Spanish economic forecasts panel: May 2023*

Funcas Economic Trends and Statistics Department

GDP growth projection for 2023 increased to 1.7%

In the first quarter of 2023, GDP grew by 0.5%, according to the provisional advance, 0.4pp higher than expected by the analysts’ consensus. The contribution of domestic demand to growth was negative, -0.8 pp, basically due to the sharp fall in private consumption. On the other hand, the foreign sector contributed 1.3 pp, due to an increase in exports of greater magnitude than that of imports. Exports of tourism services were particularly strong. The results for the last two quarters of 2022 were also revised upwards, from 0.2% growth in each quarter to 0.4%. This introduces a positive carry-over effect on the 2023 annual growth rate that previous forecasts did not contemplate, which would imply the need to revise previous forecast upwards, if the 2023 outlook remains unchanged.

Regarding the beginning of the second quarter of 2023, the few indicators available remain similar to previous months, some slightly below (PMI) and others above (confidence indices).

Nevertheless, the consensus forecast for GDP growth for 2023 as a whole was increased by 0.2pp to 1.7% compared to the previous Panel, after 11 panelists revised their forecasts upwards. Regarding the quarterly profile, growth in the remaining quarters of the year is expected to be lower than in the first quarter, at around 0.2%-0.3% (Table 2).

The contribution of domestic demand to GDP growth is expected to be one percentage point, two tenths less than in the previous consensus forecast. The panelists revised downward the growth of private consumption and investment in machinery and equipment. The foreign sector is expected to add 0.7pp to GDP growth, an improvement of four tenths compared to the March Panel, as a result of an upward revision in export growth (Table 1).

2024 forecast reduced to 1.8%

The consensus forecast for GDP growth in 2024 was reduced by three tenths to 1.8%, compared to the previous Panel. However, this result would imply an acceleration of the economy by 0.1pp with respect to growth in 2023. This forecast is slightly lower than that announced by the Bank of Spain, the Government and international organizations, such as the IMF and the European Commission.

It is interesting to note that of the eleven panelists who have revised their forecast upwards for 2023, most (eight) have simultaneously revised downwards their forecast for 2024.

The higher growth of private consumption and investment will more than offset the lower dynamism of public consumption predicted for next year. As for the foreign sector, a decrease of 0.1pp is expected – as opposed to the seven tenths it should contribute this year – due to slightly higher growth in imports compared to exports.

Upward revision of the core CPI forecast

After being interrupted at the beginning of the year, the moderation of the overall CPI continues based on the results for March and April, although the importance of the base effect in these data should be noted. The core index, for its part, continues to grow at a relatively high rate.

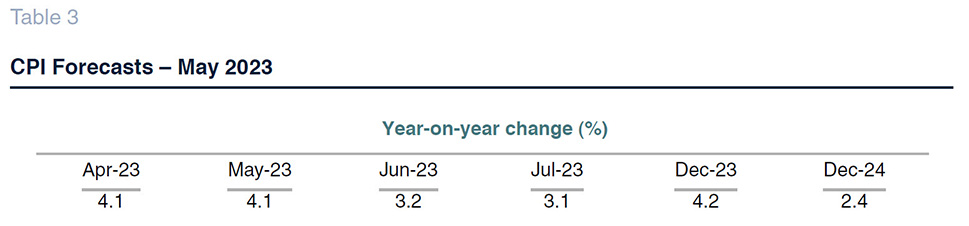

In line with recent trends, the forecast for average annual inflation has been revised downwards by two tenths to 4%, while that of the core index has been raised by three tenths to 5.8%. For 2024, rates of 2.9% and 3.4% are expected for the overall and core indices, respectively.

The expected year-on-year rates for December 2023 and December 2024 are 4.2% and 2.4%, correspondingly.

Employment expected to continue to grow, and the unemployment rate to fall to 12.5% by 2024

According to the Labor Force Survey, employment increased by 1.2% in the first quarter of the year, after eliminating seasonal effects, which represents a higher rate of growth than in the previous four quarters. The unemployment rate stood at 13.3%, 0.3pp lower than in the same period of the previous year. Social Security enrollment also points to an acceleration in the rate of growth of employment in the first quarter, although of a lesser magnitude than that indicated by the LFS. In April, the labor market continued to perform well, with the hospitality industry playing a leading role.

The average employment growth estimate for 2023 has been increased by two tenths to 1.3%, while the forecast for 2024 has been reduced by three tenths to 1.3%.

The implied forecast productivity and unit labor cost (ULC) growth is derived from the forecasts for GDP, employment and wage growth. Productivity per full-time equivalent job is expected to grow by 0.4% this year and by 0.5% in 2024. As for ULCs, they should increase by 3.6% in 2023 and 2.9% in 2024, four and one tenth more compared to the previous Panel, respectively.

The average annual unemployment rate is expected to be 12.8% on average in 2023, one tenth less than in the previous Panel and should fall to 12.5% in 2024, one tenth more than in the previous Panel (Table 1).

External surplus outlook improved

According to the revised figures, the current account balance recorded a surplus of 7.8 billion euros in 2022, 0.6% of GDP, down from 11.524 billion euros in the previous year due to a poorer performance of the income balance. The total trade balance recorded a similar result last year, although with a very different composition: a sharp increase in the trade deficit (due to the deterioration of the real terms of trade, in a context of higher imported energy prices) but an intense growth in the surplus of services, both tourism and non-tourism. In the first two months of this year, the income balance deficit was slightly higher, while the trade balance improved significantly compared to that recorded in the same period of 2022. Thus, the current account balance went from a negative result of 3.9 billion euros to a surplus of 5.6 billion euros in the first two months of the year.

The panelists´ expect a current account surplus of 1% of GDP for 2023, and 0.8% for 2024, 0.2pp higher than in the previous forecast (Table 1).

Public deficit forecast maintained

The public administration recorded a deficit of 4.8% in 2022 –0.3pp higher than that anticipated by the panelists– compared to 6.9% in the previous year. The first months of 2023 also show improvement in different levels of government.

The Panel forecasts a reduction in the public deficit over the next two years to 4.2% of GDP in 2023 and 3.7% in 2024, the same amount as the March forecast. These data deviate by three and seven tenths from the Government’s forecast (Table 1).

International uncertainties persist with economic and financial repercussions

The IMF’s spring round of forecasts paints an uncertain picture for the next two years due to inflation, geopolitical tensions and their impact on international trade, and financial turbulence following the crisis episode in regional banking in the United States and the collapse of Credit Suisse in Europe. The Fund’s experts forecast global growth of 2.8% in 2023, 0.6pp less than in 2022, and 3% for 2024. The slowdown would be particularly pronounced in the case of the eurozone, but the US economy would also show significant weakening, especially in the second half of the current fiscal year, due to tightening monetary policies.

The European Commission agrees on the outlook for weaker growth in Europe, although it also points to favorable factors, including lower energy prices, the good performance of the labor market and the strong recovery in tourism. As a result of this turnaround, Brussels has revised upwards its growth forecast for the eurozone to 1.1% in 2023 (0.3pp higher than in the last Panel) and to 1.6% in 2024 (0.1pp higher).

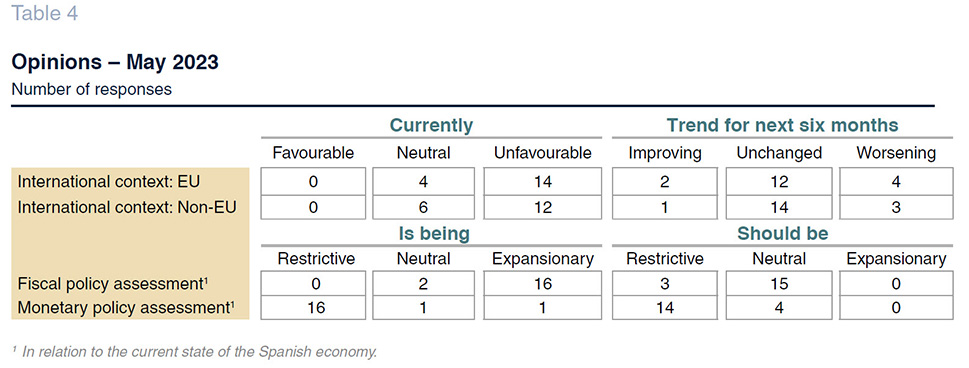

Nevertheless, the panelists’ assessment of the international environment remains largely unchanged. Most are of the opinion that the external environment remains unfavorable, both in Europe and beyond, anticipating little change in the coming months.

Monetary and credit tightening continues

Since March, the ECB has raised its main interest rates by 25 basis points, a slower pace since the start of the monetary turnaround almost a year ago and in line with the Federal Reserve’s policy. Moreover, Frankfurt is not committing to further tightening, making future decisions dependent on the evolution of inflation and the economy. However, according to its latest statement, the central bank will redeem all maturing bonds as of July under the APP purchase program with the expectation to accelerate the reduction of its balance sheet as part of its quantitative tightening policy.

On the other hand, the bank lending survey anticipates a contraction in new lending, mainly as a consequence of the interest rate hikes that have already been implemented. The current period of financial stress could also influence criteria for new lending.

In any case, analysts expect monetary policy to be tightened which should be reflected in short-term rates, although they also point to a slight easing in the second part of 2024. The ECB’s deposit facility would rise until the end of the year, to 3.75% according to most panelists, and would start a downward path beginning in the first quarter of next year.

On the other hand, few changes in market rates are anticipated in relation to the previous Panel. The one-year Euribor is expected to be close to 4% by the end of 2023, before falling to below 3.5% by the end of 2024. Spanish 10-year government bonds are expected to peak at 3.6% at the end of this year and then fall to 3.3% in the second half of 2024.

Euro appreciation against the dollar

The path of rate hikes is expected to last longer in Europe than in the U.S., so markets anticipate a narrower yield differential between the two sides of the Atlantic. In line with these expectations, analysts forecast an appreciation of the euro against the dollar in the coming months (Table 2), following a steeper slope than predicted in the last Panel.

* The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 18 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 18 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.