The shifting income structure of Spanish banks

While recording among the lowest share of fee and commission income as a percent of total earnings compared to other EU banks, in line with their peers, Spanish banks too adapted to the low interest rate environment by raising fee and commission revenues. With interest rates on their way up and volatility increasing, rising net interest income and trading gains for Spanish banks may help reverse downward pressures on profitability.

Abstract: The ultra-low rate environment has exerted pressure on banks’ net interest income, forcing them to seek out alternative sources of income in order to generate returns at the level expected by investors. The average net interest margin hit a record low of 0.8% of assets in 2021, dropping to 49% as a share of total income. In parallel, fee and commission income has increased, and now accounts for 31% of total income. The composition of both interest income and fee mix has also evolved over the years. Compared to European banks, Spanish banks stand out for having the highest share of interest income in total earnings and among the lowest share of fee and commission income in total earnings. Fee and commission income, measured as a percentage of average total assets, is in line with the eurozone average.

Foreword

In recent years, rates have been ultra-low, dipping into negative territory, until not long ago. The EURIBOR was negative between February 2016 and March 2022 because of the ECB’s extremely accommodative monetary policies. The existence of negative rates for a prolonged period eroded bank interest margins, which hit a low of 0.8% of average total assets (ATA) in Spain in 2021. In that context, banks have sought out other sources of income to lift their profitability to the levels expected by their investors. This has meant cultivating fee income, which has been steadily increasing as a percentage of bank income. In addition, the income mix is changing in tandem with the business model, with the contribution of interest income falling in line with the banks’ exposure to the lending business.

In parallel to the reduction in net interest income, other factors have exerted downward pressure on the banks’ profitability in recent years. This includes intense deleveraging by the private sector, which is evident by the 35% contraction in the stock of outstanding credit since 2008. In absolute terms, this translates into a loss of business of about 659 billion euros. This largescale deleveraging has led the weight of the private resident sector in the overall credit portfolio to decline nearly 20 percentage point from its level just before the 2007-2008 financial crisis, to about 41%, a low not seen in several decades. The cost of complying with increasingly stringent capital requirement regulations has also increased. As a result, the profitability of the Spanish banks’ home market business has trailed their cost of capital. This includes 2021, a year of broad earnings recovery where the sector’s return on equity (ROE) ended at 6.9%, below its cost of capital. At the consolidated level, however, (i.e., including their international subsidiaries) Spanish banks’ ROE (11.3%) exceeded that cost of capital. That performance was not shaped by operating income, but rather a reduction in provisions for credit impairment following the intense provisioning effort of 2020 in anticipation of the impact of the COVID-19 crisis.

Against that backdrop, the purpose of this article is to analyse the trend in the Spanish banks’ income structure. We analyse various classes of income comprising banks’ statements of profit and losses for the domestic business in Spain and at the consolidated level (to include their international subsidiaries). The period analysed runs from the start of the Global Financial Crisis in 2008 until 2021 and includes the impact of the pandemic.

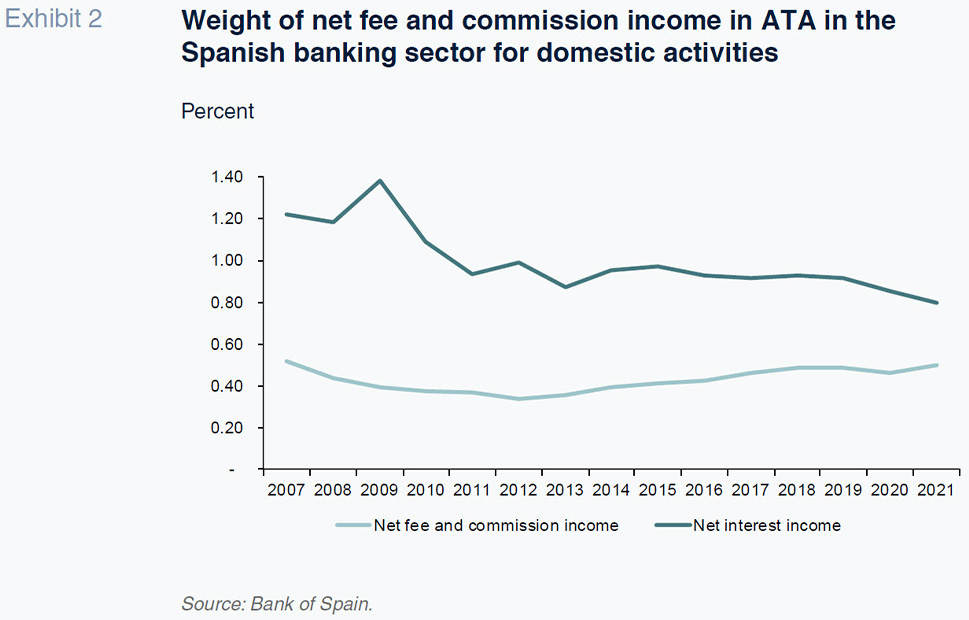

Trends in the income mix of Spanish banks

The prolonged period of negative rates in the eurozone began in June 2014 because of the ECB’s expansionary policy (for the deposit facility). This development applied downward pressure on banks´ net interest margins. For Spain’s domestic banking business, net interest margins, which represented 1.19% of ATA in 2008, fell to an all-time low of 0.8% in 2021. This implies that since 2016 (the year in which 12-month EURIBOR turned negative), their net interest income has been insufficient to cover their operating expenses (in 2021, they covered 88%). As a result, banks have had to resort to different sources of income, the most important being fees and commissions.

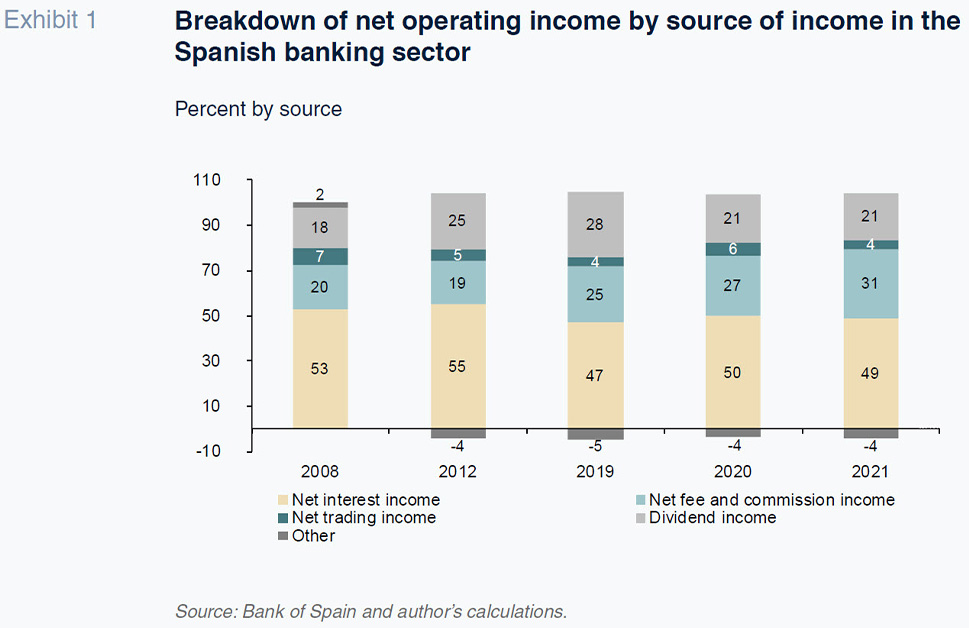

As shown in Exhibit 1, in 2008, net interest income accounted for 53% of net operating income from the domestic banking business in Spain. By 2021, that contribution had fallen to 49%. In parallel, the weight of fee and commission income had increased to 31% by 2021, up from 20% in 2008, representing the highest growth in contribution for any segment compared to 2008.

Other sources of income, such as dividend income, has been more volatile, as it depends to a greater degree on the economic cycle and financial entities’ profits. In 2009, a year of deep recession in Spain, when GDP contracted by 3.7%, dividends accounted for just 12% of net operating income, while in 2019 the contribution by dividends more than doubled to 28%. With the onset of the pandemic, the weight of dividend income fell to 21% in 2020, a level it stayed at in 2021. Net trading income (gains and losses on the purchase and sale of assets) contributed as much as 18% of net operating income in 2013 (almost 10 billion euros), and also made a sizeable contribution in 2014 and 2015 as a result of ECB rate cuts and the corresponding asset revaluations. However, once interest rates approached their lower bound and there was little room for further cuts, the scope for generating trading gains narrowed. This led to net trading income accounting for just 4%, or 1.8 billion euros, of net operating income in 2021, about one-fifth of the level obtained in 2013.

In relation to ATA, net interest income has fallen by 33% between 2008 and 2021, reaching an all-time low of 0.8% in 2021 (Exhibit 2). Over the same period, (2008 to 2021) the 12-month EURIBOR dropped from an annual average of +4.8% in 2008 to negative 0.42% in 2021.

Initially, when EURIBOR turned negative, specifically between 2016 and 2019, the net interest margin proved resilient. However, the persistence of negative rates made it impossible to continue to defend those margins.

Regarding net fee income for domestic Spanish banks (fee and commission income less fee and commission expense), its weight of ATA has increased from 0.44% in 2008 to 0.5% in 2021, albeit falling between 2008 and 2012. From a level of 0.36% in 2012, the weight of this source of income has increased by 46%, almost revisiting pre-2007 crisis levels. With the onset of the COVID-19 crisis, fees and commissions per unit of assets fell (from 0.49% to 0.46%) but recovered to 0.5% in 2021.

Breakdown of interest income

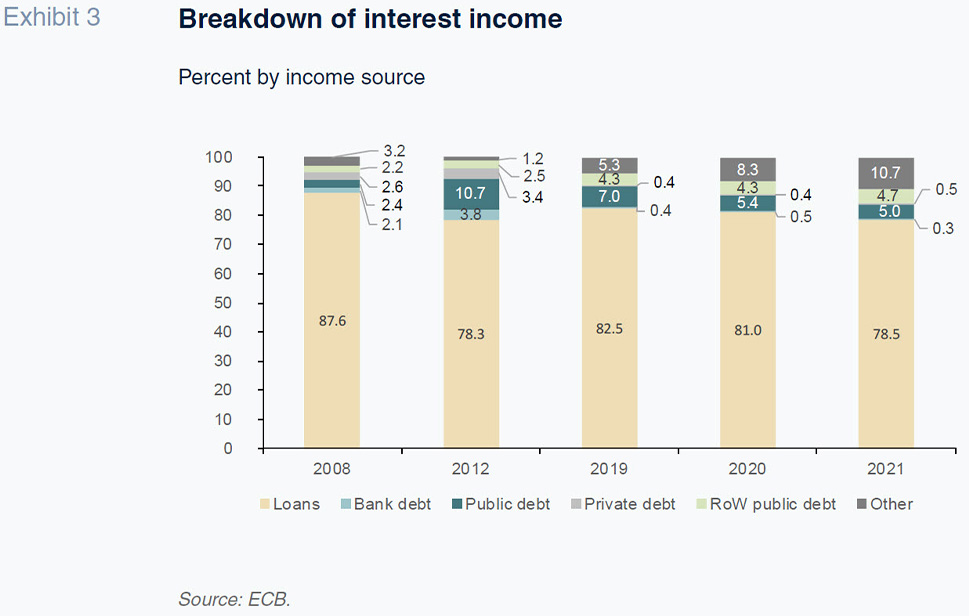

Another noteworthy aspect of the trend in banking income in Spain in recent years is the shift in the composition of interest income. This shift stems mainly from two sources: loans extended by banks and investments in fixed-income securities. Whereas in 2008, lending activity accounted for 88% of interest income, by 2021, its weight had fallen by 9.5 points to 78.5% (Exhibit 3). Despite making the same contribution in 2021 and in 2008 (~10%), the weight of interest income generated by investments in fixed-income securities has been falling steadily since 2014, when it accounted for a little over one-quarter of interest income. That performance is attributable to the banks’ investments in Spanish public debt, which in 2014 accounted for 15.5% of their total interest income, versus just 5% in 2021. The weight of interest generated by investments in foreign debt has been increasing however, contributing roughly the same amount as Spanish sovereign debt holdings (4.7%) in 2021 (almost €1.4 billion).

When interpreting the role played by Spanish sovereign debt holdings in interest generation, it is important to consider the weight of those holdings as a percentage of assets. Spanish sovereign debt holdings have fallen from about 10% of average total assets (ATA) in early 2015 to 6.7% by the end of 2021, with the gradual reduction in exposure translating into lower interest income from these investments. The opposite is true of other sovereign exposures, whose weight of ATA increased to 3.5% by the end of 2021 (113 billion euros).

The growing importance of fees and commissions

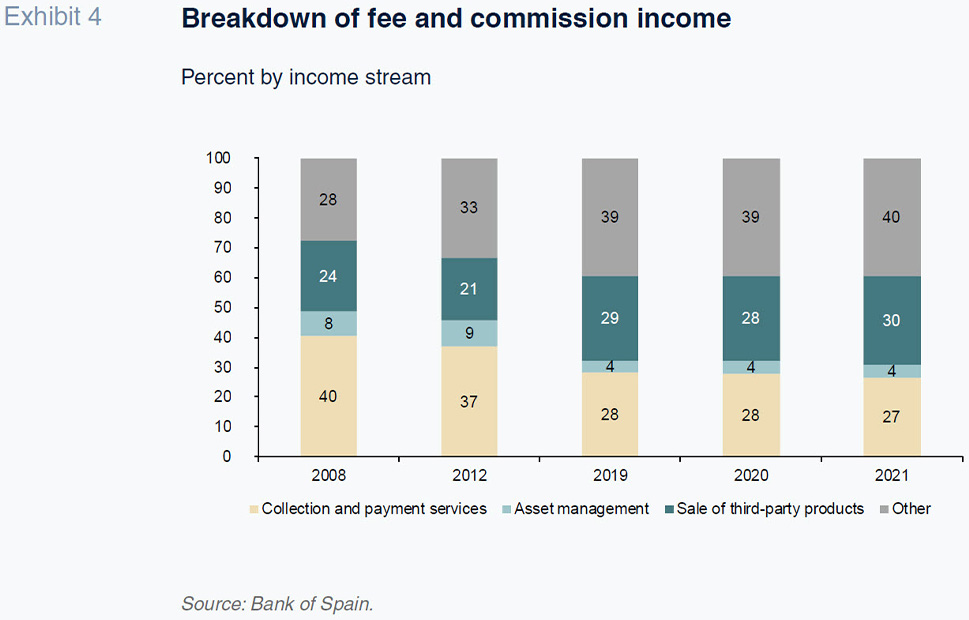

The growing weight of fee and commission income as a percentage of net operating income and average total assets (ATA) is taking place concurrently with a shift in composition. Within the fee and commission mix, the contributions by collection and payment services (transfers, checks, account maintenance, etc.) and securities services (administration and custody, subscription, management, underwriting and placement) have declined. Whereas the fees and commissions derived from the marketing and sale of banking products and services have risen. This category includes income from products distributed, but not managed by banks, such as the sale of third-party investment and pension funds and insurance policies. Fees from those sales accounted for 30% of total fee and commission income in 2021 (Exhibit 4). This exceeds the amount banks generated from collection and payment services, which amounted to 27% of the total in 2021 (down from 40% in 2008). The entry of new online entities offering collection and payment services (such as Fintech players) is eroding the market shares of traditional banks and wearing away the volume of fees and commissions that banks can collect.

The weight of fees from securities services has also decreased, declining steeply from 8% in 2008 to 4% in 2021. Other sources of fee and commission income currently represent 40% of the total. These fees and commissions are generated by activities, such as the sale of foreign currency, extension of financing (analysis, arrangement, prepayment fees, etc.), assumption of contingent risks (such as bonds and sureties), extension of contingent commitments (credit lines), and provision of advisory services, etc.

Income structure: Comparative international analysis

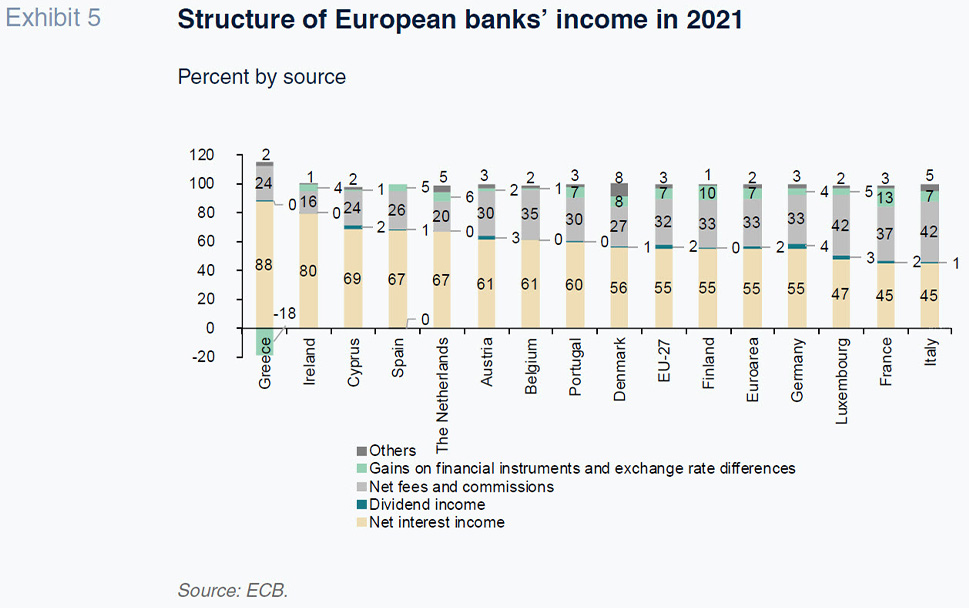

To compare the Spanish banks’ income structure with that of its European peers, we rely on the data published by the ECB for consolidated financial groups, which includes the international subsidiaries of various banking groups. The most recent data reveal that the traditional deposit-taking and lending business garners a higher weight in the Spanish banks’ interest income relative to their European peers. Whereas the traditional intermediation business –net interest income– accounts for 67% of total income in Spain (Exhibit 5), the average in the EU-27 and eurozone is 55%, 12 percentage points lower.

Fees and commissions are the second biggest source of revenue for the Spanish banks, accounting for 26% of total income, 6 percentage points below the EU-27 average (32%) and 7 below the eurozone average (33%). Dividends contribute just 1% of income (half the EU-27 and eurozone average), while net trading income represents 5% of net operating income (2 pp below the european averages). In the ranking of the EU-27 banking sectors, Spain is positioned at the high end of the range in terms of the share of net operating income contributed by net interest income.

If instead of focusing on the breakdown of income, we analyse its weight over the ATA, as an indicator of average prices, Spanish banks boast net operating margins above the European average. The net operating margin in Spain was 2.49% of ATA, 49 basis points above the eurozone average. The main difference lies in that net interest margins (at 1.68%, which is twice the metric secured by the Spanish business – compared to Spanish banks’ foreign subsidiaries) are 58 basis points above the eurozone average. The weight of dividends in ATA is very low (0.03% vs. 0.04% in the eurozone), while that of fee and commissions is almost identical (0.65% vs. 0.66%). This last figure is higher than the 0.5% weight accounted for by fees and commissions as a percentage of assets in the domestic business in Spain. This suggests that the Spanish banks’ foreign subsidiaries charge higher commissions than at home.

Focusing more closely on fee and commission income as a percentage of ATA, the most recent figure for 2021 places Spanish banks at a consolidated level in line with the eurozone average (0.65%), below Italy (0.97%) and France (0.68%), and just ahead of Germany (0.61%).

Conclusion

The intensity of the factors that have shaped profitability for Spanish banks in recent years (particularly the ultra-low rate environment) has driven considerable changes in their income structure. The share of interest income has declined, while the share of fees and commissions has grown. This change has unfolded in tandem with shifts observed in the business models of Spanish banks. This has come in the form of private sector deleveraging and considerable reduction in credit over assets. Today, private resident credit stands at 41% of assets down nearly 20 points from its level prior to the 2007-2008 financial crisis. Faced with these shifts, in recent year, Spanish banks have struggled to generate returns from their domestic business that satisfy investors.

Highlights of the analysis of Spanish banks’ income structures and trends are the following:

- The drop in rates has exerted pressure on the banks’ net interest margins, which hit a record low of 0.8% of ATA in 2021. Net interest income accounted for 49% of net operating income in 2021, down 4 points from 2008.

- The drop in interest income has forced the banks to look for alternative sources of income, chiefly fees and commissions. In 2021, this category contributed 31% of total income and has grown considerably since 2008. As a percentage of ATA, fee and commission income for domestic Spanish banks increased to 0.5%, a level that is still below 2007, prior to the financial crisis.

- The fee and commission income mix has also changed considerably. The weight of payment and collection services has declined (partially due to competition from the Fintech players) and the contribution of fees from the sale and marketing of third-party products, such as funds and insurance policies has increased. In 2021, fees from payment and collection services accounted for 27% of total income (a low since 2008), whereas fees from the sale and marketing of third-party products accounted for 30% (a high since 2008).

- Interest income composition has also shifted, with interest income from the lending business falling (accounting for 78.5% in 2021, 9.5 points less than in 2008) and that from fixed-income investments increasing. For interest income from fixed-income investments, the contribution generated by interest earnings from Spanish sovereign debt holdings has decreased, while that generated by other countries’ debt has increased.

- When comparing Spanish banks and their foreign subsidiaries to the average of European banks, Spanish banks stand out for their relatively higher weight of interest in their income structure (67% vs. 55% in the eurozone) and the lower weight of fee and commission income (26% vs. 33%). As a percentage of ATA, however, fee and commission income in Spain at the consolidated level is in line with the European banks’ average (0.65%). Net interest income over assets, however, is higher in Spain than in the eurozone (1.68% vs. 1.10%).

Notes

So far in 2022, EURIBOR has rebounded sharply and was trading at over 1% at the time of writing.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF