Cost of equity for Spanish and European banks

The banks’ earnings recovery in 2021, and the prospect of rate normalisation in the relatively near future, drove significant growth in the Spanish and European banks’ share prices up until the outbreak of the crisis between Russia and Ukraine injected fresh market volatility. Nevertheless, the perception remains that the banks’ return on equity (ROE) does not sufficiently cover the estimated cost the market attributes to that capital (COE); however, if recent favourable ROE performance is sustainable over time, there could be significant room for upside in bank stock valuations.

Abstract: The banking sector was one of the hardest hit during the worst months of the pandemic, with losses at one point reaching as high as 50%. The corollary has been a more intense recovery of European and Spanish bank stocks, until the rally was truncated by the escalation of geopolitical tensions between Russia and Ukraine. That intense post-pandemic rally is largely attributable to: i) the improvement in sector earnings in 2021, in particular in the case of the Spanish banks, which recognized more provisions in 2020 and have benefitted in 2021 from non-recurring gains; and, ii) a shift in the outlook for European benchmark rates, specifically an end to negative rates that have remained intact over the last five years, especially EURIBOR, of greatest relevance to the retail banking business. Despite that recovery, the banking sector continues to trade at a price-to-book ratio of less than one, highlighting the gap between the cost of equity (a parameter which is not directly observable and thus has to be estimated) demanded by investors and the returns generated by the sector. That said, if the ROE generated by the sector in 2021 proves sustainable in time, there could be scope for upside in bank valuation. Nevertheless, recent developments on the geopolitical front have raised concerns over the banks’ stock market rally, as they have complicated central banks´ task of controlling inflation without dampening recovery prospects. This scenario is raising uncertainty over the ultimate pace of monetary policy normalization, an expectation that has largely driven the revaluation in bank stocks observed in recent months.

Recovery in the European banks’ market value

The geopolitical crisis and conflict unleashed between Russia and Ukraine in recent weeks has fuelled market uncertainty and volatility and translated into sharp stock market corrections in every sector, corrections that have hit the banks particularly hard on account of their pro-cyclical nature.

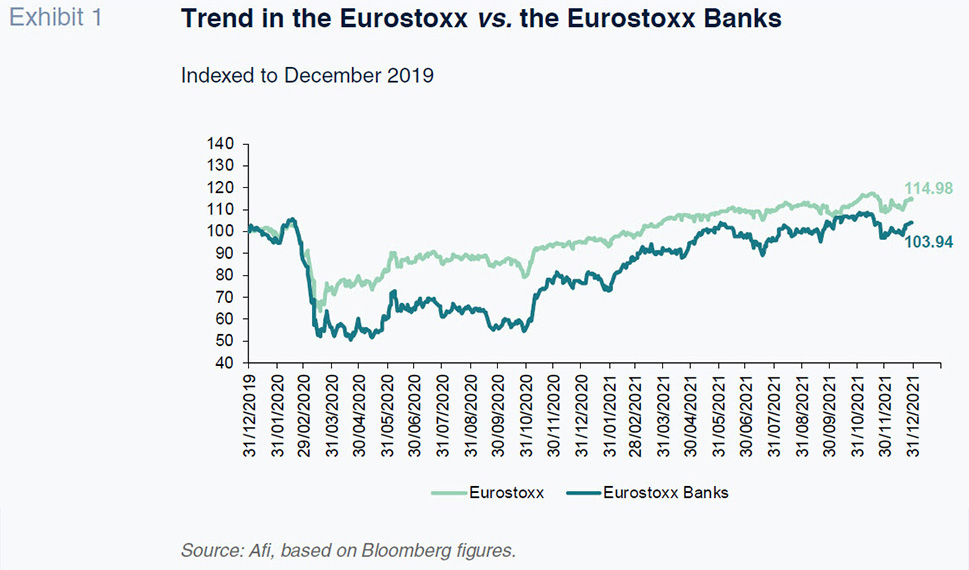

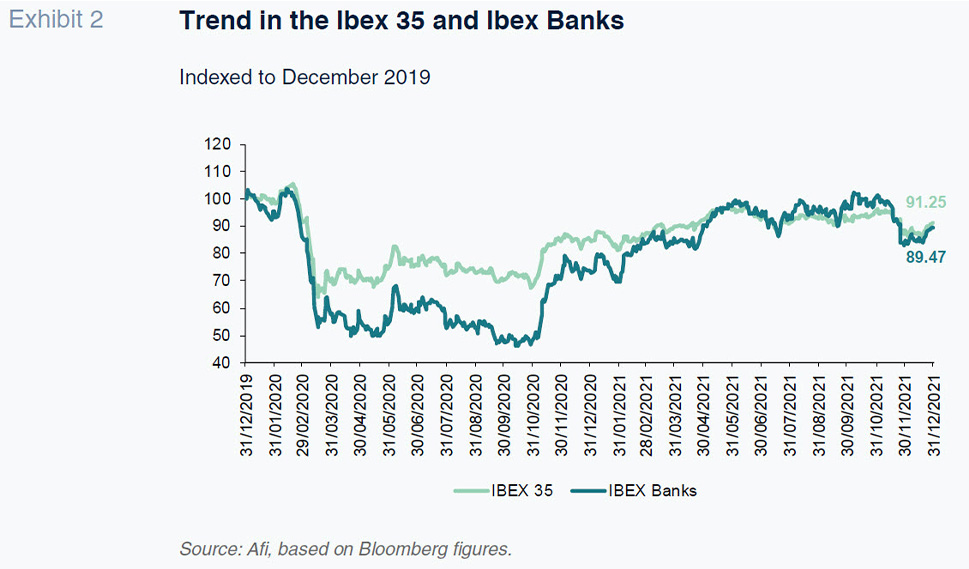

Those developments mark a drastic turnaround in the trend in the banks’ stock market valuations, having rallied strongly for the last 18 months following the intense correction suffered during the initial months of the pandemic, when restrictions were at their harshest. At the height of the pandemic, the European and Spanish banking sectors were the hardest hit, with 50% of their value wiped out at one point, which is nearly twice the loss sustained by the market as a whole. However, the recovery staged since then has also been far more intense in banking compared to other sectors. The Spanish banks’ market value was almost back at pre-pandemic levels before geopolitical tensions spiralled out of control in the last couple of weeks.

Such sharp movements in market value in both directions clearly evidence the pro-cyclical or higher-risk nature of the banking sector, whose ‘beta’ coefficient is well above 1.

Factors underpinning the rally

Drilling down deeper into the factors possibly underpinning the rally in bank stocks following the worst months of the pandemic, it is worth highlighting two points: one related with the sector’s performance during the past year; and the other triggered by a more upbeat outlook for the retail banking business.

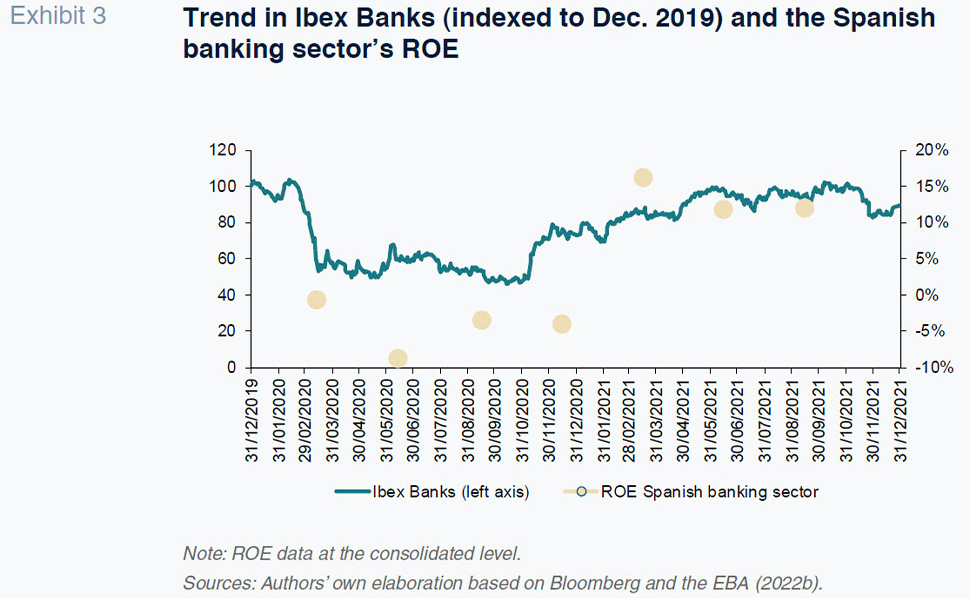

The first relates to the banks’ healthy earnings performance in 2021, having frontloaded their non-performance provisions in 2020. The earnings momentum in 2021 could continue over the coming years given that provisioning remains high relative to pre-pandemic levels, leaving the banks with margin to absorb potential increases in non-performance with a charge against those provisions.

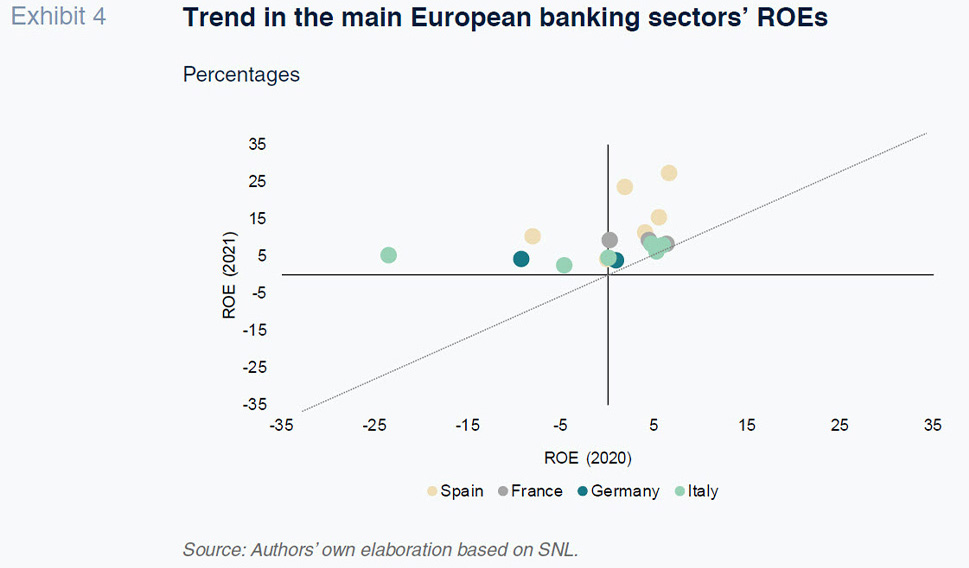

The improvement in banks´ earnings was observed across the European sector but was particularly robust in Spain, as shown in Exhibit 4. The exhibit shows the significant jump in profitability over the past two years for a broad sample of European and Spanish banks, with all of them situated above the diagonal line. The year-on-year growth in ROE in 2021 is particularly noteworthy in the case of the Spanish banks, which recognised significantly more provisions in 2020 and also benefitted from non-recurring gains in 2021, further shoring up their reported earnings.

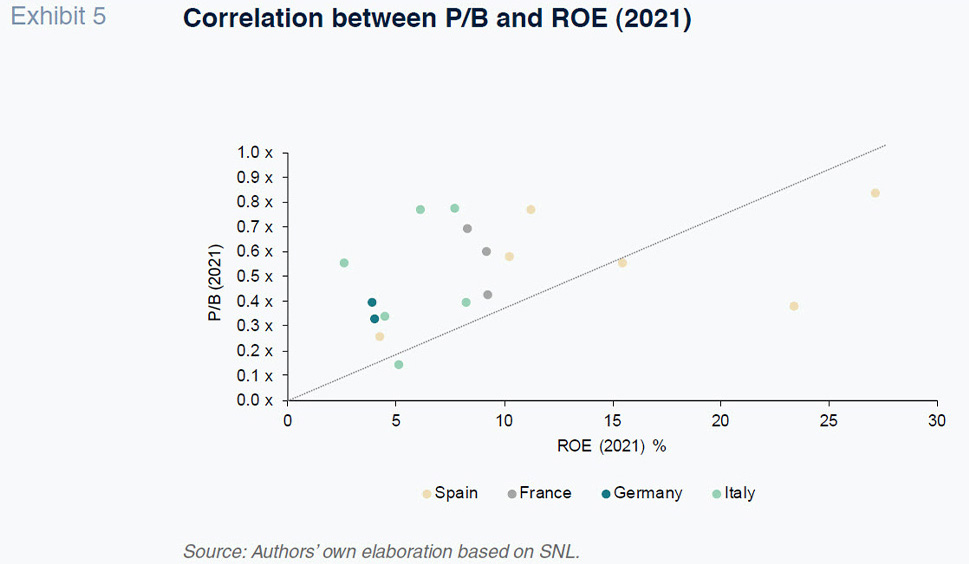

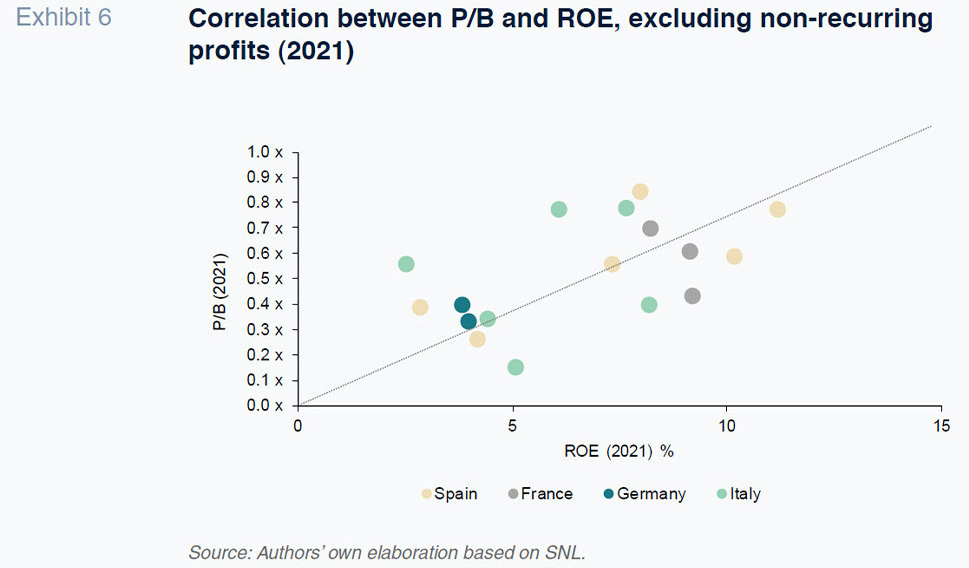

Within the overall upward trend in sector profitability, the individual banks’ returns remain remarkably uneven, a factor which the market undoubtedly takes into consideration when ascribing value. That is evident in Exhibits 5 and 6, which show the correlation between the relative value of each bank (measured using their price-to-book ratios) and their return on equity metrics (ROE).

As shown, there is a clear-cut positive correlation between the two variables, indicating that the market assigns more value to the banks that generate –and that it expects will generate– higher returns on their capital. That positive correlation is clearer still and increases in explanatory power if, as shown in Exhibit 6, we strip out the non-recurring gains recognised by certain banks (particularly those immersed in mergers and other M&A activity) in 2021 as those items had a significant impact on their reported earnings, so distorting a more recurring vision of their ROE.

In addition to pricing in the banks’ earnings momentum last year, the market has discounted another important possible development: normalisation of interest rates, after more than five years in negative territory, which would have a positive impact on banks´ margins and, by extension, sector profitability.

The outlook for an increase in rates relevant to the banking business, implicit in the yield curves, started to play a significant role in the final months of 2021, when the Federal Reserve began to clearly signal its intention of raising rates in relative quick succession in 2022 – in fact the Federal Reserve has already made the first rise in March. Meanwhile, the European Central Bank (ECB), despite initially appearing more reluctant to raise its benchmark rates, started to send similar signals in the early weeks of this year, albeit stressing that the intensity and nature of the spike in inflation in Europe is very different than in the US and, as a result, less of an argument for rate hikes, foreshadowing later and less intense rate increases on this side of the Atlantic.

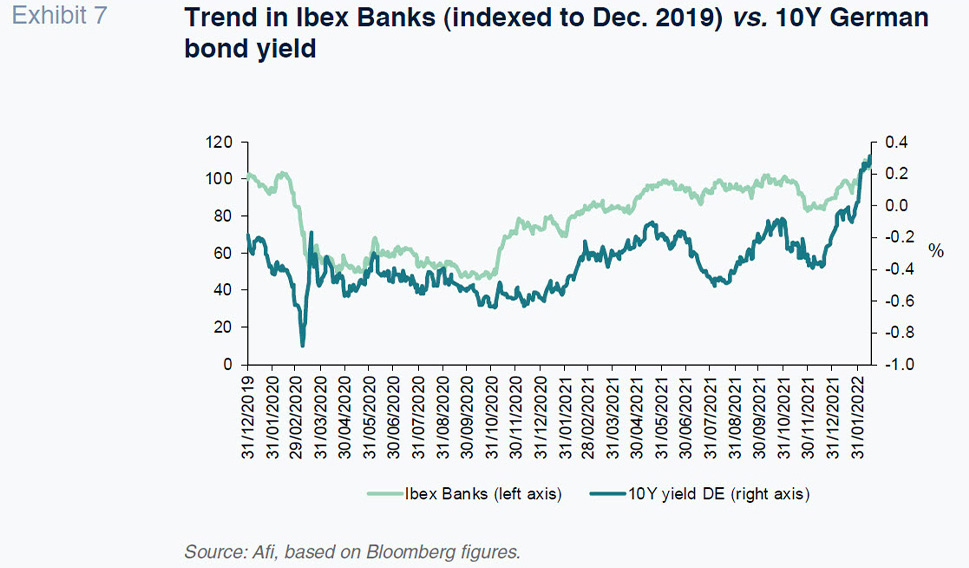

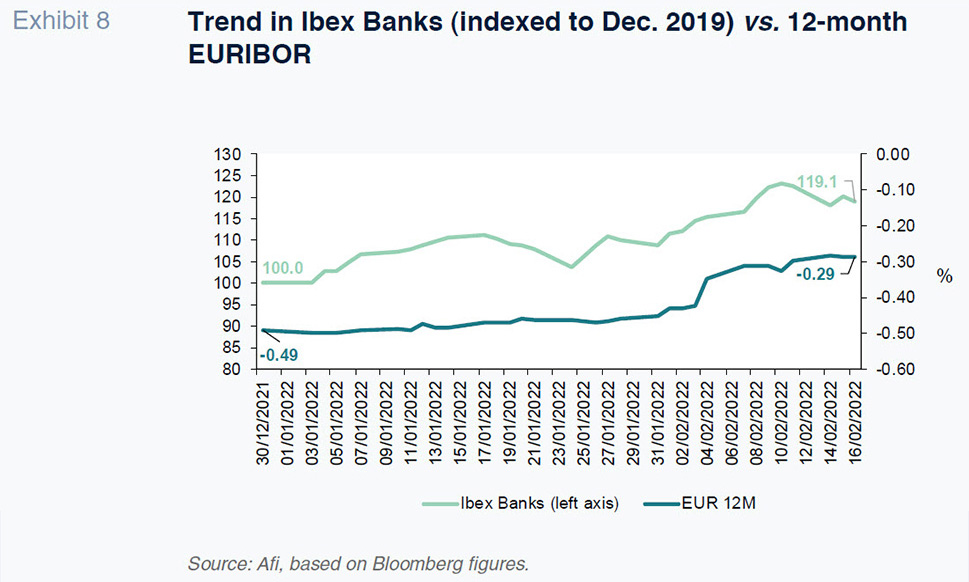

Regardless, that shift in expectations regarding the outlook for rates provided the banks’ market valuations with an additional boost. As shown in Exhibit 7, long-term risk-free rates (represented in the case of Europe by the yield on German bonds) have historically been closely positively correlated with the banks’ market values. An analysis of more recent trends (Exhibit 8) highlights how the prospect of sooner and faster rate hikes in the eurozone and the impact of that expectation on short-term interest rates until mid-February intensified the correlation between sector valuation and 12-month EURIBOR, insofar as the latter movement should prove highly beneficial for the European banks, particularly those whose assets are more sensitive to rate changes.

Estimated cost of equity in European banking

Notwithstanding the significant rally sustained by the European banks over the past year and a half, most of the entities continue to trade below their book values, suggesting that a significant number of the banks are not generating the returns required by investors (cost of equity). The European supervisor has been noting for several years its concern about the sector’s low profitability and, above all, its low market valuation, which impedes the issuance of shares in order to shore up capital.

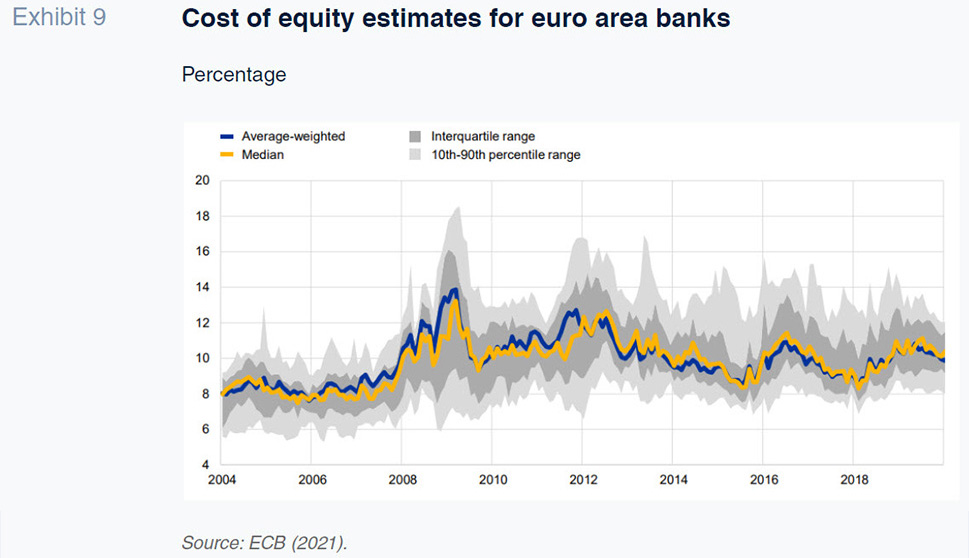

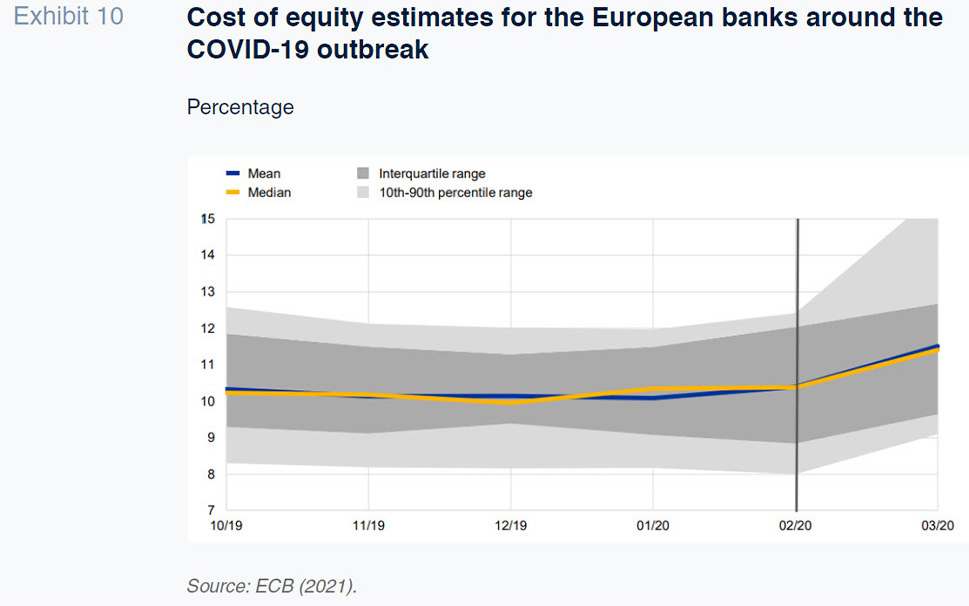

Given that the cost of equity is not a directly observable variable, it is necessary to rely on estimates such as those published on a recurring basis by the ECB. As shown in Exhibit 9, at the end of 2019, the banks’ cost of equity estimates vary significantly, ranging between 8% in the 10th percentile and 12% in the 90th. Those estimates also highlight the distress generated by the pandemic as regards the banks’ cost of equity. That upward movement began in February when the financial markets sustained heavy losses in the wake of the COVID-19 outbreak and continued throughout the months of harshest restrictions and greatest uncertainty (Exhibit 10).

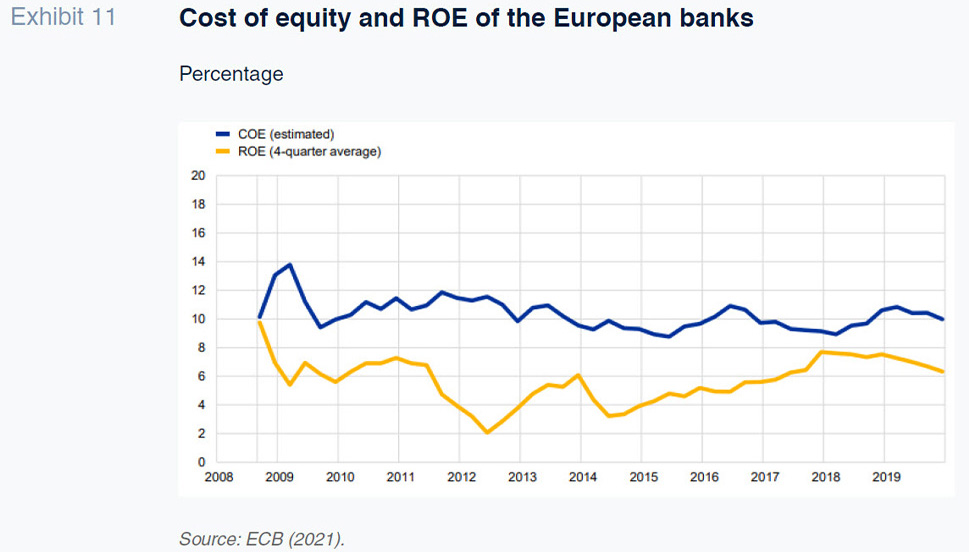

Using those estimates, the gap between the COE estimates and ROEs of the European banks in recent years (Exhibit 11) highlights how the return demanded by their shareholders (cost of equity) has trended systematically and substantially above the return generated by the sector, justifying the contraction in the European entities’ price-to-book ratios, which are widely trading under 1x, since the financial crisis.

The European regulator, the European Banking Authority (EBA), recently published its estimate of the sector’s cost of equity and return on capital based on its estimates and/or the self-assessments of a broad sample of banks.

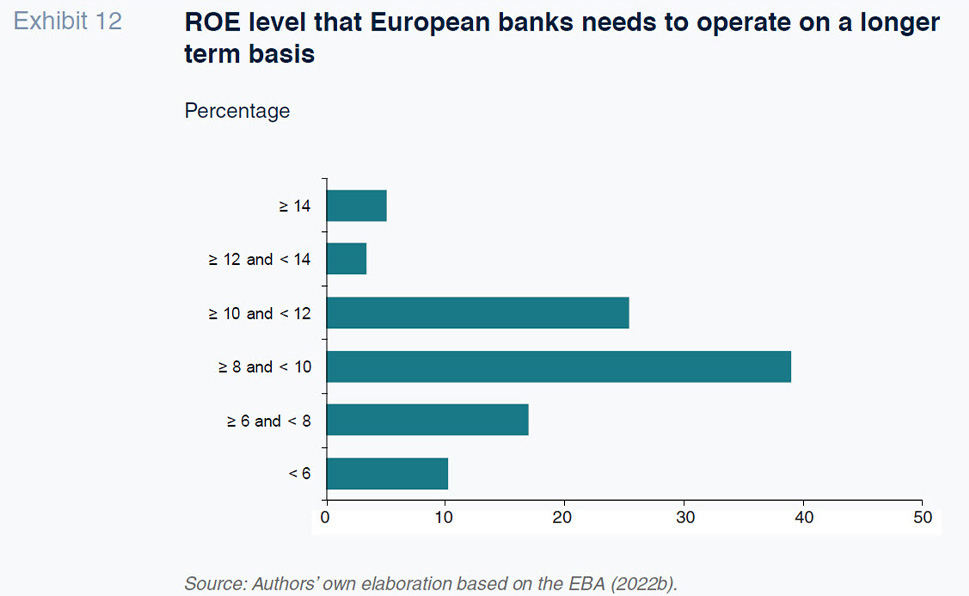

According to the EBA’s most recent Risk Assessment Questionnaire, which dates to October 2021, a significant ~40% of the sample estimate their sustainable long-term ROE at around 8-10%, while approximately 25% believe returns will be a little higher, at 10-12%.

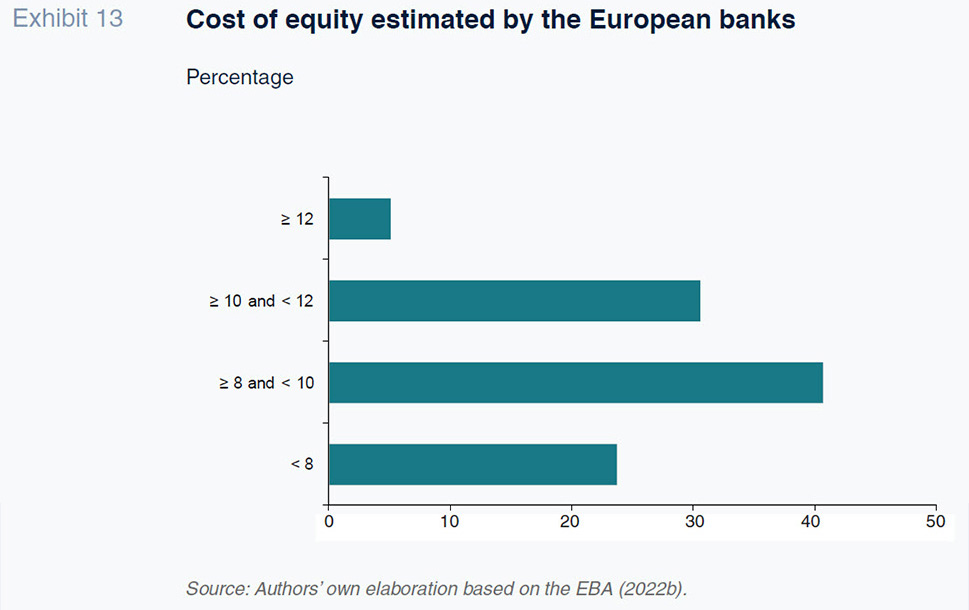

In parallel, a significant share (again ~40%) of those same entities put their estimated COE at levels of between 8 and 10%.

To complement the estimates published by the ECB and EBA, it is worth taking a look at the cost of equity implicit in how the market is valuing the banks in terms of price-to-book, ratios that remain under 1x despite the sector rally sustained throughout the months of brightening economic outlook.

Assuming that the ROE generated by the European banks in 2021 (without considering non-recurring gains) is sustainable at cruising speed, that level of profitability coupled with current valuations in terms of price-to-book imply a cost of equity for the European banks as a whole of around 13-14%, albeit, as found by the ECB, with significant differences from one bank to the next. That estimate is at the upper end of the range estimated by the ECB and above the levels estimated by the main European banks themselves in the most recent Risk Assessment Questionnaire published by the EBA.

There are at least two possible explanations for such a significant gap between the implicit cost of equity and return on equity. On the one hand, it could relate to investors’ perception that the ROE generated by the sector in 2021 (even before non-recurring items) is not sustainable in time, which is why they value the entities at a price-to-book of less than one. In contrast, by way of a more optimistic alternative, it is possible that last year’s ROE is indeed sustainable in time, so implying significant upside in bank valuations, assuming a cost of equity of around 10% based on the self-assessed estimates of a significant percentage of the European banks.

Conclusions

The banking sector, in keeping with its pro-cyclical nature, was one of the hardest hit during the worst months of the pandemic crisis; the corollary has been a more intense recovery until the rally was truncated by the crisis between Russia and Ukraine. That intense post-pandemic rally is largely attributable to the improvement in sector earnings in 2021, as well as a shift in the outlook for rates, specifically an end to the abnormality of negative rates, especially EURIBOR, of greatest relevance to the retail banking business.

Despite that recovery, the banking sector continues to trade at a price-to-book ratio of less than one, highlighting the gap between the cost of equity demanded by investors and the returns generated by the sector, which, if the ROE generated by the sector in 2021 proves sustainable in time, could imply bank valuation upside. Nevertheless, recent developments on the geopolitical front have raised concerns over the banks’ stock market rally, as they have complicated central banks´ task of controlling inflation without dampening recovery prospects. This scenario is raising uncertainty over the ultimate pace of monetary policy normalization, an expectation that has largely driven the revaluation in bank stocks observed in recent months.

References

EBA (2022a). Risk Dashboard, Q3 2021. EBA, January.

EBA (2022b). Risk Assessment Questionnaire – Summary of Results, Autumn 2021. EBA, January.

ECB (2021). Measuring the cost of equity of euro area banks. ECB Occasional Paper Series, No 254, January.

Marta Alberni, Ángel Berges and María Rodríguez. A.F.I. - Analistas Financieros Internacionales, S.A.