Spanish economic forecasts panel: January 2023*

Funcas Economic Trends and Statistics Department

GDP growth estimate increased by 5% in 2022

According to the panelists´ forecasts, GDP grew by 5% in 2022, half a percentage point more than in the November forecast. The revision is primarily due to the upward adjustment by the INE of the National Accounts figures, which left cumulative growth during the first three quarters of the year at 6.3%, compared to 5.7% in the estimate included in the previous Panel. In addition, the consensus for the fourth quarter is for zero growth, compared to an anticipated 0.4pp decline in GDP in November.

Domestic demand should contribute 1.7pp to GDP growth (0.1pp more than in the previous Panel) and external demand 3.3pp (0.4pp more).

The forecast for growth in 2023 is 1.3%, two tenths pp higher than the previous Panel

The panelists forecast for GDP growth in 2023 increased to 1.3%, 0.2pp higher than the previous Panel. Zero growth is expected in the first quarter, followed by gains of 0.5%-0.6% for the remaining quarters (Table 2).

The increase in activity for the year as a whole will come from domestic demand, while the foreign sector will not make any contribution (compared to a detraction of two tenths of a percentage point in the previous Panel). Compared to 2022, the slowdown will be felt in private consumption, investment and foreign trade, while public consumption will return to positive rates after the declines recorded last year (Table 1).

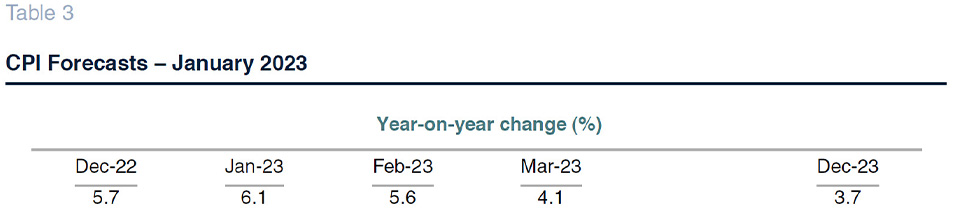

Downward revision of the overall CPI forecast in 2023, and upward revision of core CPI

Overall CPI has continued its moderation, which started in September, in the last months of 2022, due to a more favorable performance of energy prices coupled with base effects. However, the core inflation rate rose to a 30-year high in December of 7%. On average for the year as a whole, overall CPI rose by 8.4%, and core inflation by 5.2% (forecasts were compiled before the publication of the final December figures, which is why the panel estimates do not coincide with the final result).

The analysts´ forecast for average annual inflation in 2023 declined by one tenth of a percentage point with respect to the last Panel, to 4%. The projected year-on-year rate of the overall index for December is 3.7% (Table 3). As for core inflation, the annual average rose to 4.5%, 0.5pp more than the previous forecast.

According to Social Security enrollment figures, job creation in the fourth quarter was similar to that from previous quarters. For the year as a whole, the average enrollment numbers increased by 3.9%, 750,000 more when compared to 2021.

Employment will grow by 1% in 2023 and the unemployment rate will rise slightly to 13%

The forecast for employment growth is 3.7% for 2022 and 1% for 2023, increasing by two tenths and one tenth, respectively, compared to the November Panel. Based on growth expectations in GDP, employment and salaries, the forecast implicitly predicts an increase in productivity and unit labor cost (ULC). Productivity per full-time equivalent job will increase by 1.3% in 2022 and is forecast to grow by 0.3% this year. ULCs are expected to increase by 0.6% in 2022 and by 3.1% in 2023.

The average annual unemployment rate will remain at 12.9% in 2022, according to analysts, then rise to 13% in 2023 (Table 1).

Downward revision of the trade surplus for 2023

The balance of payments of the current account showed a surplus of 4.44 billion euros up to October 2022, compared to 9.76 billion euros in the same period of the previous year. This worsening mainly reflects higher energy costs. The panelists expect a surplus of 0.6% of GDP in 2022, as per the last Panel, and a surplus of 0.3% for 2023 -0.2pp less than in the last Panel (Table 1).

Public deficit forecast continues to improve

Public administrations, excluding local authorities, recorded a deficit of 15.17 million euros up to October, compared to 53.28 million euros in the same period of the previous year. This improvement was due to a larger than expected increase in revenue of 48.284 billion euros, much greater than the increase of 10.067 billion euros in expenditures.

The analysts expect a public deficit of 4.5% of GDP for 2022, 0.3pp less than in the last Panel. This estimate is lower than that contemplated by the government, which places the deficit at 5%. For 2023, the Panel expects a deficit of 4.3% of GDP, which, in this case, is more pessimistic than the government’s estimates.

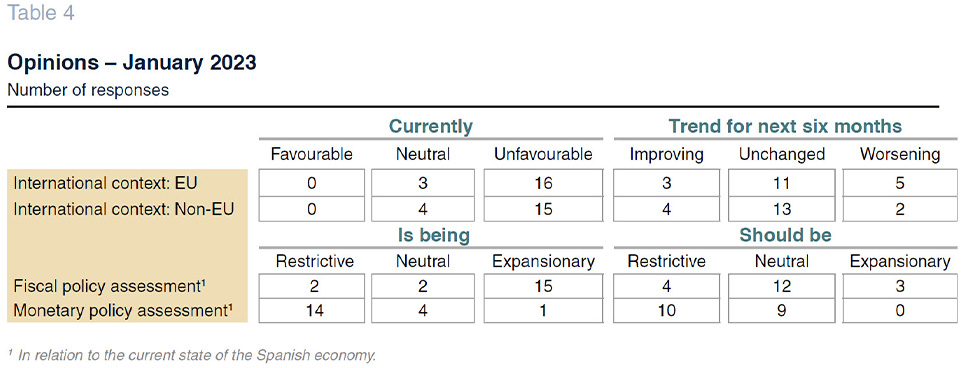

The international landscape is gloomier than in the last Panel

While the global landscape remains highly uncertain, some of the factors behind the inflation outbreak and the current phase of economic weakness seem to have lost steam in recent months. First, energy prices – the main source of the “stagflation” shock – have moderated markedly. Brent crude is trading at around $85 a barrel, almost $10 less than in November, and gas has fallen even more sharply since mid-December, to around $55 per MWh. They are reminiscent of price levels present before the outbreak of the war in Ukraine, facilitating the de-escalation of energy inflation. This, combined with the unusually mild winter in Europe so far, has helped reduce the risks emanating from the spectre of a hydrocarbon supply cut. While geopolitical risks remain high, the worst-case scenarios that were weighing on business and consumer confidence over the past year (spillovers from the war, nuclear threat, etc.) are now looking less likely.

The result is a slight improvement in the global PMI index at the end of the year (which is still in contractionary territory) and in business expectations (as attested by the rise in the global PMI of anticipated orders in the coming months). In its latest forecast for 2023, the ECB predicts positive growth in the eurozone of 0.5%.

Thus, the panelists are somewhat less pessimistic about the international environment, both in Europe and beyond. While the majority continue to believe that the current situation is unfavorable, fewer now believe that the outlook could worsen in the coming months both in the EU (with 5 analysts forecasting a deterioration, compared to 9 in the November Panel) and outside Europe (2, compared to 6 in the previous Panel).

Interest rates will continue to rise

Although inflationary pressures seem to be easing, monetary policy continues to tighten. In the US, there is some sign of a turnaround. The Fed has slowed the pace of hikes of its main interest rate, which now stands at 4.25-4.50%, 50 basis points more than in the previous Panel. But the signs are less clear on this side of the Atlantic. The ECB has increased its deposit facility by the same amount as the Fed, to 2%, while also suggesting that similar rate hikes will follow. On the other hand, as part of the quantitative tightening (QT) process, the incentives for repayment of targeted long-term refinancing operations (the so-called TLTROs) to support bank lending to the private sector continue, while the central bank confirms its intention to reduce the outstanding amount of government bonds in its portfolio.

The prospect of further adjustments by the ECB in the short-term has continued to put upward pressure on the one-year Euribor, the main benchmark for mortgages. It is above 3.3%, half a point higher than in November. On the other hand, the Spanish 10-year bond yield has hovered around 3.1% with no discernable trend – possibly reflecting the markets’ anticipation of a turning point in monetary policy in the coming year, in line with the evolution of inflation. The risk premium remains stable at around 100 basis points, a number indicative of the absence of financial tensions in the public debt markets.

In their assessments, the panelists are betting on a slower pace of interest rate hikes. The ECB’s deposit facility is expected to reach close to 3% at the end of the forecast period, half a point higher than in the previous consensus (Table 2). Euribor has been revised by a similar magnitude to around 3.5%, while the 10-year bond yield would evolve without major changes compared to the last Panel (flattening of the yield curve).

The euro appreciates against the dollar

In recent months, the euro has tended to recover some of the ground lost against the dollar, as a result of the ECB’s interest rate hikes, so markets expect a narrower spread in financial yields between the two sides of the Atlantic. Analysts anticipate a slight appreciation in the coming months (Table 2), compared to the stability predicted in the previous consensus.

* The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.