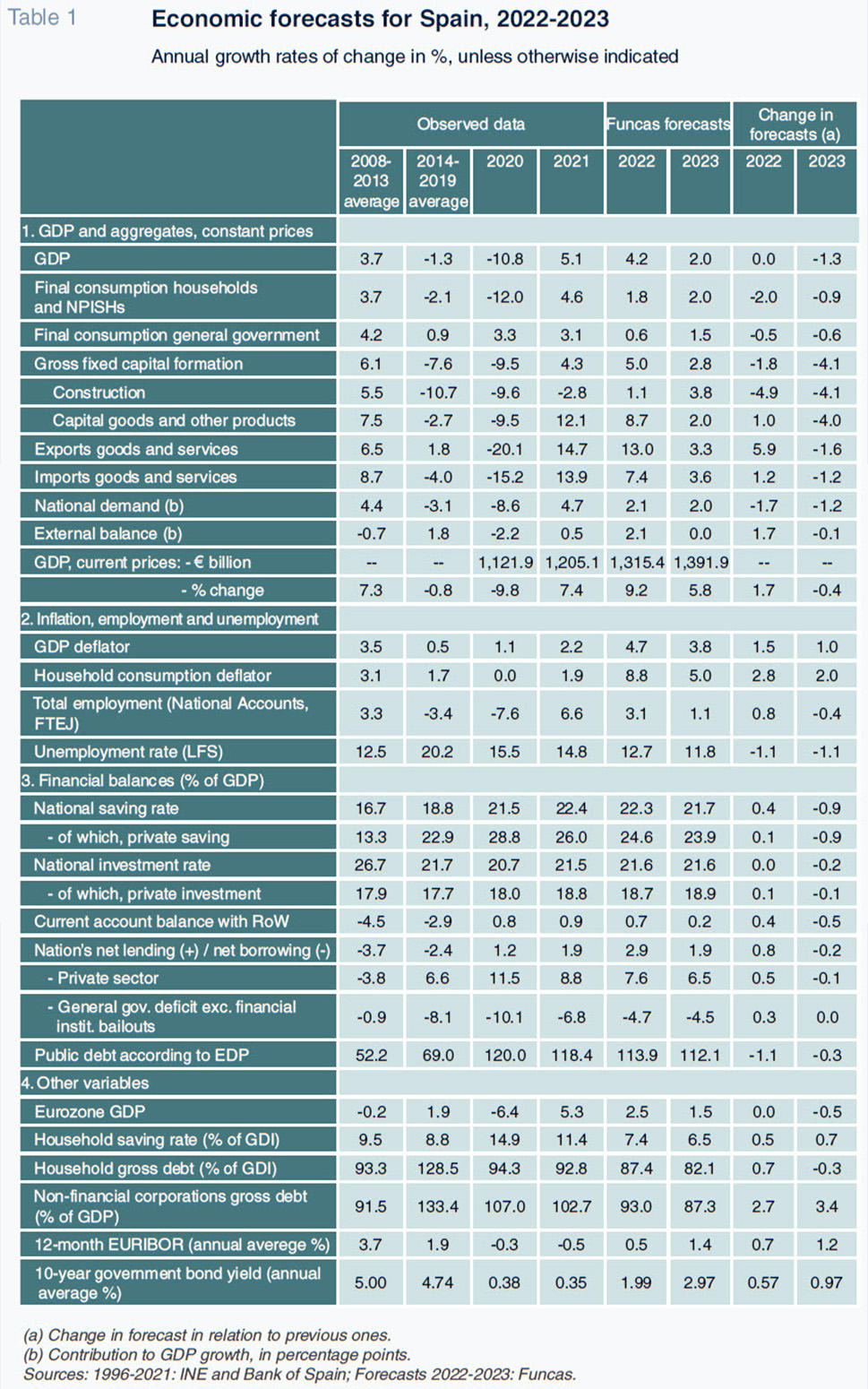

Spanish economic forecasts for 2022-2023

Despite a weak start to the year and headwinds from high energy prices and double-digit inflation, Spain’s prospects for the next few months remain favourable. However, after the end of the tourism season, the loss of consumers´ purchasing power along with more restrictive financial conditions and geopolitical risks mean growth is expected to slow considerably from the end of 2022.

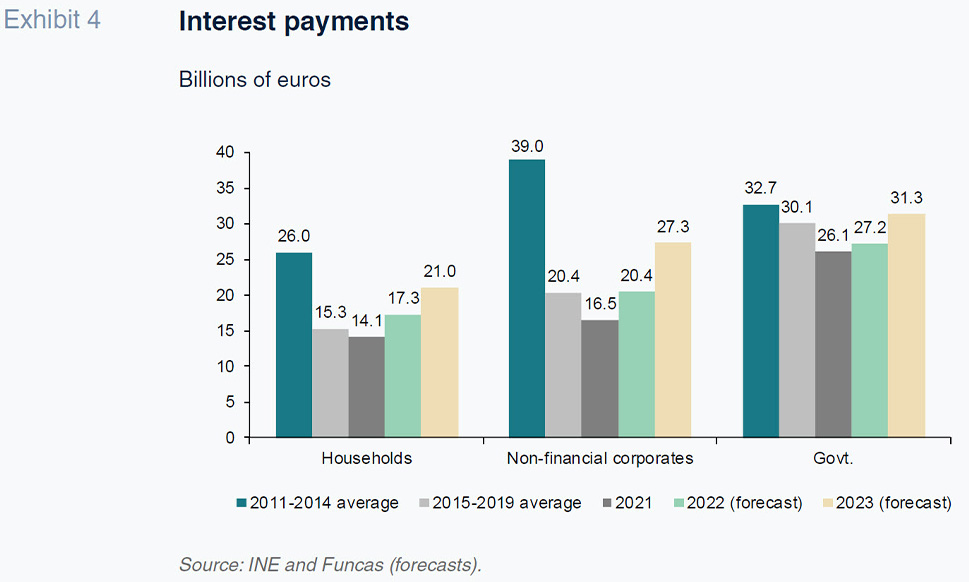

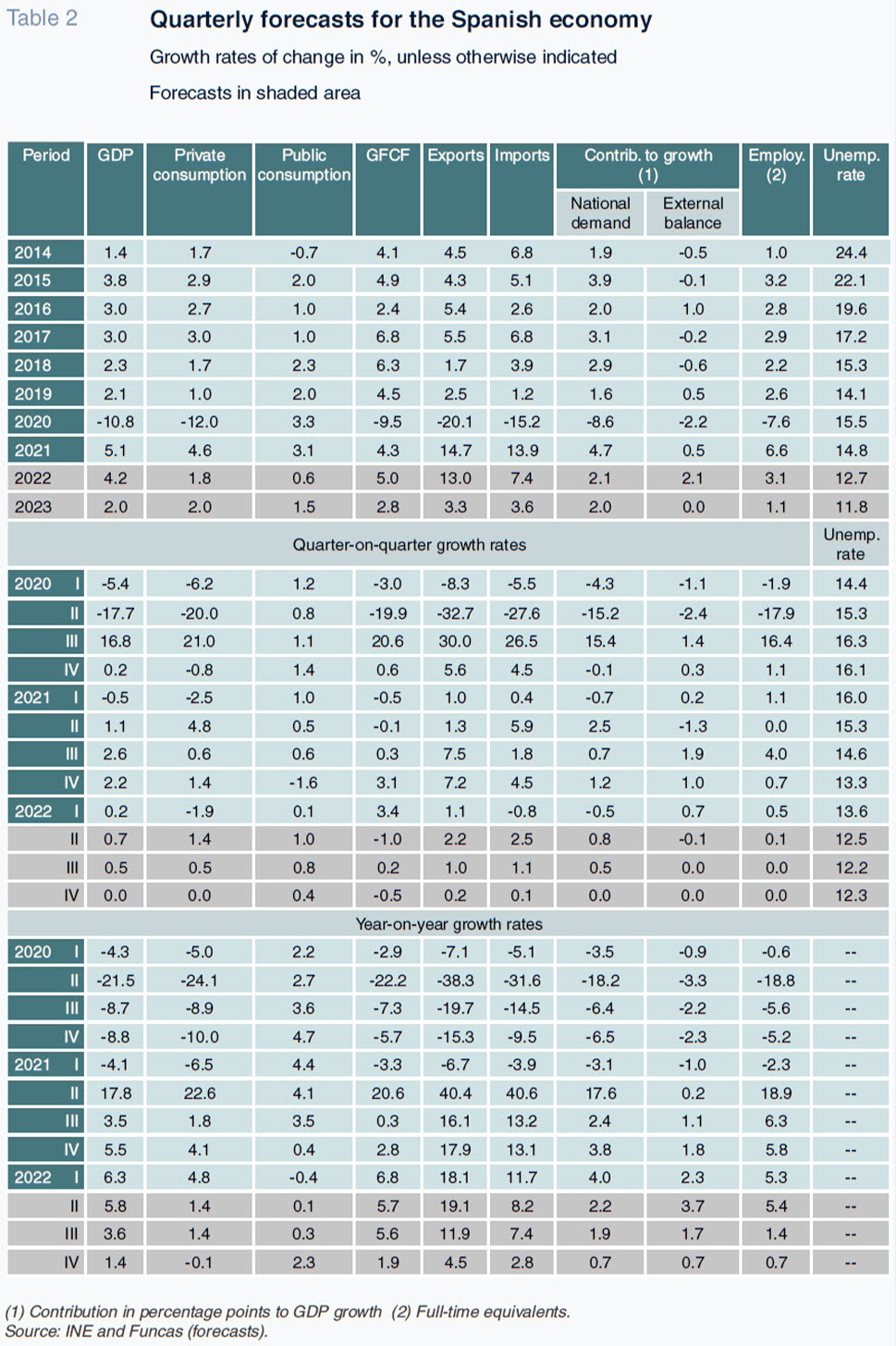

Abstract: Despite an extremely modest expansion in the first quarter of the year, Spain’s economy is still expected to grow by 4.2% in 2022. Investment, goods and non-tourism services exports and tourism are expected to drive growth until the third quarter. Thereafter, headwinds related to inflation, high energy prices, geopolitics and more restrictive monetary policy will cause growth to slow significantly. GDP is expected to grow by 2.0% in 2023 (lower than the previous March forecast of around 3.3%). Over the forecast horizon, high and persistent inflation is expected to dampen households’ purchasing power and real consumption. Investment will still be supportive, partly driven by Next Generation EU (NGEU) funds. While the pace of job creation should slow, the unemployment rate could fall below 12% by the end of the projection period. Spain’s balance of payments should remain favourable with strong tourism earnings offsetting rising energy import costs. As growth slows into 2023, household and corporate balance sheets appear to be in a position to sustain higher interest rates, especially when compared to the 2011-2014 financial crisis. Public finances are more vulnerable to the turn in monetary policy. They should remain sustainable if growth continues and deficits are gradually reduced. Risks to growth include geopolitics (war in Ukraine) and higher energy prices, along with monetary tightening and the prospect of fragmentation in eurozone financial markets.

Recent performance of the Spanish economy

According to the recently revised national accounts, Spain’s GDP expanded by 0.2% in the first quarter of this year. This weak performance represents a significant loss of momentum compared to the robust growth experienced in the second half of 2021.

The slowdown in growth is mainly attributable to a slump in private consumption, which, despite registering modest growth in nominal prices, contracted by 1.9% in real terms. The result is that private consumption remains about 8.1% below pre-COVID levels.

Growth near historic highs in capital goods investment offset weakness in private consumption. The strong performance of capital goods investment in the first quarter of 2022 followed vigorous growth in the preceding quarter, making this component of demand the best-performing during this period of recovery. Investment in capital goods now stands 16.8% above its pre-pandemic level.

Exports of goods and services also expanded during the first quarter, with the trend in exports of non-tourism services standing out. Due to strong growth in recent quarters, the exports of non-tourism services will stand at 11.7% above pre-pandemic levels as of the end of the first quarter of 2022. International tourism has also contributed to the recovery, although the pace of growth eased in the first quarter of 2022 by comparison to the second half of 2021 due to the imposition of restrictions in a number of countries in late 2021 aimed at curtailing the spread of the Omicron variant.

Growth in employment, measured as the number of hours worked, increased by 3.2% in Q12022, outpacing GDP growth by a substantial margin. As a result, productivity per hour worked remains below pre-pandemic levels.

The household savings rate came in at -0.8% of gross disposable income. However, this variable tends to be highly unfavourable during the initial months of the year. Moreover, the fall in the savings rate is considerably smaller than was customary in the same period in the years prior to the pandemic. Adjusting for seasonality, the savings rate came to 7.5% in Q12022, which is below the level recorded throughout 2021, but still slightly above the average for the pre-pandemic expansionary period, 2014-2019.

Looking ahead to the second quarter of 2022 PMI readings point to continued economic growth, underpinned by the services sector, but with manufacturing expected to remain weak. Tourism looks likely to put in a very strong performance. The number of international tourists visiting Spain in May was 88% of the May 2019 figure. Domestic tourism is also very buoyant, with the number of overnight hotel stays by Spanish residents in April revisiting pre-pandemic levels.

Judging by the retail sales index in May, consumption is recovering. Car sales in April and May were also higher compared to the previous quarter, albeit remaining well below last year’s figures. Industrial orders for consumer goods also look to be recovering, despite the dip in the consumer confidence index. Elsewhere, employment remained very dynamic throughout the second quarter according to the Social Security contributor reports, with the recovery in the hotel sector standing out.

Inflation stayed above forecast levels throughout the second quarter. This trend was more noticeable for core inflation, suggesting that increases in production costs are being passed on to end consumer prices to a higher degree than anticipated. In addition to energy products, growth in food prices was notable at over 10%. Non-energy goods and services registered lower, but still significantly above target, rates of price growth of close to 4%.

Forecasts for 2022-2023

The outlook is clouded by the turbulence that is engulfing the global economy on three fronts: (i) geopolitical tensions and, more specifically, the war in Ukraine; (ii) the energy crisis; and, (iii) the shift in monetary policy prompted by the persistence of inflation. Each of these factors is dampening growth forecasts, while at the same time inflation projections lie considerably above central bank targets.

During the next few months, the rebound in tourism, ongoing positive trade dynamics (goods as well as non-tourism services) and labour market buoyancy are expected to continue to support growth. However, these tailwinds will probably lose steam towards the end of the peak tourism season, just as the geopolitical tensions, energy crisis, and more restrictive monetary policy gain force, thereby weighing on internal demand.

Overall, we expect the expansionary forces to offset recessionary pressures for the year as a whole, and as a result still forecast headline GDP growth of 4.2% (unchanged from our previous forecasts). While our forecast headline growth rate is unchanged, we now expect the contribution from domestic demand to fall to 2.1 points (1.7 points below our March forecasts). This downward revision is primarily attributable to consumers’ loss of purchasing power resulting from rampant inflation. Nominal household gross disposable income is expected to increase at 6% (thanks to moderate wage growth combined with employment gains), implying a contraction of 2.6% after adjusting for CPI inflation. Households are likely to draw down excess savings accumulated during the pandemic to fund spending, enabling slight growth in private consumption, albeit at a slower pace than projected in the March forecasts. Non-energy companies are also facing margin contractions because of the surge in the cost of energy and other raw materials. That said, despite tighter margins, investment is still expected to expand partly due to accelerating execution of the recovery plan financed by the NGEU funds.

In contrast to domestic demand, we have raised our forecast for the contribution to GDP growth of net exports to 2.1 points (up 1.7 points from March). This upward revision is fuelled by the recovery in receipts from tourism to pre-pandemic levels and, to a lesser degree, the recovery in external sales of goods and non-tourism services. Imports, on the other hand, are expected to increase in parallel with growth in domestic demand, translating into slower growth relative to that in exports.

We are forecasting a sharp slowdown in 2023, specifically GDP growth of 2%, down 1.3 percentage points from the previous set of forecasts. This downgrade reflects the end of the rebound in tourism and reduced export demand in line with a prospective slowing of growth across the EU as a result of the risks associated with Russian gas supplies. Even if Russian gas supplies are not cut off entirely, a reduction is expected to detract one point from eurozone growth in 2023. The contribution of the external sector to economic growth is therefore expected to turn neutral next year, in marked contrast with the dynamism predicted for this year.

Domestic demand, meanwhile, is expected to register a small recovery, but not sufficient to totally offset the reduced contribution of the external sector. Household consumption is predicted to recover a small part of the ground lost this year, assuming both that salaries stage a slight recovery, and that the savings rate dips further, to below the long-run average. Nevertheless, by the end of 2023, spending on private consumption in real terms would still be around 3% below pre-pandemic levels. On the other hand, investment, though losing steam as a result of prevailing uncertainty and interest rate increases, should remain a driver of growth thanks to the European funds.

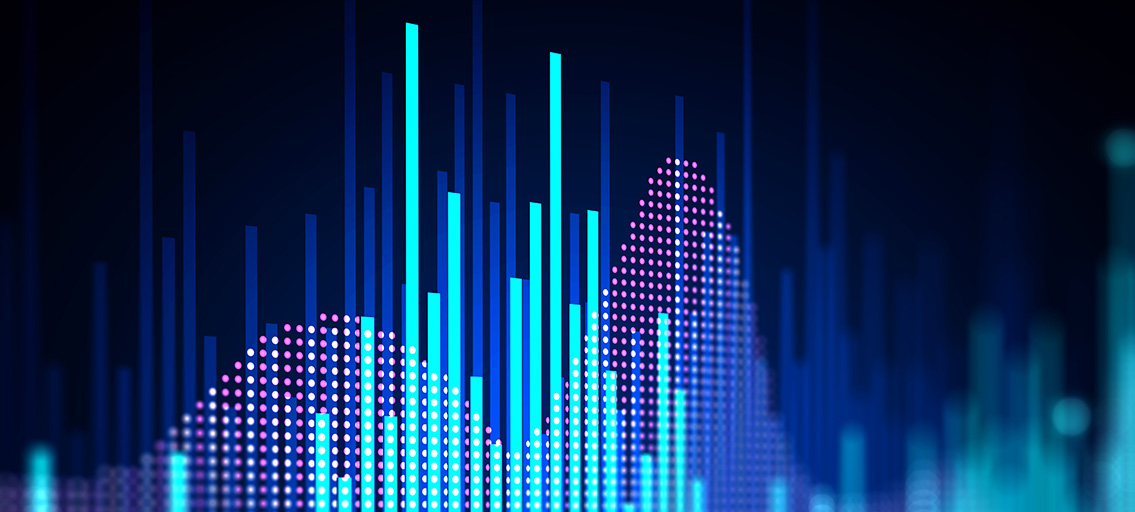

Inflation will continue to shape the economic outlook. Assuming that energy prices continue to rise until next spring before stabilising, particularly in the case of gas, we are forecasting the consumption deflator at 8.8% this year and at 5% in 2023 (Exhibit 1). These forecasts incorporate the Spanish government’s newest anti-inflation plan. As for the GDP deflator, the variable that best reflects internal prices, we are projecting significantly lower rates of 4.7% and 3.8% in 2022 and 2023, respectively. The gap between consumer prices and the GDP deflator is at a historical high since the 1970s. This extremely large differential between internal and external prices evidences the exceptional nature of the import price shock and the loss of purchasing power which is currently being borne by the Spanish economy.

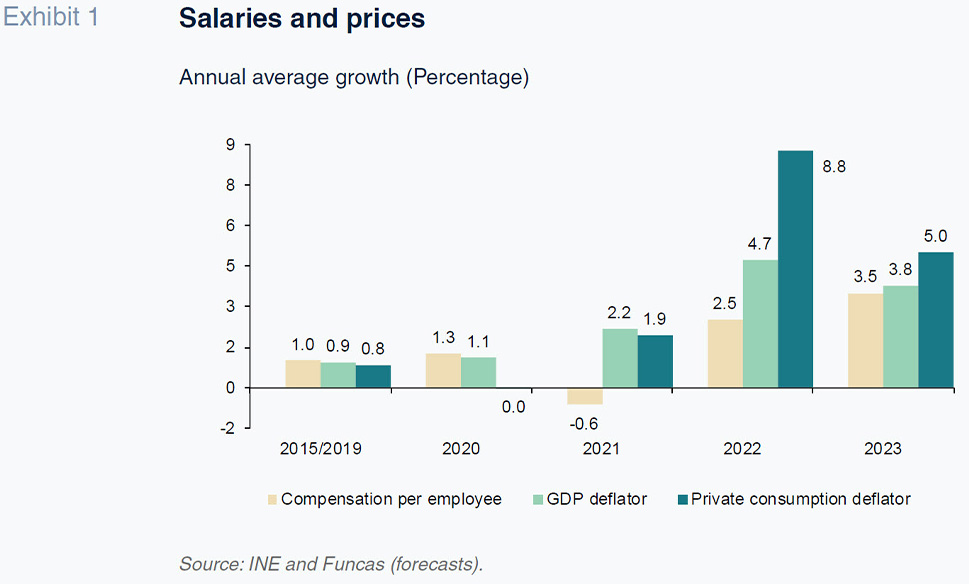

Despite the surge in import prices, the external accounts are expected to remain in surplus throughout the projection period (Exhibit 2). The nation’s net lending position is attributable to the growth in tourism receipts, partially offsetting the higher cost of the energy bill, as well as transfers from Europe under the scope of the NGEU scheme.

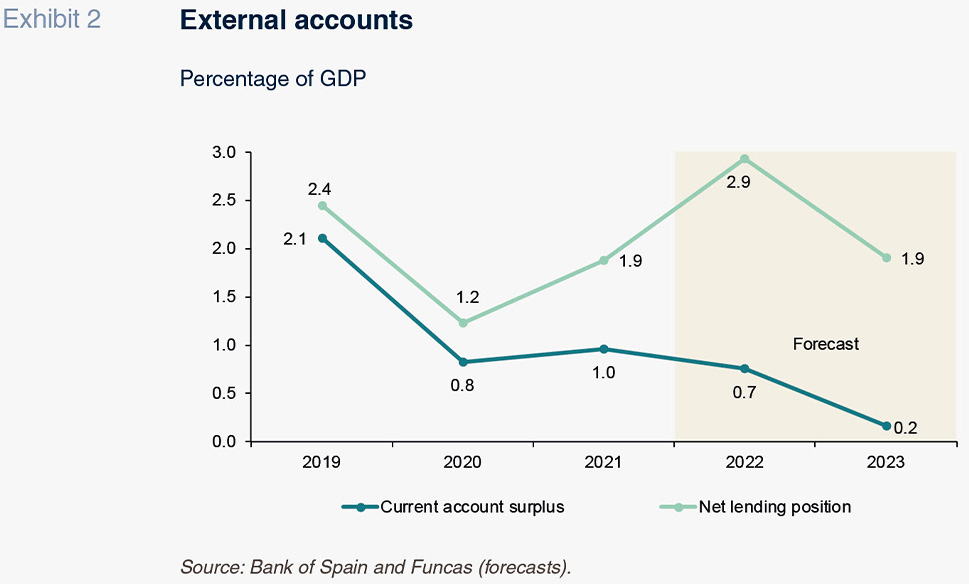

Job market dynamics are predicted to continue (Exhibit 3), albeit marked by slowing growth in tandem with the sharp economic slowdown. We are forecasting the creation of 600,000 jobs by the end of 2023, driving unemployment to below 12%.

The public deficit is set to come down this year thanks to the interplay of automatic stabilisers, coupled with inflation dynamics. However, little progress is expected on addressing the prevailing imbalances in 2023 on account of the economic slowdown, public sector pay increases and indexation of certain budget headings, such as pensions. The deficit is forecast at around 4.5% of GDP in 2023, which is close to its structural level, with public debt at around 112%.

The persistence of inflation has forced the ECB to re-evaluate its stance and is compelling it to raise its key rates. That shift needs to be gradual, however, so as not to accelerate the economic slowdown, and be accompanied by firewalls against financial fragmentation (for which the exact mechanism has yet to be defined at the time of writing). Our forecasts envision an increase in the deposit facility to 1.5% by the end of the projection period. That would be consistent with EURIBOR trading around that threshold and a yield on 10-year Spanish bonds of close to 3%.

Risks

These forecasts are subject to a high degree of uncertainty around key drivers such as the duration of the war in Ukraine and the trend in energy prices. A negotiated end to the conflict would improve the outlook for inflation substantially and inject confidence all around. That would be propitious to using the savings buffer built up during the pandemic out of precaution to invest and spend. All of which would revitalise the economy. To the contrary, a perpetuation of the armed conflict or its extension to other countries could ultimately lead to stagflation.

The extent to which monetary policy is able to cope with stagnation tendencies is another crucial issue. As already noted, these forecasts contemplate moderate interest rate increases, in line with what the market is discounting. The result would be an increase in household and corporate financial burdens, albeit to levels relatively affordable by comparison with the 2011-2014 financial crisis (Exhibit 4). Strong economic growth, private sector deleveraging in recent years (which has not reverted in spite of the pandemic) and the banks’ relatively healthier exposure compared to the past, have made balance sheets more resilient compared to a decade ago.

In the case of the public sector, however, the anticipated monetary policy tightening will have a more pronounced effect considering the scale of the existing imbalances. However, the public sector should remain in a sustainable position so long as economic growth continues and a credible roadmap for gradually correcting the deficit is put in place. Unquestionably, the creation by the ECB of an effective anti-fragmentation mechanism would also help contain financial risks.

Raymond Torres and María Jesús Fernández. Funcas