The impact of the pandemic on Spanish household and corporate sector accounts

Data show that COVID-19’s impact on Spanish households has been smaller than that sustained by its non-financial corporations, thanks in part to generous support schemes for Spanish workers. Going forward, additional measures will be required to buoy Spanish firms, but this could leave Spain´s public debt more vulnerable if the ECB tightens its monetary policy stance.

Abstract: Although the impact of COVID-19 on the Spanish economy was substantial, the extent to which it hit the household and corporate sectors’ finances differed in several notable ways. Thanks to generous government protection measures, such as the furlough and income support schemes, households’ gross disposable income (GDI) declined by just 3.3% in 2020, which is considerably lower than the contraction in GDP. Notably, Spain’s household savings rate shot up to 14.7% of GDI in 2020 from 6.3% in 2019. That said, it is possible the drop in income was concentrated in low-income households, while the growth in savings occurred primarily in medium- and high-income households, which could have consequences for post-pandemic consumption and savings trends. Meanwhile, gross operating profit of the non-financial corporate sector declined by 18% in 2020 with the sector’s net lending position deteriorating to 2.4% of GDP. This has contributed to a fall in the number of businesses operating in Spain. While the recently announced government support measures directed towards the business community were a welcome development, these data suggest that additional measures are needed in order to prevent even greater structural damage. That said, the increase in public indebtedness could leave the economy more vulnerable when the ECB eventually winds down asset purchases.

Introduction

The COVID-19 pandemic has wreaked unprecedented havoc on global and national economies. For Spain, the economic pain has been particularly severe, with GDP contracting by 10.8% in 2020. This paper analyses the impact on the financial situation of Spain’s households and businesses based on the non-financial quarterly accounts by institutional sector compiled by Spain’s national statistics office, the INE, and the financial accounts drawn up by the Bank of Spain.

The data show that the impact on Spain’s households has been smaller than that sustained by its non-financial corporations, primarily because the bulk of the protection measures implemented by the government have been targeted at households. In fact, one of the most noteworthy consequences of this crisis has been the record rise in the household savings rate. It is important to note, however, that while at first sight the impact of COVID-19 on households appears moderate, significant disparity likely exists below the headline data.

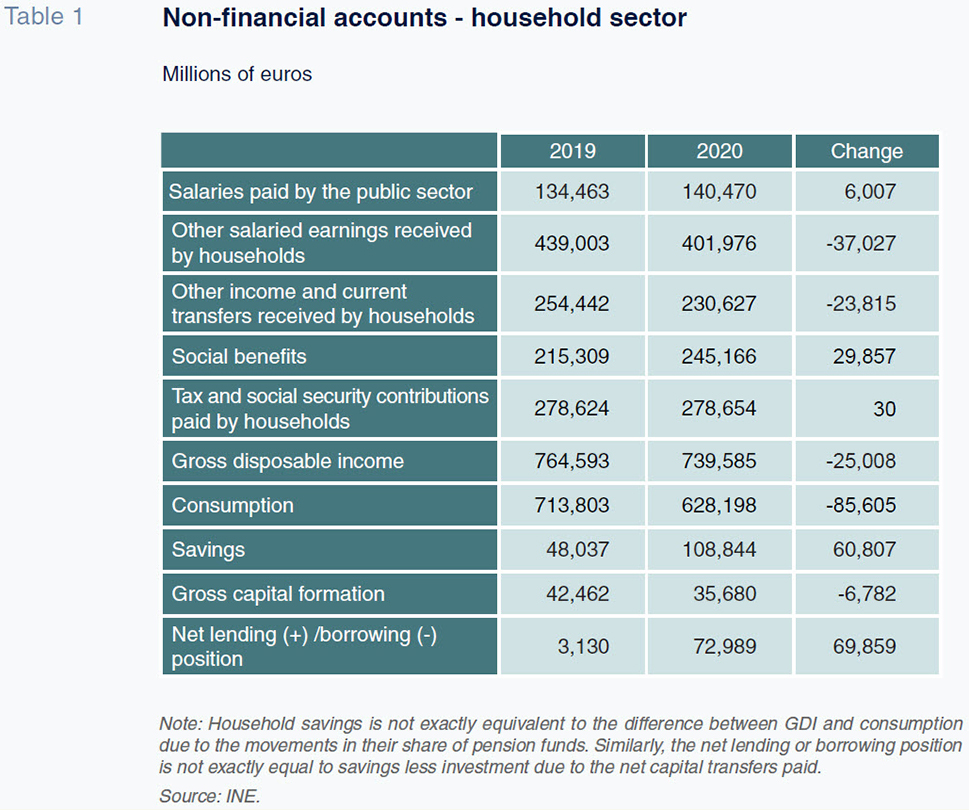

Spain’s households generate record savingsHouseholds’ gross disposable income (GDI) declined by 3.3%, or 25 billion euros, in 2020, a reduction that appears modest compared with the scale of Spain’s GDP contraction. Notably, at 8.7%, the drop in salaries paid by corporations, and in other income, such as the gross operating profit of the self-employed and dividend income, was greater than the fall in GDI. This is explained by two factors: (i) growth in the salaries paid by the public sector, which increased by 4.5%; and, (ii) a sharp increase in social benefits, of close to 14% (Table 1). The increase in social benefits materialised through: payments made by the government to furloughed employees and to self-employed professionals forced to stop working; growth in unemployment benefits; and growth in pension expenditure, among other benefits. The taxes and social security contributions paid by households barely changed, despite the dip in their GDI.

The 12% drop in consumption was significantly greater than the reduction in income. As a result, savings surged by 60.8 billion euros to reach 108.8 billion euros, which is more than double the 2019 figure. The savings rate, which was equivalent to 6.3% of GDI in 2019, shot up to 14.7% in 2020, a record high (the last record in the series —of 11.3%— was recorded in 2009).

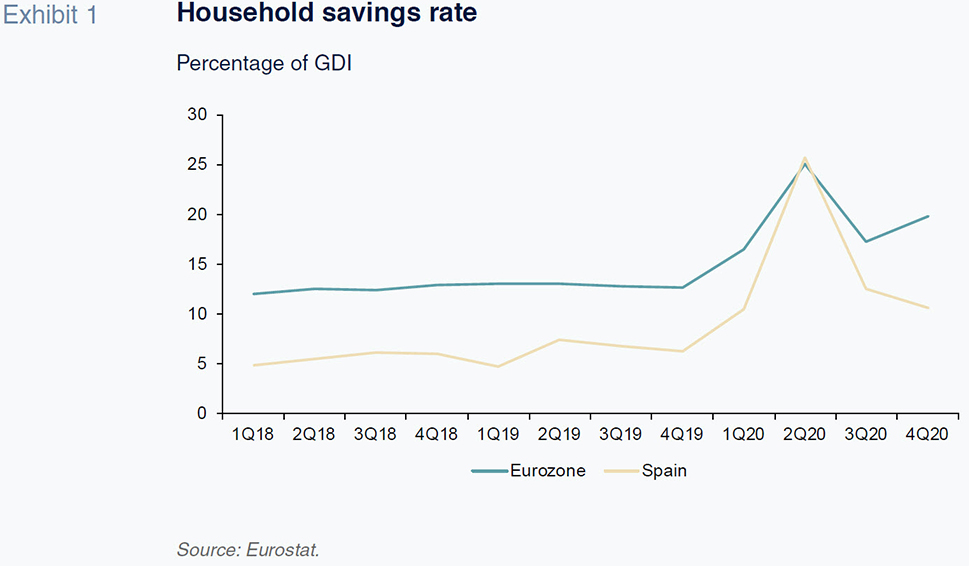

As for the quarterly trend, the savings rate peaked at 25.7% during the second quarter, which corresponds to the strictest lockdown period. The savings rate subsequently fell to 10.6% in the fourth quarter. The second quarter’s sharp increase in the savings rate reflects the fact that opportunities to spend were highly constrained by lockdown measures. In the following quarters, as the lockdown ended and businesses reopened, forced savings declined but did not disappear, due to continued restrictions on opening hours, capacity, interregional mobility, etc. That, coupled with the probable increase in precautionary savings and, possibly additional savings as a result of the voluntary avoidance of certain activities outside the home, explains why the savings rate stayed so high.

This pattern mirrors that etched out across the eurozone, although the increase in the savings rate in Spain has exceeded the eurozone average (Exhibit 1). While the eurozone’s savings rate reached a similar level to Spain’s during the second quarter, it started from a level that was twice that of Spain’s savings rate. The bigger increase in Spain’s savings rate reflects a bigger contraction in private consumption, as a result of the greater impact of the crisis, coupled with more stringent restrictions. As well, relative to the eurozone average, Spaniards spend more of their income on those activities and purchases curtailed by lockdown and social distancing measures. For example, in 2015, the last year for which comparable data are available, expenditure on hotels and restaurants accounted for 9.3% of Spaniards’ total annual expenditure, compared to 6% in the eurozone, helping explain the higher initial drop in consumption in Spain.

The trend in Spain’s savings rate has been markedly pro-cyclical since the turn of the century, falling by more than the eurozone average during periods of growth and rising higher during economic crises. It is possible that these trends could be self-fulfilling. As savings fall significantly during periods of growth, households build up less of a financial buffer, so that when the next crisis comes along, they have to tighten their belts more intensely.

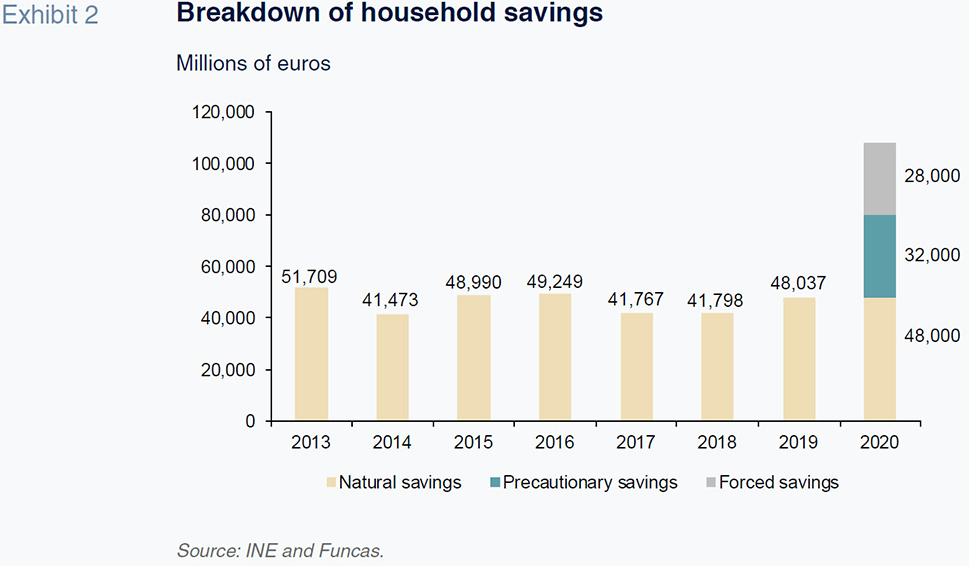

It is possible to estimate the magnitude by which household savings are above the level desired by calculating the difference between effective savings (108 billion euros) and the result of multiplying the average savings rate recorded between 2014 and 2019 —6.4%— by GDI. Based on that calculation, surplus savings stand at around 60 billion euros, which is equivalent to 8.5% of consumption in 2019. Elsewhere, we can estimate the volume of precautionary savings at 32 billion euros

[1], which puts the level of forced or surplus savings over precautionary savings at around 28 billion euros (Exhibit 2).

Note that the aggregate trend for the household sector may mask pronounced differences at a more disaggregated level. It is probable, for example, that the drop in income was concentrated in low-income households while the growth in savings occurred primarily in medium- and high-income households. Although there are no statistics available yet to confirm this assumption, it is underpinned by the fact that most of the jobs destroyed or negatively affected by the crisis have been relatively unskilled jobs

[2].

It is unlikely that households will spend all their savings accumulated in 2020. One reason for this is that those savings are concentrated in higher-income households with a lower marginal propensity to spend. Nevertheless, it constitutes an important potential driver of growth in household consumption —or even investment— once the remaining business and mobility restrictions are removed. Savings accumulated in the rest of the eurozone should also prove a source of growth in spending, providing additional momentum for the Spanish economy via exports. If the savings buffer is not spent or invested, the result would be a reduced need for credit, thereby accelerating the household deleveraging process.

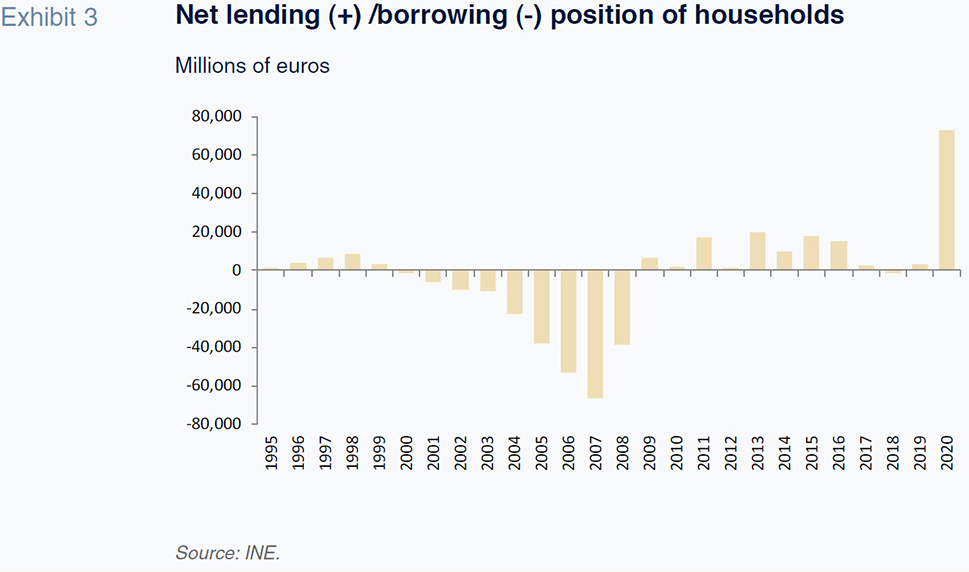

Of the 108 billion euros of savings accumulated in the crisis, households invested 35 billion euros, down 16% from 2019. As a result, Spain’s households generated a net lending position of close to 73 billion euros, equivalent to 6.5% of GDP in 2020. Note that the previous high of 19.9 billion euros was recorded in 2013 (Exhibit 3).

Meanwhile, 4.3 billion euros of the savings surplus was used to repay debt. This is well below the amount earmarked for debt repayment between 2011 and 2016. Considering that new loans to households declined by 10 billion euros in 2020, it is fair to say that money was used not to prepay debt but rather to reduce reliance on credit. Despite the reduction in household borrowings in absolute terms, as a percentage of GDP, leverage rose to 62.5%, the first increase since 2009. Given that that increase was entirely attributable to the contraction in the denominator, it is foreseeable that once the recovery gains traction, the leverage ratio will return to its pre-crisis trendline. This is made more likely by the fact that the financial buffer generated in 2020 could reduce households’ reliance on credit.

The rest of the financial surplus went mainly to bank deposits (64.5 billion euros) and, to a far lesser degree, to increased cash holdings or the purchase of other financial assets. Despite the huge volume of net purchases of financial assets in 2020 and the decline in liabilities, the household sector’s overall net asset value declined as a result of the correction in the value of equities and investment fund holdings.

Deleveraging at non-financial corporations interrupted

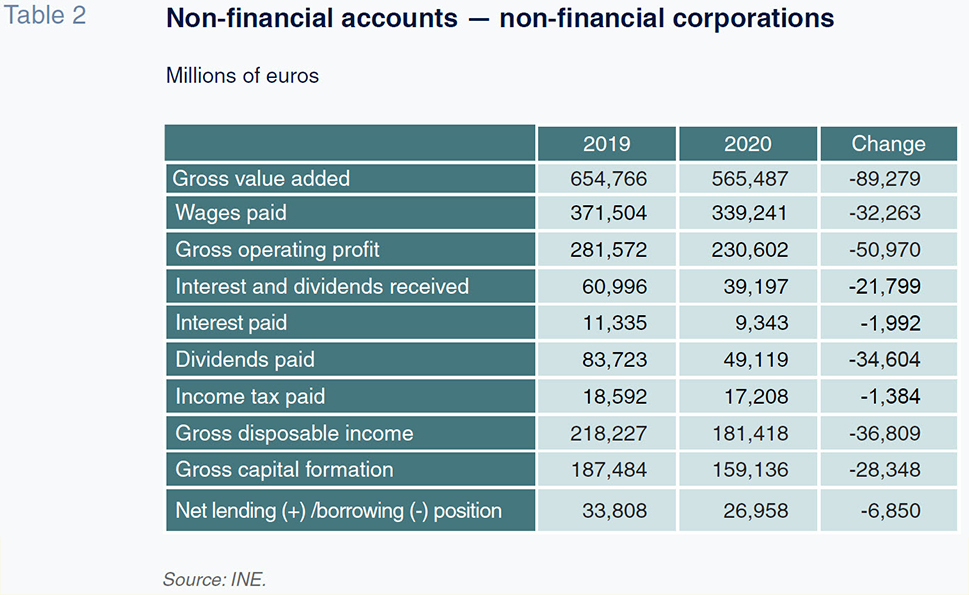

The gross operating profit (GOP) of the non-financial corporate sector declined by 18% in 2020, which is equivalent to nearly 51 billion euros, the biggest drop in the series. The decline in profit was greater than the reduction in salaries paid, so that the percentage of gross value added accounted for by GOP declined to 40.8%, the lowest level since 2008.

The drop in GOP is echoed in the earnings reported by the Bank of Spain, specifically by its central balance sheet data office, which points to a drop in GOP of 36.8% in 2020, accompanied by a significant reduction in profitability margins (refer to the Bank of Spain, 2021). Likewise, the percentage of firms reporting negative profit margins increased by 8 percentage points to around 35%.

Dividend income fell sharply, while net interest paid on borrowings also fell. Lastly, tax payments decreased by 1.4 billion euros, while the sum earmarked to the payment of dividends declined by nearly 35 billion euros. As a result, the corporate sector’s disposable income —profit after tax and dividend payments— declined by 36.8 billion euros. Thus, despite cutting investment sharply, the non-financial corporations’ net lending position fell significantly to 2.4% of GDP (Table 2).

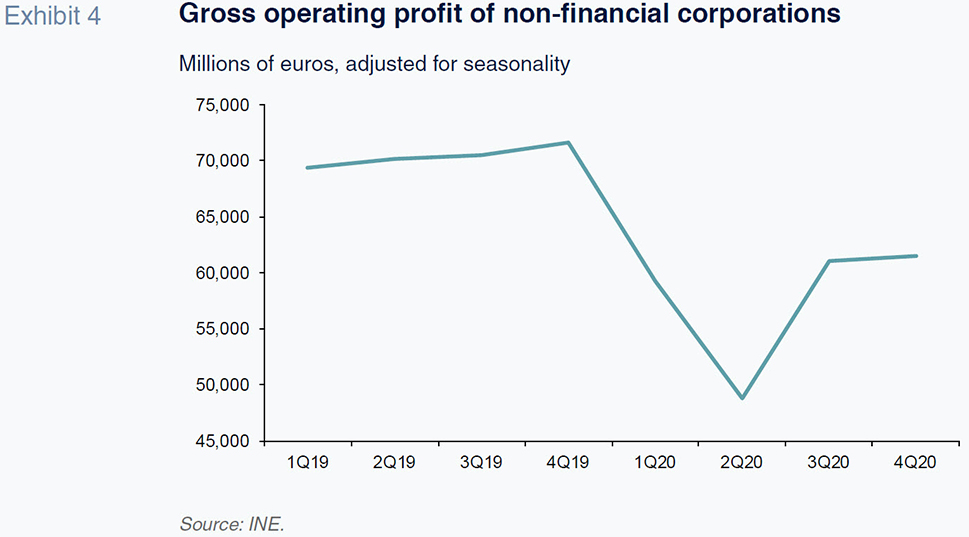

Analysing the results by quarter reveals that GOP sustained the biggest contraction in the second quarter, going on to recover only partially in the third quarter. During both the third and fourth quarters (when the recovery stalled), the non-financial corporations’ GOP remained below pre-crisis levels by around 10 billion euros (in each quarter) (Exhibit 4).

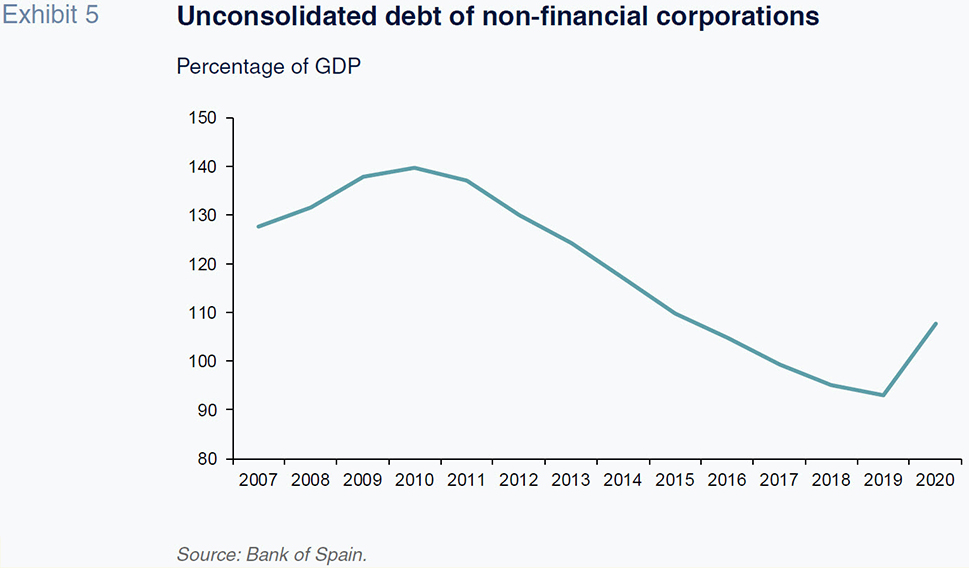

As for the financial accounts, Spain’s corporations increased their borrowings and their financial asset holdings. The increase in the latter may reflect the rerouting of profits that would otherwise have been invested in order to build a liquidity buffer in the face of such pronounced uncertainty. The ratio of unconsolidated debt to GDP increased considerably to 107.7%, albeit more due to the contraction in GDP than the increase in absolute borrowings. That made 2020 the second year (after 2019) in which the corporate sector increased its debt in absolute terms after eight years of non-stop deleveraging, and the first year in which it increased as a percentage of GDP since 2010 (Exhibit 5).

Despite that, the amount of interest paid decreased, such that the increase in the sector’s financial burden, whether expressed as debt to GOP or interest payments in relation to GOP, was mainly attributable to the reduction in profits, and not the higher cost of debt. Moreover, Spain’s firms took advantage of the state guarantee scheme to lengthen their debt maturity profiles. Therefore, it is likely that the sector’s credit ratios will return to more favourable levels once the recovery consolidates. However, the impact of the crisis varies as we drill down into the numbers, as shown by the increase in the number of firms in a more vulnerable situation, i.e., presenting less sustainable leverage ratios (refer to the Bank of Spain, 2021).

That increase in vulnerability, coupled with growth in the number of firms with negative profit ratios, materialised in a high rate of business destruction in 2020. By the end of the year, there were 44,000 fewer companies registered with the Social Security than before the crisis. The longer the business and mobility restrictions last, the more firms will suffer irreversible damage and disappear. In fact, having stabilised in number during the second half of 2020, the early months of 2021 have been marked by fresh business destruction (Exhibit 6). Against that backdrop, the aid package passed by the Spanish government, which includes 7 billion euros of direct aid for viable troubled businesses, appears insufficient.

Conclusions

Despite the severity of COVID-19’s impact on the Spanish economy in 2020, the overall effect on the household sector accounts has been fairly moderate, thanks to the protection measures rolled out by the government in the form of the furlough scheme and extraordinary income support for the self-employed. Spain’s households posted an unprecedented increase in savings and continued to reduce their indebtedness. Drilling down into the numbers, the impact on the lower income households was probably harsher, although we do not yet have the statistics to support this.

The crisis has taken a greater toll on the corporate sector’s finances and earnings. That sector has not enjoyed the same level of government support provided to Spain’s households and has suffered record losses in earnings and an increase in indebtedness and financial pressure. Notably, some firms have suffered more than others, with the share of firms posting negative margins and finding themselves above certain vulnerability thresholds increasing. This has led to a reduction in the number of Spanish businesses.

Although the government’s protection measures were costly, they were necessary to mitigate the social fallout from the crisis and prevent even greater structural damage. It is even possible to argue that these measures have not gone far enough in their support of Spain’s business community. However, the flip side has been an alarming increase in public indebtedness, leaving the Spanish economy particularly vulnerable. This vulnerability will become even more acute when the European Central Bank winds down its asset purchases.

Notes

This uses a model to calculate household savings as a function of the change in households’ real disposable income and the number of hours worked, with an error correction. Using that model, savings in 2020 should have been around 80 billion euros, with the difference up to the 108 million euros actually saved constituting the level of non-precautionary forced or surplus savings.

Taking fourth-quarter 2020 data: 95% of the jobs lost compared to a year earlier were workers with low qualification levels; 9% of all people with low qualifications lost their job, compared to 0.2% of those with medium- or high-level qualifications; and 42% of the people on furlough came from the hospitality sector, where salaries are 40% below the average.

References

María Jesús Fernández. Funcas