An assessment of the main revenue and expenditure figures in the 2023 general state budget

The 2023 general state budget is underpinned by an optimistic GDP forecast of 2.1%, which would unlock a reduction in the deficit from 5.0% in 2022 to 3.9% in 2023. Nonetheless, positive performance on the revenue side is underpinned mainly by sharp inflation, together with essentially temporary measures set to take effect in 2023, rather than tax reform, while expenditure figures are largely structural and also remain sensitive to upcoming decisions on extension of support measures into the coming year.

Abstract: The 2023 general state budget (2023 Budget) is underpinned by an optimistic GDP growth forecast (2.1%). It assumes a revenue-GDP elasticity of 1.1 and an expenditure-GDP elasticity of just over 0.6, which would unlock a reduction in the deficit from 5.0% in 2022 to 3.9% in 2023. On the revenue side, the forecast growth of 7.6% (at all levels of government) is shaped by the sharp growth in inflation (71.4% according to AIReF). Other contributing factors to the favourable revenue outlook include the measures set to take effect in 2023, with a net positive contribution to the state’s coffers of 2.71 billion euros. The new sources of tax revenue stem mainly from essentially temporary measures (92.9% and 92.6% of tax revenue gains in 2023 and 2024, respectively) rather than genuine tax reform, as promised to Brussels for the first quarter of 2023 and upon which the release of 7 billion euros in European funds is conditional. On the expenditure side, the estimated figures are sensitive to the pending decision as to the rollover to 2023 of the household and business aid put in place in 2022, whose overall cost, if not adjusted, would be around 18 billion euros.

Snapshot of total public revenue and expenditure in 2023

In the span of just two years, history has repeated itself: the budget has been formulated in a highly complex environment, this time on account of the invasion of Ukraine. The draft state budget for 2023 (2023 Budget), passed by the Cabinet on October 6th, is underpinned by forecast real GDP growth of 2.1% in 2023. That forecast looks optimistic in light of the range of estimates recently published by the leading Spanish and international organisations (1.5% forecast by AIReF; 1.4% by the Bank of Spain; 1.2% by the IMF; 1% by BBVA-Research; and 0.7% by Funcas). On October 15th, the government sent Brussels its Budgetary Plan for 2023 (2023 Plan) which contained a few relevant details not included in the initial 2023 Budget. Specifically, it features a so-called Scenario 2, which sets out a more optimistic trend in tax revenue in 2022 and 2023.

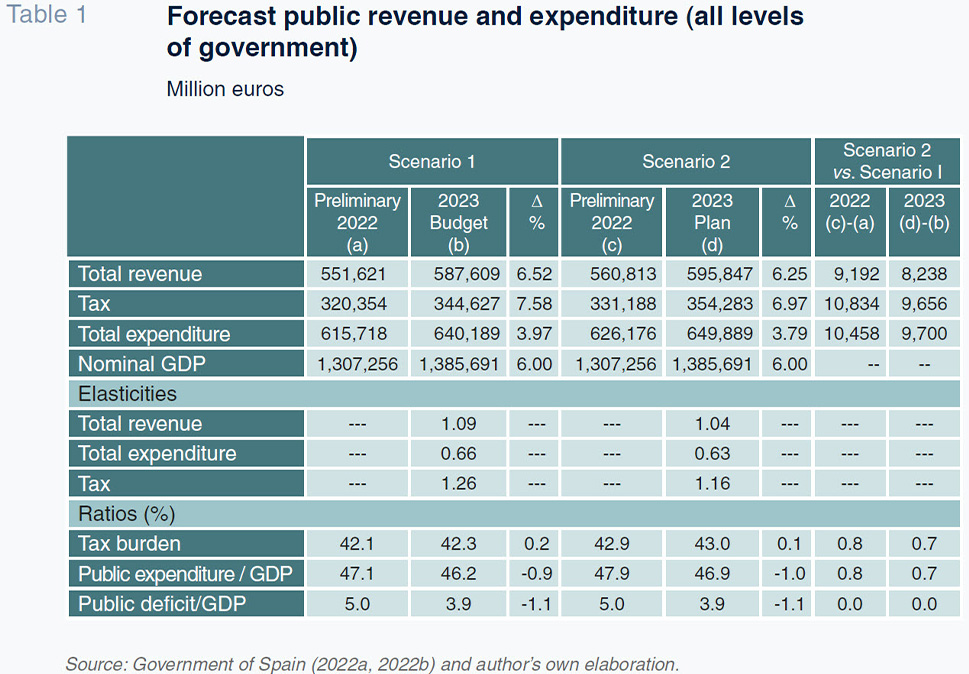

As shown in Table 1, Scenario 2 assumes that total tax revenue in 2022 will top the estimate used in the 2023 Budget by 9.19 billion euros. And it assumes that 2023 revenue will come in 8.24 billion euros above the estimate provided in the 2023 Budget. In both scenarios (1 and 2), total revenue is expected to increase by between 35 and 36 billion euros, or between 6.2% and 6.5%, between 2022 and 2023. Expenditure, meanwhile, is expected to increase by between 23.7 billion and 24.5 billion euros, equivalent to around 4%.

Scenario 2 puts the tax burden at 42.9% in in 2022 (compared to 42.1% in Scenario I), increasing to 43.0% in 2023 (vs. 42.3% in Scenario 1). However, Scenario 2 makes no changes to the public deficits forecast in the 2023 Budget (5% in 2022 and 3.9% in 2023). In fact, the assumption is that expenditure and revenue will increase by 0.8 points of GDP in 2022 and 0.7 points in 2023 in both Scenarios I and 2. The 1.1-point reduction in the ratio of the deficit-to-GDP is attributable to an elasticity in total revenue-to-GDP of close to 1 compared to an elasticity in expenditure-to-GDP of just over 0.6.

If the Scenario 2 forecasts are borne out, the government will have 9.66 billion euros of additional revenue in 2023 with which to roll over the measures approved over the course of 2022 and/or implement new initiatives to protect businesses and households. [1] Note that the estimated cost of the three packages of temporary measures passed in 2022 is 15.77 billion euros, which is equivalent to 1.2% of GDP (AIReF, 2022). That figure encompasses the revenue foregone (e.g., the electricity and gas VAT rate cut from 21% to 5%) as well as the items of expenditure (e.g., public transportation card and fuel subsidies). [2] As a result, the rollover of the existing measures and/or approval of new ones will affect the expenditure and revenue figures contemplated in the 2023 Budget. [3] It is probable that some of them, such as the above-mentioned VAT rate cut, with an estimated cost of 3.1 billion euros in 2022, will be extended to 2023 (AIReF, 2022a). In contrast, judging by the information available, the government may not extend the universal fuel subsidy, which cost an estimated 6.03 billion euros in 2022 (Government of Spain, 2022b). [4] That subsidy may be discontinued as a universal measure and retargeted at select sectors only, such as the transport sector.

A big-picture assessment of the revenue and expenditure figures contained in the two budgetary documents referred to above yields the following conclusions:

- A significant portion of the increase in spending in 2023 will be structural. The forecast growth in spending on state pensions (+20 billion euros) and public sector pay (+5 billion euros) stands out for their magnitude. That increase is equivalent to 1.8% of GDP in 2023, indicating the scale of the growth in those sources of structural spending.

- On the revenue side, inflation is having a major impact on collection. AIReF (2022b) estimates an impact of 49.3% in 2022 (15.12 billion euros), rising to 71.4% in 2023 (17.33 billion euros). By taxes, in 2023, 10.09 billion euros of the growth will stem from Social Security contributions, 3.92 billion euros from personal income tax and 3.32 billion euros from VAT. The first two will materialise as a result of pay increases. The growth in VAT receipts, meanwhile, will derive from the automatic impact of higher prices on revenue.

- Elsewhere, as we will see in next section, the bulk of the growth in revenue derived from measures slated to take effect in 2023 will be temporary in nature, rather than as a result of the genuine tax reform which the government promised to deliver to Brussels by the first quarter of 2023. The situation generated by the war has created an urgent need to boost revenue in 2023 in order to support vulnerable households and businesses by making intensive use of a small number of temporary measures. Far, therefore, from the more than 100 proposals set forth in the White Paper on Tax Reform (Tax Reform Committee, 2021). [5]

In short, underlying the 2023 Budget is a worrying mismatch between growth in revenue from short-term gains as a result of either temporary instruments or inflation compared to growth in structural items of expenditure. That imbalance will exert additional pressure on the structural deficit, which has been deteriorating in Spain since 2018. Spain needs to urgently pursue public spending and revenue policies framed by a longer-term vision and the criteria of equity and effectiveness so as to be in a position to absorb the shocks that will undoubtedly come its way, as they did unexpectedly in 2008, 2020 and, now again, in 2022.

State revenue: Measures promised for 2023

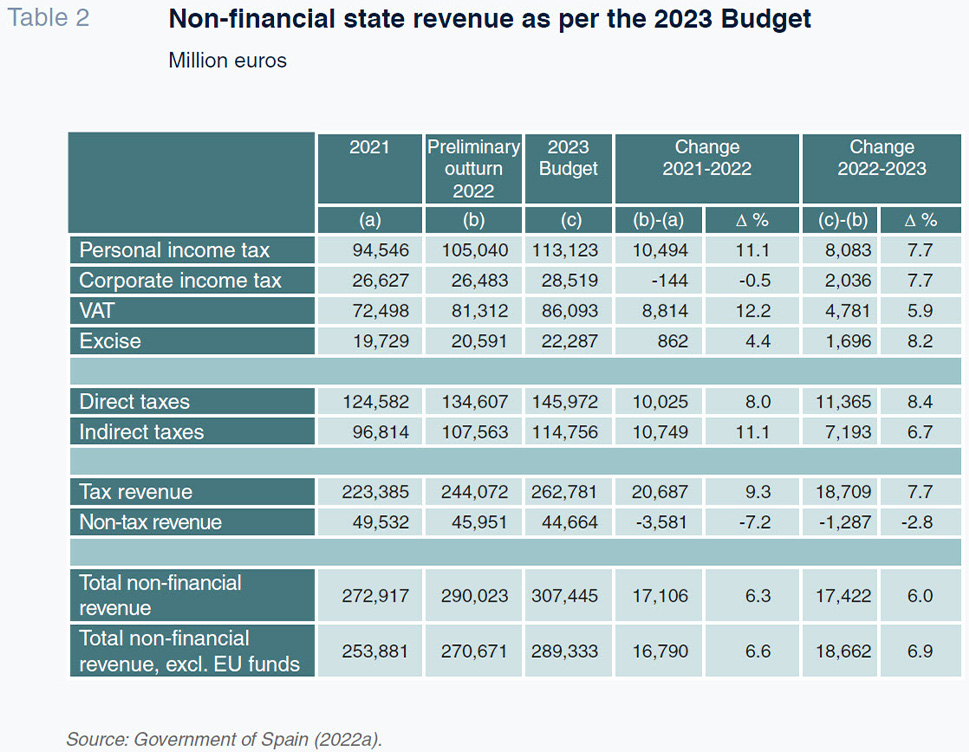

As shown in Table 2, the 2023 Budget contemplates growth in non-financial income at the state level of 6.9% to 289.33 billion euros (growth of 18.66 billion euros). Tax revenue is expected to increase by 18.71 billion euros in 2023, with direct taxes contributing 60.7% of that growth and indirect taxes, the remaining 38.3%. By tax, the biggest increase is set to come in personal income tax, at 8.08 billion euros (growth of 7.7%), followed by VAT, at 4.78 billion euros (+5.9%), corporate income tax, at 2.04 billion euros (+7.7%) and excise duty, at 1.7 billion euros (+8.2%). Those forecasts are underpinned by consumer price inflation of 4.1% and growth in national demand of 2.4%.

As we will show next, the 2023 Budget is underpinned by a mix of changes, of differing impact, in the main taxes, as well as the implementation of new levies.

[6] Those measures, essentially temporary in nature, are far removed from the tax reform commitments made to Brussels, a milestone upon which the release of 7 billion euros of European funds is conditional. Moreover, the changes made to the existing taxes mark continuation of the traditional stopgap solutions applied to the Spanish tax system. The economic situation created by the war, coupled with the fact that the current government is entering its final period (barring a snap election, there will be general elections in November 2023), make genuine tax reform in 2023 highly unlikely. Such reform was, however, one of the commitments assumed as part of Item #28 of the Recovery, Transformation and Resilience Plan.

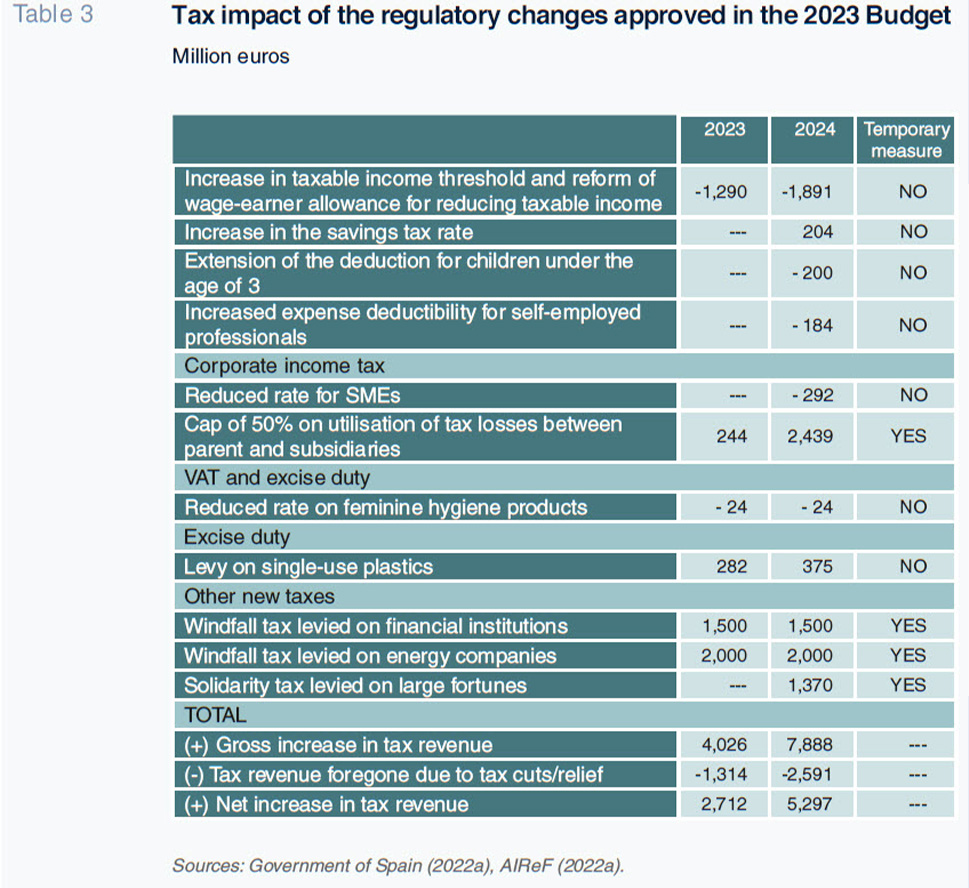

As shown in Table 3, the bulk of the growth in tax receipts generated by the regulatory changes already approved for 2023 is concentrated in a small number of measures: new levies in the financial and energy sectors; a 50% cap on the offset of unused tax losses between parents and subsidiaries and the new ‘solidarity’ tax to be levied on large fortunes. However, the solidarity tax could become permanent within two years, according to the 2023 Plan. These new taxes are expected to generate gross revenue gains of 4.03 billion euros in 2023 and 7.89 billion euros in 2024. However, the net revenue gains,

i.e., discounting the cost of the tax cuts to be rolled over from this year, comes to 2.71 billion euros in 2023 and 5.3 billion euros in 2024. In other words, temporary measures account for 92.9% and 92.6% of gross tax revenue gains in 2023 and 2024, respectively.

Personal income tax

Inflation, especially of the intensity observed in 2022, has a direct impact on households’ purchasing power. Unlike in Spain, some countries, including Germany, France, the Netherlands, Belgium, Denmark, Sweden, Norway and the UK, regularly adjust their income tax brackets for inflation (Bunn, 2022).

[7] It is smart to prevent bracket creep even in times of low inflation as the impact on the tax burden builds up over time. Along these lines, nearly half of the Spanish regions that participate in the nation’s common tax regime, duly availing of their power to do so, have announced measures of varying scope for the adjustment of the regional tranches of personal income tax: Andalusia, Castile-Leon, Valencia, Galicia, Madrid and Murcia.

[8]

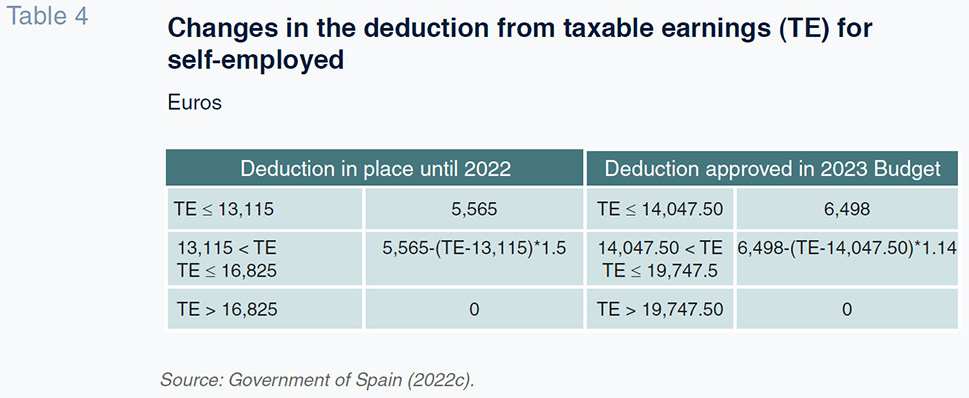

The 2023 Budget only adjusts the lowest income tax brackets for inflation. To do that, it increases the earnings threshold for becoming eligible to pay income tax from 14,000 to 15,000 euros. It also increases the diminishing personal allowances against wage earnings for taxpayers with after-tax earnings of less than 19,747.50 euros (pre-tax earnings of 21,000 euros) (Table 4). That new threshold is very close to the average level of after-tax wage earnings, which in 2020 amounted to 20,999 euros (AEAT, 2022). Middle-income taxpayers, defined broadly as those reporting taxable income of between 21,000 and 60,000 euros, have been excluded as potential beneficiaries. That universe of taxpayers accounts for 54.9% of all income tax returns and contributes 60.8% of the total tax take.

On the other hand, the budget contemplates increasing taxation on savings income by increasing the rate for tax bases of over 200,000 euros from 26% to 27%. A new bracket has been introduced whereby tax payers with savings income of over 300,000 euros will pay a marginal rate of 28%. That measure is expected to affect 17,814 large investors and have an average impact of 11,500 euros per tax payer. The budget extends the annual deduction of 1,200 euros for every child under the age of three, for all mothers, irrespective of whether or not they are working. Lastly, the 2023 Budget allows self-employed professionals who calculate their taxable income using the simplified regime to deduct five points more of expenses.

Corporate income tax

The statutory rate for companies with less than 1 million euros of revenue is being reduced from 25% to 23%. That rate cut stands to benefit over 400,000 small enterprises. According to data published by the National Statistics Office (INE, 2022), as many as 161,000 industrial micro enterprises with fewer than 10 employees (and average revenue of less than 240,000 euros) could benefit from this measure. The reduction in rate around this threshold may be appropriate for a situation of economic deterioration and sharp uncertainty such as this. However, leaving similar thresholds in place

ad infinitum can encourage strategic behaviour with negative effects on the growth, productivity and survival of these companies (Tsuruta, 2020). That is exactly why the special lower rate for SMEs was eliminated in 2014.

[9] Elsewhere, the ability to offset unused losses between parent companies and their subsidiaries will be capped at 50% for 2023 and 2024, a measure expected to affect around 3,600 large business groups.

Value added tax

The 2023 Budget reduces the rate of VAT on feminine hygiene products from 10% at present to 4%. Similar measures are already in effect in other European countries, such as the UK, where they are taxed at a rate of zero, and Italy, where they are taxed at 4%, as in Spain. Two criticisms are usually levelled against this kind of tax cut. Firstly, they generate the same amount of tax savings for all households irrespective of their “income”. It should be noted that this criticism likewise applies to the gas and electricity VAT rate cuts enacted to mitigate the effects of the crisis. Secondly, all of these rate cuts, whether temporary or permanent, exacerbate the “amount of tax expenditure” (AIReF, 2020).

Levies on financial institutions and energy companies

In 2023 and 2024, financial institutions with revenue of more than 800 million euros will become subject to a new tax of 4.8%, to be levied on their ordinary income (net interest and fee/commission income). That tax’s design is noteworthy for a few reasons. Firstly, it is covered by the regulations applicable to public service contributions (

prestación patrimonial pública) even though it resembles a tax.

[10] Secondly, it is expressly forbidden to pass its economic effects on to other economic agents, which is surprising in a market economy such as the European Union. Thirdly, the Bank of Spain has been authorised to verify the possible pass-through of the new tax; it is entitled to exact penalties of 150% of the tax passed through. Against that backdrop, on November 3

rd, the European Central Bank (ECB) published a non-binding ruling on the matter questioning, as was expected, various aspects of the tax, specifically including the prohibition to pass on the tax burden. The ECB urged the Spanish government to study the possible negative consequences of the tax on financial stability, lending and economic growth before enacting it. Nevertheless, at the time of writing, the government had no plans to make any changes to its proposed tax at the ECB’s request.

Elsewhere, the new levy on energy sector players (across the electricity, gas and oil spectrum) shares the core aspects of the bank levy outlined above with the following two specific attributes. Firstly, it will be levied on companies with revenue of over 1 billion euros at a rate of 1.2% of that revenue. Secondly, it will be up to the energy sector watchdog, the CNMC, to implement the penalty regime in the event of tax pass-through.

Solidarity tax on large fortunes

In 2023 and 2024, the new wealth tax will be levied on individuals with a net worth of over 3 million euros. Specifically, a rate of 1.7% will be levied on individuals with a net worth of between 3 and 5 million euros; a rate of 2.1% will apply to those with fortunes of between 5 and 10 million euros; and a rate of 3.5% will be exacted from anyone with a net worth of over 10 million euros. This new tax is levied on the same base —net worth— as the existing property or wealth tax, which has been devolved to the regional governments, potentially raising the scope for intergovernmental litigation. The amount of tax payable is deductible from that property tax, except in the regions where that tax is already 100%-deductible, as is the case in Madrid and Andalusia. That deductibility avoids double taxation while forcing taxation on wealth in the regions where the property tax is subsidised, potentially opening the door to appeals before the Constitutional Court.

Levy on single-use plastics

A new and permanent tax on the manufacture or import of single-use plastics is due in 2023. The rate of taxation is 0.45 euros per kilogram and the tax will foreseeably be borne by end consumers. It constitutes an environmental tax, a category whose weight in the Spanish economy is among the lowest in the European Union (Eurostat, 2021).

Public expenditure: Estimated trend in main headings

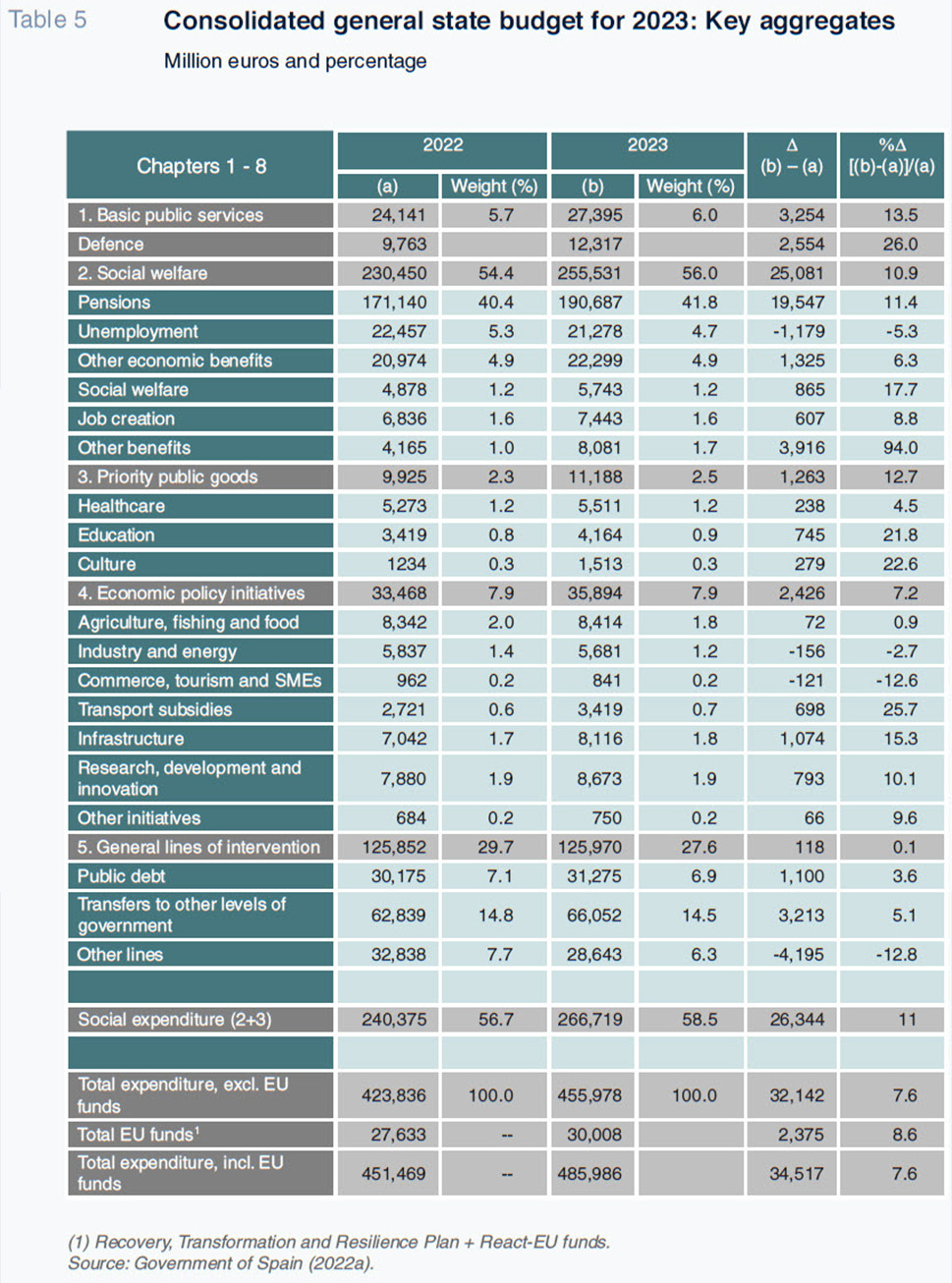

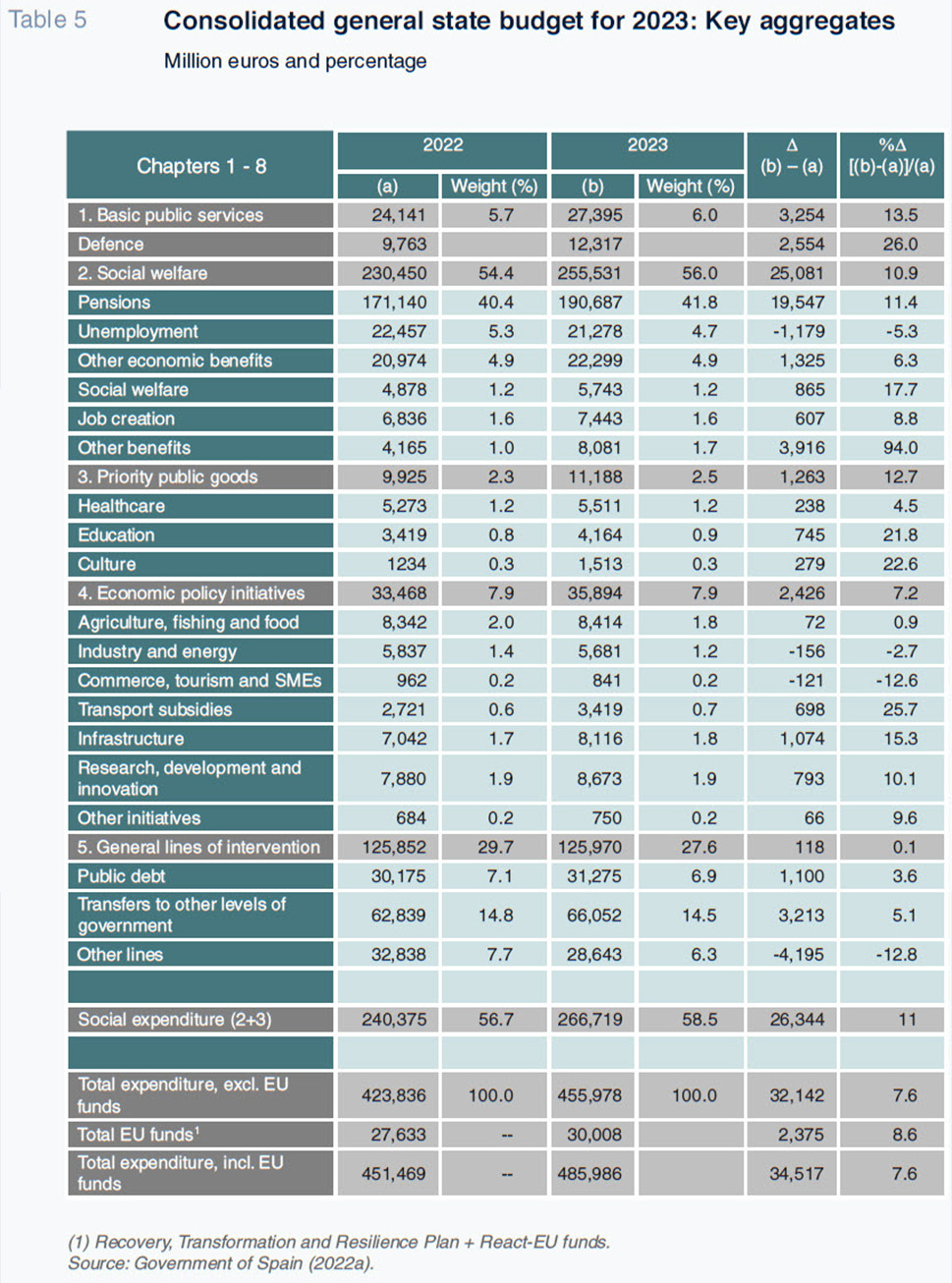

Table 5 summarises the budgeted spending figures at the state level (i.e., regional and local government spending is excluded). Public expenditure is expected to reach 455.98 billion euros in 2023, growth of 7.6% (or 32.14 billion euros) from 2022. The largest heading of this functional classification is social spending, which is expected to increase from 56.7% of the total in 2022 to 58.5% in 2023, with 74.2% of the increase attributable to pension spending. Indeed, public pensions are budgeted to absorb 41.8% of the total, followed by transfers to other levels of government (14.5%), debt servicing (6.9%), other economic benefits (4.9%) and unemployment benefits (4.7%).

Incoming European funds are budgeted at 30.01 billion euros, equivalent to 6.2% of total public expenditure. Those funds will be earmarked primarily to R&D and digitalisation activities (25.5%), industry and energy sector initiatives (19.7%) and infrastructure projects (15.5%). It is worth highlighting the funds earmarked to the 11 government-approved strategic projects for economic recovery and transformation, notable among which those devoted to the manufacture of chips, renewable energies, electric vehicles, the food sector, cutting-edge healthcare and industry decarbonisation. Despite the importance of the NGEU funds, the percentage actually invested (or in the process thereof) stands at just 21.6% of the forecast total, with some projects, such as the chips and circular economy plans, at very incipient phases (Funcas, 2022). Clearly there are bottlenecks in the management of the funds which are delaying their implementation excessively. Some 25.7% of the European funds will go to social spending.

Public pensions are budgeted at a record level of 190.69 billion euros in 2023, growth of 19.55 billion euros (11.4%) from 2022. We highlight two of the several factors accountable for that sharp growth. Firstly, as per the Toledo Pact recommendations, all public pensions are restated in line with the year-on-year change in the consumer price index, which on this occasion implies an increase of close to 8.5%. The cost per point of restatement is estimated at 1.8 billion euros (Bank of Spain, 2022b). As a result, the pension cost generated by inflation alone will be around 15.3 billion euros in 2023. Some organisations, including the Bank of Spain, maintain, we believe correctly, that the pension increases should have been more targeted, focusing on the lowest pensions, especially considering the fact that inflation looks set to remain high for some time, framed by an income pact involving the rest of the economic agents. A second reason for the growth is the rising number of pensioners (a baby boom effect, with 9.95 million pensioners today) and growth in the average pension (1,257 euros in the case of retirement pensions) (INSS, 2022). [11] Elsewhere, public pay is set to increase by 3.5%, or 4.9 billion euros, in 2023. The Bank of Spain (2022b) estimates an annual increase in public sector pay of 1.4 billion euros for every percentage-point increase. In short, the growth in structural spending as a result of pension and public pay hikes comes to roughly 25 billion euros (approximately 1.8% of GDP) in 2023.

Expenditure on unemployment benefits is expected to decrease by 4.7% to 21.28 billion euros in 2023. The 2023 Budget assumes that the number of beneficiaries of contributory unemployment benefits will decline by 95,000. It is modelled on an unemployment rate of 12.2%, which is below the 12.8% estimated by AIReF and the 12.9% forecast by the Bank of Spain. As a result, unemployment spending may be underestimated by 1.5 billion euros or more. Expenditure earmarked to fostering employment is budgeted 8.8% higher, at 7.44 billion euros. Of the total, 4.07 billion euros (54.6%) will go to incentives for hiring youths and long-term job seekers, while 3.24 billion euros (44.3%) will go to the provision of professional training. Within social spending, an additional 600 million euros has been earmarked to the area of dependent care, for a cumulative 3-year increase of 1.77 billion euros. ‘Other economic benefits’ includes the minimum income scheme, designed to prevent poverty and social exclusion. Its cost is expected to increase by 2.5% to 3.1 billion euros in 2023. That scheme benefits nearly 1.5 million people (523,486 households) of whom 42.5% are minors (MISSM, 2022). Nevertheless, the coverage provided under the scheme remains significantly below the 850,000 households the government initially estimated as potential beneficiaries.

Expenditure on debt servicing is forecast to increase by 6.9% to 31.28 billion euros in 2023 (2.2% of GDP). Debt is expected to increase in absolute terms from 1.51 trillion euros in 2022 to 1.56 trillion euros in 2023 but to decrease as a percentage of GDP from 115.2% to 112.4%. That increase in the volume of debt (around 52 billion euros), coupled with the need to refinance some of the outstanding stock of debt at higher interest rates in the wake of the shift in monetary policy, explain the higher debt service burden budgeted in 2023. The average life of Spain’s debt stands at 7.9 years and the average interest rate, at 1.63%, having increased by 0.084 points between January and September.

In the context of the war in Ukraine, defence spending is budgeted at 12.32 billion euros in 2023, up from 7.92 billion euros in 2022. That increase of 26% will bring Spain close to delivering the commitment made to NATO to increase defence spending to 2% of GDP. It will also have a direct impact on employment in the defence sector. Indeed, the 2023 Budget estimates that the 509 firms certified by the Ministry of Defence will create 167,000 direct jobs and a further 240,000 induced jobs. Finally, investment in infrastructure is budgeted 15.3% higher at 8.12 billion euros and will be boosted a further 4.52 billion euros by Recovery and Resilience Facility funds. The largest items of expenditure include the 5.41 billion euros earmarked to rail infrastructure (2.51 billion euros of which to high-speed rail), the 2.29 billion euros to roads, 1.11 billion euros to hydraulic infrastructure, the 1.07 billion euros to port infrastructure and the 263 million to coastal infrastructure and environmental initiatives.

Notes

For a comparative analysis of the measures implemented in Spain, refer to Sgaravatti (2022).

In fact, the 20-cent petrol subsidy is not included in the 2023 Budget.

The rollover of all of the measures to 2023 would cost approximately 18 billion euros, equivalent to 1.3 points of GDP (AIReF, 2022a).

A subsidy of 20 cents per litre, of which 15 cents is borne by the government (charged to the state budget) and the remaining 5 cents are borne by the service stations.

The Spanish government approved the creation of a Tax Reform Committee in April 2021 whose non-binding proposals were delivered one year later.

In Spain, new taxes cannot be created via budget acts.

Income tax brackets were adjusted on a discretionary basis in 2005 and 2006. That year, the brackets were deflated by 2% in the context of inflation of around 3%.

Other regions, like Castile-La Mancha, have opted to directly reduce the applicable regional income tax rates.

In that same vein, the reduced corporate income tax rates currently available for entrepreneurs and start-ups have a time limit of two years.

In other words, the levy’s mandatory and universal nature (the latter meaning it will be earmarked to the neediest without distinction). The government has used that formula of avoiding tax nomenclature in an attempt to avoid conflict with the regional governments’ legal regimes.

To ensure the sustainability of the pension system, an additional special-purpose contribution will be levied in 2023 to feed into the Social Security Reserve Fund.

References

AEAT. (2022).

Personal income tax payer statistics. Retrievable from:

https://sede.agenciatributaria.gob.es/Sede/datosabiertos/catalogo/hacienda/Estadistica_de_los_declarantes_del_IRPF.shtmlAIReF. (2020). Tax benefits study. Retrievable from:

https://www.airef.es/wp-content/uploads/2020/10/Docus_Varios_SR/Estudio_Beneficios_Fiscales_Spending_Review.pdfAIReF. (2022a). Report on the projects and fundamental lines of the budgets of public administrations: General State Budgets 2023 Report 49/22. Retrievable from:

https://www.airef.es/wp-content/uploads/2022/10/CONGRESO/Informe-sobre-los-Presupuestos-Generales-del-Estado-2023_web.pdfAIReF. (2022b). Report on the projects and fundamental lines of the budgets of public administrations for 2023: Autonomous Regions and Local Governments. Report 52/22. Retrievable from:

https://www.airef.es/wp-content/uploads/2022/10/LINEAS_FUNDAMENTALES/Informe-Plan-Presupuestario-2023_web-20221028.pdfBANK OF SPAIN. (2022a). Spanish economic projections report. Retrievable from:

https://www.bde.es/bde/es/secciones/informes/analisis-economico-e-investigacion/proyecciones-macro/relacionados/boletin-economico/informes-de-proyecciones-de-la-economia-espanola/BANK OF SPAIN. (2022b). Bank of Spain Governor’s testimony before the Parliamentary Budget Committee in relation to the Draft State Budget for 2023. Congress of Deputies. Retrievable from:

https://www.bde.es/f/webbde/GAP/Secciones/SalaPrensa/IntervencionesPublicas/Gobernador/Arc/Fic/IIPP-2022-10-17-hdc.pdfBBVA RESEARCH. (2022).

Spain Economic Outlook. October 2022. Retrievable from:

https://www.bbvaresearch.com/publicaciones/situacion-espana-octubre-2022/BUNN, D. (2022).

Inflation and Europe’s personal income taxes. Tax Foundation. Retrievable from:

https://taxfoundation.org/income-tax-inflation-adjustments-europe/COMMITTEE OF EXPERTS COMMISSIONED TO FORMULATE THE WHITE PAPER ON TAX REFORM. (2022). White Paper on Tax Reform. Retrievable from:

https://www.ief.es/docs/investigacion/comiteexpertos/LibroBlancoReformaTributaria_2022.pdfEUROSTAT. (2021).

Taxation trends in the European Union. Retrievable from:

file:///C:/Users/Alvaro/OneDrive%20-%20Universidad%20Rey%

20Juan%20Carlos/_A_ESCUELA%20DE%20DOCTORADO/Jornadas%20supervision%20Junio%

202020/taxation%20trends%20in%20the%20european%20union-KPDU21001ENN.pdfFUNCAS. (2022). Economic forecasts for Spain, 2022-2023. Retrievable from:

https://www.funcas.es/textointegro/previsiones-economicas-para-espana-2022-2023-1022/GOVERNMENT OF SPAIN. (2022a).

Presentación del Proyecto de Presupuestos Generales del Estado 2023 (Libro Amarillo) [Presentation of the Draft National Budget for 2021 (Yellow Book)]. Retrievable from:

https://www.sepg.pap.hacienda.gob.es/sitios/sepg/es-ES/Presupuestos/PGE/ProyectoPGE2023/Documents/LIBROAMARILLO2023.pdfGOVERNMENT OF SPAIN. (2022b). Draft Budgetary Plan for 2023. Retrievable from:

https://www.hacienda.gob.es/CDI/EstrategiaPoliticaFiscal/2023/Plan-Presupuestario-2023-ES.pdfGOVERNMENT OF SPAIN. (2022c). Draft State Budget for 2023. Legal wording – Red Series. Retrievable from:

https://www.sepg.pap.hacienda.gob.es/Presup/PGE2023Proyecto/MaestroDocumentos/PGE-ROM/N_23_A_R.htmIMF. (2022).

World Economic Outlook. Countering the cost of living crisis. October. Retrievable from:

https://www.imf.org/en/Publications/WEO/Issues/2022/10/11/world-economic-outlook-october-2022#:~:text=The%20IMF%20forecasts%20global%20growth,acute%20phase%20of%20the%20pandemicINE. (2022).

Structural Business Statistics: Industrial Sector. Retrievable from:

https://www.ine.es/dynt3/inebase/es/index.htm?padre=6600&capsel=6601MINISTRY OF INCLUSION, SOCIAL SECURITY AND MIGRATION. (2022). Minimum income scheme beneficiaries. Retrievable from:

https://www.inclusion.gob.es/web/guest/w/mas-de-523.000-hogares-han-recibido-el-ingreso-minimo-vital%C2%A0#:~:text=El%20Ingreso%20M%C3%ADnimo%20Vital%20ha,Social%20hasta%

20finales%20de%20octubreNATIONAL SOCIAL SECURITY INSTITUTION. (2022). Contributory pensions in force as of October 1st, 2022. Retrievable from:

https://www.seg-social.es/wps/wcm/connect/wss/a2dd3686-d4f4-48f3-b029-5b70a667fd11/S202210.pdf?MOD=AJPERES&CONVERT_TO=linktext&CACHEID

=ROOTWORKSPACE.Z18_2G50H38209D640QTQ57OVB2000-a2dd3686-d4f4-48f3-b029-5b70a667fd11-ogH7WXZSGARAVATTI, G.. TAGLIAPIETRA, S. and ZACHMANN, G. (2022).

National fiscal policy responses to the energy crisis. Bruegel. Retrievable from:

https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-pricesTSURUTA, D. (2020). SME policies as a barrier to growth of SMEs.

Small Business Economics, 54, 1067-1106.

Desiderio Romero-Jordán. Professor of Applied Economics, Rey Juan Carlos University