An analysis of non-performing loans: Spain in the European context

Despite the intensity of the two crises sustained by the Spanish economy in the last three years (the COVID-19 crisis and the energy crisis exacerbated by the war in Ukraine), measures rolled out to mitigate the impact of those events have helped to avert an overall increase in Spanish banks’ non-performing loan ratios, albeit differences across industry sectors are noteworthy. However, given the challenging economic backdrop for 2023, non-performance will likely hit an inflexion point in the coming months, requiring the maintenance of adequate provisioning.

Abstract: Despite the intensity of the two crises sustained by the Spanish economy in the last three years (the COVID-19 crisis and the energy crisis exacerbated by the Ukraine-Russia war), the Spanish banks’ non-performing loan (NPL) ratio has not increased, in part thanks to the measures rolled out to mitigate the impact of those events (furlough and credit relief schemes, etc.). However, in the corporate segment, a detailed analysis by sector reveals considerable differences in absolute NPL ratios and in the trend in recent years. Although a majority of sectors has reported a decrease in their NPL ratios, in those more vulnerable to the impact of the pandemic, that ratio has increased, for example, in hospitality (whose NPL ratio has increased by 4 pp to 9.26%) and activities related with leisure and entertainment (up 7.6 pp to 14.75%). By comparison with the EU, the arts, recreation and entertainment sector stands out sharply, with an NPL ratio in Spain twice the European average. Given the downward revision of GDP growth forecasts for 2023, with high inflation leading to rate hikes and the attendant tightening of financing conditions, non-performance will in all likelihood hit an inflexion point in the coming months. Against that backdrop, the banks would be well advised not to relax their provisioning policies, in line with guidance from supervisory authorities.

Introduction

There have been two economic crises affecting Spain in a little over two years: the crisis that erupted at the start of the pandemic in March 2020 and the crisis that emerged towards the end of 2021 when commodity prices started to rise, which has intensified sharply since the onset of the war between Ukraine and Russia. As a result of the first crisis, Spain’s GDP contracted by 11.3% in 2020. With the second crisis still upon us, a host of institutions (OECD, Bank of Spain, IMF, European Commission, etc.) are making deep cuts to their growth forecasts for 2023, framed by prevailing uncertainty in a context of high inflation which is forcing rate increases and in turn sending borrowing costs higher.

Despite that complicated macroeconomic context, there have been no signs of a spike in loan non-performance. In fact, the banks’ NPL ratios are currently below pre-pandemic levels. That anomalous outcome is the result of the host of measures rolled out to mitigate the impact of the crisis, including the furlough scheme, credit relief schemes, public guarantee schemes (preventing the destruction of jobs) and regulatory “breaks” (such as in accounting requirements for asset risk classification).

Nevertheless, although the overall non-performance ratio continues to come down, that aggregate figure masks considerable differences by sector, which is only logical considering the fact that the COVID-19 crisis had a much bigger impact on certain sectors of the economy, namely those more affected by the ensuing mobility restrictions (restaurants, accommodation, retail, leisure, etc.).

In addition to differences in the direction taken by the ratio, there are also significant differences in absolute levels depending on the purpose of the loan and within the corporate lending segment, also between sectors.

The purpose of this paper is to analyse recent dynamics in bank loan performance, drilling down into as much detail as possible in terms of loan purpose and business sector. The main goal is to analyse the differential impact of the last two crises by sector and to compare the situation at the Spanish banks with that in Europe. To do so, we compare the situation as of the third quarter of 2019 – the first period for which the European Bank Authority (EBA) provides the data broken down by line of business – with that of the second quarter of 2022 – the most recent data available. We look firstly at the data for the consolidated groups (which include the business generated by the Spanish banks’ overseas subsidiaries), in order to compare the situation in the Spanish and EU banking sectors, and then provide additional insight into the domestic business in Spain.

Recent trend in non-performance

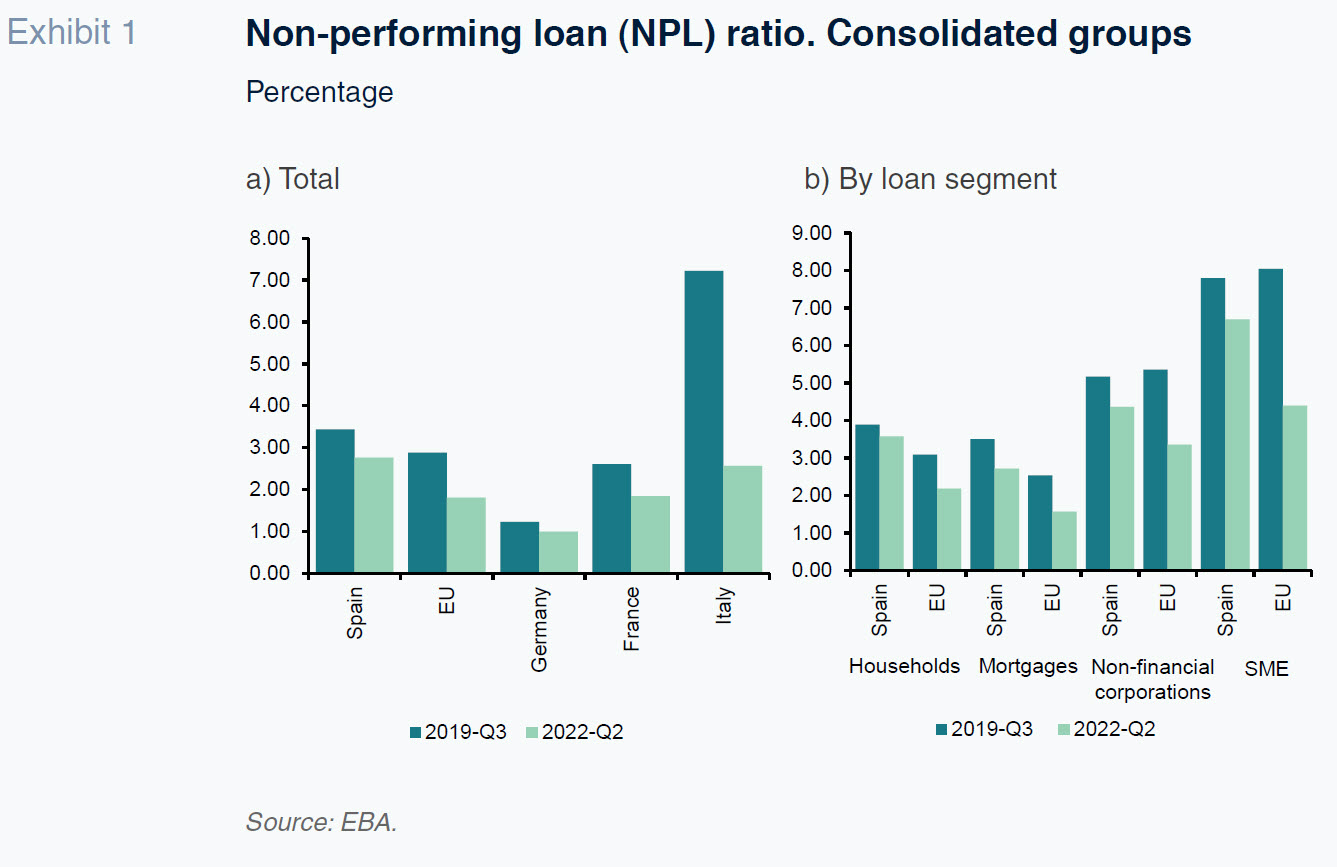

Before the onset of the pandemic, the Spanish banks’ NPL ratio (at the consolidated group level) was 3.44%, which was 0.56 pp above the average for European banks of 2.88%. Compared to the main European banking sectors, non-performance was higher in Spain than in Germany (1.23%) and France (2.6%), but well below that of Italy (7.22%).

As of June 2022 (most recent figure available), the NPL ratio in Spain had fallen to 2.76%, a trend similarly observable across the rest of the European banks within the EU´s main economies. However, the gap with the EU had widened from 0.56 pp as of the end of 2019 to 0.95 pp by June 2022. The drop in the NPL ratio in Italy is remarkable: in just two-and-a-half years, that system’s NPL ratio has gone from 7.22% to 2.57%, below that of the Spanish banks. Therefore, as of the second quarter of 2022, the Spanish banks’ NPL ratio was higher than that observed in the main EU banking systems.

Non-performance is higher in corporate lending (4.36%) than in the household lending segment (3.57%). [1] Within the former, it is substantially higher in the SME segment (6.7%) and in the latter, lower in the mortgage segment (2.71%). The biggest gap with respect to the EU is in the SME lending segment, where Spain’s NPL ratio is 2.3 pp above the European average. In both business and household loans, non-performance is higher in Spain.

Turning to the impact of the two crises sustained since early 2020, in no instance has non-performance increased. Indeed, it has come down in all loan categories in Spain, as well as the in EU.

Non-performance by business sector

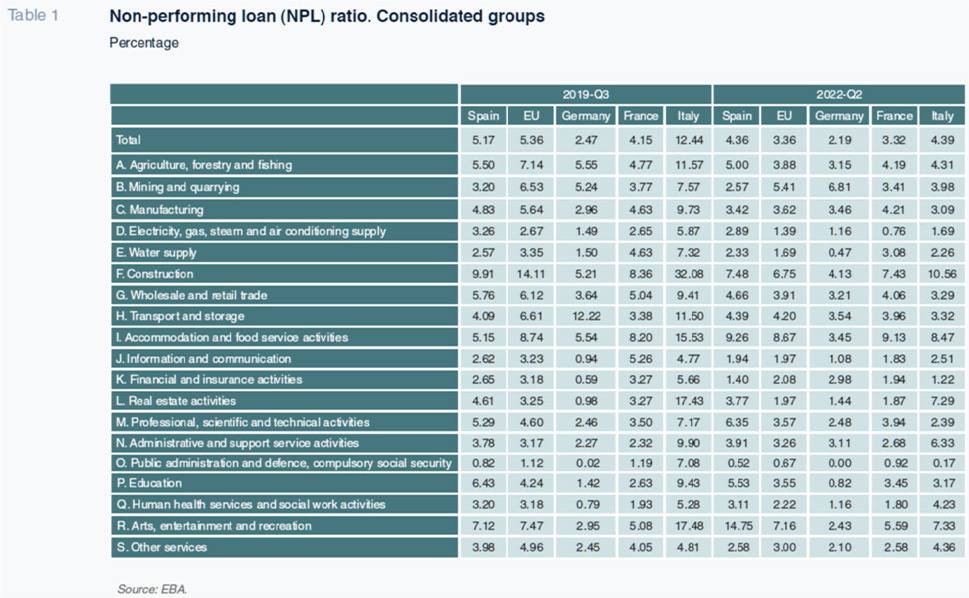

Within the business lending segment, the EBA provides information broken down into 19 lines of business, so enriching the performance analysis. Table 1 shows that despite having dipped across the majority of sectors in Spain, in some areas of the economy non-performance has risen, and sharply, between 2019 to 2022. For example, in arts, recreation and entertainment activities, where non-performance has doubled from 7.12% to 14.75%. The magnitude of that increase makes it by far the sector with the highest incidence of non-performance at present. Moreover, that increase contrasts with the trend observed in Europe, where the ratio has actually come down. It is also worth highlighting the 4.11 pp increase in non-performance on loans to the accommodation and food services (or hospitality) sector, from 5.15% to 9.26%. Of the 19 lines of business tracked, accommodation and food services currently represent the second-highest non-performing loan ratio. Once again, the increase in non-performance in Spain contrasts with the broader EU trend. Both the leisure and hospitality activities were hit hard by the mobility restrictions induced by the pandemic, leaving them highly vulnerable.

Another noteworthy takeaway from Table 1 is the breadth in the range of non-performance across the sectors in Spain, from a high of 14.75% in arts, recreation and entertainment to a low of 0.52% on loans to public administrations. Besides the activities related with leisure and hospitality, non-performance is also high in construction (7.48%), although that is a legacy issue carried over from the past which is gradually being addressed.

By comparison with the EU, the arts, recreation and entertainment sector stands out sharply, with that sector’s NPL ratio in Spain double the European average (14.75% vs. 7.16%), and significantly higher than that of the main European banking sectors.

Non-performance by loan segment

The most recent data – as of June 2022 – put the volume of the Spanish banks’ non-performing loans at 78.87 billion euros, which is 21% of the EU total. Of that amount, 55% is concentrated in loans to households, with the remainder in loans to corporations. Within the household lending segment, mortgage non-performance accounts for 29% of the total for the Spanish banks and within the business loan segment, SME loans account for 44% of total non-performance. By comparison with the EU, household loans account for a much larger share of non-performing loans (16 pp more, of which 11 pp are in the mortgage segment), which makes sense considering the relatively higher weight of mortgage lending in the Spanish banking system.

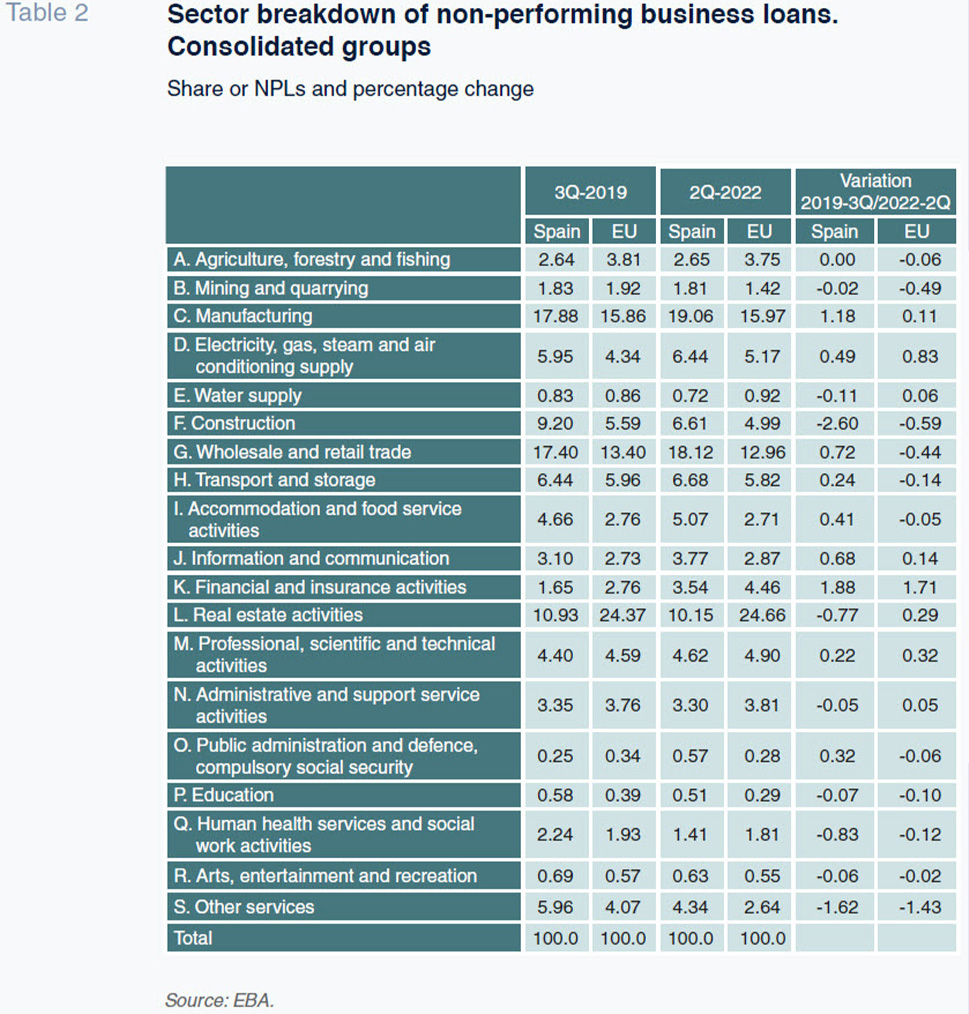

Turning our attention to the business lending segment in order to analyse the different impact of the crisis from one sector to the next, the sector breakdown of non-performing loans by the 19 sectors tracked reveals that between 2019 and 2022 the weight of non-performing loans has increased in the financial and insurance sector (from 1.65% to 3.54%, a percentage increase in line with the EU average), the manufacturing sector (from 17.88% to 19.08%) and in information and communication (from 3.1% to 3.77%). In contrast, those shares have fallen in construction (from 9.20% to 6.61%) and other services (from 5.96% to 4.34%).

If we take the current sector breakdown of non-performing loans in Spain and compare it with that of the EU, what jumps out is the real estate sector’s much smaller share of non-performance in Spain, at 10.15%, compared to 24.66% in Europe. On the other hand, in Spain the retail (18.12% vs. 12.96%), manufacturing (19.06% vs. 15.97%) and accommodation and food services (5.07 vs. 2.71%) sectors are more significant contributors to loan non-performance. Between them, the manufacturing industry, retail trade and real estate activities account for almost half of non-performing loans in Spain.

Non-performance in the Spanish domestic banking business

Within the Spanish business, non-performance in loans to other resident sectors stood at 3.86% as of August 2022 (47.24 billion euros), down 1pp from before the onset of the pandemic. In the business lending segment (as of June), that ratio was 4.55%, compared to 3.33% in household loans (2.71% in mortgages and 4.59% in consumer lending). In all instances, the current levels are below those observed before the start of the pandemic, so that the impact of the crisis has yet to be felt in terms of loan performance. Likewise, the volume of loans classified as stage-2 impaired continues to come down, to 7% of the total (albeit higher than before the pandemic in percentage terms).

By productive area, [2] non-performance in the domestic banking business has come down across the board other than in hospitality, where the non-performing loan ratio has increased by 2.9 pp, from 5.44% in March 2020 to 8.41% in June 2022. Non-performance has also increased, albeit marginally, in the transport, transport material manufacturing and mining and quarrying industries. In contrast, non-performance has come down sharply in construction (by 3.1 pp, from 11.44% to 8.39%), the manufacture of non-metallic minerals (6.7 pp, from 12.25% to 5.56%) and metallurgy (2.23 pp, from 8.53% to 6.24%).

As of June 2022, non-performance in the Spanish banking business was highest (i.e., above 6%) in the hospitality (8.41%), construction (8.39%), metallurgy (6.24%) and mining (6.20%) industries. In contrast, it was lowest (below 3%) in the oil (0.03%), finance (0.32%), chemicals (2.24%) and transport materials (2.29%) sectors.

Non-performance in public guarantee schemes

One area of concern is the increase in non-performance in the loans extended, in the case of Spain, by the country’s official credit institute, the ICO, in order to mitigate the impact of COVID-19 on corporate borrowers. The volume of those loans peaked at 109 billion euros, with 99 billion euros outstanding as of June 2022. Those loans have been vital to propping up the most vulnerable sectors.

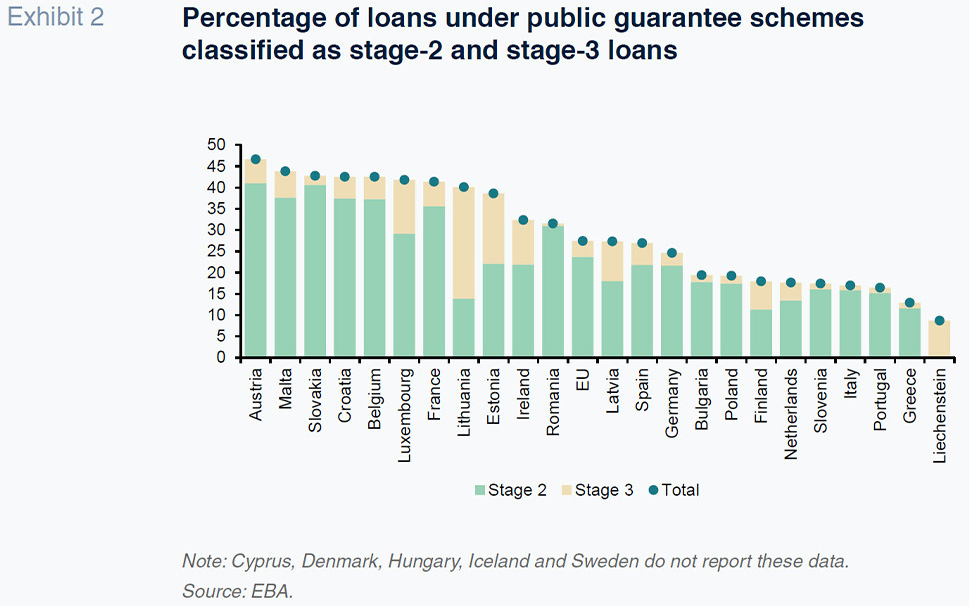

The EBA also provides information on the quality of loans with public guarantees, enabling an analysis of the trend in those loans’ creditworthiness over time and insight into the situation at present. As of June 2022, the sum of loans classified as stage-2 and stage-3 impaired accounts for 26.9% of all loans provided under public guarantee schemes. That percentage has been edging higher over time, specifically by 7.3pp in the last 12 months. Of that percentage (26.9%), non-performing (stage 3) loans account for 5.13pp, with the remaining 21.79pp represented by loans classified as stage-2 impaired. The NPL ratio has increased by 3.1pp since July 2021 and the incidence of stage-2 loans has increased by 4.2pp, signalling the deteriorating quality of the loans backed by the ICO.

By comparison with the rest of the EU, the weight of loans under public guarantee schemes classified as either stage-2 or stage-3 is slightly lower in Spain than the European average (27.44%). However, the incidence of stage-3 loans is 1.38pp higher in Spain (5.13% vs. 3.75%). Compared to the main eurozone economies, non-performance on loans extended under public guarantee schemes is higher in Spain than in Germany (2.94%) and Italy (1.14%) but lower than in France (5.74%).

Conclusions

Despite the intensity of the COVID-19 crisis, the incidence of non-performance continues to come down in Spain and across the European banking systems, in part thanks to the measures rolled out to mitigate the impact of the crisis, staving off job destruction. However, in the sectors more exposed to the mobility restrictions, particularly activities related to leisure and hospitality, non-performance has increased. It is also good news that the percentage of stage-2 loans has come down in Spain (albeit still above pre-pandemic levels) and is below the European average.

Despite those encouraging figures, non-performance remains higher in the Spanish banking system than in its European counterparts, warranting ongoing efforts to reduce it further. Moreover, in light of the uncertainty clouding the macroeconomic outlook (with GDP growth forecasts for 2023 being cut against the backdrop of high inflation), the banks need to remain alert on the provisioning front as non-performance is bound to increase in the months to come. There are energy-intensive sectors whose future looks very complicated in the current climate of high energy prices, which is bound to affect creditworthiness in those sectors. Meanwhile, tighter financing conditions will impact both business lending (the SME segment being more vulnerable, starting from higher levels of non-performance) and household lending (rate increases), which will affect their ability to service their debts and ultimately impact non-performing loan ratios. Supervisors, such as the Bank of Spain (2022) and the EBA (2022 a,b), have recently reached similar cautionary conclusions.

Notes

The non-performance ratios provided by the EBA relate to loans carried at amortised cost.

The breakdown by business activity provided by the Bank of Spain for the domestic banking business is less detailed than that provided by the EBA for the consolidated groups.

References

BANK OF SPAIN. (2022a). The situation of Spanish banks in the new macro-financial environment, V Foro Banca/elEconomista, Pablo Hernández de Cos, Governor, October 4th, 2022.

BANK OF SPAIN. (2022b). Financial Stability Report, November, 2022.

EBA (2022). Risk Dashboard. Data as of Q2 2022.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF