How banked is Spain in the European context?

While there exists the perception that Spain is overbanked relative to other EU countries, the banking sector’s contribution to the Spanish economy (in terms of gross value added and employment) is lower and has fallen, with the industry’s credit to GDP ratio just 3 percentage points above the eurozone average. Interestingly, this has occurred alongside an expansion of auxiliary financial services, which have become more attractive due to the prolongation of historically low interest rates.

Abstract: Spanish banking services generate 2.7% of the Spanish economy’s gross value added and 1.1% of its jobs. Those percentages are below the eurozone averages of 3% and 1.4%, respectively. In the wake of the crisis, the banking sector’s contribution to the economy has fallen in both Spain and the eurozone, albeit more intensely in Spain. Despite growth in financial disintermediation, the banks remain at the core of the Spanish financial system, accounting for 70% of its GVA and 61% of the employment generated. It is worth highlighting the growing importance of auxiliary activities to financial services, which contributed 12% of the income and 24% of the employment generated by the Spanish financial system in 2017. This can be explained by the growth in fund management, which in the context of low interest rates, has made bank deposits less attractive. Although the Spanish economy continues to rely on bank credit relatively more than the rest of Europe, the intense private sector deleveraging observed has drastically narrowed this difference–measured in terms of credit/GDP, this statistic stands at 101% in Spain versus 98% in the eurozone.

[1]

Introduction

It is a widespread belief that the Spanish economy is highly banked, with data points such as its high corporate dependence on bank financing, the importance of the banking business in the overall financial system and the high number of bank branches often cited as evidence of this supposed fact. However, the use of alternative, more rigorous banking penetration indicators, such as the sector’s weight in terms of value added and job generation, weakens this assumption. Indeed, Spain’s weight in the value added by banks in the eurozone (9.6%) is lower than its weight in the overall eurozone economy (10.5%). The pattern is the same with employment in the banking sector. The weight in European banks’ activities (10%) is lower than in the overall economy (12.5%).

The fact that the banking sector garners a higher weight in the overall financial system in Spain than in other economies does not imply a higher weight in the overall Spanish economy. In fact, the Spanish financial system is characterised not by the significant weight of its banks but banking penetration, which, based on a proxy measurement of the weight of banks in the economy in terms of value added and job generation, is below the eurozone average. Moreover, although bank loans remain the most important source of financing in Spain, the intensive deleveraging recently observed in the Spanish private sector has reduced the percentage of credit over GDP, which since 2018 has been almost in line with the eurozone average. The density of branch networks has also fallen significantly in recent years and although it remains high by comparison with other EU states, the branches in Spain are smaller. In fact, based on the number of employees and assets per branch, Spain’s branches are among the smallest in the EU. These data explain why the weight of total bank assets in GDP is below the eurozone average.

Further analysis provides insight into the structural shift of the composition of Spain’s financial system, in which the banks have lost significant relative importance in favour of auxiliary financial service activities, such as fund management and financial advisory services. Although the trend in Europe is similar, the shift has been more pronounced in Spain. Additionally, in the early years of the crisis, banks’ role in financial intermediation diminished in both the EU and Spain, alike. However, the loss in Spain has been greater, as the weight of the banks in the economy’s total value added has contracted by 40% since 2009, compared to contractions of 17% and 19% in the eurozone and EU, respectively. The loss of prominence is less pronounced in terms of jobs. Over the same period, the banking industry’s share of total employment fell by 21% in Spain, versus 13% and 12% in the eurozone and EU, respectively.

These takeaways are based on an analysis of Eurostat data. Eurostat publishes information on the breakdown of value added and employment by sector of activity. One such sector is financial services, under which is the banking sector. That information is complimented by additional data from the ECB’s records of banks’ balance sheets. These data date back to 1995, thereby facilitating the identification of structural changes as well as the impact of the recent crisis on the weight of the banking sector in the economy. Given the existence of disaggregated information by country, it is possible to conduct a comparative analysis of the Spanish banking sector in the European context.

This paper is comprised of four sections, with the goal of answering the following questions: a) what is the banking sector’s contribution to the value added and employment in the economy? b) what size is the banking sector in terms of assets- and credit-to-GDP? c) what is the relative weight of the banking sector in the overall financial system in terms of value added and employment? and, d) are we witnessing disintermediation (and an increase in shadow banking) such that the relative weight referred to in part c is declining over time? And has that trend been affected by the recent crisis?

How significant is financial intermediation in the economy?

Economic activity can be classified under various sectors using the NACE statistical classification of economic activities. Sector 64 includes financial service activities (excluding insurance and pension funds services), which is where banks’ activities are included.

[2] As a result, sector 64 is the starting point for approximating the size of the banking sector in the economy.

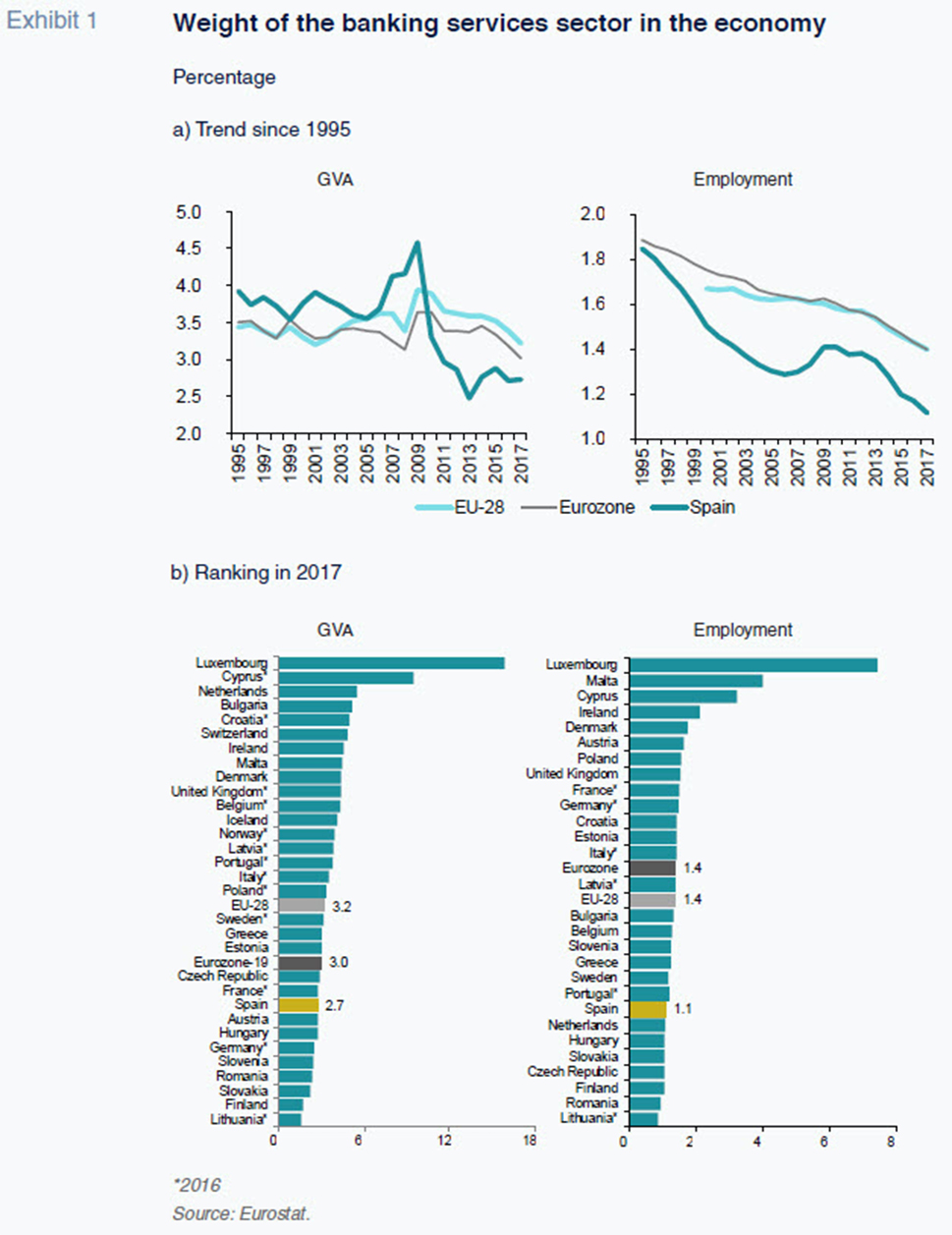

As shown in Exhibit 1, the weight of banking services in the economy’s overall gross value added (GVA) was higher in Spain than the European average until 2009. Since then it has declined, ultimately falling to 2.7% in 2017, compared to 3% and 3.2% in the eurozone and EU, respectively. In 2017, the last year for which the figures are available, the weight of the Spanish banks was low in comparison to most of the main European economies. For instance, the weight of national banks in their home economies stood at 2.8%, 3.5%, 4.3% and 2.4% in France, Italy, the UK and Germany, respectively.

The Spanish economy also looks relatively less banked in terms of the total weight of banking service jobs. In 2017, banking service activities accounted for 1.1% of employment (217,020 jobs) in Spain, compared to 1.4% in the EU and the eurozone. Of the major European economies, Spain is the least banked in terms of the sector’s contribution to total employment, with the sector accounting for 1.4% of employment in Italy and 1.5% in Germany, France and the UK.

The trend since 1995 reveals a loss of banking sector weight in terms of employment across Europe, albeit more intensely in Spain since 2010, in tandem with the far-reaching sectoral restructuring and elimination of surplus capacity. Since 1995, the weight of the bank sector in employment has fallen by 40% in Spain (compared to 26% in the eurozone), decreasing from 1.8% to 1.1%. In terms of GVA, the weight in 2017 was 30% lower than in 1995, although this loss of significance primarily occurred after the onset of the financial crisis.

Considering all of the financial system’s (banking, insurance, pensions funds and auxiliary activities) activities, the weight in the overall economy is also lower in Spain than in the eurozone and the EU. Using the 2017 figures, the Spanish financial system accounted for 3.9% of GVA and 1.8% of overall employment, below the equivalent eurozone readings of 4.5% and 2.5%. Turning to employment, the weight of the Spanish financial system is lower than the major EU economies, although in terms of GVA it was higher in 2017 than in Germany (3.8%) and France (3.5%).

Weight of the banking sector in GDP by assets and credit

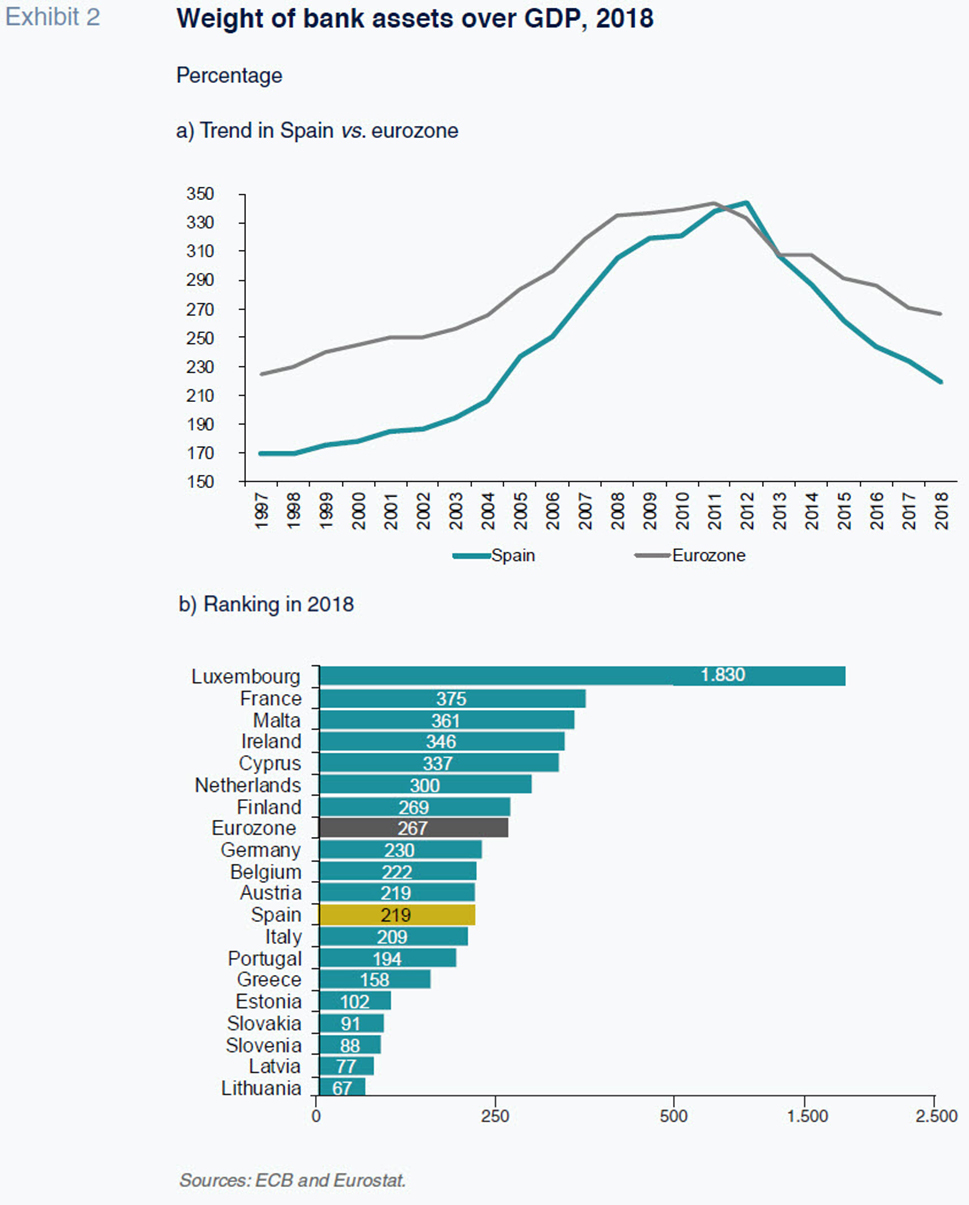

It is not possible to judge the extent to which the Spanish economy may be overbanked by solely relying on the weight of bank assets in GDP. Analysis of monetary financial institutions’ (MFIs) assets, a proxy valuation for the size of the domestic banking sector, published by the ECB shows that in 2018 that percentage stood at 219% in Spain, which is nearly 50 percentage points below the eurozone average (Exhibit 2). This percentage is a little higher than in Italy (209%) but lower than in Germany (230%) and France (375%). Looking at the trend since 1997 (the first year available), the growth in the Spanish banking sector was higher than the eurozone average, so that the gap went from 55 percentage points below the average that year to a peak of 10 percentage points above the average in 2012. Since then, the intense private sector deleveraging has widened this gap to 48 percentage points in 2018.

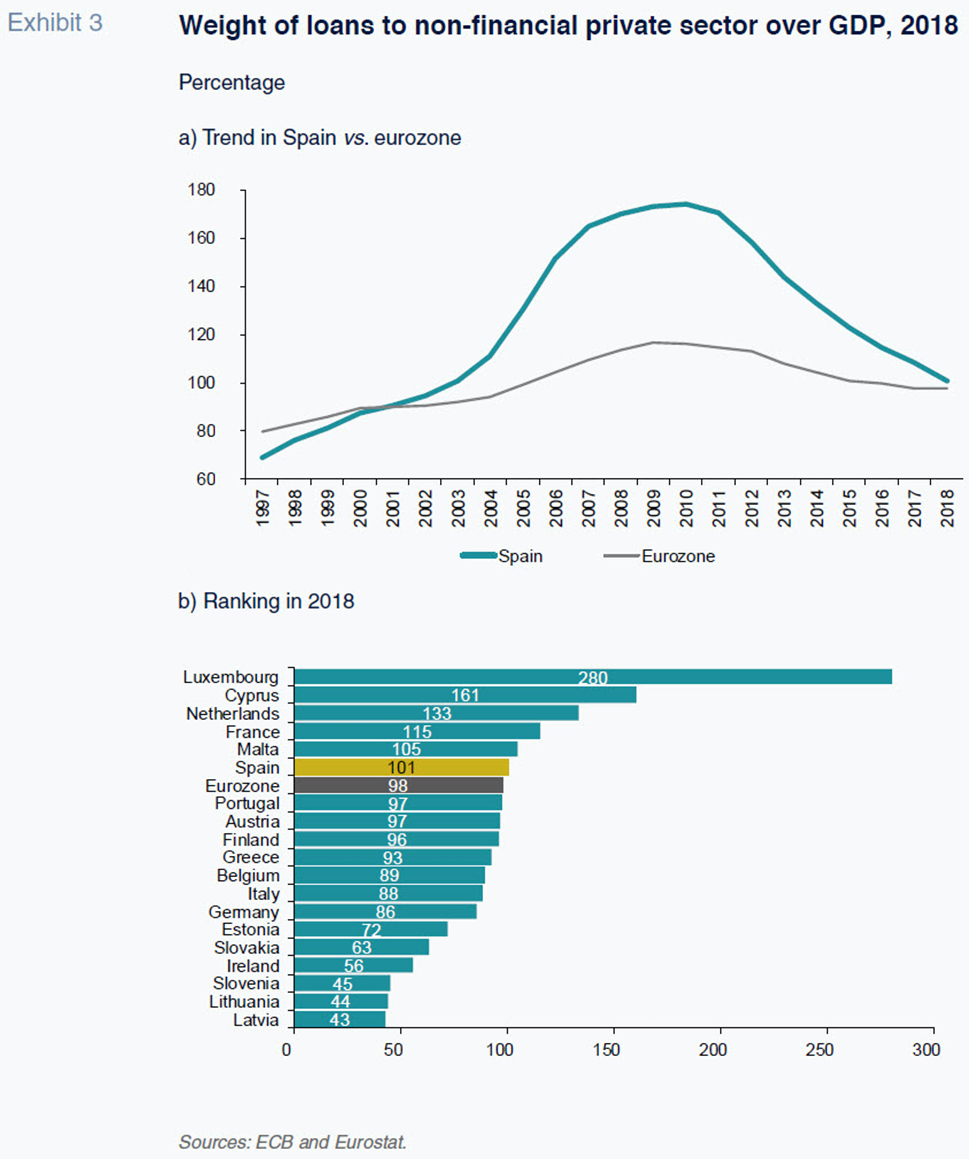

The shift in the weight of Spain’s banking sector in GDP has been influenced by the trend in private sector credit, which grew at rates of close to 20% during the boom years until 2007. Significantly, these growth rates exceeded that of GDP expansion. This rapid growth in credit pushed the banking sector’s weight in GDP to a peak of 174% in 2010, 58 percentage points above the eurozone average (Exhibit 3). The subsequent collapse in credit drove that ratio down to 101% of GDP in 2018, narrowing the gap with the eurozone average to just 3 percentage points. Thus, although the weight of credit in the Spanish economy is higher than in the main European economies (excluding France), the gap with respect to the eurozone average is very small.

Composition of the financial system: Weight of the banking sector

In addition to banking service activities (sector 64), the financial sector includes sector 65 (insurance and pension funds, except for compulsory social security) and sector 66 (activities auxiliary to financial services and insurance). Sector 66 includes fund management activities and activities provided by other firms specialised in credit cards, financial advisory, custody, etc.

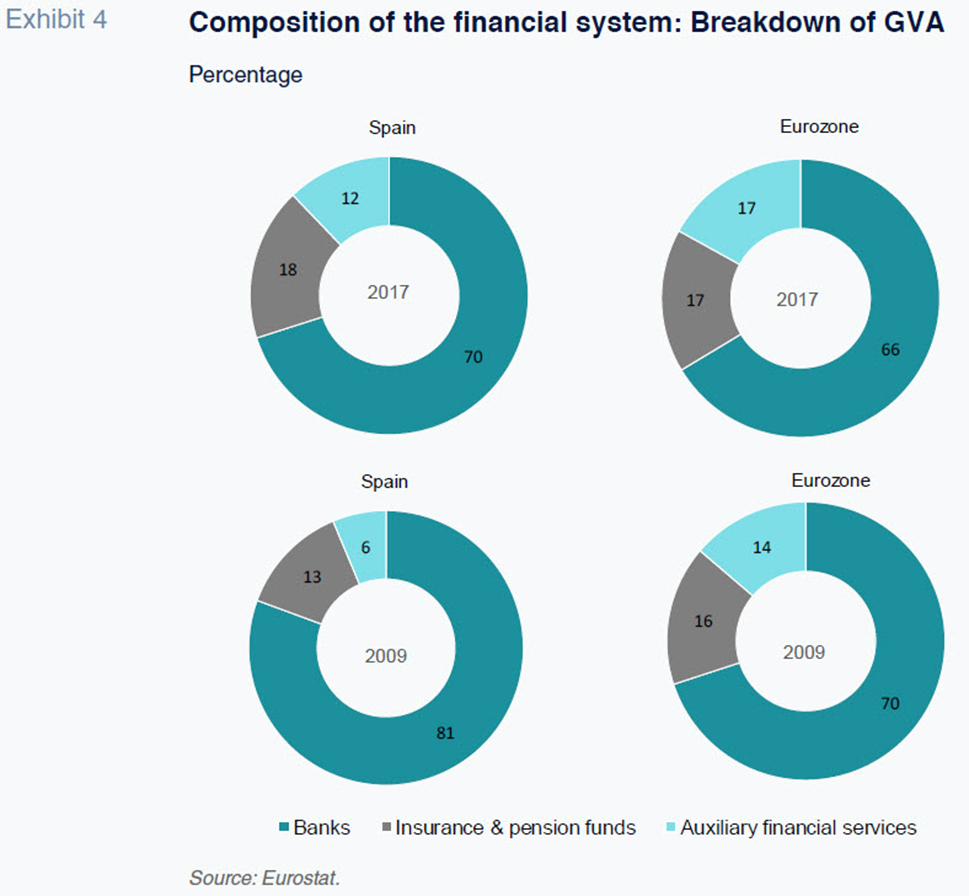

Although the banking sector’s weight in the Spanish economy is small in terms of GVA and employment compared to the eurozone average, its weight in the financial system is greater. Using 2017 figures, the banks (sector 64–financial services) accounted for 70% of the GVA generated by the financial system, 4 percentage points above the eurozone average (Exhibit 4). The insurance companies and pension funds contributed 18% and the remaining auxiliary financial services represented 12%. In comparison with the major eurozone economies, the Spanish banking sector commands a higher weight in the overall system than in Germany (61%) and Italy (67%), but not in France (76%). Turning to employment, the banking sector is also relatively more significant in Spain than in the eurozone, contributing 5 percentage points more to overall financial system jobs (61%

vs. 56%). Meanwhile, the insurance and pension sector accounted for 15.3% of jobs in the Spanish financial system and the activities auxiliary to financial services represented the remaining 23.9%.

It is worth highlighting the banks have lost relative importance in the overall financial system in Spain in recent years. In 1995, they accounted for 82% of GVA and 73% of jobs. However, by 2017, those percentages had fallen to 70% and 61%, respectively, clearly evidencing a process of disintermediation in parallel with growth in shadow banking. The banks have also lost weight in the financial system in the rest of the eurozone, albeit less intensely. Specifically, this loss accounts for 5 percentage points in terms of GVA (vs. 12 percentage points in Spain) and 8 percentage points in terms of jobs (12 percentage points in Spain). The insurance and pension funds sector’s share of the financial system’s GVA and employment has increased by 8 percentage points and 1 percentage point, respectively, while the auxiliary activities segment’s share has gained 3 percentage points and 11 percentage points, respectively. The boom in fund management in recent years coincided with prevailing low interest rates, which made bank deposits less appealing. This partially explains the growth in these activities’ share in the overall financial system.

The most recent snapshot of the financial services sector in terms of the contribution to the economy shows that in 2017 it accounted for income (GVA) of 28.92 billion euros and 217,020 jobs.

[3] The insurance and pension funds sector contributed 7.33 billion euros of GVA and 54,500 jobs, while the auxiliary financial services accounted for 5.02 billion euros of income and 85,200 jobs. In total, the Spanish financial system accounted for 41.27 billion euros of gross value added and 356,800 jobs.

It is worth highlighting the different trends etched out by the various agents in the Spanish financial system since the onset of the crisis. In the case of the banks, their contributions to GVA and employment in 2017 were 37% and 23% below the peaks of 2009/2008. In 2017, the activities carried out by the banks generated 17.21 billion euros less GVA than in 2009 and 65,800 fewer jobs than in 2008. The insurance and pension funds sector has also seen its share of value added and employment decrease since the crisis, albeit at a slower pace than the banks. However, the share commanded by the auxiliary financial services has increased. In 2017, these services accounted for nearly one-quarter of all employment in the Spanish financial system (23% more than in 2010), which is 9 percentage points more than the insurance and pension funds sector. In terms of GVA, their share has increased by 51% since 2011, but has continued to lag that of the insurance and pension funds sector by 6 percentage points.

Conclusions

- Although the Spanish economy is highly dependent on bank financing (in part due to the high incidence of SMEs), the ratio of private credit to GDP is just 3 percentage points above the eurozone average, thanks to intense deleveraging by enterprises and households in recent years.

- Measuring the importance of the banking sector by the weight of activities performed by the banks (financial intermediation) in the economy shows that Spain is less banked than the eurozone. Specifically, those banking service activities contributed 2.7% of GVA and 1.1% of all employment in the Spanish economy in 2017, compared to 3% and 1.4% in the eurozone, respectively. The weight of the financial system in the overall economy (3.9% of GVA and 1.8% of total employment) is similarly lower in Spain than in the eurozone (4.5% and 2.5%).

- Another indicator that shows the weight of the banking sector in the Spanish economy is below the eurozone average is its contribution to total value added and employment in the overall European banking sector in comparison with the weight of the Spanish economy in the overall European economy. Specifically, in 2017, the Spanish banking sector accounted for 9.6% and 10% of overall European banking GVA and employment, compared to the Spanish economy’s shares of European GVA and employment of 10.5% and 12.5%, respectively.

- Following the impact of the recent economic crisis, the weight of banking activities in the economy has declined in terms of both GVA and employment in the eurozone and, more intensely, in Spain. Financial disintermediation has, therefore, taken place.

- The weight of the banks in the overall financial system is higher in Spain than in the eurozone. In 2017, the activities carried out by the banks accounted for 70% of the GVA generated by the Spanish financial system, which is 4 percentage points above the eurozone average. In terms of employment, those activities accounted for 61% of the Spanish financial system total, 5 percentage points above the eurozone average. As a result, the weight of the other activities comprising the financial system (those performed by the insurance companies and pension funds and the other entities that perform auxiliary activities) is relatively lower in Spain.

- As a result of the crisis, the banks’ ability to generate jobs and GVA has diminished. The current readings are 37% and 23%, below peaks observed in 2008/2009. The insurance and pension funds sector has also seen its share of value added and employment decrease since the crisis, albeit at a slower pace than the banks. In contrast, the activities auxiliary to financial services have grown in relative importance. In 2017, they accounted for nearly one-quarter of jobs in the Spanish financial system, although their share of GVA was considerably lower (12%). One of the drivers of this growth is the boom in the fund management business (part of the shadow banking system), whose services have become more attractive in the wake of the drop in returns on bank deposits.

Notes

This paper falls under the scope of research project ECO2017-84828-R under the Spanish Ministry of the Economy, Industry and Competitiveness.

It also includes the activities performed by other entities such as central banks, financial holding companies, etc., although the banks are by far the most important component.

That employment figure is higher than reported by the Bank of Spain (192,626), which not only includes jobs created by the credit institutions and specialised credit institutions (EFCs for their acronym in Spanish) but also those generated by other entities that provide financial services.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF