Regional governments’ market access: Takeaways from the European debate

The current macroeconomic environment represents an opportunity for reforming Spain’s system of regional government financing, which until now has relied on the temporary Regional Financing Fund. Interestingly, the eurozone’s debate over the incorporation of ‘risk mitigation’ and ‘risk sharing’ into its fiscal reforms offers guidance in terms of the direction Spain’s own reforms may take.

Abstract: The Regional Government Financing Fund, initially introduced as a temporary measure, has allowed regional governments to borrow at lower costs, but has also gone hand in hand with historically high levels of regional government debt in Spain. In many ways, this conundrum is mirrored at the EU level, with the eurozone debate on fiscal and financial reform centred on both ‘risk mitigation’ and ‘risk sharing’. In the case of Spain, there are three possible funding models under consideration. Spain could extend the current financing scheme based on a single issuer of public debt instruments, divide regional debt into tranches, or rely on direct participation by the regional governments in capital markets. However, tapping capital markets would imply risks due to fluctuations in borrowing costs. While compliance with fiscal rules could limit this risk, it could take decades to reduce debt to a level that effectively minimizes it and would require abandoning regional fiscal policy as a counter-cyclical stabilization tool. It is for these reasons that observers have started to discuss the possibility of a redemption fund as an alternative solution.

[1]

Introduction

The economic crisis has affected the Spanish public sector’s borrowing in two ways. Firstly, government borrowing has increased considerably, topping 100% of GDP in 2014. Secondly, it has transformed the system by which the regional governments’ financing needs are met.

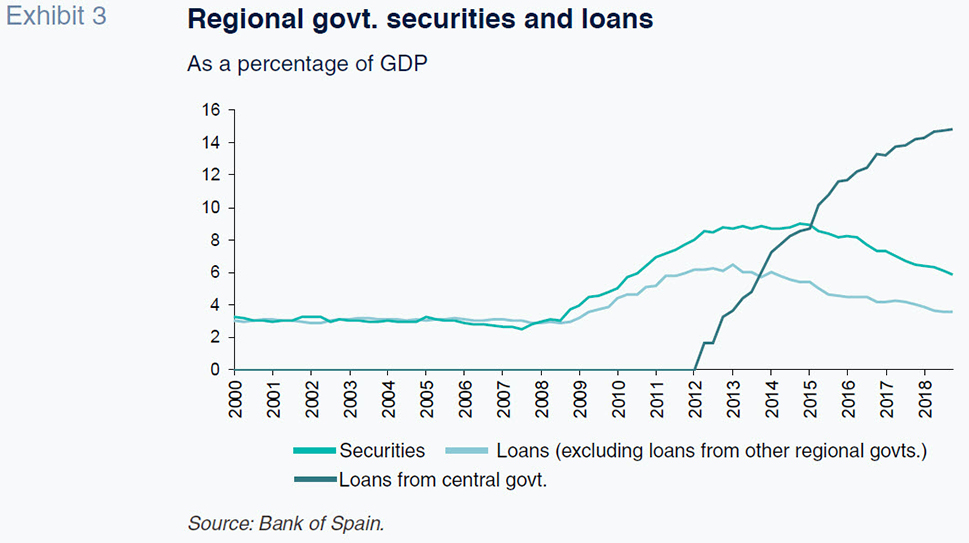

In 2018, over 60% of regional government debt was concentrated in the so-called Regional Government Financing Fund,

[2] a system based on bilateral loans between the state and regional governments. This arrangement allows regional governments to borrow at the lower central government rate.

Originally, the Regional Government Financing Fund was introduced as a temporary measure. However, its prolongation means it is now necessary to consider the optimal design of a stable debt financing framework for the medium-term. This paper draws from the arguments emerging as part of the debate about how to approach fiscal and financial reform in the eurozone.

How do the regional governments currently meet their financing needs?

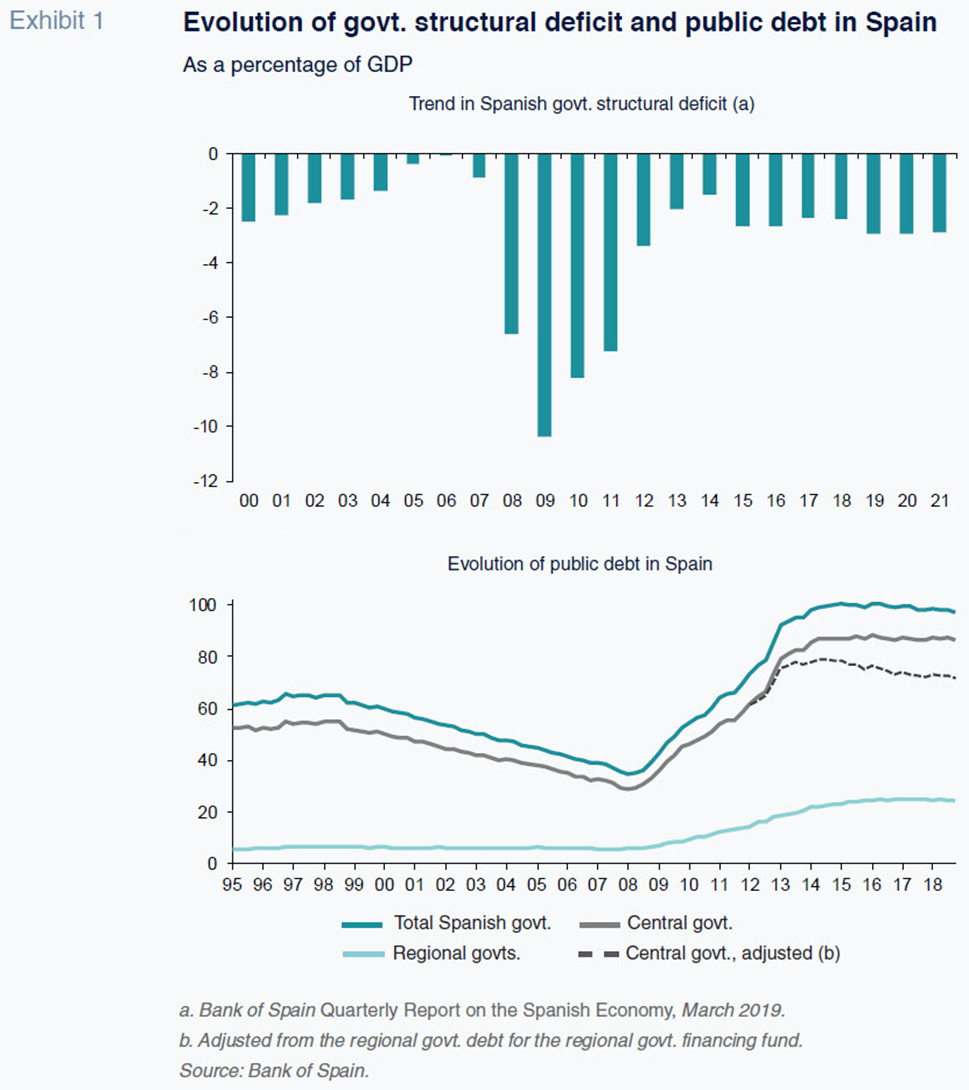

The total value of Spanish government borrowing, expressed as a percentage of GDP, is very high by historical standards (Exhibit 1).

[3] Reducing this debt level over the medium-term is crucial and must be tackled with two priorities in mind. Firstly, compliance with the fiscal rules, which provide credibility to the public sector deleveraging process (Refer to Hernández de Cos, López Rodríguez and Pérez, 2018), and mitigate vulnerability as a result of swings in investor sentiment, is essential. Secondly, in light of the interdependence between the various levels of government, the deleveraging process needs to be spread across the various subsectors.

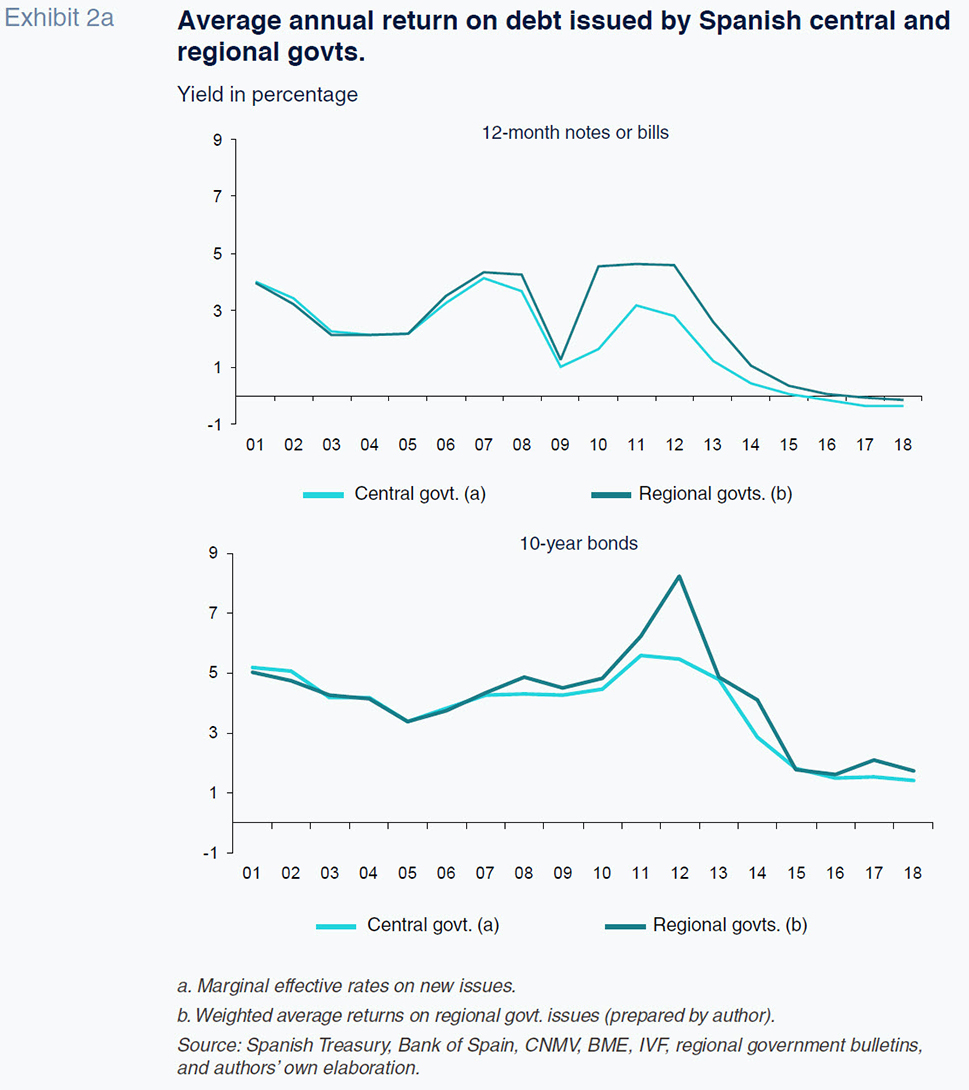

This interdependence between the different levels of government highlights the link between the borrowing costs of the central and regional governments (Exhibit 2). The regional governments that raise funds through capital markets pay a risk premium above that of the sovereign debt issued by the central government. If there is a spill-over of regional borrowing risk to the central government, this could drive an increase in the overall borrowing costs of the public sector.

The system’s current design for covering regional governments’ financing requirements was shaped by the exceptional liquidity constraints experienced during the recent financial crisis. The fact that the central government acts as the main source of funding for the regional governments (Exhibit 3), imposing in exchange reinforced supervision of the public finances of the regions resorting to that formula, is key to the system’s operation.

[4]

The result of the current framework is that regional government debt has become high by international comparison. This situation, together with fiscal discipline rules such as those set down in the Stability Act, raises the question as to what a permanent financing system for the regional governments should look like. The new system needs to factor in the initial state of the regional governments’ financing, their ability to service their debt going forward and the market’s perception of their commitment to fiscal responsibility.

Regional government market access: Takeaways from the European debate

The debate about how to reform the regional governments’ financing system is similar to certain aspects of the discussion regarding the eurozone’s economic governance. The latter is particularly focused on ‘risk mitigation’, which refers to the need to reduce debt levels, and ‘risk sharing’, whereby a permanent mechanism would enable more vulnerable countries to access the markets on similar terms as other members, particularly during times of macroeconomic stress.

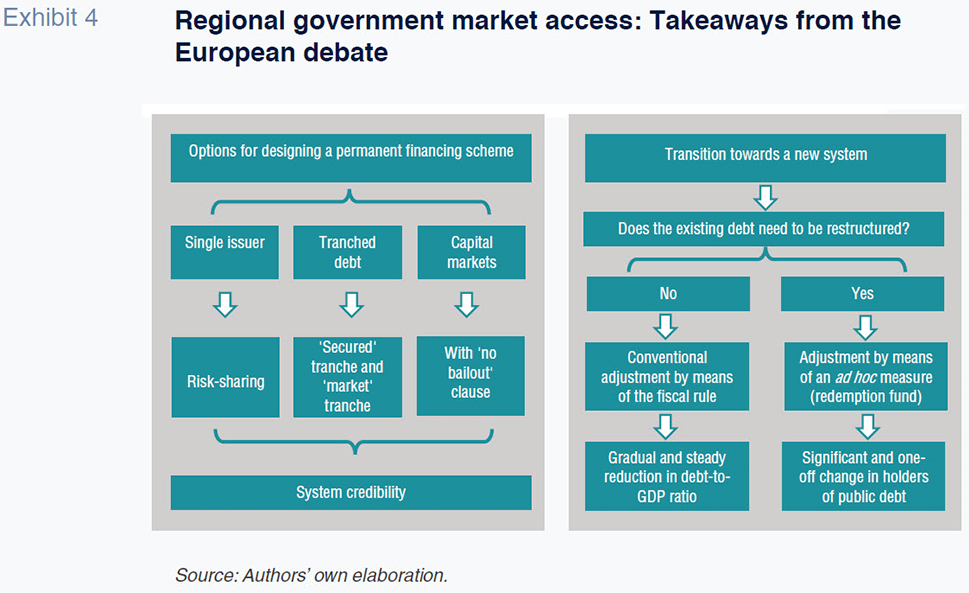

[5] In this section, we outline some of those aspects in order to articulate the various financing scenarios potentially applicable to Spain’s regional governments (Exhibit 4).

Firstly, it is possible to extend the current financing scheme based on a single issuer of public debt instruments (i.e., the central government). This issuer would raise funds, which would then be channelled to the regional governments in the form of loans. The system constitutes a risk-sharing scheme between the participating regional governments and the central government, guaranteeing a flow of financing in the event of idiosyncrasies that could affect individual regions.

However, the fact that the system can lead to the transmission of regional governments’ financial vulnerabilities to the state’s borrowing costs means that certain inefficiencies can arise. To correct this problem, regional governments must stringently comply with measures designed to ensure disciplined fiscal conduct. Such measures are reflected in legislation, specifically the National Stability Act, which includes a body of fiscal rules designed to foster budgetary discipline.

[6] Importantly, the Stability Act largely embodies European rules on fiscal discipline. Strict compliance with those rules, particularly in the event of intervention by the central government, is essential to the functioning of the system.

A second option for covering the regional governments’ financing needs would involve the division of regional debt into tranches. The issuance of debt below a threshold that is compatible with fiscal discipline targets

[7] could be channelled by the central government. This entails the sharing of both risks and benefits.

[8] The issuance of debt above that threshold would occur in the securities markets in the form of subordinated debt.

[9]

Subordinated debt offers less advantageous terms for investors than other securities. For example, the purchaser has lower seniority relative to other security holders in the event of restructuring.

[10] These types of issuances imply an increase in the marginal cost of financing, thereby incentivizing the maintenance of fiscal discipline at the regional level. For those tranches over the stipulated threshold, it will be necessary to include a contract that allows the buyers to correctly assess the associated risk. This document would include the precise terms on which a potential restructuring process would be carried out (refer to Bénassy-Quéré

et al., 2018).

A third route entails the direct participation by the regional governments in the capital markets. In this scenario, risk would not be shared between the central and regional governments. Although the viability of this system depends on the size and frequency of the issues (in relation to the costs associated with the process), fund-raising in the public debt market would give the regional governments greater autonomy over their financing decisions. Moreover, for those fiscally responsible regional governments, it could provide access to cheaper financing.

It is important to highlight that the regional governments’ access to the capital markets would depend on strict compliance with two aspects of the Stability Act. Firstly, given that the markets do not always function efficiently, it is essential to guarantee compliance with fiscal rules so as to prevent the accumulation of chronic fiscal imbalances at the regional level. Secondly, a credible ‘no bailout’ agreement with the central government is necessary to encourage fiscal discipline. Strict observance of such a clause would require the existence of additional procedures that would boost the credibility of those responsible for enforcing it. For example, the inclusion of automatic debt restructuring mechanisms as a prerequisite for accessing central government assistance would increase the credibility of the no bailout clause. It would also boost the disciplinary pressure exercised by the capital markets through the different risk premiums assigned to the various governments.

Participation in the capital markets would imply risks due to the fluctuations in borrowing costs. Markets can suddenly change how they rate the risk premium of sovereign debt. Exposure to this risk factor would be higher for the more indebted governments, notwithstanding potentially solid economic fundamentals. For that reason, some economists have warned of the risk of basing this type of system on the imposition of ‘market discipline’ in highly indebted economies (refer to Tabellini, 2018).

Compliance with fiscal rules could limit this risk. They facilitate the running of primary surpluses, which is compatible with gradual deleveraging under the scope of a medium-term stabilisation plan. However, it could take decades to bring the ratio of debt-to-GDP to a level that minimises risk inherent in capital markets. Furthermore, it would imply renouncing regional fiscal policy as a counter-cyclical stabilisation tool.

It is for these reasons that

ad hoc options designed to reduce an economy’s indebtedness have emerged.

[11] Those proposals tend to be articulated around two common aspects: (i) creation of a redemption fund (

e.g., an interregional fund) that would enable the buyback and removal from the market of the portion of a government’s debt that lies above an acceptable threshold (

e.g., the debt in excess of 13% of GDP), while financing itself with its own issuance; and, (ii) in order to ensure functionality, participants in this mechanism would commit to financing the redemption fund.

[12]

The viability of such a process would rely on the credibility generated by the participants vis-à-vis compliance with the fiscal playbook. The governments involved in the debt redemption fund may be tempted to flout fiscal discipline by issuing debt above the specific threshold. That possibility could lead buyers of the debt issued by the redemption fund to demand a higher risk premium as compensation for transaction viability issues and potential intervention at the central government level. It would therefore be necessary to reinforce the mechanism with binding aspects designed to eliminate the existence of moral hazard and time inconsistency, such as safeguards that would allow the reversal of debt redemption transactions or the introduction of an automatic debt restructuring mechanism designed to induce fiscal discipline on the part of its participants.

Conclusions

The current system for covering the regional governments’ debt financing requirements was designed as a temporary mechanism and shaped by specific conditions that no longer exist. Against this backdrop, the debate over eurozone fiscal and financial reform can serve as a source of ideas for the creation of a new, permanent system in Spain. The current macroeconomic environment, characterised by low interest rates and economic growth, represents an opportunity for reforming the system.

[13]

Notes

The views expressed in this paper are those of the authors and do not necessarily reflect those of the Bank of Spain or the Eurosystem.

The Regional Government Financing Fund, implemented on January 1st, 2015, includes the Fund for Financing Supplier Payments and the Regional Liquidity Fund. Refer to Delgado-Téllez et al. (2015).

Spain’s Organic Law on Budget Stability and Financial Sustainability (the Stability Act) stipulates a debt ceiling of 60% of GDP. That target is divided up between the different levels of government, assigning a limit of 44% of GDP to the central government and one of 13% to the regional governments. Refer to Hernández de Cos and Pérez (2013) for a detailed review of the legislation.

The use of the regional government funds, coupled with the persistence of ultra-low rates and the high incidence of loans as a percentage of total regional government borrowings, has enabled them to reduce their average borrowing costs substantially. Refer to Jiménez and López (2017) for more detailed analysis.

The overlap between the debate about regional financing and relations between the European Union member states is evident, for example, in the similarity between the wording of the ‘no bailout” clause of the Stability Act (article 8) and that included in the European Union Treaty with respect to relations between member states (article 125 of the consolidated version of the Treaty on the Functioning of the European Union).

Specifically, the Stability Act imposes a public deficit ceiling, a spending control rule and explicit public debt targets. In addition, the Stability Act comes with detailed mechanisms for central government control and monitoring of subcentral financing, as well as preventive and corrective mechanisms that are triggered in the event of imbalances. For further details, refer to Hernández de Cos and Pérez (2013).

The Stability Act imposes a borrowing limit on the regional governments of 13% of GDP.

Such a mechanism could be implemented either by using the existing regional financing framework (the regional liquidity fund) or via the joint issuance of securities by the regional and central governments (Delgado-Téllez et al., 2016).

Refer to Delpla and von Weizsäcker (2010) for a proposal for the introduction of seniority into the public debt market in order to foster explicit differentiation between different levels of debt security risk depending on the issuer’s indebtedness. In their original proposal, which relates to eurozone state financing, the authors divide debt issuance into two groups of securities: ‘blue bonds’, jointly and severally guaranteed by member states that keep their sovereign debt at under 60% of GDP. Above that threshold, the states would have to finance themselves by issuing ‘red bonds’ (exclusively national), with junior ranking in the event of debt restructuring processes. Brunnermeier et al. (2011) offer another alternative for the creation of tranches based on sovereign bond backed securities.

Other forms of introducing different levels of seniority are based on the issuance of GDP-linked bonds. Refer to Benford et al. (2018) for a detailed discussion.

Refer to Pâris and Wyplosz (2014) and Cioffi et al. (2019). The way in which the redemption mechanism works is based on the argument that the massive increase in borrowing sustained in the last decade is attributable exclusively to developments related with the economic crisis, i.e., a perception of debt as a legacy from previous economic conditions.

There are a number of proposals that vary in terms of the scale and time horizon for implementing the redemption, how it should be funded (VAT, wealth tax, seigniorage funds) and the mechanisms devised to create credibility. For more details, refer to Corsetti et al. (2016) and the authors referenced therein.

Cantalapiedra and Jiménez (2017) warn of the risks implied by leaving the regional government funds intact for too long to the extent that the administrations that are financing themselves exclusively using the current mechanism could find themselves faced with significant costs when they return to the capital markets.

References

BÉNASSY-QUÉRÉ, A., BRUNNERMEIER, M., ENDERLEIN, H., FARHI, E., FRATZSCHER, M., FUEST, C., GOURINCHAS, P., MARTIN, P., PISANI, F., REY, H., SCHNABEL, I., VÉRON, N., WEDER DI MAURO, B. and ZETTELMEYER, J. (2018). Reconciling risk sharing with market discipline: A constructive approach to euro area reform.

CEPR Policy Insight No. 91.

BENFORD, J., OSTRY, J. D. and SHILLER, R. (2018).

Sovereign GDP-Linked Bonds: Rationale and Design. CEPR Press.

BRUNNERMEIER, M., GARICANO, L., LANE, P., PAGANO, M., REIS, R., SANTOS, T., THESMAR, D., VAN NIEUWERBURGH, S. and VAYANOS, D. (2011).

European Safe Bonds. The Euronomics Group.

CANTALAPIEDRA, C. and JIMÉNEZ, S. (2017). The autonomous regions’ funding model: between the state and the markets.

Spanish Economic and Financial Outlook, 6(1), January.

CIOFFI, M., ROMANELLI, M., RIZZA, P. and TOMMASINO, P. (2019). Outline of a redistribution-free debt redemption fund for the euro area.

Bank of Italy Occasional Papers, No. 479.

CORSETTI, G., FELD, L. P., LANE, P., REICHLIN, L., REY, H. VAYANOS, D. and WEDER DI MAURO, B. (2016).

A New Start for the Eurozone: Dealing with Debt, Monitoring the Eurozone 2. CEPR Press. London.

DELGADO-TÉLLEZ, M., GONZÁLEZ, C. I. and PÉREZ, J. J. (2016).

Regional government access to market funding: international experience and recent developments. Economic Bulletin, February. Bank of Spain, pp. 21-32.

DELGADO-TÉLLEZ, M., HERNÁNDEZ DE COS, P., HURTADO, S. and Pérez, J. J. (2015). Extraordinary mechanisms for payment of general government suppliers in Spain.

Bank of Spain Occasional Papers, No. 1501. DELPLA, J. and VON WEIZSÄCKER, J. (2010). The blue bond proposal.

Bruegel Policy Brief 2010/03, May.

HERNÁNDEZ DE COS, P., LÓPEZ RODRÍGUEZ, D. and PÉREZ, J. J. (2018). The challenges of public deleveraging.

Bank of Spain Occasional Papers, No. 1803.

HERNÁNDEZ DE COS, P. and PÉREZ, J. J. (2013). The new budget stability law.

Economic Bulletin, April 2013. Bank of Spain, pp. 65-78.

JIMÉNEZ, S. and LÓPEZ, C. (2017). Autonomous regions leading decline in debt servicing costs.

Spanish Economic and Financial Outlook, 6(6), November.

PÂRIS, P. and WYPLOSZ, C. (2014). PADRE: Politically Acceptable Debt Restructuring in the Eurozone.

Geneva Special Report on the World Economy 3, ICMB and CEPR.

TABELLINI, G. (2018). Risk sharing and market discipline: Finding the right mix.

Voxeu.org.

Mario Alloza, Mar Delgado-Téllez and Javier J. Pérez. Bank of Spain