The new EURIBOR gets through a challenging 2020

In the aftermath of the financial crisis, regulators proposed a new methodology for calculating EURIBOR. Despite the volatility wrought by COVID-19, this methodology performed well in 2020, reflecting expectations for benchmark rates and perceived bank credit risk and capturing the indirect effects of the dislocation sustained in the FX swap market.

Abstract: The onset of the global financial crisis in 2008 forced regulators and supervisors to rethink the suitability of the IBORs as benchmark rates of interest. In Europe, the FSB’s recommendations affect two key benchmark rates – EURIBOR and EONIA – and have resulted in the creation of the euro short-term rate, or €STR, to replace the EONIA following a period during which the two indices will co-exist. Importantly, EURIBOR must at all times and in differing market conditions reflect the cost to banks’ of obtaining funding in the euro unsecured interbank lending market at different tenors. Despite the volatility wrought by COVID-19 in 2020, it is fair to say that the EURIBOR has surmounted a very challenging year, helped significantly by a new hybrid calculation methodology developed in the aftermath of the financial crisis. Specifically, the EURIBOR rates trended in a manner that was consistent with expectations for benchmark rates and perceived bank credit risk and captured the indirect effects of the dislocation sustained in the FX swap market as a result of the surge in global demand for dollar funding in the early stages of the COVID-19 crisis.

Backdrop for the reform of the interbank offered rates (IBORs)

For decades now, the interbank offered rates (“IBORs”) have constituted the benchmark interest rates for unsecured interbank lending at different maturities or tenors. Those rates layer unsecured bank credit risk on top of the risk-free rates and have historically provided a benchmark for setting the prices of a very broad range of financial contracts (loans, derivatives and fixed-income securities).

The onset of the global financial crisis in 2008 forced regulators and supervisors to rethink the suitability of the IBORs as benchmark rates of interest. Their construction via surveys and non-binding rates left them open to manipulation. The loss of liquidity and trading volumes in the interbank markets made it harder to calculate them on the basis of actual transactions. As well, the distribution of bank credit risk undermined the ability of IBORs to reflect common counterparty risk. Lastly, the concentration of bank funding in lower-risk segments (repos) reduced the relevance of the interbank lending market.

In response to scandals over the manipulation of IBOR contributions by the banks participating in the panels, coupled with the fact that IBORs were determined almost exclusively on the basis of the expert judgement of those participants (due to the decline in liquidity in the interbank unsecured funding markets), the G20 spearheaded the global reform of reference rates in 2013. The G20 tasked the Financial Stability Board (FSB) to establish guidelines and recommendations for creating a new set of regulations that could address the current system’s shortcomings and correct the issues implicit in prevailing reference rates. In 2014, the FSB recommended: (i) reinforcing the methodology used to calculate the reference indices, tying them wherever possible to real transactions and improving data supply processes and controls (the basis for the so-called “IBOR reform”); and, (ii) identifying alternative risk-free reference rates.

The replacement of the IBORs with new reference rates means most calculations of IBORs will cease between December 2021 and June 2023.

[1] In Europe, the FSB’s recommendations yielded Regulation (EU) 2016/1011, known as the EU Benchmark Rates Regulation, or EU BMR. The EU BMR affects two key benchmark rates – EURIBOR and EONIA

[2] – and has resulted in the creation of the euro short-term rate,

[3] or €STR, to replace the EONIA following a period during which the two indices will co-exist.

A new method for calculating the EURIBOR rates was rolled out in 2019

The European Money Markets Institute (EMMI) administers the current and former

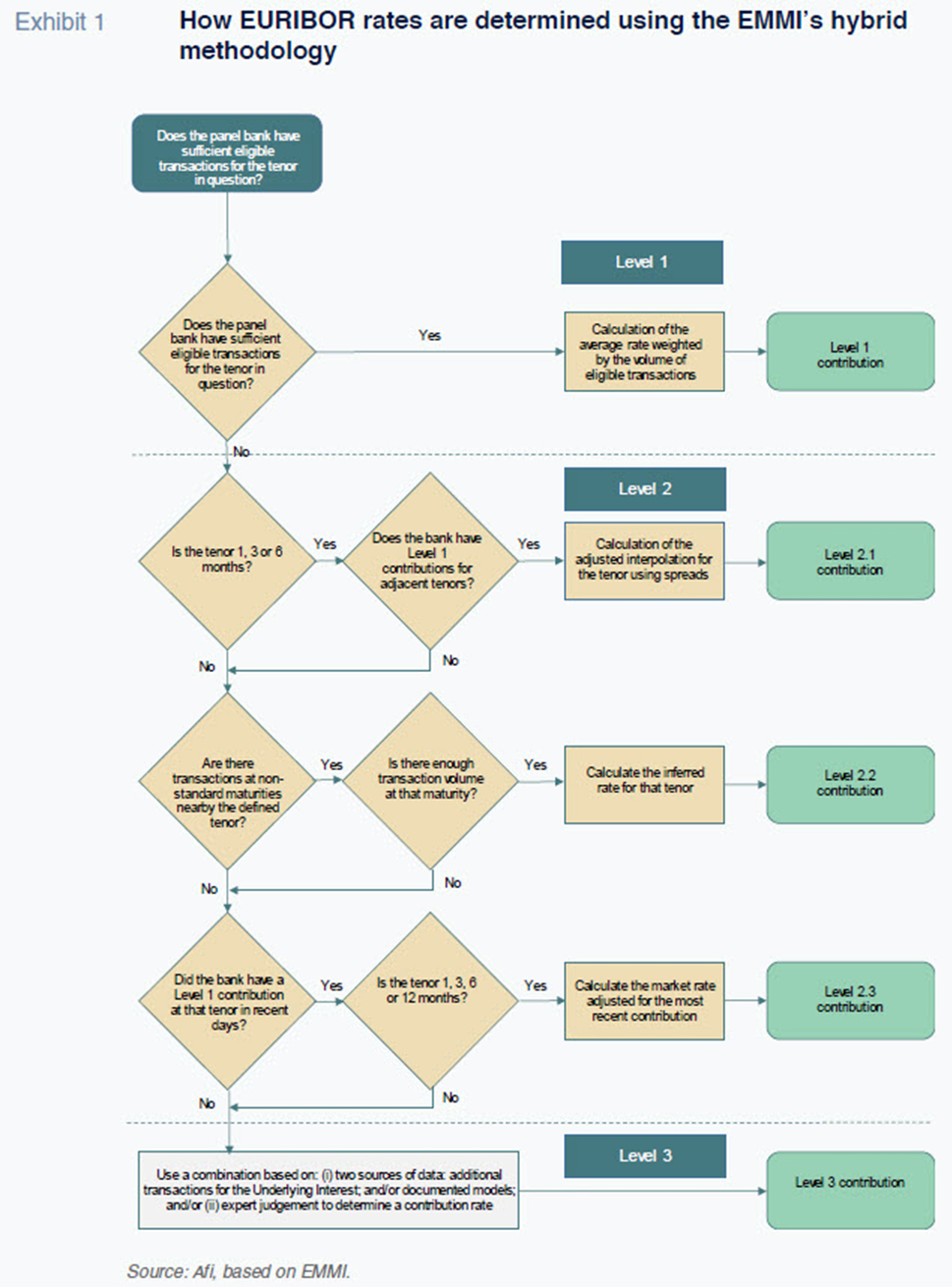

[4] EURIBOR and EONIA rates. Under the EU BMR, the EMMI has been the official administrator of the EURIBOR rates since July 2019. As such, it is obliged to define and implement a robust system of governance and set of control mechanisms to ensure the integrity and reliability of the EURIBOR rates. The EMMI’s current methodology – still provisional – for determining the EURIBOR rates is summed up as follows:

- The methodology is based on contributions by a group of credit institutions – the panel banks – that participate actively in the euro money markets. The number of panel banks [5] must be sufficient to constitute a representative sample for the purposes of determining an average rate and to reflect activity in the unsecured euro money market.

- Every day, each panel bank’s final contribution to each tenor is determined using a hierarchical or waterfall approach. To the extent possible, the EMMI strives to ground EURIBOR in euro money market transactions that reflect the Underlying Interest [6] at the defined tenor from the prior TARGET day (Level 1). When it is not possible to arrive at a result based on actual transactions, the calculation uses a defined range of formulaic calculation techniques provided by EMMI (Levels 2.1, 2.2 and 2.3) based on transactions in the Underlying Interest across the money market maturity spectrum and from recent TARGET days. Lastly, if it is not possible to obtain Level 1 to Level 2.3 results, the calculation relies on contributions from the banks based on transactions in the Underlying Interest and/or other data from a range of markets closely related to the unsecured euro money market, using a combination of modelling techniques and/or the panel bank’s judgement (Level 3).

- Based on this new methodology, the EMMI is tasked with determining the panel banks’ contributions following Level 1 and 2 rules by using individual transaction data provided by the latter. In the absence thereof, given the diverse composition of the EURIBOR panel of banks (designed specifically to capture the geographical diversity of the euro money market), each panel bank is responsible for determining its individual Level 3 contribution.

Although the new EURIBOR methodology continues to rely on the panel banks’ expert judgement, it only does so as a last resort, in an orderly fashion and governed by documented models and procedures. The new hybrid methodology is, nevertheless, still in the testing phase, which means it could be subject to certain adjustments. This would require publicly consulting the market participants in the event the changes prove material.

EURIBOR, risk-free rate + bank credit risk: A technical aside

Before getting into our analysis of the trend in EURIBOR rates in 2020, it is worth making a technical detour to review the various instruments in the money market and their interrelationship (EURIBOR, the risk-free interest rates, the interest swaps written over them and forward rate agreements or FRAs).

EURIBOR must at all times and in differing market conditions reflect the cost to banks’ of obtaining funding in the euro unsecured interbank lending market at different tenors. Given the existence of counterparty risk in respect of the principal and interest, the EURIBOR rates should trade at a spread over the risk-free rates with the same maturities. That spread will oscillate as a function of the trend in perceived counterparty risk.

Agreements known as forward rate agreements, or FRAs, are written over the EURIBOR rates. FRAs are derivatives that use a combination of interbank rates and futures over the latter to establish a forward price (i.e. the forward rate of interest) for notional interbank loans or debentures. The EURIBOR rate two days before the start or settlement date is the reference used to settle FRAs as per money market conventions.

The overnight risk-free reference rate is the €STR, which is calculated and published by the ECB and reflects the wholesale euro overnight borrowing cost of banks located in the eurozone. The overnight index swaps, or OISs, are traded over the overnight reference rates, €STR and EONIA. Those instruments are simply fixed-for-floating interest rate swaps in which the floating leg is the overnight reference rate, which is quoted daily. Since it is a contract written over a notional amount, (i.e. the principal of the underlying loans is not exchanged, and the swaps are not collateralised), counterparty risk is negligible.

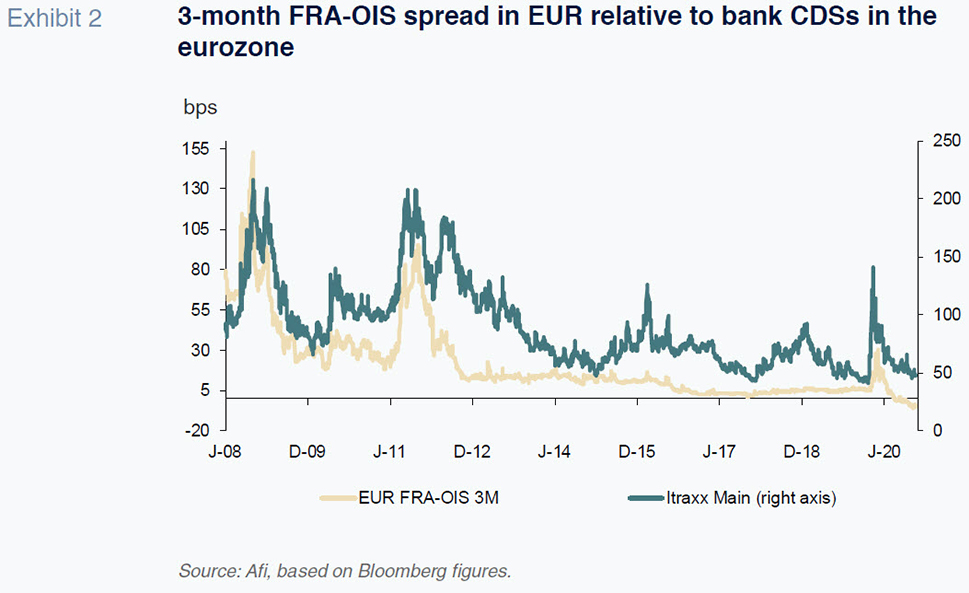

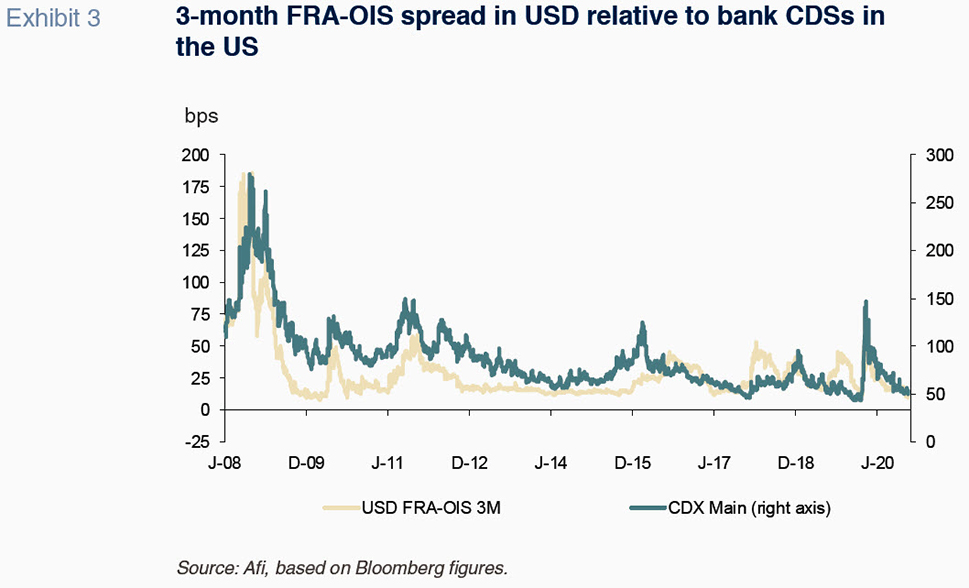

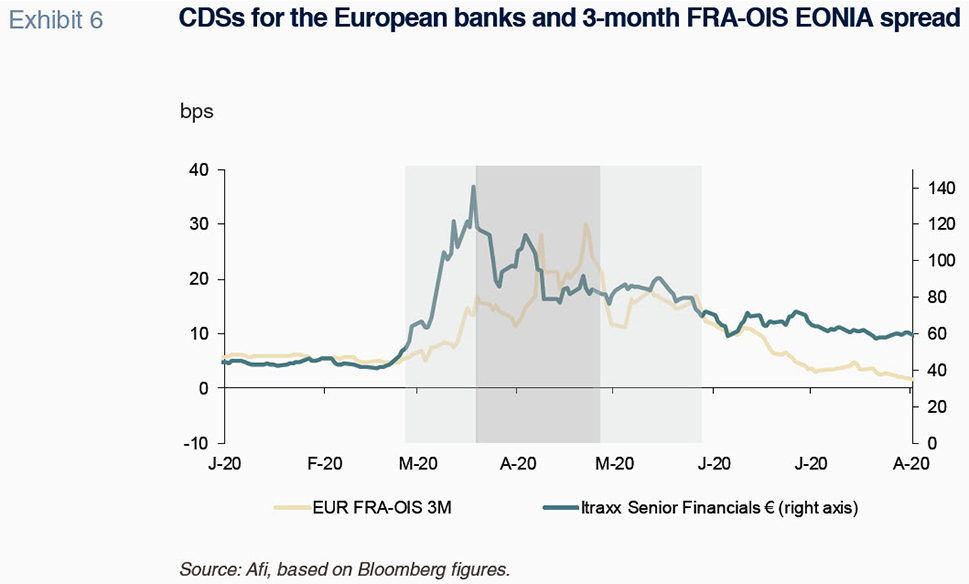

The spreads between the EURIBOR rates and OISs written over EONIA or €STR at a given tenor, coupled with the spread between the 3-month FRA and OIS rates, are the standard benchmark for measuring common credit or counterparty risk in the banking sector. The FRA-OIS spread is very closely correlated with the price of banks’ credit default swaps (CDSs) (Exhibits 2 and 3).

EURIBOR in 2020: A year marked by the onset of COVID-19

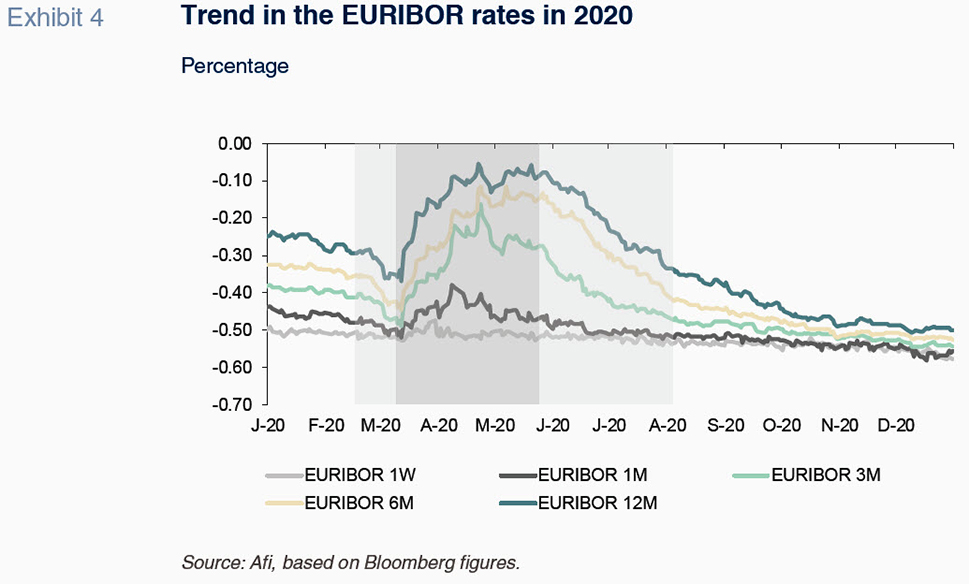

The EURIBOR rates were fairly volatile in 2020. The onset of COVID-19 triggered major ups and downs in the outlook for short-term risk-free rates and, at times, a considerable increase in banking counterparty risk. In addition to those two factors, the profound dislocation of the US dollar money market in March and April had a significant knock-on effect in other jurisdictions, reflecting the extent of global funding market interconnectedness.

The performance of the EURIBOR rates in 2020 can be grouped into three distinct phases. First, the collapse right before the second week of March, when the COVID-19 crisis was at its height. A second phase, which ran from mid-March until May, in which the EURIBOR rates with maturities of longer than one week rebounded strongly. The third phase, which ran between May and August, was marked by a reduction in rates and slope flattening across the various EURIBOR tenors. We will focus our analysis on the first two phases, which are of greater interest to the task of determining whether the EURIBOR rates correctly reflected evolving expectations for the risk-free rates and common bank credit risk intrinsic in trading in unsecured interbank loans.

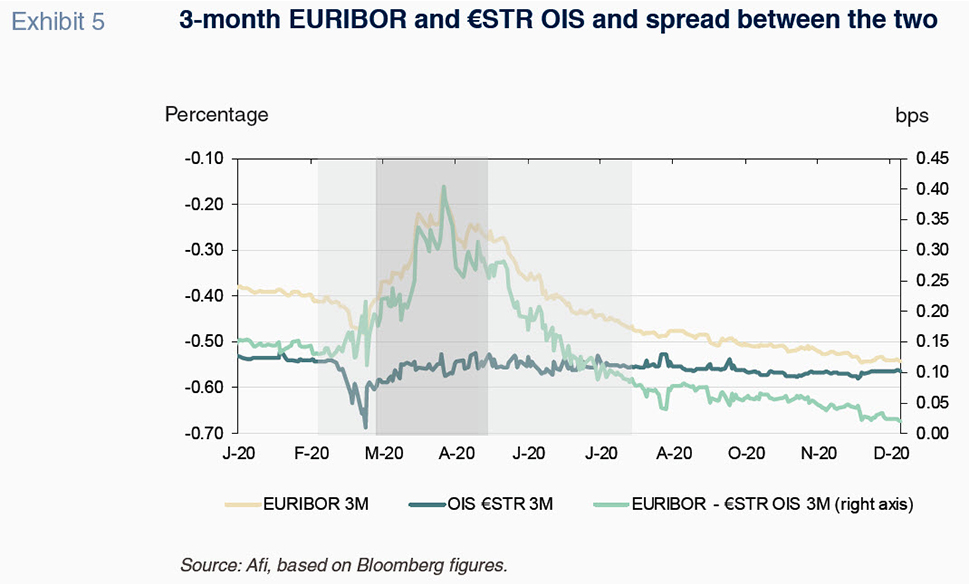

The EURIBOR rates provided a faithful reflection of the collapse in outlook for risk-free rates during the initial phase and of the reversal of expectation for lower rates during the second phase. Nevertheless, during the latter phase (until early May), the EURIBOR rates continued to rise. That is when we witnessed intense displacement of the EURIBOR rates above the €STR OIS rates (refer to Exhibit 5). What that movement reflected was a substantial and sudden increase in bank credit risk during the first half of March, as is evident in the widening spread observed in the European banks’ credit default swaps, as measured by the Itraxx Senior Financials Index (Exhibit 6).

The increase in perceived bank counterparty risk was not the only factor in play during that second phase. Indeed, it was not sufficient to explain the fact that the spread between the EURIBOR rates and the €STR OIS continued to widen and remained at high levels after the banks’ CDSs turned around and embarked on, from March 18

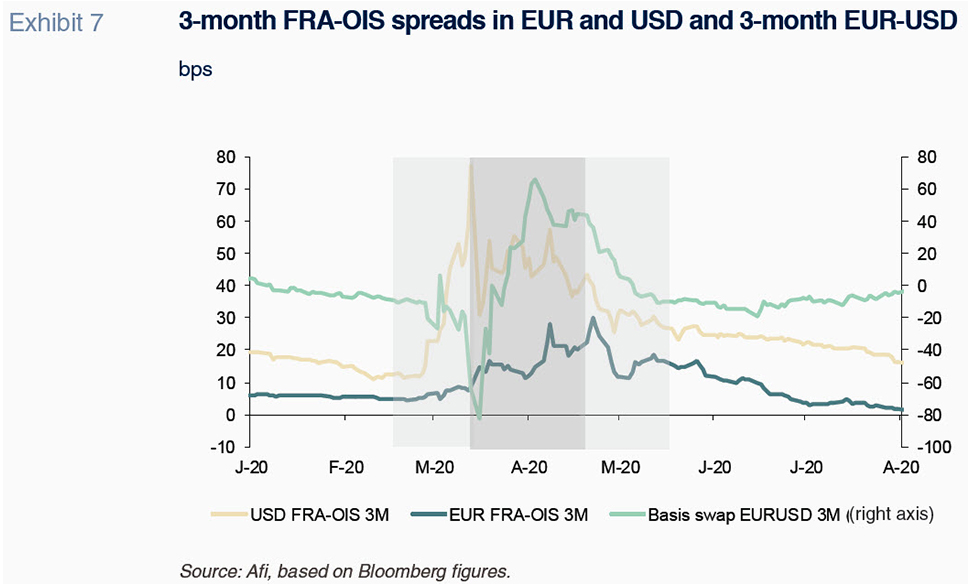

th, a downtrend that would last until the end of the summer. Moreover, the spreads between the 3-month FRA and OIS rates continued to widen sharply (Exhibit 7), peaking on April 22

nd, over one month after the CDS index for the European bank sector hit its high. That apparent decoupling between the two benchmarks for bank counterparty risk is intimately related with the liquidity issues encountered in the short-term dollar funding market during that same period. The effect of this was upward pressure on the EURIBOR rates that was unrelated with either the shifts in benchmark interest rate expectations or the trend in the common counterparty risk associated with the European banks.

Global dollar funding stress and its impact on driving EURIBOR higher

Before explaining how dollar funding stress exerted upward pressure on the EURIBOR rates, we should introduce the concept of the foreign exchange basis rate swap (also known as an FX basis swap or simply a basis swap). In the case of the US dollar, the basis is the difference between the dollar money market interest rate and the implied dollar interest rate in the FX swap market, where US dollars are borrowed against another currency as collateral. In the absence of financial stress, the basis hovers at close to zero. However, during episodes of dollar funding scarcity, the basis can turn significantly negative (and vice versa, it can be significantly positive when there is excess dollar liquidity).

The movements in the basis therefore reflect changes in the balance between supply and demand for dollars in the global market. On the dollar demand side, the institutional investment sector plays a very significant role, as some of the assets under its management

[7] are denominated in US dollars, which are financed by swapping their domestic currencies (euros, yens, sterling,

etc.) into dollars in the FX swaps market. The dollar sellers are the banks and the rest of the financial intermediaries, which raise dollars on the global capital markets. The numerous regulatory changes pushed through in the wake of the global financial crisis and the sharp drop in interest rates have reduced the supply of dollars in the system, which has translated into bigger swings in the basis swap during episodes of heightened financial stress.

During March and some of April 2020, the turbulence observed in the financial markets drove a swift and intense reduction in dollar providers’ ability to supply the market with liquidity. The run-on liquidity on the banks resulting from the massive drawdown of credit lines by the non-financial corporate sector coincided with the prime

[8] money market funds’ reduced ability to offer the system dollars due to heavy investor redemptions fuelled by heightened credit risk aversion. The prime money market funds are one of the biggest buyers of the short-term debt securities issued by banks (commercial paper and certificates of deposit).

The reduced market supply of dollars led to a sharp increase in the indicators that reflect the cost of short-term dollar funding in both the money and FX swap markets (the latter used as an alternative by the non-US banks to borrow dollars). The spread between 3-month dollar LIBOR and the OIS shot up to 120 basis points, while the spread between the 3-month dollar FRA and the OIS neared 80 basis points during the second week of March. In the FX swap market, strong demand for dollars drove the USD-EUR basis swap sharply negative (to -80 basis points

[9]; refer to Exhibit 7), indicating that it had become far more expensive to borrow dollars in exchange for euros in the FX swap market than to do so in the spot market for money market instruments.

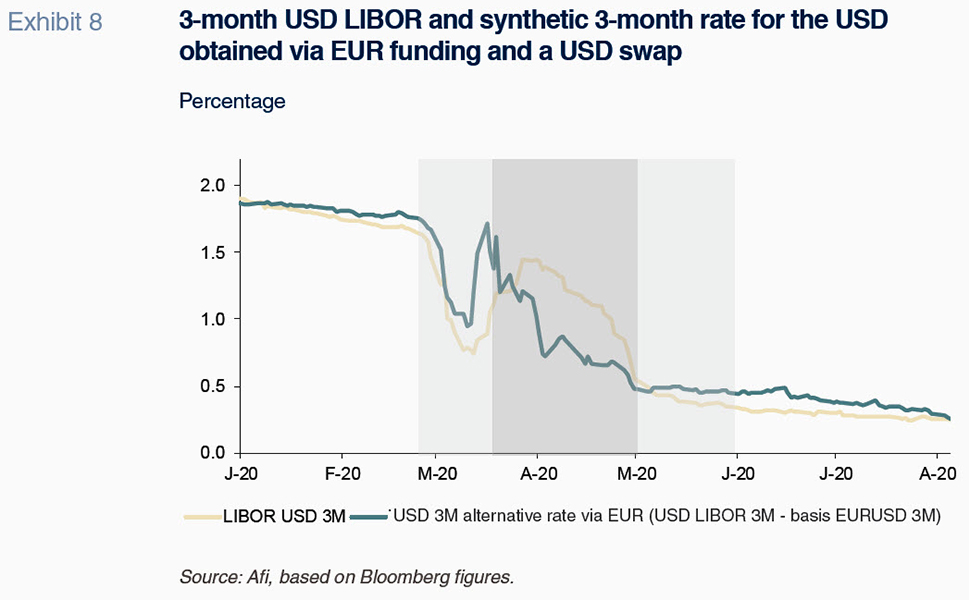

As part of a coordinated action with other central bank, the Federal Reserve announced on March 15th a series of measures related to its FX swaps lines that paved the way for gradual normalisation of the dollar basis swap against other currencies. In parallel, on March 17th and 18th, the Fed set up the Money Market Mutual Fund Liquidity Facility (MMLF) and the Commercial Paper Financing Facility (CPFF), use of which was fairly limited. The varying rates of success of those actions created an unusual situation in terms of access to dollar funding. Namely, it became cheaper to obtain dollars in the FX swap market than in the dollar money market. That anomaly arose because the difference between rates in the unsecured funding market (LIBOR and FRA) and the risk-free rate (OIS) took longer to narrow than it took access to dollar funding in the FX swap market to normalise. The USD-EUR basis swap traded at significantly positive levels throughout much of April and May, putting the cost of dollar funding via euros in the FX swap market (Exhibit 7) well below the cost of obtaining it directly in the dollar unsecured money market. In other words, it was cheaper to obtain funding in euros in the 3-month euro interbank money and then swap it into dollars by paying the basis swap than it was to obtain funding directly at 3-month USD LIBOR.

The arbitrage opportunity that resulted from that situation

[10] exerted upward pressure on the EURIBOR rates (driven by the demand for euros in order to obtain dollar funding synthetically via FX swaps) and downward pressure on the USD LIBOR rates (due to the placement of dollars at slightly lower rates than the latter). Exhibit 8 shows the cost of obtaining 3-month dollar funding in the money market (3-month USD LIBOR) and the end cost of raising the same amount of dollars by first borrowing euros at the 3-month EURIBOR rate and then swapping the balance into dollars. For more information, refer to Eren, Schrimpf and Sushko (2020) and to Avdjiev, Eren and McGuire (2020).

From that juncture on, the above-mentioned arbitrage play, coupled with a gradual reduction in financial stress levels in the global markets, gave way to a third phase of gradual and steady reduction in the EURIBOR rates and convergence towards the risk-free rates (the €STR and EONIA OISs).

Determination of EURIBOR during the episodes of market stress in 2020

The experience since 2007 suggests that during periods of financial stress, the liquidity and depth of the unsecured funding markets drop sharply. Against that backdrop, 2020 provided the acid test for the new EURIBOR calculation methodology. On top of sharp swings in the outlook for risk-free rates and perceived counterparty risk in the bank sector, the markets were highly distorted following the episode of acute dollar funding stress in the US.

The minutes of the EMMI Steering Committee meeting show that:

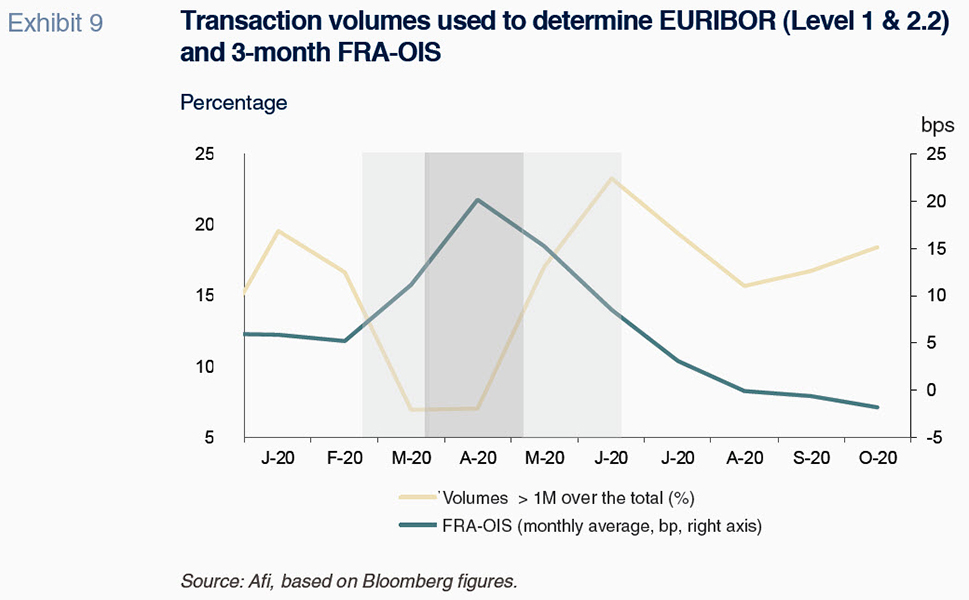

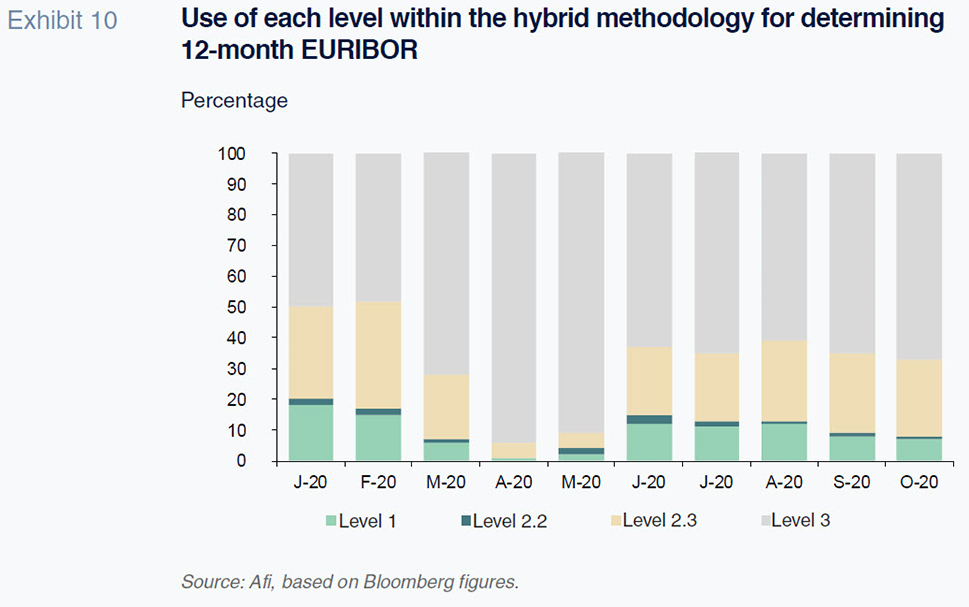

- Between the end of February and the middle of March, volatility rose sharply. There were delays in receiving contributions from the EURIBOR panel banks, and the transaction volumes on which the panel contributions are based (Levels 1 and 2.2) fell, particularly for the longer-dated tenors. Additionally, there was a significant increase in Level 3 contributions. Nevertheless, throughout the period the EURIBOR rates traded consistently, falling when the expectation grew that benchmark rates would be reduced, albeit mitigated by an offsetting increase in perceived counterparty bank risk.

- In April, the volume of transactions at the longer tenors plummeted (there was barely any Level 1, 2.2 or 2.3 transaction volume). At the same time, reliance on Level 3 contributions reached a high not registered since the new hybrid methodology was deployed. That month, EURIBOR rates dated longer than one week sustained sharp increases, which was consistent with the elimination of the expectation of a benchmark rate cut (increase in the €STR OIS rates) and strong demand for funding in euros for swapping into dollars, the effect of which offset the reduction in perceived bank counterparty risk (drop in banks CDSs) by a wide margin.

- Lastly, the June 11th meeting minutes show that from May the EMMI’s dependence on Level 3 contribution to determine the EURIBOR rates began to fall, as transaction numbers and volumes in the longer-dated tenors started to recover.

Conclusion

It is fair to say that the EURIBOR has surmounted a very challenging year, helped significantly by the new hybrid calculation methodology. The EURIBOR rates trended in a manner that was consistent with their two key drivers: expectations for benchmark rates and perceived bank credit risk. In addition, they consistently captured the indirect effects of the dislocation sustained in the FX swap market as a result of the surge in global demand for dollar funding in the early stages of the COVID-19 crisis.

Notes

The Intercontinental Exchange (ICE), which administers the LIBOR rates, issued a consultation paper on December 4

th, 2020, regarding the potential cessation of the calculation and publication of the euro, sterling, yen and franc LIBOR rates, scheduled for December 31

st, 2021, and of the US dollar LIBOR rates between December 31

st, 2021 (1-week and 2-month rates), and June 30

th, 2023 (overnight and 1-, 3-, 6- and 12-month rates). For more information,

https://www.theice.com/iba/libor

The Euro Overnight Index Average – EONIA – is the index representing the average overnight euro rate on interbank funding. It is calculated by the European Central Bank (ECB) on the basis of data provided by a panel of credit institutions. It is the benchmark rate used in numerous derivative products. The calculation and publication of EONIA will be discontinued on January 3rd, 2022.

The euro short-term rate, or €STR, is a reference rate that reflects the intra-day rate of interest on loans between eurozone banks. The ECB calculates and publishes the €STR, which replaced EONIA in October 2019.

The EMMI used to be called Euribor-EBF. The name change took place for legal purposes on June 20th, 2014, and was framed by the entity’s effort to reinforce the perceived transparency and reliability of its benchmark index administration work.

At present, 18 banks comprise the EURIBOR panel.

The “Underlying Interest” for EURIBOR is stated as: “The rate at which wholesale funds in euros could be obtained by credit institutions in the EU and EFTA countries in the unsecured euro money market”.

Asset managers, insurers, pension funds, among others. At the end of 2019, the volume of assets under management worldwide amounted to around 89 trillion dollars (according to Boston Consulting Group).

Money market funds, targeted at retail and institutional investors, invest primarily in corporate debt securities. Assets under management in both categories – retail and institutional – suffered outflows equivalent to over 10% of total assets during March 2020.

The basis swaps between dollars and other currencies, particularly those with which the Federal Reserve did not have currency swap lines (nearly all the emerging market currencies) shot to much higher levels.

The minutes of the meeting held by the ECB’s Money Market Contact Group (MMCG) on May 4th show the clearcut influence of the arbitrage opportunity in the currency swap market on the trend in EURIBOR.

José Manuel Amor. A.F.I. - Analistas Financieros Internacionales, S.A.