Spanish banks ahead of the return to positive interest rates

Now that interest rates are finally back in positive territory, banks have the opportunity to advance on the challenge of increasing profitability. However, prevailing macroeconomic conditions of uncertainty and pessimism, together with risks, both those carried over from the previous financial crisis and emergent ones, mean that translating rate increases into commensurate growth in banks’ earnings may not be so straight forward a task.

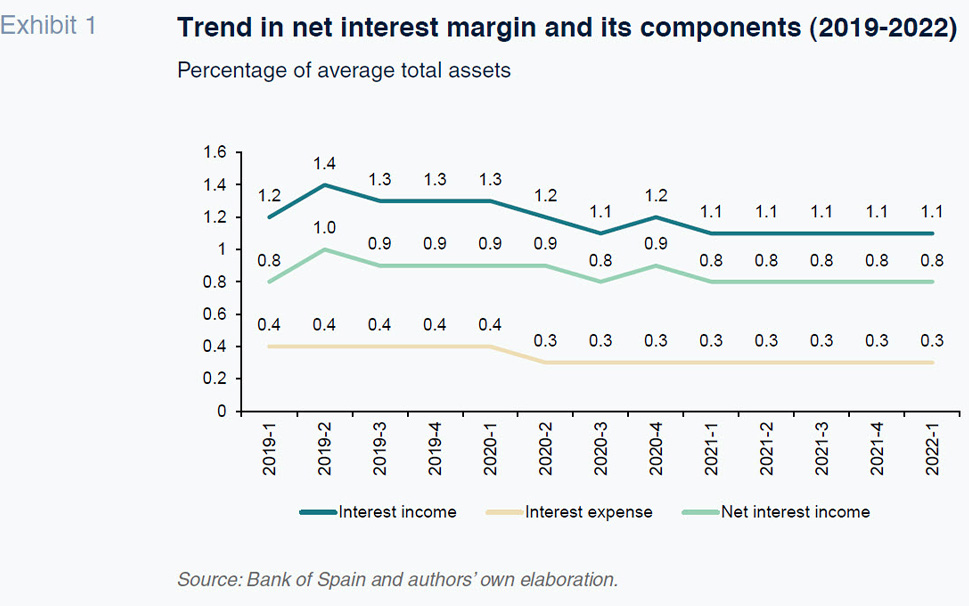

Abstract: Banks have the opportunity to advance on the challenge of boosting their profitability. With interest rates gradually rising, the banks are looking at business and margin growth prospects not enjoyed in recent years. However, the new rate climate is not all good news for the banks, particularly in the current complex economic environment, characterized by high uncertainty (largely as a result of inflation and deteriorating confidence), which does not bode well for immediate growth in business lending volumes sufficient to translate into significant growth in profitability in the near-term. Indeed, latest available figures show that prior to ECB rate hikes, Spanish banks´ net interest margins remained stuck at 0.8% of average total assets, with interest income at around 1.1% and interest expense at 0.3%. That said, Spanish banks remain at the forefront of increasing operating efficiency through reducing operating expenses and fee and commission income has been growing, albeit displaying a high degree of volatility. Moreover, a number of risks carried over from the previous financial crisis remain, including those related to: business sector vulnerability; the ability to repay the state-guaranteed loans extended during the pandemic; and, the looming end of the various credit relief schemes.

Recent banking and monetary climate

The geopolitical events of recent months have highlighted structural, energy-related weaknesses across a large number of economies and generated, along with other factors, an inflationary spiral not seen in Europe or the US since the 1970s. That has meant that the long-awaited shift in monetary policy direction has taken place swiftly, with central banks moving to tighten financing conditions forcefully.

That more contractionary monetary policy is evident in the rollback of the extraordinary monetary facilities that had been deployed and interest rate hikes that spell the end of an extensive period of zero or negative rates in many jurisdictions. The Federal Reserve and Bank of England were the first to make their moves. The European Central Bank joined the fray in July of this year, moving resolutely, spurred on by a set of circumstances that pose a huge challenge for the central banks. A recurring question is to what extent will the rise in interest rates have a positive impact on the banking business after so many years in which the existence of ultra-low or negative rates made it very hard to eke out net interest margins. This article attempts to address that issue. That being said, all interpretations and forecasts should be taken with caution in light of the scale of uncertainty surrounding the macroeconomic and financial environment at present.

On July 21st, the ECB’s Governing Council decided to raise its three official interest rates by 50 basis points. Significantly, it also approved the so-called monetary policy Transmission Protection Instrument (TPI). The ECB had decided it was “appropriate to take a larger first step on its policy rate normalisation path than signalled at its previous meeting.” According to the monetary authority, that decision was based on the Council’s “updated assessment of inflation risks and the reinforced support provided by the TPI for the effective transmission of monetary policy.” As a result, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility were increased to 0.50%, 0.75% and 0.00%, respectively, with effect from July 27th, 2022.

The ECB implied that its previous forward-looking approach, which usually took the form of forward guidance, would be replaced by a more contingent approach to interest-rate decision-making when it alluded to a “transition to a meeting-by-meeting approach to interest rate decisions.” However, at its meeting on September 8th, described below, the ECB announced successive increases in the official price of money in the months to come, suggesting that it has not done away with its forward guidance altogether.

Elsewhere, the ECB’s approval last July of the TPI was deemed a necessary step in normalising monetary policy transition without causing excessive turbulence for certain eurozone member states, namely those in which sovereign risks were beginning to become palpable as rates rallied and other liquidity support programmes began to be rolled back, such as Italy. Specifically, the ECB noted that the TPI “can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the smooth transmission of monetary policy across the euro area” and that the “scale of TPI purchases depends on the severity of the risks facing policy transmission”. Very importantly, the ECB made it explicit that purchases would not be restricted ex ante, leaving the monetary authority with significant room for manoeuvre in the event of market disruption. TPI purchases will be focused on public sector securities (marketable debt securities issued by central and regional governments as well as agencies, as defined by the ECB). Purchases of private sector securities could be considered, if appropriate. In the event the new instrument is deemed crucial, it would be activated following “comprehensive assessment of market and transmission indicators and an evaluation of the eligibility criteria”.

At its meeting on September 8th, 2022, the ECB decided to hike its three official interest rates once again, this time by 75 basis points. As a result, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility were increased to 1.25%, 1.50% and 0.75%, respectively, with effect from September 14th, 2022.

For the banks, the market and, in general, much of the economy, the increase in interest rates should be seen as part of the process of normalising financing conditions and exiting the extraordinary arrangements that date back virtually to the financial crisis of 2007-2008. In theory, the banks, investors and other market agents can operate in a climate more propitious to generating returns and assessing them as a function of their risks. That does not mean, however, that the increases in interest rates and rollback of liquidity programmes will necessarily spell immediate growth in bank profits or dispel operating uncertainties. All processes involving a change in monetary conditions are shaped by supply and demand factors and the current process of normalisation is replete with challenges and difficulties, not least of which a severe inflationary episode, the threat of economic slowdown and/or recession and financial weakness across a large swath of businesses in numerous countries.

Last July, the Spanish banks reported their earnings for the first half of 2022. The six largest financial institutions reported year-on-year bottom-line growth of 36% to 3.74 billion euros in the first six months of the year. As we will show later in this paper, net interest income did not make much of a contribution to that earnings growth. Instead, an additional 12.4% drop in operating expenses was the most relevant factor. The banks were also able to recognise fewer loan-loss provisions than in 2021, with impairment losses decreasing by 133.4%.

What do rising interest rates imply? Opportunities and risks

With interest rates gradually rising, the banks are looking at business normalisation prospects not seen in recent years. It would be easy to jump to the conclusion that the increase in the price of money will drive commensurate growth in the banks’ earnings. Despite the fact that several studies have indicated that the existence of negative interest rates has had an adverse effect on net interest margins, it cannot be concluded that positive rates will be a panacea, particularly in light of the current complex environment.

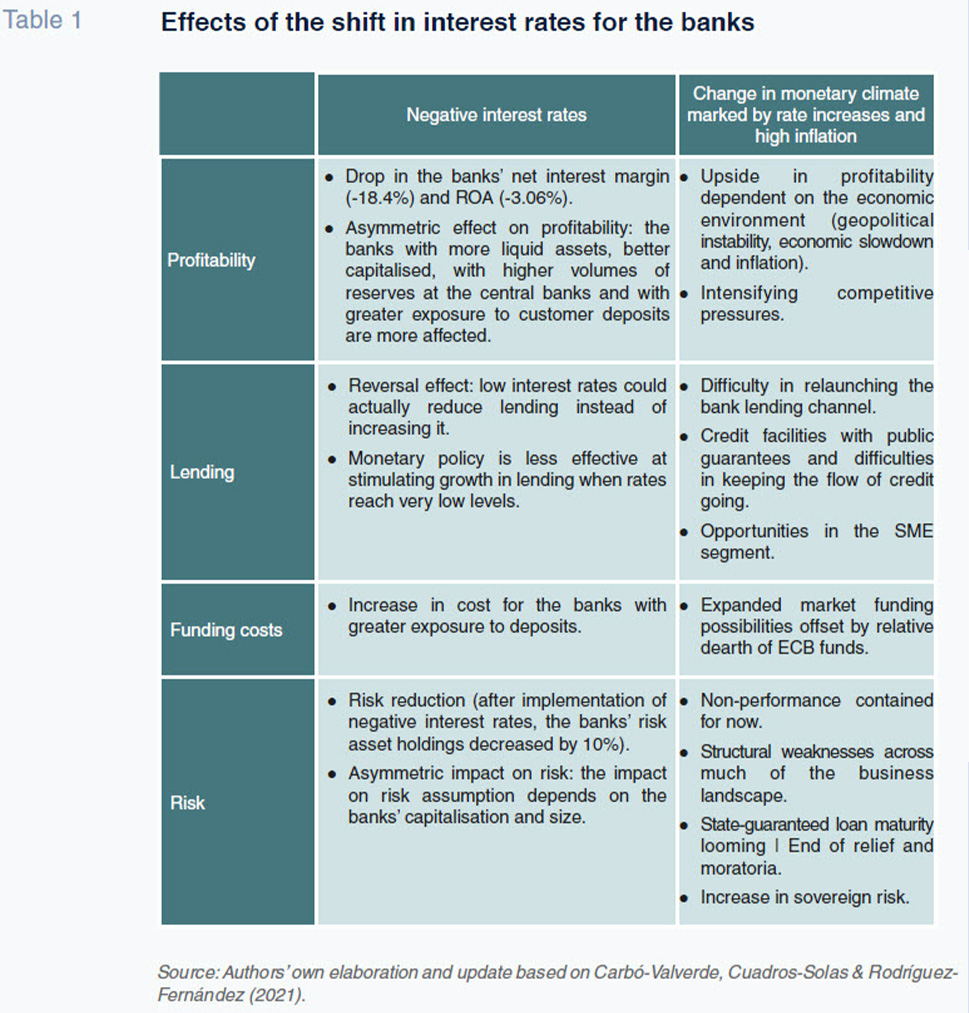

Table 1 enumerates some of the main effects for the banks from the transition between the two monetary policy biases. Firstly, in terms of profitability, prior studies (refer to the Table´s source) have shown that the banks’ net interest income declined by 18.4% on average in the countries where rates turned negative, reducing their return on assets by an average of 3%. That phenomenon has had a bigger impact on the banks with more liquidity, larger deposit pools and more capital. Although the shift towards much higher interest rates may well be accompanied by higher profitability, a lot will depend on the outcome of the various problems causing macroeconomic instability at present. It is also worth noting that competitive pressures are also intensifying, shaped by competition between the banks themselves but also from newcomers from the world of technology.

It has also been established that overly-low interest rates send a negative signal about the state of the economy which impedes growth in lending volumes despite the reduced cost of money. As a result, the monetary policy transmission channel suffers. With interest rates on the rise, the central banks are continuing to encounter difficulty in revitalising the lending channel. That is partly due to structural weaknesses across a swath of the business community that are carried over from the financial crisis. The only significant growth observed in lending in the eurozone took place in the wake of the pandemic-induced fiscal stimulus measures (including government loan guarantee schemes), after which lending growth returned to modest levels. Nevertheless, the banks do face opportunities in the context of rising interest rates, particularly in business lending and especially in SME lending, where they should be better positioned to properly assess the risk-reward trade-off once the key sources of macroeconomic uncertainty dissipate.

The banks also saw how their own funding costs did not come down by a commensurate amount when rates were ultra-low or negative, especially the banks with bigger deposit pools, due to the practical difficulty in applying zero or negative rates to that source of funding. Nevertheless, the ECB made abundant liquidity facilities available.

Lastly, it is important to consider how risk levels are changing. With rates in negative territory, the banks were more inclined to assume risk, due in part to the existence of tighter regulatory pressure at the time. With rates moving higher, although the banks can better assess the trade-off between risks and rewards, new sources of uncertainty are emerging in relation to the viability of many companies in the face of rising financing costs. It is also worth watching the trend in non-performance on the loans guaranteed by the state and following the end of the credit moratoria schemes.

Outlook for the Spanish banks’ earnings and margins

The data paint a picture of improving earnings in the Spanish banking sector, while also pointing to some lingering uncertainties. Based on the data reported by the Bank of Spain as of the first quarter of 2022, i.e., before the ECB embarked decisively on monetary tightening, the sector’s net interest margin was stagnant at 0.8% of average total assets, with interest income at around 1.1% and interest expense at 0.3% (Exhibit 1).

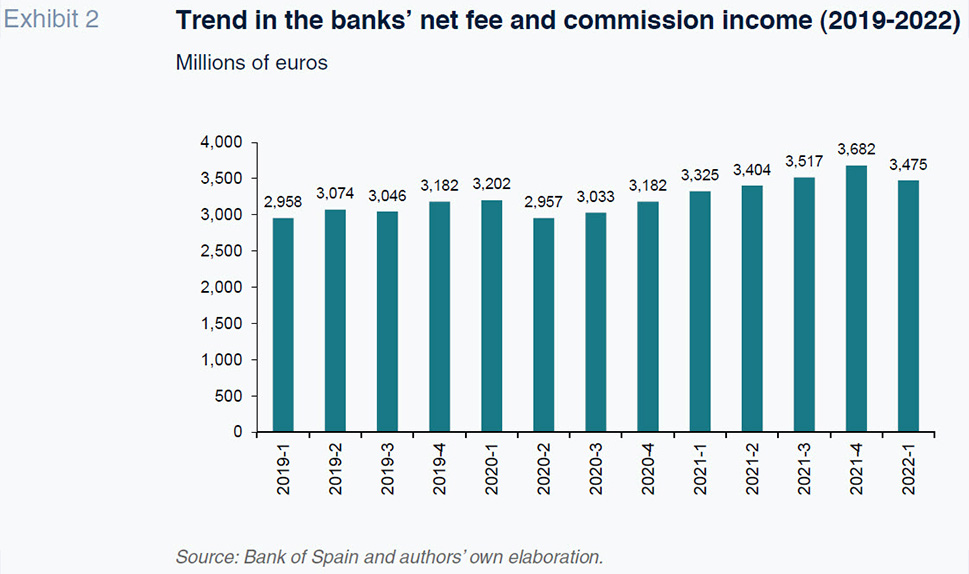

In an increasingly competitive environment, with net interest margins under pressure, the banks have had to expand their value-added services and generate more income from “other recurring products”. As shown in Exhibit 2, fee and commission income has increased, having contracted during the pandemic. However, that stream of income has slowed somewhat compared to the beginning of 2022.

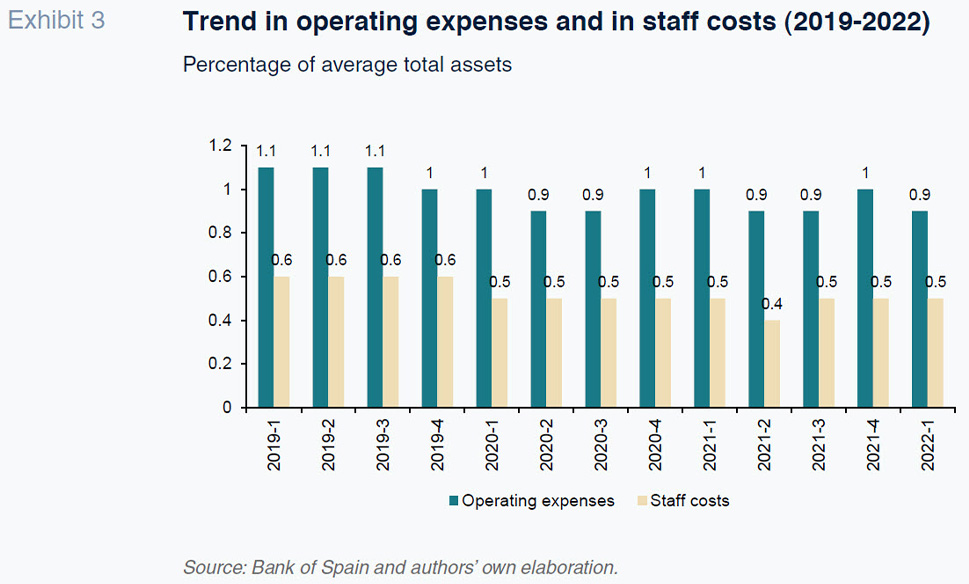

Meanwhile, the Spanish banks remain focused on reducing their operating expenses and they remain at the forefront of their eurozone peers as far as efficiency is concerned. That trend is being accompanied by a restructuring effort marked by a growing strategic commitment to digital over physical channels. Operating expenses account for between 0.9% and 1% of average total assets, half of which corresponds to staff costs (Exhibit 3).

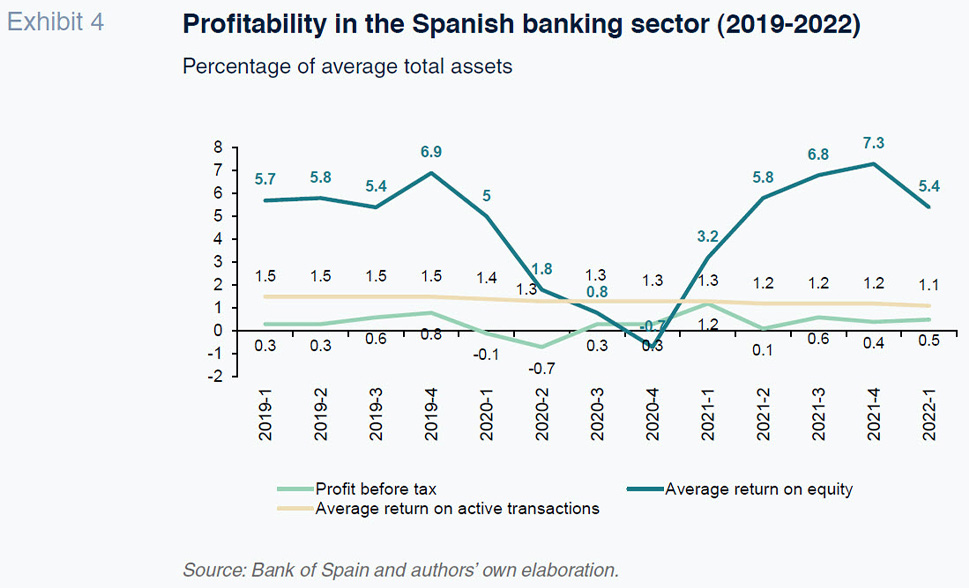

As for their profitability, measured using profit before tax (Exhibit 4), the Spanish banks continue to face a sizeable challenge, as do their peers in the rest of the world. It is common to get mixed up between absolute and relative profit readings. As with any other type of enterprise, what counts is the amount of profit generated for shareholders in relation to the business, or earnings per share. In other words, the profitability the market demands for investing in a company. Against that backdrop, the Spanish banks’ pre-tax profit stands at a scant 0.5% of average total assets, albeit recovered from the losses reported during the pandemic, mainly a consequence of the high volume of provisions recognised to cover possible negative contingencies. As a result, their return on equity increased to 7.3% by the end of 2021 but in the first quarter of 2022, as economic uncertainty intensified, that metric once again fell back to 5.4%. Those readings are still far below the double-digit returns observed before the financial crisis. The average return on active transactions has been virtually flat in recent quarters, at around 1.1%–1.2%.

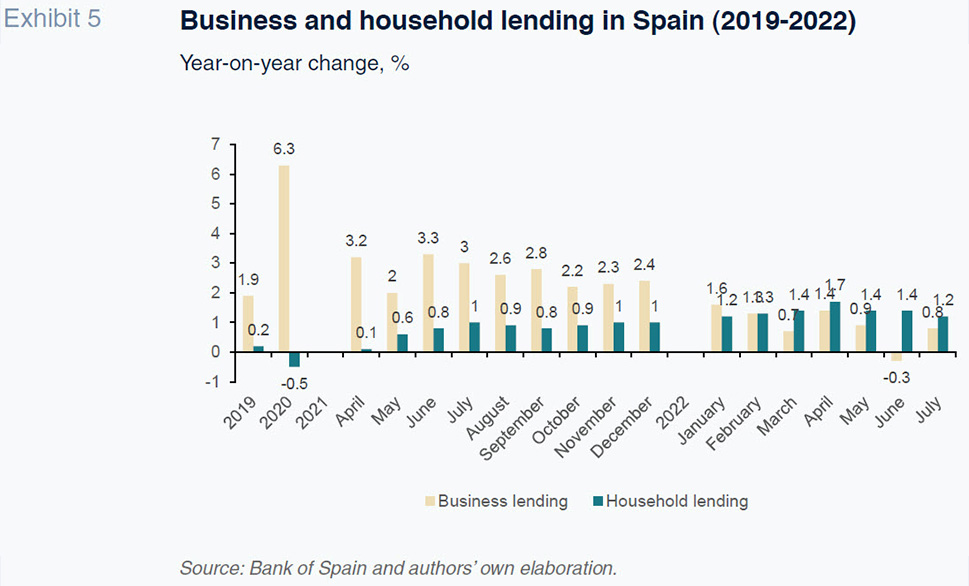

It could be argued that the growth in the banks’ core business –lending– could contribute to growth in business volumes and profitability in an environment marked by rising rates. However, in light of the year-on-year growth rates fuelled by the special programmes articulated during the pandemic (in the business lending segment), the post-pandemic years have been marked by far more moderate growth. Business lending actually contracted year-on-year in June 2022, albeit trending back in line with the average of recent months in July (0.8%). Household lending increased by 1.2% in July, slowing somewhat by comparison with recent months.

Conclusions

This paper analyses the outlook for the banking business in Spain now that rates are back in positive terrain. Our conclusions are necessarily preliminary as the key data do not yet provide enough insight to assess the issue with the precision required. Nevertheless, in general terms, it can be said that:

- The rise in interest rates should be understood as a development that will normalise the assessment of the risk-reward trade-off, which had become muddied by the protracted existence of zero or negative rates.

- The banks have the opportunity to advance on the challenge of boosting their profitability. However, the prevailing macroeconomic uncertainty (especially, inflation and pessimistic expectations) does not bode well for immediate growth in business lending volumes sufficient to translate into significant growth in profitability in the near-term.

- Risks remain, a high number of which are carried over from the financial crisis. Many are related with vulnerabilities in part of the business community, particularly the more indebted firms. Other risks include the ability to repay the state-guaranteed loans extended during the pandemic and the looming end of the various credit relief schemes.

References

CARBÓ-VALVERDE, S., CUADROS-SOLAS, P. J. and RODRÍGUEZ-FERNÁNDEZ, F. (2021). The effects of negative interest rates: A literature review and additional evidence on the performance of the European banking sector. The European Journal of Finance, 27(18), pp. 1908-1938.

Santiago Carbó Valverde and Francisco Rodríguez Fernández. University of Granada and Funcas