Market values of European and Spanish banks: Contraction and recovery against the backdrop of COVID-19

European and Spanish banks’ share prices took a significant hit during the worst periods of the COVID-19 crisis, only to outperform other stocks once a recovery took hold. Interestingly, banks’ CoCo bonds performed even better, registering a smaller contraction and a stronger rebound.

Abstract: European and Spanish banks’ share prices took a significant hit during the peak of the COVID-19 crisis. Measured using price-to-book value, Spanish and European banks were trading at a low of 0.3x (i.e. at a discount to their book value of 70%) in 2020. At the start of the crisis, some bank stocks lost more than 50% of their value, compared to average index correction of 20-25%. However, towards the end of 2020 and beginning of 2021, banks have been one of the best-performing sectors, significantly outperforming the broader indices. Although both European and Spanish banks’ share prices have rebounded, the recovery has been more intense for the Spanish banking sector. These strong recoveries are due to monetary and fiscal measures as well as a rebound in M&A activity and progress on the vaccination front. Banks’ shares also received a significant boost from the sizeable upward shift in rate curves. Notably, the experience of banks’ CoCo bonds has highlighted the asymmetric nature of these instruments. Their prices contracted by less than ordinary bank shares yet went on to rebound more strongly.

Introduction

In the year since the World Health Organization (WHO) declared the outbreak of COVID-19 a pandemic, stock market valuations have etched out a V-shape, starting with a collapse during the initial lockdown in March 2020 followed by a strong recovery that has proven particularly intense since the end of 2020 and into the beginning of 2021. That rally has been underpinned by the markedly dovish stance taken by central banks and governments, as well as progress made on developing and administering vaccines. More recently, valuations have been boosted by clear signals, such as the upward shift in the US Treasury rate curve, that the economic recovery is gaining traction.

Those swings in market valuations have by no means been evenly distributed across the various sectors. If one sector stands out for its swings in valuations, it is the bank sector. Banking has a long-standing reputation as a highly cyclical sector of the stock market, with a beta well in excess of 1 (~1.3 - 1.5), which translates into outsized movements relative to the market during rallies and corrections alike.

Against that backdrop, Spanish and European banks suffered an initial correction at the onset of the pandemic that was far more intense than that sustained by other sectors. However, these banks have performed much better in the aftermath, conforming to a V-shaped recovery. Those swings in market value have had an impact on trading multiples (relative to book value), which posted lows during the height of the pandemic only to recover and, in some sectors, keep pace with the general indices.

The purpose of this paper is threefold. First, we compare valuation multiples between the banks and other sectors and between Spain and Europe. We then examine in more detail the factors that have driven the intense recovery in the banks’ stock prices since the peak of the health crisis. Lastly, we analyse the extent to which the swings in their equity market values have been echoed in the banks’ other key loss-absorbing instrument, contingent convertible bonds (CoCos or AT1 instruments), which in recent years have been the main vehicle for recapitalising the European and Spanish banks.

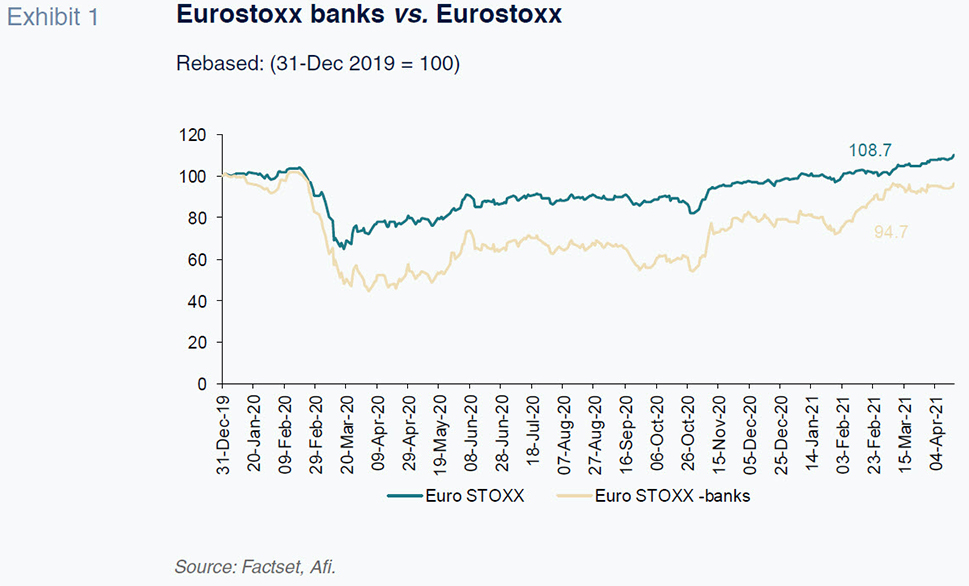

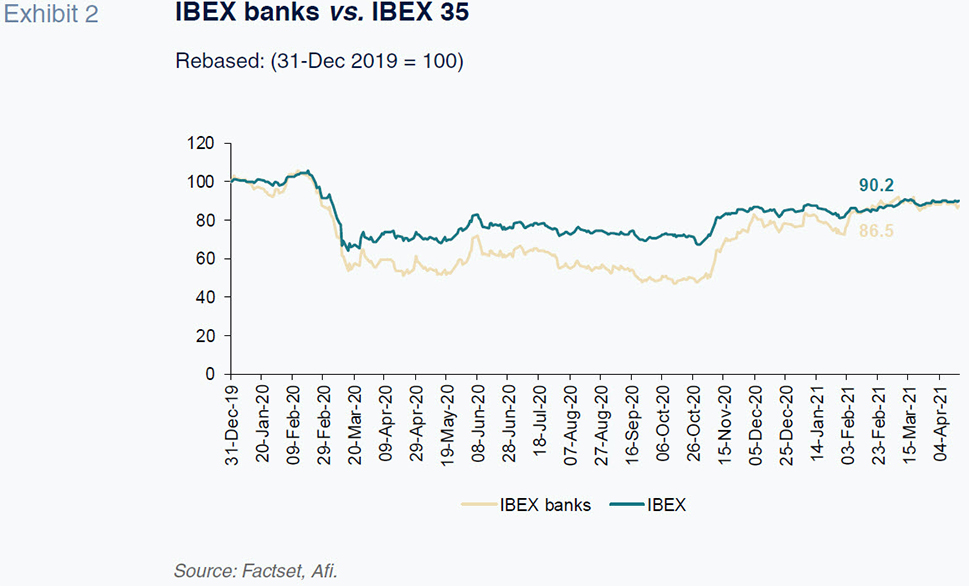

Bank sector stock market recovery in Spain and EuropeThe trends outlined above are depicted in Exhibits 1 and 2, which show how the banks were one of the sectors hardest hit by the pandemic. Some bank stocks lost more than 50% of their value at the start of 2020, compared to average index correction of 20-25%. However, during the rally towards the end of 2020 and beginning of 2021, banks have been one of the best-performing sectors, significantly outperforming the broader indices.

Within those patterns, Spanish banks sustained a sharper and more abrupt correction in March than their European counterparts yet went on to stage a more pronounced recovery at the end of 2020 and beginning of 2021. The relatively bigger correction in March is attributable to the Spanish banks’ higher exposure to those sectors more affected by business closures during lockdown.

The recovery in Spanish banks’ share prices at the end of 2020, in addition to the factors already mentioned (support from central banks and governments; advances on the vaccine front), was boosted by the reactivation of M&A activity as a means to: (i) accelerating the reconfiguration of their productive structures for a business environment in which it is becoming much harder to generate interest income; and, (ii) facilitating the absorption of non-performance which, despite originating in 2020, will be reflected on the banks’ financial statements over the course of 2021 and 2022.

It is worth mentioning the notable effort made to frontload impairment charges in 2020, which was a significant advantage for Spanish banks. Specifically, Spanish banks provisioned around 1.4% of total assets, which is more than twice the level provisioned by other main European banking systems.

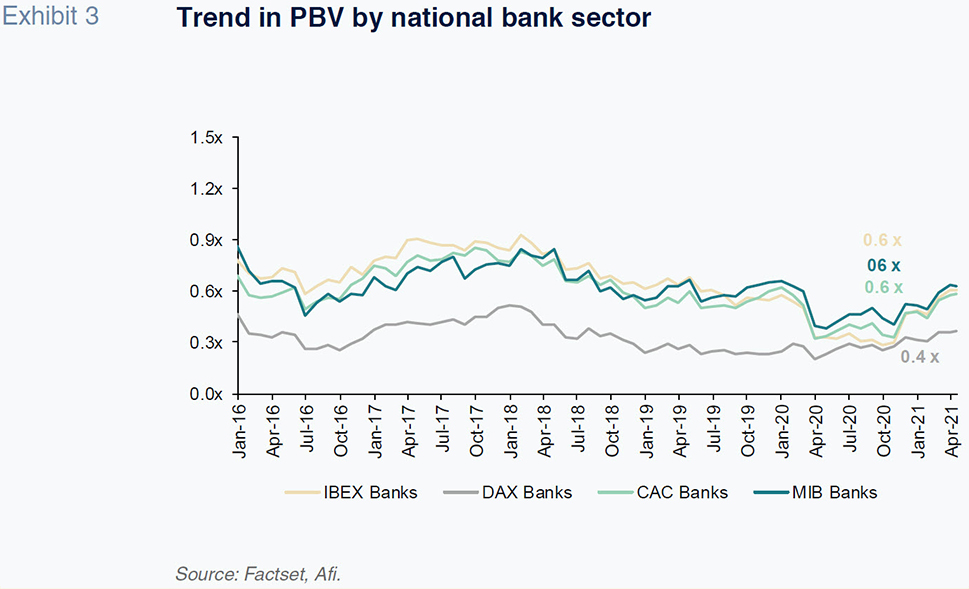

In relative valuation terms, measured using the ratio between market value and book value, or price-to-book value (PBV), Spanish and European banks were trading at a low of 0.3x (

i.e. at a discount to their book value of 70%) during the worst periods of the pandemic (Exhibit 3). The subsequent recovery has nearly doubled that multiple, which stood at around 0.6x on average at the end of the first quarter of 2021.

Despite the recovery, those multiples remain depressed, indicating that the market is pricing in the banks’ inability to generate a return on capital equivalent to their costs, which will unquestionably make it harder for banks to tap the capital markets. In order to illustrate the scale of that discount to book value, recall that Spain’s eight listed banks at year-end 2020 (Bankia was delisted in March 2021 as a result of its merger with Caixabank) had own funds of around 180 billion euros. Nevertheless, the market is valuing them at around 110 billion euros.

If the market is valuing all European banks (listed and unlisted) at those multiples, the implicit discount, considering total eurozone banking system own funds of somewhere over 1.5 trillion euros, is equivalent to around 700 billion euros, reflecting either potential impairment provisions or the banks’ inability to remunerate shareholders on terms sufficiently appealing to attract their investment.

The rate curve is propping up bank valuations

Although both European and Spanish banks’ share prices have rebounded, the recovery has been more intense for the Spanish banking sector. Several factors account for these strong recoveries.

During the last few months of 2020, the recovery in banks’ share prices was primarily driven by economic support measures (monetary, regulatory and, above all, fiscal policies), accompanied by the progress made on the vaccination front.

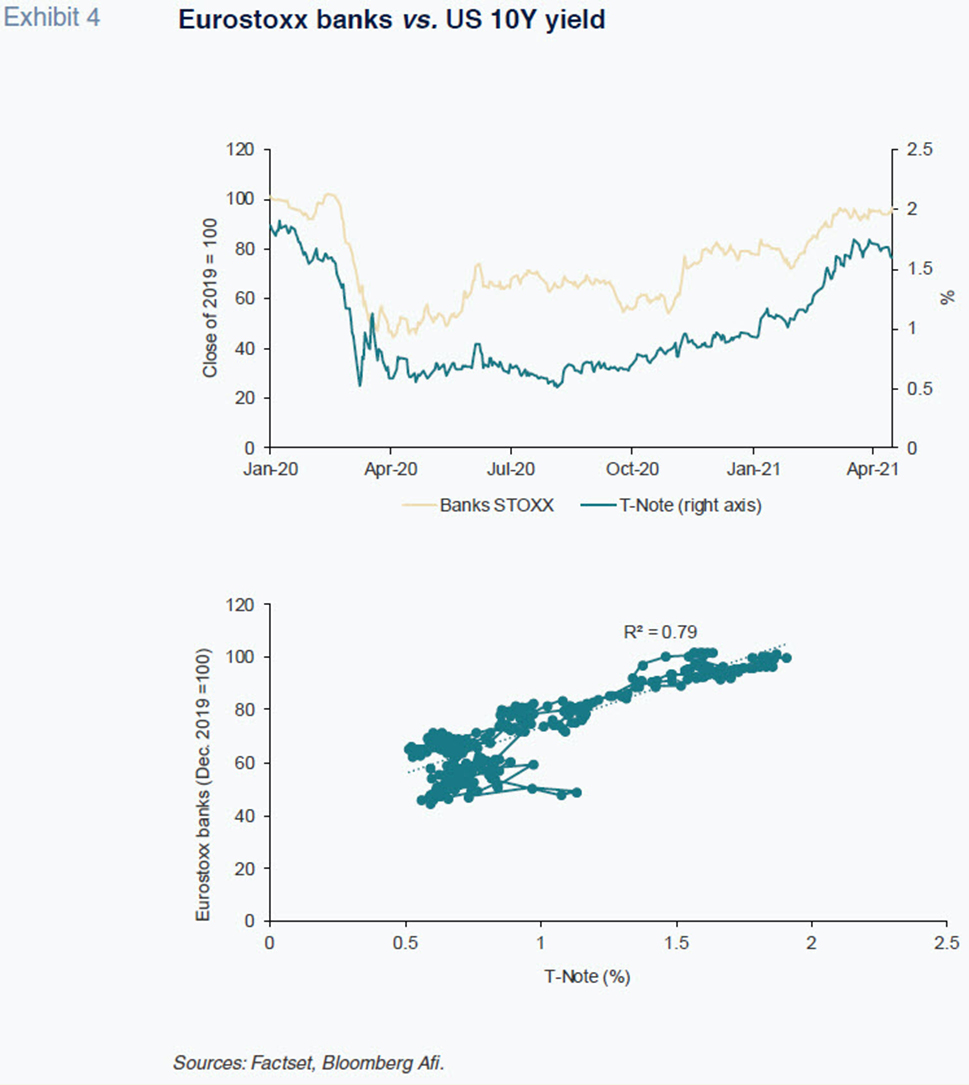

In 2021, bank valuations have received a significant boost from the sizeable upward shift in rate curves, initially in US Treasuries and subsequently followed by German government bonds. The latter are relevant given that they act as the main anchor for long-term rates in the various eurozone countries.

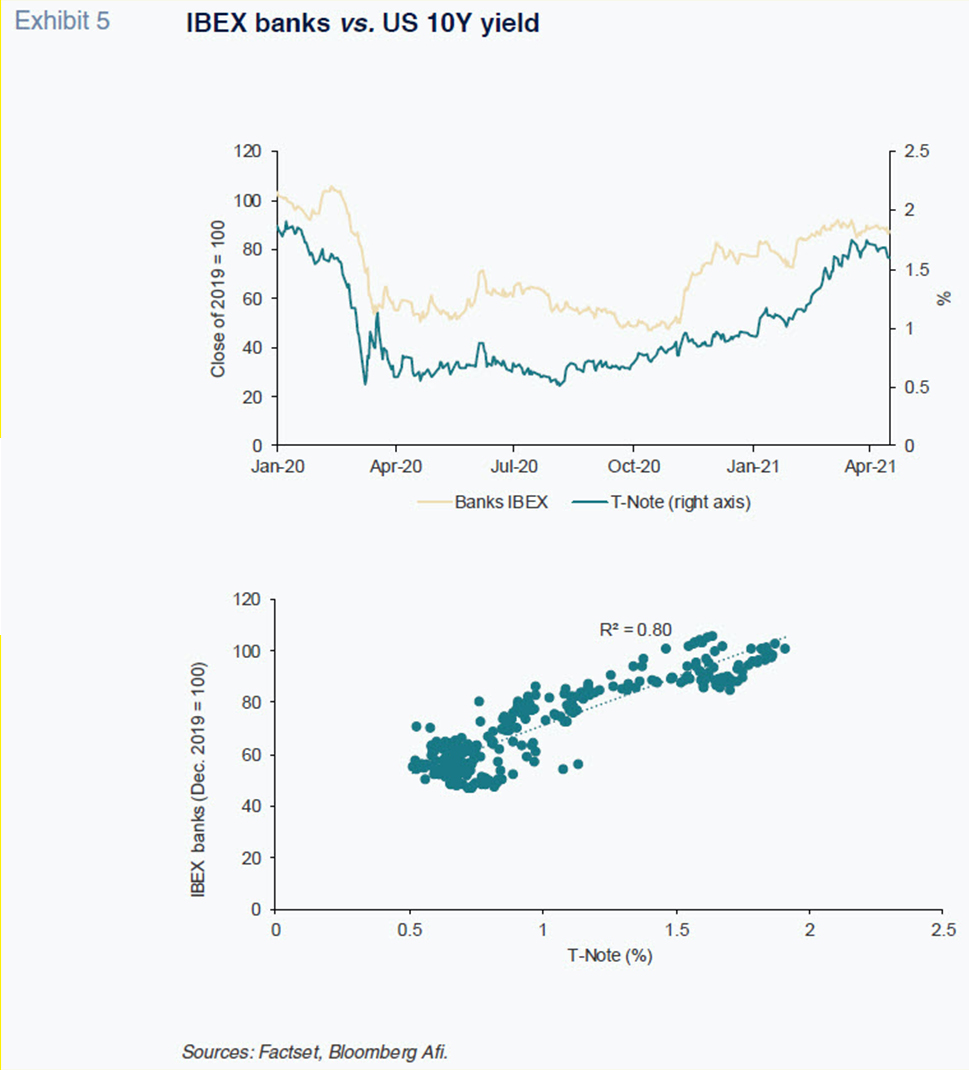

Exhibits 4 and 5 demonstrate the high correlation (close to 80%) between European (and Spanish) bank market values and the yield on US Treasuries, clearly the main benchmark for rate expectations.

This correlation is attributable to two key factors. Firstly, an increase in benchmark rates paves the way for growth in the banks’ net interest income, which is particularly important for European and Spanish banks whose business models are more reliant on the retail banking business (deposit-taking and loan-making) than other banking systems, such as the American system, which is more exposed to investment banking. An economy with structurally higher rates than prevailing interest rates can alleviate the pressure that the negative rate phenomenon exerts on profitability in the retail banking segment.

Secondly, a high absolute risk-free rate is associated with growth cycles, in which lending activity rises and non-performance falls, unquestionably benefitting stock market valuations in a sector as cyclical as the banking business.

CoCos versus bank share prices: A different tale

Having observed the banks’ stock market swings during the pandemic, it is helpful to analyse the different trend in the price of their contingent convertible bonds (CoCos or AT1 instruments). After the banks’ ordinary shares, those instruments constitute the banks’ next loss-absorbing instrument. Notably, in recent years these instruments have grown to become an outsized share of Spanish and European banks’ market capitalisations.

CoCos corrected by relatively less at the height of the pandemic, but went on to recover more intensely, so that CoCos registered net gains in 2020. The banks’ share prices, on the other hand, have only recovered just over half of the value destroyed, so that they are still trading 25% below pre-pandemic levels today.

The most noteworthy trend, however, is the difference in performance from one bank to another, particularly the asymmetry in that disparity during the episodes of correction versus recovery. In the case of the CoCos, the disparity between banks widened extraordinarily at the height of the pandemic, whereas prices converged to an extraordinary degree during the subsequent recovery (far more so than the banks’ share prices).

That extraordinary asymmetry in the banks’ CoCo prices, far more pronounced than in the case of their share prices, is the result of the very nature of those instruments, which combine features of a fixed-income asset (payment of a —relatively high— coupon in normal conditions), with equity features, as the bonds automatically convert into equity ready to absorb losses if the entity enters resolution or its CET1 falls below a certain threshold.

It is the contingent and convertible nature of the CoCos that shapes that asymmetric price performance. During ‘good times’, in which the probability of mandatory conversion into equity is minimised (the beginning and end of 2020 and the first quarter of 2021) we see significant convergence among the banks, with the small divergences mainly attributable to the entities’ differing business models. During the height of the lockdown, however, the various banks’ CoCo prices diverged significantly, due to the risk of resolution priced in by the market for each entity.

Looking at the performance of the listed banks, it is reasonable to conclude that the perceived risk to banks has dissipated. The current risks priced in by the market relate to business model risks associated with the scant margins of some of the banks, as well as the anticipated rise in non-performance, similarly associated with some of the banks’ business models and exposure.

Conclusion

Over the past year, banks’ share prices have undergone far greater swings than other sectors, providing further evidence of their markedly pro-cyclical nature. Their shares corrected far more severely than those of other sectors during the initial lockdown, as the market priced in the expectation that the sector would be hardest hit as their asset quality deteriorated in the midst of a recession. They then went on to stage a more intense recovery fuelled by the expectations of economic recovery and helped by monetary and, most importantly, fiscal stimulus measures and the progress made on the vaccine front.

It is also worth highlighting the positive influence on bank valuations that the upward shift in the US long-term rate curve has had in recent months. This yield curve, more than any other, is foreshadowing a degree of normalisation in the negative rate environment that has been so harmful for the banking business in Spain and Europe in general.

Lastly, the analysis of the trend in the banks’ CoCos, in contrast to their share prices, reveals a much better performance. Although they were penalised less during the height of the crisis, they have made a stronger subsequent recovery. However, it is important to underline the asymmetric nature of those instruments. During episodes of deep crisis, they expose investors to a ‘tail risk’ that differs from one bank to the next.

References

ALTAVILLA

et al. (2021). Measuring the cost of equity of euro area banks.

Occasional Paper Series, No 254. European Central Bank.

BERGES, A., ALBERNI, M. and AIRES, D. (2020). Banks’ market value in times of COVID-19,

SEFO, Vol. 9, No. 4, July. Retrievable from:

https://www.funcas.es/articulos/banks-market-value-in-times-of-covid-19/EUROPEAN BANKING AUTHORITY (EBA). Risk Dashboard as of April 2021.

Ángel Berges, Fernando Rojas and Diego Aires. A.F.I. – Analistas Financieros Internacionales, S.A.