Spain´s dependence on foreign capital flows and the need for improved public debt sustainability

Seven countries currently account for over two-thirds of total foreign investment into Spain. To shore up international investor confidence, Spain needs to make its public debt more sustainable, a task that is currently more pressing given the potential for an increase in risk premium within the context of a normalisation of ECB monetary policy.

Abstract: An analysis of IMF and Bank of Spain data ranging from the onset of the financial crisis of 2007-2008 through the present reveals that seven countries (France, Germany, Luxembourg, the US, the Netherlands, Italy and the UK) account for over two-thirds of total foreign investment (portfolio and direct) into Spain. Consequently, Spain’s high level of foreign debt leaves the country vulnerable to potential interest rate increases, as a higher percentage of Spanish income would get transferred abroad as debt service. To shore up international investor confidence, Spain needs to make its public debt more sustainable, as public borrowings have increased significantly in recent years, rising from 95.5% of GDP in 2019 to 121.8% of GDP as of September 2021, in contrast to the deleveraging observed in the private sector. The challenge of improving public debt sustainability is currently more pressing given the growing prospects of an increase in the risk premium if the ECB accelerates the withdrawal of its debt repurchases to tackle rising inflation.

Introduction [1]

For an economy to grow and prosper, it needs investment –the main source of economic growth and job creation. Often a country cannot save enough to finance its investments, forcing it took look abroad for savings, so taking on foreign borrowings. However, to borrow abroad, a country needs to be attractive to foreign investors and that appeal in turn depends on how risky those investors perceive their investments to be. The healthier an economy and the more solid its macroeconomic fundamentals (borrowing levels, growth expectations, stability, etc.), the higher the likelihood of capturing foreign investor appetite and the lower the cost of so doing.

That investor appetite materialises in two main ways –direct investment and portfolio investment. When they invest directly, foreign investors take a long-term approach (buying shares or debt securities in companies for a stake of over 10%). When investors do not have a long investment horizon or high degree of influence over their investees, they invest in securities (equity and debt securities and investment funds).

The purpose of this article is to analyse the trend in foreign investor appetite with respect to the Spanish economy, breaking the data down by country and distinguishing between direct and portfolio investments. We focus on the breakdown by source country so as to analyse the key trends from the last change of cycle, in 2007-2008, until today. Given that the period analysed runs from 2007 until the end of 2020, we are able to analyse the impact of the financial crisis that broke out in 2007, the situation when things became critical in 2012 (the year in which the risk premium rose above 600bp, when Spain had to ask for financial assistance from the European authorities) and the situation in 2020, following several years of growth since the economy emerged from recession during the second half of 2013. That enables us to identify the countries that show the greatest appetite for the Spanish economy and the shifts that have taken place since 2007.

Trend in foreign investment in Spain

Foreign investment in Spanish assets takes the form of direct investment, portfolio investing and other investments. Direct investment in turn takes the form of a long-term investments, bringing significant managerial influence over the investees, specifically equity interests of more than 10% (which can materialise in investments in shares, other equity instruments, profit reinvestment, property investments and intercompany loans). Investments with a shorter-time horizon without the ambition to influence are considered portfolio investments (investments in shares and investment funds, debt securities with an original maturity of more than one year and debt securities with an original maturity of one year or less). There is a third type of investments that gets classified under “Other investments” in the official statistics and constitutes, mainly, loans and deposits. That category also includes, albeit separated in the statistics, the change in the Bank of Spain’s liabilities vis-à-vis the Eurosystem.

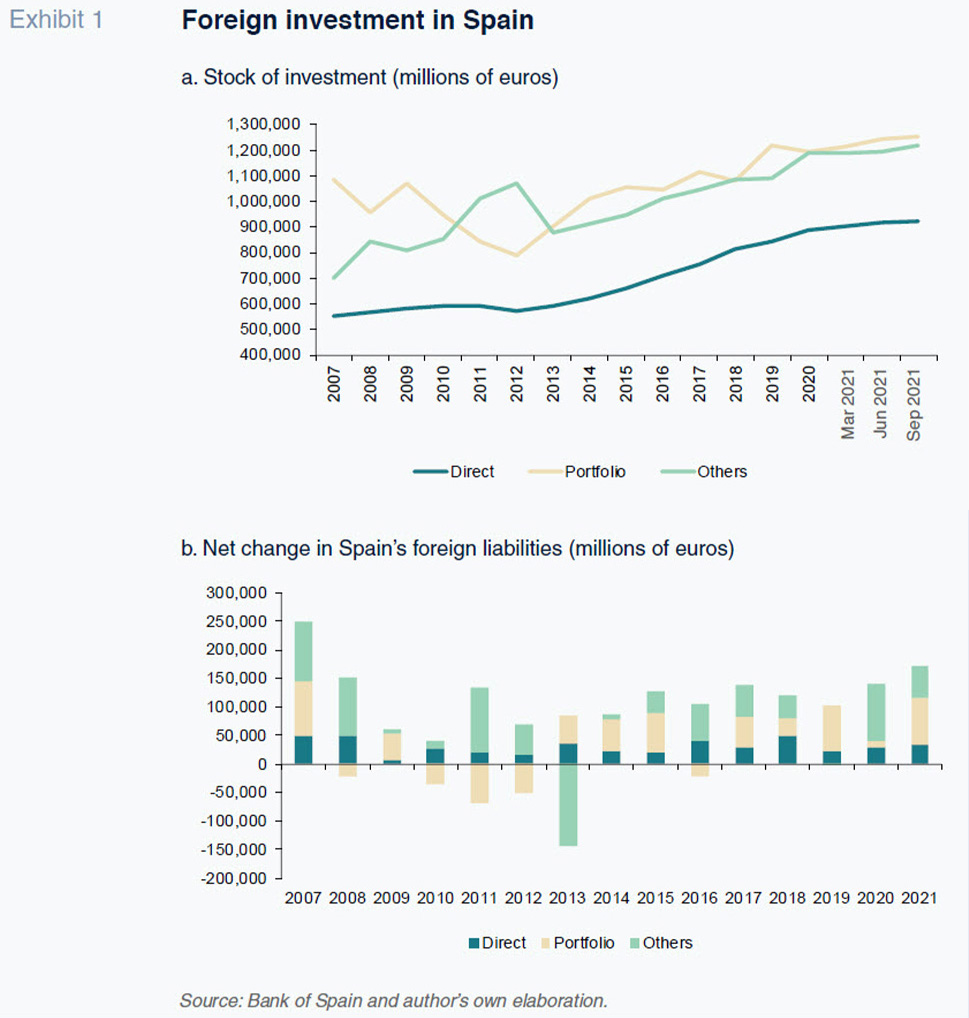

As shown in Exhibit 1, the movement in the Spanish economy’s foreign liabilities is cyclical in nature. Liabilities increased by 250 billion euros in 2007 (before the onset of the financial crisis), by just 150 billion euros in 2008 and one year later, a year in which the Spanish economy contracted by 3.8%, by around 50 billion euros. When Spain came out of recession in 2013, the growth in liabilities recovered but remained at levels far below those of 2007, shaped by the deleveraging effort of the private sector. By components, direct investment has been far more stable and remained in positive territory. Portfolio investment, in contrast, has been more volatile, contracting in some years, notably between 2010 and 2012. Lastly, other investments have proven similarly volatile; the significant decrease observed in 2013 is attributable to the Bank of Spain.

As a result of those annual changes, the stock of foreign direct investment has been rising almost continually to stand at 920 billion euros by September 2021. In the case of portfolio investment, the 2007-2008 financial crisis had a clear impact and the recovery in the wake of the recession that the crisis induced has driven that component to 1.25 trillion euros today. “Other investments” currently stand at 1.22 trillion euros, to put Spain’s foreign liabilities at 3.39 trillion euros in total.

Within portfolio investments, the composition by agent has changed substantially since 2007, a pattern that clearly reflects the contrasting trends in public versus private sector leverage. In the public sector, the debt owed to foreign investors multiplied by a factor of 3.3 between 2007 and September 2021, with the ratio of public debt-to-GDP surging from 35.8% to 121.8% over that same timeframe. In contrast, intense private sector deleveraging has driven a reduction in that sector’s foreign liabilities of close to 30%. The most recent data, as of the third quarter of 2021, indicate that public debt accounts for 47.6% of Spain’s total foreign liabilities, [2] compared to just 16.4% in 2007. In other words, the 166 billion euro increase in foreign portfolio investment in Spain between 2007 and 2021 masks a decrease of 253 billion euros of private debt and an increase of 419 billion euros of public debt.

Which countries make portfolio investments in Spain?

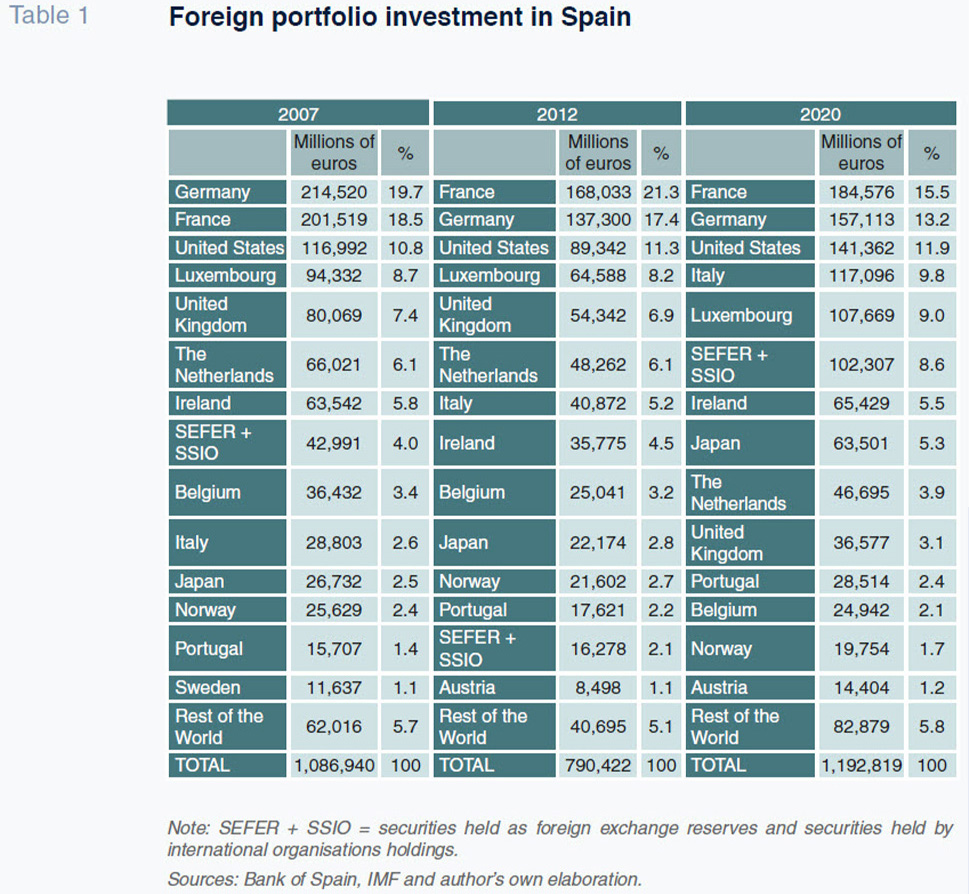

The Bank of Spain’s balance of payments statistics include details about foreign portfolio investing in Spain but do not provide a country-by-country breakdown. The IMF does provide that information by country (in dollars). In our analysis, we take the percentage breakdown by country provided by the IMF and apply those percentages to the total euro investment figures published by the Bank of Spain. That information is provided in Table 1 for 2007 (year of the change in cycle), 2012 (year of maximum tension in the financial markets) and 2020 (last year available in the IMF series).

Before the onset of the financial crisis, three countries accounted for over half of the portfolio investments in Spain: Germany, France, and at a considerable distance, the US. Germany and France each held nearly 20% of foreign portfolio investment in Spain, whereas the US held 10.8%. Luxembourg, the UK, the Netherlands and Ireland held percentages of between 5% and 10% so that seven countries held three-quarters of portfolio investment. Of the countries with holdings of between 1% and 5%, just one country (Japan) is non-European and two (Japan and Norway) are non-EU. In Latin America, Brazil was the biggest foreign investor in 2007, but with just 0.2% of total portfolio holdings.

Following the intense impact of the financial crisis, which intensified with the sovereign debt crisis of 2010 and reached its zenith in the summer of 2012 when the risk premium on Spanish sovereign bonds traded at over 600bp and Spain had to ask for financial assistance to bail out its banking sector, the portfolio investment country breakdown was hardly any different, with France, Germany and the US still Spain’s biggest creditors, accounting for half of the total investment. The only change worth highlighting at that juncture is the increased relative importance of Italy, whose share doubled from 2.6% to 5.2%.

Bigger changes are observed when we compare the country breakdown in 2012 with that of 2020. By that year, the first three countries no longer held half of total investments, but rather 40%, with Italy joining the ranks (increasing its share from 5.2% to 9.8%) to round out that 50%. It is also worth highlighting the loss of relative importance of France (from 21.3% to 15.5%) and Germany (from 17.4% to 13.2%), while the US has kept its share at close to 12%. Another trend worth pointing out is the halving of the UK’s share of portfolio investment (in fact, the UK is one of the few countries to reduce its exposure in absolute terms) and the increased in Japanese holdings (from 2.8% to 5.3%). None of the Latin American countries has a meaningful position, as the biggest investor in the region, Brazil, commands a share of just 0.04%. Russia, the focus of the world’s attention right now in the context of its war with Ukraine, only has marginal portfolio investments in Spain, at just 164 million dollars.

In short, in the case of portfolio investment, the most recent data indicate that France, Germany, the US, Italy and Luxembourg are the countries with the strongest appetites for Spanish securities, accounting for 60% of the total. The UK, which in 2012 was Spain’s fifth largest creditor, has fallen down the ranking, having more than halved its relative exposure to Spain’s foreign investment portfolio.

Which countries hold the biggest direct investments in Spain?

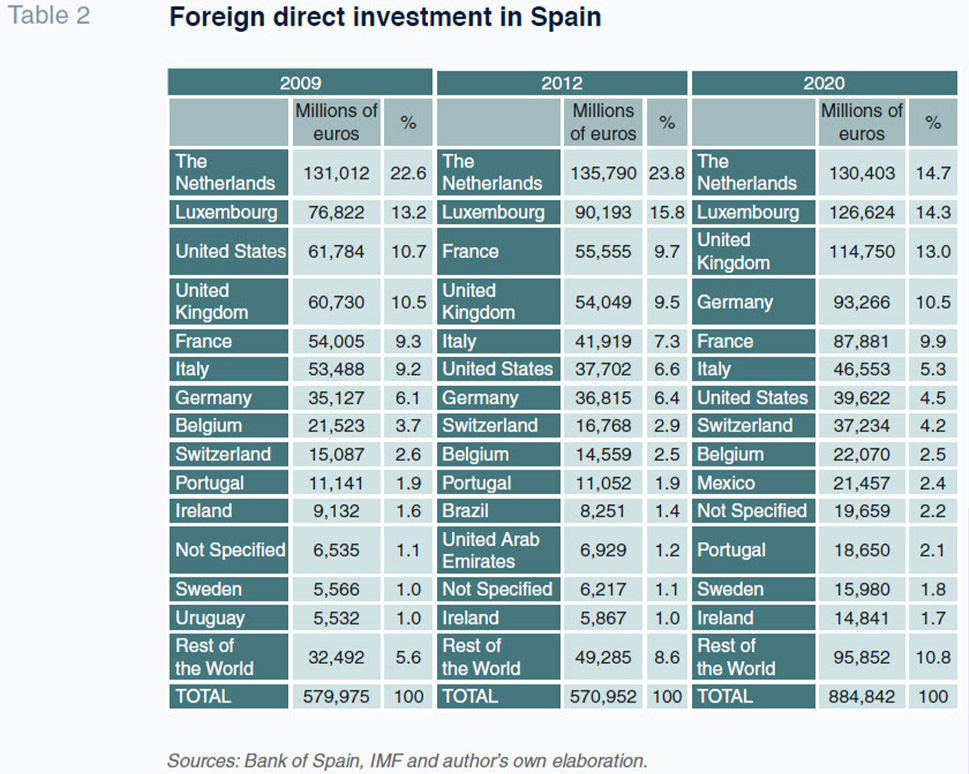

As we did with the portfolio investment statistics, in analysing foreign direct investment (FDI) we applied the percentage breakdowns gleaned from the IMF database to the investment figures reported each year by the Bank of Spain. That exercise gives rise to the analysis summed up in Table 2, which shows the main sources of inward FDI in Spain in 2009, 2012 and 2020. Here it is not possible to provide information dating to the crisis of 2007, as the IMF database only includes information from 2009.

Focusing first of all on the most recent figures, for 2020, we note that five countries account for nearly two-thirds of FDI in Spain: Netherlands, Luxembourg, the UK (each with exposures of over 100 billion euros), Germany and France. If we add Italy, the US and Switzerland to the list, we get to a combined exposure of 75%. No other single country accounts for more than 2.5% of Spain’s total stock of FDI. The only Latin American country in the ranking of the top 15 investors is Mexico, whose direct investment stands at over 21 billion euros. Russia’s direct investments in Spain are again relatively small, at 3.36 billion euros, which is more, however, than Spain has invested there (591 million euros).

Direct investment in Spain has become more geographically diversified since 2012, the year when financial market stress was at its peak. For example, whereas in 2012 Spain’s biggest direct investor was the Netherlands, which accounted for 23.8% of the total, by 2020 it garnered a nearly 10pp-smaller share. It is worth highlighting the growth in Germany’s and the UK’s stock of FDI in Spain, the former having multiplied by 2.6x and the latter, by 2.1x. In contrast, Italy’s and the US’ positions have increased by much less, by 11% and 5%, respectively. Albeit with far smaller positions in absolute terms, Switzerland and Ireland have increased their direct investments far more significantly, more than doubling their positions between 2012 and 2020.

Another noteworthy characteristic is that the Netherlands has been Spain’s biggest direct investor at least since 2009, even though its share of the total has declined. Luxembourg remains its second biggest investor, but by contrast its position has increased by 65% since 2012. The US and Italy have reduced their share of direct investments over the past decade.

Which countries invest the most in Spain?

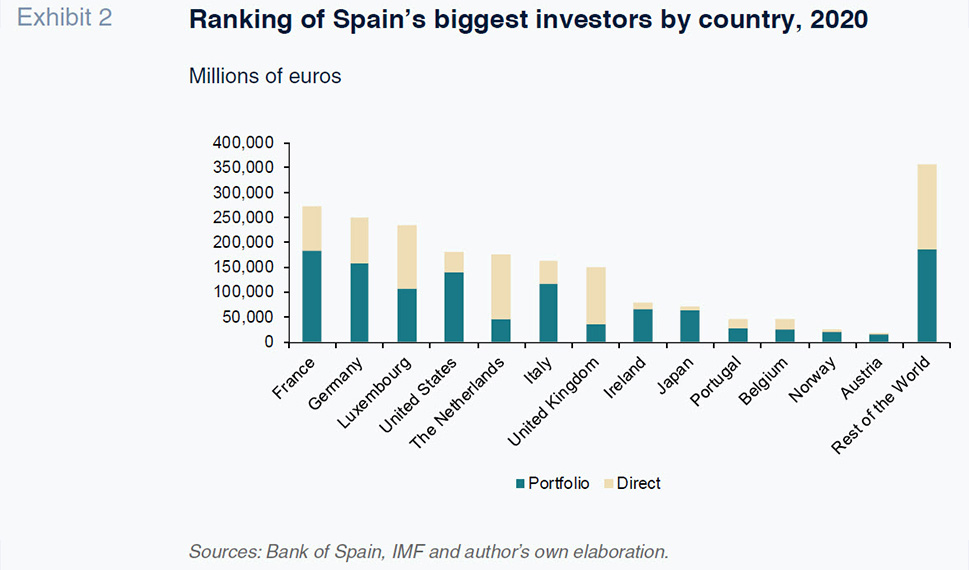

Considering portfolio and direct investment together, France, Germany and Luxembourg are Spain’s biggest investors, with positions of over 760 billion euros, or 36% of the total, between them: France holds 272.5 billion euros of investments in Spain, Germany holds 250 billion euros and Luxembourg, 234 billion euros. The countries with positions sized between 150 and 200 billion euros are the US (181 billion), the Netherlands (177 billion), Italy (164 billion) and the UK (151 billion), such that the seven countries listed account for more than two-thirds of foreign investment in Spain. Outside of Europe, only Japan merits mentioning (72 billion euros).

Conclusions

The analysis of the key trends in foreign direct investment and portfolio investment in Spain presented in this paper shows that the Spanish economy’s indebtedness has been possible thanks to the appetite displayed by third countries. Portfolio investment, although still pretty concentrated, is becoming increasingly geographically diversified, which is a positive development. In 2020, five countries (France, Germany, the US, Italy and Luxembourg) accounted for 60% of the total.

In the case of direct investment, having stagnated around the time of the financial crisis of 2007-08, the stock of FDI recovered as Spain emerged from recession in 2013, climbing to 920 billion euros by September 2021, which is good news for the country, as those investments tend to get channelled into more innovative companies that employ more skilled labour. FDI also often helps recipient companies expand internationally and become more competitive.

The Spanish economy’s high level of foreign debt obliges it to remain attractive to overseas investors, if nothing else in order to be able to continuously refinance its existing debt. That means Spain needs to become more competitive to increase its potential growth and attract foreign investment. Although the Spanish economy had decreased its negative net international investment position from 97.7% of GDP in mid-2014 to 70% by the end of 2021, it remains heavily indebted to foreign investors in net terms (in the EU only Portugal, Cyprus, Ireland and Greece are more dependent in that respect), leaving it vulnerable to the potential rate hikes looming on the horizon. To that end, it is vital for Spain to continue to generate a net lending position in the years to come in order to reduce its foreign debt. That requires making the economy more competitive (which is where structural reforms come into play) and reducing the main source of Spain’s need for financing in the first place, which is its structural deficit. While the private sector has been deleveraging in recent years (leaving it more solvent), the opposite has happened in the public sector, so that Spain now must reduce its indebtedness to ensure the sustainability of its debt and generate international investor confidence.

Since the start of the financial crisis in 2007, and with greater intensity since the onset of the sovereign debt crisis in Europe in 2010, which peaked in Spain in the summer of 2012 (with the banking sector bailout), Spain’s country risk premium has been kept in check thanks largely to the ECB’s intervention. The monetary authority’s debt repurchase programmes, which have been consistently rolled over to help tackle a succession of negative shocks (the most recent being the COVID-19 crisis) have been decisive in keeping the risk premium, and thereby Spain’s borrowing costs, under control. A very clear indicator of just how much Spain owes the ECB is the fact that today some 33% of its public debt is held by the ECB, which is therefore one of our main “guarantors”. That support makes Spain’s debt more sustainable by bringing down its borrowing cost. The risk is that as those buyback programmes get rolled back (which is likely to happen sooner than originally expected so that the ECB can pursue its inflation target) and rates are increased, the sustainability of Spanish debt will deteriorate, thus the country will have to transfer more of its income abroad to service its debt. No matter what way one looks at it, the government needs to prioritise public sector deleveraging and reducing the structural deficit.

Unfortunately, the complicated macroeconomic scenario of stagflation has become more likely within the context of the outbreak of the war between Ukraine and Russia. This will complicate fiscal consolidation efforts, given the additional pressures of the potential rise in ECB rates to face the increase in inflation. In this context, efficiency in controlling public spending is more important than ever.

Notes

This article falls under the scope of research project ECO2017-84828-R of the Spanish Ministry of the Economy, Industry and Competitiveness and AICO2020/217 of the Valencian Government.

According to the Spanish Treasury’s statistics, non-resident investors hold 43.4% of all Spanish public debt (as of November 2021), making them the largest holders, followed by the Bank of Spain (which holds 33.1%). In 2007, the Bank of Spain only held 3.1% of Spanish public debt, indicating the scale of the ECB’s debt repurchase programmes.

References

BANK OF SPAIN (2022). Balance of payments and international investment position.

IMF (2022a). Coordinated portfolio investment survey (CPIS).

IMF (2022b). Coordinated direct investment survey (CDIS).

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF