Cost of deposits and Euribor: Why this time is different

Deposit beta pass-through appears to be slower this time around relative to previous episodes of monetary tightening. While understanding the rate of pass-through requires a holistic examination of banks’ pricing strategies, ultimately competitive pressures will culminate in driving up deposit beta over time.

Abstract: More than one year after 12-month Euribor abandoned negative terrain, after rallying to levels not seen since before the financial crisis, the big dilemma facing the banks is at what pace and to what extent they should pass the increase in market rates on to their customers, embodied by the so-called ‘beta’ coefficient, by analogy with that used in the equity markets to measure share price sensitivity to the market index. So far, the percentage of the buildup in Euribor that gets passed through, or the deposit beta, in Spain is proving smaller than that being observed on the asset (lending) side of the business and in other European countries, drawing sharp attention from the media. Compared to past episodes of rate tightening in Spain, we are seeing a weaker/slower pass-through beta this time around, in particular in the case of term deposits. However, the loan pass-through beta is also lower by comparison with other periods on account of the intensity of the upward shift in the curve, the effect of rate repricing on the banks’ portfolios and the relatively higher weight of fixed-rate loans at present. In any event, any analysis of the current situation requires taking stock of the banks’ holistic pricing strategy as a function of their combined positioning in assets and liabilities, the make-up of their customer bases on both sides of the business and their transformation and capital cost structures. Nevertheless, sooner or later, competitive pressure is bound to drive an increase in the deposit beta.

Trend in Euribor and pass-through to the cost of assets and liabilities

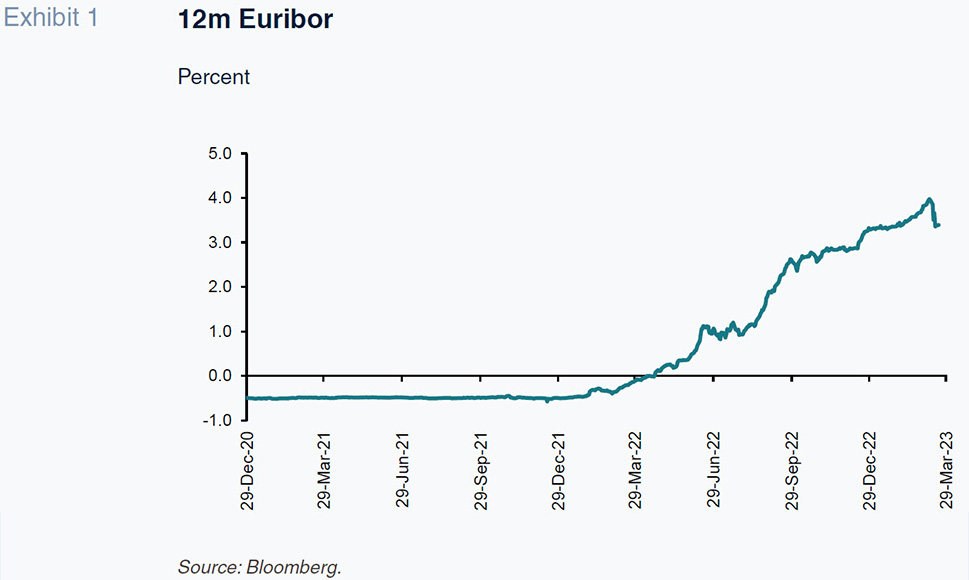

After more than five years trading at negative values, 12-month Euribor moved back into positive territory in early 2022, going on to climb significantly higher for the rest of last year and start of this year. That rally was truncated at the start of March due to the bouts of stress that overtook certain US banks and Credit Suisse, reminiscent of recent episodes of financial instability, forcing the central banks to intervene in a coordinated manner to supply liquidity and send clear messages regarding their willingness to ease or pause additional rate hikes.

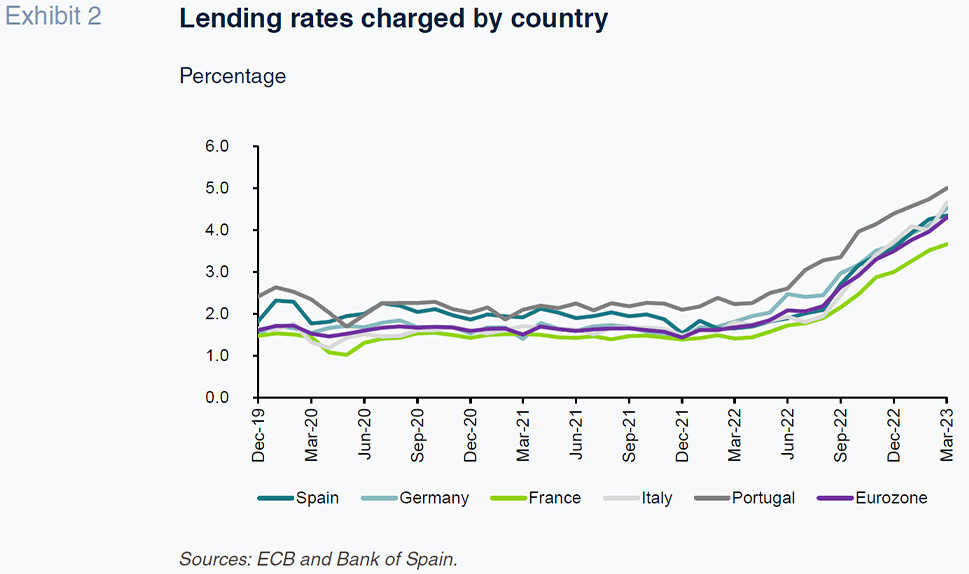

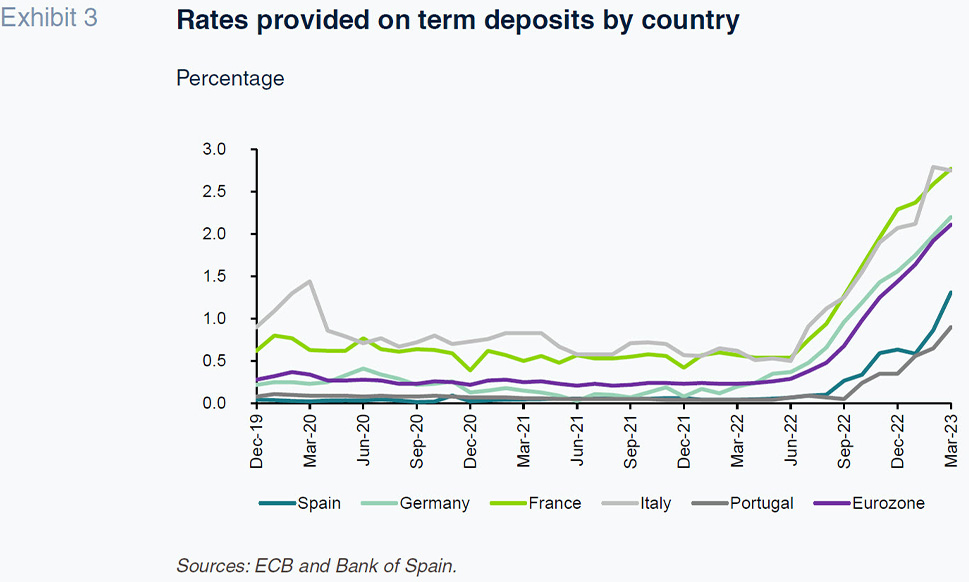

The upward movement in Euribor in 2022 has been passed on very differently on either side of the customer business– the banks have been more aggressive increasing the cost of their loans than the rates offered on their deposits. Moreover, that asymmetry between lending and deposit rates is far more pronounced in Spain and Portugal than in the other three major European markets (Germany, France and Italy), as illustrated in Exhibits 2 and 3.

The banks’ relative resistance to raising deposit rates in Spain and Portugal may be related with structural aspects in both countries, such as lower income levels, the existence of much smaller average deposit balances and less of a tradition in both countries of collecting fees and commissions for the provision of banking services, making deposits bigger contributors to their core revenues (NII + fee income).

Such pronounced and asymmetric differences in Spain are sparking media interest, fuelled further by the recent queues to buy Treasury bills in search of returns the banks have so far failed to provide. There is probably some correlation between that keenness to purchase Treasury bills offering an annual return of around 3% and the drop observed in bank deposits during the first few months of 2023, which was much more pronounced than in the same period of previous years.

That same search for returns in the absence of remuneration on deposits is likely behind the intense flow of capital into mutual funds since mid-2022, concentrated in fixed-income and guaranteed return funds. Net inflows into fixed-income funds in Spain to February 2023 were running at above €20 billion, with another almost €11 billion invested in guaranteed and targeted returns funds, marketed heavily by the banks themselves.

Asset and liability ‘betas’: Evidence from previous episodes of rate tightening

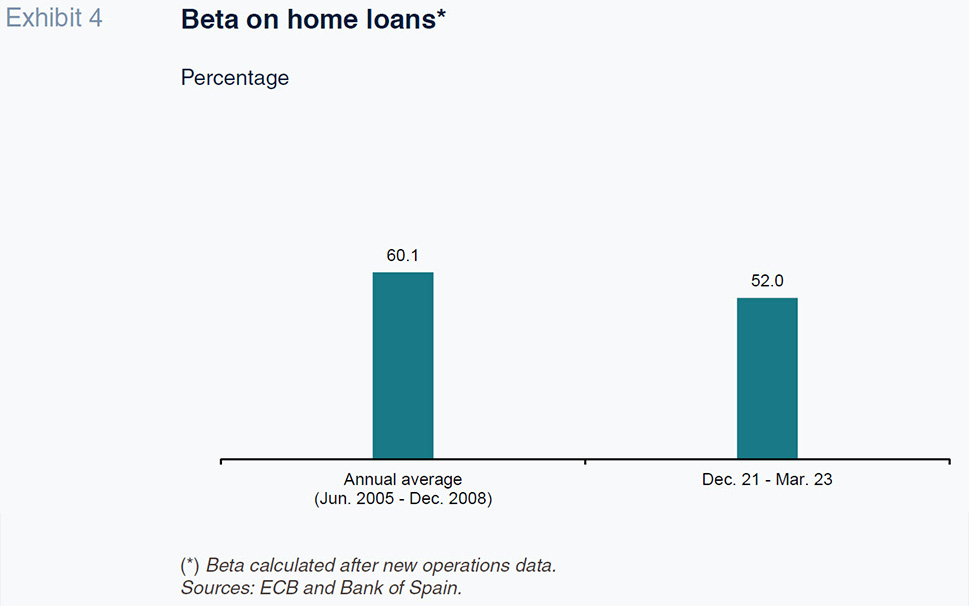

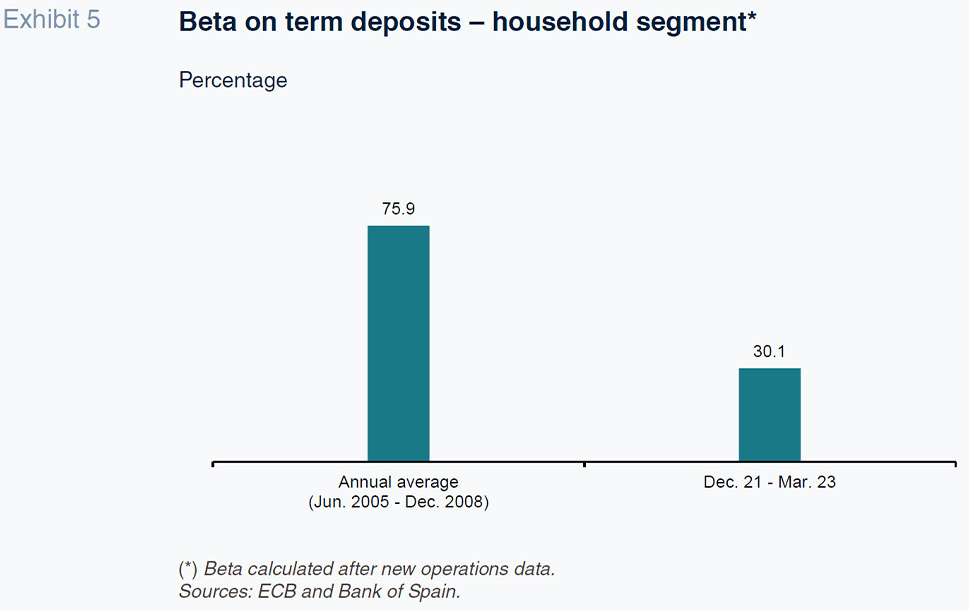

To address the banks’ dilemma from an analytical standpoint, we estimate the response or fit (the beta coefficient of the regression) in the two most important segments of the retail business – home loans on the asset side and household term deposits on the liability side – to the change in the key benchmark rate, namely 12-month Euribor.

Compared to the evidence for the last period of interest rate tightening, between June 2005 and December 2008, it seems clear that on this occasion, the beta is proving weaker and/or slower, particularly in the case of term deposits. The loan pass-through beta is also lower by comparison with other periods on account of the intensity of the upward shift in the curve, the effect of rate repricing on the banks’ portfolios and the relatively higher weight of fixed-rate loans at present.

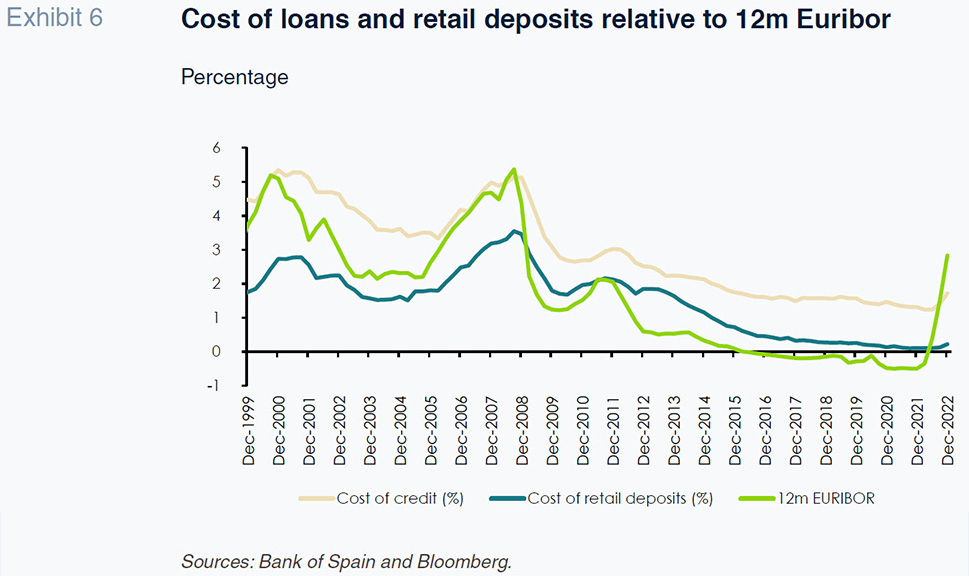

At any rate, as illustrated in Exhibit 6, the time lag between asset and liability repricing when benchmark rates go up and down has been a constant throughout the years. As that exhibit shows, the movements in the cost of loans and deposits are fairly parallel, translating into significant retail banking margin stability. When rates are on the rise, considering that loan portfolios are repriced, on average, every 12 months, that pattern of parallel movements reflects the need to wait for credit returns to price in the rate increases before the banks pass the increase on in the form of deposit costs. Likewise, when rates are falling, as returns on lending activity come under pressure, the reduction in rates gets passed onto customer deposits in order to compensate for that loss of income. The movements therefore reflect how the banks manage their margins and competitive positioning throughout cycles of rate tightening and easing, except when liquidity problems come into play, as happened in 2012. In those circumstances, which are certainly not the case today, liquidity management takes priority over margin management, with the banks offering better returns to deposit holders at the expense of higher margins.

Asset and liability betas: Why this time is different

This phenomenon, which we could label interest income sensitivity to rate increases, is the first factor explaining the fact that so far the banks have hardly raised the rates paid on retail deposits, the Spanish entities’ chief source of funding. They are waiting for credit returns to fully price in the new interest rate paradigm.

As for the factors that could be altering the traditional timing lag in deposit repricing, it is worth noting that the banks currently have far more liquidity than in the past in a context of weak demand for credit and still-high TLTRO III holdings. With respect to the latter, although the banks have repaid sizeable amounts of that interbank financing facility in recent months (the Spanish banks have repaid nearly 180 billion euros), they continue to hold 110 billion euros. A lot of that liquidity falls due mid-2023, three years after introduction of these targeted long-term refinancing operations, but some of the banks may not have to repay their holdings until well into 2024, depending on when they applied for the funds in the first place.

In addition to being awash with liquidity, the outlook for interest rates has been marked by volatility and uncertainty in recent months. Rates and the slope have increased sharply. However, as the ECB itself has reiterated over and over, there is a strong sense that tightening could prove transitory, as borne out by market expectations, with market rates correcting substantially in March when trouble hit certain banks in the US and Switzerland.

In a context such as this, with sight deposit volumes so high, faster pass-through of rate increases to term deposits could prove very harmful if the rate rally were to revert.

At any rate, that sizeable pool of sight deposits needs to be analysed together with the level of concentration at each entity, as that is key to determining the sensitivity of retail funding to rate increases. At banks whose sight deposits are less concentrated, it is likely that pressure from customers (transactional customers, above all) to earn more on their savings will be lower than at banks where those balances are concentrated among fewer customers, who could exert more pressure, making it harder for those banks to keep deposit rates low.

Elsewhere, it is reasonable to assume that households in lower income brackets will be motivated to earmark some of their deposits to prepayment of their loans. Indeed, that is why it is so important to manage liability and asset rates holistically in the household segment given the pressure being felt by borrowers in the wake of rate increases, particularly by borrowers who are more financially vulnerable (measured as the relationship between their loan service costs and net disposable income) and/or economically vulnerable (individuals or businesses particularly exposed to sectors of the economy that are more vulnerable in the current climate), generating uncertainty around the future of loan performance in the sector.

Although many of the banks have adhered to the government’s Code of Good Practices in mortgage lending, the number of mortgage holders applying for the relief it offers has been small. Nevertheless, irrespective of the workings of that Code, the banks have taken on board the concern manifested by the government in formulating it, evidencing their willingness to renegotiate loan terms and conditions, renouncing some of their upside on the lending side of the business, in order to manage another key factor, which is none other than the sensitivity of loan quality to interest rates, in order to manage customer relationships and loyalty to the entity, preventing their departure in a market which remains competitive on the asset side.

Other elements of the banks’ income statements are sensitive to the new context of higher inflation and interest rates and likewise reduce their ability to pass rate increases through to deposit costs, in other words, earnings sensitivity to interest rates. Here it is worth highlighting the impact of inflation on transformation costs and the possibility that an increase in loan non-performance could translate into higher credit impairment losses. It is also worth highlighting potential adverse impacts on income statements at a time of rising costs of capital due to the increase in both the risk-free rate and the risk premium (on the back of the potential deterioration of asset quality).

In short, all these factors have helped make the banks particularly cautious to date in passing higher benchmark rates through to deposit costs. Some banks could consider using some of the slack around their low funding costs as a buffer for the provision of some servicing relief to vulnerable borrowers, so curbing any increase in non-performance.

That linkage between asset and liability rates is nuanced by differing levels of exposure to and composition of customers on both sides of the business from one entity to the next, such that the most appropriate response will be entity-specific. Nevertheless, sooner or later, competitive pressure is bound to drive an increase in the percentage of the buildup in Euribor that gets passed through to deposit rates (deposit beta).

References

BANK OF SPAIN. (2023). Financial Stability Report. Spring 2023.

HERNÁNDEZ DE COS, P. (2023). Situación del sector bancario en España [State of play in the Spanish bank sector]. Third edition of the Finance Observatory organised by El Español – Invertia (7 March 2023).

Marta Alberni, Ángel Berges and María Rodríguez. Afi