Spain’s 2021 budget: An assessment

The Spanish government’s 2021 budget is notable for its marked optimism regarding the country’s economic growth and revenue prospects, its ability to rein in public expenditure, and by extension, the country’s deficit and debt levels. Consensus forecasts are more downbeat, with lower growth estimates, higher deficit and debt levels, as well as doubts surrounding the economic impact on forecasted revenue growth and the Next Generation EU funds.

Abstract: In comparison with consensus forecasts, Spain’s 2021 budget appears overly optimistic about the Spanish economy’s growth prospects. The government is forecasting growth of 9.8% and a deficit of 7.7% in 2021, while other institutions’ estimate lower growth and higher deficits. The government’s favourable forecasts are based on key assumptions regarding global and eurozone growth levels, as well as Spain’s export markets. Its expectations relating to the Next Generation EU programme may also prove overly confident given Spain’s previous track record absorbing EU funds and the essentially political composition of the committee constructed to oversee the funds’ use. Additionally, the government’s deficit estimate was calculated before the extension of the furlough and income support schemes, which will put upward pressure on expenditures. As a result, in the absence of fiscal consolidation, Spain’s public debt is set to rise in the years to come, and will be highly exposed to an upward trend in interest rates. In terms of the government’s forecast for revenue growth of 14.53%, its dependence on GDP growth and revenue elasticities also raises concerns over exceedingly optimistic projections. Lastly, considering regional, local and central government spending, state expenditure will increase to 50.8% of GDP in 2021. The biggest government expenses forecast include pensions (35.8%), public debt service (6.9%) and unemployment benefits (5.4%).

Introduction

This paper outlines the main sources of revenue and expenditure contemplated in the 2021 state budget. We begin by addressing the macroeconomic forecasts underpinning the budget and the levels of debt and deficit estimated. We next evaluate the revenue estimates. Lastly, we describe the state’s public spending policies.

The macroeconomic scenario underpinning the 2021 budget

Economic growth forecasts

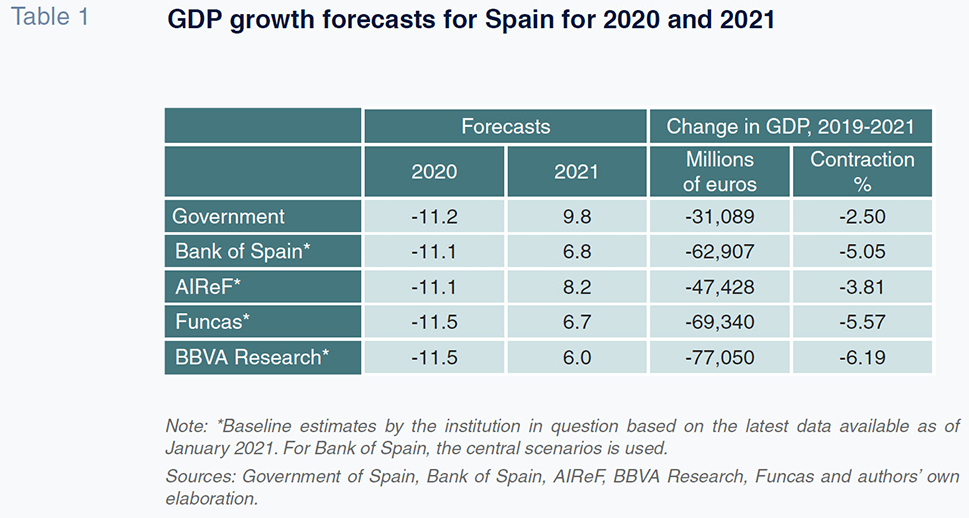

Table 1 compares the GDP forecasts presented by the Spanish government and by other institutions for 2020 and 2021 at the time the draft 2021 budget was unveiled. It also shows the change in GDP between December 2019 and December 2021 assuming that the forecasts are met. The numbers reveal that the government is forecasting a sharp correction in GDP in 2020 (-11.2%). However, its forecasts for 2021 are considerably more optimistic, with growth forecast at 9.8% in 2021. Even if those estimates prove accurate, Spanish GDP would decline by over 31 billion euros between 2019 and 2021. This drop would be equivalent to 2.5% of 2019 GDP.

The forecasts compiled by the rest of the institutions featured in Table 1 are more pessimistic for growth in 2021. Whereas the government’s forecasts for 2020 lie in the middle of the range of estimates presented by the rest of the forecasters, its 2021 forecasts are clear outliers. Specifically, the Bank of Spain and AIReF estimate that Spanish GDP will end 2021 between nearly 4%-5% below year-end 2019 levels, while Funcas and BBVA Research put that contraction at an even higher approximately 6%. At the time of writing this article, other institutions such as the OECD and the General Council of Economists were estimating year-on-year growth of around 5% in 2021, i.e., little more than half of what the government is forecasting.

As set down in the 2021 budget, the government’s growth forecasts are based on: (i) the assumption that the pandemic will evolve favourably; (ii) recovery in the global economy (6.2%); (iii) economic recovery in the eurozone (5% ); and, (iv) in particular, a rebound in Spain’s key export markets (7.3%). However, as pointed out by several institutions, including AIReF and the Bank of Spain, the intensification of the pandemic in recent months has since rendered that scenario less plausible. The government’s optimistic forecasts also factor in a downtrend in long-term interest rates in 2021, oil prices of less than 50 dollar per barrel and the so-called Recovery, Transformation and Resilience Plan, underpinned by the Next Generation EU programme (NGEU). The NGEU is expected to amount to 140 billion euros in the form of transfers and loans (equivalent to 11% of Spanish GDP) starting in 2021. According to the government, the NGEU will inject 27 billion euros into the Spanish economy in 2021, accounting for 2.6 percentage points of total estimated GDP growth this year (9.8%). However, there are significant downside risks that suggest that the government’s growth forecast for 2021 is overly optimistic. The chief risk relates to the uncertain outlook for the pandemic, specifically the risk of even greater damage to the business environment leading to further job losses. Unemployment is expected to top 17% in 2020. Moreover, the recently-struck Brexit deal does not fully eliminate uncertainty regarding how its implementation will affect the European economy in general and the Spanish economy in particular.

With respect to the GDP contribution of the NGEU, as noted by AIReF, it is only credible if the large majority (around 80%) of the 27 billion euros is earmarked to public investment. In addition, as stressed by the Bank of Spain’s Governor during testimony provided to the Congress of Deputies on November 4th, 2020, there are significant execution risks. The Governor also pointed out a lack of precision regarding the use of funds expected to be received in 2021. To make his case, the head of the Bank of Spain drew on historical evidence to call attention to Spain’s difficulties to mobilise the funds associated with other European programmes. Specifically, he cited the last three rounds of structural European funds (smaller than the NGEU), of which less than 80% of which has been absorbed over the seven years they have been in place. The Bank of Spain also emphasised the fact that the European funds’ multiplier effect requires their investment in human capital and technology, the real drivers of sustainable economic growth. In a similar vein, García-Arenas (2020) notes that the figure of 27 billion euros is extremely optimistic, as the first drawdown of NGEU funds will be equivalent to just 10% of total transfers, which translates into 5.9 billion euros for Spain. What that means is that the government presumably plans to advance the remainder, to reach the total figure of 27 billion euros, taking on debt to do so. Moreover, the budget would not appear to have factored in the fact that the NGEU, albeit approved by the European Council and Parliament, is pending ratification by certain national parliaments. That process could encounter obstacles, as we saw when Poland and Hungary attempted to veto the plan. Although that situation has since been resolved, the two countries are now threatening to delay final approval until after the summer of 2021.

Lastly, it is worth highlighting the fact that the NGEU constitutes a significant opportunity to modernise the Spanish economy. However, the success of the related initiatives will depend on how well the mechanisms are constructed and how effectively the designated institutions select, design, implement and execute the investment projects carried out under their purview. Unlike the technocratic models proposed by other countries,

[1] Spain has opted for a strictly political committee limited to Cabinet members, thus politicizing the governance framework for the application and distribution of the European funds in Spain. The creation of a mixed committee of economic experts, successful private sector businessmen and women, particularly drawn from the high-tech sector, and political authorities from the various regional and local administrations would have been a more balanced choice.

Public deficit and debt forecasts

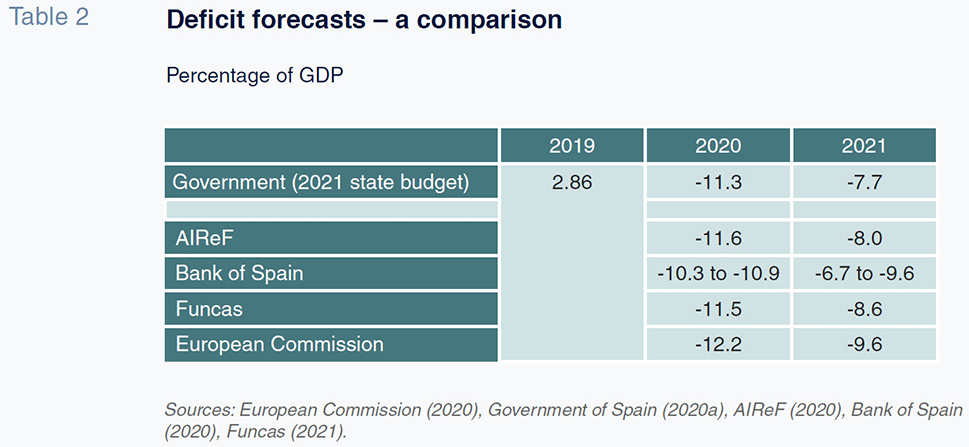

The financial crisis of 2008 drove the public deficit to new highs, peaking at 11.28% of GDP in 2009. After a decade of fiscal consolidation, the deficit narrowed to 2.48% in 2018, enabling Spain to exit the excessive deficit procedure. The downward trend stalled in 2019, when the deficit climbed back up to 2.86%, even though the Spanish economy grew faster than the European average that year. With that backdrop, in February 2020, the government set ambitious deficit targets of 1.8% for 2020 and 1.5% for 2021. However, the effects of the pandemic on economic growth, the sharp drop in public revenue and the massive increase in public spending did away with those targets within a matter of just a few weeks. Given the gravity of the situation, the European Commission was forced to activate the general escape clause of the Stability and Growth Pact (SGP), allowing the member states to deviate from their budget targets in 2020 and 2021. That was the context in which the macroeconomic forecasts underpinning the 2021 budget were drawn up. Specifically, the government is forecasting a deficit of 11.3% in 2020, which would imply an increase of 8.4 percentage points from 2019. Nevertheless, the government expects that growth in GDP, the reining in of spending (assuming no new waves of the pandemic) and its forecasted increase in public revenue (which we will analyse below) will reduce the deficit to 7.7%, or 93.5 billion euros, in 2021. Table 2 compares the deficit estimates presented in the state budget with those compiled by the European Commission, AIReF, Bank of Spain and Funcas. These institutions’ deficit estimates for 2021 range from 6.7% to 9.6%, i.e., between 80.5 and 116.5 billion euros.

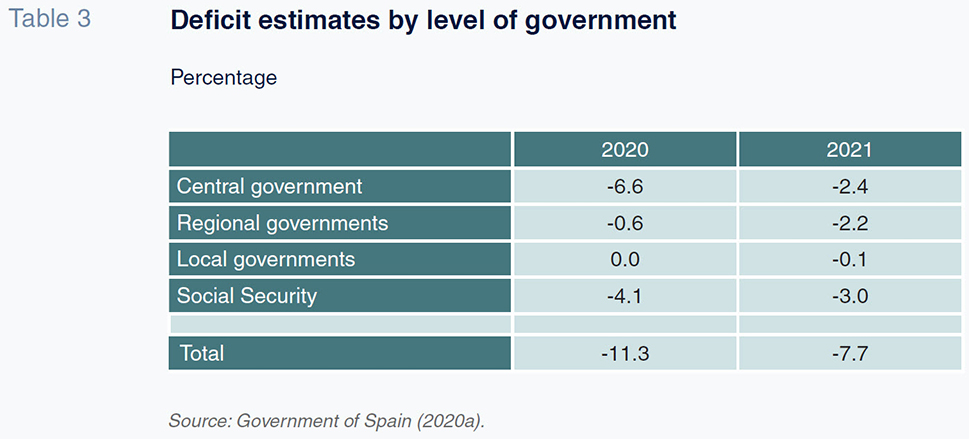

As shown in Table 3, the bulk of the deficit forecast for 2020 is accounted for by the central government (58.4%) and Social Security (36.3%), given that most of the measures taken to cushion the economic and social impact of the pandemic has fallen to the state employment service (SEPE) and the Social Security administration. The measures with the biggest economic impact in 2020 included the income support and tax exemptions extended to self-employed professionals at a cost of close to 8.1 billion euros and the benefits extended under the furlough scheme, at a cost of 24.2 billion euros. The draft 2021 budget sent to Brussels on October 15th assumed a drastic reduction in the cost of the furlough and income support schemes in 2021 to 1.72 billion euros, based on the assumption that they would not be extended beyond January 31

st, 2021 (Government of Spain, 2020b). However, towards the end of January, both schemes had been extended until the end of May, which would inflate their cost to approximately 8.5 billion euros. At present, 780,000 employees are under the furlough scheme and 350,000 self-employed professionals are benefit from the corresponding income support and tax relief.

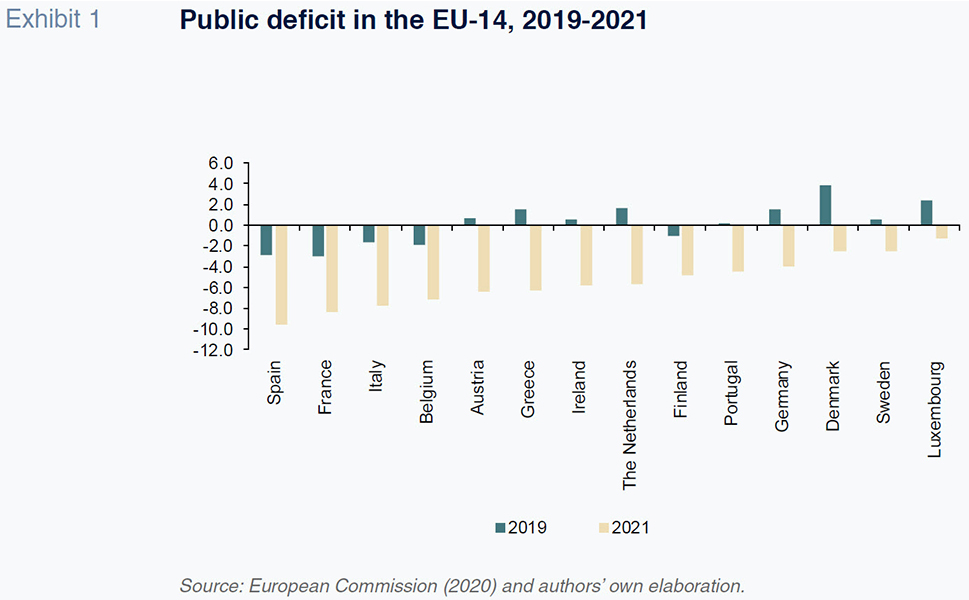

On a comparative basis, at 9.6% of GDP, the European Commission forecasts that Spain will report the highest deficit in the EU in 2021, followed by France (-8.3%), Belgium (-8.1%) and Italy (-7.8%). At the opposite end of the spectrum lie Luxembourg (-1.3%), Sweden (-2.5%), Denmark (-2.5%) and Germany (-4.0%). Indeed, as is shown in Exhibit 1, the countries with the largest deficits are those that ended 2019 with the weakest public finances. That situation evidences the need to urgently draw up a credible medium-term fiscal consolidation plan backed by genuine political commitment. Recall that during the crisis of 2008, the EU-15 member states took an average of five years to bring their deficits back under 3%, whereas Spain took a decade. In fact, it was the country that took the longest to reach that threshold, more than the nine years it took Greece and France, the eight years it took the UK and Portugal or the seven years it took Ireland (Romero and Sanz, 2019). Moreover, unlike Spain, some of those countries, including Ireland, Portugal and Greece, ended 2019 with a fiscal surplus.

The size of the structural deficit and the risk that it becomes chronic is without a doubt one of the biggest challenges facing the Spanish economy over the coming decade. The Bank of Spain (2020) estimates that the structural deficit has increased from 3.1% in 2019 to at least 5%. That sharp increase is the direct result of the massive increase in public spending associated with the pandemic, a portion of which is structural. However, it also reflects the approval of other spending policies unrelated to the pandemic. Two examples include: the minimum income scheme, whose cost is initially estimated at 3 billion euros; and the increase in public sector wages and contributory pensions in line with forecast inflation (0.9%), at a cost of around 3 billion euros. The Bank of Spain believes it will take a decade to correct the structural deficit considering that the fiscal stability rules forecast correction will occur at the measured pace of 0.5 percentage points per annum. In short, in the best-case scenario, assuming a firm commitment to achieving a balanced budget, the structural deficit will not correct before 2032.

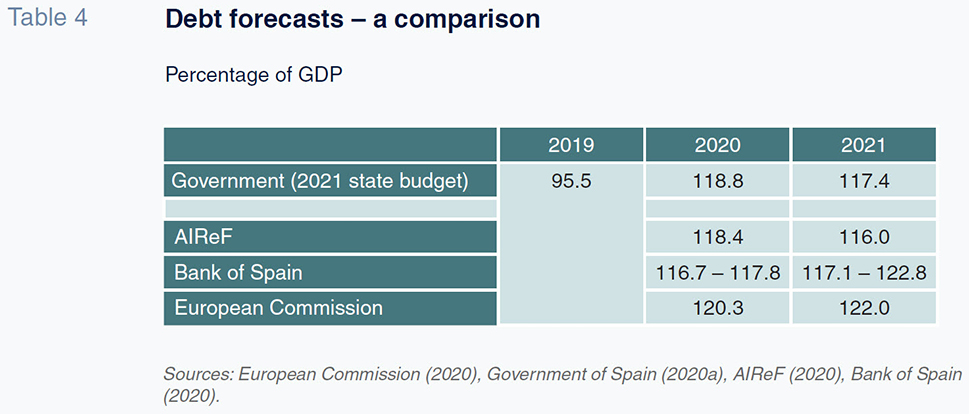

The scale of the deficit in 2020 will also lead to record levels of public debt in Spain. According to the government’s forecasts presented in Table 4, public debt will increase from 95.5% in 2019 to 118.8% in 2020, falling to just 117.4% in 2021. In other words, as a result of the pandemic, the government expects public indebtedness to increase by 23.3 percentage points in 2020 and 21.9 points in 2021 from 2019 levels. According to the European Commission (2020), Spain will also top the charts in terms of the increase in its indebtedness between 2019 and 2021 (26.5 percentage points), followed by Italy (24.8) and Greece (20.2). Table 4 compares the government’s estimates with those compiled by the European Commission, AIReF and the Bank of Spain. The numbers show that the European Commission believes that the Spanish government has understated its 2020 forecast for indebtedness by 1.5 percentage points. Also, the European Commission and the Bank of Spain expect the level of public debt in Spain to be as much as five percentage points higher than the government is forecasting for 2021. In the absence of fiscal consolidation measures, public indebtedness in Spain is destined to rise in the years to come. To the contrary, an austerity roadmap that delivers a reduction in the structural primary deficit of 0.5 percentage points per annum would put the public deficit back at 2019 levels by 2035 (Bank of Spain, 2020).

Prevailing low interest rates are key to preventing the debt service burden from skyrocketing. In the short-term, interest expense is set to remain stable thanks to the benign financing conditions - the rate on new issues was 0.23% in 2019, a figure that had fallen to 0.21% by October 2020, and rates were negative for paper with more than a five-year maturity (AIReF, 2020). Prevailing conditions would leave debt service costs at around 31.7 billion euros in 2021, compared to 31.3 billion euros in 2019.

[2] In the absence of a fiscal consolidation roadmap designed to gradually reduce the deficit as a percentage of GDP, the sustainability of Spain’s public debt is excessively exposed to an upward trend in interest rates.

Public revenue

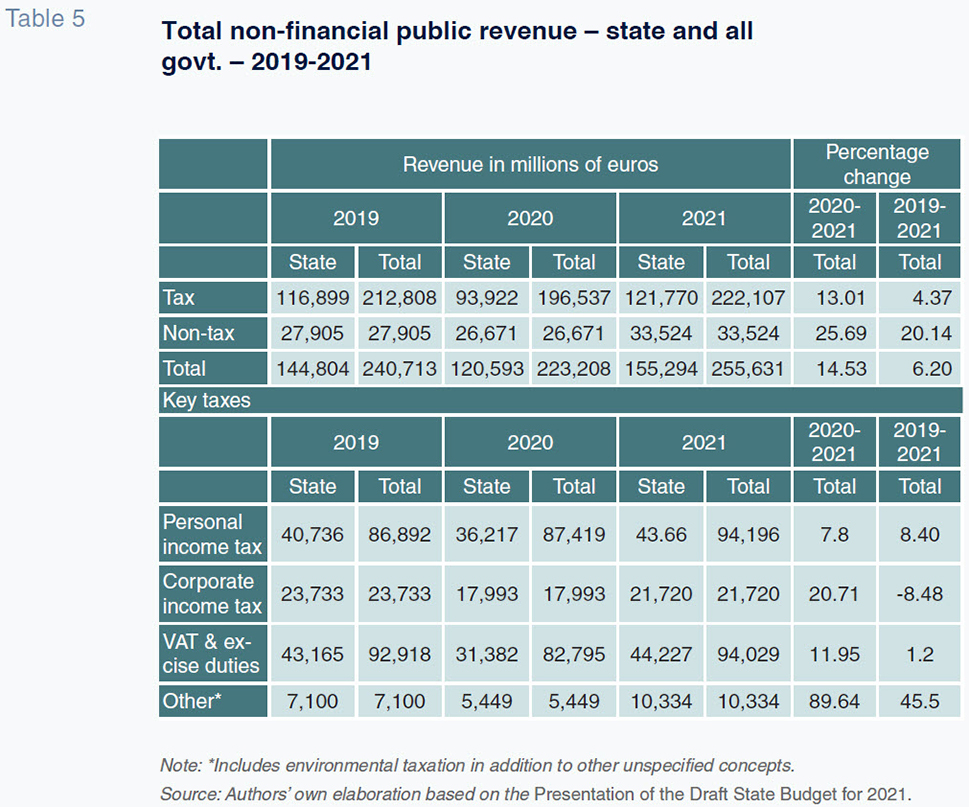

As summarised in Table 5, the government is forecasting year-on-year growth in non-financial revenue in Spain of 14.53% in 2021, which would imply growth of 6.2% with respect to 2019. By tax sources, it is estimating very significant growth in the main taxes – personal income tax, VAT and excise duties and corporate income tax - compared to 2020, corporate income tax being the only one estimated to generate less revenue in 2021 than in 2019. Delivery of those revenue targets primarily depends on three factors: (i) how accurate the growth forecasts prove to be; (ii) the impact of the economic cycle on the various tax bases; and, (iii) the discretionary measures (regulation changes) approved for 2021 across a number of taxes. It looks very likely that the government’s revenue forecasts will prove too optimistic.

As for the cyclical (automatic) growth forecast in revenue, this will depend on both delivery of the GDP growth forecasts for 2020 and 2021 and on the revenue elasticities implicitly assumed for each source of tax. As already noted above, the government’s GDP growth forecasts for 2020 and 2021 (-11.2% and +9.8%, respectively) look overly optimistic when compared with the consensus forecasts gleaned from the leading Spanish and international analysts. Another issue casting doubt over the forecasts for 2021 is the various revenue elasticities implicitly assumed by the government. Even assuming that the government has its macroeconomic forecasts right, application of the elasticities estimated in recent literature,

e.g. Sanz-Sanz, Castañer and Romero-Jordán (2016); Mourre and Princen (2015); Creedy and Sanz (2010),

[3] leads to the conclusion that by virtue of the cyclical component alone, personal income tax revenue may fall with respect to 2019 levels to 83 billion euros (-4.5%); revenue from the consumption taxes, VAT and duties, may drop to 90.6 billion euros (-2.5%); and receipts from corporate income tax may fall to 22.73 billion euros (-4.2%).

[4] If we assume the most pessimistic growth scenario foreshadowed by the OECD in which growth reaches just 5% in 2021, the revenue lost in respect of the three main taxes – personal, corporate and indirect taxation – would top 13 billion euros, which is 6.5% less than the government is forecasting. In line with those figures, the cycle-induced revenue forecast by the government also looks out of sync with the elasticities with respect to the output gap endorsed by the EU’s Economic Policy Committee for calculating the trends in revenue and expenditure for the Spanish economy. Specifically, the elasticities used for these calculations are 1.84 for personal income tax, 1.56 for corporate income tax and 1 for tax on consumption.

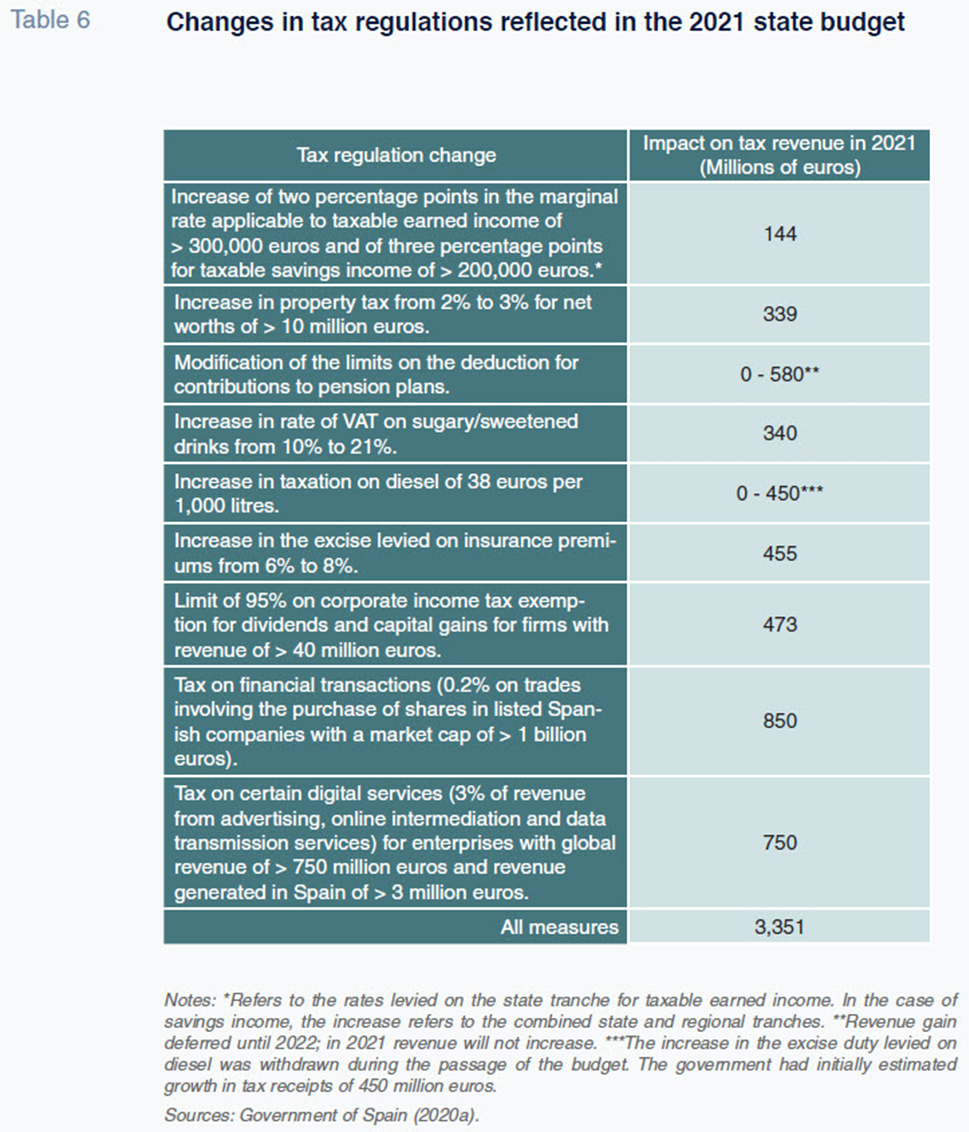

As for the discretionary measures, Table 6 summarises the main tax developments introduced for 2021 and the revenue gains the government expects them to yield, figures which AIReF has dubbed overly optimistic. As the table shows, in the best-cast scenario, the new discretionary measures will, according to the government, bring in a further 3.35 billion euros, which is not enough to offset the revenue lost on account of cyclical effects. Moreover, the 3.35-billion-euro figure does not factor in the possible loss of revenue associated with behavioural changes which the tax hikes could induce. It therefore looks as if Spain’s public finances will sustain greater revenue fallout than foreshadowed in the state budget for 2021.

Public expenditure

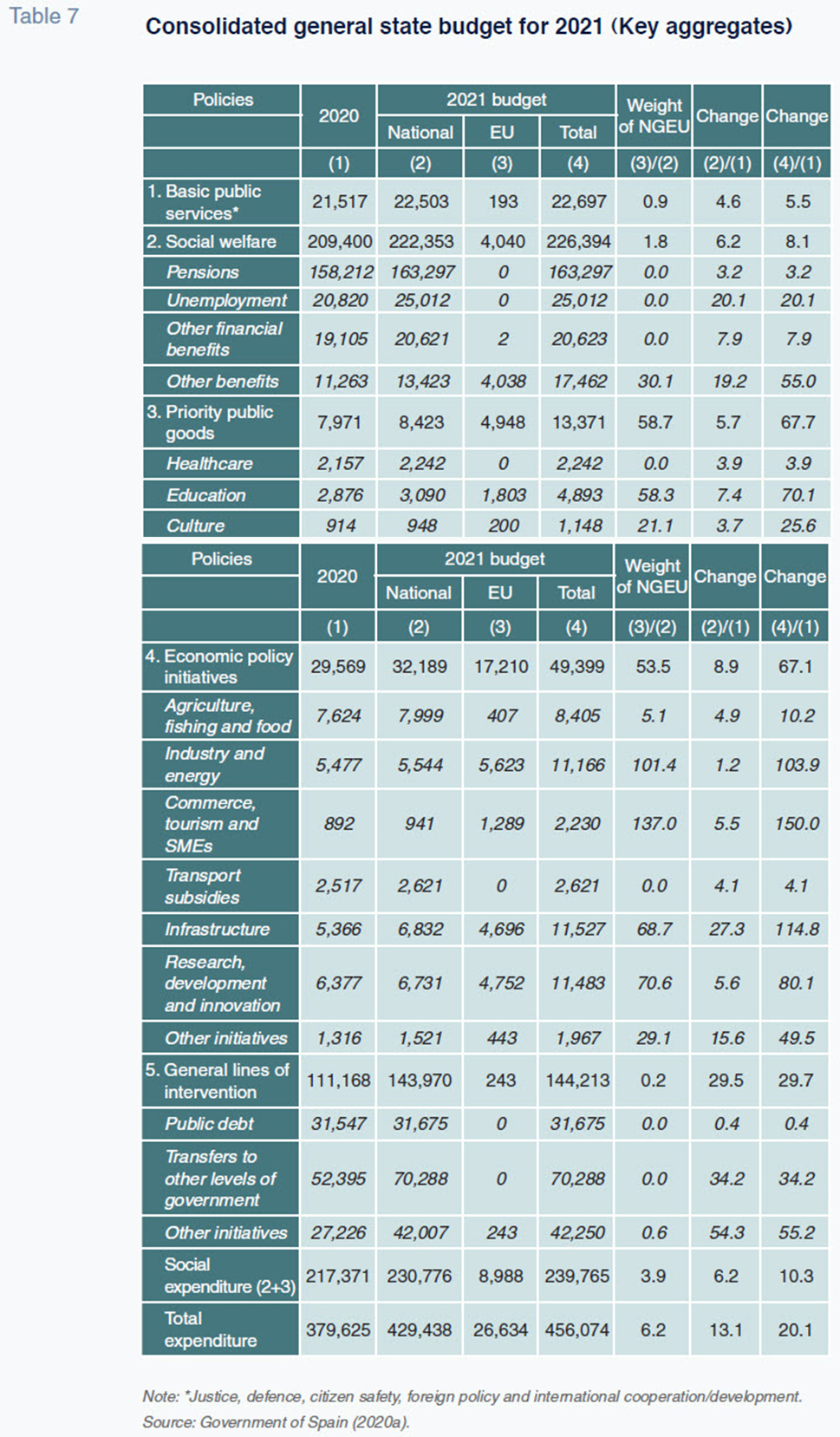

Table 7 sums up the public expenditure figures set down in the 2021 state budget. Public spending is expected to total 456.07 billion euros in 2021, of which 26.63 million euros (5.8%) is set to come from the NGEU fund. The plan is to earmark 67% of those European funds to industry and energy (5.62 billion euros), R&D and digitalisation (4.75 billion euros), resilient infrastructure and eco-systems (4.7 billion euros) and healthcare (2.95 billion euros).

The official figures point to growth in state expenditure of 20.1% in 2021 (13.1% excluding the European funds), boosting its weight as a percentage of GDP from 34.3% to 37.2% (35.0% excluding the NGEU). However, if we layer in the spending contemplated at the regional and local government levels, public expenditure at all levels of government as a percentage of GDP rises to 50.8% (48.0% excluding the European funds). In sum, the government plans to lift spending across all levels of government from 42.1% of GDP in 2019 to 50.8% in 2021, an increase equivalent to approximately 92.5 billion euros.

The direct expenses of greatest relevance in the budget are pensions (35.8%), public debt service (6.9%) and unemployment benefits (5.4%). Expenditure on pensions is expected to reach 163.3 billion euros in 2021, growth of 3.2% (or 5.09 billion euros) from 2020. That sharp growth is attributable to the interplay of three factors: (i) the agreed pension increases (0.9% for contributory pensions and 1.8% for non-contributory pensions); (ii) the forecasted increase in the number of pensioners; and, (iii) the forecasted growth in the average pension. The pension increase is based on estimated inflation for 2021 of 0.9% (as is the increase in public sector wages). Expenditure on unemployment benefits is estimated at 25.01 billion euros in 2021 (2020: 20.82 billion euros), growth of 20.1%, even though the government expects the rate of unemployment to decline by one percentage point this year to 16.1%. The government attributes the growth in this heading to the cost of extending the furlough scheme until January 31st and the extension of the right to continued assistance when unemployment benefits cease from the age of 55 to 52. Further extension of the furlough scheme, which has recently been agreed until May 31st, will have the effect of increasing the cost of unemployment benefits considerably, specifically by an estimated 8.7 billion euros.

Notes

France is a prime example, having opted to set up a committee of international experts. France’s committee is presided by the economists Jean Tirole (Nobel prize-winner in 2014) and Olivier Blanchard (Chief Economist at the IMF between 2008 and 2015). Other renowned members include Dani Rodrik (Harvard), Carol Propper (Imperial College of London), Stefanie Stantcheva (Harvard), Paul Krugman (Nobel prize-winner in 2008) and Peter Diamond (Nobel prize-winner in 2010).

[2]

The Spanish Treasury is expected to issue around 175 billion euros of debt in 2021, taking advantage of the current low rates.

[3]

More specifically, those elasticities are 1.48% for personal income tax, 1% for consumption tax and 1.43% for corporate income tax. It is also assumed that the tax bases will move in tandem with GDP. In reality, that is a conservative assumption as the evidence suggests that tax bases are also elastic to changes in GDP. In short, it is foreseeable that gross household income, consumer spending and corporate profit will move by more than the change in GDP, making it very likely that these revenue projections would ultimately constitute a minimum threshold that would very probably be exceeded.

[4]

Based on those assumptions, in 2020, revenue from personal income tax (due to the cyclical effect) would amount to 72.49 billion euros (-16.6%); revenue from VAT and duties would amount to 82.51 billion euros (-11.2%); and revenue from corporate income tax would amount to 19.93 billion euros (-16.1%).

References

AIReF (2020). Report on the main lines of the 2021 budgets of the public administrations.

Autoridad Independiente de Responsabilidad Fiscal Report, 29/20.

BANK OF SPAIN (2020).

Macroeconomic projections for the Spanish economy (2020-2023): The Banco de España’s contribution to the Eurosystem’s December 2020 joint forecasting exercise. Bank of Spain. Retrievable from:

https://www.bde.es/f/webbde/SES/AnalisisEconomico/AnalisisEconomico/ProyeccionesMacroeconomicas/ficheros/be11122020-proy.pdf BBVA RESEARCH (2020).

Spain Economic Outlook. Fourth Quarter 2020.

EUROPEAN COMMISSION (2020). European Economic Forecast.

Autumn 2020. Institutional Paper, 136. Retrievable from:

https://ec.europa.eu/info/sites/info/files/economy-finance/ip136_en_2.pdf CREEDY, J. and SANZ, J. F. (2010). Revenue Elasticities in Complex Income Tax Structures: An Application to Spain.

Fiscal Studies, 31, pp. 535-561.

FUNCAS (2021).

Spanish economic forecasts panel. January 2021. Retrievable from:

https://www.funcas.es/wp-content/uploads/2020/11/PP2011.pdfGARCÍA-ARENAS, J. (2020). Next Generation EU: a golden opportunity for the Spanish economy.

Monthly Report, No. 450, November. CaixaBank Research, pp. 23-24.

GOVERNMENT OF SPAIN (2020a).

Presentación del Proyecto de Presupuestos Generales del Estado 2021 [Presentation of the Draft State Budget for 2021].

—(2020b).

Draft Budgetary Plan for 2021. MOURRE, G. and PRINCEN, S. (2015). Tax Revenue Elasticities Corrected for Policy Changes in the EU.

Discussion Paper, 18. European Commission.

ROMERO, D. and SANZ, J. F. (2019). Zero-deficit target for 2022: Where is Spain coming from and where is it headed?

Spanish Economic and Financial Outlook, Vol. 8, No. 5, September 2019.

SANZ-SANZ, J. F., CASTAÑER, J. M. and ROMERO-JORDÁN, D. (2016). Consumption tax revenue and personal income tax: analytical elasticities under non-standard tax structures.

Applied Economics, Vol. 42, pp. 4042-4050.

José Félix Sanz-Sanz. Madrid’s Complutense University and the FUNCAS Public Finance Observatory (OFEP)

Desiderio Romero-Jordán. King Juan Carlos University and the FUNCAS Public Finance Observatory (OFEP)