the Social Security budget for 2023 is directly related with a loan from the state in the amount of 10 billion euros, which will not accrue interest and must be repaid, as stipulated in the draft State General Budget Act, over a maximum term of 10 years. However, as has been the case with previous loans, in all likelihood that loan will end up becoming a sort of perpetual zero-rate loan. By year end, the Social Security’s debt with the state will stand at over 106 billion euros.

The real problem, however, is not the volume of debt piled up with the state but rather the financial sustainability of the Social Security system in the medium– and long-term. That is why it is important to accurately trace the expected trajectory in revenue and expenses, especially those related to the pension system, which will determine the system´s overall health.

References

BANDRÉS MOLINÉ, E. (2021). Social Security budget for 2022: Short-term state support yet a need for structural reform. Spanish Economic and Financial Outlook, Volume 10, No. 6.

MINISTRY OF FINANCE AND CIVIL SERVICE. (2022). Presentación del Proyecto de Presupuestos Generales del Estado 2023 [Presentation of the Draft State Budget for 2017]. Government of Spain.

Eduardo Bandrés Moliné. University of Zaragoza and Funcas