Allocation of NGEU funds in Spain: Companies and sectors

As of December 2022, Spain was not even at the halfway mark as regards allocation of the non-reimbursable component of funds awarded under Next Generation EU (NGEU), as tenders and grants (35.83 billion euros), reached 43.7% of the total assigned to Spain by this point. Given that Spain has until August 2026 to implement the funds, the country will need to accelerate implementation, all the more so considering the additional funds awarded under the June 2023 Addendum.

Abstract: By the end of 2022, Spain had called tenders and grants for 43.7% of the Next Generation EU (NGEU) funds allocated thus far. If we compare the volume of calls (35.83 billion euros) with the amount awarded as of year-end (16.35 billion euros), we arrive at an implementation rate of 45.6%, with more than half of the volume called yet to be allocated. Of the volume already awarded, almost three-quarters (73.4%), or 12 billion euros, have gone to the business community. Of the aid awarded to Spanish businesses, more than half has gone to large enterprises (59.3% of total), with SMEs receiving 40.7%. By sector, the services sector has been the biggest beneficiary so far (46.9% of the total), followed closely by construction (41.6%). Within services, the information and communication sector (15.4% of the total) and wholesale and retail trade (12.1%) have been the biggest recipients. In manufacturing, a noteworthy 3.6% of the aid has gone to the automotive sector. Under the current scenario, Spain will have to accelerate the implementation process if it is to use the rest of its non-reimbursable funds by the August 2026 deadline.

Foreword

Spain has been assigned 173.67 billion euros of NGEU funds under the Recovery and Resilience Facility (RRF) and the Recovery Assistance for Cohesion and the Territories of Europe (the REACT-EU funds, created to tackle the fallout from the pandemic), of which 89.67 billion euros are non-reimbursable transfers. Of the latter figure, 81.96 billion euros were assigned initially and a further 7.71 billion euros were allocated as part of a subsequent Addendum approved in June 2023. If we add in the allocation under the REPowerEU Plan, which is also part of the Addendum (2.6 billion euros), the total volume of funds available for award for investment reaches 176.26 billion euros, of which 92.26 billion are non-reimbursable and the remaining 84 billion euros are loans.

These funds are being implemented across the various levels of government in Spain by means of three instruments: the grants and tenders called by the state; transfers to the regional and local authorities, and the so-called Strategic Economic Recovery and Transformation Plans (PERTEs for their acronym in Spanish), modelled after the Important Projects of Common European Interest concept (IPCEIs).

The investments eligible for funding from NGEU funds in Spain are set out in the Recovery, Transformation and Resilience Plan submitted by the Spanish government to the European authorities. That plan is structured around the six pillars established by the European Union: 1) green transition; 2) digital transformation; 3) smart, sustainable and inclusive growth including economic cohesion, jobs, productivity, competitiveness, research, development and innovation and a well-functioning internal market with strong SMEs; 4) social and territorial cohesion in the Union; 5) health, economic, social and institutional resilience with the aim of increased crisis preparedness and response capacity; and, 6) policies for the next generation, children and youth such as education and skills.

The Spanish government has a dedicated website for reporting on its progress, where it provides implementation update reports, the third of which was published in February 2023. However, those reports do not provide information about matters of interest such as the level of fund execution (percentage awarded with respect to amount called), fund destination by sector and the types of companies the funds are benefitting. That is the goal of this paper: to quantify the volume of NGEU funds that have actually flowed to the real economy (i.e., called and awarded via tenders and grants), ring-fence those that have reached the business community and within the latter arrive at a breakdown by sector of activity and type of firm.

To achieve this objective, we start from the list of tenders and grants published on the government’s official Recovery and Resilience Plan website, complemented by information taken from the public sector contracting platform (in the case of tenders) and the national grant database. Our analysis runs as far as the end of 2022, so that the benchmark figure are the funds that had been allocated to Spain by that cutoff (81.96 billion euros of non-reimbursable transfers).

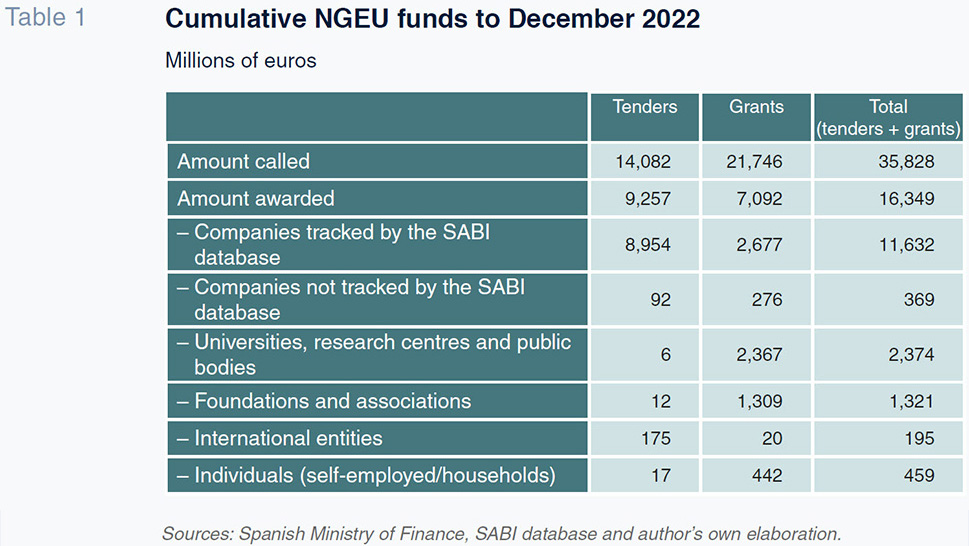

Quantification of the NGEU funds reaching Spanish companies

In the case of funding via tenders, we have identified 10,604 tenders totalling 14.08 billion euros financed using NGEU funds. As for grants, we have pinpointed 1,936 calls for a total of 21.75 billion euros. In order to avoid double counting within the grants, we then flagged and eliminated those that were called by the state for earmarking to other public bodies for the purpose of organising new calls and which, therefore, have been accounted for via this latter channel. In total, by year-end 2022, the volume of NGEU-funded calls amounted to 35.83 billion euros. That is 43.7% of the total assigned to Spain as of that date.

However, a significant portion of the called funds had not reached the real economy as the amount actually awarded is much lower, particularly in the case of the grants. That is because there are some calls for which the proposals submitted remain under evaluation and others that have been published for which the deadline for presenting bids has not elapsed. As a result, the amount actually awarded stands at 16.35 billion euros, implying an implementation rate of 45.6%.

Of the amount allocated, it is possible to identify the contractors (tenders) and beneficiaries (grants). There are several classes of recipients: companies; universities, research centres and public bodies; foundations and associations; international entities; and, individuals (including self-employed persons and households).

In the case of the recipient firms, we can cross the information from the tender and grant databases with the SABI database, so long as we have the company’s tax ID number, and it is included in the database. This firm-level database is fed by information from the Companies Register and does not include all of the companies that are obliged to file their financial statements. As a result, we can monitor the NGEU funds reaching the universe of companies tracked in SABI, which excludes the self-employed. Of the 16.35 billion euros of NGEU funding effectively awarded, 12 billion euros has gone to the business sector. It is possible to track 97% of those funds as the SABI database provides information about the size of the companies (revenue and employees) and business sector (NAVE code). In sum, the funds that had reached Spanish companies by December 2022 that we can analyse represent 71% of all funds allocated (Table 1).

What type of companies are receiving the NGEU funds?

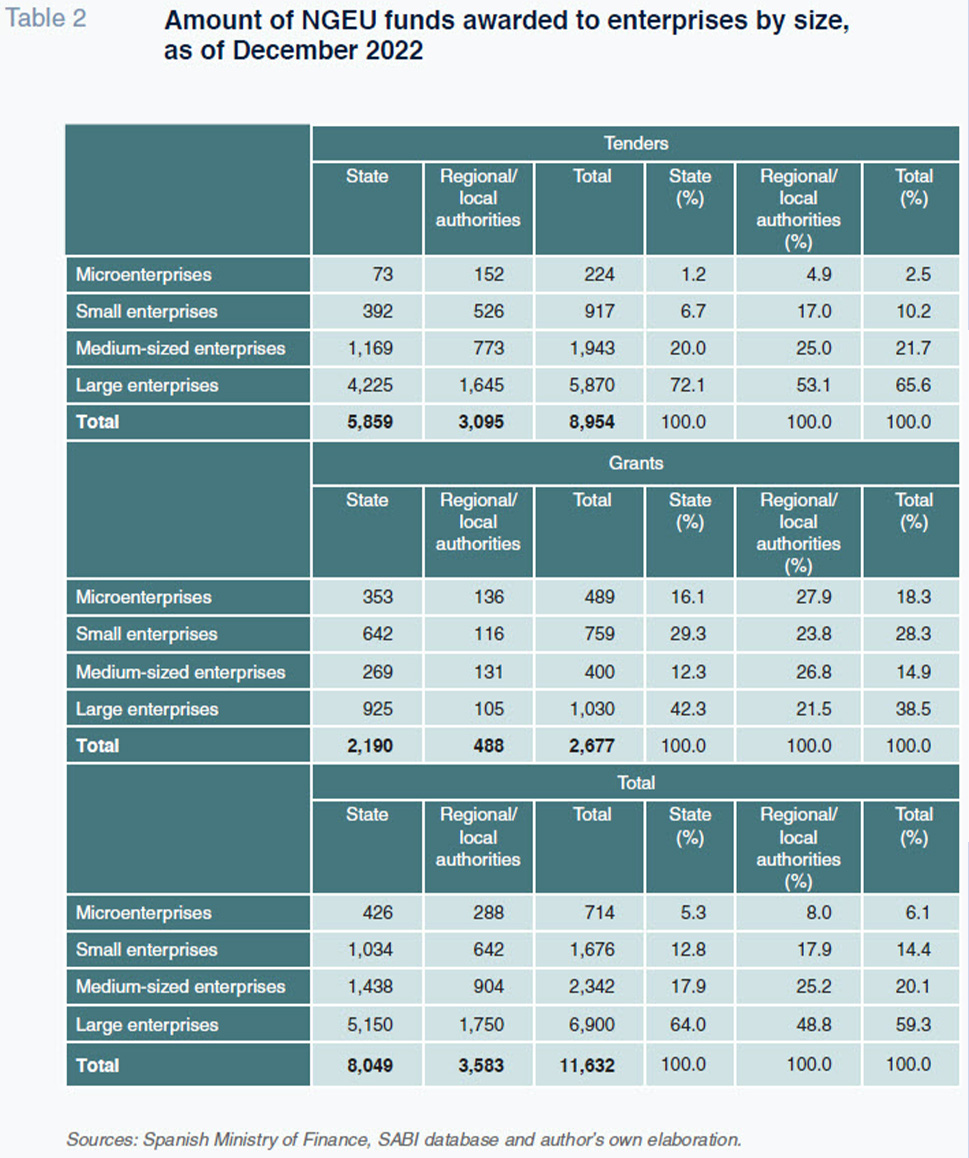

As noted earlier, having pinpointed in the SABI database the firms that have received NGEU funds via grants or tenders, we have access to information about each company’s size (annual turnover and headcounts), so allowing us to classify them into four categories, in keeping with Commission Recommendation 2003/361/EC: 1) microenterprises, which employ fewer than 10 persons and whose annual turnover and/or annual balance sheet total does not exceed 2 million euros; 2) small enterprises, which employ fewer than 50 persons and whose annual turnover and/or annual balance sheet total does not exceed 10 million euros; 3) medium-sized enterprises, which employ fewer than 250 persons and whose annual turnover does not exceed 50 million euros and/or whose annual balance sheet total does not exceed 43 million euros; and, 4) large enterprises, which are the firms that do not fall into any of the previous categories.

As shown in Table 2, of the total funds awarded to the business community, large enterprises have received the largest share, specifically 59.3% (6.9 billion euros). The next biggest share has gone to medium-sized enterprises (20.1% | 2.34 billion euros), followed by small enterprises (14.4% | 1.68 billion euros) and microenterprises (6.1% | 714 million euros). That means that out of every 100 euros of aid awarded to Spanish companies, 40.7% has gone to SMEs, with the large corporations benefitting more.

This breakdown by company size varies depending on the tendering/granting body. In the case of aid provided by the state, the percentage reaching large enterprises is even higher, at 64% of the total. On the other hand, a lower 48.8% of the aid extended by the regional and local authorities has gone to the bigger companies. The reason lies with the tender component, as the larger firms participate in the state-run calls to a greater degree. Indeed, large enterprises account for almost three-quarters of the funding awarded against the NGEU funds (72.1%), with just 1.2% and 6.7% going to micro and small enterprises, respectively. In the case of grants, on the other hand, the large enterprises’ share falls sharply, especially in those awarded at the regional and local levels, where their share drops to 21.5%, for a far more even distribution across the various company sizes.

Fund destination by sector

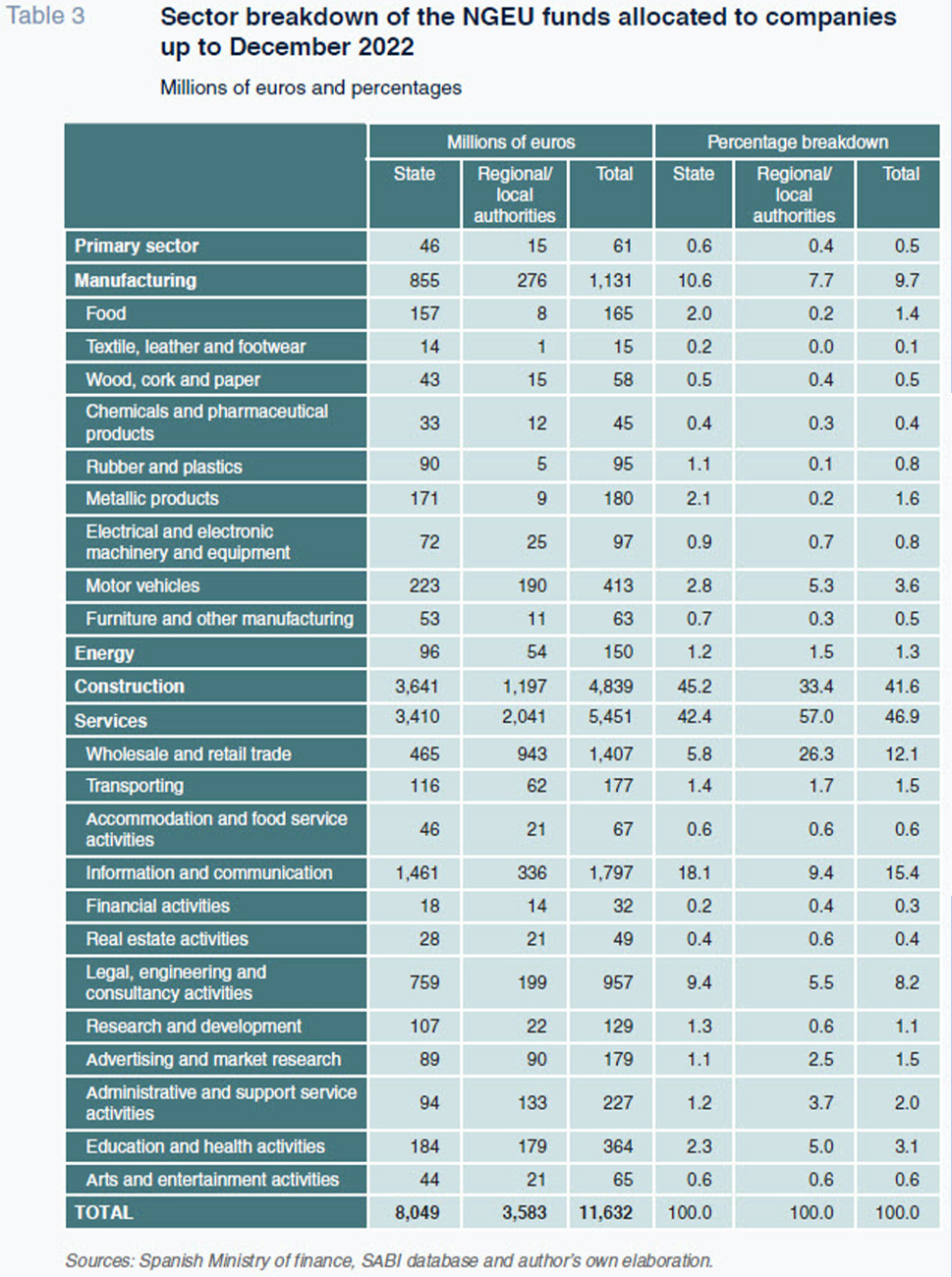

Based on the business sectors reported by the various companies (via NACE codes), we note that the services sector has received the biggest share, specifically 46.9% of the total (5.45 billion euros), followed very closely by construction (41.6% | 4.84 billion euros). Lagging significantly behind is manufacturing (9.7% | 1.13 billion euros), with the energy (1.3% | 150 million euros) and primary sectors (0.5% | 60.9 million euros) garnering negligible amounts.

In the construction sector, of the 4.84 billion euros allocated, 96% was awarded via public tenders. Of those, it is worth highlighting those called by ADIF (42% of all funds awarded to businesses from the construction sector) for the construction of rail infrastructure.

If we dive deeper into the data, we see that within services, information and communication services stand out, garnering 15.4% of all funds awarded in Spain (1.8 billion euros). Within this category, a noteworthy sum has been devoted to government digitalisation which has taken the form of digital broadband infrastructure and aid for R&D projects in artificial intelligence and digital technology. Close behind is the wholesale and retail trade (12.1% | 1.41 billion euros) and legal, engineering and consultancy services (8.2% | 957 million euros). Within trade it is worth highlighting the purchase of electric buses and high-tech health equipment from specialist firms. Within manufacturing, the area to have benefitted the most from the NGEU funds is the automotive industry (3.6% | 413 million euros), with more than twice the aid received by the next biggest recipients, the metallic products (1.6% | 180 million euros) and food (1.4% | 165 million euros) sectors.

If we look at the sector breakdown by tenderer, the key difference is the greater share of the aid awarded by the regional and local authorities commanded by wholesale and retail trade, at a little over a quarter of the total. On the other hand, the share garnered by the information and communication sector is much higher in state-run awards.

Implications

Our analysis of the NGEU funds awarded up until December 2022 shows that Spain is not even at the halfway mark yet as the calls made, between tenders and grants (35.83 billion euros), represent 43.7% of the total assigned to Spain by then. Spain has until August 2026 to implement the funds, which means it still has to invest over half of its total allocation (the non-reimbursable amount) in the roughly three years left to go.

As of December 2022, the implementation rate stood at 46%, as over half of the total called had still to be awarded, piling more pressure on getting all the NGEU funds flowing to the real economy before August 2026. Spain needs to accelerate implementation, all the more so considering the additional funds awarded under the June 2023 Addendum (10.29 billion euros via the RRF and new REPowerEU Plan).

Of the total already awarded, almost three quarters (12 billion euros | 73.4%) has flowed to the business community. Large enterprises have garnered the biggest share of funds, specifically 59.3% of the total, with 40.7% going to SMEs. The services sector has been the biggest beneficiary so far (46.9% of the total), slightly outstripping construction (41.6%). Manufacturing (9.7%), energy (1.3%) and the primary sector (0.5%) have benefitted less from the NGEU funds. Within services, the information and communication sector (15.4% of the total) and wholesale and retail trade (12.1%) have received the most aid. In manufacturing, a noteworthy 3.6% of the aid has gone to the automotive sector.

References

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF