Consolidation in the EU banking sector: Scope and timing

After several years of limited consolidation across the European banking sector, the announced merger between CaixaBank and Bankia has bolstered expectations of renewed M&A activity. This expectation is further supported by the existence of surplus capacity, digitalisation trends, and the economic consequences of COVID-19 for banks.

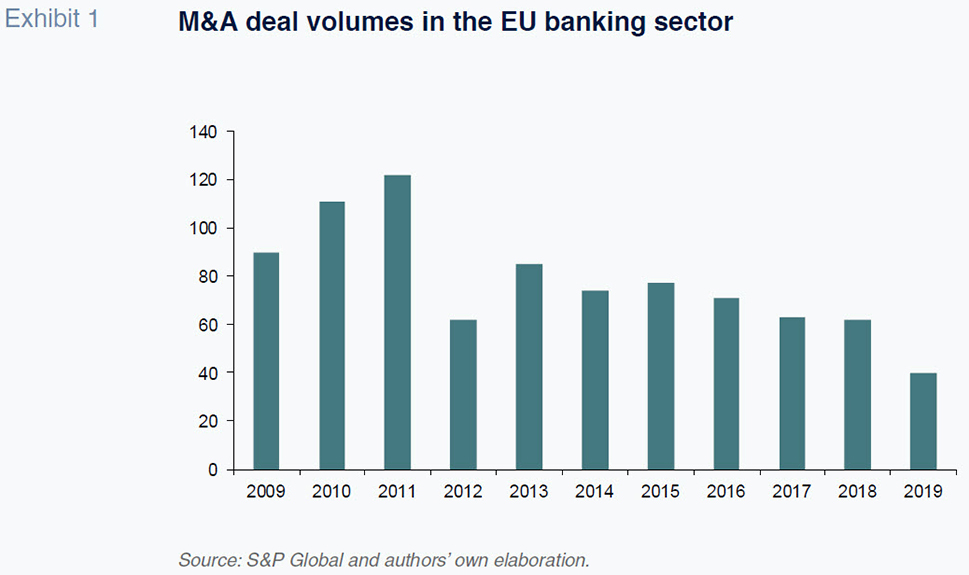

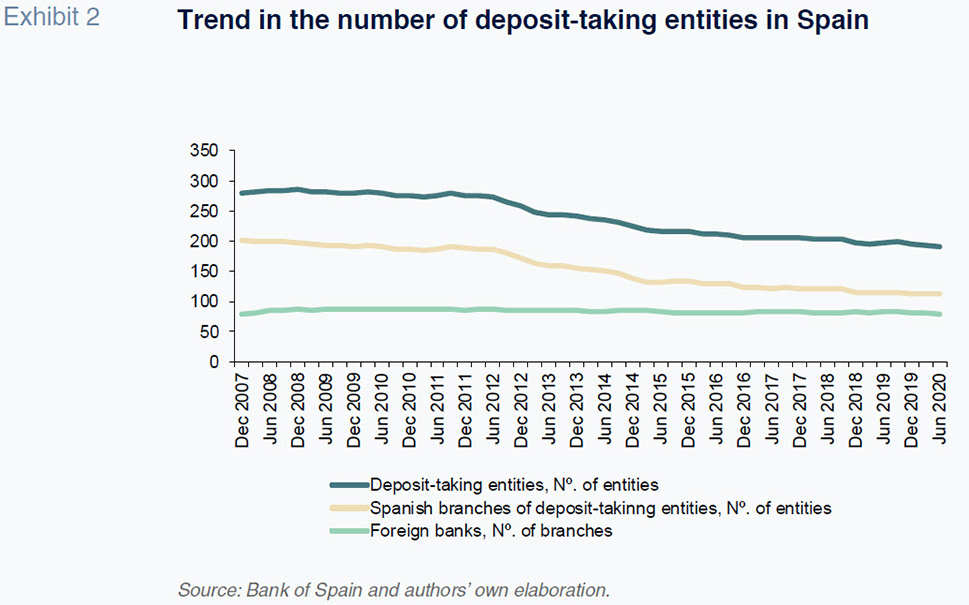

Abstract: The merger between CaixaBank and Bankia has sparked commentary surrounding the possibility of a new wave of consolidation across the European banking sector. In recent years, M&A activity had been muted compared with the period directly following the financial crisis. Specifically, there were 385 deals between 2009 and 2012, compared to 236 between 2016 and 2019. In Spain, the number of deposit-taking entities has declined by 31.4% (from 280 to 192) since 2007. Notably, evidence shows that there is still surplus capacity in the banking sector, thereby justifying additional consolidation. The changing nature of financial services, as well as the entrance of both Big Tech and larger fintech firms, has confirmed the benefits associated with scale such as data processing, multi-channel services, and digitalisation. Moreover, the economic consequences of COVID-19 have further depressed interest rates, necessitating a defensive cost-cutting strategy among Europe’s banks. Nevertheless, it is important to underline that consolidation is just one of the strategies banks can pursue to boost their profitability and market value.

Introduction: Mergers as a strategic response and other challenges facing the EU banking sector

The waves of consolidation in the EU banking sector have been driven by different factors and taken place with varying intensity since the financial crisis. Initially, many banks across Europe absorbed other entities whose viability had become compromised. At the same time, the banking sector suffered from surplus capacity which, combined with the funding difficulties in the wholesale banking market and general restructuring processes underway (branch and employee downsizing), reduced the number of larger-than-average entities. Efficiency gains have also encouraged consolidation as part of the gradual transition of banking services to a multi-channel digital environment. The new business paradigm has once again evidenced the virtues of economies of scale in the sector, prompting the banks to seek size via organic and M&A-led growth.

There are certain paradoxes associated with this ‘size-friendly’ environment. Despite a high number of merger discussions among European financial institutions in recent years, many never actually occurred. One explanation for this is the scarcity of “windows of opportunity” in the markets. The banks’ share prices have been subject to swings that have only accelerated in the past year. In a short period of time, the outlook has shifted from one of rate tightening and curve normalisation to a situation of renewed monetary easing and prolonged low rates to combat the economic ramifications of COVID-19.

Perhaps conscious of that mismatch between consolidation expectations and opportunities, on July 1st, 2020, the European Central Bank issued a note in which it announced “supervisory tools to facilitate sustainable consolidation projects”. Concretely, the ECB alluded to two top-priority issues:

- It signalled that capital requirements would not hinder sustainable integration plans. Specifically, the ECB would not penalise credible plans and would be open to temporary favourable capital treatments in order to speed up viable mergers.

- It also announced that the negative goodwill, or badwill, which arises when assets are acquired for less than their carrying amount will be taken into account and “preferably used to increase resistance”. This was perhaps the most important and commented on measure announced in recent months in terms of facilitating mergers involving businesses that may have sustained losses in an adverse economic climate (e.g., a pandemic). Indeed, the ECB signalled that “Consolidation may help euro area banks achieve economies of scale, become more efficient and improve their capacity to face new challenges.... and is important for increasing the resilience of banks and their capacity to service the economy, including in the context of the coronavirus (COVID-19) pandemic.”

The recently announced merger between CaixaBank and Bankia in Spain has injected new energy into the debate about the possibility of a fresh wave of mergers in the European banking sector. In Spain, the bank restructuring process has been particularly intense (having started with a considerably denser branch network relative to the European average), sparking the expectation that more deals may lie in store. That being said, mergers should not be viewed in the same manner as 20 years ago. The way the banks compete, the size and shape of the market, the way prices are formed and the manner in which the inputs are collected and their prioritisation (data being the most important input today) have all changed. Banking is an intermediation service market and digitalisation is dictating a transition from vertical relationships (the banks sell and the consumers pay a price) to articulation around platforms (multiple services and bundled prices). That is extraordinarily relevant with or without mergers. What we are observing in other services that operate around platforms (technology-based services, for example) is that scale is fundamental.

The banking sector is in the process of transitioning to a multi-platform business model. It is harder for the banks to concentrate the banking business in their conventional intermediation activity (taking short-term funds and making long-term loans) with rates low and curves flat (difference between long-term and short-term rates). Although other fee- and commission-generating services are gaining importance, competition for those fees has been fierce. Furthermore, consumers believe they are entitled to receive many services at low or zero cost, a notion that is proving hard to shake. With rates so low, the ability to generate income is shifting to the platforms and new ways of providing financing and capturing savings, underpinned by new risk measurement techniques based on big data. However, only big banks can generate the necessary big data, providing a new rationale for the emphasis on scale.

The changing nature of the marketplace, accelerate by COVID-19, is yet another challenge faced by the banking sector. In particular, proximity matters much less than previously. Consumers can access online financial services offered by numerous providers and the market for many products is no longer as regional. Competition in retail banking is intense and increasingly concentrated in intangible, non-branch channels. For these reasons, market concentration does not necessarily lead to monopolistic power. Several examples in the industrial economy have demonstrated that there can be more competition among a few concentrated rivals than between dozens of players that carve up businesses or markets or collude on prices. On the matter of distance, the geographic rationale for mergers is debatable as cross-border mergers remain few and far between due to the tendency to protect national champions. The banks themselves have also exhibited a reduced appetite for cross-border deals. This suggests that the financial crisis and Banking Union initiative have not sparked the integration needed in terms of mergers and acquisitions. It looks as if each country will have to have national players with a sufficient presence in each service market in order to compete across open platform markets. Indeed, where we are seeing the European banks increasingly cooperating is on the creation of common payment platforms in an attempt to compete with incumbents such as Visa or MasterCard.

Bank size indicators in the EU and limits on cross-border transactions

As shown in Exhibit 1, despite the expected uptick in mergers and acquisitions in the European banking sector, the reality is that the number of transactions completed in recent years has been considerably lower than the volumes observed in the years following the financial crisis. Between 2009 and 2012, 385 deals closed, falling to 236 between 2016 and 2019, with momentum waning as the expectations of a recession became stronger.

Uncertainty has intensified in 2020 with the onset of COVID-19. The pandemic is bound to have an adverse impact on the banks’ financial statements, mainly via increased non-performance. Whether or not that will trigger an episode of financial instability similar to 2008 remains to be seen. The Spanish and European banks are better capitalised and their asset quality is higher than a decade ago. Moreover, they have recorded provisions and impairment losses in anticipation. Against that backdrop, it looks likely that COVID-19 could make the merger route look like an opportune defence strategy for some. So long as competition is duly protected, growth in scale may be the best way to tackle a crisis of this nature. In the short-term, a merger delivers volume-driven growth at a time of negative rates and rising non-performance. Moreover, when mergers are confined to the home market, they can bring significant cost savings by eliminating overlap. The prevailing dynamics encourage concentration within a given country in a bid to boost profitability and capital. Given the international uncertainty and exchange-rate instability, it makes more sense to boost assets in euros.

It is worth considering the Spanish banking sector from a strictly institutional perspective. Since 2007, the number of deposit-taking entities has declined by 31.4% (from 280 to 192). That downsizing is mainly attributable to the mergers arranged in the wake of the financial crisis which reshaped the Spanish banking landscape. Although this process is forecast to continue, the current macroeconomic and financial uncertainty is bound to be a truly conditioning factor.

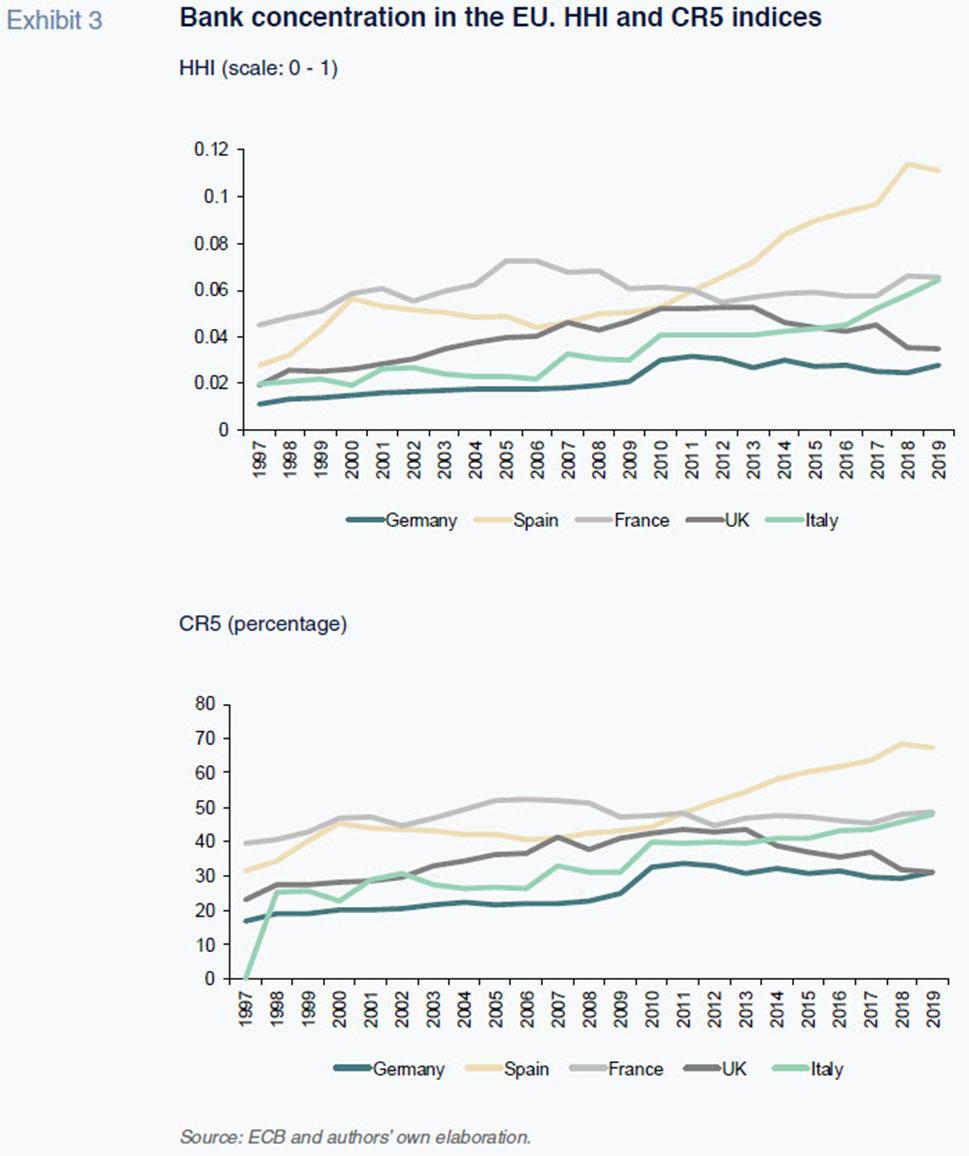

In the EU, there is considerable scope for bank consolidation. If we use the Herfindahl-Hirschman Index (HHI) to measure market concentration (calculated by squaring the market share of each firm competing in a market and then summing the resulting numbers) we note that concentration in Spain is a scant 0.12 (on a scale from 0 to 1) and is even lower in other European Union markets (Exhibit 3). Although the indicators are calculated at the national scale (and not for sub-markets such as provinces or regions), they paint a picture of moderate concentration levels. Business volumes tend to be concentrated among the largest banks in each country. The CR5 indicator shows how the five largest banking institutions account for over 60% of assets. Nevertheless, as we noted earlier, increased concentration does not imply reduced competition and the growing influx of non-bank players (including even from BigTech) is expected to further intensify competition.

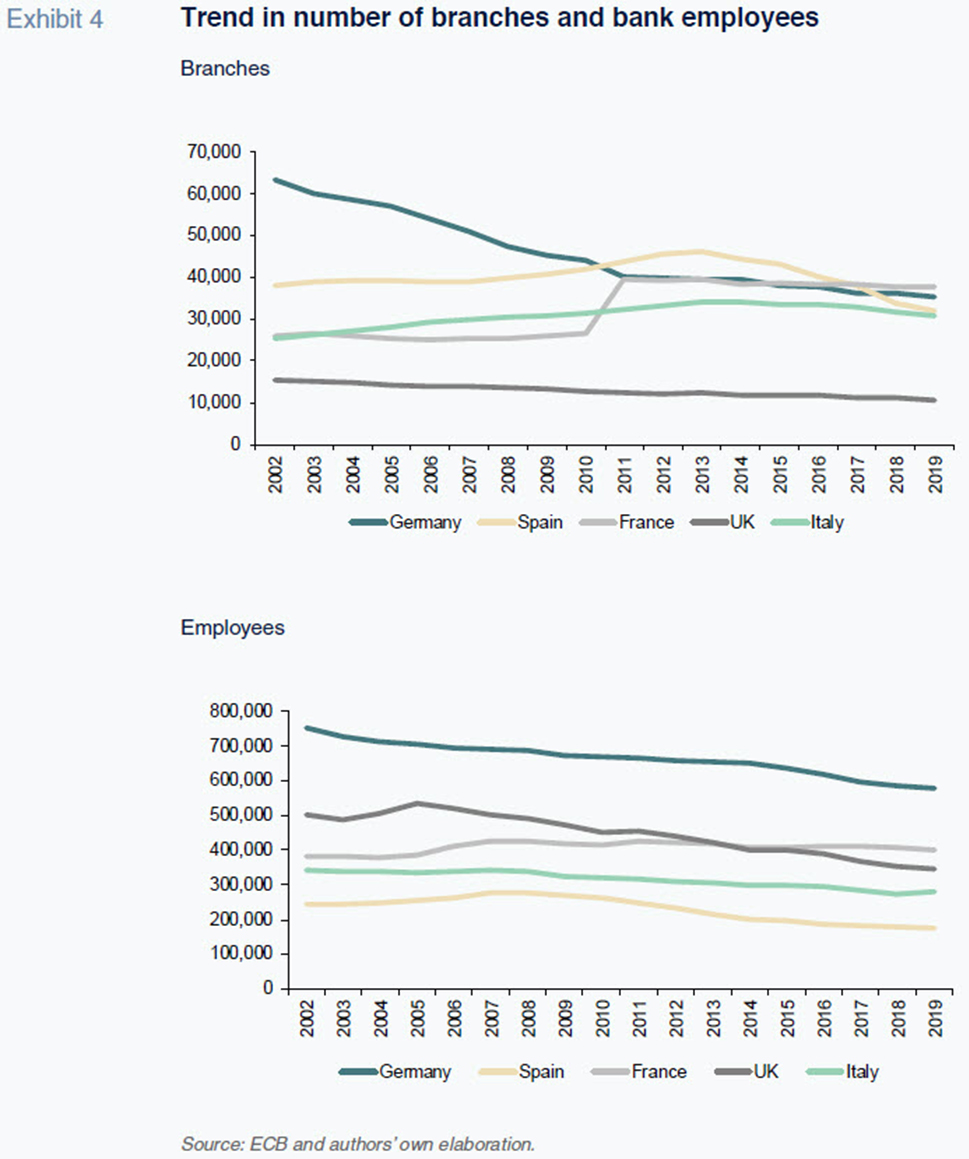

As the landscape for new mergers and acquisitions takes shape, intense restructuring has continued. However, the restructuring effort has been uneven across countries between 2002 and 2019. As shown in Exhibit 4, countries such as Germany, Spain and the UK have downsized their branch networks substantially, whereas in others, including France and Italy, that effort has been considerably less noticeable. Job-wise, the cuts have been less noticeable. Once again, though, the UK, Spain and Germany stand out, with net reductions in banking sector employment of 31.4%, 28.7% and 23.2%, respectively.

Conclusions

The recently announced merger between CaixaBank and Bankia has garnered a lot of attention across the EU, having been interpreted as the potential catalyst for a fresh wave of M&A activity in the European banking sector. Although certain regulatory considerations and the need to intensify the cost-cutting effort could encourage more M&A activity, it is important to note such activity requires market stability, which has been undermined by COVID-19.

Although mergers may provide a partial solution to the major challenges the banking sector is facing, they are not a complete panacea. In the current competitive climate, customers are of increasing value as units of information for banks, which must now compete with other information and risk management platforms for these data. Moreover, these new types of banking services do not provide the same benefits associated with economies of scale.

Scale is also a key strategy in the medium-term for competing with the technology newcomers, who are encroaching on the territory of traditional financial institutions. The banks still provide the bulk of financial services and probably will continue to do so for a long time. However, the competitive threat posed by BigTech and the larger fintech firms is real. Gaining scale also appears necessary to compete technologically.

Santiago Carbó. CUNEF, University of Granada, Bangor University and Funcas

Francisco Rodríguez. University of Granada and Funcas