Spanish economic forecasts panel: January 2021*

Funcas Economic Trends and Statistics Department

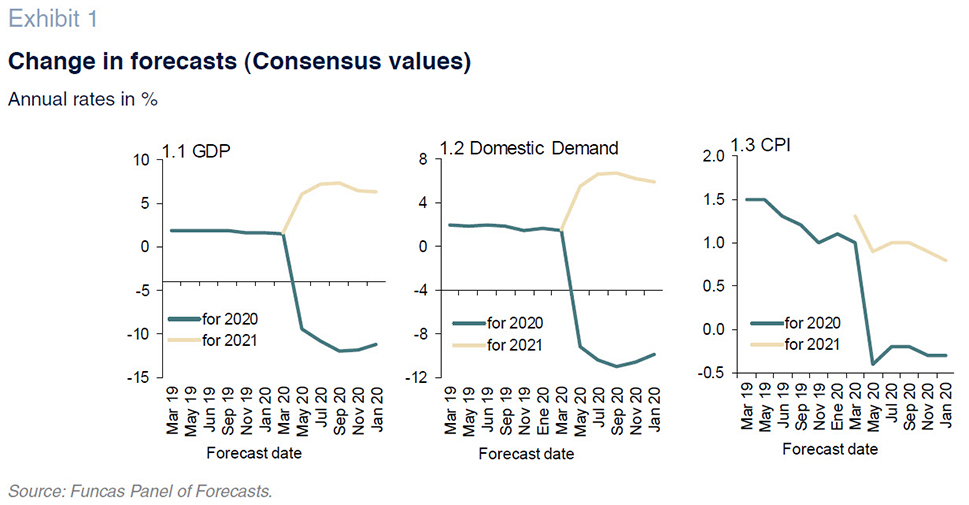

GDP contraction estimated at 11.2% in 2020

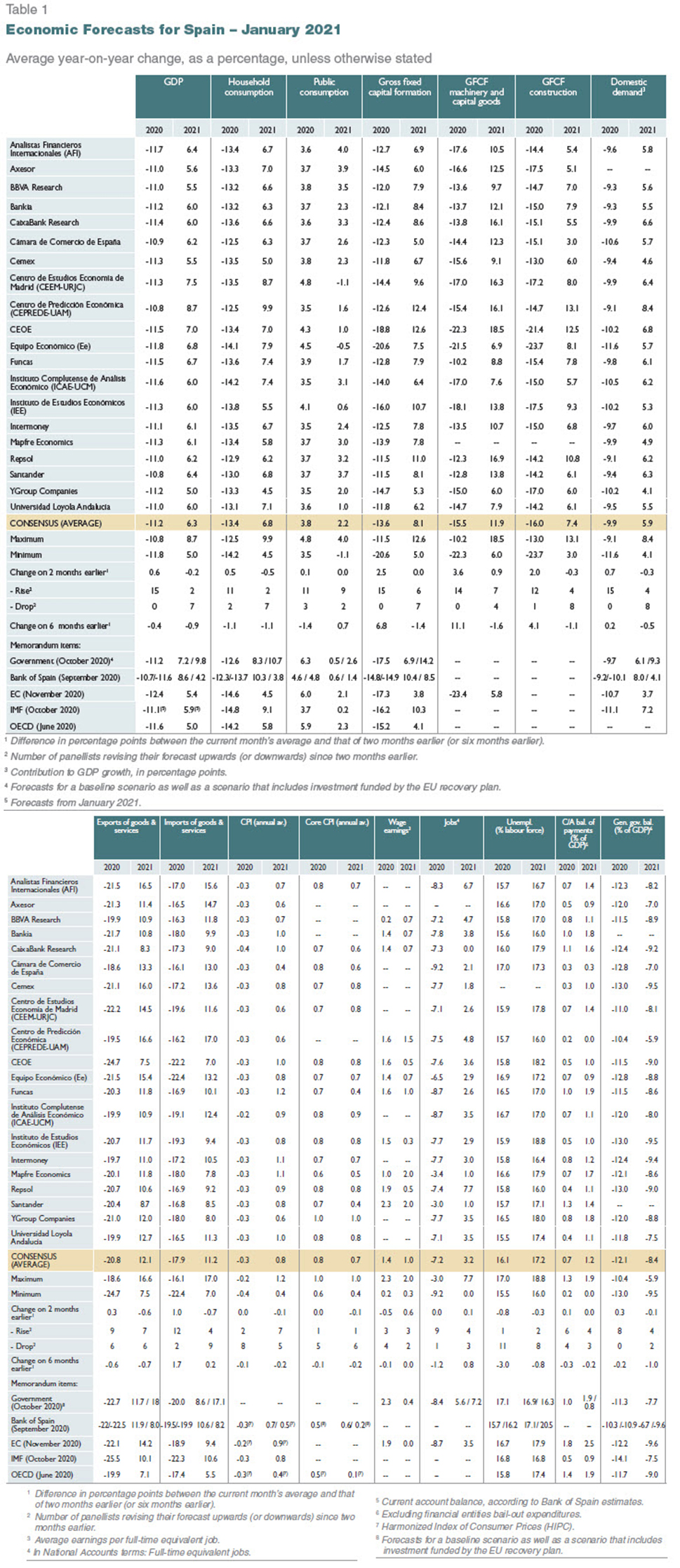

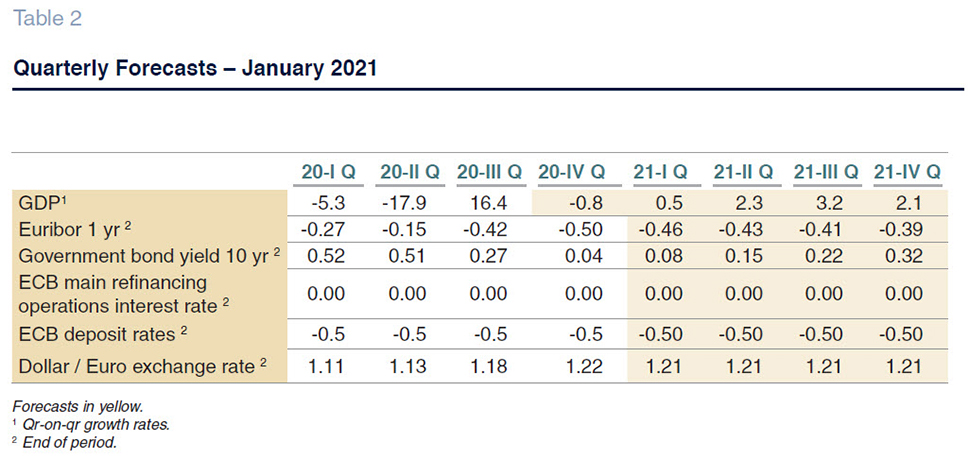

The consensus forecast is for a GDP contraction of 11.2% in 2020 – 0.6pp smaller than what was forecast in November – driven by the upward revision to the estimated fourth-quarter contraction to 0.8% (Table 2), compared to the 3% fall estimated at the time of the last survey.

National demand is estimated to have accounted for 9.9 percentage points of the GDP contraction (0.7pp better than was forecast in November), with 15 of the analysts revising their estimates upwards in that respect. The consensus is that foreign demand detracted 1.3 percentage points, rather than the 1.2 percentage points forecast in the last survey. The forecasts for growth in exports and imports have been revised upwards.

The growth forecast for 2021 stands at 6.3%, down 0.2pp from the last report

The consensus forecast is for GDP growth of 6.3% in 2021, down 0.2pp since the last report. As for the quarterly profile, the outlook for the first quarter has been trimmed since November, with growth expected to rise to between 2% and 3% in the following quarters (Table 2).

To arrive at their forecasts, most of the analysts assume that between 30% and 45% of the population will have been inoculated by June and between 70% and 80% by December.

Growth in 2021 is expected to be driven most significantly by domestic demand, which is forecast to contribute 5.9 percentage points, down 0.3pp from November. All components of national demand other than public consumption are expected to register growth even though the forecast for growth in household consumption has been trimmed by 0.5 percentage points. Foreign trade is expected to contribute 0.4 percentage points to growth, up 0.1 percentage point from the last set of forecasts.

CPI forecast for 2021 trimmed slightly

As foreshadowed in November, in December 2020 the year-on-year rate of inflation stood at -0.5%, putting the annual average at -0.3%, compared to 0.7% in 2018. The drop in inflation was mainly attributable to the sharp correction in oil prices and slower price growth in other areas, most notably services, the sector hardest hit by the pandemic.

The consensus forecast is for average inflation of 0.8% in 2021, down 0.1pp since the last report, with the year-on-year rate reaching 1.4% in December (Table 3). The consensus forecast for core inflation has been cut by 0.1 percentage point to an average rate of 0.7%, compared to 0.8% in 2020.

Unemployment estimated at 17.2% in 2021

According to the Social Security contributor numbers, job creation slowed in the fourth quarter compared with the third quarter. The number of employees under the furlough scheme increased in November and December relative to prior months, as did the number of self-employed professionals receiving the extraordinary income support scheme. In 2020, the number of contributors declined by 396,000, or 2.1%.

The consensus estimate for employment, in terms of full-time equivalents, is for a contraction of 7.2% in 2020 (unchanged from November) and a recovery of 3.2% in 2021 (up 0.1pp from the last set of forecasts). The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULC). Productivity is expected to have fallen by 4% in 2020 but is projected to rise 3.1% in 2021. ULCs, meanwhile, are expected to increase by 5.4% in 2020 and fall back by 2.1% in 2021.

The average annual unemployment rate is estimated at 16.1% for 2020, rising to 17.2% in 2021, down 0.8 and 0.3 percentage points, respectively, from the analysts’ November estimates.

External surplus expected to widen in 2021

The current account surplus stood at 3.97 billion euros to October, compared to 21.05 billion euros in the same period of 2019. That significant reduction is due to a 56% decline in the trade balance, driven mainly by the sharp drop in tourism receipts, which more than offset the improvement in the income deficit.

The consensus forecast is for a surplus equivalent to 0.7% of GDP in 2020 (up 0.1pp from November), widening to 1.2% in 2021 (unchanged).

Surge in public deficit

In the first 10 months of the year, the deficit at all levels of government except for the local corporations stood at 78.9 billion euros, compared to 16.8 billion euros at the same juncture of 2019. The deterioration is the result of a 21.7 billion euro drop in revenue coupled with growth of 40.4 billion euros in spending, of which around 33 billion euros is related to the pandemic. Spain’s public debt increased by 111 billion euros between the onset of the pandemic and November 2020.

The analysts are currently estimating a public deficit in Spain of 12.1% of GDP in 2020, which is 0.3 percentage points less than they were forecasting in November. The deficit forecast for 2021 stands at 8.4%, up 0.1 percentage points.

External environment expected to improve in the coming months

The economic indicators point to weak activity levels across the EU as a result of the business restrictions imposed in recent weeks. The December eurozone PMI remains in recessionary territory, evidencing the difficulties facing the services sector. The manufacturing index is still above the 50 mark, signalling expansion, albeit not enough to offset the weakness in services.

The US economy appears to be withstanding the latest wave relatively better, while in China the recovery is gaining traction. According to an initial estimate, China’s GDP registered growth of 2.3% in 2020, making it the only major economy to have grown last year, albeit at one of the weakest rates in recent decades. Lastly, many emerging economies are facing significant turbulence due to a collapse in capital flows coupled with scant margin for fiscal manoeuvre. The IMF has signalled Latin America as one of the hardest-hit regions.

In short, the external environment remains largely unfavourable, as is reflected in the analysts’ assessments. However, prospects are expected to improve as inoculation levels rise. The analysts expect things to turn around in the coming months, both within the EU and beyond. Overall, their assessment has not change significantly since November in this respect.

Rates trend lower, helped by the ECB

During its last meeting of the year, the ECB decided to extend its pandemic asset purchase plan (PEPP). Its net securities purchases will now run until March 2022 and the ECB expects to reinvest proceeds from maturing assets until at least the end of this year. Against that expansionary backdrop, interest rates have continued to trend lower, from already ultra-low levels. 12-month EURIBOR is trading below -0.5%, having traded above that threshold last November. The yield on 10-year government bonds has dipped on occasion into negative territory for the first time in the history of the Spanish Treasury. The spread over the German bond is around 65 basis points.

Given the outlook for economic recovery, the analysts think interest rates will move somewhat higher in the coming quarters, albeit remaining at low levels.

Euro appreciation

The euro’s appreciation against the dollar is one of the most noteworthy developments since November. Specifically, the euro is trading at 1.20/dollar, which is 3% stronger than at the time of the last report. The analysts believe the exchange rate will remain close to current levels throughout 2021.

Fiscal policy needs to prop up the economy

The analysts unanimously consider that monetary and fiscal policies are expansionary and all of them believe they should remain so for the coming months. No major change in the ECB’s benchmark rates are expected over the projection horizon.

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.