Spanish economic forecasts panel: September 2022*

Funcas Economic Trends and Statistics Department

GDP growth estimate for 2022 remains unchanged at 4.2%

According to provisional data, second quarter GDP growth was 1.1%, 0.6 percentage points more than expected by the panellists. Domestic demand contributed 2.1pp, while the foreign sector contributed negatively to growth by 1pp. Leading indicators showed solid performance, although in the months to come they point to a change in this trend, except for the labour market, which continues to record positive data.

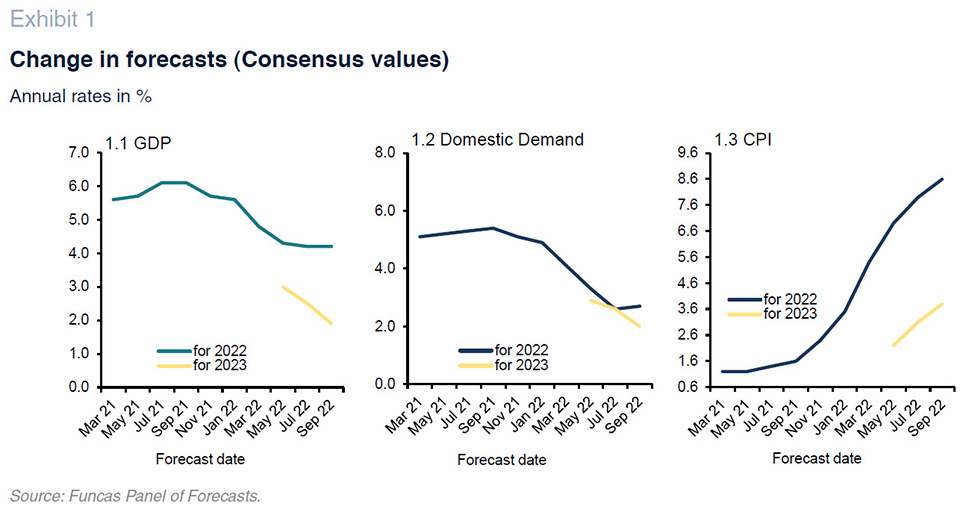

The analysts´ forecasts point to a very weak growth in the third quarter of just 0.1%, followed by a drop of two tenths of a percentage point in the fourth quarter (Table 2), with the majority of the panellists expecting a negative growth rate. For the year as a whole, the average estimate stands at 4.2%, unchanged from the previous set of forecasts (Table 1).

In terms of the composition of GDP growth for 2022, the contribution of domestic demand is expected to be 2.7pp (one tenth more than the last Panel), while that of the foreign sector is forecast to decline to 1.5pp (0.1pp less than in the last Panel). The forecast for household consumption and investment was revised upwards, while that of public consumption was revised downwards by 0.9pp. As for exports and imports, the forecasts were raised by 0.3 and 0.8pp, respectively (Table 1).

The 2023 forecast is down six tenths to 1.9%

The expected sharp slowdown in the second half of 2022 has had an impact on the projected growth rate for 2023, which, as a result of a carryover effect, has been reduced by 0.6pp from the previous forecast, to 1.9%. As for the quarterly forecast, growth of 0.3% is expected in the first quarter, followed by growth of around 0.7%-0.8% for the remaining quarters of the year (Table 2).

The foreign sector is expected to make a slightly negative contribution. Domestic demand, on the other hand, will still foster economic activity – albeit less than anticipated in the last Panel. Both investment and household consumption are expected to grow less than in 2022, while the opposite trend is predicted for public consumption.

Upward revision of the inflation forecast

The CPI increased over 10% year-on-year in June, July and August, due to strong pressure from energy prices and their indirect effects on other prices. Core inflation has maintained its upward trend, reaching 6.4% in August in year-on-year terms. In the remaining months of the year, inflation is expected to moderate, largely due to base effects (Table 3).

The forecast for the average annual inflation rate for 2022 has been raised by 0.7pp to 8.6%, while the forecast for core inflation has been raised by 0.4pp to 5%. As for 2023, the consensus forecast has been revised upwards to 3.8%, for both headline and core inflation (Table 1).

The projected year-on-year rates of the overall index for December 2022 and December 2023 are 7.5% and 2.4%, respectively (Table 3).

Unemployment continues to fall

According to Social Security enrolment figures, the seasonally adjusted pace of employment growth weakened in July, but recorded a good performance in August, both at the aggregate level and in the main sectors.

The implied forecast of productivity growth and unit labour cost (ULC) growth is derived from the forecasts of GDP growth, employment and wage growth. Productivity per full-time equivalent job will increase by 0.9% this year and 0.4% in 2023. ULCs are projected to increase by 1.8% in 2022 and 2.5% in the next year, in line with the July Panel´s forecasts.

The average annual unemployment rate will continue to fall to 13.3% in 2022 –0.2pp lower than in the last Panel – and 13% in 2023 – 0.1pp lower.

External surplus maintained despite rising energy costs

Leading up to June, the current account deficit was 1.23 billion euros, compared with a surplus of 2.09 billion recorded in the same period of the previous year. This worsening mainly reflects the decline in the surplus on the balance of goods and services, as a result of higher energy costs.

The negative sign of the current account in the first months of the year has a highly seasonal component. For this reason, the panellists expect a positive current account balance for the year as a whole, equivalent to 0.5% of GDP (the same as in the last Panel). For 2023, the consensus forecast has been lowered by 0.1pp to 0.8%.

Gradual reduction of the public deficit

The fiscal deficit, excluding local authorities, amounted to 29.64 billion euros as of June of this year, compared to 54.3 billion in the same period of the previous year. This improvement was due to a larger than expected increase in revenue of 28.31 billion, greater than the 3.66 billion increase in expenditures.

The analysts expect the overall deficit to come down over 2022 and 2023. Thus, the public deficit is forecast at 5.2% of GDP this year and 4.6% next year. Note that these forecasts are more pessimistic than those of the Spanish government and the Bank of Spain (Table 1).

The global and European economies face severe turbulence

The international context has deteriorated sharply since the July Panel. According to leading indicators, the risk of recession has increased in three of the world´s economic engines, namely the US, China and the eurozone. For the first time since the start of the post-COVID recovery period, the global purchasing managers’ index (global PMI) fell below 50 in August, marking the threshold for a contraction.

First and foremost, this deterioration reflects the intensification of the energy crisis, particularly where gas is concerned. Since the last Panel, the price of this commodity has increased by 33.5% on the European TTF market, exacerbating inflationary pressures. In addition, Russian exports through the Nord Stream 1 pipeline have suffered numerous disruptions in a turbulent geopolitical environment marked by the invasion of Ukraine. The threat of a complete shutdown is increasingly palpable, augmenting the risk of a recession in Europe while straining electricity markets. Other supply shock factors, such as the cost of shipping, food commodities and oil, have moderated since July, but without mitigating the previous upward cycle.

The stagflationary nature of the energy disruption has prompted the ECB to cut its growth forecasts for the eurozone and sharply raise those for inflation.

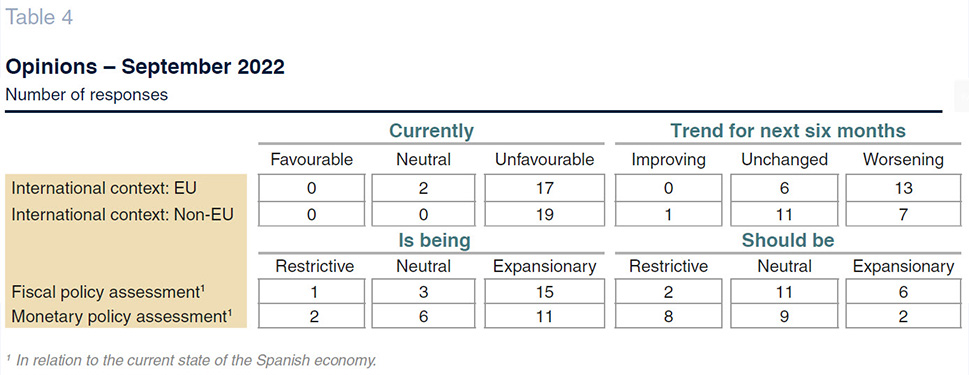

In such an uncertain context, the analysts´ assessments of the international environment in the coming months remain pessimistic (Table 4). Virtually all see it as unfavourable, both within and outside the EU – with little changed since the July Panel. And the quasi-unanimous expectation is that this situation will persist or even deteriorate in coming months.

Sharp upward revision of projections for interest rates, in line with ECB tighter stance

Faced with persistent inflation and an increasingly substantial risk of second-round effects on domestic prices and wages, the major central banks of advanced economies have accelerated their exits from the era of quantitative easing. In less than two months, the ECB has increased its principal interest rate (the deposit facility) by 1.25pp, a move that follows in the footsteps of the Federal Reserve and at a speed that is unprecedented in the history of the euro. Moreover, President Christine Lagarde has announced between two and four additional interest rate hikes in the coming months. Frankfurt is also considering reducing the outstanding amount of bonds in its portfolio.

The markets have been quick to incorporate the shift in monetary policy – the one-year Euribor stands at around 2%, twice as high as when the last Panel was published. Likewise, the yield on the Spanish 10-year bond is above 2.8%, 35 basis points higher than in July. However, the risk premium has not undergone major changes and is hovering around 120 basis points, a level that shows the absence of financial tensions, at least at present.

The analysts have revised their interest rate forecasts sharply upwards. The ECB´s deposit facility is expected to be close to 1.5% at the end of the forecast period (Table 2), half a point higher than in the previous forecast. Euribor has been revised by a similar magnitude to 2.3%, while the 10-year bond yield, for its part, is expected to exceed 3.1%, 0.1pp higher than in July.

The euro´s depreciation against the dollar slows down

As a result of the ECB´s interest rate hikes, the markets are anticipating a narrowing of the yield spread between the two sides of the Atlantic. Thus, after a period of depreciation, the euro has stabilized around parity against the dollar. Analysts expect little change in the exchange rate of the euro (Table 2), in line with the previous forecast.

Macroeconomic policy should be less expansionary

Concerns about inflation and its costs for households and businesses are reflected in analysts´ views on economic policy. Thus, while there is still near unanimity on the expansionary nature of fiscal policy at present (Table 4), the number of panellists who believe that fiscal policy should be more neutral or even restrictive in relation to the economic cycle is growing. Likewise, all but two members (there were three in the last Panel) believe that monetary policy should not be neutral or restrictive, and not expansionary.

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.