Spain: Reduced vulnerability to gas rationing relative to other European countries

Spain´s lower expected reduction in demand under the pan European plan, together with a generally lower consumption of Russian gas by the country´s industry, translates into less sensitivity to current geopolitical tensions. Nonetheless, Spain will still be exposed to the risks generated by the adverse geopolitical environment heading into the autumn-winter.

Abstract:

The “Save Gas for a Safe Winter” plan approved by the European Commission involves a 15% reduction in gas demand between August 1st, 2022, and March 31st, 2023, although some countries, such as Spain, will only face a reduction of 7%. On the productive side, the economic sector most sensitive to a rationing of gas consumption will be industry and, in particular: (i) chemicals and pharmaceuticals; and, (ii) the transport and storage sector, which have the greatest direct weight in Spain’s GVA (also in the euro area). From a country perspective, among the large European nations, Germany and Italy are most exposed to this geopolitical risk, while Spain is less sensitive, not only because its industry consumes very little Russian gas, but also because the country´s expected reduction in demand will be lower. In any case, Spain will still be exposed to the risks that this adverse geopolitical environment poses for the coming autumn-winter.

Introduction

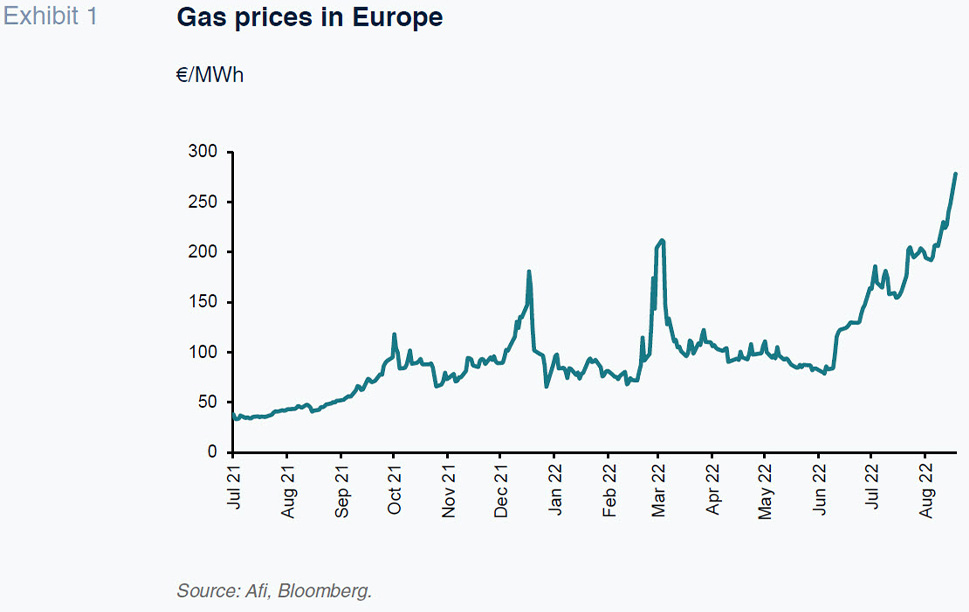

The rise in gas prices in recent weeks (Exhibit 1) responds to the risk of a cut in Russian supplies of this raw material, which is so important for Europe, as Russia will continue to use gas as a geopolitical tool against Europe and in efforts to secure a relaxation of economic sanctions imposed as a result of the war in Ukraine. The most likely scenario being discounted by the market is that supply will suffer, leading to different gas rationing scenarios to be considered for the coming autumn-winter.

This article attempts to identify which economic sectors are more intensive in energy consumption and which are more dependent on supplies from Russia, with the aim of quantifying their direct weight and anticipating the economic impact that could arise if this risk materializes.

The European gas demand rationing plan: “Save gas for a safe winter”

Aware of the risk that gas supply could be cut-off from Russia, the European Commission designed and published at the end of July: (i) a draft legislation; and, (ii) a plan (“Save Gas for a Safe Winter”) aimed at reducing the use of gas in Europe by 15% between August 1st, 2022, and March 31st, 2023.

The legislation consists of a new Council Regulation that would give the Commission the possibility to declare, after consulting with member states, a ‘Union Alert’ on security of supply, imposing a mandatory gas demand reduction on all member states. That alert could be triggered when there is a substantial risk of a severe gas shortage or exceptionally high demand for gas. The member states are being asked to update their national emergency plans by the end of September to show how they intend to meet the reduction target and to report to the Commission on progress every two months.

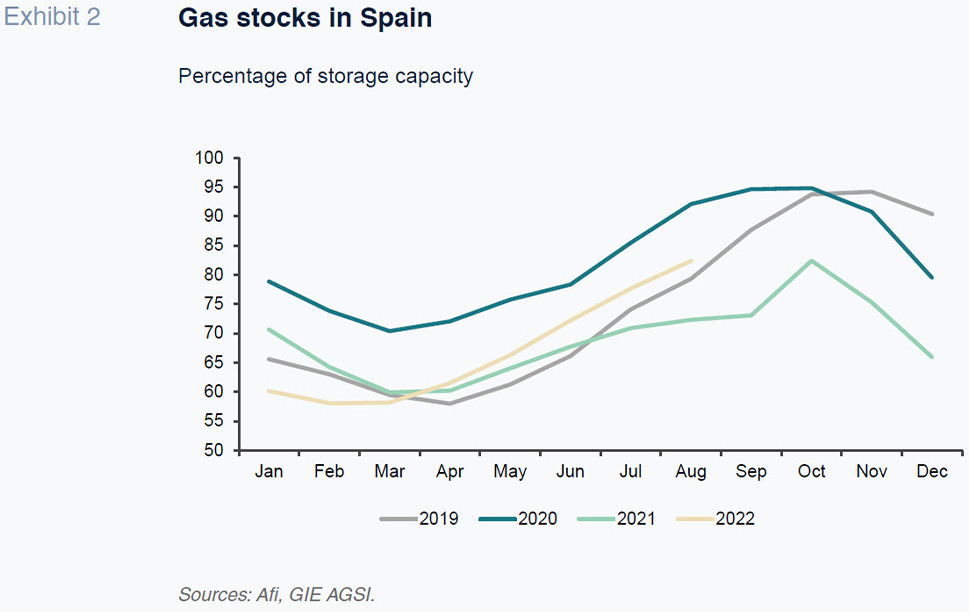

To help member states deliver the necessary demand reductions, the Commission has also adopted a European Gas Demand Reduction Plan which sets out measures, principles and criteria for coordinated demand reduction. As anticipated, the new plan not only urges retail consumers to change their habits so as to reduce their energy consumption (e.g., limit air conditioning thermostats to 25 degrees in the summer and heating to 19 degrees in the winter), it also urges the business population to use alternative sources of energy (prioritising renewable sources but acknowledging that a switch to coal, oil or nuclear power could be necessary as a temporary measure) in order to increase gas reserves as soon as possible (even though Spain is not as dependent on supplies from Russia and has already set aside over 80% of its total storage capacity by the end of August – Exhibit 2). The plan contemplates rationing measures that could reduce production in certain important sectors, weighing on growth for the rest of this year and, above all, in 2023 by more than we are currently contemplating.

Economic sectors dependent on Russian gas: Direct and indirect impact

Following the approval of this Plan by Brussels and all the member states, it is worth asking which economic sectors are more energy dependent and which of them consume more gas from Russia, in order to anticipate which economic activities will be more sensitive to this rationing of demand. Although the following exercise has been carried out for Spain, it has also been replicated for the euro area and its main member states, allowing comparisons to be made and conclusions to be drawn as to which countries are most exposed to this geopolitical risk.

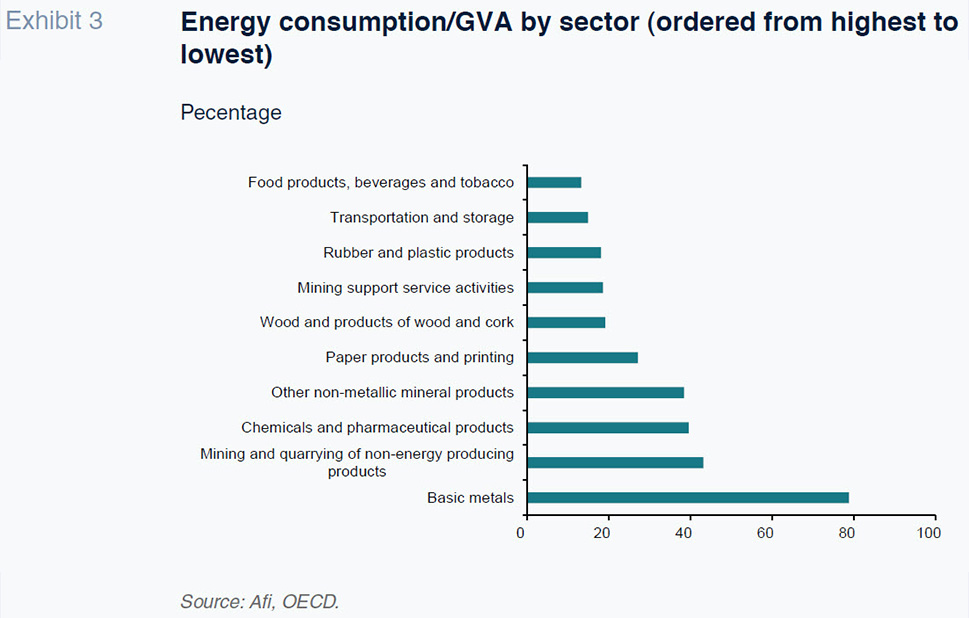

The input-output tables for the main European countries [1] provided by the OECD [2] show that the manufacturing sector is the most intensive user of energy. Tracking the weight of energy consumption over total sector gross value added (GVA) reveals that the metallurgy (basic metals) sector is the most dependent on energy (energy consumption accounts for nearly 80% of its GVA). That sector is followed by the extraction of non-energy products, the chemicals and pharmaceuticals industry, and other non-metallic minerals, whose energy consumption represents roughly 40% of the GVA they generate. Rounding out the top 10, with energy consumption ratios of over 10% of GVA and above the manufacturing sector average are activities such as: paper and printing; timber and cork; the extractive industry (mining support services); rubber and plastics; transportation and storage; and the agri-food industry (Exhibit 3). These energy-intensive economic activities in Spain are the same as those detected for the euro area as a whole.

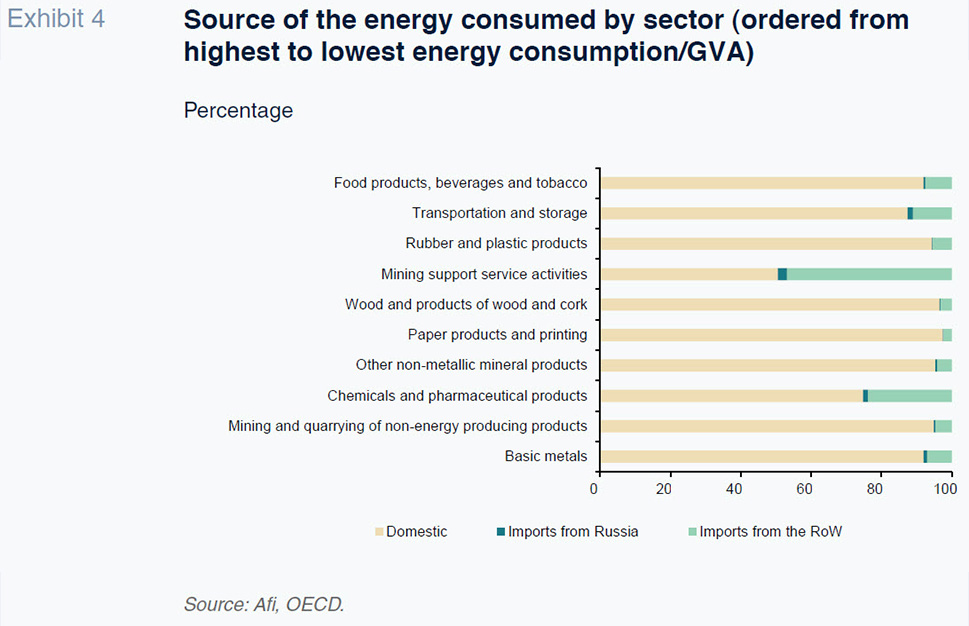

However, the activities in Spain most dependent on energy sourced from Russia are, in this order, the extractive industry, the chemicals and pharmaceuticals industry and the transportation and storage sectors (Exhibit 4). In all of these, the energy imported from Russia accounts for over 1.5% of their total consumption (5% in the case of their eurozone equivalents), leaving them more vulnerable to a cut – total or partial – in energy supply during the coming months and rendering them some of the energy-intensive activities that may have to rationalise their activity the most, judging by the plan published by the Commission in July 2022.

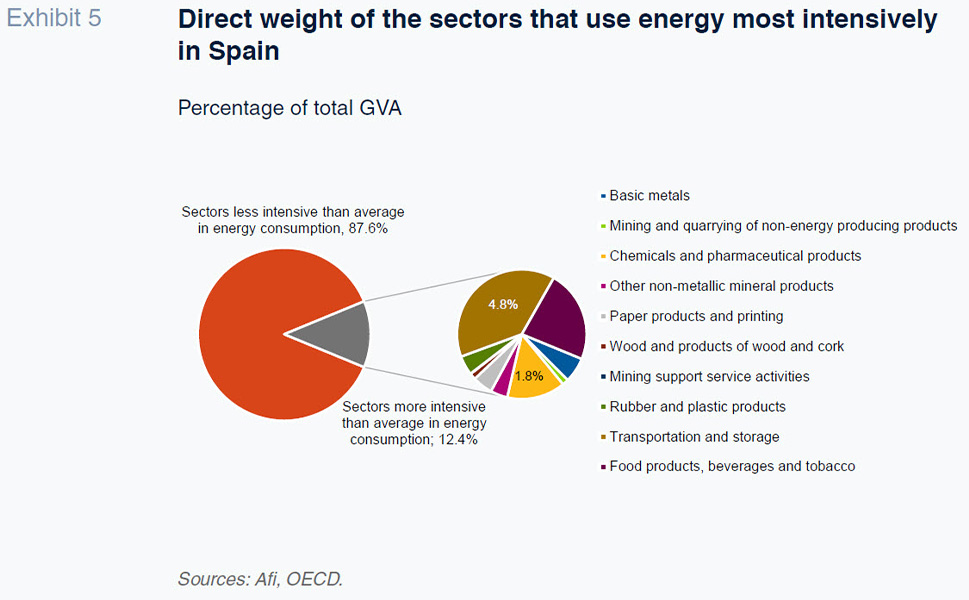

Other than the extractive industry, the other two economic sectors most dependent on Russian gas are those with the highest direct weight in the Spanish economy of the 10 sectors analysed above. Specifically, the transportation and storage sector is the most important of the three, as it generates 5% of total GVA. The chemicals and pharmaceuticals industry, meanwhile, is less significant, as its direct impact is a lower 2% of GVA. On aggregate the 10 sectors that are most dependent on energy account for 12.4% of GVA (Exhibit 5), painting a picture of the magnitude of the potential impact of the suspension of gas supply in the eurozone and of the Commission’s proposed rationing policy.

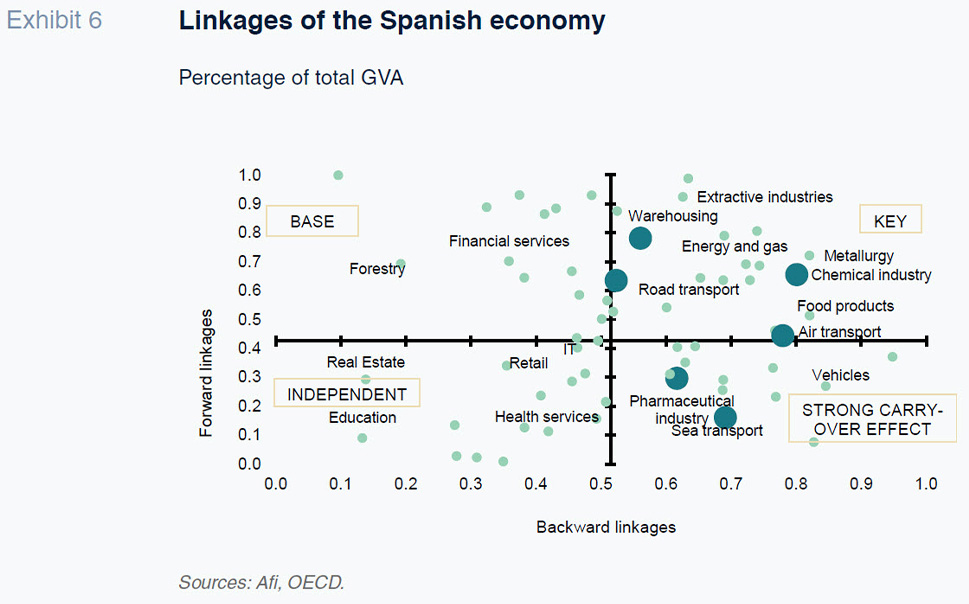

Moreover, the chemical and pharmaceutical sectors and the different means of transport are activities of significant strategic importance in the Spanish economy. Firstly, all of these sectors have an important carry-over effect over the rest of the economy, so that a negative shock on their turnover would lead, additionally, to a decrease in revenue (and activity) for suppliers and other auxiliar activities, and would also impact their capacity to generate employment; these are the “backward linkages”. Secondly, these two sectors also produce inputs to other value chains in the economy, so that the imposibility to serve orders, or a sharp increase in prices, would rapidly affect other sectors, both in terms of production and margins. These effects are particularly prevalent in the chemical industry, air and road transport, and warehousing, and are measured through the “forward linkages” (Exhibit 6).

[3]

However, a comparison with other European countries indicates that Spain would be one of the countries least affected by this situation. That is not to say, however, that it is immune to the rationing policies imposed by the Commission. Germany and Italy are the major economies most exposed, specifically via their respective chemicals and pharmaceuticals industries.

That sector unquestionably stands to be one of the most affected by the rationing policies imposed over the coming months. Energy rationing will not only be guided by criteria of economic relevance but also the classifications made by each member state of their critical sectors in order to safeguard supply to their citizens. Against that backdrop, the European Gas Demand Reduction Plan published by the European Commission this week also helps the member states to identify and prioritise those critical sectors which, so far, include services related with health, food, safety, security, refining and defence.

At any rate, the authorities will have to implement fiscal policy measures to support the sectors most affected by energy rationing in order to mitigate all the adverse effects that may derive from this situation. In fact, the European Commission’s plan contemplates the member states providing support to their industries by amending the State aid Temporary Crisis Framework. The amendments increase the amount of direct aid that can be provided to companies in need to €500,000, specifying that the aid may cover only up to 70% of the beneficiary’s gas and electricity consumption during the same period of the previous year.

Conclusion

The European “Save Gas for a Safe Winter” plan approved by Brussels and ratified by all member states involves a 15% reduction in gas demand between 01/08/22 and 31/03/23, in general, although some countries will suffer a lower cut (7%), as is the case of Spain.

The plan includes a series of recommendations for member states to implement measures to reduce gas demand, which will mainly affect the productive sector, although households will also have to make an effort in this respect. Within the productive fabric, the sector most sensitive to a rationing of gas consumption will be industry and, in particular, the extractive industry, the chemical and pharmaceutical industry, and the transport and storage sector. These last two sectors are the most dependent on Russian supplies and among the most important in the production structure of the euro area.

Their weight varies from country to country, with Germany and Italy being the most exposed and whose economies could suffer more from the direct and indirect effects of gas being potentially cut-off, possibly leading to a greater reduction in their activity than that contemplated in the analysts’ consensus forecasts. Spain, on the other hand, is less sensitive, not only because it hardly consumes any Russian gas, but also because its expected reduction in demand will be lower. In any case, it will also be exposed to the risks that the adverse geopolitical environment poses for this coming autumn-winter.

In this sense, the approval of measures to support these economic sectors as a way of mitigating the negative effects that may derive from this hypothetical risk should not be ruled out.

Notes

The following countries have been considered for the preparation of this article: Germany, France, Italy, Spain and Portugal. Together they represent approximately 80% of the GDP of the euro area.

The latest available data refer to 2015.

Backward Linkages are the result of dividing Intermediate Consumption by total Production. The higher the ratio, the stronger the carry-over effects (or economic spillovers) on the rest of the economy. “Forward Linkages” are the result of dividing total Intermediate Demand by total Production (intermediate consumption and final demand). The higher the ratio, the larger the share of a sector’s production that will be used as input in other sectors’ productive processes.

References

María Romero and Juan Sosa. A.F.I. – Analistas Financieros Internacionales, S.A.