The European Central Bank’s supervisory priorities

The shift in the macroeconomic environment facing the financial sector and the attendant switch in monetary policy tack, together with the recent episodes of financial turbulence in a number of markets, have strengthened the European Central Bank’s resolve to reinforce the resilience of the European banking system. Despite the current environment’s risks, through an assessment of the ECB’s supervisory priorities, recent findings support the strength and adaptability of the European banking sector, so mitigating the probability of future episodes of financial turbulence, such as those observed in other regions.

Abstract: Compared to the recent episodes of financial instability in the US and Switzerland, where several banks suffered structural balance sheet issues forcing their intervention and/or acquisition by other banks, the European banks’ earnings and capital structures look relatively strong. Without question, this is largely thanks to the intense regulatory and supervisory activity undertaken by the European authorities focused on avoiding episodes of stress similar to those observed in other geographies. Nevertheless, recent developments have highlighted the need for banks’ business models to focus on risk-adjusted returns, with high interest rates favouring the maturity transformation business. Elsewhere, the banks will inevitably have to address regulatory changes related to liquidity buffers, as recent events have shown these may potentially mask underlying issues. Lastly, going forward, the focus should be on strengthening the banks’ capital and liquidity self-assessments, as this will help improve dialogue with supervisory authorities, while at the same time demonstrating the viability of their business models, hence underpinning stable performance of business activities and the correct functioning of credit channels.

Foreword

The turbulence sustained in the financial system in the early months of 2023, concentrated in the US regional banks and the Swiss banking system, further highlights the need to prioritise bank oversight measures. However, in contrast to earlier episodes of banking instability, the recent events were shaped by the change in the macroeconomic setting, on the one hand, and the shift in monetary policy direction, on the other, marked by the elimination of the main unconventional measures (specifically, the ECB’s TLTROs, PSPP, etc.) and a rapid rise in interest rates in response to more persistent inflation than initially expected (Lagarde, 2023).

These shocks are being felt most keenly by businesses and households. The business sector has sustained an earnings shock as a result, mainly, of global supply chain bottlenecks, growth in raw material costs and higher energy costs, all of which accompanied by increased leverage as a result of the economic policies deployed to tackle the pandemic [1] (Blanco et al., 2021; Blanco and Mayordomo, 2023), leaving some firms very vulnerable to the increase in interest rates. As for the household sector, the build-up in savings during the pandemic and recent quarters, coupled with the growth in household wealth and deleveraging, has cushioned the impact of inflation and higher borrowing costs (Bank of Spain, 2023), albeit not preventing an increase in financial vulnerability. As a result, the supervisor has urged the banks to prudently plan and set aside provisions and capital (Bank of Spain, 2023b).

In addition to the outlook for household and business finances, the financial markets and specifically the trend in interest rates constitutes another source of risk for the banks. Concern is currently focused on fixed-income asset valuations (particularly sovereign bond holdings), as the banks have built up significant exposure to this asset class (whose value varies inversely with interest rates) in recent years to offset the drop in demand for bank credit and the fallout from higher savings rates.

Another prime source of concern for the supervisors is bank balance sheet stability in the face of structural change in their composition. In the past, and particularly before the pandemic, the trend in the interest rate curve [2] increased the banks’ risk tolerance for investments (retail and wholesale) at fixed rates in order to generate reasonable returns.

The problems, from the standpoint of financial stability, emerged when macroeconomic conditions changed, intensely and briskly, and the central banks switched – suddenly – to monetary policy normalisation. When all this happened, the banks that were significantly exposed to assets bearing fixed rates (structural or balance sheet risk) were able to hold them so long as they were not significantly concentrated and there was no financial turbulence requiring their recognition at market value (recognising losses). However, the rapid withdrawal of deposits due to the existence of these very risks at certain institutions required some banks, particularly in the US, to restate their assets to market value all of a sudden. It is worth noting the contrast with the European banks whose business models are more oriented around retail banking, and which present more diversified and granular sources of financing, as well as being subject to specific interest rate and liquidity risk regulations binding upon all financial institutions irrespective of their size, significantly curtailing the accumulation of these structural risks.

The risk factor scenario described in this section, coupled with the warning shots fired by the bank runs observed in the American and Swiss banking systems, has affected macro-financial and financial stability supervisory priorities, as outlined next.

Supervisory priorities: Strengthening the banks’ resilience to immediate macro-financial and geopolitical shocks

The ECB’s supervisory division, known as the single supervisory mechanism, or the SSM, fine-tunes the supervisory priorities for the European banking system annually on the basis of the results of the stress tests and supervisory reviews. Specifically, it establishes a map of priorities which is reviewed annually, framed by a medium-term horizon, in this instance 2023-2025.

In its most recent review, the ECB pinpointed a large volume of latent risks for the banks triggered by the prevailing geopolitical and macroeconomic situation, risks the SSM will concentrate on for the 2023-25 cycle. The risks associated with the geopolitical and macroeconomic situation have been classified as priority 1 within the three main risks flagged by the supervisor for this cycle. The other two supervisory priorities are: (2) addressing digitalisation effectively and strengthening management bodies’ steering capabilities; and, (3) stepping up efforts to address climate change.

“Due to the impact it is having on financial stability in other geographies, we believe it is key – and timely – to focus our analysis on priority 1.” As indicated by the SSM in its recent publication (ECB, 2023a), it is “(…) essential for supervisors to keep monitoring and reviewing the adequacy and soundness of banks’ provisioning practices and capital positions as well as projections and distribution plans as part of their regular supervisory activities”. This includes the assessment of banks’ paths towards compliance with the minimum requirement for own funds and eligible liabilities (MREL)...”.

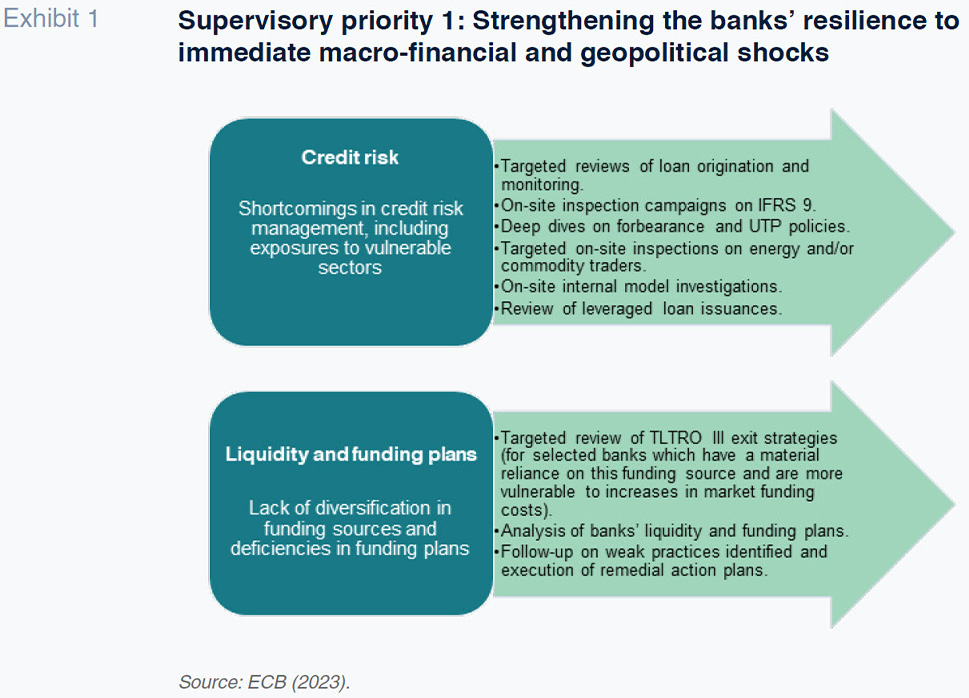

As part of its ongoing work procedures, the SSM detects the main vulnerabilities of supervised banks, as depicted in Exhibit 1.

Among the vulnerabilities identified, the supervisor has stressed the need to strengthen the credit risk management cycle, a supervisory activity initiated since the outbreak of the pandemic. Although non-performance has not trended upwards in the wake of the shifts identified earlier, the trend in the environment in recent quarters, particularly in the transformation of maturities, has highlighted a series of risks evidencing the need for the banks to step up managerial oversight in order to assess and anticipate credit risk on exposures to vulnerable sectors. The supervisor is specifically concerned about the real estate sector and the financial systems more exposed to floating-rate mortgages (Muellbauer, 2022), since, following a period of negative interest rates, the probability of underestimating repayment capabilities has increased.

The gradual remediation of the vulnerabilities identified should result in better classification of distressed borrowers, as well as adequate implementation of the provisioning practices stipulated in current regulations.

As a result, the SSM has established a series of supervisory activities designed to deliver its medium-term targets, while transparency is considered key to enabling the system to move towards self-regulation.

Elsewhere, in relation to liquidity risk, the supervisor has flagged a high concentration of funding sources, to which end it has asked the banks to draw up and execute sound multi-year funding plans, taking into account challenges stemming from changing funding conditions.

Although the supervised institutions reported comfortable liquidity coverage ratios (LCRs) and net stable funding ratios (NSFRs), some banks have increased their central bank funding, mainly via the ECB’s targeted longer-term refinancing operations (TLTROs), the unconventional facilities designed to inject liquidity into the financial system to stimulate bank lending, so downscaling their market-based funding and reducing funding diversification. The expected repayments or prepayments (at the time of writing the first and main prepayment window had lapsed on 28 June 2023, with the European banks cancelling 29.46 billion euros) will require the banks to diversify their funding sources and replace part of their central bank funding. Nevertheless, the system loan-to-deposit statistics do not point to funding pressure.

The supervisor has similarly announced a series of activities designed to remedy the vulnerabilities identified which are mainly focused on analysing the banks’ liquidity and funding plans and fostering funding source diversification.

Data-driven assessment of the European financial system’s potential sources of instability

In this section, based on the data gleaned from the results of SREP 2022 (ECB, 2023b), we attempt to dive deeper into the health of the European banks in order verify whether the system is effectively exposed to the above-listed risks.

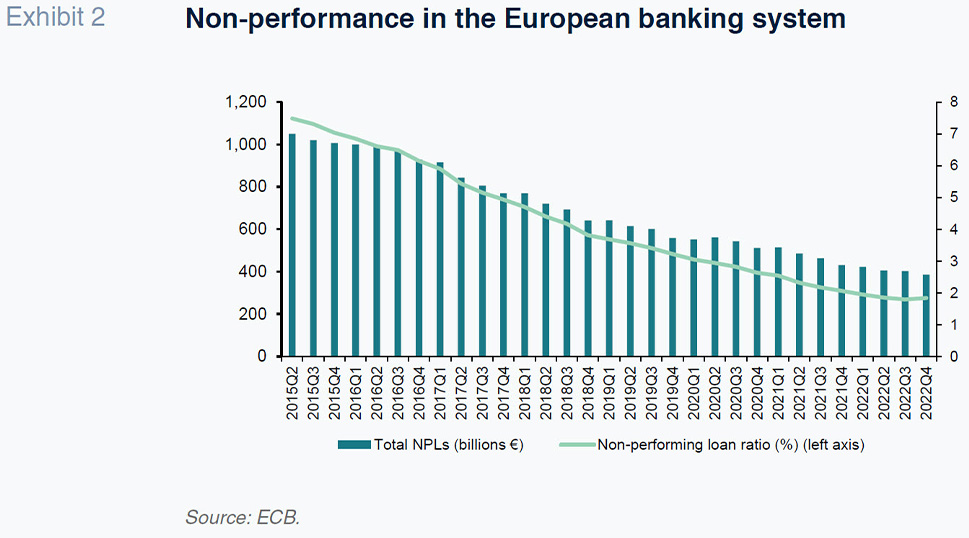

The first step in assessing the European banks’ performance around credit risk is to analyse the trend in non-performance. Exhibit 2 illustrates a downward trend in the non-performing loan ratio in both absolute and relative terms in recent years. The European banks have therefore demonstrated their ability to digest non-performing assets, which have decreased by over half of the NPL stock existing in 2015, evidencing a significant net annual decline, even during the height of the pandemic crisis, as shown in the ECB’s most recent financial stability report (ECB, 2023c).

The data therefore suggest that credit risk has not materialised to a significant degree. More important, however, is to assess the volume of assets showing potential signs of future impairment. The ECB’s most recent report talks of latent risk via stage 2 exposures, namely those presenting a significant increase in credit risk without becoming non-performing. Stage 2 exposures have been increasing since 2018, mainly in the corporate segment but also in the household segment. As already noted, this increase is mainly related with the increase in costs derived from the current bout of inflation and sharp increase in interest rates, which is hitting companies that are highly leveraged (a situation exacerbated by the pandemic) particularly hard. This has prompted the SSM to set reinforced management of the credit risk cycle as one of its top, if not the top, supervisory priorities, so that the banks anticipate these risks and quantify and classify them in order to get an accurate picture of the risks lingering on their balance sheets.

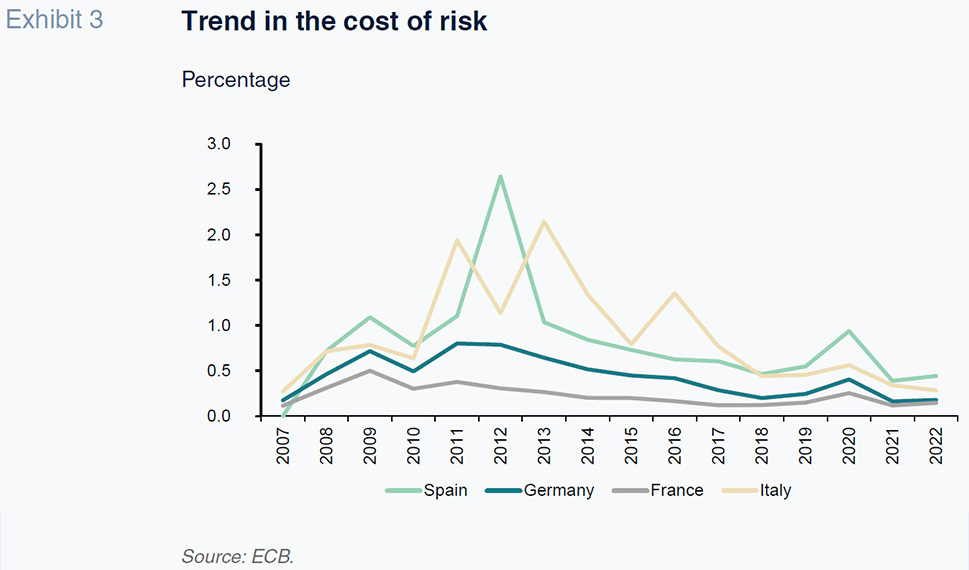

The first step to this end is to assess the banks’ first line of defence, which is their very business model. In other words, the sustainability of their models in terms of accommodating the need for new provisions as a result of a significant increase in credit risk. In order to get a clearer picture of this risk, Exhibit 3 shows the trend in the cost of risk, defined as annual NPL provisions over total assets. Here we paint an aggregate picture for the main eurozone countries, illustrating the impact of provisions on earnings over time, particularly during the financial crisis of 2008 and the subsequent sovereign debt crisis in the eurozone.

The data provided reveal an average cost of risk between 2008 and 2014 of 1.17% of average total assets (ATAs) in Spain, compared to 0.63% in Germany, 0.32% in France and 1.24% in Italy.

As for liquidity risk, the ratios reported by the European banks on aggregate are adequate and sufficient, specifically an LCR of approximately 160% in 2022, with no major differences between the major banking systems, and an NSFR of around 120%.

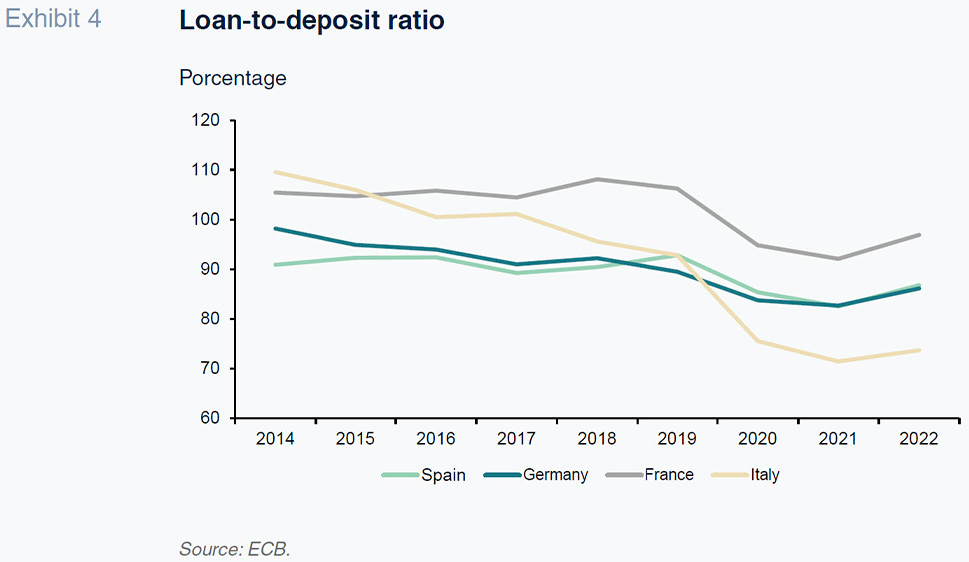

Analysing the various banking systems’ funding strategies, measured using the loan-to-deposit ratio, reveals that the banks have been replacing market funding with retail deposits, as shown in Exhibit 4, particularly in the wake of the COVID-19 period when household savings increased sharply (and faster than lending activity).

Turning to the funding obtained via the TLTROs, its repayment has not generated to date, significant financial market issues. Proof of the scant tension prompted by the repayment process is the lack of stress in the short-term refinancing (repo) and interbank market rates.

As a result, in light of the data analysed, it can be said that, from an aggregate standpoint, the European banking system is not showing signs of potential liquidity or funding issues, with banks adapting their sources of funding naturally to the change in monetary policy, as is evident in the repayment of the TLTRO III funds.

Conclusion

There is no doubt that the current environment poses a challenge for the economic agents, the banking system being no exception. In light of the risks to which the banking system is exposed, this paper attempts to put the European banking system’s current situation into context against the backdrop of the ECB’s number-one macroprudential risk oversight priority – strengthening banks’ resilience to macro-financial and geopolitical shocks. Compared to the recent episodes of financial instability in the US and Switzerland, where several banks suffered structural balance sheet issues forcing their intervention and/or acquisition by other banks, the European banks’ earnings and capital structures look relatively strong. Without question, this is largely thanks to the intense regulatory and supervisory activity undertaken by the European authorities focused on avoiding episodes similar to those observed in other geographies.

Nevertheless, recent developments have highlighted the need for the banks to continue to work to articulate their business model development around a clear-cut focus on risk-adjusted returns, with high interest rates favouring the maturity transformation business.

Elsewhere, the banks will inevitably have to address changes in LCR and NSFR regulations. Indeed, recent events have proven that those metrics, despite the banks reporting sufficient liquidity buffers, fail to reflect concentration across the various funding sources, potentially masking underlying issues.

Lastly, going forward, the focus should be on strengthening the banks’ capital and liquidity self-assessments (ICAAP and ILAAP, respectively), as this will help improve dialogue with the supervisor, all the more so in light of the looming regulatory changes around the liquidity metrics, while demonstrating that the banks’ business models are viable and sustainable over time with respect to different stress scenarios and proving that there are no issues around capital planning that could prevent the ordinary performance of their business activities and the correct functioning of credit channels. To that end, the ECB’s recently published supervisory bulletin included a new risk appetite framework (RAF) designed to facilitate a tighter focus on the supervisory priorities so as to translate into greater flexibility on the part of the supervisory authorities by assigning greater priority to the most relevant risks emerging from its various successive assessments.

Notes

The state-guaranteed loans provided through the ICO have played a significant role in increased indebtedness.

Prior to the pandemic, Euribor was trading in negative terrain and the swap markets were discounting rates staying at around 0% for the next 10 years, creating the impression that rates would stay ultra-low for the foreseeable future.

References

BANK OF SPAIN. (2023).

Report on the Financial Situation of Households and Firms. First half of 2023.

BANK OF SPAIN. (2023).

Financial Stability Report. Spring 2023.

BLANCO, R. and MAYORDOMO, S. (2023). Evidencia sobre el alcance de los programas de garantías públicas y de ayudas directas a las empresas españolas implementados durante la crisis del COVID-19 [Evidence regarding the scope of the public guarantee and direct aid schemes provided to Spanish firms during the COVID-19 crisis].

Occasional Papers, 2317. Bank of Spain.

BLANCO, R., MAYORDOMO, S., MENÉNDEZ, A. and MULINO, M. (2021). Impact of the COVID-19 crisis on Spanish firms’ financial vulnerability.

Occasional Papers, 2119. Bank of Spain.

ECB, EUROPEAN CENTRAL BANK. (2023a). Supervisory priorities and assessment of risks and vulnerabilities.

https://www.bankingsupervision.europa.eu/

banking/priorities/html/ssm.supervisory_priorities202212~3a1e609cf8.en.htmlECB, EUROPEAN CENTRAL BANK. (2023b). Aggregated results of SREP 2022.

https://www.bankingsupervision.europa.eu/

banking/srep/2023/html/ssm.srep202302_aggregateresults2023.en.htmlECB, EUROPEAN CENTRAL BANK. (2023c).

Financial Stability Review. May 2023.

ECB, EUROPEAN CENTRAL BANK. (2023). Supervision Newsletter. August 2023.

LAGARDE, C. (2023). Breaking the persistence of inflation. Speech by Christine Lagarde, President of the ECB, at the ECB Forum on Central Banking 2023 on

Macroeconomic stabilisation in a volatile inflation environment in Sintra, Portugal. Sintra, 27 June 2023.

SALAS, J. (2022). Real Estate Booms and Busts: Implications for Monetary and Macroprudential Policy in Europe.

ECB Forum on Central Banking, 27-29 June 2022.

Diego Aires. Madrid´s Carlos III University

Antonio Mota. Madrid´s Autónoma University

Fernando Rojas. Madrid´s Carlos III University and Madrid´s Autónoma University

Francisco del Olmo. Alcalá University and IAES