Spanish employment data in 2022: Resilience in the context of a conundrum

The recent trends in the Spanish labour market have been seemingly positive, insofar as employment is already above pre-pandemic levels and continued to grow in 2022 despite the complex environment. Nevertheless, on the whole, Spanish labour market data remain mixed, impeding a clear picture of its possible structural changes.

Abstract: The recent performance of the Spanish labour market has been favourable as regards employment (in both Labour Force Survey - LFS - and contributor terms), which has already surpassed pre-pandemic levels and continued to grow in 2022 despite a challenging economic and geopolitical context. The reduction in temporary contracts since the passage of the most recent labour reforms is another positive development. Indeed, the incidence of temporary workers in total contributors stood at 15% (the lowest level in the historical series) by the end of 2022, compared to 27% in previous years, evidencing the favourable impact of labour reforms in terms of job quality. However, the rationale behind the evolution of some labour market data remains uncertain and the performance of other indicators remains mixed, complicating a straightforward interpretation. Firstly, it is not clear why Social Security contributor growth has been so intense, outpacing both GDP and LFS employment growth. Part of the explanation could be attributable to the formalisation of the informal economy, a testament to labour market resilience in the context of extreme economic uncertainty. Lastly, despite some of these favourable trends, there was a sharp drop in actual hours worked per job holder, in line with the trend across the eurozone, adding to the mixed picture. Given the somewhat ambiguous nature of recent trends, it may simply be too early to come to a definitive conclusion over the evolution of Spain´s labour market and the extent to which it may have undergone structural changes.

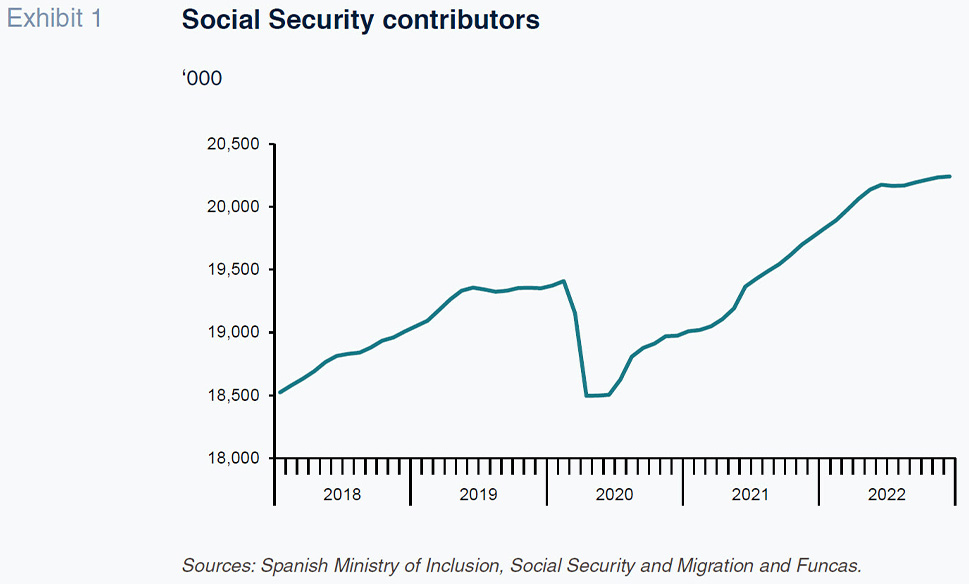

Trend in Social Security contributors

The number of Social Security contributors stood at 20,296,271 as of December 2022, evidencing a growth of 471,000 from a year earlier. Due to seasonal factors, however, the December figure was not the highest for the year: contributors peaked at 20,348,330 in June. The pace of year-on-year growth in contributor numbers halved towards the end of the year by comparison with the first half, shaped to a degree by lower monthly growth rates but more significantly by the fact that the bulk of the post-pandemic job recovery was concentrated in the second half of 2021, distorting the comparison. In the first half, we accordingly saw year-on-year increases of around 890,000 contributors, compared to the above-mentioned 471,000 by December (Exhibit 1). To obtain a truer picture of the annual trend, it makes more sense to compare the annual averages. By that measure, the annual average number of contributors was 750,000, or 3.9%, higher in 2022 than in 2021.

By sector, contributors fell in agriculture and rose in industry, construction, and services. Within the latter, growth was higher in market services than in government services. Stripping out the agricultural and public sectors, shaped by forces exogenous to the economic climate, the results reveal that the non-farm, private sector payroll increased by 4.8% in 2022 (still using annual averages), equivalent to 724,000 contributors.

Average contributors last year were also 4.3% higher than in 2019 (with non-farm private sector contributors 3.9% above 2019 levels). Indeed, the number of contributors topped pre-pandemic levels as early as autumn 2021, even though GDP was still well below 2019 levels. In 2022, after sharp growth in the first semester, contributor growth slowed in the second semester but continued to outpace GDP (which rose a scant 0.2% quarter-on-quarter in the third and fourth quarters), despite a very adverse backdrop marked by high uncertainty and the energy crisis. That dynamism in contributors relative to GDP growth is one of the most noteworthy aspects of Spain’s economic performance in the wake of the pandemic. It is conceivable that at least some of that trend is attributable to the formalisation of undeclared jobs, which would mean that some of the growth in contributor numbers did not stem from the creation of new jobs.

At the start of 2022, there were still around 120,000 people on furlough. After the spring, spurred by regulatory changes to that scheme and with the economy fully reopened, that figure fell to around 25,000, where it stayed throughout the second half, punctuated by the odd spike due to stoppages at automotive factories when supplies ran out.

It can be said, therefore, that the employees furloughed, a significant 3.5 million at the start of the pandemic, have been virtually fully reabsorbed by the economy without any perceptible loss of work at the aggregate level. The payroll in the hospitality sector, the area hit the hardest by the health crisis, topped pre-pandemic levels in May 2022. However, the number of self-employed contributors has yet to revisit those levels. In general, the trend in non-employed contributors has been weak by comparison with that in employees: their population grew by 0.8% in 2022, topping 2019 levels by 2%.

Implementation in March 2022 of the labour reforms passed in December 2021 sparked intense flows from temporary to permanent contracts. As of December 2022, Spain had 1.8 million fewer contributors on temporary contracts than a year earlier and 2.3 million more on permanent contracts; within the latter category, the ranks of fixed-discontinuous employees swelled by 450,000. As a result, the incidence of temporary workers in total contributors stood at 15% by the end of 2022, compared to 27% in previous years. That is the lowest level in the historical series, evidencing the favourable impact of labour reforms in terms of job quality. Elsewhere, growth in full-time employment was higher than in part-time work, so that the incidence of part-time work fell to 19%, extending the downtrend underway since 2017.

Results of the Labour Force Survey

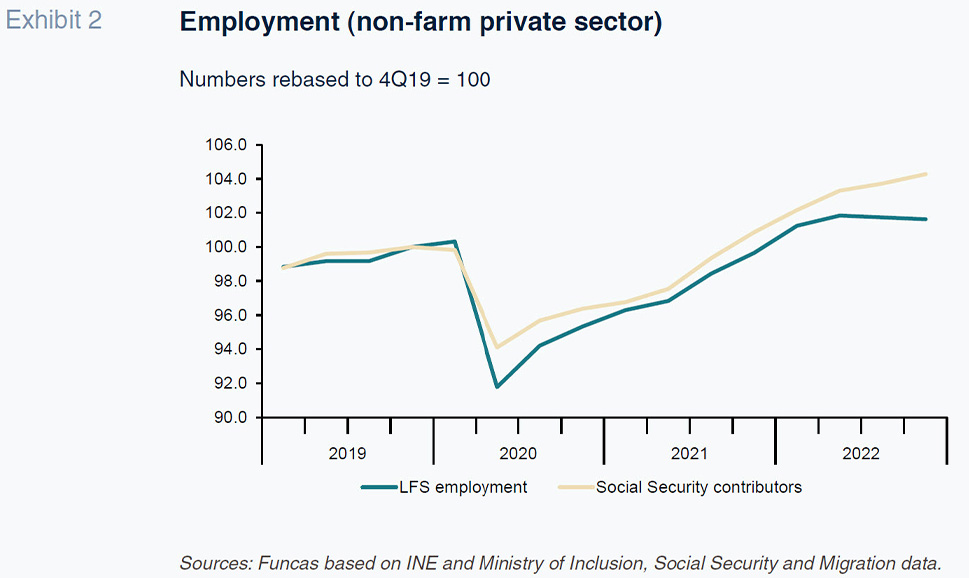

Growth in employment in 2022 according to the Labour Force Survey (LFS) was somewhat less vigorous than signalled by the Social Security contributor numbers. The average number of job holders by that measure was 617,000 higher in 2022 than in 2021 (compared to an average of 750,000 more contributors). Moreover, in the last two quarters, growth ground to a halt, with non-farm private sector employment contracting slightly in both periods. Nevertheless, the LFS figures likewise point to more people in work than before the pandemic, albeit by a smaller margin than indicated by the contributor reports (Exhibit 2).

The slower pace of growth in Labour Force Survey terms compared to the number of Social Security contributors is not an isolated phenomenon in the historical series for those two statistics, although the scale of the divergence on this occasion is unusual. Only in 2017 was a difference of similar magnitude observed. As noted earlier, the rationale may lie, at least in part, in the above-mentioned formalisation of informal employment, jobs which are captured in the LFS figures but not so in the contributor ranks. It is tricky, however, to calibrate the extent to which that phenomenon may be at play, as the volume of informal employment is not directly observable and the differences between the two statistics can also be the result of other factors.

Like the Social Security contributor reports, the LFS also reveals a drop in the incidence of temporary work to a record low of 17.9% by the end of the year. Another interesting takeaway from the LFS relates to the trend in the participation rate. In Spain, there has been nothing like the so-called great resignation observed in the US, where labour force participation dropped sharply at the onset of the pandemic and had only partially recovered in 2022. Following an initial drop, the participation rate in Spain revisited 2019 levels in 2022 (58.6%). By age groups, it has dropped in the youngest bracket and among those aged between 30 and 39, and increased among those aged 45 and over, doing so particularly intensely in the 60 to 64 (from 47.2% in 2019 to 53.8% in 2022) and 65 to 69 age brackets (from 6.9% to 10.1%), essentially accelerating the upward trend already being observed in those categories. Lastly, the annual average unemployment rate dipped to 12.9%, its lowest level since 2011.

Mismatch between job holders and the number of hours worked

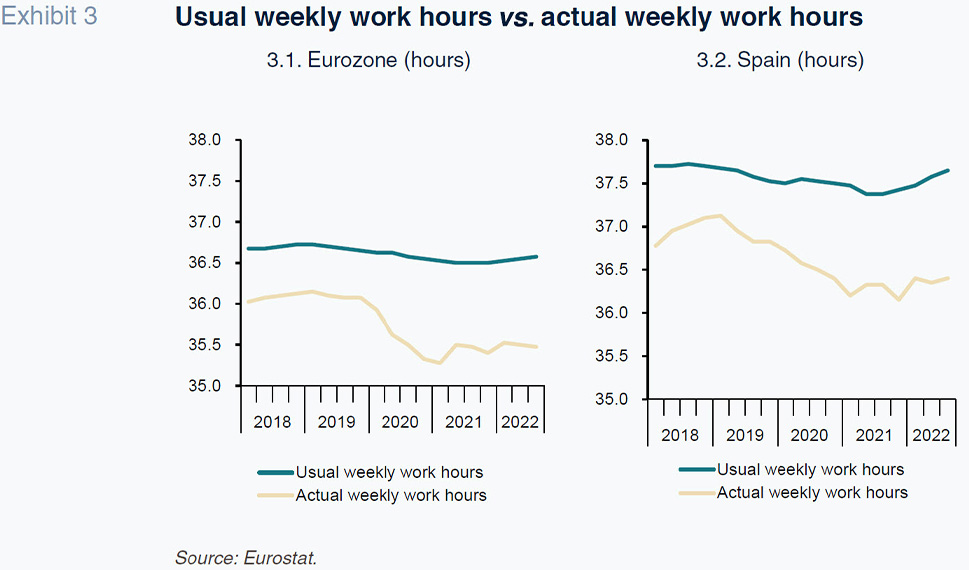

One of the most remarkable aspects of recent labour market trends is the fact that although employment measured by job holders (whether using the LFS or the Social Security contributor reports) is back above pre-pandemic levels, the same does not hold for the number of hours worked: at year-end 2022, that metric was still 1% below the level observed before the health crisis, according to the national accounts. That implies a reduction in the average number of hours worked per job holder, a trend corroborated by the LFS statistics. As a result, although productivity per job holder was still 1.8% below year-end 2019 levels at the end of last year, productivity per hour worked was the same.

The reasons for the drop in the actual number of hours worked per person does not lie with growth in part-time employment, which, as already noted, has fallen as a percentage of total employment. Moreover, according to the LFS, the length of the usual workweek was virtually unchanged in comparison with 2019. That phenomenon (barely any change in usual weekly hours worked but a drop in actual hours worked) is also observed in the eurozone (Exhibit 3).

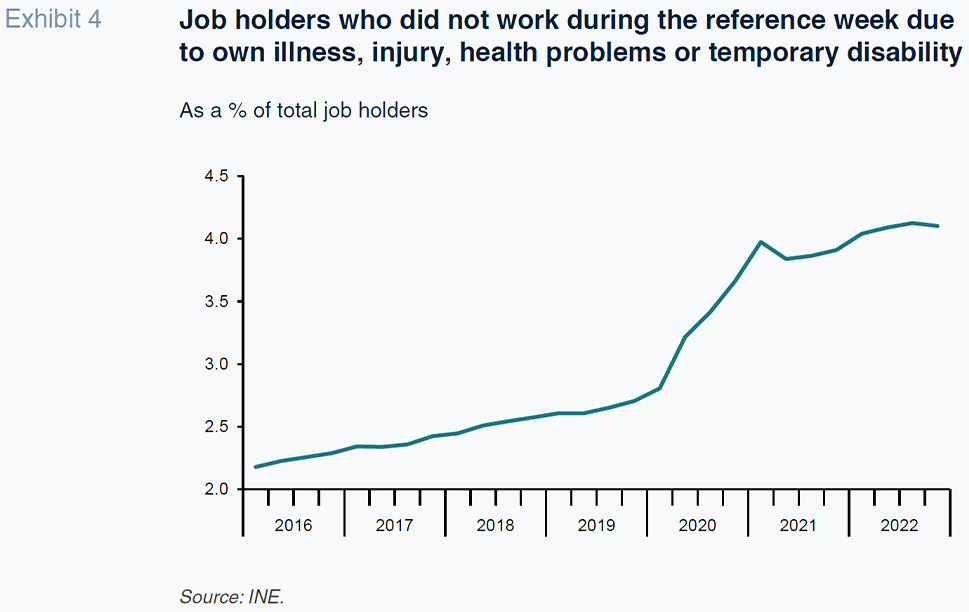

The decline in the number of actual work hours is, therefore, attributable to an increase in absenteeism by job holders. According to the LFS, the percentage of jobs holders that did not work in the week in which the survey was conducted increased from 8.5% before the health crisis to 11.5% in 2021 and 2022.

One of the reasons tracked in the LFS for absence from work is illness, injury, and temporary disability. The percentage of jobholders absent from work for that reason increased with the onset of the pandemic and, in 2022, despite the end of the health crisis, far from coming back down, had increased (Exhibit 4). Another reason given for the increase in the number of job holders absent from work during the reference week, albeit less decisive, is holidays or leave.

Conclusions

The recent trend in the Spanish labour market yields some – apparently – good news, insofar as employment (in both LFS and contributor terms) is already above pre-pandemic levels and continued to grow in 2022 despite the complex environment. The reduction in temporary contracts since the passage of the most recent labour reforms is another positive takeaway. However, there are trends that are hard to interpret. Firstly, it is unclear why Social Security contributors have registered such intense growth since the pandemic, considerably outpacing GDP and LFS employment growth. The reason could lie with the formalisation of informal jobs. Even during the second half of 2022, amidst an energy crisis, intense uncertainty and meagre GDP growth, contributor numbers continued to rise, while LFS employment stagnated. If indeed the reason for that lies with the ongoing formalisation of underground jobs, the fact that that process continued throughout a period of such uncertainty and complexity is likewise remarkable and a sign of economic and labour market resilience. Lastly, the above trends took place against the backdrop of a sharp drop in actual hours worked per job holder, a phenomenon likewise observed in the eurozone, further clouding the interpretation of what is happening in the labour market. It may simply be a matter of letting more time go by to gain better insight into the structural changes that may be taking hold.

María Jesús Fernández. Senior Economist at Funcas