Spanish economic forecasts panel: November 2020*

Funcas Economic Trends and Statistics Department

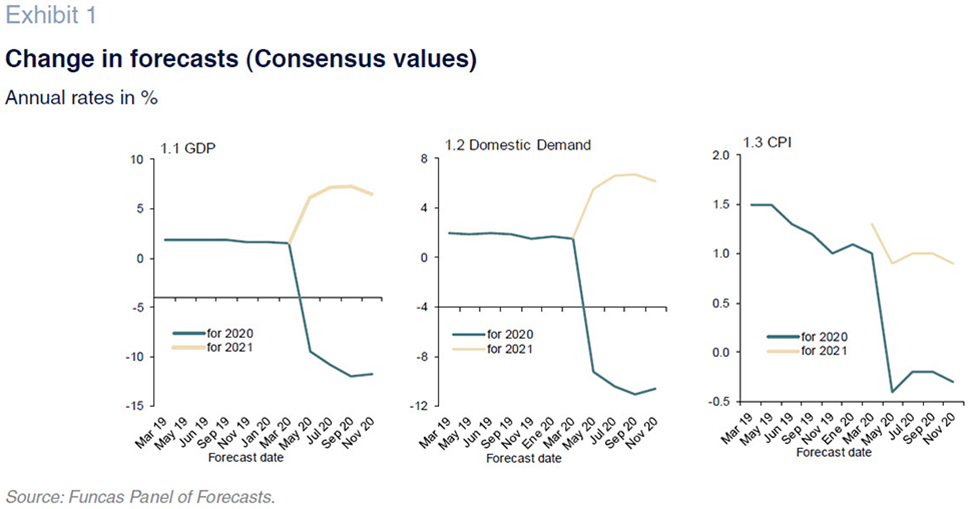

Estimated 2020 GDP contraction improves 0.2pp to 11.8%

According to Spain’s National Statistics Office, the INE, Spanish GDP grew by 16.7% in 3Q20, which is almost 4 percentage points above the last Panel consensus forecast. However, in October and November, due to new restrictions imposed to stem the second wave of COVID-19 infections, the indicator suggests that the recovery has stalled.

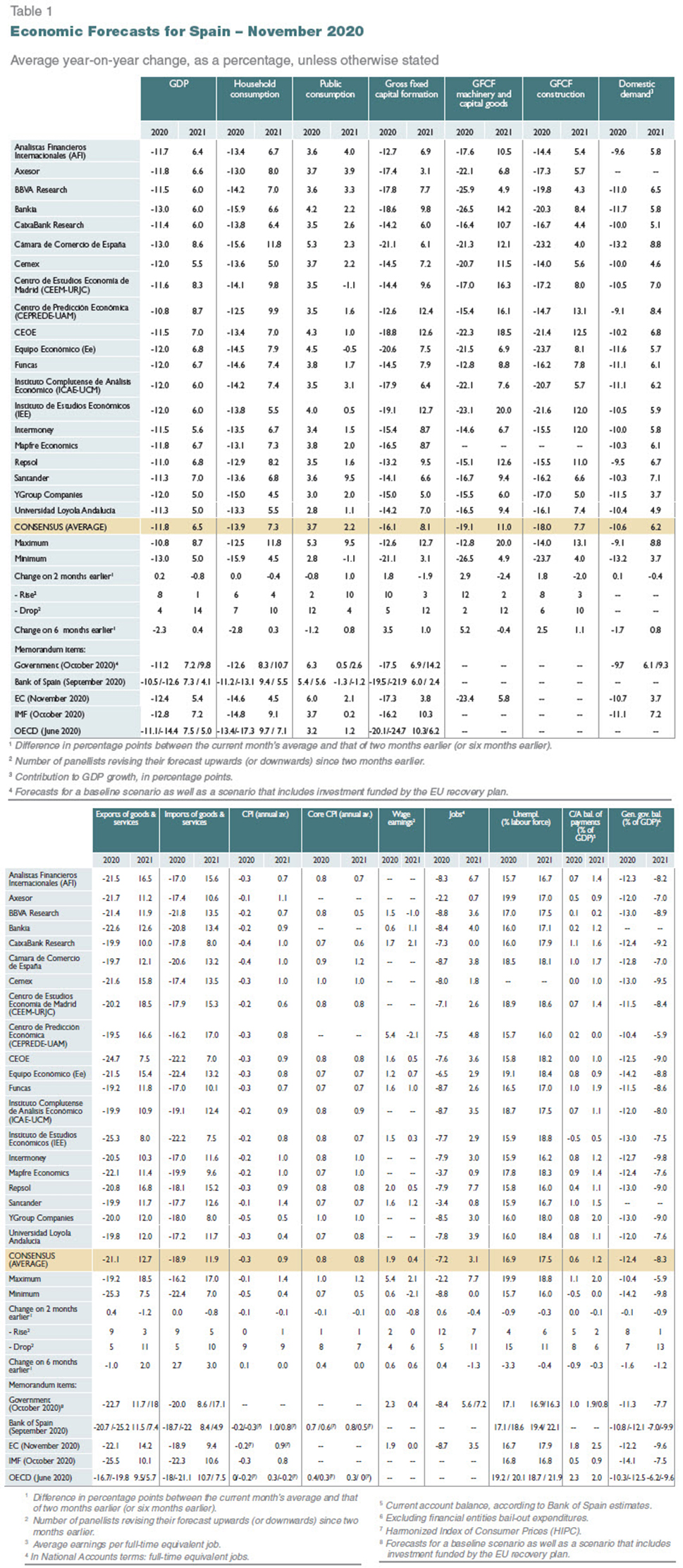

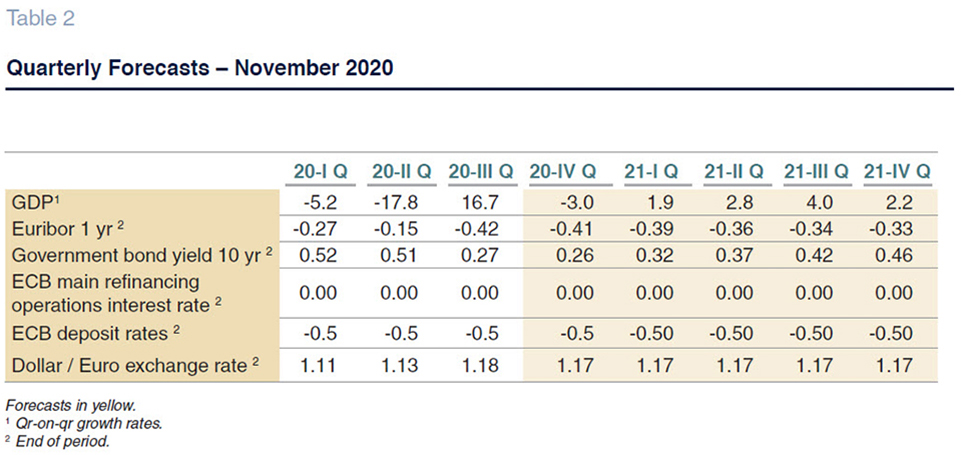

For 2020 as a whole, the consensus forecast is now for a contraction of 11.8%, 0.2 percentage points less unfavourable than the last consensus forecast (Table 1). The improvement is the result of the higher than expected official 3Q20 growth estimate, which more than offsets the downward revision in most analysts’ forecasts for the last quarter: a contraction of 3% (Table 2) versus growth of 3.9% as of last September.

Domestic demand is expected to detract 10.6 percentage points from growth, while foreign demand detracts the remaining 1.2 percentage points of forecasted growth. By comparison with the last set of forecasts, the private consumption and investment estimates have improved slightly, albeit still pointing to sharp contractions. The estimates continue to foreshadow a hefty fall in both exports and imports, with the net contribution largely unchanged compared to September.

The forecast for 2021 has been cut by 0.8pp to 6.5%

Most of the analysts have layered the European Union funds into their estimates, albeit by differing amounts. Most also assume that the effects of the vaccine on the economy will start to become tangible during the second half of 2021.

For next year, 14 out of the 20 analysts have trimmed their growth forecasts, leaving a consensus of 6.5%, down 0.8 percentage points from September. Note that the downward revision of the annual forecast reflects the knock-on-effect of the weak figure anticipated for the fourth quarter rather than a deterioration in the outlook for next year, for which the quarterly estimates are actually higher than they were in September (rising to 4% by the third quarter).

The rebound in 2021 is expected to be fuelled mainly by an uptick in domestic demand, which is expected to contribute 6.2 percentage points of GDP growth (down 0.4 percentage points from September). That growth is in turn projected to be driven by an improvement in all of its components other than public expenditure, where growth is forecast to ease (although here the analysts have upgraded their forecasts by 1 percentage point). Foreign trade is expected to contribute 0.3 percentage points to growth, down 0.4 percentage points from the last set of forecasts.

CPI forecasts for 2020 and 2021 trimmed slightly

The headline inflation rate continues the downward trend initiated during the peak months of the pandemic, due to a fresh correction in oil prices and price easing in other categories, notably services.

The analysts’ estimates for average inflation have been trimmed a scant 0.1 percentage points to -0.3% and 0.9% in 2020 and 2021, respectively. The forecasts for core inflation have also been reduced by 0.1 percentage point to 0.8% for both years. Most of the panellists believe inflation will remain in negative territory for the rest of the year and early 2021.

The year-on-year rates forecast for December 2020 and December 2021 stand at -0.4% and +1.3%, respectively (Table 3).

Unemployment estimated to reach 17.5% in 2021

Over 50% of all of the jobs lost between March and April have been recovered since May. In addition, more than 2.7 million furloughed workers are back at work. The number of people covered by the furlough scheme has decreased from a high of nearly 3.4 million at the end of April to around 600,000 at the end of October. However, the trend is very different between sectors. While construction is nearly back to pre-crisis employment levels, with just 0.5% of its job-holders still on furlough as of the end of October, in the hospitality, transport, culture and travel agency sectors, employment is 6% below February levels and nearly 10% of their employees remain on furlough.

The consensus forecast for employment, in terms of full-time equivalents, is for a contraction of 7.2% in 2020 (a 0.6 percentage point improvement from September) and a recovery of 3.1% in 2021 (down 0.4 percentage points from the last set of forecasts). The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULC). Productivity is expected to fall by 4.6% this year and advance by 3.4% in 2021. ULCs, meanwhile, are expected to increase by 6.5% in 2020 and fall back by 3% in 2021.

That would put average annual unemployment at 16.9% this year and 17.5% in 2021, which is 0.9 and 0.3 percentage points better than forecast in September.

The external balance will remain in surplus, though less than in the previous consensus

To August, Spain presented a current account surplus of 3.45 billion euros, down 13.66 billion euros from the same period of 2019. That sharp reduction is due to a 53% decline in the trade balance, driven mainly to the slump in tourism receipts, which more than offset the improvement in the income deficit.

The consensus forecast is for a surplus of 0.6% of GDP in 2020, unchanged from the last set of forecasts, rising to 1.2% in 2021, down 0.1 percentage points from September.

Public deficit expected to widen

The fiscal deficit, excluding local authorities, amounted to 78.13 billion euros in the first eight months of 2020, compared to 25.65 billion euros during the same period in 2019. That downturn is the result of a 17.16 billion euro drop in revenue coupled with growth of 35.33 billion euros in spending, of which around 27.9 billion euros is related to COVID-19 expenditure.

The analysts are currently estimating a public deficit in Spain of 12.4% of GDP in 2020, which is 0.1 percentage points wider than they were forecasting in September. The deficit forecast for 2021 stands at 8.3%, up 0.9 percentage points.

External environment expected to improve in the coming months

The third-quarter economic recovery has been widespread. In the eurozone, GDP recovered to 4.4% below year-earlier levels and in the US, to 2.9% below. China, meanwhile, reported year-on-year growth of 4.9%.

Nevertheless, more recent indicators point to a deterioration in economic momentum since September, spearheaded by the services industry. The eurozone PMI contracted sharply in November due to the new restrictions introduced to curb the second wave of COVID-19 infections. All signs suggest that the European economy will contract again in the fourth quarter.

In line with recent trends, virtually all of the analysts describe the external environment as unfavourable. They also agree that things will improve in the coming months, both within the EU and beyond.

EURIBOR and bond yields continue to trend lower

The ECB’s monetary stimulus strategy continues to be felt in the markets. In October and the early weeks of November, 12-month EURIBOR continued to trend lower, reaching -0.48%. The yield on Spanish bonds, meanwhile, dipped below 0.10%, while the spread over German bonds narrowed to 65 basis points. The analysts expect that both interest rates will move only slightly up from current levels next year.

Recent euro stability

Since the September survey, the euro has been trading steadily against the dollar at between 1.17 and 1.18. The analysts believe the exchange rate will remain close to current levels throughout 2021.

Fiscal policy needs to prop up the economy

The analysts unanimously consider that both monetary and fiscal policy are expansionary and nearly all of them believe they should remain so for the coming months. No major changes in the ECB’s benchmark rates are expected over the projection horizon.

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.