The ECB’s policy conundrum

Higher and more persistent than expected inflation disrupted the ECB’s initial forward guidance from late 2021. As the ECB pivots to unwind stimulus more aggressively to tame inflation, it must minimize fragmentation risk and the disruption of monetary policy transmission across eurozone financial markets.

Abstract: The European Central Bank’s Governing Council faces a conundrum as it speeds up the withdrawal of stimulus to tackle accelerating inflation. The rapid tightening of monetary policy and expectations of its future path threatened to incite financial market fragmentation through widening spreads on sovereign bonds across the eurozone over the spring of 2022. The Governing Council of the ECB must walk a fine line between unwinding its unconventional monetary policy tools, while preventing the fragmentation of European financial markets and potential disruption of the monetary transmission mechanism. This challenge is complicated by the fact that much of the potential for disruption lies in the minds of market participants. In order to maintain the ability to shape market expectations, the Governing Council requires credibility, yet that credibility suffered a hit as the ECB had to walk back much of its forward guidance from late 2021. Fortunately, the Governing Council appears to have a plan, and that plan appears to be working. The next two meetings will be crucial in deciding just how much it can deliver.

Introduction

On December 16th, 2021, European Central Bank (ECB) President Christine Lagarde announced the Governing Council’s plan to wind up the pandemic emergency purchase program (PEPP) by the end of the next quarter. [1] Her message was cautiously optimistic. The critical phase of the pandemic-induced emergency had ended and the recovery of the eurozone’s economy had taken root. Inflation was already accelerating, but the Governing Council could confidently look through it to a medium-term when expected price inflation would be below the 2 percent target for ‘price stability’. Therefore, some monetary accommodation remained necessary. Indeed, the Governing Council planned to expand net purchases under the regular (i.e., non-pandemic) asset purchase program to smooth the transition away from the pandemic emergency program. Policy rates would not come up until net purchases under the regular asset purchase program ended. Prior to the meeting, Largarde made it clear that market participants should not expect that kind of normalisation of monetary policy until after the coming calendar year (see Arnold and Lagarde, 2021).

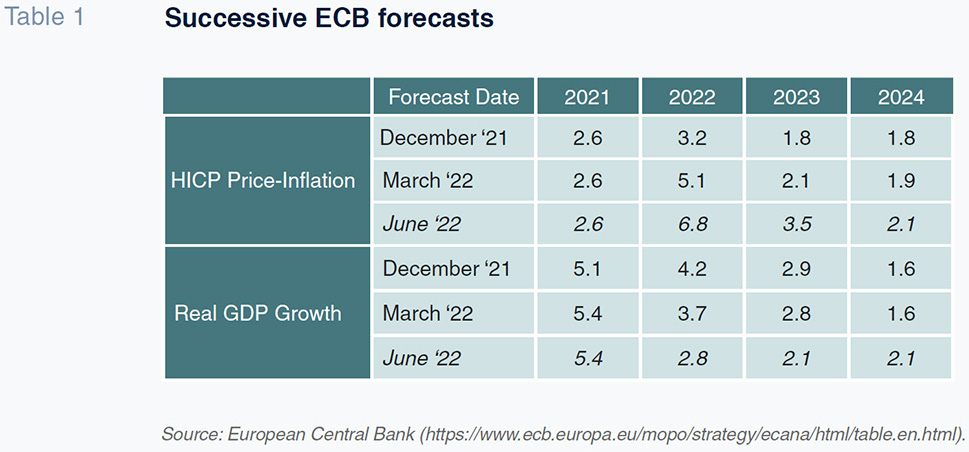

Six months later, inflation was much higher than the Governing Council anticipated. (see Table 1). Some of this was due to the Russian invasion of Ukraine and the impact that had on food and energy prices. However, much of the elevated inflation was due to the surprising resilience of pre-war trends, including continued supply chain disruptions due to the ongoing pandemic. By this point it was clear to almost everyone on the Governing Council that it might not be possible to ‘look through’ currently high rates of inflation. The ECB’s own estimates showed that price inflation would be above the 2 percent target for the rest of the forecast period. Consequently, Lagarde used her June 9th monetary press conference to announce that net asset purchases would cease by the end of the second quarter.

[2] She also promised that policy rates would increase by 25 basis points (or one quarter of one percent) when the Governing Council meets on July 21

st. She committed to another rate increase the following September, conceding that it could be larger than 25 basis points if the revised estimates showed higher than expected inflation. She also insisted that the Governing Council would not allow this ‘normalisation’ of monetary policy to disrupt the monetary policy transmission mechanism. In practice that means she promised to hold down the spread between long-term government bond yields across the euro area.

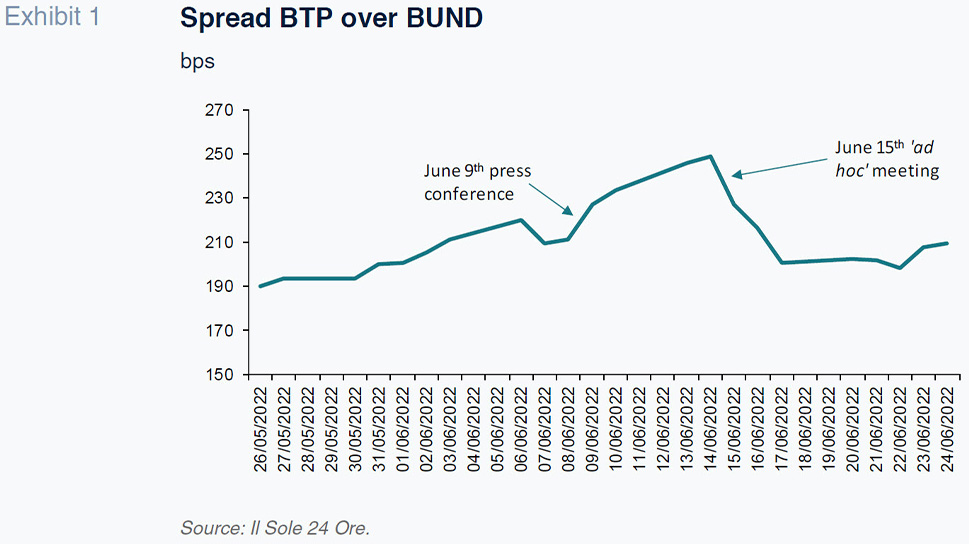

The reaction within the markets to this change in policy was not immediately favourable. Many market participants complained that the Governing Council was too far behind the curve of accelerating inflation. They worried that the ECB remained too committed to its forward guidance and too timid in the pace of removing monetary accommodation. As a result, these market participants argued, Lagarde ran a real risk of losing control over inflation expectations. If she did, she would not face another sustained period of high inflation like many European countries saw in the 1970s. Instead, she would have to make a much sharper policy correction in the near future as the Governing Council over-corrected its own errors. Such a policy adjustment would be very unfavourable for highly indebted countries, with Italy a particular concern. Hence market participants started speculating against long-term Italian sovereign debt prices, and in doing so, widened the yield spread between Italian and German bonds. This development threatened to disrupt the monetary transmission mechanism. The Governing Council responded by calling an ‘ad hoc’ or emergency meeting on June 15

th. At the end of that meeting, the Governing Council promised to do whatever it takes to achieve its objectives without breaking Europe’s monetary union.

[3] The details for this new action remained unclear, but market participants reacted with reassurance and the spread declined as a result (see Exhibit 1). The question now is whether the Governing Council can deliver both in terms of price stability and in holding together the monetary transmission mechanism.

Sequencing

To understand the complexity of the challenge, it is useful to review the sequencing that the Governing Council announced as part of its forward guidance for normalizing its monetary policy stance. The initial plan was to run down net purchases on both the pandemic emergency and regular asset purchase programs, then to continue monitoring economic activity until it looked as though expected inflation would converge on or marginally overshoot two percent per annum over the forecast period before starting to raise the policy rates. Along the way, the Governing Council would continue to reinvest the maturing principal on its existing holdings. Simultaneously, the ECB would run down the third round of targeted long-term refinancing operations introduced during the pandemic to encourage banks to lend to firms at concessionary interest rates.

This sequencing is important for two reasons. The first is redistributive. Any increase in policy rates will immediately put downward pressure on bond prices. If the ECB were to continue to make net asset purchases in such an environment, as ECB Executive Board Member Isabel Schnabel explained last November, central banks would be willingly accepting losses on their balance sheets that would ultimately lead to losses for the average taxpayer, and the continuation of net asset purchases would benefit mostly wealthier households (see Schnabel, 2021). Of course, such losses apply only to the extent to which the central banks are looking to sell their holdings before they mature. This is how policy rate increases interact with decisions to reinvest the maturing principal of any holdings rather than allow the central bank’s balance sheet to shrink. It also suggests the challenges associated with portfolio re-allocation decisions to sell any one group of assets before it matures to expand holdings of (and therefore demand for) other assets – particularly across countries. Given that national central banks hold the risks associated with their purchases of the securities from their own country, including government bonds, the gains and losses from any portfolio reallocation decisions could have important redistributive implications across governments and households.

The second reason for the sequencing relates to effectiveness. Increases in the ECB’s policy rates help to withdraw liquidity from the market and so reduce monetary accommodation. This occurs via two channels, the first is mechanical and relates to how banks pass along the costs of meeting their own liquidity requirements via the interbank market. The other is psychological and relates to how market participants speculate against asset price movements as they anticipate the implications of future policy moves for macroeconomic and market performance. This is also referred to as the expectations channel. Whether and how smoothly any change in the policy rates can withdraw monetary accommodation and so slow down the pace of economic activity and therefore price inflation depends upon how much impact it has through both channels.

The ECB’s targeted long-term refinancing operations effectively shut down the mechanical transmission of policy rate rises through the banking system because banks can use these long-term concessionary loans to meet their liquidity requirements, at least for the next several months. The first tranche of the pandemic emergency lending was €1.3 trillion and will mature only at the end of June 2023. Another €700 billion will mature in quarterly increments through the end of June 2024. The last two bundles –€98 billion and €52 billion– will run off by the end of that year. This large liquidity overhang explains why very few banks in the euro area try to meet their regulatory liquidity requirements either through the interbank market or through the ECB’s main refinancing operations. For example, euro area banks borrowed only €700 million in the weekly liquidity auction that was concluded on June 22

nd.

[4]

When euro area banks do not get their liquidity at a cost close to the main refinancing rate, then any movement in that rate will not translate mechanically into borrowing costs. That does not mean that there is no impact of a rate rise. On the contrary, banks will not only respond to policy rate increases by changing the cost of borrowing for customers, but they will anticipate them. Banks have been raising the cost of mortgages consistently for the past six months, leading the ECB to warn about a possible fall in house prices (see Arnold, 2022). The point to underscore is that this impact is largely psychological and reflects market assessments of what the ECB’s policy moves mean for future asset prices. Moreover, because these market assessments rely on various different factors, this psychological or expectations channel is relatively more volatile than the mechanical influence of monetary policy changes as they operate through the need for banks to meet their regulatory liquidity maintenance requirements through the interbank market.

The ECB’s original sequencing for withdrawing from its unconventional monetary policy stance was designed to minimize both the political sensitivities surrounding the central banks’ large asset holdings and the implicit constraints that would arise if the ECB had to shrink or restructure its balance sheet. That sequencing was also intended to restore the mechanical transmission of monetary policy changes, while at the same time providing clear guidance for market participants as they shaped expectations about how the normalization of monetary policy would impact on future asset prices. In essence, the strategy was to ensure that the Governing Council maximized both its flexibility and its effectiveness. Both elements were always going to be important; no one imagined that exiting from the ECB’s unconventional policy stance was ever going to be easy (see Jones, 2017). The huge expansion of the ECB’s balance sheets alongside government borrowing during the pandemic has only increased the degree of complexity.

Acceleration

Unfortunately, the pace of events has accelerated beyond expectations. As a result, much of the sequencing announced by the Governing Council in its forward guidance appears to be collapsing. The ECB is ending net asset purchases before increasing the policy rates, but only by a short period of time, and the huge overhang of liquidity created by the targeted long-term refinancing operations remains in place. Worse, market participants initially reacted to the acceleration of policy tightening by speculating that some assets would suffer more dramatic price declines than others. That is why the spread between Italian and German government bonds suddenly started to widen. Such movements threatened to disrupt the mechanical transmission of monetary policy changes by creating a division between Italian and German interbank markets. Those markets may not be necessary for routine liquidity operations in the banking system at the moment, but they are essential if the ECB is to be able to run down its targeted long-term refinancing operations without creating significant financial distress in Italy. Therefore, it was necessary for the Governing Council to reassure the markets that any relative movement in Italian and German government bond prices could be contained sufficiently for the cross-border interbank market to function efficiently over the next two-to-three years. That is why the Governing Council held its ad hoc meeting on June 15th.

This acceleration of events has challenged the effectiveness of ECB policy. The promise to create some kind of ‘anti-fragmentation’ tool to hold European interbank markets together appears to have succeeded both psychologically and in more mechanical terms. Market participants are willing to accept that the Governing Council knows what it is doing and that it will do whatever it takes to preserve the monetary transmission mechanism.

The challenge now is for the Governing Council to address Isabel Schnabel’s distributive implications, both across households and across national governments. To understand why, imagine what such an anti-fragmentation tool would need to respond to if an increase in speculation caused a further widening of the Italian and German spreads. There is an important debate about conditionality here that this discussion ignores. Governments that receive support under such a program should demonstrate they are not subject to moral hazard. But how that demonstration takes place is for another argument. Instead, the focus is on the identification of relative gains and losses.

The first line of defence would be to redistribute the reinvestment of the principal on the pandemic emergency purchase holdings of €1.7 trillion from bonds that trade at a relatively high price to bonds that are under pressure in the markets. According to reporting from Bloomberg Business, roughly €17 billion in assets from that program mature each month, of which €12 billion could be redirected (see Randow and Migliaccio, 2022). This volume is small relative to the €20 billion in monthly net asset purchases that are coming to an end. However, this volume is considerable relative to the share of purchases directed at countries that could face market speculation. This commitment is sufficient to restore the status quo through the end of 2024, which is the period when the ECB expects to continue reinvesting the maturing principal on its pandemic emergency program purchases. The net result would be to redistribute holdings from one group of countries to another, so to bolster government bond prices (and therefore hold down relative borrowing costs) for the target group. Such distributive consequences would be significant, but arguably proportionate to the need to sustain the monetary transmission mechanism – especially given the challenges associated with winding up the concessionary long-term refinancing operations introduced during the pandemic.

The next line of defence would be to bolster the purchase of assets facing speculation in the markets by anticipating the sale of holdings for those countries not facing speculation. This becomes more complicated because any sale of assets before they mature would have to take place in secondary markets and so would likely be below the par value that the bonds would garner as they mature. The result would be to impose losses on the central banks (and hence taxpayers) of those governments that sell their holdings early to the advantage of central banks (and governments) of those countries facing speculation. The gains would come not only in terms of high bond prices but also in the yield to maturity of the assets that are purchased. It could be possible to mitigate this discrepancy by anticipating the portfolio redistribution across time rather than matching new purchases with early sales. However, this would increase liquidity and so work against the normalization of monetary policy (and the removal of monetary accommodation) necessary to push back against inflation. Hence it is more likely that the Governing Council will need to ‘sterilize’ any net asset purchases for countries facing speculation with sales on other parts of its asset portfolio to remain consistent with its goal of promoting price stability.

The proportionality of this second line of defence is more controversial given the greater distributive consequences. Nevertheless, the ECB has been clear that there is no a priori objection to this kind of instrument. That is what the ‘ad hoc’ Governing Council meeting concluded. As a result, market participants face a high level of uncertainty in speculating how aggressively the ECB might commit to this line of defence. If speculation has calmed in the aftermath of that meeting, it is because few in the markets are willing to risk underestimating the Governing Council’s commitment. So far, the ECB’s ‘anti-fragmentation’ tool is a success in terms of shaping market expectation in that sense.

Beyond politics

The challenge will come if the Governing Council needs to step up the pace of its monetary policy normalization. This will come by either raising policy rates more quickly or by reconsidering the pace at which it runs down the size of its balance sheet both in terms of its pandemic emergency purchases and its other accumulated asset holdings. In such an environment, market expectations for the relative strength of government bond prices will depend on many factors beyond the Governing Council’s commitment– because governments in Europe face very different macroeconomic challenges while relying on equally varied political coalitions. Some differentiation in government bond prices is warranted in such circumstances, and the temptation in the markets will be to find just how much variation the Governing Council will be willing to tolerate.

The distributive consequences of accelerating the normalization of monetary policy would also become more important. Here Schnabel’s observation is critical, because slimming down the ECB’s balance sheet, while simultaneously raising interest rates will impose losses on central banks – particularly if the structure and pace of that balance sheet consolidation depends upon disposing assets before they mature. This may require a third line of defence to redistribute losses across national holdings to offset the distribution of gains that arise from the operation of any anti-fragmentation instrument, real or implicit.

The mistake would be to assume that the problem the ECB faces is purely or even primarily political. There is a clear tension between the Governing Council’s need to stabilize the monetary transmission mechanism and its ability to shape the course of actual and expected inflation. That tension emerges from the way in which the normalization of monetary policy interacts with the way that policy has an impact on the markets, both mechanically and through the psychology of market participants. The Governing Council has managed to strike a fine balance in terms of convincing market participants to hold judgement. What the Governing Council does in the July and September meetings will determine the policy’s overall effectiveness.

Notes

Referencias

ARNOLD, M. (2022). ECB Warns a House Price Correction Is Looming as Interest Rates Rise.

Financial Times (25 May 2022).

https://www.ft.com/content/4ca7ff91-35bc-428e-8690-e3617afab47c ARNOLD, M. and LAGARDE, C. (2021). Says EU Inflation Passing “Hump” and 2022 Rate Rise “Very Unlikely”.

Financial Times (3 December 2021).

https://www.ft.com/content/dfd205bd-bb19-46f2-9a75-47af00a843b5 JONES, E. (2017). Now for the Tricky Part: Unwinding the European Central Bank’s Unconventional Monetary Policy Stance.

SEFO – Spanish Economic and Financial Outlook, 6(3), pp. 7-17.

https://www.funcas.es/wp-content/uploads/Migracion/

Articulos/FUNCAS_SEFO/031art02.pdf RANDOW, J. and MIGLIACCIO, A. (2022). ECB Likely to Offset Bond Buying under New Crisis Tool.

Bloomberg Business (16 June 2022).

SCHNABEL, I. (20221). Speech by Isabel Schnabel, Member of the Executive Board of the ECB, at a virtual conference on

Diversity and Inclusion in Economics, Finance, and Central Banking, Frankfurt am Main, 9 November 2021.

https://www.ecb.europa.eu/press/key/date/2021/html/

ecb.sp211109_2~cca25b0a68.en.html

Erik Jones. Professor and Director of the Robert Schuman Centre for Advanced Studies at the European University Institute