COVID-19 and its impact on inflation in Spain

Although Spain recorded an inflation rate of -0.3% in 2020, the only clear-cut case of crisis induced deflation was in energy products, with subcategories in the services sector exhibiting both inflationary and disinflationary trends. Over the near-term, it is likely that inflation will bounce back due to rising vaccination rates, the lifting of social distancing measures, and a decrease in the historically high savings rate.

Abstract: It was thought that, initially, the COVID-19 crisis would have an inflationary impact on the Spanish economy but the subsequent drop in GDP would cause prices to fall. However, in 2020, inflation averaged -0.3% in Spain. And yet, closer analysis shows that the only clear-cut, crisis-induced deflation is in energy products and some of the services most severely impacted by social distancing measures, such as hotels and air travel. In terms of the services sector, only one-fifth of its total subcategories sustained deflation, with negative year-on-year rates between July and November. Importantly, in those cases where price growth slowed but remained positive, the effect has been disinflation rather than deflation. Looking forward, these dynamics may well change. In 2020, energy products detracted one percentage point from the headline inflation rate. In 2021, they could boost it by a little over one percentage point. Furthermore, progress on vaccination rates and an easing of social distancing measures is expected to buoy demand. While the historic savings rate reached during the crisis implies a significant future upside for consumption, it is difficult to estimate to what extent and at what pace that surplus will translate into spending.

Introduction

The health crisis has sparked an unprecedented economic crisis. Spanish GDP contracted an estimated 11% in 2020, with some sectors affected far more than others. The hardest hit sectors were the hospitality, transport and leisure sectors, followed by retail. Conversely, the contractions in the manufacturing and construction industries were considerably smaller.

There has been debate about the potential impact of the crisis on inflation. It was thought that the pandemic-induced disruption to production chains would initially push prices higher, with the subsequent sharp drop in GDP to below potential output causing prices to fall. Elsewhere, the consequences of the European Central Bank’s substantial expansionary monetary policy on inflation are uncertain. The purpose of this paper is to analyse the trends in Spanish inflation in in 2020 across different categories of goods and services in order to paint a picture of the short-term impact of the crisis on prices.

Inflation in 2020

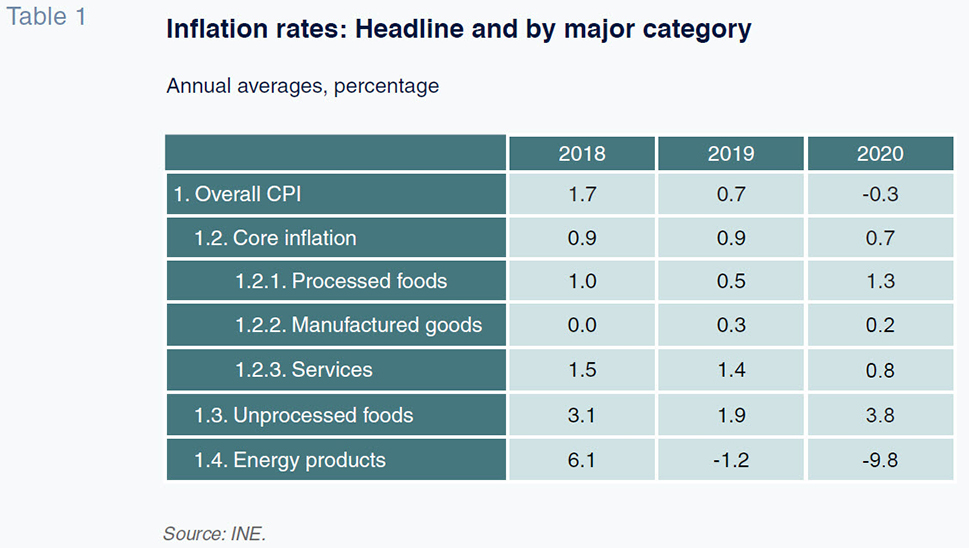

In 2020, inflation averaged -0.3% in Spain. The negative rate was the result of a sharp drop in energy prices, which later recovered somewhat due to the subsequent oil price correction. That commodity, which was trading at over $60 per barrel before the health crisis, fell close to zero on occasion during the month of April on account of the economic fallout from the pandemic. From June, oil prices rebounded to around $40 per barrel, climbing to above $50 per barrel in December, thanks to progress made on a COVID-19 vaccine. The sharp correction in oil prices meant that energy product inflation fell as low as -9.8% –annual average–, detracting one percentage point from the headline rate. These data illustrate the immediate deflationary impact of COVID-19 on energy products.

Unprocessed foods, whose prices are also highly volatile, saw their average annual rate of inflation climb to 3.8%. Core inflation fell to 0.7% on average for the year, shaped by the sharp decline in service price inflation to 0.8% compared to rates of around 1.5% in prior years. That decline was not offset by the higher rate of inflation in processed foods (Table 1).

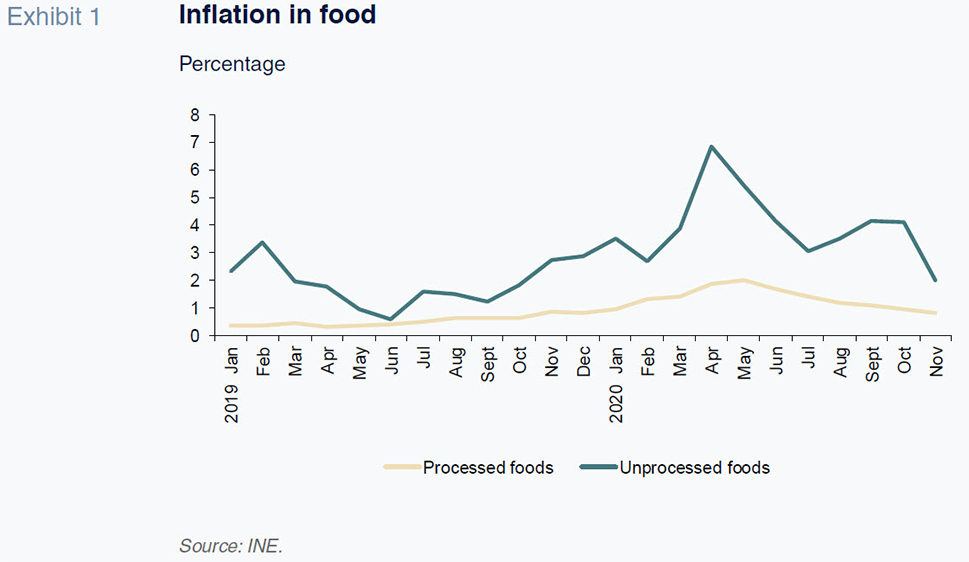

As for unprocessed foods, the prices of a significant number of products jumped considerably from April. Those products included fresh fruit and, to a lesser degree, grains, fresh vegetables and lamb. Fresh fish, chicken and eggs also became more expensive although the inflationary spike for those products was shorter-lived (Exhibit 1). At the onset of the health crisis, certain agricultural activities’ production chains were disrupted as a result of the restrictions brought in to control the pandemic (

e.g. reduced access to immigrant labour, curtailing supply and fuelling prices). However, many factors shape the trend in these products’ prices, which are typically volatile. For this reason, it would require more in-depth and individual analysis to establish the extent to which the health crisis contributed to the inflation sustained in unprocessed foods . That being said, it appears that the initial impact was inflationary.

Within the products that comprise the core inflation index, processed foods also saw an upward movement in prices between April and June, after which prices eased. Note, however, that processed food prices had been rising gradually for several months before the onset of the pandemic (Exhibit 1). That pattern is very widespread if we consider the trend in the various products that comprise this category. As was the case with unprocessed foods, it would require more detailed analysis to distinguish the impact of the crisis from other forces that could have been at play at the time. That being said, the widespread acceleration in inflation rates suggests the existence of an inflationary impact.

In services, the trend was starkly different from that observed in food. As noted above, the rate of service inflation fell from 1.4% in 2019 to 0.8% on average in 2020. The real drop was, however, greater than indicated by the change in the annual average rates. During the months of hard lockdown, many services were unavailable for purchase, resulting in a lack of price data for them. As a result, the National Statistics Office (INE) used estimated prices in order to calculate the headline inflation rate. From June to July, all services began to operate once again and the inflation rate, now based on observed prices, fell sharply with respect to the INE’s estimated inflation for the previous months. This indicates that the rates estimated for service prices during the months affected by the business closures may not be representative, so that their inclusion in the average annual rate calculation could overstate the actual rate, obscuring part of the real impact of the crisis on inflation.

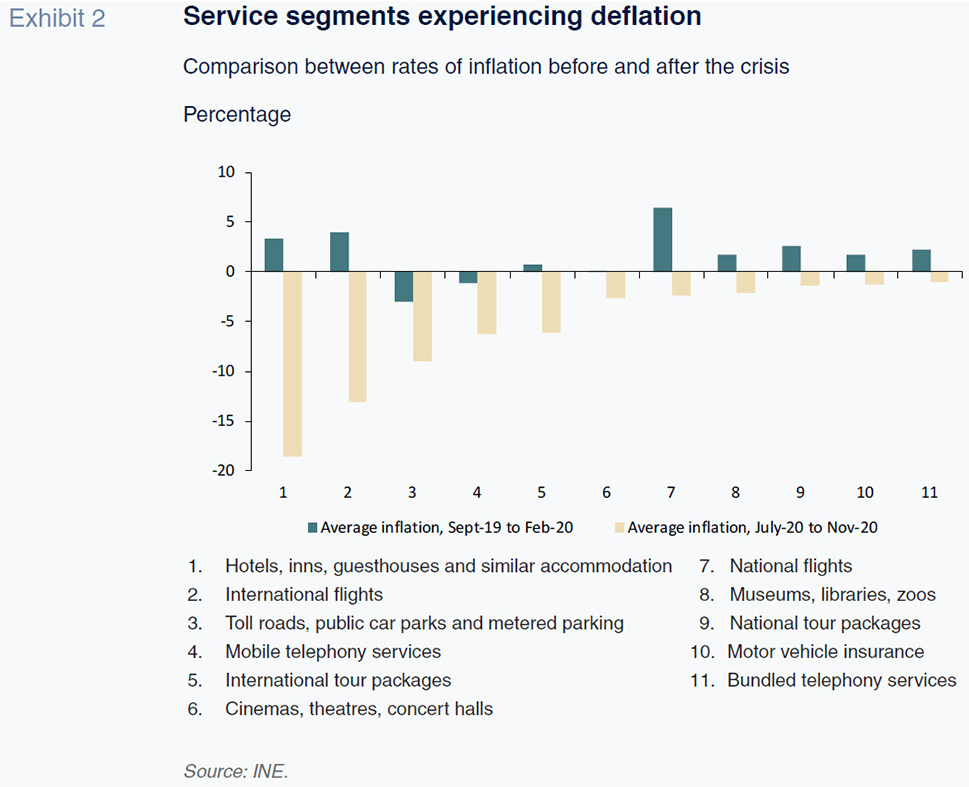

We can compare the year-on-year rates of service inflation for the months prior to the lockdown, between September 2019 and February 2020, with the rates observed between July and December 2020. Note that when observed prices are available in the latter period, there is a bigger decline in inflation than calculated by comparing the annual averages: from 1.5% to 0.2%. This phenomenon becomes more evident if we drill down by component. From here on, the comparisons we make will be performed on that basis.

If we analyse all of the sub-categories within the services index, we see that only one-fifth of the total sustained deflation, with negative year-on-year rates between July and November. Additionally, in a couple of instances, service prices were already falling before the crisis. This analysis reveals a decline in inflation rates for the large majority of service sub-segments while remaining in positive territory. Prices have continued to rise, but at a slower pace than before the crisis, so that it is more appropriate to talk about disinflation, rather than deflation.

Among the categories that experienced clear-cut deflation are hotels and other accommodation services, where inflation went from around 3.4% before the pandemic to an average of -18% from July (Exhibit 2). Hotels were followed by international flights, where prices fell by around 13%. After hotels and international flights, the categories registering the biggest contractions were tolled services, public car parks and metered parking, which are mainly regulated and were already in negative territory before the crisis. Similarly, the crisis has accelerated the decline in prices for mobile telephony services, a trend which predates COVID-19. After those services, the next hardest-hit categories were international tour packages, cinemas and theatres, national flights, museums, libraries and zoos and national tour packages. The other categories where prices contracted were car insurance and bundled telephony services. Most of these service categories are within the sectors hit hardest by the crisis as a result of mandatory closures and restrictions on mobility imposed to control transmission. These include hotels, air travel, tour packages and cultural and artistic activities.

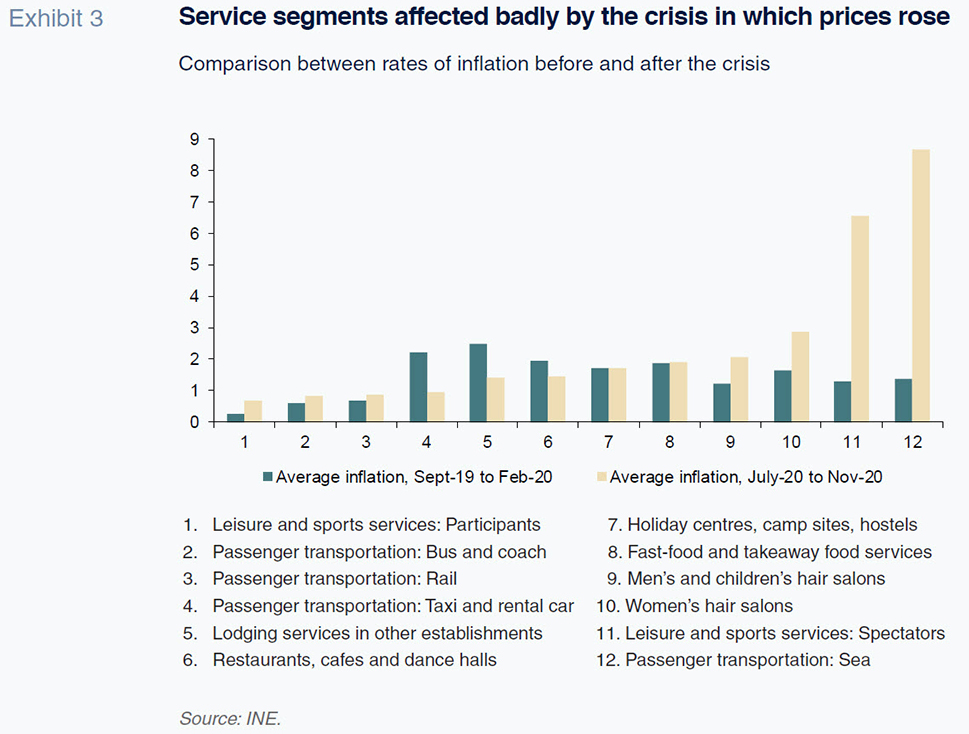

However, other service sectors affected badly by the crisis did not see their prices fall. In fact, some service sectors saw an increase in inflation. Exhibit 3 compares the rates of inflation before and after the onset of the crisis for several of the service sub-segments hit hardest by the crisis, including lodgings other than hotels, passenger transport by bus, train, taxi and sea, certain personal services such as hairdressing, sports and leisure services and, lastly, one of the biggest victims of the pandemic, restaurants and cafes. In nearly all of the above categories, the rates of inflation actually increased during the crisis. In the case of restaurants and cafes, inflation has eased but remained at relatively high levels, of around 1.5%.

Lastly, with respect to prices for non-energy manufactured goods, inflation has eased in recent months from already very subdued levels. The trend by sub-category has been highly uneven, although it is worth singling out the considerable slump in second-hand car prices. In clothing and footwear, where sales have been affected significantly by the crisis, inflation after the onset of the crisis has trended very much in line with pre-crisis levels, at around 1%.

In short, a clear-cut, crisis-induced deflationary impact is only apparent in energy products and some of the services affected most severely by the restrictions. In most services, including some hit very badly, the impact has not been deflationary but rather disinflationary, i.e., the crisis has generally brought about a slowdown in price growth rather than a drop in prices. In food, on the other hand, the impact has been inflationary. It is therefore inaccurate to describe the impact of the crisis as deflationary. Rather, the impact has been starkly different depending on the category of goods or services in question, the net impact being a drop in the rate of core inflation.

Outlook for the months ahead

As the rollout of vaccination gains pace and the restrictions on business activities and mobility are lifted permanently, the first effect will be felt in energy prices, which are bound to trend in the other direction this time. In fact, oil prices began to trend higher last November, fuelled by the positive expectations of a COVID-19 vaccine. In 2020, energy products detracted one percentage point from the headline rate of inflation. In 2021, they may well boost it by a little over one percentage point.

The trend in service prices will be determined by the scale of the recovery in demand and supply. In the second half of the year, assuming sufficient progress on vaccination rates in Spain and Europe in general, demand is expected to recover strongly, buoyed by year-on-year growth in international tourism (although it will be a long time before pre-crisis levels are revisited). As for national demand, there is scope for a significant rebound, even in the short-term. Despite the severe social impact of the pandemic, the household savings rate shot up to unprecedented levels in 2020, thanks largely to the measures rolled out to shore up income (furlough scheme, benefits for self-employed professionals). In the second quarter of last year, that rate stood at 24.4% of disposable household income and in the third quarter, 15.1% – the previous historical maximum was 12.1%. In the first three quarters of the year, the savings generated by households more than tripled that achieved in the same period of the previous year. That unprecedented growth stems partly from ‘forced’ savings derived from the closure or opening restrictions of many businesses during lockdown and subsequent months, which significantly decreased spending opportunities, as well as from precautionary savings triggered by the uncertainty surrounding the economic downturn.

That increase in savings, which has mainly taken the form of higher cash and deposit holdings, means that Spain’s households are sitting on surplus liquidity, above desired levels, implying a significant future upside for consumption. However, it is hard to estimate to what extent and at what pace that surplus will translate into spending, as it is probable that households will hold on to their precautionary savings for some time.

As for the recovery in supply, in those sectors affected most by the crisis, including those in which prices have not fallen, capital destruction has been significant. Many businesses have disappeared or will do so in the coming months and, by the time the crisis ends, those that have survived will be more indebted and their funds depleted, having had to cover fixed costs from zero or insufficient income for many months. In sum, the productive fabric has suffered business losses and decapitalisation, a phenomenon that could considerably slow the supply-side recovery in those sectors. Observers should therefore keep an eye out for significant hysteresis effects that could undermine potential output. It may well be that the recovery in demand will be stronger than that in supply in the near-term.

In the case of the service categories that have sustained deflation, such as hotels and air travel, which are heavily exposed to international tourist demand, it is foreseeable that their prices will rise once the restrictions are removed, albeit possibly falling short of pre-crisis levels due to the limited recovery in tourist arrivals. In other hard-hit services, in which the rate of inflation remained positive, it is possible that price growth will accelerate, driven by national demand, particularly in the regions less dependent on international tourism. It is likely that during the second half of the year, the volume of surplus productive capacity will not be as high as that indicated by the drop in GDP with respect to pre-crisis levels due to the reduction in potential output and the recovery in demand. Elsewhere, given the serious financial damage sustained by the firms in those sectors, it is highly probable that businesses will take advantage of the potential surplus of demand over diminished supply to restore their financial health by boosting margins.

As for the possible inflationary impact of the increase in the money supply derived from the ECB’s ultra-expansionary monetary policy, the likely chain of events is largely interrelated with the potential recovery in demand. This will originate largely from the economic policy measures introduced to support income, which have been financed by the ECB through the buyback of bonds issued by the state. Over the medium-term, it is conceivable that when the velocity of money recovers, the increase in the money supply will put upward pressure on inflation. Although there is still considerable uncertainty regarding the scale of that impact, it is not expected to seriously jeopardise the target rate of 2%.

In short, the normalisation, albeit incomplete, of prices in the areas of activity whose prices corrected during the crisis, coupled with a potentially stronger recovery in demand relative to supply in certain sectors and regions, could fuel growth in the core component of the consumer price index during the second half of the year, boosting the inflationary impact already observed in energy product prices. Thus, Funcas’ forecasts for the average annual inflation rate for 2021 have been revised upwards. Assuming that the price of oil, which rose to $ 55 per barrel in the first weeks of January – a rise only partially offset by the appreciation of the euro – continues to rise to about $ 60 per barrel at the end of the year, the forecast for the average annual inflation rate is 1.2%, and the forecast for the December annual rate is 2%.

Conclusions

Strictly speaking, the COVID-19 crisis has not had a widespread deflationary impact. Other than energy products, only a handful of goods and services saw their prices actually contract. Disinflation, implying a reduction in the positive rate of inflation, was the more common phenomenon. Among the services affected most significantly by the crisis, some prices fell sharply (hotels and air travel), while price growth for others merely slowed (restaurants and other transportation). In some cases, there was even an acceleration of inflation. The crisis appears to have had an inflationary impact on food prices at the start of the crisis.

Looking to the near future, once the restrictions on mobility and business activities are definitively removed, inflation will foreseeably trend higher, particularly in the segments hit hardest by the crisis, which are poised to take advantage of a stronger recovery in demand relative to supply to restore their financial health by boosting their margins.

María Jesús Fernández. Economic Perspectives and International Economy Division, Funcas